- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Courses in Bradford

We couldn't find any listings for your search. Explore our online options below.

Know someone teaching this? Help them become an Educator on Cademy.

Online Options

Show all 57Property Taxation Strategies Masterclass Unlock the secrets of effective Property taxation with our Property Taxation Strategies Masterclass. Master Property research and leverage Property tax credits for wealth creation. Learning Outcomes: Understand the historical context of Property taxes. Utilise Property Tax Credits effectively. Apply wealthy tax strategies to your Property. Conduct thorough Property research for tax benefits. Comprehend Property building regulation insights. More Benefits: LIFETIME access Device Compatibility Free Workplace Management Toolkit Key Modules from Property Taxation Strategies Masterclass: Brief History of Taxes: Gain a comprehensive understanding of how Property taxation has evolved over time. Property Tax Credits Explained: Utilise tax credits to minimise your Property tax burden effectively. Wealthy Tax Strategies for Property: Implement tried-and-true tax strategies for Property to preserve and grow your wealth. Property Research: Execute comprehensive Property research to understand tax implications and benefits. Property Building Regulation Insights: Acquire knowledge on building regulations to maximise Property value and minimise tax liabilities. Marketing Your Property: Utilise targeted marketing strategies to increase your Property value, benefiting your tax strategy.

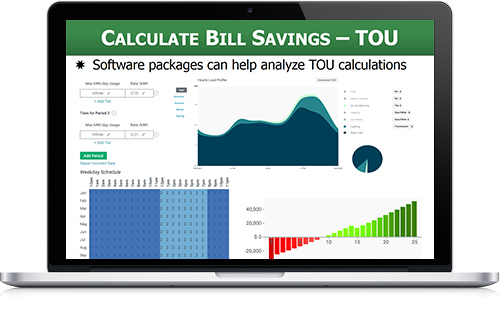

PVOL206: Solar Training - Solar Business and Technical Sales - Online

By Solar Energy International (SEI)

Students who complete PVOL206 will be able to: Discuss the basics of policy and its effect on the solar industry Identify resources to learn more about policy and keep up to date with new developments Describe general sales tips Discuss common objections Identify techniques to close a sale Identify customer motivations and needs Discuss project timeline with customer Manage customer expectations and advise about PV system limitations Discuss manufactures, installation, and roof warranties Explain expected system performance Identify jurisdictional issues (zoning, fire marshal regulations) and city, county, and utility requirements Understand electric bill terminology, key information, and billing procedures Recognize any variations in energy use Determine property type, house orientation, roof tilt/angle, and available area Identify any shading and evaluate obstructions Estimate array size based on customer budget, kWh consumption, and / or available roof area Price array size based on average $/watt Develop price range, savings estimate, and preliminary economic analysis Present (verbal / brief) initial ballpark proposal and benefits, discuss customer's budget limits Identify overall customer considerations and general safety requirements Define the electrical meter and main service panel information required Identify point of interconnection, location for electrical equipment, and location for conduit runs Describe factors to consider with data monitoring Determine maximum PV capacity that can be connected to a specific service and/or electrical panel Create a final array layout Accurately estimate PV system production Define metrics to evaluate labor and material costs Calculate an average residential system cost & identify the major contributing factors Identify the main benefits of reviewing actual build data (job costing) Define property tax exemptions, tax deductions, transfer credits, sales tax exemptions Explain performance based-initiatives Evaluate taxability of credits and other incentives Review net-metering and feed-in tariff laws Identify different utility financial structures and regulated and deregulated markets Describe demand charges & the duck curve Outline financing basics Explore ownership models Calculate annual and cumulative cash flow, determine payback Calculate the environmental benefits of installing solar Identify what to include in a proposal, the proposal process, and what tools are available to generate proposals

Property Taxation on Capital Gains

By Compliance Central

Are you looking to enhance your Property Taxation on Capital Gains skills? If yes, then you have come to the right place. Our comprehensive course on Property Taxation on Capital Gains will assist you in producing the best possible outcome by mastering the Property Taxation on Capital Gains skills. The Property Taxation on Capital Gains course is for those who want to be successful. In the Property Taxation on Capital Gains course, you will learn the essential knowledge needed to become well versed in Property Taxation on Capital Gains. Why would you choose the Property Taxation on Capital Gains course from Compliance Central: Lifetime access to Property Taxation on Capital Gains course materials Full tutor support is available from Monday to Friday with the Property Taxation on Capital Gains course Learn Property Taxation on Capital Gains skills at your own pace from the comfort of your home Gain a complete understanding of Property Taxation on Capital Gains course Accessible, informative Property Taxation on Capital Gains learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Property Taxation on Capital Gains Curriculum Breakdown of the Property Taxation on Capital Gains Course Module 01: The Property Law and Practice Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: Property Taxation on Capital Gains Module 05: VAT on Property Taxation Module 06: Property Taxation Tips for Accountants and Lawyers Module 07: Changes in the UK Property Market CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Property Taxation on Capital Gains course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Property Taxation on Capital Gains. Requirements To enrol in this Property Taxation on Capital Gains course, all you need is a basic understanding of the English Language and an internet connection. Career path Tax Consultant: £30,000 to £60,000 per year Property Tax Advisor: £25,000 to £50,000 per year Tax Analyst: £25,000 to £45,000 per year Tax Manager: £40,000 to £80,000 per year Real Estate Investment Analyst: £35,000 to £60,000 per year Property Portfolio Manager: £30,000 to £70,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Property Wholesaling Masterclass Elevate your Property investment game with our Property Wholesaling Masterclass. Gain mastery over Property acquisition and risk mitigation. Unearth intelligent Property tax strategies. Learning Outcomes: Master Property acquisition techniques. Resolve objections in Property sales negotiations. Deploy Property risk mitigation strategies. Understand tax implications specific to Property. Identify Property licensing requirements and benefits. More Benefits: LIFETIME access Device Compatibility Free Workplace Management Toolkit Key Modules from Property Wholesaling Masterclass: Property Acquisition Secrets: Uncover lucrative Property acquisition tactics for stellar investment portfolios. Overcoming Objections in Property Sales: Learn key negotiation techniques to resolve Property sales objections effectively. Property Risk Mitigation Secrets: Implement proven Property risk mitigation strategies to secure your investments. Taxes and Property Ownership: Decode the complex tax landscape affecting Property ownership for tax-optimized returns. Property Licensing: Gain a comprehensive understanding of Property licensing requirements to operate legally. Property Maintenance Insurance: Navigate the Property insurance options to ensure the utmost protection for your assets.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Real Estate Investment, Property Sales & Development - QLS Endorsed Certificate

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | 10 CPD Courses | Lifetime Access | 24/7 Tutor Support

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Legal Administrative Assistant: 8-in-1 Premium Online Courses Bundle

By Compete High

Start your legal admin career strong with the Legal Administrative Assistant: 8-in-1 Premium Online Courses Bundle, the perfect mix of law fundamentals, office skills, and professional communication. 📝 Prepare for roles in law firms, property conveyancing, court admin, and legal document control with skills in tax, property law, contract law, minute taking, and more. 📞 Learn how to communicate like a pro, organise files precisely, and stay on top of stress in a high-paced legal setting. ✅ Compete High learners rate us 4.8 on Reviews.io and 4.3 on Trustpilot. 📝 Description Legal admin assistants are the unsung heroes of law offices. This bundle gives you the multi-skill edge needed for: Office coordination Document management Legal communication Property & tax support Also includes: RIDDOR awareness Telephone and client handling Workplace wellbeing skills Ideal for jobs in: Legal admin Contract and tax offices Property law departments ❓ FAQ Q: Can this help me start in law support? A: Definitely. The bundle is made for entry-level legal admin professionals. Q: Will I learn soft skills too? A: Yes — communication, etiquette, stress handling, and minute taking are all included. Q: How do learners rate this? A: Compete High consistently receives 4.8 on Reviews.io and 4.3 on Trustpilot.

Passive Income With Real Estate

By Compete High

Overview With the ever-increasing demand for Passive Income in personal & professional settings, this online training aims at educating, nurturing, and upskilling individuals to stay ahead of the curve - whatever their level of expertise in Passive Income may be. Learning about Passive Income or keeping up to date on it can be confusing at times, and maybe even daunting! But that's not the case with this course from Compete High. We understand the different requirements coming with a wide variety of demographics looking to get skilled in Passive Income . That's why we've developed this online training in a way that caters to learners with different goals in mind. The course materials are prepared with consultation from the experts of this field and all the information on Passive Income is kept up to date on a regular basis so that learners don't get left behind on the current trends/updates. The self-paced online learning methodology by compete high in this Passive Income course helps you learn whenever or however you wish, keeping in mind the busy schedule or possible inconveniences that come with physical classes. The easy-to-grasp, bite-sized lessons are proven to be most effective in memorising and learning the lessons by heart. On top of that, you have the opportunity to receive a certificate after successfully completing the course! Instead of searching for hours, enrol right away on this Passive Income course from Compete High and accelerate your career in the right path with expert-outlined lessons and a guarantee of success in the long run. Who is this course for? While we refrain from discouraging anyone wanting to do this Passive Income course or impose any sort of restrictions on doing this online training, people meeting any of the following criteria will benefit the most from it: Anyone looking for the basics of Passive Income , Jobseekers in the relevant domains, Anyone with a ground knowledge/intermediate expertise in Passive Income , Anyone looking for a certificate of completion on doing an online training on this topic, Students of Passive Income , or anyone with an academic knowledge gap to bridge, Anyone with a general interest/curiosity Career Path This Passive Income course smoothens the way up your career ladder with all the relevant information, skills, and online certificate of achievements. After successfully completing the course, you can expect to move one significant step closer to achieving your professional goals - whether it's securing that job you desire, getting the promotion you deserve, or setting up that business of your dreams. Course Curriculum Chapter 1 Produce Income By Buying Mortgages Produce Income By Buying Mortgages 00:00 Chapter 2 Tax Liens and Rental Property Tax Liens and Rental Property 00:00 Chapter 3 Taking the Plunge Taking the Plunge 00:00

Search By Location

- Property Tax Courses in London

- Property Tax Courses in Birmingham

- Property Tax Courses in Glasgow

- Property Tax Courses in Liverpool

- Property Tax Courses in Bristol

- Property Tax Courses in Manchester

- Property Tax Courses in Sheffield

- Property Tax Courses in Leeds

- Property Tax Courses in Edinburgh

- Property Tax Courses in Leicester

- Property Tax Courses in Coventry

- Property Tax Courses in Bradford

- Property Tax Courses in Cardiff

- Property Tax Courses in Belfast

- Property Tax Courses in Nottingham