- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

386 Courses in Belfast

Overview This course in Public Sector Accounting and Budgeting training seminar is designed to provide a comprehensive briefing on the fundamental principles and key functions in the continuously developing sphere of public sector finance. Non-financial public sector employees and managers are regularly required to both provide input to the budget process and respond to information presented in departmental financial reports.

National Vocational Beach Lifeguard Proficiency Award

By Freewavesurfacademy

The one day National Vocational Beach Lifeguard Proficiency Award will re-qualify the learner with the knowledge and skills required in order to provide professional patrolling and water services, in surf conditions, with rescue skills and advanced fitness requirements. Aspects of the course are physically demanding and will include running, swimming to set times and some lifting. The Award is comprised of a variety of units and all must be successfully passed to attain the qualification. There is a minimum of 20 hours learning required for this course is. As this is not achievable within the one day period it is prior learning and continual professional development will be assessed before being able to sign on to the course. As well as this CPD a certain amount of pre course learning will need to take place before the course commences.

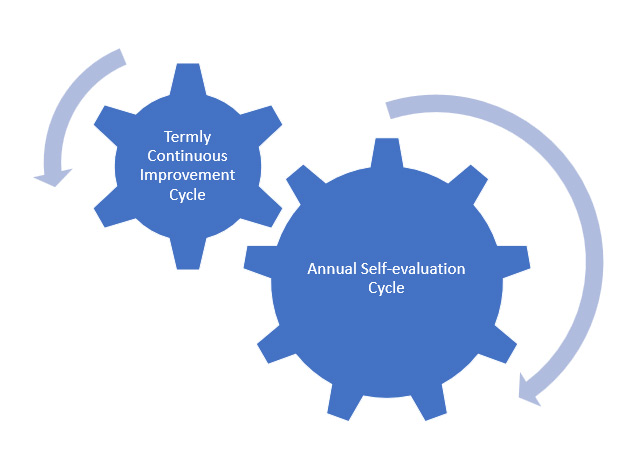

How to build a system that drives school improvement

By Marell Consulting Limited

If you want to be able to offer a consistently better quality of education for your pupils without the stress that comes with worrying about Ofsted all the time, this workshop is for you.

How to ensure consistent compliance with the Independent School Standards (for upto 20 people)

By Marell Consulting Limited

A workshop for independent schools that are inspected by Ofsted. Providing a proven strategy for ensuring compliance with the independent school standards.

Making sure that learning takes place

By Marell Consulting Limited

Who is this course for? Newly qualified teachers, teaching assistants, learning support assistants What will be covered? learning and progress working memory & long-term memory how we learn strategies for making sure pupils learn using assessment effectively feedback and progress using prompt, structure interventions

Preparing to Teach

By Marell Consulting Limited

This session is for those who find themselves teaching even though they have not gone through teacher training. It is designed to give you the basic tools you need to begin delivering to ensure that learning takes place.

Maximising Pupil Progress

By Marell Consulting Limited

This workshop outlines strategies for making sure that learning takes place and that pupils in non-association independent schools make progress in the limited time they have.

Overview The Equality and Diversity, Inclusion training focus on key areas where equality covers areas with people's rights and law covering diversity, handling and eradicating unlawful discrimination with the motive to have an efficient workflow environment. This is very challenging and requires a lot of knowledge, skills and understanding along with interpersonal skills to carry on Equality and Diversity.

Overview Consolidating a financial statement is very important and is one of the major tools to combine everything related to finance. This course is designed to deliver robust training on consolidated financial statements and prepare you in a perfect manner to directly implement at your workspace when you leave the training session This course will provide you with all the skills required to understand accounting and financial statements in the organisation or local government. It provides complete coverage to all the areas of financial statements with in-depth knowledge of partnerships and fiduciary accounting.

Overview The most significant network between the organisation and their investors is Financial Statements and annual reports. It is very important to understand the role of these factors to have better communication channels. This course will give you intense knowledge to prepare financial statements according to International Financial Reporting Standards. IFRS regulates financial reporting standards and according to it the company's financial reporting should be transparent. Thus, if it is as per IFRS rules, its credibility can be trusted. It will also help to analyse the financial statement and annual reports. It will enable you to evaluate corporate accounts and make strong decisions and judgements about the company's status.

Search By Location

- professional development Courses in London

- professional development Courses in Birmingham

- professional development Courses in Glasgow

- professional development Courses in Liverpool

- professional development Courses in Bristol

- professional development Courses in Manchester

- professional development Courses in Sheffield

- professional development Courses in Leeds

- professional development Courses in Edinburgh

- professional development Courses in Leicester

- professional development Courses in Coventry

- professional development Courses in Bradford

- professional development Courses in Cardiff

- professional development Courses in Belfast

- professional development Courses in Nottingham