- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6747 Finance courses

Uncover Excel 2019's potential through our comprehensive Microsoft Excel course. It empowers you to master features, calculations, data analysis, and automation. Whether you're new to spreadsheets or aiming for data expertise, this course is tailored for you. Our Microsoft Excel course simplifies Excel's complexities, making it beginner-friendly. It equips you with skills vital in today's data-driven landscape. Beyond personal growth, this Microsoft Excel course boosts career prospects. Excel proficiency is valuable in a competitive job market, opening doors to diverse opportunities. Our course is a transformative journey into Excel 2019, unlocking potential, enhancing skills, and advancing careers. Whether you're a novice or aspiring data pro, it's your key to Excel's power and your potential. Learning Outcomes of our Microsoft Excel course: Master Microsoft Excel 2019's latest features. Perform complex calculations with ease. Create visually appealing and well-formatted worksheets. Analyze and visualize data effectively using charts and PivotTables. Automate workbook tasks with Excel VBA. Why buy this Advanced Diploma in Microsoft Excel Complete Course 2019 at QLS Level 7? Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Who is this Advanced Diploma in Microsoft Excel Complete Course 2019 at QLS Level 7 for? Individuals new to Microsoft Excel looking to build a strong foundation. Students and job seekers aiming to enhance their employability. Business professionals wanting to improve data management and analysis skills. Entrepreneurs seeking to streamline their business processes. Anyone interested in harnessing the power of Excel for personal or professional growth. Prerequisites This Advanced Diploma in Microsoft Excel Complete Course 2019 at QLS Level 7 was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Data Analyst: £25,000 - £40,000 per year Financial Analyst: £30,000 - £50,000 per year Business Intelligence Analyst: £30,000 - £55,000 per year Operations Manager: £35,000 - £70,000 per year Project Manager: £40,000 - £70,000 per year Excel VBA Developer: £35,000 - £60,000 per year Certification After studying the course materials of the Advanced Diploma in Microsoft Excel Complete Course 2019 at QLS Level 7 you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £4.99. Original Hard Copy certificates need to be ordered at an additional cost of £8. Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for only £135 to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Course Curriculum Microsoft Excel 2019 New Features Introduction to Microsoft Excel 2019 New Features 00:07:00 CONCAT 00:02:00 IFS 00:01:00 MAXIFS 00:01:00 MINIFS 00:01:00 SWITCH 00:02:00 TEXTJOIN 00:01:00 Map Chart 00:02:00 Funnel Chart 00:01:00 Better Visuals 00:06:00 Pivot Table Enhancements 00:02:00 Power Pivot Updates 00:01:00 Getting Started with Microsoft Office Excel Navigate the Excel User Interface 00:28:00 Use Excel Commands 00:10:00 Create and Save a Basic Workbook 00:19:00 Enter Cell Data 00:12:00 Use Excel Help 00:05:00 Performing Calculations Create Worksheet Formulas 00:15:00 Insert Functions 00:17:00 Reuse Formulas and Functions 00:17:00 Modifying a Worksheet Insert, Delete, and Adjust Cells, Columns, and Rows 00:10:00 Search for and Replace Data 00:09:00 Use Proofing and Research Tools 00:07:00 Formatting a Worksheet Apply Text Formats 00:16:00 Apply Number Format 00:08:00 Align Cell Contents 00:09:00 Apply Styles and Themes 00:12:00 Apply Basic Conditional Formatting 00:11:00 Create and Use Templates 00:08:00 Printing Workbooks Preview and Print a Workbook 00:10:00 Set Up the Page Layout 00:09:00 Configure Headers and Footers 00:07:00 Managing Workbooks Manage Worksheets 00:05:00 Manage Workbook and Worksheet Views 00:07:00 Manage Workbook Properties 00:06:00 Working with Functions Work with Ranges 00:18:00 Use Specialized Functions 00:11:00 Work with Logical Functions 00:23:00 Work with Date & Time Functions 00:08:00 Work with Text Functions 00:11:00 Working with Lists Sort Data 00:10:00 Filter Data 00:10:00 Query Data with Database Functions 00:09:00 Outline and Subtotal Data 00:09:00 Analyzing Data Apply Intermediate Conditional Formatting 00:07:00 Apply Advanced Conditional Formatting 00:05:00 Visualizing Data with Charts Create Charts 00:13:00 Modify and Format Charts 00:12:00 Use Advanced Chart Features 00:12:00 Using PivotTables and PivotCharts Create a PivotTable 00:13:00 Analyze PivotTable Data 00:12:00 Present Data with PivotCharts 00:07:00 Filter Data by Using Timelines and Slicers 00:11:00 Working with Multiple Worksheets and Workbooks Use Links and External References 00:12:00 Use 3-D References 00:06:00 Consolidate Data 00:05:00 Using Lookup Functions and Formula Auditing Use Lookup Functions 00:12:00 Trace Cells 00:09:00 Watch and Evaluate Formulas 00:08:00 Sharing and Protecting Workbooks Collaborate on a Workbook 00:19:00 Protect Worksheets and Workbooks 00:08:00 Automating Workbook Functionality Apply Data Validation 00:13:00 Search for Invalid Data and Formulas with Errors 00:04:00 Work with Macros 00:18:00 Creating Sparklines and Mapping Data Create Sparklines 00:07:00 MapData 00:07:00 Forecasting Data Determine Potential Outcomes Using Data Tables 00:08:00 Determine Potential Outcomes Using Scenarios 00:09:00 Use the Goal Seek Feature 00:04:00 Forecasting Data Trends 00:05:00 Excel VBA Data Management Create a Macro Using the Macro Recorder 01:00:00 Edit a Macro 01:00:00 Debug a Macro 00:30:00 Customize the Quick Access Toolbar and Hotkeys 00:30:00 Set Macro Security 01:00:00 Insert Text 00:30:00 Format Text 00:30:00 Sort Data 00:30:00 Duplicate Data 01:00:00 Generate a Report 01:00:00 Determine the Dialog Box Type 00:15:00 Capture User Input 01:00:00 Insert, Copy, and Delete Worksheets 00:30:00 Rename Worksheets 00:30:00 Modify the Order of Worksheets 00:15:00 Print Worksheets 00:30:00 Create User-Defined Functions 00:30:00 Automate SUM Functions 00:30:00 Excel Templates Excel Templates 00:00:00 Resources Resources - Microsoft Excel - Beginner Course - Cpd Accredited 00:00:00 Mock Exam Mock Exam - Microsoft Excel Complete Course 2019 00:20:00 Final Exam Final Exam - Microsoft Excel Complete Course 2019 00:20:00 Order your QLS Endorsed Certificate Order your QLS Endorsed Certificate 00:00:00

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! Attention all aspiring fundraisers! Are you ready to unlock the secrets to successful fundraising? Look no further than the Fundraising From Scratch bundle - a collection of 11 must-have courses to take your skills to the next level! From the QLS-endorsed Introduction to Fundraising course to the 10 CPD-QS accredited courses covering topics such as financial management, anti-money laundering, tax accounting, and cross-cultural awareness, this bundle has everything you need to excel in the world of fundraising. Gain the fundamental knowledge required to kickstart your career in fundraising with a hardcopy QLS certificate to showcase your expertise. With the anti-money laundering course, learn to detect and prevent financial crimes, while the tax accounting course will provide insight into complex tax structures and regulations. But that's not all - the public relations and media diploma will teach you how to craft a compelling message and effectively communicate your organisation's goals, while the cross-cultural awareness training will help you navigate the diverse landscape of modern-day fundraising. Don't wait to get started - seize this opportunity to learn from the best and become a master fundraiser with the Fundraising From Scratch bundle. Enrol today! This Fundraising From Scratch Bundle Package includes: Course 01: Advanced Diploma in Fundraising at QLS Level 7 10 Premium Additional CPD QS Accredited Courses - Course 01: Concept of Charity Accounting Course 02: Financial Management Course 03: Capital Budgeting & Investment Decision Rules Course 04: Anti-Money Laundering (AML) Course 05: Tax Accounting Course Course 06: Introduction to Accounting Course 07: Managerial Accounting Training Course 08: Public Relation Course 09: Media and Public Relations Diploma Course 10: Cross-Cultural Awareness Training Why Prefer This Fundraising From Scratch Bundle? You will receive a completely free certificate from the Quality Licence Scheme Option to purchase 10 additional certificates accredited by CPD Get a free Student ID Card - (£10 postal charges will be applicable for international delivery) Free assessments and immediate success results 24/7 Tutor Support After taking this Fundraising From Scratch bundle courses, you will be able to learn: Develop a thorough understanding of fundraising fundamentals Master the principles of charity accounting and financial management Understand capital budgeting and investment decision rules Gain expertise in anti-money laundering regulations and compliance Learn how to navigate complex tax structures and regulations Enhance communication skills with a diploma in public relations and media Build cross-cultural awareness and navigate diverse fundraising landscapes ***Curriculum breakdown of Introduction to Fundraising*** Module 01: Introduction to Fundraising Module 02: Hiring and Training Development Staff Module 03: The Fundraising Cycle Module 04: Establishing Governance Module 05: Managing Budget, Taxes and Accounting Module 06: Fundraising Sources Module 07: Arranging Successful Fundraising Events Module 08: Marketing, Public Relations and Communications Module 09: Tools and Resources that Can Help in Fundraising Module 10: Crowdfunding Module 11: The Organisation and Use of Volunteers Module 12: Risk Management Module 13: Legal Responsibilities How is the Fundraising From Scratch Bundle Assessment Process? You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you successfully pass the exams. CPD 280 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring fundraisers looking to kickstart their career Experienced fundraisers seeking to expand their knowledge and skills Individuals interested in charity accounting and financial management Professionals interested in anti-money laundering regulations and compliance Career path This bundle will be beneficial for anyone looking to pursue a career as: Fundraising Officer - £19k to £32k per annum Fundraising Manager - £27k to £46k per annum Financial Manager - £35k to £75k per annum Tax Accountant - £23k to £49k per annum Anti-Money Laundering Specialist - £24k to £70k per annum Public Relations Specialist - £21k to £51k per annum Certificates Advanced Diploma in Fundraising at QLS Level 7 Hard copy certificate - Included CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location.

Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry - 30 Courses Bundle

By NextGen Learning

Get ready for an exceptional online learning experience with the Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle! This carefully curated collection of 30 premium courses is designed to cater to a variety of interests and disciplines. Dive into a sea of knowledge and skills, tailoring your learning journey to suit your unique aspirations. The Energy And Environmental Engineering, Sustainable Energy & Forestry is a dynamic package, blending the expertise of industry professionals with the flexibility of digital learning. It offers the perfect balance of foundational understanding and advanced insights. Whether you're looking to break into a new field or deepen your existing knowledge, the Energy And Environmental Engineering, Sustainable Energy & Forestry package has something for everyone. As part of the Energy And Environmental Engineering, Sustainable Energy & Forestry package, you will receive complimentary PDF certificates for all courses in this bundle at no extra cost. Equip yourself with the Energy And Environmental Engineering, Sustainable Energy & Forestry bundle to confidently navigate your career path or personal development journey. Enrol today and start your career growth! This Bundle Comprises the Following Energy Engineering, Environmental Engineering, Sustainable Energy & ForestryCPD Accredited Courses: Course 01: Diploma in Sustainable Energy Course 02: Energy Engineer Course Course 03: Renewable Energy: Solar Course 04: Energy Auditing Training: ISO 50001 Course 05: Energy Saving in Electric Motors Course 06: Energy Efficient Lighting Course 07: Environmental Law Course 08: Sustainable Living Course 09: Energy Saving in Boiler Course 10: Environment Management Course 11: Environmental Health Course 12: Environmental engineering Course 13: Conservation Diploma Course Course 14: Introduction to Petroleum Engineering and Exploration Course 15: Oil and Gas Industry Course 16: Logistics of Crude Oil and Petroleum Products Course 17: Electrical Engineering for Electrical Substations Course 18: High Voltage Generation for Electrical Engineering Course 19: Agricultural Science Course 20: Horticulture Course 21: Arboriculture Course 22: Forestry Course 23: Meteorology Course 24: Diploma in Water Treatment Course 25: Land Management Course 26: Marine Biology Course - Online Diploma Course 27: Town Planning Course 28: Architectural Studies Course 29: COSHH - Control of Substances Hazardous to Health Course 30: Organic Cleaning Products For A Clean Green Home What will make you stand out? Upon completion of this online Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle, you will gain the following: CPD QS Accredited Proficiency with this Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry After successfully completing the Energy And Environmental Engineering, Sustainable Energy & Forestry bundle, you will receive a FREE CPD PDF Certificates as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials of this Energy And Environmental Engineering, Sustainable Energy & Forestry. The online test with immediate results You can study and complete the Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle at your own pace. Study for the Energy And Environmental Engineering, Sustainable Energy & Forestrybundle using any internet-connected device, such as a computer, tablet, or mobile device. Each course in this Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Embrace the future of learning with the Energy And Environmental Engineering, Sustainable Energy & Forestry, a rich anthology of 30 diverse courses. Each course in the Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle is handpicked by our experts to ensure a wide spectrum of learning opportunities. ThisEnergy And Environmental Engineering, Sustainable Energy & Forestry bundle will take you on a unique and enriching educational journey. The bundle encapsulates our mission to provide quality, accessible education for all. Whether you are just starting your career, looking to switch industries, or hoping to enhance your professional skill set, the Energy And Environmental Engineering, Sustainable Energy & Forestry bundle offers you the flexibility and convenience to learn at your own pace. Make the Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry package your trusted companion in your lifelong learning journey. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle is perfect for: Lifelong learners looking to expand their knowledge and skills. Professionals seeking to enhance their career with CPD certification. Individuals wanting to explore new fields and disciplines. Anyone who values flexible, self-paced learning from the comfort of home. Requirements You are cordially invited to enroll in this bundle; please note that there are no formal prerequisites or qualifications required. We've designed this curriculum to be accessible to all, irrespective of prior experience or educational background. Career path Unleash your potential with the Energy Engineering, Environmental Engineering, Sustainable Energy & Forestry bundle. Acquire versatile skills across multiple fields, foster problem-solving abilities, and stay ahead of industry trends. Ideal for those seeking career advancement, a new professional path, or personal growth. Embrace the journey with thisbundle package. Certificates CPD Quality Standard Certificate Digital certificate - Included 30 CPD Accredited Digital Certificates and A Hard Copy Certificate

Get Going With QuickBooks 2021 for Windows

By Nexus Human

Duration 2 Days 12 CPD hours Overview Automatic Payment Reminders for open customer invoices Ability to automatically include the PO# (purchase order number) to Invoice Emails Able to combine multiple emails which allows you to attach multiple sales or purchasing documents to a single email Quickly locate a company file using the new company file search feature Smart Help is an improved search experience that includes access to live experts through messaging and call back options The behind-the-scenes journal entry for transactions is now included. First-time QuickBooks users will learn the basic features of the software. Experienced QuickBooks users will quickly learn the new features and functionality of QuickBooks 2021. This course covers features that are in QuickBooks Pro and Premier 2021 Getting Started Starting QuickBooks Setting QuickBooks Preferences Components of the QuickBooks Operating Environment Using QuickBooks Help Identifying Common Business Terms Exiting QuickBooks Setting Up a Company Creating a QuickBooks Company Using the Chart of Accounts Working with Lists Creating Company Lists Working with the Customers & Jobs List Working with the Employees List Working with the Vendors List Working with the Item List Working with Other Lists Managing Lists Setting Up Inventory Entering Inventory Ordering Inventory Receiving Inventory Paying for Inventory Manually Adjusting Inventory Selling Your Product Creating Product Invoices Applying Credit to Invoices Emailing Invoices Setting Price Levels Creating Sales Receipts Invoicing for Services Setting Up a Service Item Changing the Invoice Format Creating a Service Invoice Editing an Invoice Voiding an Invoice Deleting an Invoice Entering Statement Charges Creating Billing Statements Processing Payments Displaying the Open Invoices Report Using the Income Tracker Receiving Payments for Invoices Making Deposits Handling Bounced Checks Working with Bank Accounts Writing a QuickBooks Check Voiding a QuickBooks Check Using Bank Account Registers Entering a Handwritten Check Transferring Funds Between Accounts Reconciling Checking Accounts Entering and Paying Bills Handling Expenses Using QuickBooks for Accounts Payable Entering Bills Paying Bills Entering Vendor Credit Using the EasyStep Interview Using the EasyStep Interview Additional course details: Nexus Humans Get Going With QuickBooks 2021 for Windows training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Get Going With QuickBooks 2021 for Windows course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Get Going With QuickBooks 2020 for Windows

By Nexus Human

Duration 2 Days 12 CPD hours Overview Automatic Payment Reminders for open customer invoices Ability to automatically include the PO# (purchase order number) to Invoice Emails Able to combine multiple emails which allows you to attach multiple sales or purchasing documents to a single email Quickly locate a company file using the new company file search feature Smart Help is an improved search experience that includes access to live experts through messaging and call back options The behind-the-scenes journal entry for transactions is now included. First-time QuickBooks users will learn the basic features of the software. Experienced QuickBooks users will quickly learn the new features and functionality of QuickBooks 2020. This course covers features that are in QuickBooks Pro and Premier 2020 Getting Started Starting QuickBooks Setting QuickBooks Preferences Components of the QuickBooks Operating Environment Using QuickBooks Help Identifying Common Business Terms Exiting QuickBooks Setting Up a Company Creating a QuickBooks Company Using the Chart of Accounts Working with Lists Creating Company Lists Working with the Customers & Jobs List Working with the Employees List Working with the Vendors List Working with the Item List Working with Other Lists Managing Lists Setting Up Inventory Entering Inventory Ordering Inventory Receiving Inventory Paying for Inventory Manually Adjusting Inventory Selling Your Product Creating Product Invoices Applying Credit to Invoices Emailing Invoices Setting Price Levels Creating Sales Receipts Invoicing for Services Setting Up a Service Item Changing the Invoice Format Creating a Service Invoice Editing an Invoice Voiding an Invoice Deleting an Invoice Entering Statement Charges Creating Billing Statements Processing Payments Displaying the Open Invoices Report Using the Income Tracker Receiving Payments for Invoices Making Deposits Handling Bounced Checks Working with Bank Accounts Writing a QuickBooks Check Voiding a QuickBooks Check Using Bank Account Registers Entering a Handwritten Check Transferring Funds Between Accounts Reconciling Checking Accounts Entering and Paying Bills Handling Expenses Using QuickBooks for Accounts Payable Entering Bills Paying Bills Entering Vendor Credit Using the EasyStep Interview Using the EasyStep Interview Additional course details: Nexus Humans Get Going With QuickBooks 2020 for Windows training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Get Going With QuickBooks 2020 for Windows course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Embark on a journey to establish a successful cleaning business in the UK with our comprehensive course. Learn start-up costs, business models, legal aspects, and client satisfaction strategies. Ideal for entrepreneurs eager to thrive in the cleaning industry.

Complete Massage Therapy Online Course This Investment Banking Training: LBO, IPO and M&A course gives you a clear and practical introduction to the world of investment banking. You will learn how investment banks operate, how they value companies, and how major financial deals like leveraged buyouts, initial public offerings and mergers and acquisitions work. The course explains these processes in a simple, step-by-step way, helping you build the skills to succeed in corporate finance and deal-making. Course Curriculum Module 1: Introduction to Investment Banking Module 2: Structure and Side of Investment Banking Module 3: Valuation Methods in Investment Banking Module 4: Leveraged Buyout (LBO) Module 5: Initial Public Offering (IPO) Module 6: Merger and Acquisition Module 7: Ethics in Investment Banking (Learn more about this online course)

Investment Banking: LBO, IPO and M&A Online Course This Investment Banking Training: LBO, IPO and M&A course gives you a clear and practical introduction to the world of investment banking. You will learn how investment banks operate, how they value companies, and how major financial deals like leveraged buyouts, initial public offerings and mergers and acquisitions work. The course explains these processes in a simple, step-by-step way, helping you build the skills to succeed in corporate finance and deal-making. Course Curriculum Module 01: COSHH Explained Module 02: COSHH Regulations Module 03: Health Problems Related to Hazardous Substances Module 04: Identifying Hazardous Substances Module 05: COSHH Risk Assessments Module 06: Control Measures and Monitoring Module 07: Implementing Control Measures (Learn more about this online course)

Online Video Marketing Online Course This Investment Banking Training: LBO, IPO and M&A course gives you a clear and practical introduction to the world of investment banking. You will learn how investment banks operate, how they value companies, and how major financial deals like leveraged buyouts, initial public offerings and mergers and acquisitions work. The course explains these processes in a simple, step-by-step way, helping you build the skills to succeed in corporate finance and deal-making. Course Curriculum Module 1: Introduction to Investment Banking Module 2: Structure and Side of Investment Banking Module 3: Valuation Methods in Investment Banking Module 4: Leveraged Buyout (LBO) Module 5: Initial Public Offering (IPO) Module 6: Merger and Acquisition Module 7: Ethics in Investment Banking (Learn more about this online course)

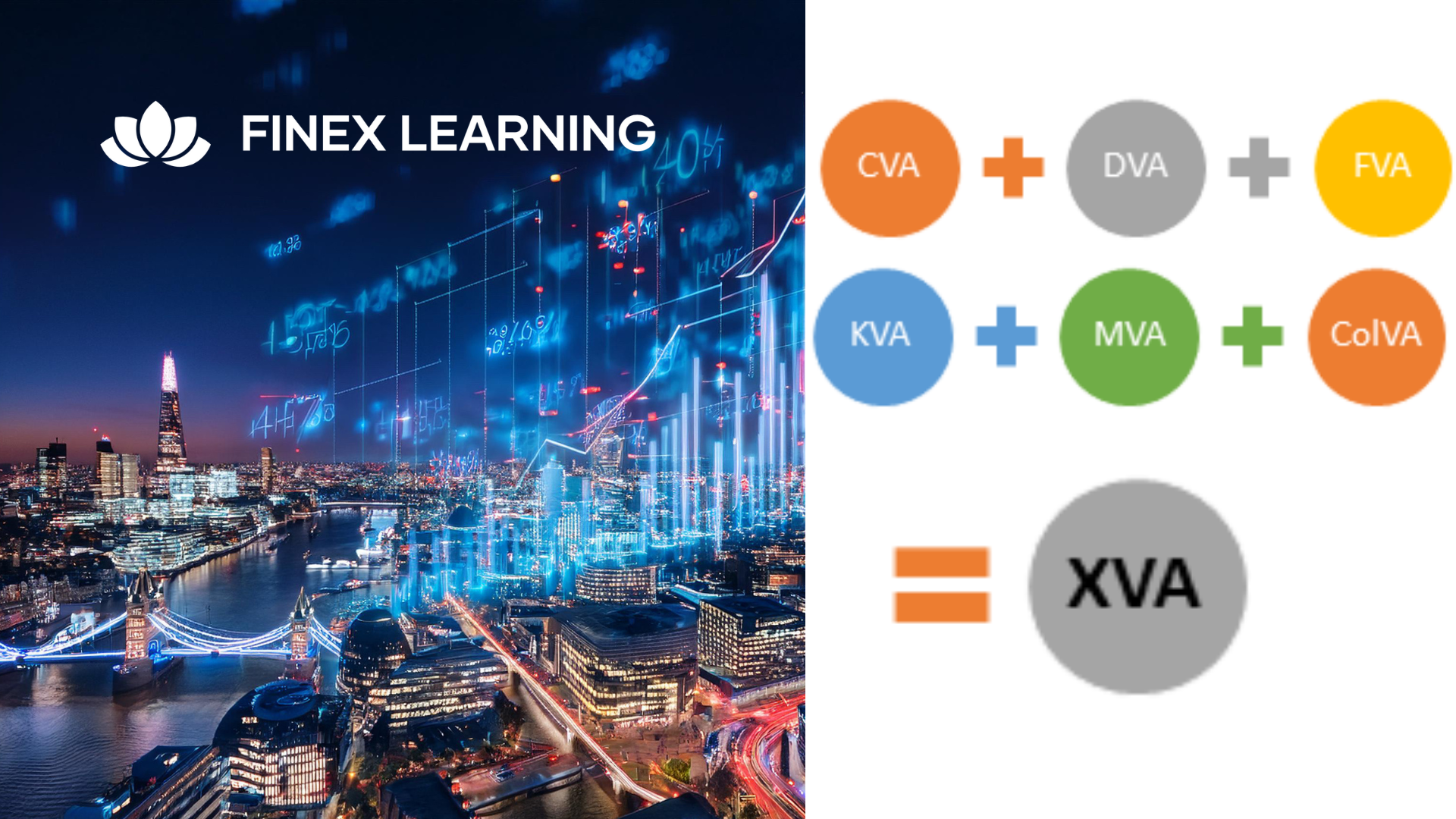

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Finance Courses in London

- Finance Courses in Birmingham

- Finance Courses in Glasgow

- Finance Courses in Liverpool

- Finance Courses in Bristol

- Finance Courses in Manchester

- Finance Courses in Sheffield

- Finance Courses in Leeds

- Finance Courses in Edinburgh

- Finance Courses in Leicester

- Finance Courses in Coventry

- Finance Courses in Bradford

- Finance Courses in Cardiff

- Finance Courses in Belfast

- Finance Courses in Nottingham