- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

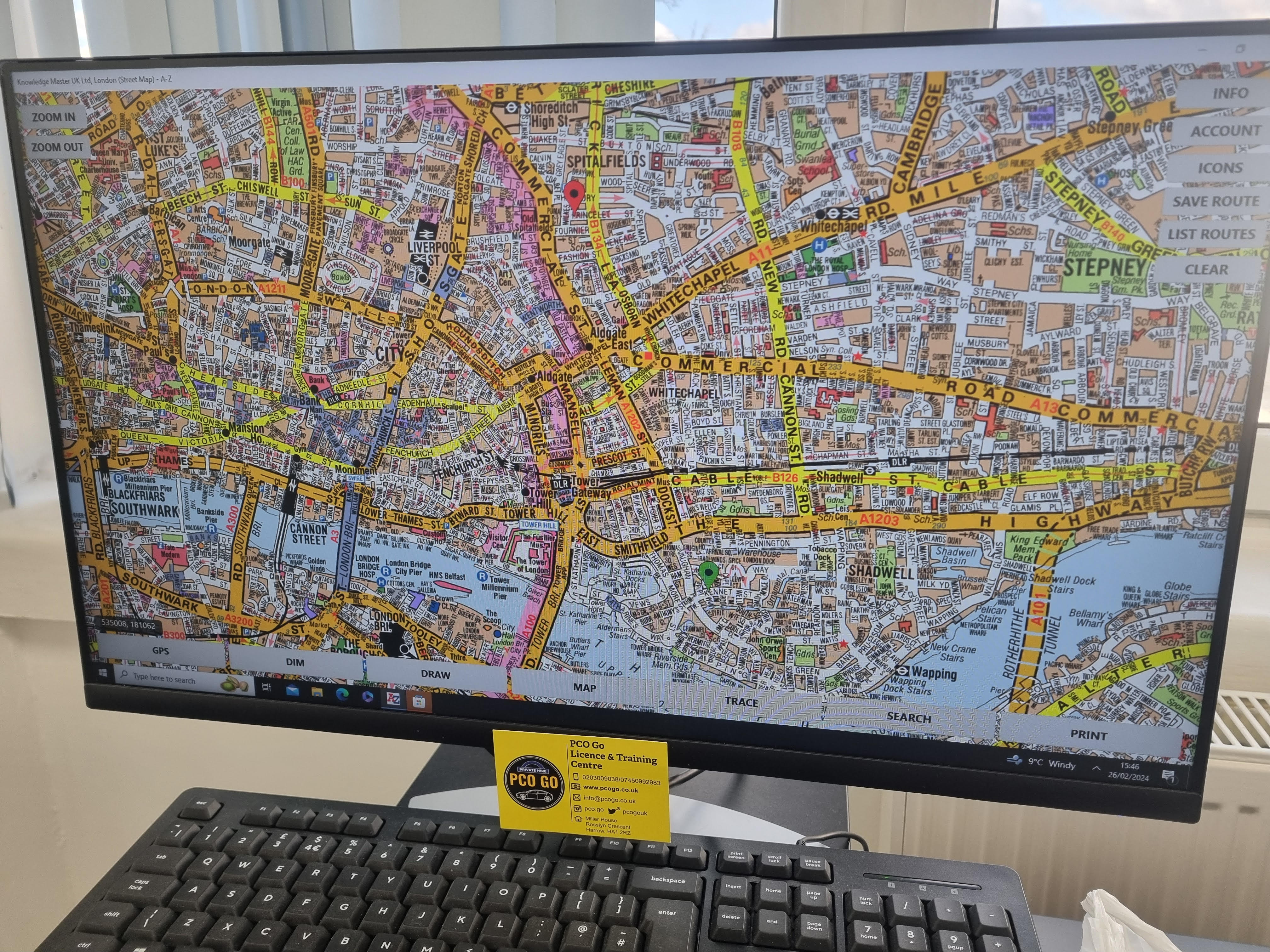

TOPOGRAPHICAL MAP ROUTE PLANNING TRAINING You will use the appropriate software to learn how to plan map routes. We will train you on the routes that you will most likely be tested on in your assessment. Most of our training is provided one to one, so as to give you our undivided attention and prepare you to the best of your ability, thereby giving you the best chance of passing this test. TOPOGRAPHICAL MOCK TEST We will provide you with topographical multiple choice questions mock test based on the actual test questions, to best prepare you. You will use the actual ’Master Atlas of Greater London’ which TfL uses in their test, to best prepare you to answers the multiple choice questions.

This 3 Days programme will equip you to use, price, manage and evaluate interest rate and cross-currency derivatives. The course starts with the building blocks of money markets and futures, through yield curve building to interest-rate and cross-currency swaps, and applications. The approach is hands-on and learning is enhanced through many practical exercises covering hedging, valuation, and risk management. This course also includes sections on XVA, documentation and settlement. The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation.

Creative Problem Solving

By Centre for Competitiveness

Firefighting or solving the same problems week after week? Create a problem-solving culture in your business with this proven methodology.

TRAILER LESSONS

By Lloyds School Of Motoring

This course is particularly relevant for those wishing to tow a horsebox or caravan and those involved in construction. Car / Jeep and Trailer (Category B+E) training is available as a three day course, with an average training time of some six to eight hours, depending upon driving experience.

SHUNTER TRAINING

By Lloyds School Of Motoring

Yard Shunter Training is designed to provide the necessary skills to drive vehicles safely on site to minimise risk.

LORRY TRAINING

By Lloyds School Of Motoring

Lloyds School of Motoring provides lorry training in our privately owned fleet of vehicles across all categories.

REFRESHER TRAINING

By Lloyds School Of Motoring

Refresher training courses are available for drivers of any vehicle category to assist with skills fade and improve driving competence.

Search By Location

- MA Courses in London

- MA Courses in Birmingham

- MA Courses in Glasgow

- MA Courses in Liverpool

- MA Courses in Bristol

- MA Courses in Manchester

- MA Courses in Sheffield

- MA Courses in Leeds

- MA Courses in Edinburgh

- MA Courses in Leicester

- MA Courses in Coventry

- MA Courses in Bradford

- MA Courses in Cardiff

- MA Courses in Belfast

- MA Courses in Nottingham