- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

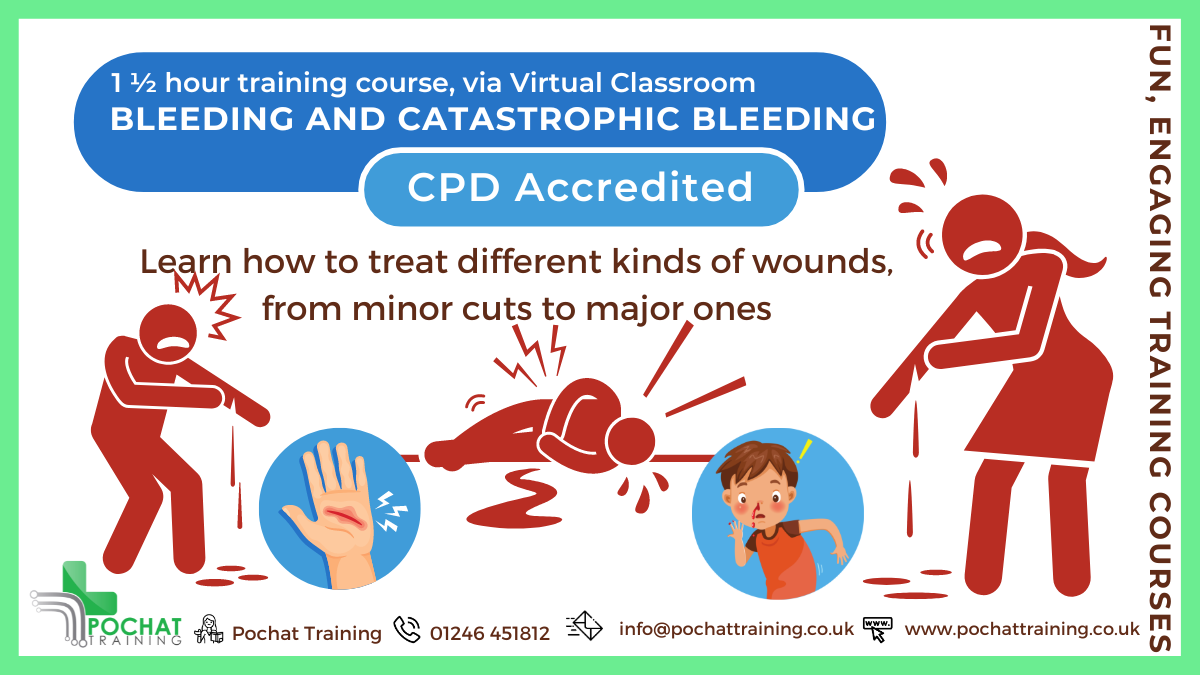

CPD Accredited, Interactive Short Course 1½ hr session Learn to deal with bleeding, from minor bleeds to catastrophic bleeds Become a life-saving hero if ever someone is seriously injured Course Contents: How to treat minor bleeding How to treat major bleeding Types of bleeding How to treat catastrophic bleeding Tourniquets Why to use a tourniquet How to use a tourniquet How to make an improvised tourniquet How to use a Tourni-Key Wound packing How to use Celox Z-Gauze How to improvise packing a wound How to treat gunshot wounds Practical elements: There is an option of learning how to deal with catastrophic bleeding in person, so you get to practice these skills (and play about with fake blood 😀). For that, see our Catastrophic Bleeding course module. Benefits of this Short Course: We all have regular injuries which cause us to bleed If not properly cared for, even a small cut can turn septic and kill or maim Serious car accidents, machinery accidents at work, weapon wounds, terrorist attacks and more can also lead to catastrophic bleeding Did you know that a person could bleed out in just five minutes..? You're got to act quick, decisive and correctly Please don't do what you see in the movies - you will kill the person even quicker...

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

The Silence In Between - English Book Club Course - Mondays from 8th September

5.0(22)By Book Club School

English language book club to use and improve your English. Qualified and experienced British English teacher.

There are Rivers in the Sky - English Book Club Course - Tuesdays from 9th September

5.0(22)By Book Club School

English language book club to use and improve your English. Qualified and experienced British English teacher.

The Secret History - English Book Club Course - Tuesdays from 9th September

5.0(22)By Book Club School

English language book club to use and improve your English. Qualified and experienced British English teacher.

Lessons in Chemistry English Book Club Course - Tuesdays from 9th September

5.0(22)By Book Club School

English language book club to use and improve your English. Qualified and experienced British English teacher.

Rally Navigation - Regularity for Improvers

By Rally Navigation Training Services

Historic Road Rallying training webinar on Regularity focusing on Average Speed Table style regularities.