- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

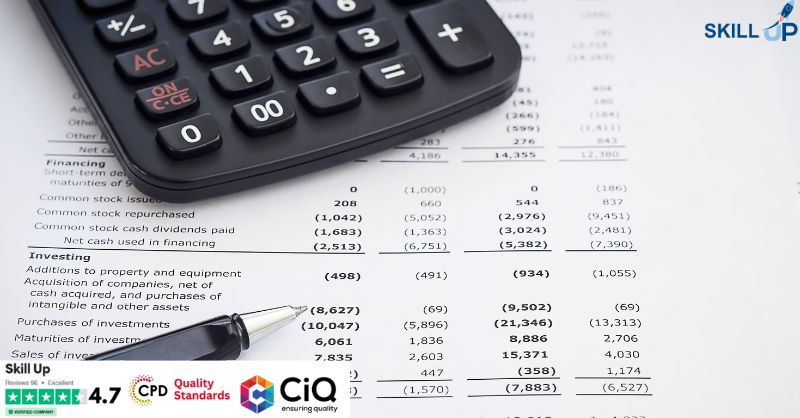

Mastering Financial Stability- Part 4 - Corporate Financial Reporting and Analysis

By Compete High

ð Unlock Financial Mastery with 'Mastering Financial Stability - Part 4: Corporate Financial Reporting and Analysis' ð Are you ready to elevate your financial acumen to new heights? Dive deep into the intricate world of corporate finance with our comprehensive online course - Part 4 of the highly acclaimed 'Mastering Financial Stability' series. ð Course Overview: 'Corporate Financial Reporting and Analysis' is your passport to unraveling the complexities of financial statements and making informed decisions for a prosperous financial future. This course is designed to empower you with the knowledge and skills necessary to navigate the dynamic landscape of corporate finance confidently. ð Curriculum Highlights: Module 1: Income Statement Explained ð Gain a solid foundation by understanding the core elements of the income statement. ð¡ Uncover the secrets behind revenue recognition and expense categorization. ð Learn to interpret key financial metrics for insightful analysis. Module 2: Income Statement Walk-Through Explained ð Take a guided tour through real-world income statements. ð Analyze case studies to develop a keen eye for identifying financial trends. ð Master the art of dissecting income statements for strategic decision-making. Module 3: Cash Flow Statement ð° Delve into the lifeblood of any business - cash flow. ð Understand the intricacies of operating, investing, and financing activities. ð Harness the power of cash flow analysis for robust financial forecasting. ð Why Choose 'Mastering Financial Stability - Part 4'? Expert Instruction: Learn from industry experts with years of practical experience in corporate finance. Interactive Learning: Engage in hands-on activities and real-world case studies to reinforce your understanding. Flexible Schedule: Study at your own pace, with 24/7 access to course materials. Practical Applications: Apply your newfound knowledge to real business scenarios for immediate impact. Lifetime Access: Enjoy unlimited access to course updates and new materials, ensuring your skills remain cutting-edge. ð¡ Who Should Enroll? Finance Professionals Business Analysts Entrepreneurs Students and Graduates Anyone Seeking Financial Mastery ð Secure Your Spot Today! Don't miss out on the opportunity to transform your financial expertise. Enroll in 'Mastering Financial Stability - Part 4' now and embark on a journey toward financial mastery. ð Click [here] to enroll and embark on your journey to financial mastery! [Insert Enroll Now Button] ð Elevate Your Financial Future - Enroll Today! ð Course Curriculum Income Statement Explained Income Statement and Cash Flow Considerations 00:00 Income Statement (P&L) Basics 00:00 Income Statement (P&L) Tells a Story about Your Business 00:00 Income Statement Walk-Through Explained 5 Key Areas of an Income Statement (P&L) 00:00 Income Statement (P&L) Inputs 00:00 Cash Flow Statement The Cash Flow Statement Worksheet 00:00 Modeling Styles Aggressive, Conservative, and Most Likely 00:00

Forex Trader Complete Bundle - QLS Endorsed

By Imperial Academy

10 QLS Endorsed Courses for Forex Trader | 10 QLS Hard Copy Certificates Included | Lifetime Access | Tutor Support

Managing accounts receivable isn't just about chasing invoices—it’s about mastering the flow of cash with the finesse of a financial conductor. This course takes you through the art and strategy behind credit control, client invoicing, and debt recovery without ever sounding like a textbook. Whether you’re polishing up your knowledge or stepping into the finance game with a keen eye, we’ve built this for the sharp-minded professional who knows every penny delayed is more than just a minor inconvenience. Expect a clear, structured approach to understanding how receivables shape business health and how to keep them in check. Learn how to minimise overdue payments, improve cash flow forecasting, and create smoother client transactions—without feeling like you’re lost in spreadsheets. If you're after savvy financial control without the fluff, this course is your ledger-friendly companion. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01 : Introduction to Accounts Receivable Management Module 02 : Credit Policies and Procedures Module 03 : Billing and Invoicing Module 04 : Receivables Collection Strategies Module 05 : Cash Application and Reconciliation Module 06 : Accounts Receivable Technologies and Trends Learning Outcomes: Analyse and implement efficient credit policies. Streamline billing and invoicing procedures. Develop effective receivables collection strategies. Master the art of cash application and reconciliation. Stay updated with the latest Accounts Receivable technologies and trends. Enhance your financial management skills for a competitive edge. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Finance professionals Business owners and managers Accountants Financial analysts Administrative professionals Anyone interested in financial management Graduates seeking to enhance their financial knowledge Those looking to advance their career in finance Career path Credit Manager Financial Analyst Accounts Receivable Specialist Finance Manager Business Owner Accounting Clerk Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

In today’s world, the accounting and finance industry is more competitive than ever and goes beyond simply having theoretical qualifications. Candidates who desire to make an impression are required to have an understanding of computerised packages such as Sage 50 Accounts & Microsoft Excel. Our 3-month training programme provides everything you need to become fully qualified in Sage 50 Accounts & Microsoft Excel. Once you have completed your training session you will gain accredited certifications and three months of remote experience directly with one of our clients. After completing this programme candidates will be able to showcase that they have the following: Sage 50 Accounts Beginners Sage 50 Accounts Intermediate Sage 50 Accounts Advanced Microsoft Excel for Accountants beginners to advanced 3 months of remote work experience Job reference Career support This comprehensive training programme has been developed to enhance your CV and boost your job prospects. CPD 480 CPD hours / pointsAccredited by The CPD Certification Service Description What’s included 3 months access to the online course Professional qualifications Guaranteed work placement (12 weeks) Accountancy certifications Learn industry-leading software to stand out from the crowd Information-packed practical training starting from basics to advance principles Course content designed considering current software and the job market trends A practical learning experience working with live company data Who is this course for? Part Qualified, Freshly Qualified Accountancy Students Graduates with No or little Job Experience Students Currently Studying or intending to study Accountancy or want to refresh knowledge on tax and accounting People who are already working in the industry but want to gain further knowledge about tax and accounting And Thinking of opening an accountancy/Tax/Payroll Practice Requirements There are no formal entry requirements for this course. We also expect the candidates to have basic knowledge of Accountancy. Career path Candidates who have completed this programme have secured jobs in the following roles; Trainee Accountant – Salary £24,750 Credit Controller – Salary £21,434.43 General Ledger Accountant – Salary £23,850.60 Accountant – Salary £28,985.77 Insurance Accountant – Salary £29,541.25

Financial Probing for Business

By Compete High

Unleash the Power of Financial Probing for Business! ð¼ð° Are you ready to unlock the secrets of financial success in the world of business? Introducing our groundbreaking course: Financial Probing for Business! ð What is Financial Probing? Financial probing is a strategic approach to analyzing and understanding the financial aspects of a business. It involves delving deep into financial data, identifying key metrics, and uncovering valuable insights that drive informed decision-making and business growth. With the right skills and knowledge, financial probing can be a game-changer for businesses of all sizes, from startups to multinational corporations. Why Take Our Course? ð Uncover Hidden Opportunities: Learn how to dig beneath the surface of financial statements to uncover hidden opportunities for growth and profitability. ð Drive Informed Decisions: Gain the skills to interpret financial data accurately, empowering you to make informed decisions that drive business success. ð¡ Strategic Insights: Discover how to extract strategic insights from financial information, enabling you to anticipate market trends and stay ahead of the competition. ð Global Perspective: Our course offers a global perspective, equipping you with the knowledge to navigate financial landscapes across different industries and regions. ð©âð¼ Enhanced Professional Skills: Develop highly sought-after skills that are valued in a wide range of industries, from finance and consulting to entrepreneurship and beyond. Who is this for? ð©âð¼ Business Professionals: Whether you're a seasoned executive or an aspiring entrepreneur, our course is designed to help you sharpen your financial acumen and drive business success. ð Students and Graduates: Gain a competitive edge in the job market by mastering the art of financial probing and demonstrating your ability to analyze and interpret financial data with confidence. ð¼ Small Business Owners: Take control of your financial future and gain valuable insights into your business's financial health, enabling you to make strategic decisions that drive growth and profitability. Career Path ð Financial Analyst: Become a trusted advisor to businesses by providing in-depth financial analysis and strategic insights. ð Business Consultant: Help businesses optimize their financial performance and achieve their strategic objectives through expert financial probing. ð Entrepreneur: Use your financial probing skills to identify opportunities, mitigate risks, and drive the success of your own ventures. ð Global Business Leader: Lead multinational organizations with confidence, leveraging your expertise in financial probing to make informed decisions in diverse market environments. FAQ Q: Is this course suitable for beginners? A: Yes! Our course is designed to cater to learners of all levels, from beginners to experienced professionals. We start with the fundamentals and gradually build upon them to ensure everyone can follow along and grasp the concepts effectively. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and commitment. On average, learners complete the course within [insert estimated duration], but you have the flexibility to study at your own pace. Q: Will I receive a certificate upon completion? A: Yes! Upon successfully completing the course, you will receive a certificate of achievement, which you can proudly showcase on your resume and LinkedIn profile to enhance your professional credentials. Q: Can I access the course materials on mobile devices? A: Absolutely! Our course platform is fully mobile-responsive, allowing you to access the course materials anytime, anywhere, from your smartphone or tablet. Q: Is there any prerequisite knowledge required? A: While prior knowledge of finance or business may be beneficial, it is not a requirement. Our course covers the fundamentals and is designed to be accessible to learners from diverse backgrounds. Enroll Today and Unlock Your Financial Potential! Don't miss out on this opportunity to transform your understanding of business finance and propel your career to new heights. Enroll now in Financial Probing for Business and take the first step towards a brighter financial future! ðð¼ð° Course Curriculum Module 1 Introduction to Financial Probing Introduction to Financial Probing 00:00 Module 2 Financial Data Collection and Analysis Financial Data Collection and Analysis 00:00 Module 3 Financial Probing for Investment and Risk Assessment Financial Probing for Investment and Risk Assessment 00:00 Module 4 Financial Probing for Strategic Planning and Performance Evaluation Financial Probing for Strategic Planning and Performance Evaluation 00:00 Module 5 Financial Probing for Working Capital Management and Operational Efficiency Financial Probing for Working Capital Management and Operational Efficiency 00:00 Module 6 Financial Probing for Risk Management and Compliance Financial Probing for Risk Management and Compliance 00:00

Accounting is at the heart of every successful business, and understanding its fundamentals is key to making informed financial decisions. The Introduction to Accounting Fundamentals Course offers a clear and accessible pathway into the world of accounting, perfect for those who want to build a strong foundation in financial management. By grasping core principles like double-entry bookkeeping, financial statements, and cost analysis, this course will give you a solid understanding of how businesses track and manage their financial transactions. Whether you're looking to work in accounting or simply want to improve your financial literacy, this course offers valuable insights into the basic concepts of the field. It’s ideal for beginners and those who wish to refresh their knowledge, giving you the confidence to understand the financial workings behind everyday business operations. With clear explanations and engaging content, you’ll quickly become familiar with the essential terminology and processes. A great first step for anyone seeking to navigate the world of business finance with ease and assurance. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Accounting Module 02: Who are Accountants? Module 03: The Accounting System Module 04: What are Financial Statements? Module 05: Introduction to Financial Statement Analysis Module 06: Budgeting and Its Importance Module 07: Financial Markets and Bonds Module 08: Dealing with Financial Risk Management Module 09: Investment Management and Analysis Module 10: Auditing and Risk of Frauds Learning Outcomes: Analyse financial statements proficiently. Grasp the intricacies of financial risk management. Demonstrate competence in investment analysis. Navigate the dynamics of financial markets and bonds. Develop budgeting skills for effective financial management. Gain insights into auditing and the prevention of frauds. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Recent graduates with a finance-related degree. Professionals seeking to enhance financial knowledge. Individuals aspiring to enter the finance sector. Accounting enthusiasts eager to deepen their understanding. Business students looking to master financial analysis. Career changers aiming for roles in financial management. Entrepreneurs wanting to manage their business finances effectively. Anyone keen on understanding the complexities of accounting. Career path Financial Analyst Audit Associate Investment Analyst Budget Analyst Risk Management Officer Finance Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

***24 Hour Limited Time Flash Sale*** QLS Endorsed AML and KYC Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Discover a world of opportunity with our AML and KYC - QLS Certificate bundle. This all-inclusive learning package features 7 powerful courses, including 2 QLS-endorsed courses - Certificate in Anti Money Laundering (AML) and KYC. Enhance your theoretical understanding of these fields, as our courses are backed by the Quality License Scheme. Once completed, you'll receive a hardcopy certificate for these two courses, a valuable addition to your professional portfolio. But the learning doesn't stop there. Delve into 5 more relevant CPD QS accredited courses, designed to complement your AML and KYC knowledge. As you journey through Financial Investigator: Financial Crimes, Certificate in Compliance, Internal Audit Skills, GDPR, and Financial Management, you'll acquire a comprehensive grasp of finance's pivotal aspects, nurturing a profound theoretical understanding. Equip yourself with an AML and KYC bundle, your pathway to an accomplished future. This bundle comprises the following courses: QLS Endorsed Courses: Course 01: Diploma in Anti-Money Laundering (AML) Training at QLS Level 4 Course 02: Certificate in KYC at QLS Level 3 CPD QS Accredited Courses: Course 03: Financial Investigator : Financial Crimes Course 04: Certificate in Compliance Course 05: Internal audit skills Course 06: GDPR Course 07: Financial Management Learning Outcomes By the end of this AML and KYC - QLS Certificate bundle course,learners will be able to: Gain a comprehensive understanding of Anti Money Laundering (AML) principles and procedures. Develop a strong foundational knowledge of KYC regulations. Master the techniques used in financial investigations pertaining to financial crimes. Gain a solid understanding of compliance in the financial sector. Build your internal audit skills to enhance organisational efficiency. Understand the intricacies of GDPR and how it impacts financial institutions. Grasp essential financial management principles to improve decision making. Attain a hardcopy certificate for the 2 QLS-endorsed courses. This course bundle uniquely weaves together crucial aspects of AML and KYC, financial investigation, compliance, internal audit skills, GDPR, and financial management. By diving into the theoretical underpinnings of these fields, you will cultivate a well-rounded understanding of financial regulation. The QLS-endorsed courses offer an in-depth study of AML and KYC, crucial elements in maintaining financial transparency and integrity. The CPD QS accredited courses round off your learning with a broader look at relevant aspects of the financial sector. The end result? A robust, in-depth understanding of finance's core aspects. Knowledge from these courses can enable you to navigate the financial landscape efficiently, leading to more informed decisions and better risk management. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This AML and KYC - QLS Certificate course is ideal for: Individuals aspiring to enter finance and looking to understand its core concepts. Professionals in the financial sector aiming to enhance their knowledge base. Compliance officers seeking to improve their understanding of AML and KYC. Auditors aiming to expand their skillset and knowledge in finance. Career path Anti-Money Laundering (AML) Specialist - £35,000 to £50,000 annually KYC Analyst - £30,000 to £45,000 annually Financial Investigator - £40,000 to £60,000 annually Compliance Officer - £30,000 to £50,000 annually Internal Auditor - £30,000 to £55,000 annually Financial Manager - £45,000 to £65,000 annually Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Financial Management - QLS Endorsed Certificate

By Imperial Academy

5 QLS Endorsed Course With Certificates | 5-in-1 Bundle | CPD Accredited | Career Guided Program | Lifetime Access

Excel Skills for Financial Modelling

By Capital City Training & Consulting Ltd

Enroll today and gain the Excel modelling skills needed for corporate finance roles, investment analysis, business planning, and data-driven decision making. 2+ Hours of Video 4+ Hours to Complete10+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Excel Financial Modelling program teaches the essential Excel skills needed to build flexible and dynamic financial models. Financial modelling is a vital skill for business analysts, investment bankers, corporate financiers, and other finance professionals. Through step-by-step video lessons and over 30 hands-on exercises, this course will teach you Excel best practices to analyse financial data, forecast business performance, and evaluate strategic decisions. The self-paced online format is ideal for busy professionals looking to expand their financial analysis skillset. With over 7 hours of content, our program covers everything you need to become an expert in using Excel to build financial models. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Time Value of Money Principles and Calculations Net Present Value and Internal Rate of Return Metrics Calculating Averages and Statistical Measures Understanding and Measuring Financial Risk 16+ Practice Exercises and Applications Certificate Upon Successful Course Completion