- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

213 Finance courses in Chorleywood

Contract and commercial management for practitioners (In-House)

By The In House Training Company

This five-day programme empowers participants with the skills and knowledge to understand and effectively apply best practice commercial and contracting principles and techniques, ensuring better contractor performance and greater value add. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Practitioner (CCMP) qualification. By the end of this comprehensive programme the participants will be able to: Develop robust contracting plans, including scopes of work and award strategies Undertake early market engagements to maximise competition Conduct effective contracting and commercial management activities, including ITT, RFP, negotiated outcomes Understand the legalities of contract and commercial management Negotiate effectively with key stakeholders and clients, making use of the key skills of persuading and influencing to optimise outcomes Undertake effective Supplier Relationship Management Appreciate the implications of national and organisational culture on contracting and commercial activities Appreciate professional contract management standards Set up and maintain contract and commercial management governance systems Take a proactive, collaborative, and agile approach to managing commercial contracts Develop and monitor appropriate and robust KPIs and SLAs to manage the contractor and facilitate improved contractor performance Appreciate the cross-functional nature of contract management Collaborate with clients to deliver sustainable performance and to manage and exceed client expectations Understand the roles and responsibilities of contract and commercial managers Use effective contractor selection and award methods and models (including the 10Cs model) and use these models to prepare robust propositions to clients Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Effectively manage the process of change, claims, variations, and dispute resolution Develop and present robust propositions Make appropriate use of best practice contract and commercial management tools, techniques, and templates DAY ONE 1 Introduction Aims Objectives KPIs Learning strategies Plan for the programme 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Critical success factors Essential features of professional commercial and contract management and administration The 6-step model 4 Putting the 'management' into commercial and contract management Traditional v 'new age' models The need for a commercial approach The added value generated 5 Definitions 'Commercial management' 'Contract management' 'Contracting' ... and why have formal contracts? 6 Stakeholders Stakeholder mapping and analysis The 'shared vision' concept Engaging with key functions, eg, HSE, finance, operations 7 Roles and responsibilities Contract administrators Stakeholders 8 Strategy and planning Developing effective contracting plans and strategies DAY TWO 1 Contract control Tools and techniques, including CPA and Gantt charts A project management approach Developing effective contract programmes 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Tendering Overview of the contracting cycle Requirement to tender Methods Rationale Exceptions Steps Gateways Controls One and two package bids 4 Tender assessment and contract award I - framework Tender board procedures Role of the tender board (including minor and major tender boards) Membership Administration Developing robust contract award strategies and presentations DAY THREE 1 Tender assessment and contract award II - processes Pre-qualification processes CRS Vendor registration rules and processes Creating bidder lists Disqualification criteria Short-listing Using the 10Cs model Contract award and contract execution processes 2 Minor works orders Process Need for competition Role and purpose Controls Risks 3 Contract strategy Types of contract Call-offs Framework agreements Price agreements Supply agreements 4 Contract terms I: Pricing structures Lump sum Unit price Cost plus Time and materials Alternative methods Target cost Gain share contracts Advance payments Price escalation clauses 5 Contract terms II: Other financial clauses Insurance Currencies Parent body guarantees Tender bonds Performance bonds Retentions Sub-contracting Termination Invoicing 6 Contract terms III: Risk and reward Incentive contracts Management and mitigation of contractual risk DAY FOUR 1 Contract terms IV: Jurisdiction and related matters Applicable laws and regulations Registration Commercial registry Commercial agencies 2 Managing the client-contractor relationship Types of relationship Driving forces Link between type of contract and style of relationships Motivation - use of incentives and remedies 3 Disputes Types of dispute Conflict resolution strategies Negotiation Mediation Arbitration DAY FIVE 1 Performance measurement KPIs Benchmarking Cost controls Validity of savings Balanced scorecards Using the KPI template 2 Personal qualities of the contract manager Negotiation Communication Persuasion and influencing Working in a matrix environment 3 Contract terms V: Drafting skills Drafting special terms 4 Variations Contract and works variation orders Causes of variations Risk management Controls Prevention Negotiation with contractors 5 Claims Claims management processes Controls Risk mitigation Schedules of rates 6 Close-out Contract close-out and acceptance / completion HSE Final payments Performance evaluation Capturing the learning 7 Close Review Final assessment Next steps

PfMP Exam Prep: In-House Training

By IIL Europe Ltd

PfMP® Exam Prep: In-House Training This is an intensive PfMP® Exam preparation course. This learning experience guides you through the multi-faceted discipline of portfolio management by focusing on the related technical, leadership, and business skills required to navigate it in the real world. First and foremost, this is an intensive PfMP® exam preparation course. Over the course, we go beyond exam prep to provide selected practice in applying key portfolio management skills, tools, and techniques. This learning experience guides you through the multi-faceted discipline of portfolio management by focusing on the related technical, leadership, and business skills required to navigate it in the real world. The journey zooms in and out between governance context and specific operational activities. The ultimate goal is practical application, with the bonus of certification along the way. What You Will Learn By the end of this program, you will be able to: Align and manage the portfolio, strategically, to satisfy organizational objectives and priorities, through benefit realization Articulate and emulate the role of a portfolio manager Apply the principles and skills of a portfolio manager to your real-world environment Study and prepare for the PfMP® Examination Apply for the certification, per the PMI PfMP Handbook and pass the initial panel review on your application Getting Started Course Overview Details of the PfMP® Certification process Foundation Concepts Projects, program, and portfolios A portfolio management process Strategy and value The role of the portfolio manager The role of key stakeholders Life cycle management The Portfolio Life Cycle Overview of Life Cycle Portfolio Management Information System (PMIS) Governance within the Portfolio Life Cycle Strategic Management Strategy concepts Supporting documentation and the strategic plan Planning and optimization Organizational risk appetite Managing strategic change Governance Management Overview and Guiding Principles The Concept of Governance Effective Design Factors Governance Roles Capacity and Capability Management Overview and Guiding Principles Capacity Management and Planning Supply and Demand (Management and Optimization) Organization Capabilities (Assessment and Development) Performance Management (Reporting, Analytics, and Balance) Stakeholder Engagement The Importance of Stakeholders Overview and Guiding Principles Definition and Identification Analysis and Planning Communications Approaches and Management Value Management Overview (Guiding Principles, Definition, and Components) Negotiating Expected Value Maximizing Value Assuring Value Realizing Value Measuring and Reporting Value A Look at Tools Risk Management Overview and Guiding Principles Portfolio Risk Planning Portfolio Risk Identification Portfolio Risk Assessment Portfolio Risk Response Examination Content Outline (ECO) Overview Structure Strategic Tasks Mapping Governance Tasks Mapping Performance Tasks Mapping Risk Tasks Mapping Communication Tasks Mapping List of Knowledge and Skills Exam Prep and Practice Overview Documenting experience Submitting the application Preparing to sit for the exam

A series of hourly small group sessions where we look at different aspects of Excel Duration: 1 hr sessions Alternatively, we can do you one-to-one sessions, either via virtual classroom or in person at our training course. These are £30 per hour, or £125 for 5-hour blocks.

Certified Associate in Project Management (CAPM) Exam Prep: In-House Training

By IIL Europe Ltd

Certified Associate in Project Management (CAPM)® Exam Prep: In-House Training: In-House Training This course gives you the knowledge you need to pass the exam and covers CAPM®-critical information on project management theory, principles, techniques, and methods Are you planning on taking the CAPM® examination? This course gives you the knowledge you need to pass the exam and covers CAPM®-critical information on project management theory, principles, techniques, and methods. You'll also have an opportunity for practical applications and time to review the kinds of questions you'll find in the CAPM® Exam. What you Will Learn Apply for the CAPM® Examination Develop a personal exam preparation plan Describe the structure, intent, and framework principles of the current edition of the PMBOK® Guide Explain the PMBOK® Guide Knowledge Areas, as well as their inter-relationships with the each other and the Process Groups Getting Started Program orientation The CAPM® certification process Certified Associate in Project Management (CAPM®) Examination Content Outline CAPM® eligibility requirements Code of Ethics and Professional Conduct Application options Foundation Concepts Skills and qualities of a project manager Project management terminology and definitions Relationship of project, program, portfolio, and operations management Project lifecycle approaches Project Integration Management Review Project Integration Management Knowledge Area Develop Project Charter Develop Project Management Plan Direct and Manage Project Work Manage Project Knowledge Monitoring and Controlling Perform Integrated Change Control Close Project or Phase Project Stakeholder Management Review Project Stakeholder Management Knowledge Area Identify Stakeholders Plan Stakeholder Engagement Manage Stakeholder Engagement Monitor Stakeholder Engagement Project Scope Management Review Project Scope Management Knowledge Area Plan Scope Management Collect Requirements Define Scope Create WBS Validate Scope Control Scope Project Schedule Management Review Project Schedule Management Knowledge Area Plan Schedule Management Define Activities Sequence Activities Estimate Activity Durations Develop Schedule Control Schedule Project Cost Management Review Project Cost Management Knowledge Area Plan Cost Management Estimate Costs Determine Budget Control Schedule Project Resource Management Review Project Resource Management Knowledge Area Plan Resource Management Estimate Activity Resources Acquire Resources Develop Team Manage Team Control Resources Project Quality Management Review Project Quality Management Knowledge Area Plan Quality Management Manage Quality Control Quality Project Risk Management Review Project Risk Management Knowledge Area Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Implement Risk Responses Monitor Risks Project Communications Management Review Project Communications Management Knowledge Area Plan Communications Management Manage Communications Monitor Communications Project Procurement Management Review Project Procurement Management Knowledge Area Plan Procurement Management Conduct Procurements Control Procurements Summary and Next Steps Program Review Mock CAPM® Exam Getting Prepared for the CAPM® Exam After the CAPM® Exam

M.D.D PRE-MARITAL COUNSELLING LONDON PACKAGE (COUPLES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Introducing Pre-Marital Counselling London Package: Building a Strong Foundation for a Lifelong Partnership Are you planning to tie the knot and seeking guidance to ensure a strong and healthy foundation for your marriage? Miss Date Doctor’s Pre-Marital Counselling London Package offers you expert support and valuable insights to prepare for a fulfilling and lasting partnership. Pre-marital counselling is a proactive approach that helps couples explore their expectations, communication styles, and potential areas of growth before entering into marriage. Our experienced counsellors in London are dedicated to helping you lay the groundwork for a successful and harmonious marriage. Here’s how the Pre-Marital Counselling London Package can support you: Effective Communication: Our counsellors will guide you in developing open and effective communication skills to express your feelings and needs clearly, fostering understanding and connection. Conflict Resolution: Pre-marital counselling addresses conflict resolution strategies, ensuring that you are equipped with healthy ways to navigate disagreements and challenges in your marriage. Exploring Expectations: We’ll help you and your partner explore and align your expectations about various aspects of marriage, such as roles, finances, family, and lifestyle. Strengthening Intimacy: Pre-marital counselling provides a safe space to discuss emotional and physical intimacy, fostering a deeper connection and understanding between you and your partner. Financial Planning: Our counsellors will assist you in creating a financial plan, emphasizing financial transparency and teamwork to manage shared resources. Building Trust: Trust is a fundamental aspect of a successful marriage. Pre-marital counselling helps you and your partner build and strengthen trust through open and honest discussions. Shared Values and Goals: We’ll explore your shared values and long-term goals, ensuring that you are aligned in your vision for the future. Handling Life Transitions: Pre-marital counselling can prepare you for various life transitions, such as starting a family, changing careers, or dealing with unexpected challenges. The Pre-Marital Counselling London Package at Miss Date Doctor offers you an opportunity to invest in the foundation of your marriage. Our skilled counsellors provide a safe and supportive space to discuss important topics, discover each other’s strengths, and build a solid framework for a successful partnership. Take the first step towards a joyful and harmonious marriage with the Pre-Marital Counselling London Package. Embrace the opportunity to grow together, nurture your relationship, and create a lasting bond that will withstand the tests of time. Let our experienced counsellors guide you towards a fulfilling and loving marriage that stands the test of time. 3 x 1 hour https://relationshipsmdd.com/product/pre-marital-counselling-london-package/

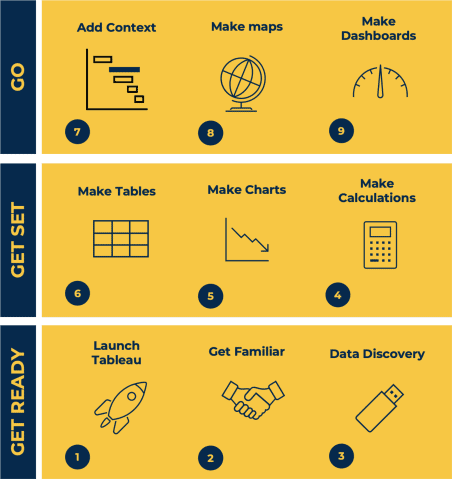

Tableau Desktop Training - Foundation

By Tableau Training Uk

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Fraud (In-House)

By The In House Training Company

Fraud should not happen, but it does. It can happen at the highest to lowest levels in an organisation. Recent surveys show that incidents of fraud are not decreasing. Fraud costs companies money and, perhaps even more importantly, reputational damage. The losers are not just the shareholders, suppliers, customers, etc, but society as a whole. This programme shows why frauds happen, how organisations put themselves at risk and what they can do to prevent it. This programme will help directors and others understand: The motives for committing fraud Directors' responsibilities for identifying and reporting fraud What types of frauds there are How frauds are perpetrated How they can be prevented How regulators deal with fraud Above all, the principal objective of this programme is to help make your organisation as secure as possible from the threat of fraud. 1 Motives for committing fraud - drivers of fraud Session objective: to understand why people might commit fraud Drivers of fraudulent behaviourAmbitionGreedTheftConceit? And more! 2 Accounting mechanisms that allow fraud Session objective: to review the elements of the accounting, internal control and management processes that allow creative accounting Income or liability? Asset or expense? Coding errors and misclassification Netting off and grossing up Off-balance sheet items 3 Structures that allow fraud Session objective: to consider company and trading structures that allow frauds to be perpetrated Group structures Trading structures Tax havens Importing and exporting 4 Interpretations and other non-compliance that allow fraud Session objective: to look at how creative interpretations of law and accounting practice may permit fraud The place of accounting standards Accounting policies Trading methods The place of auditing standards 5 Money laundering Session objective: to review what constitutes money laundering Types of money laundering Identifying laundering Preventing laundering 6 Preventing fraud - proper management structures Session objective: to review the place of proper corporate governance Corporate governance Company management structure Audit committees The place of internal audit 7 Preventing fraud - proper accounting Session objective: to review best accounting and auditing practice Accounting standards Internal accounting policies Adequacy of internal controls Internal audit 8 Preventing fraud - regulation Session objective: to look at how regulators aim to prevent fraud The regulatory environment Financial services regulation 9 Conclusion Course review Open forum Close 10 Course summary - developing your own cost action plan Group and individual action plans will be prepared with a view to participants identifying their cost risks areas and the techniques which can be immediately applied to improve costing and reduce costs

Overview A comprehensive and practical 3 days workshop on pricing, using and managing structured interest rate derivatives. What used to be called exotic interest rate derivatives are now commonplace and an essential part of the financial marketplace either as legacy transactions or embedded in new structures. This intensive course is for anyone who wishes to be able to use, price, manage, market or evaluate standard interest rate derivatives such as Constant Maturity Swaps, Range Accruals and Quantos. We also look in detail at such important products as CMS spread-linked structures and volatility/variance swaps, always from a pragmatic practitioner’s perspective. Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers IPV professionals Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

How to start a small business and set it up for success

By Accountant Calgary

Starting a small business can be a rewarding journey, but it requires careful planning and the right strategies to succeed. From creating a solid business plan to organizing finances and finding the right support, this guide will help you establish a foundation for a thriving business. For entrepreneurs in Calgary, key resources like reliable bookkeeping services can make a significant difference. Here’s how to start a small business and set it up for lasting success. Developing a business plan A clear, well-researched business plan serves as a roadmap for your business. It outlines your goals, target market, competitive advantage, and financial projections. This plan will also help attract investors or secure loans. To create an effective business plan: Define your mission and vision: Explain why your business exists and what you aim to achieve. Identify your target audience: Determine who your customers are and what problems your business will solve for them. Analyze competitors: Study your competitors to understand what they offer and find ways to differentiate your business. Set realistic financial projections: Estimate costs, revenue, and profits. This will give potential investors confidence in your business. Choosing a business structure Selecting the right business structure is essential, as it affects your taxes, liability, and daily operations. Common options include: Sole proprietorship: Simple to set up, with minimal paperwork, but offers no separation of personal and business liability. Partnership: Ideal for two or more owners, allowing shared responsibilities, but partners share liabilities. Corporation: Provides liability protection, but involves more paperwork and regulatory requirements. LLC (Limited Liability Company): Offers liability protection without the complexity of a corporation. Choose a structure that best suits your needs, and consult a legal professional to ensure compliance with Calgary’s business regulations. Securing funding Most small businesses require some level of funding to get started. Consider various financing options to find the best fit: Personal savings or family support: Often the first source of funding for many entrepreneurs. Business loans: Many banks offer small business loans with varying interest rates. Grants and government programs: Explore government grants and programs specifically designed to support small businesses in Calgary. Angel investors or venture capital: For businesses with high growth potential, attracting investors may be an option. Registering your business To operate legally, you’ll need to register your business. This process involves choosing a unique name, filing the necessary documents, and obtaining a business license in Calgary. You may also need specific permits depending on your industry. Completing these steps ensures that your business complies with all local regulations. Organizing your finances Managing finances effectively is crucial for any small business. Accurate bookkeeping keeps your business organized, tracks income and expenses, and prepares you for tax season. Many small businesses in Calgary choose to hire a bookkeeper in Calgary to handle these responsibilities, allowing owners to focus on growth. Working with one of the best bookkeeping services in Calgary can provide: Accurate financial records: Professional bookkeepers help maintain up-to-date records, which is essential for financial health. Compliance with tax laws: Calgary’s best bookkeeping services are familiar with local tax regulations, ensuring that you file correctly and on time. Insights for decision-making: With accurate records, you can make informed decisions on budgeting, spending, and investments. Creating a strong brand identity Building a brand that resonates with your target audience is essential. Your brand identity includes your business name, logo, colors, and messaging, as well as the experience you offer customers. Developing a consistent brand identity sets you apart from competitors and builds trust with customers. Here are some steps to create a strong brand identity: Design a logo and visual theme: Choose a professional logo, color scheme, and design elements that reflect your brand’s personality. Develop a unique brand voice: Whether it’s friendly, professional, or playful, keep your brand voice consistent in all communications. Focus on customer experience: Aim to provide exceptional service that keeps customers coming back and sharing their positive experiences. Building an online presence In today’s digital world, an online presence is crucial for reaching potential customers. Start by creating a professional website where customers can learn more about your products or services. Next, consider establishing a presence on social media platforms that suit your audience. Key components of a strong online presence include: User-friendly website: Make sure your website is easy to navigate, mobile-friendly, and includes essential information about your business. Social media profiles: Engage with customers and share updates on platforms like Facebook, Instagram, or LinkedIn. Google My Business: Setting up a Google My Business profile helps customers in Calgary find you more easily. Building a support network Running a small business can be challenging, and having a network of support is invaluable. Surround yourself with people who can provide advice, resources, and encouragement. Consider these ways to build a support network: Join local business associations: Groups like the Calgary Chamber of Commerce offer networking opportunities, resources, and workshops. Seek mentorship: Experienced business owners can offer guidance and insights that help you avoid common pitfalls. Hire professionals for specialized tasks: For financial and legal matters, work with professionals like accountants, lawyers, and bookkeepers. Tracking progress and making adjustments As your business grows, it’s essential to review your progress and adjust your strategies. Regularly assessing financial performance, customer feedback, and market trends can help you refine your approach and stay competitive. Working with one of the best bookkeeping services in Calgary can make tracking your financial performance much easier, giving you insight into profit margins, cash flow, and budgeting. Consider these strategies for tracking progress: Set measurable goals: Establish specific goals for growth, such as revenue targets or customer acquisition numbers. Analyze performance data: Use financial statements, sales reports, and customer feedback to assess performance. Stay flexible: Be willing to make changes to products, services, or marketing strategies if they aren’t meeting customer needs. Conclusion Starting a small business takes effort, planning, and ongoing management. By creating a solid business plan, organizing your finances, and developing a strong brand, you can set your business up for success. In Calgary, many new business owners choose to hire a bookkeeper in Calgary to ensure accurate financial management and stay compliant with local regulations. Taking advantage of the best bookkeeping services in Calgary can free up your time, allowing you to focus on growing your business and achieving long-term success. With dedication and the right strategies, your small business can thrive in today’s competitive market.

Overview 2 day course on key interest rate derivative products, covering both theory (product mechanics, market conventions and valuation) and practice (wide range of applications for wide range of market participants showcased) Who the course is for Interest rate traders, salespeople and quants Asset-liability management staff with banks and insurance companies Fixed income and credit asset managers / hedge funds / pension funds / insurance companies Corporate treasurers Risk management Anyone using interest rate derivatives Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Finance Courses in London

- Finance Courses in Birmingham

- Finance Courses in Glasgow

- Finance Courses in Liverpool

- Finance Courses in Bristol

- Finance Courses in Manchester

- Finance Courses in Sheffield

- Finance Courses in Leeds

- Finance Courses in Edinburgh

- Finance Courses in Leicester

- Finance Courses in Coventry

- Finance Courses in Bradford

- Finance Courses in Cardiff

- Finance Courses in Belfast

- Finance Courses in Nottingham