- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

812 Courses in Birmingham

Introduction to Performance Management

By Mpi Learning - Professional Learning And Development Provider

Every employee needs to have their performance managed and it is equally important to 'catch people doing something right

Classic Lashes

By The Beauty Click Academy

Includes: Hard copy take home training manual and pinkfishes.com official training kit Duration – Fast track one day practical classroom-based training plus online theory work. Theory work to be completed in your own time via The Guild student portal before your practical course date. Practical day – 10:30am – 5:30pm inc short lunch break. It is advisable that students arrive 15 mins early to ensure a prompt start. In a lot of cases the practical training can be finished earlier than expected depending on how many students there are, and the time taken on practical work. Widely recognisable and insurable qualification, allowing you to deliver this treatment on the paying general public.

GTi Manicure & Gel Polish Duo

By The Beauty Click Academy

Manicures can be found on nearly every treatment menu and are often the bread and butter of many businesses. The manicure offers the therapist or technician a whole range of options to suit nearly every client. This course will teach you everything you need to know about offering a professional manicure and includes a practical training session and assessment. Gel Polish treatments are an increasingly popular treatment within the professional beauty industry. Gel Polish is applied to the client’s nail and then cured using an LED or UV lamp to create a longer lasting nail treatment (up to 3 weeks) than a standard manicure. The GTi Gel Polish course covers how to complete gel polish application and demonstrates the correct removal techniques. The course also covers reception and consultation, contra-indications to treatment and aftercare advice. On completion of the course you will receive two recognised and insurable qualifications. Includes: 2 Hard copy take home training manuals. Duration – Fast track one day practical classroom-based training plus online theory work. Theory work to be completed in your own time via The Guild student portal before your practical course date. Practical day – 10am – 6pm. It is advisable that students arrive 15 mins early to ensure a prompt start. Widely recognisable and insurable qualification, allowing you to deliver this treatment on the paying general public. Class size - Maximum 8 students in a class

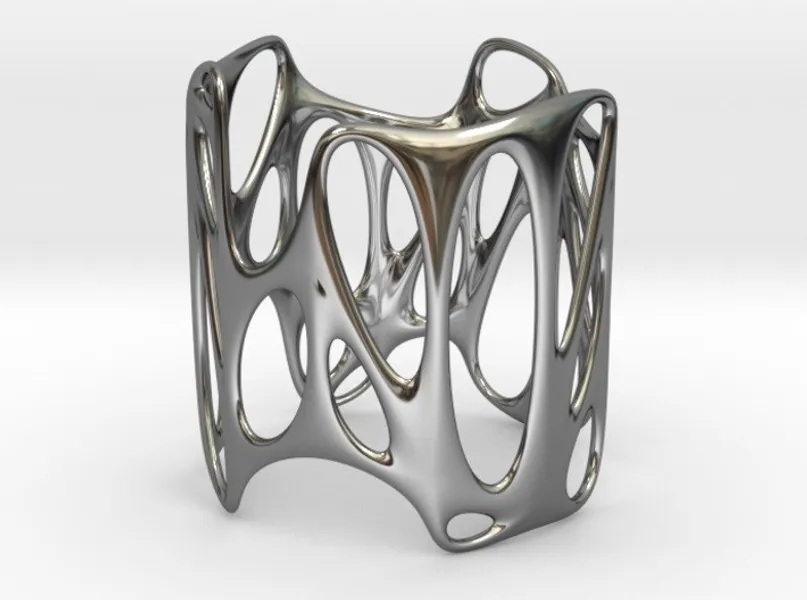

Jewellery Design Course - Create Personalised Jewellery (Blender)

By FluidDesigner

Learn to use 3D printing software to design and create your own pendants, earrings, rings and bracelets. The course is on a one-to-one basis. If you want to be in the jewellery trade as a designer and seller of modern jewellery or you simply want to create designs for yourself and your family then you should be learning how to create your own designs using apps such as Fluid Designer for 3D Printing.

Get some single girl tips speak to your coach about dates or whatever you’re going through and we will also send you a single girls information pack Items inside the package: Hair accessories Single girl relationship advice guide Lipstick Biscuits Chocolate Eyeshadow set 2x 30-minute phone calls per week to talk about your situation. Dating advice for singles https://relationshipsmdd.com/product/m-d-d-single-girls-package/

Phlebotomy (Venepuncture) & Simulated Practice Training in Birmingham

By Passion4Training

We are proud as a training organisation to be able to deliver this course in small groups. We only allow a maximum of 5 learners to attend this course as this ensures learners receive the support they require and plenty of hands on opportunity to learn this healthcare skill. This training course is delivered by Healthcare Professionals with many years of on-the-job experience and who can guide you through the theoretical and practical elements of this essential healthcare skill, and answer any questions that may arise during your training.

Designated Safeguarding Lead Online Course

By Child Protection Training Uk

This course will help you and your staff become familiar with the role and responsibilities of the designated safeguarding lead in your organisation. It will develop both your competence and confidence in carrying out the role of Designated Safeguarding Lead (DSL). Formally known as Level 3

GTi Russian Volume Eyelash Extensions

By The Beauty Click Academy

This course covers the technique for Russian Volume eyelash extension application. We also cover the removal and maintenance of lashes. The course includes anatomy and physiology of the hair and eye, contra-indications and contra-actions to treatment. Reception, consultation and aftercare guidance is covered as well as contra-indications to treatment. On completion of the course you will receive a certificate and a recognised, insurable qualification. Includes: Hard copy take home training manual Duration – Fast track one day practical classroom-based training plus online theory work. Theory work to be completed in your own time via The Guild student portal before your practical course date. Practical day – 10am – 5pm inc short lunch break. It is advisable that students arrive 15 mins early to ensure a prompt start. In a lot of cases the practical training can be finished earlier than expected depending on how many students there are, and the time taken on practical work. Widely recognisable and insurable qualification, allowing you to deliver this treatment on the paying general public. Class size - Maximum 8 students in a class

Search By Location

- ALS Courses in London

- ALS Courses in Birmingham

- ALS Courses in Glasgow

- ALS Courses in Liverpool

- ALS Courses in Bristol

- ALS Courses in Manchester

- ALS Courses in Sheffield

- ALS Courses in Leeds

- ALS Courses in Edinburgh

- ALS Courses in Leicester

- ALS Courses in Coventry

- ALS Courses in Bradford

- ALS Courses in Cardiff

- ALS Courses in Belfast

- ALS Courses in Nottingham