- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1253 Financial Analysis courses

Course Overview: According to a report by the World Economic Forum, data analysts and scientists are among the top emerging job roles. The "Data Analytics with Tableau" course is tailored to equip learners with the vital skills required to excel in this dynamic field. The course delves into the intricacies of data visualisation and analysis using Tableau, a leading software in the industry. It's not merely about understanding data but transforming it into actionable insights that drive business decisions. The course is structured to provide a comprehensive understanding of various aspects of data analytics, including sales, HR, and shipping analytics.Don't miss this opportunity to advance your career with cutting-edge skills in data analytics. Enrol in "Data Analytics with Tableau" now and embark on a journey of professional growth and endless possibilities! Key Features of the Course: CPD Certificate: Upon completion, you will receive a prestigious Continuing Professional Development (CPD) certificate, recognised globally for enhancing your career prospects. 24/7 Learning Assistance: Our dedicated support team ensures you receive prompt assistance, providing a seamless learning experience. Who is This Course For? This course is tailored for individuals who aspire to become data analysts, business intelligence professionals, marketing strategists, or decision-makers seeking to leverage data effectively. No experience with Tableau or coding is required, making it accessible and engaging for beginners. What You Will Learn: Data Analytics with Tableau, This course covers a wide range of topics, starting with connecting and preparing data, where you will learn how to import, clean, and transform data to make it analysis-ready within Tableau. Next, you will master the art of building insightful charts and visualisations using Tableau's rich set of tools, enabling you to communicate data trends and insights effectively. Additionally, you will explore the creation of captivating headline cards and interactive dashboards, gaining expertise in presenting key information and facilitating data exploration. Real-world projects, including Discount Mart, Green Destinations, Super Store, Northwind Trade, and Tesla, will provide you with outstanding experience in applying Tableau to solve practical data challenges. Lastly, you will develop a solid understanding of database concepts and learn to create compelling data stories using Tableau's storytelling features. By the end of this course, you will have the skills and confidence to make data-driven decisions and communicate insights effectively using Tableau. Why Enrol in This Course: Join the recently updated top-reviewed Data Analytics course with Tableau to keep you at the forefront of the field. Expand your analytical skills, unlock career opportunities, and stay current in the rapidly evolving world of data analytics by mastering Tableau, the industry-standard tool for visual analytics. Requirements: No prior experience with Tableau or coding is required. All you need is a computer with internet access, a curious mind, and a passion for exploring the world of data analytics. Career Path: By acquiring data analytics skills with Tableau, you open doors to exciting career paths, such as: Data Analyst (Average Salary: £35,000 - £45,000) Business Intelligence Analyst (Average Salary: £40,000 - £55,000) Marketing Analyst (Average Salary: £30,000 - £40,000) Financial Analyst (Average Salary: £35,000 - £50,000) Data Visualization Specialist (Average Salary: £40,000 - £60,000) Database Administrator (Average Salary: £40,000 - £55,000) Data Scientist (Average Salary: £45,000 - £70,000) Certification: Upon successful completion of the course, you will receive a CPD certificate, internationally recognised for its validation of your expertise in data analytics with Tableau. Enrol now and embark on a transformative journey to become a proficient data analyst and visualisation expert with Tableau! Course Curriculum 9 sections • 41 lectures • 06:47:00 total length •Introduction to the Course: 00:02:00 •What is Tableau? An Introduction to Tableau: 00:03:00 •How this course is Structured: 00:01:00 •Installing the Free Full Version of Tableau: 00:02:00 •Project Brief for Discount Mart: 00:03:00 •Connecting and Preparing Data for Discount Mart: 00:15:00 •Building Charts on Tableau for Discount Mart (Part 1): 00:33:00 •Building Charts on Tableau for Discount Mart (Part 2): 00:16:00 •Creating Headline Cards on Tableau for Discount Mart: 00:10:00 •Building and Publishing Dashboards on Tableau: 00:15:00 •Project Brief for Green Destinations: 00:02:00 •Connecting and Preparing Data for Green Destinations: 00:09:00 •Building Charts on Tableau (Part 1) for Green Destinations: 00:28:00 •Building Charts on Tableau (Part 2) for Green Destinations: 00:08:00 •Creating Headline Cards on Tableau: 00:15:00 •Building a Dashboard for Green Destinations: 00:12:00 •Publish your Dashboard to Tableau Public: 00:02:00 •Project Brief for Super Store: 00:02:00 •Connecting and Preparing Data for Super Store: 00:17:00 •Building Charts on Tableau (Part 1) for Super Store: 00:34:00 •Building Charts on Tableau (Part 2) for Super Store: 00:23:00 •Building a Dashboard: 00:18:00 •Publish your Dashboard to Tableau Public: 00:03:00 •Project Brief for Northwind Trade: 00:03:00 •Connecting and Preparing Data for Northwind Trade: 00:14:00 •Building Charts on Tableau for Northwind Trade: 00:37:00 •Building and Publishing Dashboards for Northwind Trade: 00:10:00 •Project Brief for Tesla: 00:02:00 •Creating a Data Source through Google Sheet Functions: 00:05:00 •Connect to the Data for Tesla: 00:04:00 •Building Charts on Tableau for Tesla: 00:22:00 •Building Headline Cards: 00:09:00 •Building a Tesla Dashboard: 00:08:00 •Publish your Dashboard to Tableau Public: 00:03:00 •Introduction to Database Concepts: 00:01:00 •Understanding Relational Databases: 00:04:00 •Relationships of Database Entities: 00:02:00 •Primary and Foreign Keys: 00:01:00 •Data types and Naming Conventions: 00:04:00 •Creating Stories on Tableau: 00:05:00 •Resources - Data Analytics with Tableau: 00:00:00

Overview Are you ready to dive into data analysis and unlock valuable insights that can drive business growth? Introduction to Data Analysis is a comprehensive course designed to provide learners with a solid foundation in the principles and techniques of data analysis. This course will equip you with the essential skills and knowledge to thrive in data analysis. With a comprehensive curriculum spanning 22 modules, you will delve deep into the world of data, from understanding its fundamentals to harnessing it for meaningful insights. Our expertly crafted curriculum covers data collection, process management, statistical tools, control charts, and strategies to deal with variation.Enrol today in this Introduction to Data Analysis course to succeed in all areas of your life. Let your skill become your greatest asset! Key Features of the Course This course equips learners with the essential tools and knowledge to analyse and interpret data accurately. The course is accredited, ensuring its recognition and credibility within the professional community. Learners will have access to 24/7 learning assistance, allowing them to seek guidance and support whenever needed. Who is This course for? This Introduction to Data Analysis course is suitable for students & professionals from various fields, including business, finance, marketing, healthcare, and more. It is also beneficial for individuals looking to enhance their data analysis skills for personal or professional development. What You Will Learn Throughout the course, you will delve into various modules that cover essential concepts and tools for data analysis. Starting with an introduction to process management principles, you will progress through topics such as the voice of the process, customer feedback analysis, and data visualisation using tools like Pareto charts, histograms, and run charts. You will also gain a deep understanding of variation and control charts and learn how to interpret and use them effectively for process improvement. By the end of the course, learners will have a solid understanding of these topics and be able to apply their knowledge to real-world data analysis scenarios. Why Enrol in This Course Data analysis is one of the most sought-after skills in today's job market. According to LinkedIn, data analysis is among the top 10 most in-demand skills for 2023. Data analysis can help you: Improve your decision-making skills and confidence Enhance your problem-solving and critical-thinking abilities Boost your creativity and innovation potential Increase your productivity and efficiency Advance your career and create earning potential Requirements There are no specific prerequisites for this course. However, a basic understanding of mathematics and statistics will be beneficial. Access to a computer with an internet connection is also required to complete the course. Career Path Completing this Introduction to Data Analysis course can lead to various career opportunities in data analysis. Some of the course-related professions in the UK, along with their average salaries, include: Data Analyst (£35,000 - £45,000 per year) Business Analyst (£40,000 - £55,000 per year) Financial Analyst (£40,000 - £60,000 per year) Market Research Analyst (£25,000 - £40,000 per year) Operations Analyst (£35,000 - £50,000 per year) Healthcare Data Analyst (£35,000 - £50,000 per year) Quality Control Analyst (£25,000 - £35,000 per year) Certification Upon successful completion of the course, learners will receive a CPD certificate, validating their achievement and demonstrating their commitment to professional development in the field of data analysis. Course Curriculum 3 sections • 24 lectures • 02:13:00 total length •Module 01: Introduction: 00:02:00 •Module 02: Agenda and Principles of Process Management: 00:06:00 •Module 03: The Voice of the Process: 00:05:00 •Module 04: Working as One Team for Improvement: 00:04:00 •Module 05: Exercise: The Voice of the Customer: 00:03:00 •Module 06: Tools for Data Analysis: 00:07:00 •Module 07: The Pareto Chart: 00:03:00 •Module 08: The Histogram: 00:03:00 •Module 09: The Run Chart: 00:04:00 •Module 10: Exercise: Presenting Performance Data: 00:05:00 •Module 11: Understanding Variation: 00:06:00 •Module 12: The Control Chart: 00:06:00 •Module 13: Control Chart Example: 00:04:00 •Module 14: Control Chart Special Cases: 00:06:00 •Module 15: Interpreting the Control Chart: 00:10:00 •Module 16: Control Chart Exercise: 00:07:00 •Module 17: Strategies to Deal with Variation: 00:06:00 •Module 18: Using Data to Drive Improvement: 00:14:00 •Module 19: A Structure for Performance Measurement: 00:06:00 •Module 20: Data Analysis Exercise: 00:06:00 •Module 21: Course Project: 00:03:00 •Module 22: Test your Understanding: 00:17:00 •Resources - Introduction to Data Analysis: 00:00:00 •Assignment - Introduction to Data Analysis: 00:00:00

Advanced Diploma in Sage 50 Accounting & Payroll - Level 7 (QLS Endorsed)

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support

Understanding Marginal Costing Course is designed to help individuals grasp the vital concept of marginal costing, an essential tool in financial decision-making. In today’s competitive business landscape, understanding how to calculate and apply marginal costs allows businesses to optimise operations and increase profitability. This course simplifies complex financial theories and makes them accessible for anyone looking to gain a solid foundation in cost management, whether for career progression or enhancing business performance. By the end of the course, you’ll gain a clear understanding of how marginal costing contributes to pricing decisions, cost control, and profitability analysis. It offers a clear distinction between fixed and variable costs, enabling students to make more informed decisions when analysing profit margins. With flexible online access, this course allows you to learn at your own pace, diving deep into the techniques and formulas used by financial professionals to improve business strategies. Whether you’re aiming to advance in your career or strengthen your financial acumen, Understanding Marginal Costing provides the knowledge to confidently analyse and apply costing methods effectively. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Costing Methods Module 02: Understanding Marginal Costing Module 03: Cost Classification Module 4: Cost-Volume-Profit (CVP) Analysis Module 05: Decision-Making Using Marginal Costing Module 06: Contribution Margin Ratio and Profit Planning Module 07: Limitations and Criticisms of Marginal Costing Learning Outcomes Analyze costs effectively for informed decision-making. Utilize Marginal Costing strategically for financial planning. Classify costs adeptly to enhance decision-making capabilities. Implement Contribution Margin Ratio for profitable strategies. Grasp the limitations and criticisms of Marginal Costing. Enhance financial acumen for various professional pursuits. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Entrepreneurs seeking financial mastery. Finance enthusiasts eager to deepen their knowledge. Professionals aiming to enhance decision-making skills. Students pursuing a career in finance. Business managers seeking strategic financial insights. Aspiring analysts and consultants. Individuals preparing for financial roles. Anyone interested in mastering Marginal Costing principles. Career path Financial Analyst Management Accountant Business Consultant Cost Accountant Budget Analyst Entrepreneurial Ventures in Finance Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

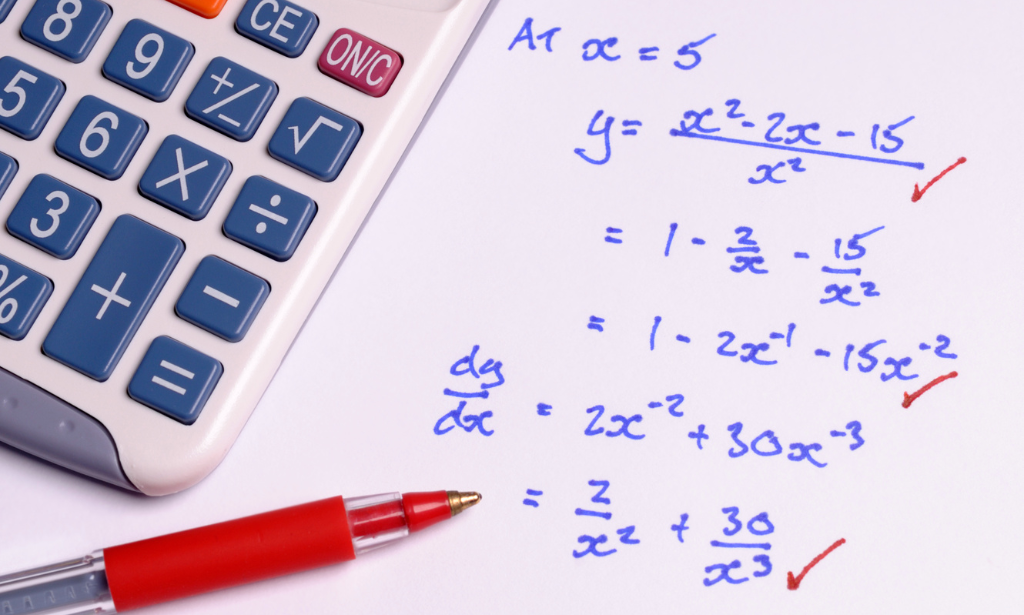

Master essential calculus concepts with Engineering Calculus - Engineering Calculus Made Simple (Derivatives). From functions to derivatives and trigonometric identities, learn advanced mathematical techniques for engineering success.

UK Tax Return Simplified Course – Overview Tax doesn’t have to be taxing—especially when you’ve got this course in your corner. The UK Tax Return Simplified Course turns confusion into clarity, guiding you through self-assessment with zero waffle. Whether you’re a freelancer, landlord, side-hustler or just sorting out your own finances, this course helps make sense of forms, figures, and HMRC rules without giving you a headache. We’ve kept it all online and straight to the point. You’ll get smart insights on income reporting, allowable expenses, deadlines, and avoiding common mistakes—without needing to read a dictionary to understand it. Learn what matters, when it matters, and how to avoid those classic “oops” moments. No fluff, no filler, just tax made easy. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Tax System in the UK Module 02: Submit a Self-Assessment Tax Return Module 03: Gathering and Organizing Documents Module 04: Income Tax Module 05: Advanced Income Tax Module 06: Expenses and Deductions Module 07: Capital Gain Tax Module 08: Tax Credits and Reliefs Module 09: Completing the Self-Assessment Tax Return Module 10: Tax Planning and Compliance Learning Outcomes: Understand the UK tax system's intricacies for informed financial decisions. Navigate the self-assessment tax return process with confidence and accuracy. Efficiently gather and organise essential documents for seamless submissions. Master the nuances of income tax and explore advanced income tax principles. Identify eligible expenses and deductions, optimising your tax obligations. Grasp the dynamics of capital gains tax, tax credits, and available reliefs. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals aiming for financial literacy and tax self-sufficiency. Small business owners seeking to navigate tax obligations independently. Aspiring accountants or finance professionals enhancing their expertise. Freelancers and self-employed professionals managing their tax responsibilities. Graduates seeking a solid foundation in the UK tax system. Individuals interested in personal financial planning and wealth optimization. Entrepreneurs wanting to make informed fiscal decisions. Anyone keen on mastering tax planning and compliance strategies. Career path Tax Consultant Financial Analyst Small Business Advisor Freelance Accountant Personal Financial Planner Entrepreneurial Tax Specialist Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

In today’s fast-paced business environment, efficient accounts payable processing is vital for maintaining smooth financial operations. Our Accounts Payable Processing Procedures Course offers a deep dive into the essential processes that ensure bills and invoices are paid accurately and on time. From handling purchase orders to understanding payment terms, this course will guide you through the core concepts and procedures necessary for effective accounts payable management. You’ll learn how to manage vendor relationships, avoid common pitfalls, and keep your financial transactions running smoothly. The course covers a variety of practical methods for streamlining the accounts payable cycle, reducing errors, and improving efficiency within your organisation. You will gain insights into best practices for invoice processing, payment schedules, and reporting, all while ensuring accurate documentation and financial integrity. Whether you're new to accounts payable or looking to fine-tune your existing knowledge, this course offers the tools you need to manage payables with confidence. The expertise shared throughout will prepare you for handling day-to-day responsibilities and tackle the challenges that come with managing payments in a professional, efficient manner. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Accounts Payable Processing Module 02: Vendor Management Module 03: Invoice & Payment Processing Module 04: Technologies in Accounts Payable Processing Module 05: Purchase Ledger Management Module 06: Financial Budgeting, Auditing, and Reporting Learning Outcomes Efficiently manage vendor relationships for optimal business partnerships. Streamline invoice and payment processes to enhance financial workflow. Apply cutting-edge technologies to advance accounts payable procedures. Master purchase ledger management for effective financial control. Demonstrate proficiency in financial budgeting, auditing, and reporting. Strategically contribute to organisational financial health and stability. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals seeking advanced accounts payable skills. Accounting graduates aiming to specialise in financial operations. Business administrators wanting to enhance financial management capabilities. Individuals aspiring to excel in purchase ledger management. Professionals keen on mastering financial budgeting and reporting. Anyone looking to upgrade skills in accounts payable technologies. Entrepreneurs aiming to streamline financial processes in their ventures. Career changers interested in entering the field of financial operations. Career path Accounts Payable Specialist Financial Analyst Purchase Ledger Clerk Finance Manager Auditor Budget Analyst Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Partnership Accounting doesn’t have to feel like decoding an ancient scroll. Whether you're sorting profits, handling capital accounts, or working out who owes who (and how much), the numbers tell a story — and this course helps you read it. The Partnership Accounting Basics Course walks you through the essentials of partnership structures, adjustments, drawings, and everything that happens when partners join or leave. It's not just about maths; it’s about understanding the language of partnerships so you’re not lost when the balance sheet starts whispering secrets. Perfect for those dipping their toes into finance or brushing up on the basics, this course makes sure you won’t be side-eyed during partnership discussions. You’ll learn how to handle profit and loss sharing, partner changes, interest on drawings, and fixed vs fluctuating capital methods — all without needing a calculator surgically attached to your hand. It’s detailed, straight to the point, and built with clarity, not confusion. Let the books balance themselves (well, almost) while you build your confidence with numbers that finally make sense. Key Features of Partnership Accounting Basics Course: This Partnership Accounting Basics Course is CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum of Partnership Accounting Basics Module 01: Introduction to Partnership Accounting Module 02: Partnership Agreement and Formation Module 03: Partnership Capital Accounts Module 04: Partnership Income Allocation Module 05: Partnership Financial Statements Module 06: Changes in Partnership Module 07: Dissolution and Liquidation of Partnership Module 08: Partnership Taxation Basics Learning Outcomes of Partnership Accounting Basics Course: Analyze partnership agreements for sound financial foundations and strategic collaborations. Execute accurate financial calculations for partnership capital and income distributions. Construct comprehensive partnership financial statements demonstrating financial health and performance. Navigate changes within partnerships adeptly, ensuring financial continuity and adaptability. Facilitate dissolution and liquidation processes with precision and compliance. Demonstrate a nuanced understanding of partnership taxation essentials and their implications. Accreditation This Partnership Accounting Basics course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this Partnership Accounting Basics course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Accounting professionals seeking a specialised understanding of partnership financial dynamics. Business owners aiming to enhance their Accounting management skills. Finance students desiring a practical grasp of partnership accounting fundamentals. Entrepreneurs involved in or considering establishing Partnership Accounting. Individuals keen on advancing their expertise in partnership taxation and accounting. Career path Partnership Accountant Financial Analyst (Specialising in Partnerships) Tax Consultant for Partnerships Business Advisor with Focus on Financial Collaborations Partnership Financial Controller Auditor Specialising in Partnership Accounting Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

The UK Corporate Tax Returns Insight Course is designed to provide a deep understanding of the UK corporate tax system and the key principles behind submitting corporate tax returns. This online course caters to professionals and individuals seeking a thorough understanding of the tax process, from preparing accurate returns to understanding the financial implications for businesses. Through a structured approach, learners will gain insights into the essential components that make up corporate tax returns and the critical steps involved in their preparation. The course is ideal for those looking to expand their knowledge of corporate tax obligations in the UK, focusing on the accurate submission of tax returns and understanding the intricacies of UK tax law. It covers various topics, including tax computation, allowances, exemptions, and reliefs available to businesses. With this course, learners will become well-versed in the essential processes and best practices involved in corporate tax compliance. This course aims to provide you with the expertise needed to navigate the complexities of UK corporate tax, ensuring that you are well-prepared to manage tax returns with confidence. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 1: Introduction to Corporate Tax Return in the UK Module 2: Income and Expenses in Corporate Tax Returns Module 3: Tax Reliefs, Credits, and Special Schemes Module 4: Compliance and Reporting Obligations Module 5: International Tax Considerations Module 6: Tax Investigation and Dispute Resolution Module 7: Emerging Trends and Updates in Corporate Taxation Module 8: Corporate Tax Calculation Learning Outcomes Analyse corporate financial data for accurate tax reporting. Implement tax strategies leveraging reliefs and credits effectively. Navigate international tax regulations for cross-border transactions. Ensure compliance with reporting obligations in corporate tax. Resolve tax investigations with strategic dispute management. Stay updated with emerging trends, adapting corporate tax strategies. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Financial professionals seeking in-depth corporate tax knowledge. Accountants aiming to enhance their expertise in tax calculations. Business owners and managers keen on optimising tax strategies. Tax consultants looking to stay abreast of international tax norms. Aspiring tax advisors seeking a comprehensive understanding. Legal professionals wanting to specialise in corporate taxation. Finance students preparing for a career in corporate tax. Individuals aiming to excel in financial management with a focus on taxation. Career path Corporate Tax Advisor Tax Consultant Financial Analyst (Tax) Tax Compliance Manager International Tax Specialist Corporate Finance Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Search By Location

- Financial Analysis Courses in London

- Financial Analysis Courses in Birmingham

- Financial Analysis Courses in Glasgow

- Financial Analysis Courses in Liverpool

- Financial Analysis Courses in Bristol

- Financial Analysis Courses in Manchester

- Financial Analysis Courses in Sheffield

- Financial Analysis Courses in Leeds

- Financial Analysis Courses in Edinburgh

- Financial Analysis Courses in Leicester

- Financial Analysis Courses in Coventry

- Financial Analysis Courses in Bradford

- Financial Analysis Courses in Cardiff

- Financial Analysis Courses in Belfast

- Financial Analysis Courses in Nottingham