- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1231 Financial Analyst courses

Fun fact about Actuarial Science: Actuaries are often referred to as "financial doctors" because they specialise in assessing and managing financial risks, much like medical doctors diagnose and treat health risks.Actuarial Science is where logic meets numbers with purpose. This course offers a solid grounding in the mathematical and statistical methods used to evaluate risk and uncertainty—essentials in industries like insurance, pensions, finance and beyond. It's designed for those who enjoy structured thinking, precision, and the challenge of making sense of the unknown using data. You’ll explore the principles that guide informed decision-making in uncertain environments, all through the lens of actuarial methods. Whether you're curious about future career directions or simply love the clarity of numbers, this course introduces you to the mindset and models behind the actuarial profession. With theory-led insight and a strong focus on probability, statistics, and financial mathematics, you'll discover how actuaries contribute to long-term planning and forecasting. It's smart, logical, and neatly structured—just like the subject itself. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01 : Introduction to Actuary Module 02 : Actuaries and Their Environment Module 03 : The Valuation of Cash Flows Module 04 : The Basic Deterministic Model Module 05 : The Life Table Module 06 : Life Annuities Module 07 : Life Insurance Module 08 : The Stochastic Life Contingencies Model Module 09 : The Stochastic Approach to Insurance and Annuities Module 10 : Taxation and Inflation Module 11 : Probabilistic Models, Uncertain Payment and Profit Testing Module 12 : Individual Risk Models Module 13 : Principles of Premium Calculation Module 14 : Multiple Decrement Theory Learning Outcomes: Analyse and predict financial risks with confidence. Master the valuation of cash flows and basic deterministic models. Understand the intricate world of life tables and annuities. Explore the complexities of life insurance and stochastic life contingencies. Navigate tax and inflation issues in the financial realm. Gain proficiency in probabilistic models and principles of premium calculation. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring actuaries Financial analysts Risk management enthusiasts Insurance professionals Finance and economics students Anyone interested in mastering financial uncertainties Career path Actuary Financial Analyst Risk Manager Insurance Underwriter Pension Consultant Investment Analyst Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Corporate Finance Online Training Course

By Lead Academy

Our corporate finance training course is designed to equip finance professionals, aspiring analysts and business leaders with the advanced skill and strategic insights needed to navigate the complex world of Corporate Finance. You will learn about financial statement analysis, capital budgeting, risk management and more. This Course At A Glance Accredited by CPD UK Endorsed by Quality Licence Scheme Understand what are the fundamental aspects of financial statements Learn about ratio analysis in detail Be able to understand the time value of money Know what is capital budgeting and its key aspects Learn to recognise and manage cash flows Get a better understanding of the risk and return Know about the bonds Get an introduction to the stock Learn about the cost of capital Develop an understanding of the capital structure Be able to understand capital market Corporate Finance Training Course Course This corporate finance online training course is designed by industry experts to help those who are willing to become confident financial managers or financial analysts. This comprehensive online course will also help you understand the principles of financial statements and return on equity. This popular corporate finance online training course will provide you with a thorough understanding of ratio analysis, including liquidity ratios, operating efficiency ratios and leverage ratios. You will also learn about the time value of money, capital budgeting, cash flows, bonds, stocks, cost of capital and much more. By the end of the course, you will acquire the appropriate skills and experience to become a successful financial manager or financial analyst. After finishing this career advancement online course you will also obtain a comprehensive understanding of the key principles of corporate finance. Who should take this course? This corporate finance online training course is perfect for anyone willing to boost their career by becoming a professional financial manager or financial analyst. Those who want to strengthen their understanding of the fundamental elements of corporate finance can also take this self helped online course. Entry Requirement There are no academic entry requirements for this corporate finance online training course, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This corporate finance online training course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Course Curriculum Introduction Introduction Financial Statements Financial Statements Ratio Analysis Introduction 90 Liquidity Ratios Operating Efficiency Ratios Leverage Ratios Return on Equity Time Value of Money Introduction Calculator Tutorial Future Value Present Value Annuities and Cash Flows Practice Questions Loan Amortization Capital Budgeting Introduction Payback Method Payback Using Excel Net Present Value - Internal Rate of Return - Profitability Index Cash Flows Cash Flows Budgeting Steps Capital Rationing Cash Flow Examples More Examples Risk and Return Introduction Inflation and Return Risk Diversification Pricing Risk - Capital Asset Pricing Model Bonds Introduction Valuation Yield to Maturity Examples Stock Introduction Preferred Stocks Common Stocks Cost of Capital Introduction Cost of Debt Cost of Preferred Stocks Cost of Equity Weighted Average Cost of Capital Capital Structure Introduction Proposition 1 Proposition 2 Proposition 3 Capital Markets Capital Markets Assessment Assessment - Corporate Finance Online Training Course Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Quality Licence Scheme Endorsed The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. Certificate of Achievement Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Professional Certificate Course in Understanding Cost Volume Profit Analysis in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of a "Cost Volume Profit (CVP) Analysis" course is to provide learners with a comprehensive understanding of the principles and applications of CVP analysis in managerial accounting.After the successful completion of the course, you will be able to learn about the following, Understand CVP Analysis. Understanf Breakeven Point. Calculate Margin of Safety. Explore Operating Leverage. Understand Sales Mix. Analyze Sales Mix and Break-even Analysis. In a Cost Volume Profit (CVP) Analysis course, one can expect to learn about the principles and applications of CVP analysis in managerial accounting. The course will cover topics such as fixed and variable costs, contribution margin, breakeven point, and margin of safety. Student will learn how to use these concepts to make informed decisions about pricing strategies, product mix, and production volume. Student will also learn how to create and interpret CVP analysis charts and graphs, which can help you visualize the relationship between costs, sales volume, and profits. Additionally, you'll explore the impact of various factors on CVP analysis, such as changes in sales volume, costs, and product mix. The Understanding Cost Volume Profit Analysis course teaches key concepts and tools related to CVP analysis. Participants will learn about the uses and benefits of CVP analysis, the calculation of the breakeven point, the margin of safety, operating leverage, and sales mix. The course will also cover the impact of changes in the sales mix on breakeven analysis and profits. It is suitable for individuals in accounting, finance, operations, or business management roles, or anyone looking to improve their financial analysis skills. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Understanding Cost Volume Profit Analysis Self-paced pre-recorded learning content on this topic. Understanding Cost Volume Profit Analysis Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Financial Analyst Business Manager Operations Manager Management Accountant Financial Controller Cost Accountant Strategic Planner Chief Financial Officer (CFO) Budget Analyst Sales Manager. Investment Advisor Financial Planner Wealth Management Specialist Mutual Fund Manager Investment Analyst Portfolio Manager Financial Consultant Retirement Planning Specialist Investment Operations Specialist Securities Trader Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Actuarial Science : Pension, Tax Accounting & Business Analysis

By Compliance Central

GRAB LATEST ACTUARIAL SCIENCE SKILL WHEELS at the BEST OFFER of the TIME!... Are you looking to enhance your Actuarial Science skills? If yes, then you have come to the right place. Our comprehensive courses on Actuarial Science will assist you in producing the best possible outcome by learning the Actuarial Science skills. This Actuarial Science Bundle Includes Course 01: Pension Course 02: Principles of Insurance & Insurance Fraud Course 03: Insurance: Personal Lines & Commercial Lines Insurance Course 04: Financial Analysis Course 05: Business Analysis Course 06: Tax Accounting So, enrol in our Actuarial Science bundle now! Other Benefits Lifetime Access to All Learning Resources An Interactive, Online Course A Product Created By Experts In The Field Self-Paced Instruction And Laptop, Tablet, And Smartphone Compatibility 24/7 Learning Support Free Certificate After Completion Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. Pension :- Module 01: Overview of the UK Pension system Module 02: Type of Pension Schemes Module 03: Pension Regulation Module 04: Pension Fund Governance Module 05: Law and Regulation of Pensions in the UK Module 06: Key Challenges in UK Pension System Principles of Insurance & Insurance Fraud :- Module 01: Principles of Insurance Module 02: General Insurance Module 03: Insurance Fraud Module 04: Underwriting Process Insurance: Personal Lines & Commercial Lines Insurance :- Module 01: Personal Lines Insurance Module 02: Commercial Lines Insurance Financial Analysis :- Section-1. Introduction Section-2. Profitability Section-3. Return Ratio Section-4. Liqudity Ratio Section-5.Operational Analysis Section-6. Detecting Manipulation Business Analysis :- Module 1: Introduction to Business Analysis Module 2: Business Environment Module 3: Business Processes Module 4: Business Analysis Planning and Monitoring Module 5: Strategic Analysis and Product Scope Module 6: Solution Evaluation Module 7: Investigation Techniques Module 8: Ratio Analysis Module 9: Stakeholder Analysis and Management Module 10: Process Improvement with Gap Analysis Module 11: Documenting and Managing Requirements Module 12: Business Development and Succession Planning Module 13: Planning & Forecasting Operations Module 14: Business Writing Skills Tax Accounting :- Module 1: Capital Gain Tax Module 2: Import and Export Module 3: Double Entry Accounting Module 4: Management Accounting and Financial Analysis Module 5: Career as a Tax Accountant in the UK CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Actuarial Science bundle. Requirements To enrol in this Actuarial Science, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Actuarial Science, such as- Insurance Project Manager Insurance Claims Handler Financial Analyst Tax Compliance Accountant Lead Business Analyst Certificates Certificate of completion Digital certificate - Included Get 6 CPD accredited PDF certificate for Free. Certificate of completion Hard copy certificate - £9.99 Get 6 CPD accredited Hardcopy certificate for £9.99 each. The delivery charge of the hardcopy certificate inside the UK is £3.99 each, and international students need to pay £9.99 each to get their hardcopy certificate.

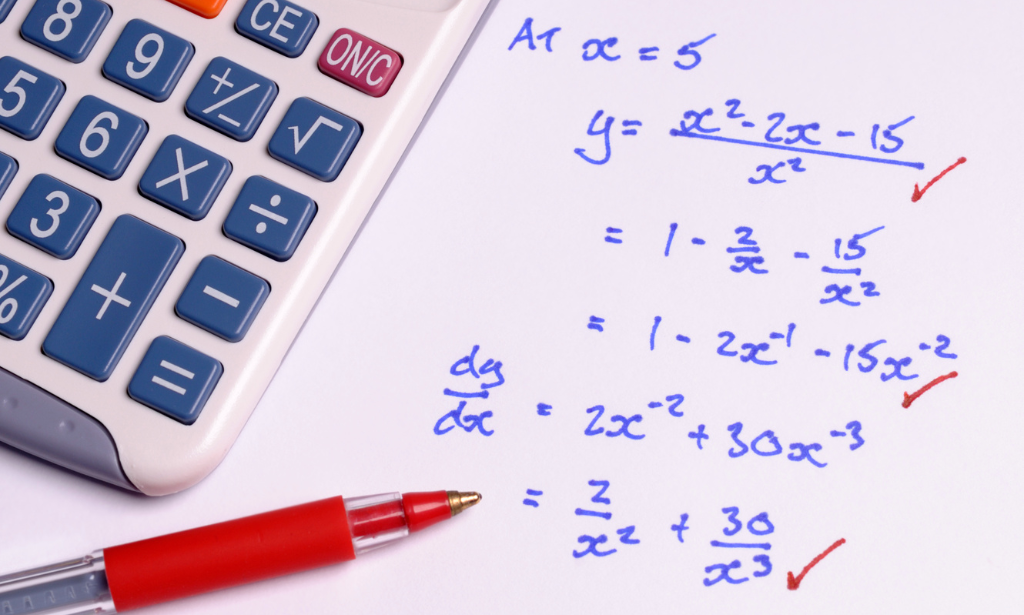

Master essential calculus concepts with Engineering Calculus - Engineering Calculus Made Simple (Derivatives). From functions to derivatives and trigonometric identities, learn advanced mathematical techniques for engineering success.

Professional Certificate Course in The Macroeconomics Environment in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of a course on "Macroeconomics Environment" is to provide students with an understanding of the economy as a whole, including its significant aggregates, such as national income, output, employment, and inflation. The course explores the relationship between these variables and the factors influencing them, including monetary policy, fiscal policy, international trade, and globalization.After the successful completion of the course, you will be able to learn about the following, Define and measure national income. Appreciate the circular flow and its components. Understand the Government policies, instruments, and objectives. Understand aggregate demand and Analyze aggregate supply. Understand the nature and application of Fiscal policy, monetary policy, inflation, its types, inflationary and deflationary gaps, and employment and unemployment dynamics. Explore concepts such as the balance of payment and exchange rate to understand international trade and globalization. The course aims to explore the relationship between these variables and the factors that influence them, including monetary policy, fiscal policy, international trade, and globalization. Students will learn about the various macroeconomic theories and models that explain the behaviour of the economy in the short run and the long run. They will also be introduced to the different macroeconomic policy tools that governments and central banks use to stabilize the economy, such as interest rate adjustments, government spending, and taxation. The course aims to explore the relationship between these variables and the factors that influence them, including monetary policy, fiscal policy, international trade, and globalization. Students will learn about the various macroeconomic theories and models that explain the behavior of the economy in the short run and the long run. They will also be introduced to the different macroeconomic policy tools that governments and central banks use to stabilize the economy, such as interest rate adjustments, government spending, and taxation. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. The Macroeconomic Environment Self-paced pre-recorded learning content on this topic. The Macroeconomics Environment Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Economist Macroeconomic Analyst Policy Analyst Financial Analyst Investment Banker Central Banker International Economist Economic Consultant Research Analyst Risk Management Analyst Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Business Management, Business Studies & Business Productivity QLS Endorsed Diploma

By Compliance Central

Recent studies show a growing demand for professionals adept in Business Management & Business Studies. With the evolving landscape of global commerce, the need for individuals equipped with comprehensive knowledge in these areas has never been more crucial. Our Business Management, Business Studies & Business Productivity QLS Endorsed Diploma offers a holistic approach, blending QLS Endorsed Diploma courses with CPD QS Accredited Courses, to provide learners with a robust foundation in Business Management & Business Studies. By amalgamating technical expertise with personal development modules, this bundle aims to nurture well-rounded professionals ready to excel in various organizational settings. In a recent survey conducted by a leading business publication, it was revealed that over 80% of companies prioritize hiring candidates with a strong background in Business Management & Business Studies. This underscores the importance of acquiring relevant skills and knowledge in these domains. Our bundle not only caters to those seeking to deepen their understanding of core business principles but also empowers individuals to harness personal growth opportunities, essential for thriving in today's competitive job market. QLS Endorsed Courses: Course 01: Award in Business Studies at QLS Level 2 Course 02: Certificate in Business Productivity at QLS Level 3 Course 03: Advanced Diploma in Business Management at QLS Level 7 CPD QS Accredited Courses: Course 04: Business Studies Course 05: Business Intelligence Analyst Course 06:Business Plan Course 07: Project Management Course 08:Accounting and Finance Course 09: Sales Skills Course 10: Marketing Course 11: Diploma in Risk Management Level 7 Take your career to the next level with our bundle that includes technical courses and five guided courses focused on personal development and career growth. Course 12: Career Development Plan Fundamentals Course 13: CV Writing and Job Searching Course 14: Networking Skills for Personal Success Course 15: Ace Your Presentations: Public Speaking Masterclass Course 16: Decision Making and Critical Thinking Seize this opportunity to elevate your career with our comprehensive bundle, endorsed by the prestigious QLS and accredited by CPD. With industry-specific knowledge and essential career skills, you'll be well-equipped to make your mark in Business Management, Business Studies & Business Productivity QLS Endorsed Diploma. Learning Outcomes: Gain advanced proficiency in Business Management strategies at QLS Level 7. Understand fundamental concepts of Business Studies at QLS Level 2. Develop essential skills in Business Productivity at QLS Level 3. Acquire expertise in various areas such as Project Management, Accounting, and Marketing from Business Management & Business Studies. Enhance personal development through Business Management & Business Studies courses focusing on networking, confidence building, and stress management. Prepare for diverse career opportunities with a comprehensive understanding of business dynamics and effective leadership principles over Business Management & Business Studies courses. Our bundle provides a comprehensive exploration of Business Management & Business Studies, catering to both novices and seasoned professionals. Beginning with the Advanced Diploma in Business Management at QLS Level 7, learners delve into strategic planning, organizational behavior, and decision-making frameworks crucial for effective leadership. Moving forward, the Award in Business Studies at QLS Level 2 offers foundational insights into business operations, including marketing strategies, financial management, and ethical considerations, laying the groundwork for a well-rounded understanding of business fundamentals. Furthermore, learners engage in specialized courses such as the Certificate in Business Productivity at QLS Level 3, which focuses on enhancing efficiency, optimizing workflows, and fostering a culture of innovation within organizations. Complementing these QLS Endorsed Diploma courses are CPD QS Accredited Courses, which provide in-depth knowledge across various disciplines, including project management, accounting, finance, sales skills, and marketing. Through this comprehensive curriculum Business Management & Business Studies, learners gain a nuanced understanding of business dynamics, preparing them for multifaceted roles in today's competitive business landscape.Moreover, our curriculum is enriched with practical case studies and real-world examples, allowing learners to apply theoretical concepts to practical scenarios. Through Business Management & Business Studies discussions and collaborative projects, participants not only deepen their understanding of business principles but also develop critical thinking and problem-solving skills essential for success in dynamic business environments. With a focus on experiential learning of Business Management & Business Studies and industry-relevant insights, our Business Management & Business Studies courses empowers individuals to navigate the complexities of modern business with confidence and competence. CPD 160 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Business Management & Business Studies bundle is suitable for: Aspiring entrepreneurs seeking to develop a strong foundation in business principles. Professionals aiming to advance their career prospects by enhancing their expertise in Business Management & Business Studies. Individuals interested in expanding their knowledge across Business Management & Business Studies by diverse domains including project management, marketing, and risk management. Students pursuing a career in business administration, commerce, or related fields. Anyone looking to boost personal development and improve networking skills for professional success in the field of Business Management & Business Studies. Those seeking to mitigate stress and anxiety while enhancing productivity in the workplace through Business Management & Business Studies. Requirements You are warmly invited to register for this bundle. Please be aware that there are no formal entry requirements or qualifications necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path This Business Management & Business Studies bundle will be helpful for anyone looking to pursue a career as: Business Manager Project Coordinator Marketing Specialist Financial Analyst Entrepreneur Operations Manager Risk Management Consultant Certificates 13 CPD Quality Standard Certificates Digital certificate - Included 3 QLS Endorsed Certificat Hard copy certificate - Included

Professional Certificate Course in Assessment of Working Capital and Lending Methods in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The course "Assessment of Working Capital and Lending Methods" aims to provide learners with an understanding of the importance of working capital management and various lending methods to finance the working capital needs of a business. The course will enable learners to evaluate the working capital requirements of a business and identify the most appropriate lending methods. After the successful completion of the course, you will be able to learn the following: Explain the Operating Cycle Method for assessing working capital. Describe the Percentage of Sales Method for assessing working capital. Analyze the Regression Analysis Method to find the average relationship between sales and working capital. Evaluate the Cash Forecasting Method for assessing working capital. Define the Balance Sheet Method for assessing working capital. Explain Tandon's First Method for Lending. Describe Tandon's-II method for lending. Analyze the Cash Budget Method for Lending. Assessment of Working Capital and Lending Methods is a finance course that covers methods of evaluating a company's working capital and different methods of lending. Students will learn about techniques such as the operating cycle, percentage of sales, regression analysis, cash forecasting, and balance sheet methods for working capital assessment, as well as Tandon's First and Second methods and the cash budget method for lending. The course "Assessment of Working Capital and Lending Methods" focuses on exploring the concept of working capital and its importance in financial management. It also covers different methods of lending and how to assess working capital requirements for effective decision-making. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Assessment of Working Capital and Lending Methods Self-paced pre-recorded learning content on this topic. Assessment of Working Capital and Lending Methods Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Financial Analyst Treasury Manager Cash Manager Credit Analyst Working Capital Manager Business Analyst Financial Controller CFO (Chief Financial Officer) Accountant Management Accountant Financial Consultant Risk Manager Operations Manager Supply Chain Manager Procurement Manager. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Excel Data Analysis (Microsoft Office) Course

By One Education

Excel isn’t just about cells and charts—it’s where numbers tell stories. This Excel Data Analysis (Microsoft Office) Course is designed for those who want to make sense of spreadsheets without staring blankly at endless rows. Whether you’re handling budgets, forecasts, or good old-fashioned reports, you’ll explore Excel’s powerful tools that help turn raw data into clear insights. VLOOKUPs, pivot tables, conditional formatting—yes, the good stuff is all here, and it’s less scary than it sounds. No fluff, just focused learning. This course cuts straight to what matters: using Excel as a decision-making companion. From sorting data like a spreadsheet whisperer to creating charts that even your boss might understand, the content is structured to be logical, easy to follow, and surprisingly enjoyable. Whether you’re in finance, admin, marketing, or somewhere in between, this is for anyone who’s had a spreadsheet say, “figure me out,” and needed the right nudge in the right direction. Learning Outcomes: Trace formulas and use Excel's Scenario Manager and Goal Seek Use Solver and Data Tables to analyse data Utilise Data Analysis Tools to draw insights from data sets Create forecasts with Excel's Forecast Sheet Understand popular formulas like Sumif, Countif, and If Apply advanced formula techniques like And, Or, and Nested If. Course Curriculum: Excel Data Analysis for Beginner Tracing Formulas Using the Scenario Manager Goal Seek Solver Data Tables Data Analysis Tools Forecast Sheet Sumif, Countif, Averageif, Sumifs, and Countifs formulas If, And, Or, and Nested If formulas How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Data Analyst - £30,000 to £45,000 Financial Analyst - £35,000 to £55,000 Marketing Analyst - £25,000 to £40,000 Business Intelligence Analyst - £35,000 to £60,000 Sales Analyst - £25,000 to £40,000 Project Coordinator - £25,000 to £35,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Search By Location

- Financial Analyst Courses in London

- Financial Analyst Courses in Birmingham

- Financial Analyst Courses in Glasgow

- Financial Analyst Courses in Liverpool

- Financial Analyst Courses in Bristol

- Financial Analyst Courses in Manchester

- Financial Analyst Courses in Sheffield

- Financial Analyst Courses in Leeds

- Financial Analyst Courses in Edinburgh

- Financial Analyst Courses in Leicester

- Financial Analyst Courses in Coventry

- Financial Analyst Courses in Bradford

- Financial Analyst Courses in Cardiff

- Financial Analyst Courses in Belfast

- Financial Analyst Courses in Nottingham