- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

299 Courses in Bristol

Dementia Care – Level 2

By Prima Cura Training

Dementia affects around 820,000 people in the UK. This figure is likely to rise to one million by 2025 and two million by 2051. It is one of the main causes of disability in later life and with research being desperately underfunded, it costs the UK over £26 billion a year. Understanding dementia and the person-centred care that is required is fundamental to high quality care.

The Sales Accelerator (In-House)

By The In House Training Company

The Sales Accelerator programme is a fresh approach to improving business development productivity. It focuses on identifying and using a series of business productivity metrics in order to build a clear action plan for improving sales results - typically within 90 days. The metrics are grouped under three headings: The basic principle is that a small improvement in each area can lead to a significant increase in sales results and productivity. And the object of the programme is to show how best to achieve that. The programme therefore looks at each of these three areas in turn, spending a day on each. Suitable for any and all businesses and all levels of experience and expertise, this is a remarkably practical and hands-on programme. During the workshop, participants discuss, review and apply many proven sales and marketing techniques and personal selling ideas. The goal is to generate and commit to changes and actions that can lead to a 10-30% increase in the next three to six months. There's also a consultancy option, rather than the workshop-based programme. See below for details. Day one - Activity Key objective This first module introduces the Sales Accelerator model. The goal here is to show participants how to increase their pro-active activity levels by around 10%. It covers all aspects of creating new business opportunities, from existing customers and non-customers alike, and is linked to personal activity improvement goals. Main elements Improve the productivity, accuracy and effectiveness of your business approach by using new and unique models and techniques. Different methods of creating and generating new business opportunities in the short, medium and long term. This includes sourcing new business, up-selling, cross-selling, warm calling and gaining referrals. Using organised persistence to track and build new customer revenue. Managing your sales time effectively. Key learning points Sales productivity - understand the dynamics of increasing the combination of activity levels, deal value and conversion rate of proposals/quotations to orders and implement an improvement plan. Sales goal setting: setting business development objectives for quantity and quality - plus tips and tricks of top performers. Maintain a peak activity level, on a consistent basis using 'organised persistence' and structured business development tracking methodology. How to prioritise opportunities and manage your time when sourcing new business. Identify potential new customers - and particularly the decision-makers and influencers - with greater accuracy. Make outbound business or appointment calls with improved confidence, control and results. Day two - Value Key objective To be able to better anticipate, identify, create, and develop business opportunities using a customer / client-focused communication-based business model and consultative skills. Main elements How to develop sales more effectively from new and existing customers; and managing the first appointment with a new customer. Use structured and assertive drawing-out skills to identify, develop and formalise business opportunities and to gain commitment. How to better position your company and your products and services against your main competitors. Create and deliver persuasive business messages based on specific need areas, criteria and value. Key learning points Advanced consultative selling - use a variety of structured and advanced questioning techniques to confidently and efficiently uncover opportunities, need areas and business criteria - confidently and efficiently. Involve the customer/client at all times, and to a far greater degree, and keep better control of business development process. Value message - differentiate your solutions clearly and accurately with customer/client-matched value statements. Presenting the right USPs, features and benefits and making them relevant and real to the customer. Qualification and reading buying signals. Day three (held around four weeks after the first module) - Conversion Key objective This module looks at how to improve the final qualification, progression and conversion of opportunities in your sales pipeline. Also includes price negotiation, overcoming objections and obstacles to gaining agreement. The module begins with a learning review, sharing participants' experiences over the last four weeks in applying the new techniques and skills acquired during the first two modules. This is an opportunity to revisit particularly challenging areas as well as to share and celebrate successes. Main elements Structuring and preparing for negotiating a deal and knowing when and how to move into the 'end-game' mode. Anticipate and answer customer objections and questions more confidently. Build more credibility and proof into your business process to reduce 'buyer's remorse' and speed-up decision-making. Being more assertive and developing better instincts and strategic thinking in progressing quotations and proposals. Key learning points Smart ways to position price, emphasise value and be a strong player without being the cheapest. Becoming more assertive in closing deals, and the importance of organised follow-up on the telephone. Qualify pipeline opportunities with more accuracy, using a proven check-list. Use an 'option generator' to simplify complex proposals, increase business value and close business faster. Writing more effective sales proposal documents and quotations. How best to draw-out, understand, isolate and answer customer objections, negotiate points and concerns. Practical methods of asking for agreement and closing a sale

Fire Marshal

By Prima Cura Training

You never know when fire, explosions or gas leaks are around the corner, but while you can’t control what happens tomorrow, you can control how ready you are to react, help and limit any damage – and that’s where fire marshal training comes in.

Emergency First Aid at Work

By Prima Cura Training

This one-day course will help you meet your regulatory requirements if your risk assessment indicates that first aid training covering emergency protocols only, is sufficient for your workplace.

Foundation level Anti Wrinkle and Dermal Fillers Course -Choose your own dates .

By Sassthetics Training Academy

One-2 one training in Aesthetics -Anti Wrinkle and Dermal fillers . Choose your own dates

Contract and commercial management for practitioners (In-House)

By The In House Training Company

This five-day programme empowers participants with the skills and knowledge to understand and effectively apply best practice commercial and contracting principles and techniques, ensuring better contractor performance and greater value add. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Practitioner (CCMP) qualification. By the end of this comprehensive programme the participants will be able to: Develop robust contracting plans, including scopes of work and award strategies Undertake early market engagements to maximise competition Conduct effective contracting and commercial management activities, including ITT, RFP, negotiated outcomes Understand the legalities of contract and commercial management Negotiate effectively with key stakeholders and clients, making use of the key skills of persuading and influencing to optimise outcomes Undertake effective Supplier Relationship Management Appreciate the implications of national and organisational culture on contracting and commercial activities Appreciate professional contract management standards Set up and maintain contract and commercial management governance systems Take a proactive, collaborative, and agile approach to managing commercial contracts Develop and monitor appropriate and robust KPIs and SLAs to manage the contractor and facilitate improved contractor performance Appreciate the cross-functional nature of contract management Collaborate with clients to deliver sustainable performance and to manage and exceed client expectations Understand the roles and responsibilities of contract and commercial managers Use effective contractor selection and award methods and models (including the 10Cs model) and use these models to prepare robust propositions to clients Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Effectively manage the process of change, claims, variations, and dispute resolution Develop and present robust propositions Make appropriate use of best practice contract and commercial management tools, techniques, and templates DAY ONE 1 Introduction Aims Objectives KPIs Learning strategies Plan for the programme 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Critical success factors Essential features of professional commercial and contract management and administration The 6-step model 4 Putting the 'management' into commercial and contract management Traditional v 'new age' models The need for a commercial approach The added value generated 5 Definitions 'Commercial management' 'Contract management' 'Contracting' ... and why have formal contracts? 6 Stakeholders Stakeholder mapping and analysis The 'shared vision' concept Engaging with key functions, eg, HSE, finance, operations 7 Roles and responsibilities Contract administrators Stakeholders 8 Strategy and planning Developing effective contracting plans and strategies DAY TWO 1 Contract control Tools and techniques, including CPA and Gantt charts A project management approach Developing effective contract programmes 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Tendering Overview of the contracting cycle Requirement to tender Methods Rationale Exceptions Steps Gateways Controls One and two package bids 4 Tender assessment and contract award I - framework Tender board procedures Role of the tender board (including minor and major tender boards) Membership Administration Developing robust contract award strategies and presentations DAY THREE 1 Tender assessment and contract award II - processes Pre-qualification processes CRS Vendor registration rules and processes Creating bidder lists Disqualification criteria Short-listing Using the 10Cs model Contract award and contract execution processes 2 Minor works orders Process Need for competition Role and purpose Controls Risks 3 Contract strategy Types of contract Call-offs Framework agreements Price agreements Supply agreements 4 Contract terms I: Pricing structures Lump sum Unit price Cost plus Time and materials Alternative methods Target cost Gain share contracts Advance payments Price escalation clauses 5 Contract terms II: Other financial clauses Insurance Currencies Parent body guarantees Tender bonds Performance bonds Retentions Sub-contracting Termination Invoicing 6 Contract terms III: Risk and reward Incentive contracts Management and mitigation of contractual risk DAY FOUR 1 Contract terms IV: Jurisdiction and related matters Applicable laws and regulations Registration Commercial registry Commercial agencies 2 Managing the client-contractor relationship Types of relationship Driving forces Link between type of contract and style of relationships Motivation - use of incentives and remedies 3 Disputes Types of dispute Conflict resolution strategies Negotiation Mediation Arbitration DAY FIVE 1 Performance measurement KPIs Benchmarking Cost controls Validity of savings Balanced scorecards Using the KPI template 2 Personal qualities of the contract manager Negotiation Communication Persuasion and influencing Working in a matrix environment 3 Contract terms V: Drafting skills Drafting special terms 4 Variations Contract and works variation orders Causes of variations Risk management Controls Prevention Negotiation with contractors 5 Claims Claims management processes Controls Risk mitigation Schedules of rates 6 Close-out Contract close-out and acceptance / completion HSE Final payments Performance evaluation Capturing the learning 7 Close Review Final assessment Next steps

Oxygen Therapy

By Prima Cura Training

This training enables users to administer oxygen safely and effectively to casualties with breathing difficulties. Delegates will learn how and when to administer oxygen to a casualty and the safety concerns with carrying, storing, and administering it.

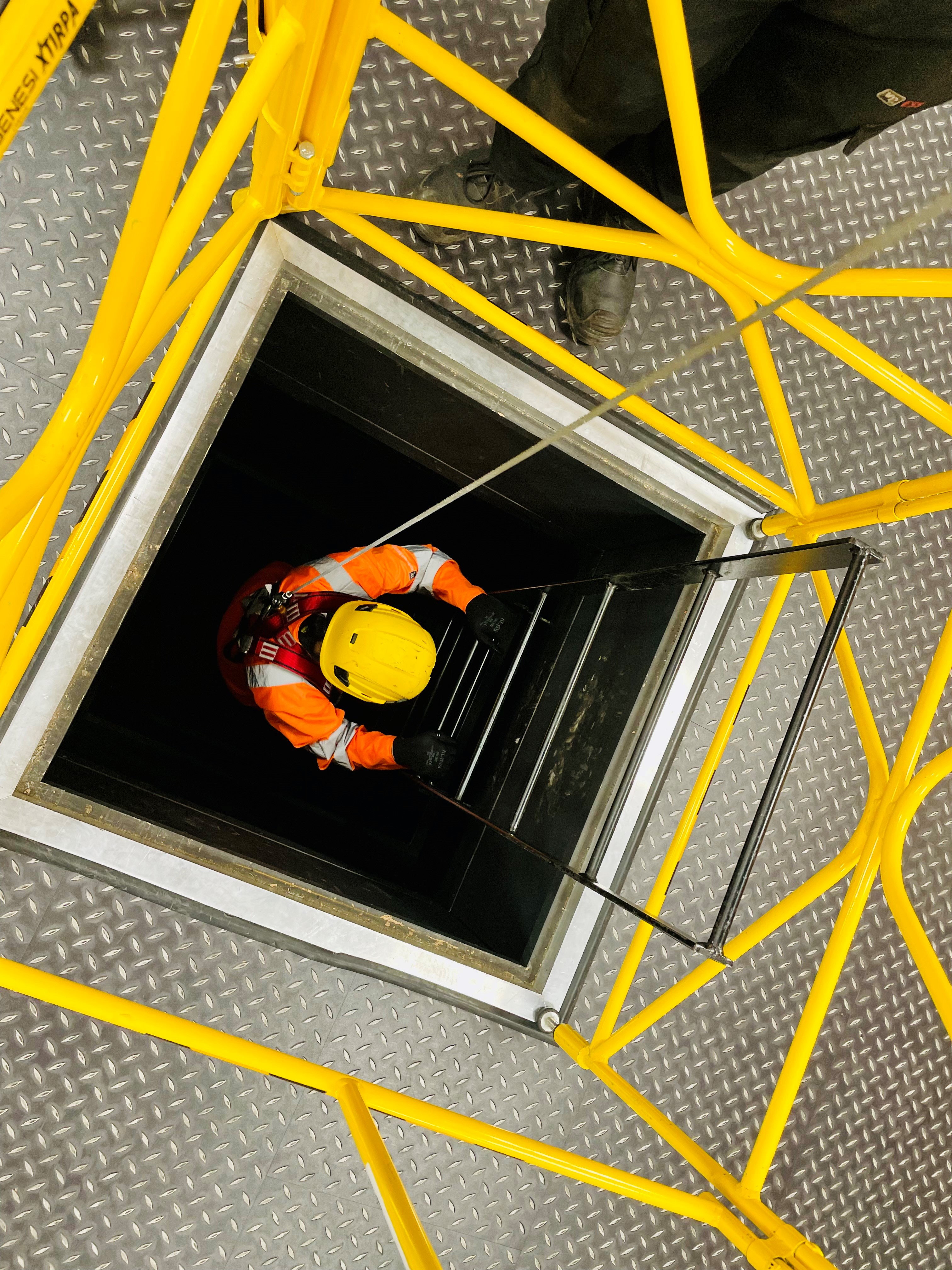

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07

By Vp ESS Training

City & Guilds Level 3 Award in Direct Emergency Rescue and Recovery of Casualties from Confined Spaces - 6160-07 - This course is designed to introduce delegates to the basics of rescue and recovery of casualties from confined spaces. Understanding emergency arrangements as set by legislation and employers, some of the equipment required to rescue a casualty and safety of the rescue team. Note: A pre-requisite qualification is required to complete this course. Delegates must hold a valid 6160-08 qualification. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-07-level-3-award-in-direct-emergency-rescue-and-recovery-of-casualties-from-cs/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

NVQ DIPLOMA IN INSULATION AND BUILDING TREATMENTS (CONSTRUCTION)

By Oscar Onsite

REFERENCE CODE 603/7493/7 COURSE LEVEL NVQ Level 2 THIS COURSE IS AVAILABLE IN Course Overview The Level 2 NVQ in Insulation & Building treatments is for those who work with different types of insulation and building treatments and want to prove their competence in one or more of the following areas: Wood preserving and damp-proofing, Wall Tie replacement, Cavity Wall insulation, Solid Floor insulation, Under Floor insulation and Cold Roof insulation. There is also a Level 2 qualification available that may be more suitable for those in the sector with a greater degree of experience or level of responsibility

Search By Location

- Qualification Courses in London

- Qualification Courses in Birmingham

- Qualification Courses in Glasgow

- Qualification Courses in Liverpool

- Qualification Courses in Bristol

- Qualification Courses in Manchester

- Qualification Courses in Sheffield

- Qualification Courses in Leeds

- Qualification Courses in Edinburgh

- Qualification Courses in Leicester

- Qualification Courses in Coventry

- Qualification Courses in Bradford

- Qualification Courses in Cardiff

- Qualification Courses in Belfast

- Qualification Courses in Nottingham