- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Coaching and Mentoring for Managers

By Dickson Training Ltd

The 2-day Coaching and Mentoring for Managers course is designed for organisations that want their managers and team leaders to apply practical coaching and mentoring skills in everyday work situations in order to develop the performance of those they are responsible for, as well as improving communication within the business. Previous attendees have included chief executives, general managers, and HR managers, right through to production line supervisors and office staff. In fact, anybody that has to work as part of a team and relies on other people's efforts will benefit from this programme. Course Syllabus The syllabus of the Coaching and Mentoring for Managers course is comprised of four modules, covering the following: Module One Introduction to Coaching and Mentoring Exploding the myths surrounding coaching Benefits of coaching and mentoring The role of a coach and mentor How to avoid everyday interference that takes your time away from coaching people to achieve results How motivation works The difference between mentoring, coaching, directing, supporting & delegating, and learning when it is necessary to apply them Why coaching is an action orientated partnership purely focused on measurable results Coaching and mentoring outcomes Module Two Managing a Coaching Session The most important skills of a business coach The key characteristics of a good coach How to ask powerful coaching questions Opportunity to role-play using the STAR/GROW model Module Three Mentoring in Action Mentoring suggestions The first meeting Between first and second meetings The second meeting The Experiential learning cycle Model discussions Frequent questions asked by Mentors Duration of mentoring End of relationships Module Four Putting Learning into Practice Building a bank of great coaching questions Demonstration of what has been taught in a live coaching/mentoring meeting Individual feedback from a professional coach Creating SMART action plans Getting started as a work coach/mentor Group review and feedback on new learning Action steps for new coaches Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

Mastering Real Estate Investments: Strategies for Success in REITs and Beyond

5.0(5)By Finex Learning

Overview Understand the structure and mechanics of Target Redemption Notes (TARNs), autocallables, accumulators, and faders. Who the course is for CEOs, CFOs, COOs with responsibility for Strategic Management Investment bankers Real estate consultants Management consultants Private Equity investors Financial analysts Institutional Funds and Portfolio Managers Retail investors Course Content To learn more about the day by day course content please request a brochure. To learn more about schedule, pricing & delivery options speak to a course specialist now

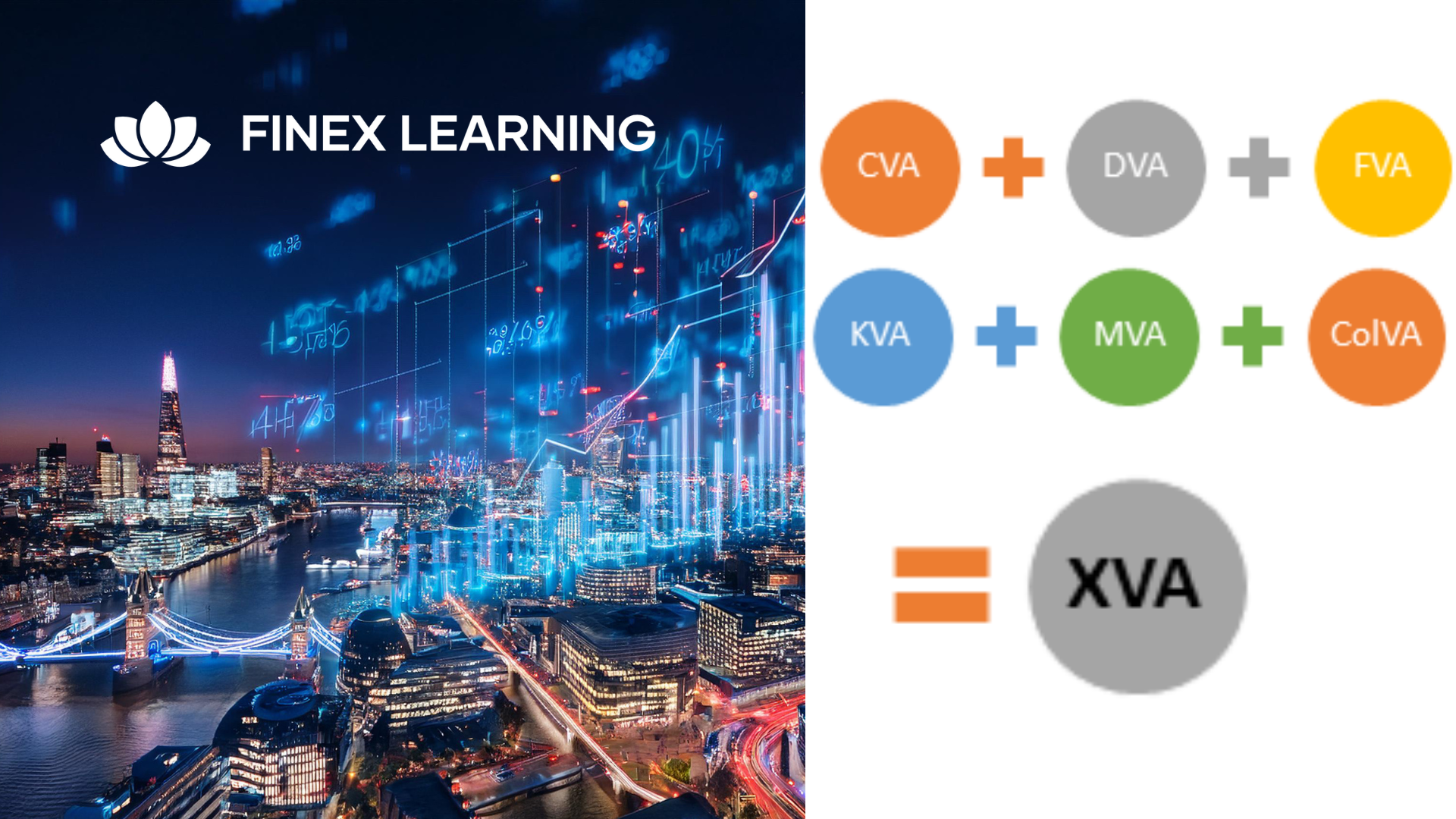

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn how to price equity options and the features that make them different from other asset classes. Explore how to use these products for taking equity risk, yield enhancement and portfolio protection Who the course is for Risk managers Bank treasury professionals Finance Internal Audit Senior management Fixed Income, FX, Credit and Equities traders Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Selling through service (In-House)

By The In House Training Company

In today's fast-moving competitive environment, sales are often made or lost on the strength of a telephone conversation or a brief email. This means that not only is customer service everyone's responsibility - so is sales. Customer service staff are failing the customer if they don't think about sales. And sales staff are failing customers if they don't think about service. And anyone failing a customer is failing both themselves and their employer. Too often, customer service staff feel neither capable nor empowered to recognise or capitalise upon a sales opportunity. Too often, sales people pursue the short-term opportunity at the expense of the bigger picture. The good news is - it doesn't have to be this way! Sales and customer service skills can be acquired, developed and polished just like any other skill. This tried-and-tested programme shows you how to do it. As a result of this course, participants will be able to: Take control of a customer conversation, with confidence Refresh and polish their customer service and sales performance Recognise and develop a sales opportunity Engage the customer and build rapport Identify a customer's needs Match the customer's needs to the organisation's products or services Handle objections confidently Ask for the order At the end of the workshop each participant will have developed their own action plan for developing and using their skills in the workplace. 1 Introduction Course overview, objectives and introductions 2 Serving or selling? Feelings and attitudes - How we can affect the outcome by our feelings and behaviour What is selling? - Selling is helping people to buy, identifying the opportunities that exist within the conversation to develop the customer's interest in our products or services 3 Developing the right skills Communication- The impact of body language, voice tone and words- How to make the best impression on the customer and create a 'buying environment' Rapport-building- What makes a good working relationship?- What do customers look for when they call us?- How can we match their expectations in terms of our own interpersonal skills? Relating to different types of people by identifying and matching their communication style on the telephone 4 Making it easy for the customer Starting it right- Opening the conversation positively- Building rapport- How to develop interest in our products or services Gaining and clarifying information- Questioning skills and questioning style- What do we need to know from the customer?- How can we use that information in the conversation? Active listening- The most under-rated skill of all- Picking up on the 'Golden Moments' when a customer shows they may be interested Presenting information confidently- Knowing the benefits of our products or services- How to tell the customer what they need to know in order to enable them to buy Closing on a positive note- When and how to ask for commitment Dealing with the customer's objections and concerns in a positive manner 5 Course summary and action plans Review of main learning points Presentation of personal action plans

Effective technical writing (In-House)

By The In House Training Company

The aim of this programme is to help attendees create better quality technical documents in an organised and efficient manner. It will give those new to the topic an appreciation of how to approach the task professionally whilst those with more experience will be able to refresh and refine their skills. The programme comprises three complementary one-day modules: The programme presents a structured methodology for creating technical documents and provides a range of practical techniques that help delegates put principles into practice. Although not essential, it is strongly advised that delegates for modules 2 and 3 have already attended module 1, or another equivalent course. Note: the content of each module as shown here is purely indicative and can be adapted to suit your particular requirements. This course will: Explain the qualities and benefits of well written technical documents Present a structured approach for producing technical documents Review the essential skills of effective technical writing Demonstrate practical methods to help create better documents Provide tools and techniques for specification and report writing Review how technical documents should be issued and controlled Note: the content of each module as shown here is purely indicative and can be adapted to suit your particular requirements. Module 1: Essential skills for technical writers 1 Introduction to the programme Aims and objectives of the module Introductions and interests of participants 2 Creating effective technical documents What is technical writing? how does it differ from other writing? Key qualities of an effective technical document Communication essentials and the challenges faced by technical writers The lessons of experience: how the best writers write The five key steps : prepare - organise - write - edit - release (POWER) 3 Preparing to write Defining the document aims and objectives; choosing the title Understanding technical readers and their needs Getting organised; planning and managing the process Integrating technical and commercial elements The role of intellectual property rights (IPR), eg, copyright 4 Organising the content The vital role of structure in technical documents Deciding what to include and how to organise the information Categorising information: introductory, key and supporting Tools and techniques for scoping and structuring the document Creating and using document templates - pro's and con's 5 Writing the document Avoiding 'blinding them with science': the qualities of clear writing Problem words and words that confuse; building and using a glossary Using sentence structure and punctuation to best effect Understanding the impact of style, format and appearance Avoiding common causes of ambiguity; being concise and ensuring clarity Using diagrams and other graphics; avoiding potential pitfalls 6 Editing and releasing the document Why editing is difficult; developing a personal editing strategy Some useful editing tools and techniques Key requirements for document issue and control Module 2: Creating better specifications 1 Introduction Aims and objectives of the day Introductions and interests of participants The 'POWER' writing process for specifications 2 Creating better specifications The role and characteristics of an effective specification Specifications and contracts; the legal role of specifications Deciding how to specify; understanding functional and design requirements Developing the specification design; applying the principles of BS 7373 Getting organised: the key stages in compiling an effective specification 3 Preparing to write a specification Defining the scope of the specification; deciding what to include and what not Scoping techniques: scope maps, check lists, structured brainstorming The why/what/how pyramid; establishing and understanding requirements Clarifying priorities; separating needs and desires: the MoSCoW method Useful quantitative techniques: cost benefit analysis, QFD, Pareto analysis Dealing with requirements that are difficult to quantify 4 Organising the content The role of structure in specifications Typical contents and layout for a specification What goes where: introductory, key and supporting sections Creating and using model forms: the sections and sub sections Detailed contents of each sub-section Exercise: applying the tools and techniques 5 Writing the specification Identifying and understanding the specification reader Key words: will, shall, must; building and using a glossary Writing performance targets that are clear and unambiguous Choosing and using graphics Exercise: writing a specification 6 Editing and releasing the document Key editing issues for specifications Issue and control of specifications Module 3: Writing better reports 1 Introduction Aims and objectives of the day Introductions and interests of participants The 'POWER' technical writing process for technical reports 2 Creating better reports What is a technical report? types and formats of report The role and characteristics of an effective technical report Understanding technical report readers and their needs The commercial role and impact of technical reports Getting organised: the key stages in compiling a technical report 3 Preparing to write reports Agreeing the terms of reference; defining aims and objectives Being clear about constraints; defining what is not to be included Legal aspects and intellectual property rights (IPR) for reports Preparing the ground; gathering information and reference documents Keeping track of information: note making, cataloguing and cross referencing Tools and techniques for developing a valid and convincing argument 4 Organising the content The role of structure reviewed; some typical report structures Who needs what: identifying the varied needs of the readership What goes where: introductory, key and supporting sections Creating and using model forms: the sections and sub sections Detailed contents of each sub-section Exercise: applying the tools and techniques 5 Writing the report Planning the storyline: the report as a journey in understanding Recognising assumptions about the reader; what they do and don't know Converting complex concepts into understandable statements Presenting technical data and its analysis; the role of graphics Presenting the case simply whilst maintaining technical integrity Exercise: writing a technical report 6 Editing and releasing the report Key editing issues for technical reports Issue and control of technical reports

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales product control research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Explore trading and hedging applications of barrier options across interest rate, FX, and equity markets. Who the course is for Executives of listed companies who want to enhance their knowledge and skills in ESG and sustainability. Corporate professionals who want to integrate ESG initiatives into their organizations and improve their ESG programs. ESG professionals who want to gain a deep understanding of ESG frameworks, reporting standards, and best practices Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- course, Courses in London

- course, Courses in Birmingham

- course, Courses in Glasgow

- course, Courses in Liverpool

- course, Courses in Bristol

- course, Courses in Manchester

- course, Courses in Sheffield

- course, Courses in Leeds

- course, Courses in Edinburgh

- course, Courses in Leicester

- course, Courses in Coventry

- course, Courses in Bradford

- course, Courses in Cardiff

- course, Courses in Belfast

- course, Courses in Nottingham