- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

MICRONEEDLING COURSE | Dermapen

By Harley Elite Academy (HeLa)

ADVANCED 8 CPD POINTS 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! This course theory will help you to understand: We will cover all you need to know in order for you to treat your patients confidently and safely. Dermapen® offers certified microneedling training & certification as part of its education program. The curriculum is available for purchase by all skin care practitioners. The microneedling training will take a look into the history and science of microneedling. 4 hour microneedling training core course The history, improvements and leaders in skin micro-needling Product usage protocols Treatment guidelines Indications and contraindications Before and after patient care Comparative and adjunctive skin therapies Treatment and technical demonstration Certification testing Practice will enable you to learn in 1-day ONE-TO-ONE Training You will also have the opportunity to view a micro needling treatment demonstration at the conclusion of the training. After each lesson, there will be a short quiz. Upon successful completion of the course, you will receive a certificate and title of Dermapen® Certified Practitioner. You need to be medically qualified as a doctor, dentist, nurse, pharmacist or paramedic with full governing body registration and have completed a Foundation Filler Course and to have administered a number of cases. Additional information ATTENDANCE ONLINE (Theory), IN CLINIC (Practice) COURSE LEVEL INTERMEDIATE | Advanced Course

FAT DISOLVING | Aqualyx or Lemon Bottle

By Harley Elite Academy (HeLa)

ADVANCED 8 CPD POINTS 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! Lipolysis (Fat Disolving) achieves good results in the following body zones: – Chin (double chin) – Hips (love handles) – Stomach (abdominal area) – Thighs (saddlebags) – Upper arms (arm toning) – Pseudo gynecomastia (male breasts) – Back (bra fat or muffin top) The acids present in Aqualyx cause fat destruction in the body. Aqualyx main active ingredient is deoxycholic acid. Deoxycholic acid is a bile acid, synthesized in the human liver. The fatty acids are then released into the body, to be broken down by our usual metabolic processes in the liver. Naturally occurring bile acid is used by the body to emulsify fat. Aqualyx comes in a water based injection that dissolves fat cells that it comes into contact with. A single vial will be sufficient. Small are for larger areas, such as the abdomen or the inner thigh, anywhere between 5 to 10 vials One treatment of AQUALYX® usually includes only 1 or 2 injection sites, as well as a local anaesthetic solution of lidocaine which is used to irradicate any pain and make the procedure as comfortable as possible. Course Content Disinfection, Health & Safety. Consultation and timings including data protection, medical history and client consent Skin Types Skin analysis Pre and post treatment procedures Injection protocol and techniques Safe handling needles, before, during and after treatment Product knowledge Setting up Treatment procedure Results clients can expects and managing expectations Contractions and aftercare advice Treatment planning and pricing Post care instruction Fat dissolving products (Lemon Bottle), very safe. Lemon Bottle is a high-concentration fat dissolve solution that combines Riboflavin (vitamin B2) and other premium ingredients that create fat decomposition by accelerating metabolism of fat cells. Become a certified Lemon Bottle fat-dissolving treatments expert with our comprehensive and accredited courses designed specifically for UK practitioners. We have the perfect course to suit your needs, focusing on the Lemon Bottle system. Minimal swelling, minimal pain. Begins working immediately. You need to be medically qualified as a doctor, dentist, nurse, pharmacist or paramedic with full governing body registration and have completed a Foundation Filler Course and to have administered a number of cases. Additional information ATTENDANCE ONLINE (Theory), IN CLINIC (Practice) COURSE LEVEL INTERMEDIATE | Advanced Course

Skin Booster Training Course

By Harley Elite Academy (HeLa)

ADVANCED 8 CPD POINTS 1 DAY INTENSIVE COURSE ONLINE or IN-CLINIC NOTE! After booking we will contact you for scheduling the exact course date! Courses dates are subject to change due to mentors availability. We will inform you via email if a date becomes available! This course theory will help you to understand: We will cover all you need to know in order for you to treat your patients confidently and safely. The Theory will cover; Anatomy and physiology Ageing Characteristic of the ideal skin booster Product Introduction Treatment Method Contraindication Complication management Pre & Post-treatment advices Using Products like Toskani, Skinecos, Jalupro etc. Using Products , PROFHILO, recommended for midd and low part of the face as well as other delicate areas of skin such as the neck, décolletage, hands or knees. Practice will enable you to learn in 1-day ONE-TO-ONE Training We will cover pertinent information including mechanism of action, safety and efficacy issues, management and treatment of complications, dilution guidelines, and more. A certification of hands-on training will be provided upon completion of the course. You will perform this procedure on live models injecting superficially and administrating the product (skinbooster) into the subcutaneous layer. This will happen under the supervision and guidance of highly experienced aesthetic practitioners. You will practice injectables with needle on; Face, Neck, Decolatege & Hands You need to be medically qualified as a doctor, dentist, nurse, pharmacist or paramedic with full governing body registration and have completed a Foundation Filler Course and to have administered a number of cases. Additional information ATTENDANCE ONLINE (Theory), IN CLINIC (Practice) COURSE LEVEL INTERMEDIATE | Advanced Course

Microsoft Project Introduction/Intermediate - In-company

By Microsoft Office Training

Price £750 inc VAT Finance options In Company training - £750 for groups of up to 8 delegates. Discounts for Nonprofits/Charities... Study method On-site Duration 2 days, Full-time Qualification No formal qualification Certificates Certificate of completion - Free Additional info Tutor is available to students Course Objectives At the end of this course you will be able to: Identify the components of the Microsoft Project environment Create a new project plan Create the project schedule Use different views to analyse the project plan Create, allocate and manage resources in a project plan Finalise a project plan Track progress View and report project plan information ' 1 year email support service Customer Feedback Very good course. Learnt a lot. Looking forward to the next level. Alexandra - CIAL 1 year email support service Take a closer look at the consistent excellent feedback from our growing corporate clients visiting our site ms-officetraining co uk With more than 20 years experience, we deliver courses on all levels of the Desktop version of Microsoft Office and Office 365; ranging from Beginner, Intermediate, Advanced to the VBA level. Our trainers are Microsoft certified professionals with a proven track record with several years experience in delivering public, one to one, tailored and bespoke courses. Our competitive rates start from £550.00 per day of training Tailored training courses: You can choose to run the course exactly as they are outlined by us or we can customise it so that it meets your specific needs. A tailored or bespoke course will follow the standard outline but may be adapted to your specific organisational needs. Description Introduction to Microsoft Project Recap on project management concepts Project environment overview The 3 databases: Tasks, Resources and Assignments Different ways of displaying the Project Plan Access Help Creating a Project Plan Create a New Project Plan Project Information Create and apply the project calendar Defining recurring exceptions to the calendar Defining the calendar's work weeks Create the Summary tasks Create the Work Breakdown Structure Task creation and scheduling Exploring the Entry Table and its fields Task editing and the Task Information window Task Durations Defining Milestones Manual Scheduling vs Automatic Scheduling Changing the Task's Calendar Create a split in a Task Create Task Relationships Adding Lag or Lead to a Relationship Identifying the Critical Path Adding Constraints and Deadlines to Tasks Create Recurring Activities Adding Notes and links to Tasks Managing Resources Exploring the Entry Table and its fields Resource editing and the Resource Information window Resource Types Fixed Costs vs Variable Costs Adding Resource Costs Defining when costs accrue Changing the Resource Calendar and Availability Project calendar vs Resource and Task Calendar Assigning Resources to Tasks Effort Driven Scheduling Resolving Resource Overallocation Tracking the Project Progress Setting a Project Baseline Entering Actuals Different ways of viewing the Progress Checking if the Project is on track Viewing and Reporting Project Detail Adding Tasks to the Timeline and sharing it Modifying the Timescale and Zoom level Formatting the Gantt View Filtering and Grouping Tasks Print and Troubleshoot the Gantt View Using built-in Reports in Microsoft Project Who is this course for? This course is designed for a person who has an understanding of project management concepts, who is responsible for creating and modifying project plans, and who needs a tool to manage these project plans. Requirements General knowledge of the Windows OS Career path Microsoft Office know-how can instantly increase your job prospects as well as your salary. 80 percent of job openings require spreadsheet and word-processing software skills

Level 4 Award Learning Coaching

By Panda Education and Training Ltd

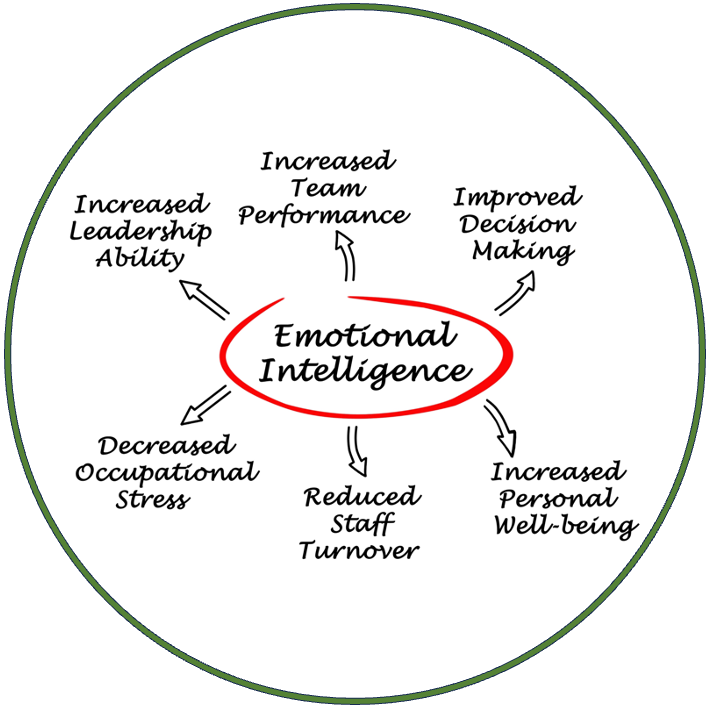

Learning Coach Qualification – is it right for me? A Learning Coach plays a vital role in guiding and supporting young people in their educational journey, helping them develop a range of skills and attributes that contribute to successful learning, personal growth, and future success. Pursuing a qualification to become a qualified Learning Coach is beneficial for enhancing skills, credibility, and effectiveness in supporting learners’ development. It provides a foundation of knowledge and expertise that contributes to successful coaching experiences. This qualification consists of three units (two mandatory, 1 optional). Please see the Agored Cymru website for full course information, where you can choose the units to suit the needs of your staff. It will cover the following: Young People’s Development: Factors influencing learning, motivation, and barriers to learning. Learning Styles and Inclusive Planning: Learning styles vs. Universal Design for Learning (UDL), planning for inclusive learning. Reflective Practice: Comparison of reflection models, engaging in reflective practice. Coaching for Learning: Communication and coaching skills, coaching models, functions of Learning Coaching Assessing Young People: Interview skills, communication styles, assessing achievements and barriers to learning. Developing Learning Pathways: Coordinating individualised learning pathways, engaging young people in goal-setting Further Information This course spans six months and covers various aspects of Learning Coaching, including understanding learning processes, personal and emotional factors affecting learning, coaching techniques, reflective practice, communication skills, inclusive planning, assessment, and the coordination of individualised learning pathways. Students will engage in assignments, reflective journals, case studies, and portfolio building to demonstrate their understanding and application of the concepts and skills covered in the course. Learning Outcomes Professional Competence: A formal qualification ensures that Learning Coaches have a solid understanding of best practices, theories, and methodologies in the field of education and coaching. It provides them with the necessary knowledge and skills to effectively support learners in their development. Credibility: Having a recognised qualification enhances the Learning Coach’s credibility and reputation. It demonstrates their commitment to their role and their ability to provide high-quality guidance and support. Improved Effectiveness: Learning Coaches who have undergone formal training are better equipped to assess learners’ needs, design personalised learning plans, and provide targeted support. This leads to more effective coaching outcomes. Personal Growth: Going through a qualification process often involves self-reflection, skill development, and continuous learning. This contributes to the personal growth and professional development of the Learning Coach. Network and Community: Enrolling in a qualification program provides Learning Coaches with the opportunity to connect with other professionals in the field. This network can offer support, resources, and collaboration opportunities.

The Essentials of EAP Training Workshop (£750 per course for up to 10 people)

By Buon Consultancy

Employee Assistance Programme Training

First Aid Essentials

By Immerse Medical

Immerse Medical are experienced at teaching first aid to young people within the educational sector. We have designed this workshop style programme specifically for those in KS3/4. The sessions are fun, engaging and focus on fundamental life saving skills. Using interactive gamification, students gain hands on experience, which they will draw upon in real life medical emergencies. These sessions are perfect as part of phase 2 of National Citizenship Service (NCS) and Duke of Edinburgh (DofE) Awards. Key points Meets national curriculum secondary education guidelines– We’ve designed this programme to exceed the requirements of the 2020 guidelines. Training by doctors, nurses and paramedics – We have years of experience working on the front line of emergency medicine; giving us real world knowledge and skills in managing injured or unwell people. Latest equipment & technology – We utilise technology enhanced learning to provide a realistic opportunity to practice fundamental life saving skills in a safe environment. More than first aid – While participating in this workshop young people will also develop their ability to work as part of team, communicate effectively and think critically in high pressure situations leading to an overall increase in personal confidence. Check out the skills included in the videos below. First Aid Courses For Young People Programmes and sessions for young people focusing on how to keep each other safe and what to do if something goes wrong. Sessions are designed with age and national curriculum in mind, from 1 hour tasters to sessions for large groups, perfect as part of NCS and Duke of Edinburgh programmes. Our training for young people is fun, engaging and focuses on fundamental life saving skills. All courses can be delivered at our training centre in Poole, Dorset or we can deliver on-site across Bournemouth, Poole, Dorset, Hampshire and the South of England.

Workplace Mediation & Conflict Resolution (£695 total for this 1-day course for a group of up to 12 people)

By Buon Consultancy

Mediation and Conflict Course

Search By Location

- break, Courses in London

- break, Courses in Birmingham

- break, Courses in Glasgow

- break, Courses in Liverpool

- break, Courses in Bristol

- break, Courses in Manchester

- break, Courses in Sheffield

- break, Courses in Leeds

- break, Courses in Edinburgh

- break, Courses in Leicester

- break, Courses in Coventry

- break, Courses in Bradford

- break, Courses in Cardiff

- break, Courses in Belfast

- break, Courses in Nottingham