- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

411 Courses in Cardiff

Overview Overview This course is designed to develop skills and gain more knowledge of Change Management. For people who want to transform their skills and career and explore every opportunity, this course well suits their needs. It is very important to understand Change Management and adopt the changes within the organisation and work culture. It will be impossible to grow or even to improve ourselves without any changes. Changes happen to take place either in a positive nature or in negative nature. No matter how it happens to appear, we need skills to respond to the changes and respond accordingly. We need to enhance our skills on a daily basis in this changing environment to handle what we encounter. It is observed that Change is very important for growth, diversity and success. Every business needs to go through the changing process to adapt the new things and walk with the new developments. Thus, as a professional, we also are in need to continually change to maintain and improve our competencies and skills and to achieve our targeted goals. We need to be extroverted with the environment to understand what is happening, where, when and what change needs to be brought.

Overview This course is specially designed to enhance the skills required to analyse risk and crisis and the cause behind this. It will feed you with the necessary skills to minimise the chances of risk and in case it happens able to manage the situation in order to keep the business in a stable position. The course content will cover different crises caused due to internal or external issues and different ways to manage them. It will help the professionals to gain skills in planning beforehand various techniques to overcome risk and crisis and implementing the plan during that phase.

Overview Competitor Analysis is a key area every professional does to understand their business presence. It gives your insight into your business standings and also knowledge of your competitors and their strength and weakness. Analysing your competitors helps you understand the market and your power to deal with the competitors. It is an essential marketing and strategic tool. It provides both an offensive and defensive strategic tool to analyse opportunities and threats.

Overview To understand the course thoroughly, you need to understand the practical application of the theory along with case studies as well as relevant examples. IT Project Management course will include those areas in managing the processes and activities related to guaranteeing the success of IT projects.

Overview Objective Understand the requirement of Information Security Concepts and Definitions of Information Security Management Systems Deeply Analysing the policies, Standards and procedures How to deliver a balanced ISMS and following its security procedures Analysing the Information risk management Evaluating the organisational responsibilities Understanding the Information security controls Scrutinising Legal framework Techniques of Cryptographic models

Overview Effective decision-making requires the adoption of decision approaches that fit the complexities of these situations and the efficient management of decision-making processes. It also requires the ability to think strategically in highly interactive markets and acute insights into the psychology behind people's behaviour. Objectives Develop critical thinking skills, sharpening your intuition in the face of risk and uncertainty Learn ways to discover, manage, mitigate and avoid decision-making traps Learn to leverage the power of 'nudges' - a light-touch way to influence human behaviour and improve decision-making Boost your ability to build high-performing teams by understanding what conditions enable teams to make better decisions than individuals Become a more strategic leader and decision-maker by understanding the long-term impact your decisions can have on your organisation

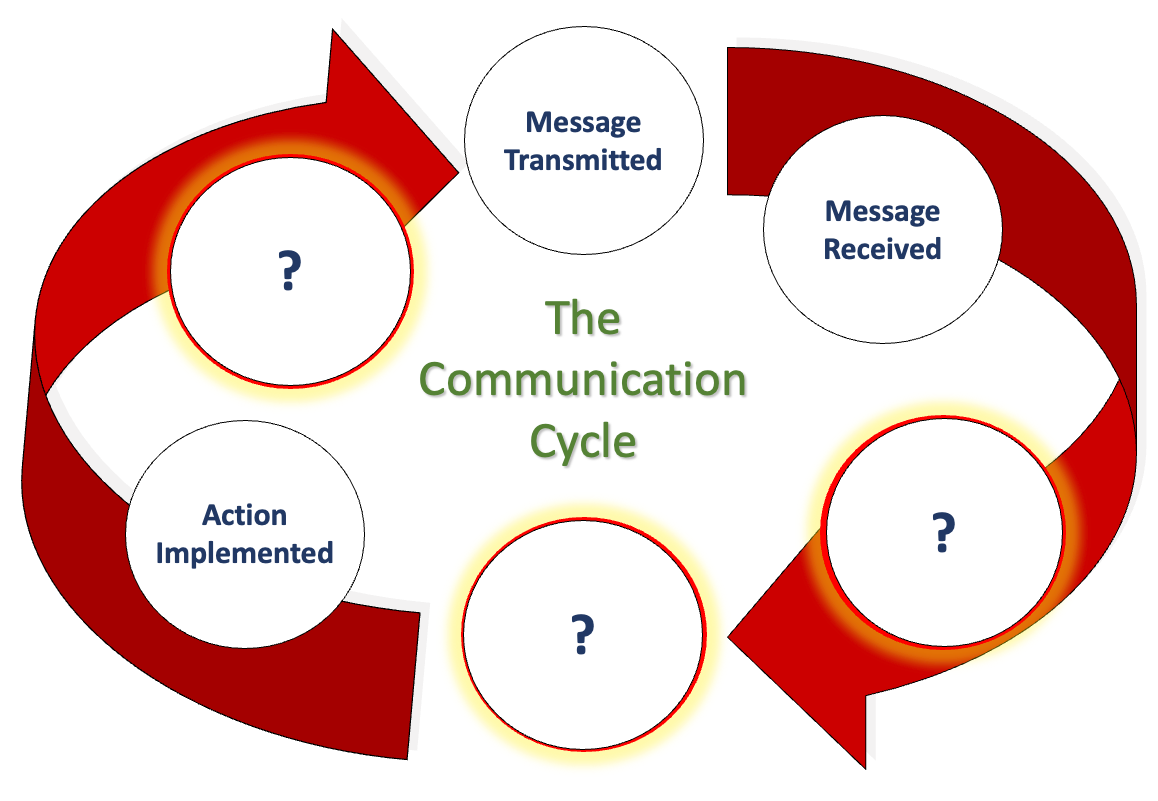

We communicate daily in many ways, including email, phone, text, Zoom, Teams, Google Meets, Slack, and even that old-fashioned thing, what was it now... oh yes, talking face-to-face. But, when we look at communication closely and really drill down into what we are doing in conjunction with how our brain works (neuroscience), how internal, organisational, and social politics control what we believe we can say, how hierarchical positioning impacts our honesty and how the lack of psychological safety means we say what we know others want to hear rather than what they need to hear…. It is oh so complicated! This workshop not only explores the concept of excellent communication, but we also want to hear what you believe it is too. We also delve into how organisational culture influences our perception of speaking up. Factors that hinder open and honest communication, and we work collaboratively towards removing these barriers to achieve a communication style that fosters trust and transparency, creating psychological safety. This workshop is particularly relevant to our Emotional Intelligence workshop (EI and Me). We firmly believe that developing emotional intelligence is the key to unlocking Clean Communication, a skill that is crucial for all of us, regardless of our roles and responsibilities, so that we thrive in our professional environment. If you want to see if we are correct, why not have us facilitate a workshop for you and see what you get by the end of it? LENGTH - Normally, one day. But please contact us to discuss your specific needs, or we can offer advice. NEXT WORKSHOP START - Please ask for more information as we deliver bespoke closed events for your people at your location or a mutually suitable location. WORKSHOP DELIVERY - The best environment for this workshop is face-to-face, but we can facilitate this workshop online. Suitability - Who should attend? Who Should Attend and Why? Who? - Perhaps think of this another way… who shouldn’t attend to ensure we can attain Clean Communication? There’s your answer. Why? - Every person needs to understand what we are saying above about how we get trapped in this organisational formatting which changes how we communicate and how it prevents us from communicating cleanly. EVERY organisation has this, despite what our values profess. And 'Values', that’s a whole other story. Workshop Content Using the 'Moccasin Approach'® to clean our personal and organisational communication LaPD’s Communication Cycle and what we must consider. (Can you work out what the ? represent above? Accountability and Responsibility raises its head in Communication. It has to. Bias, unconscious bias and its impacts on our communication. The conundrum of communicating with others and their styles (The TRAP). How would my perfect Manager/Leader communicate with me? Nonverbal communication (body language), rapport, Clean Communication. Negative communication can go viral (Self-Fulfilling Prophecy). Reflections, findings and goals (individual and team). Meeting our workshop objectives by listing five areas for development. Workshop delivery and venue This workshop is usually one day in duration, and it focuses solely on how we communicate with each other. It can also be a two-day event incorporating aspects of Emotional Intelligence (EI) with group, and individual activities to allow discussions about the various communication we need in your organisation. When you consider the content we deliver, we are sure you will understand why we always prefer to deliver our workshops, courses and programmes face-to-face. Face-to-face workshops and courses can be held at a location of your choice or, if you wish, a central UK location, such as the Macdonald Burlington Hotel in Birmingham, located directly across from the Birmingham New Street train station. We can deliver our workshops, courses and programmes online, although this will mean splitting elements into manageable learning events to suit the online environment.

Overview For internal employees who want to understand and expand their roles related to financial reporting, as well as those who simply need a refresher on financial accounting, this course is the ideal way to get up to speed. By exploring concepts that go beyond basic accounting, this course will enable participants to approach financial auditing with renewed confidence. The programme will walk participants through an analysis of an organization's financial statements using case study exercises, where participants will calculate key ratios and analyze trends over time. Engaging in discussions on both historic and current fraud cases, participants will learn how to recognize âred flagsâ in financial statement reporting.

Level 6 NVQ Diploma in Construction Site Management

By BAB Business Group

The NVQ Diploma in Construction Site Management qualification is suited to those who are working in a management role in the construction industry and are looking to become eligible for the Black CSCS Card. Candidates follow one of five pathways depending on their job role: Building and Civil Engineering Highways and Maintenance Repair Residential Development Conservation Demolition Our team will discuss the qualification process with you prior to signing up in order to ensure that you will be able to complete the qualification. Every candidate is assigned a competent and experienced assessor who will provide advice and guidance throughout the programme to ensure that candidates are supported in the successful completion of the qualification. CSCS Cards We can provide CSCS tests and CSCS cards alongside your qualification without the need to attend the test centre. Speak to our friendly and helpful team for more information.

Level 4 Diploma in Construction Site Supervision – Retrofit

By BAB Business Group

The NVQ Level 4 Diploma in Construction Site Supervision – Retrofit is appropriate for individuals who work as a Construction Site Supervisor/ Foreman or Assistant Site Manager in the Retrofit construction sector and are looking to become eligible for the Gold ‘Site Supervisor’ CSCS Card. Our team will discuss the qualification process with you prior to signing up in order to ensure that you will be able to complete the qualification. Every candidate is assigned a competent and experienced assessor who will provide advice and guidance throughout the programme to ensure that candidates are supported in the successful completion of the qualification. CSCS Cards We can provide CSCS tests and CSCS cards alongside your qualification without the need to attend the test centre. Speak to our friendly and helpful team for more information.

Search By Location

- Professional Development Courses in London

- Professional Development Courses in Birmingham

- Professional Development Courses in Glasgow

- Professional Development Courses in Liverpool

- Professional Development Courses in Bristol

- Professional Development Courses in Manchester

- Professional Development Courses in Sheffield

- Professional Development Courses in Leeds

- Professional Development Courses in Edinburgh

- Professional Development Courses in Leicester

- Professional Development Courses in Coventry

- Professional Development Courses in Bradford

- Professional Development Courses in Cardiff

- Professional Development Courses in Belfast

- Professional Development Courses in Nottingham