- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6641 Finance courses

Achieve financial freedom and stability with our comprehensive Personal Financial Management course. From budgeting to investing, explore essential tools and strategies for effective personal financial planning in the UK context. Arm yourself with the skills you need to manage money, build wealth, and secure your financial future.

Financial Advisor Training

By Training Tale

Financial : Financial Advisor Training Discover Your Path to Success as a Financial Advisor with Our Comprehensive Course Are you ready to embark on a rewarding and lucrative career as a financial advisor? Look no further! Our comprehensive Financial Advisor Course is designed to equip you with the knowledge, skills, and confidence to excel in the dynamic world of financial planning. Why Choose Our Financial Advisor Course? Expert-Led Curriculum: Our course is crafted by seasoned financial advisors with extensive industry experience. You'll learn from professionals who have successfully navigated the complexities of the financial advisory field, gaining insights and strategies that are tried and tested. Comprehensive Skill Development: We cover a wide range of essential topics, including investment planning, retirement strategies, risk management, tax planning, and more. Our curriculum is designed to provide you with a holistic understanding of financial advisory principles, ensuring you're well-prepared to meet the diverse needs of your clients. Practical Learning Opportunities: Theory alone is not enough. Our financial advisor course incorporates practical exercises, case studies, and simulations to enhance your real-world problem-solving abilities. You'll develop hands-on skills, analyze complex financial scenarios, and create tailored solutions that align with your clients' goals. Industry-Recognized Certification: Upon completion of the course, you'll receive a prestigious certification that carries weight in the industry. This financial advisor credential will not only validate your expertise but also open doors to career opportunities with established financial firms, banks, or as an independent advisor. Networking Opportunities: Our financial advisor course provides a platform to connect with fellow aspiring advisors and established professionals. Networking events, industry guest speakers, and online forums offer opportunities to build relationships, gain mentors, and expand your professional network. Don't miss out on the chance to launch your successful career as a financial advisor. Enroll in our Financial Advisor Course today and unlock your potential in the world of finance. Take the first step towards a fulfilling and prosperous future. Invest in yourself and seize the opportunity to make a meaningful difference in people's lives as a trusted financial advisor. Enroll now and let our course be your stepping stone to a successful and rewarding career. Courses: Course 01: Financial Advisor Course 02: Level 5 Accounting and Finance Course 03: Supply Chain Management Financial : Financial Advisor Training Industry Experts Designed this Financial Advisor course into 05 detailed modules. Assessment Method of financial advisor After completing each module of the Financial Advisor course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of financial advisor After completing the MCQ/Assignment assessment for this Financial Advisor course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. Who is this course for? Financial : Financial Advisor Training The Financial Advisor course is ideal for those already working in this field or are interested in becoming one. This Financial Advisor course is designed to broaden your knowledge and boost your CV. Requirements Financial : Financial Advisor Training There are no specific requirements for this Financial Advisor course because it does not require any advanced knowledge or skills. Career path Financial : Financial Advisor Training

Immerse yourself in the world of figures and fiscal responsibility with the 'Accounting Fundamentals Diploma', a gateway to mastery in the robust field of accountancy. Encompassing a journey from the foundational stones of accounting to a sophisticated understanding of financial management, this course beckons aspirants to navigate through the riveting world of budgets, investments, and financial analysis, ensuring a comprehensive grasp of the monetary mechanics. As you delve into the vital initial modules, a thorough comprehension of who accountants are and the pivotal role they play in an organisation's financial stability becomes remarkably evident. Embark on an enlightening voyage through intricate financial pathways, exploring profound modules like financial statement creation and discerning analysis, thereby enabling the demystification of complex financial data. This exploration further unravels through enlightening perspectives on budgeting and its consequential significance, coupled with a sturdy introduction to the financial markets and bonds, providing you with the critical tools to forge fiscal prudence and strategising adeptness within any business environment. Learning Outcomes Attain a robust foundational knowledge of accounting principles and practices. Develop adeptness in creating, analysing, and interpreting financial statements. Gain proficiency in budget creation and understanding its strategic role in financial planning. Acquire skills to manage, analyse, and make informed decisions regarding investments. Understand and implement risk management strategies, focusing on auditing and fraud prevention. Why buy this Accounting Fundamentals Diploma? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Accounting Fundamentals Diploma for? Aspiring accountants seeking foundational knowledge in finance and accounting. Small business owners who wish to manage their own finances and understand financial strategies. Finance students who aim to supplement their academic knowledge with applied skills. Non-finance professionals aiming to gain an understanding of financial practices for career enhancement. Individuals exploring a career change into the financial sector without prior background. Career path Chartered Accountant: £50,000 - £60,000 Financial Analyst: £30,000 - £45,000 Investment Analyst: £45,000 - £65,000 Auditor: £35,000 - £55,000 Budget Analyst: £30,000 - £46,000 Risk Manager: £50,000 - £80,000 Prerequisites This Accounting Fundamentals Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Accounting Introduction to Accounting 00:07:00 Module 02: Who are Accountants? Who are Accountants? 00:06:00 Module 03: The Accounting System The Accounting System 00:07:00 Module 04: What are Financial Statements? What are Financial Statements? 00:08:00 Module 05: Introduction to Financial Statement Analysis Introduction to Financial Statement Analysis 00:11:00 Module 06: Budgeting and Its Importance Budgeting and Its Importance 00:08:00 Module 07: Financial Markets and Bonds Financial Markets and Bonds 00:13:00 Module 08: Dealing with Financial Risk Management Dealing with Financial Risk Management 00:12:00 Module 09: Investment Management and Analysis Investment Management and Analysis 00:09:00 Module 10: Auditing and Risk of Frauds Auditing and Risk of Frauds 00:11:00

Boost Your Career By Enrolling In This FinTech Bundle To Overcome Your Challenges! 9 in 1 FinTech Bundle Improve your knowledge and enhance your skills to succeed with this FinTech bundle. This FinTech bundle is designed to build your competent skill set and enable the best possible outcome for your future. Our bundle is ideal for those who aim to be the best in their fields and are always looking to grow. This FinTech Bundle Contains 9 of Our Premium Courses for One Discounted Price: Course 01: Financial Modeling Using Excel Course 02: Finance and Financial Analysis Course 03: Financial Management Course 04: Financial Trading Course & Mentoring Course 05: Investment Course 06: Microsoft Project - Monitoring Course 07: Excel Data Analysis Course 08: Anti-Money Laundering (AML) Course 09: Tax Accounting Course All the courses under this FinTech bundle are split into a number of expertly created modules to provide you with an in-depth and comprehensive learning experience. Upon successful completion of the FinTech bundle, an instant e-certificate will be exhibited in your profile that you can order as proof of your new skills and knowledge. Stand out from the crowd and get trained for the job you want. With this comprehensive FinTech bundle, you can achieve your dreams and train for your ideal career. This FinTech bundle covers essential aspects in order to progress in your chosen career. Why Prefer Us? All-in-one package of 9 premium courses' FinTech bundle Earn a certificate accredited by CPDQS. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Globally Accepted Standard Lesson Planning Free Assessments 24/7 Tutor Support. Start your learning journey straightaway! ****Course Curriculum**** >> Financial Modeling Using Excel << Module 01: Welcome to the Course! Get the Overview of What You'll Learn Module 02: Planning your Financial Model Module 03: Building a Model Template Module 04: Projecting the Income Statement Module 05: Projecting the Balance Sheet Module 06: Projecting Cash Flows Module 07: Advanced Financial Modeling Module 08: BONUS LESSON: Top 5 Excel Features for Financial Modellers >> Financial Analysis Course << Module 01: Introduction to Financial Analysis Module 02: The Balance Sheet Module 03: The Income Statement Module 04: The Cash Flow Statement Module 05: Financial Reporting Module 06: Analysing Profitability Module 07: The Applications and Limitations of EBITDA Module 08: Credit Analysis Module 09: Equity Analysis Module 10: Ratio Analysis >> Financial Management << Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management >> Financial Trading Course & Mentoring << Module 01: Introduction to Forex Trading Module 02: Major Currencies and Market Structure Module 03: Kinds of Foreign Exchange Market Module 04: Money Management Module 05: Fundamental Analysis Module 06: Technical Analysis Module 07: Pitfalls and Risks Module 08: Managing Risk Module 09: Trading Psychology >> Investment << Module 01: Introduction to Investment Module 02: Types and Techniques of Investment Module 03: Key Concepts in Investment Module 04: Understanding the Finance Module 05: Investing in Bond Market Module 06: Investing in Stock Market Module 07: Risk and Portfolio Management >> Microsoft Project - Monitoring << Module 01: Getting Started with Microsoft Project Module 02: Working with Tasks Module 03: Working with Project Resources Module 04: Preparing a Project Plan for Finalization Module 05: Microsoft Project 2016 Advanced Module 06: Updating Task Information Module 07: Monitoring a Project Module 08: Working with Project Reports Module 09: Working with Other Projects >> Excel Data Analysis << Module 01: Excel data analysis - 1 Module 02: Excel data analysis - 2 Module 03: Excel data analysis - 3 Module 04: Excel data analysis - 4 Module 05: Excel data analysis - 5 Module 06: Excel data analysis - 6 Module 07: Excel data analysis - 7 Module 08: Excel data analysis - 8 Module 09: Excel data analysis - 9 >> Anti-Money Laundering (AML) << Module 01: Introduction to Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Development of Anti-Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Office Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Awareness and Training >> Tax Accounting Course << Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 10: Management Accounting and Financial Analysis Module 11: Career as a Tax Accountant in the UK Assessment Process Once you have completed all the modules in the FinTech Bundle, you can assess your skills and knowledge with an optional assignment. Our expert trainers will assess your assignment and give you feedback afterwards. CPD 90 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This FinTech bundle is suitable for everyone. Requirements You will not need any prior background or expertise. Career path This FinTech bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates Certificate Accredited by CPDQS Digital certificate - £10 Upon passing the Bundle, you need to order to receive a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPDQS. Certificate Accredited by CPDQS Hard copy certificate - £29 Upon passing the Bundle, you need to order to receive a Hard copy Certificate for each of the courses inside this bundle. If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Mergers & Acquisitions Modelling

By Capital City Training & Consulting Ltd

Enroll today and gain the mergers and acquisitions modelling skills needed to guide high-stakes business decisions and transactions. 1.5+ Hours of Video 3.5+ Hours to Complete20+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive M&A Modelling certification program teaches the essential skills needed to build robust financial models for merger and acquisition valuations. Through step-by-step video lessons and hands-on exercises, you will learn to structure flexible models that provide vital insights into deal outcomes. This self-paced online course focuses on real-world applications in investment banking, private equity, and corporate development. The curriculum covers all aspects of M&A models including key concepts like goodwill, accretion/dilution, consolidation of financial statements, and optimal deal structuring. With over 1 hour of content and 20+ exercises, the program provides the necessary tools and techniques to become an expert in merger modelling. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to M&A Model Components and Framework Step-by-Step Merger Model Recipe and Methods Modelling Goodwill, Purchase Price Allocation, Accretion/Dilution Consolidating Balance Sheets and Financial Statements Optimizing Ownership Structure and Capital Funding Real World Case Studies and Debriefs Certificate Upon Completion

Auditing in the Exploration & Production (E&P) Industry Level 1

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 3-day introductory-level course provides a comprehensive overview of Auditing in the Exploration & Production (E&P) industry. It is suitable for anyone who wants to gain a broader understanding of Upstream Oil & Gas Auditing - including joint venture, financial and contractual audits by government and regulatory authorities in the various granting regimes (Production Sharing Contracts, Risk Service Contracts, Concessionary). Training Objectives After the completion of this training course, participants will be able to: Gain knowledge of the unique features or key phases of the E&P Business Understand the general principles and objectives of the various different types of Upstream Oil & Gas audits Add value to your organisation by improving your audit techniques and auditing skills Review the importance of following process in order to avoid costly audit related findings. Utilize industry specific examples and exercises, develop your understanding of the most common E&P industry audit issues Target Audience This training course is suitable and will greatly benefit the following specific groups: Audit staff who are new or relatively new to the industry and who require a grounding in the various aspects of E&P Audit Finance or Accounting personnel involved in supporting audits Staff from a wide range of other business functions who are connected to / impacted by audit, such as, Supply Chain, Operations, Contracts Holders, IT, Tax and Treasury Topics will be covered from both the perspective of being part of an audit team plus that of the team being audited. Therefore, the course will appeal to staff from IOC's, NOC's and those from Government and/or Regulatory Authorities. Course Level Basic or Foundation Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 3 days in total (21 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Introduction to Exploration and Production for New Engineers and Non-Technical Professionals in Oil & Gas

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Exploration and production technology, equipment specification and processes have a unique language that must be conquered by executives such as you. A confident understanding of the technical jargon and a visual appreciation of the various pieces of equipment used provides for an overall 'big picture' of industry value chain. This serves as an excellent foundation for smooth communication and increased efficiency in inter-department project team efforts. Gain a comprehensive overview of the entire value chain and process of oil & gas upstream operations and business in this 3 full-day training course. Training Objectives By attending this industry fundamentals training course, participants will be better able to: Appreciate the dynamics of world energy demand & supply and its impact on pricing Understand the formation of petroleum reservoirs and basic geological considerations Examine the exploration process to gain an overview of the technical processes involved Gain a comprehensive overview of drilling activities - from pre-drilling preparation, through to well drilling, well evaluations and post drilling activities Get familiarised with the common production methods and the different stages of its processes Integrate your understanding of asset maintenance and downstream supply chain activities Better visualise through video presentations the various exploration equipment/ technologies and understand the major cost components Target Audience This course will be useful and applicable, but not limited to: Accounting Administration Business Development Commercial Construction E & P IT / Data Finance Finance & Treasury Health & Safety Human Resource Joint Venture Co-ordinators Legal Logistics Materials Planning Procurement Sales & Marketing Senior Management Sourcing Strategic Planning Supply Chain Tender Contract Course Level Basic or Foundation Training Methods Multi-media presentation methodology to enable better understanding and appreciation technical jargon and equipment applied in the field A pre-course questionnaire to help us focus on your key learning objectives Detailed reference manual for continuous learning and sharing Limited class size to ensure one to one interactivity Trainer Your expert course leader worked for BP for 28 years as a Research Associate and Team Leader, working on Feasibility Studies and acting as a trouble shooter covering all aspects of BPs businesses. These covered field Development Project in the North Sea and several novel resource recovery techniques which were taken from Concept to Field Pilot trials in Canada. His specific work in the offshore area covered Subsea Robotics / Automation, Seabed Production Concepts, Seabed Excavation Methods, Underwater Repair Techniques, Flexible Riser Studies and Maintenance Cost Reductions. After leaving BP in 1992, he continued working in the offshore oil industry through Azur Offshore Ltd, including activities in the assessment of Emerging and Novel Technologies, Technical and Economic Audits, Studies, Production Sharing Agreement Evaluations, Safety and Environmental issues. Clients have included Chevron UK, BP Exploration, British Gas, Technomare, Trident Consultants, Fina UK and Cameron France. He is a regular University lecturer at Crandfield School of Industrial Sciences (UK) and is a course Group Project external examiner for Crandfield. He also lectures on offshore oil industry activities at ENSIETA (France), the Technical University of Delft (Holland) and the Northern Territories University in Darwin (Australia). He is an active member of the UK Society for Underwater Technology (SUT) and serves on their Subsea Engineering and Operations Committee. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

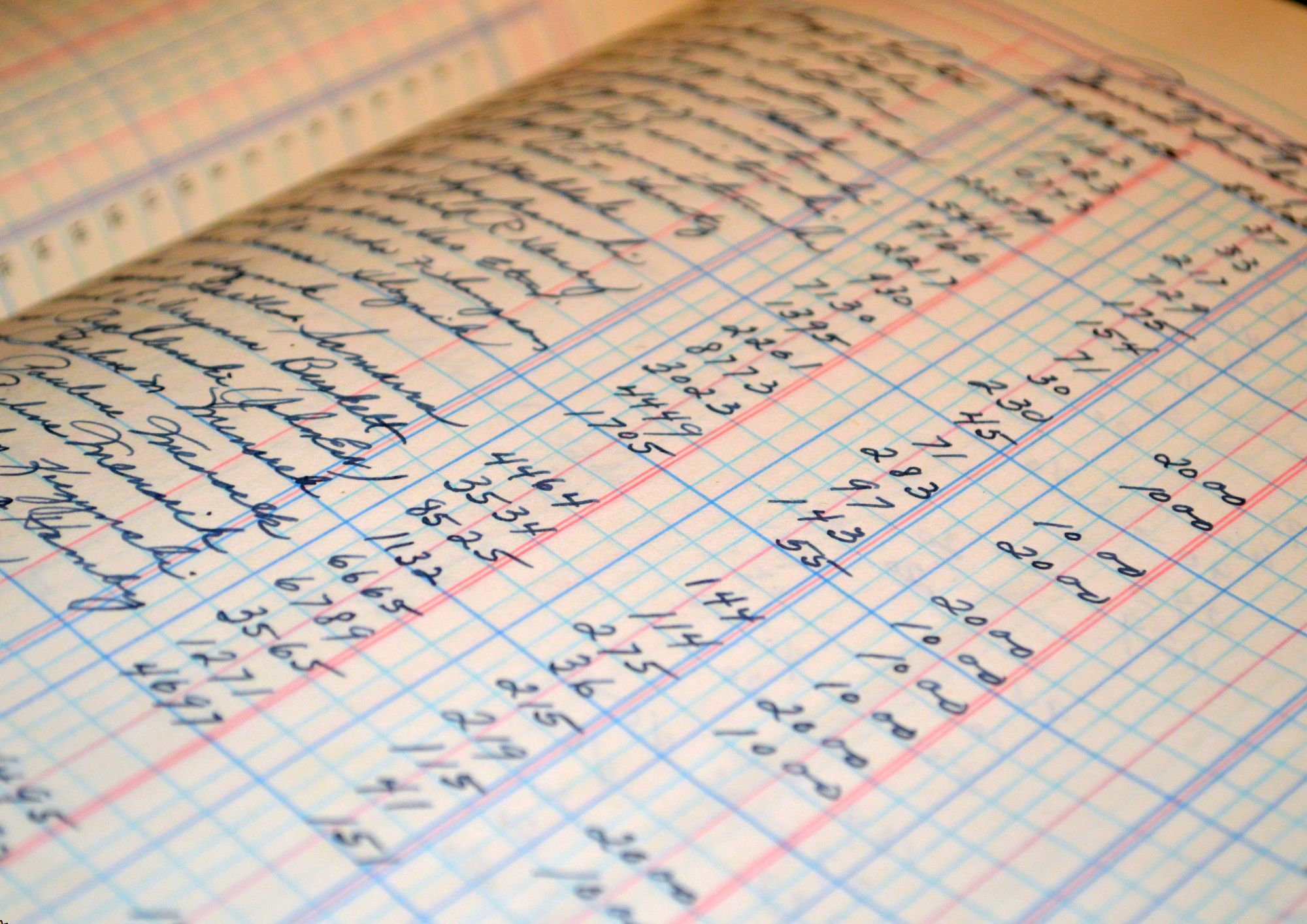

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Petroleum Engineering for Non-Petroleum Engineering Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Time is money in all industries. For the Oil & Gas industry, this is no exception and the ability to maximise return on investment is all related to where the Oil is and how easily and quickly we can get that product to the customer. Whether in a technical, managerial or supporting role, you are a valuable asset in ensuring that project delivery targets are met and profits are realised. As Petroleum Engineering (PE) activities continue to increase, professionals like you must grasp the language and technology of PE operations in order to maximise expenditures throughout the producing life of a well. Petroleum Engineering equipment and procedures have a unique language that must be conquered for maximum benefit. Clear and understandable explanations of rig equipment, completion equipment, operations procedures, and their complex interactions provide an excellent foundation for smooth communication and increased efficiency in inter-department project team efforts. A confident understanding of the technical jargon and a visual appreciation of the various pieces of equipment used provides for an overall 'big picture' of the industry value chain. This serves as an excellent foundation for smooth communication and increased efficiency in inter-department project team efforts. This course can also be offered through Virtual Instructor Led Training (VILT) format. Training Objectives By the end of this course, the participants will be able to: Define the role of Petroleum Engineering and its interaction between other departments Describe terms used in the Oil & Gas industry such as Surface/Subsurface, Upstream, Midstream and Downstream Describe the Appraisal of Oil & Gas Discoveries, the Cost Estimations, Economics & Reserves Explain what is the Formation, how do we connect to it, and how do we ensure best value Describe how to construct a well, select the equipment & methods, understand the duration that the well is required to perform for Target Audience This course will benefit those in geology, reservoir engineering, equipment and maintenance, and non-petroleum engineering technical professionals as well as forward-looking executives in the following fields who are interested to enhance their knowledge and awareness of the drilling process for increased productivity and contribution to the team that they're supporting: Accounting Administration Business Development Commercial E & P IT Estimation & Proposal Finance & Administration Finance HSE General Management Joint Ventures Legal Logistics Materials Planning Planning & Budgeting Procurement Sourcing Supply Chain Tender Contract Training Drilling Fluids Course Level Basic or Foundation Trainer Your Expert Course Trainer has over 40 years of experience in the Oil & Gas industry. During that time, he has worked exclusively in well intervention and completions. After a number of years working for intervention service companies (completions, slickline & workovers), he joined Shell as a well service supervisor. He was responsible for the day-to-day supervision of all well intervention work on Shell's Persian/Arabian Gulf platforms. This included completion running, coil tubing, e-line, slickline, hydraulic workovers, well testing and stimulation operations. An office-based role as a senior well engineer followed. He was responsible for planning, programming and organising of all the well engineering and intervention work on a number of fields in the Middle East. He had a brief spell as a Site Representative for Santos in Australia before joining Petro-Canada as Completions Superintendent in Syria, then moved to Australia as Completions Operations Superintendent for Santos, before returning to Shell as Field Supervisor Completions and Well Interventions in Iraq where he carried out the first ever formal abandonment of a well in the Majnoon Field. While working on rotation, he regularly taught Completion Practices, Well Intervention, Well Integrity and Reporting & Planning courses all over the world. In 2014, he started to focus 100% on training and became the Technical Director for PetroEDGE. Since commencing delivering training courses in 2008, he has taught over 300 courses in 31 cities in 16 countries to in excess of 3,500 participants. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Search By Location

- Finance Courses in London

- Finance Courses in Birmingham

- Finance Courses in Glasgow

- Finance Courses in Liverpool

- Finance Courses in Bristol

- Finance Courses in Manchester

- Finance Courses in Sheffield

- Finance Courses in Leeds

- Finance Courses in Edinburgh

- Finance Courses in Leicester

- Finance Courses in Coventry

- Finance Courses in Bradford

- Finance Courses in Cardiff

- Finance Courses in Belfast

- Finance Courses in Nottingham