- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

357 Finance For Non Finance Managers courses in Cardiff delivered On Demand

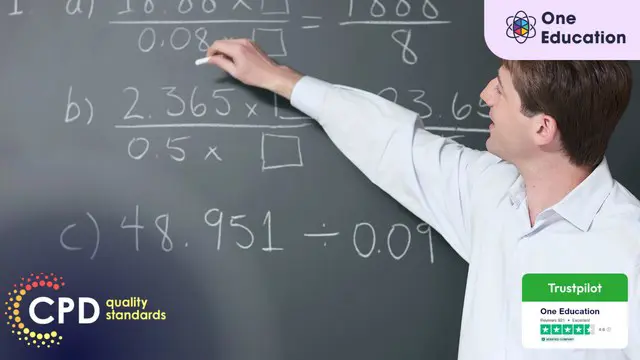

Functional Maths Training Course

By One Education

Functional Maths is about making numbers make sense – not just for passing exams, but for managing life’s everyday calculations with confidence. Whether it’s understanding bills, working out measurements, or getting to grips with percentages, this course is designed to build a solid foundation in essential maths skills, with clarity and a touch of common sense. Created for learners who want to feel more in control when numbers show up in daily life, this course breaks down the basics in a straightforward and engaging way. No confusing jargon, no unnecessary waffle – just clear explanations and useful examples. Perfect for brushing up rusty skills or gaining the confidence to take the next step, it’s a practical route to sharper numeracy that fits neatly into your schedule. Learning Outcomes: Master mathematical concepts such as integers, rational numbers, and decimals. Apply mathematical principles to solve everyday problems with ease. Simplify complex calculations using BODMAS rules. Estimate values using scientific notation and approximation techniques. Understand basic financial calculations such as profit, loss, discounts, and taxes. Work confidently with resources and materials to improve your mathematical skills This Functional Maths Training Course provides an extensive curriculum designed to help you gain practical mathematical skills. You will learn the principles of integers, rational and decimal numbers, percentages, ratios and proportions, and the unitary method. Additionally, you will understand how to calculate profit, loss, discounts, and taxes, making you an expert in basic financial calculations. The course provides a range of benefits, including the ability to estimate values using scientific notation, apply BODMAS rules to simplify complex calculations, and use fractions to solve problems. You will also gain the ability to work with resources and materials that help improve your mathematical skills. By the end of this course, you will have a solid foundation in maths, making it easier to solve problems in everyday life. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK (An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data entry clerk (£17,000 - £23,000) Retail sales assistant (£14,000 - £22,000) Bank cashier (£15,000 - £25,000) Administrative assistant (£17,000 - £25,000) Stock control clerk (£16,000 - £23,000) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Description: Budgets help organizations make financial plans and understand where money needs to be spent. It is a necessary skill all managers must possess in today's business world. Now with the help of this Budgets and Money Management Diploma Level 3 course, you can develop said skills. Through this course, you will be able to understand the fundamentals of finance and build a strong base. This is achieved by studying financial terminology, budgets of different types and sizes, budget approval process, ratio analysis and financial decisions. So get this course to learn all of these and keep your team out of the red. Learning Outcomes: Provide a definition of financial terminology Make a budget of any kind or size Have your budget approved Execute fundamental ratio analysis Take smarter financial decisions Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Budgets and Money Management Diploma Level 3 is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Budgets and Money Management Diploma Level 3 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Modules Course Overview 00:15:00 Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Mock Exam Mock Exam- Budgets and Money Management Diploma Level 3 00:20:00 Final Exam Final Exam- Budgets and Money Management Diploma Level 3 00:20:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview This comprehensive course on Financial Modelling Course - Learn Online will deepen your understanding on this topic.After successful completion of this course you can acquire the required skills in this sector. This Financial Modelling Course - Learn Online comes with accredited certification, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Financial Modelling Course - Learn Online. It is available to all students, of all academic backgrounds. Requirements Our Financial Modelling Course - Learn Online is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G.There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 1 sections • 8 lectures • 04:26:00 total length •Module 01: Basic Financial Calculations: 00:34:00 •Module 02: Overview of Financial Markets, Financial Assets, and Market Participants: 00:35:00 •Module 03: Financial Statement Modelling: 00:28:00 •Module 04: Types of Financial Models: 00:33:00 •Module 05: Sensitivity Analysis: 00:36:00 •Module 06: Sales and Revenue Model: 00:34:00 •Module 07: Cost of Goods Sold and Inventory Model: 00:36:00 •Module 08: Valuation Methods: 00:30:00

Overview This comprehensive course on Corporate Finance: Profitability in a Financial Downturn will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Corporate Finance: Profitability in a Financial Downturn comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Corporate Finance: Profitability in a Financial Downturn. It is available to all students, of all academic backgrounds. Requirements Our Corporate Finance: Profitability in a Financial Downturn is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 2 sections • 10 lectures • 02:42:00 total length •Module 1 - Introduction to Corporate Finance: 00:10:00 •Module 2 - Long Term Financial Planning and Growth: 00:28:00 •Module 3 - Analysis of the Financial Statement: 00:28:00 •Module 4 - Capital Budgeting: 00:26:00 •Module 5 - Financial Risk-Return Tradeoff: 00:18:00 •Module 6 - Profitability During Financial Downturn: 00:13:00 •Module 7 - Managing Profitability in Financial Downturn: 00:13:00 •Module 8 - Corporate Finance Regulations: 00:14:00 •Module 9 - Career Path in Corporate Finance: 00:12:00 •Assignment - Corporate Finance: Profitability in a Financial Downturn: 00:00:00

Overview This comprehensive course on History of Corporate Finance In a Nutshell will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This History of Corporate Finance In a Nutshell comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this History of Corporate Finance In a Nutshell. It is available to all students, of all academic backgrounds. Requirements Our History of Corporate Finance In a Nutshell is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 11 sections • 16 lectures • 02:11:00 total length •Introduction: 00:01:00 •Introduction.pdf: 00:02:00 •Financial and Capital Markets: 00:09:00 •The Importance of Intellectual Property Protection: 00:09:00 •Role of Government in Financial Markets: 00:12:00 •Market Efficiency and Market Crashes: 00:12:00 •Risk and Diversification: 00:15:00 •Call Options: 00:08:00 •Put Options: 00:03:00 •Shorting Call Options: 00:04:00 •Shorting Put Options: 00:03:00 •Mergers and Acquisitions: 00:25:00 •Takeovers, Leveraged Buyouts and Defence Tactics: 00:16:00 •2008 U.S. Financial Housing Collapse: 00:11:00 •Conclusion: 00:01:00 •Assignment - History of Corporate Finance In a Nutshell: 00:00:00

Register on the Improve your Financial Intelligence today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Improve your Financial Intelligence is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Improve your Financial Intelligence Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Improve your Financial Intelligence, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Section 01: Introduction Introduction - Don't be Afraid 00:04:00 Section 02: The Three Key Financial Statements Key Financial Statements - Introduction 00:01:00 The Balance Sheet - Introduction 00:03:00 The Balance Sheet - Assets, Liabilities, Owners Equity 00:04:00 The Balance Sheet - How it relates to you 00:06:00 The Income Statement - Introduction 00:04:00 The Income Statement - How it relates to you 00:03:00 The Cashflow Statement - Introduction 00:04:00 The Cashflow Statement - How it relates to you 00:01:00 Key Financial Statements - Summary 00:01:00 Section 03: Ratio Analysis The Money Making Metrics 00:03:00 Ratio Analysis 00:02:00 Profitability Ratios 00:03:00 Operating Ratios 00:02:00 Liquidity and Leverage Ratios 00:03:00 How Ratio Analysis Impacts you 00:03:00 Section 04: Profit vs Cash Profit â Cash 00:03:00 Cash but no Profit 00:05:00 Cash but no Profit 00:05:00 Why understanding the Cashflow statement matters 00:04:00 Section 05: Managing Working Capital Managing Days Sales Outstanding 00:04:00 Managing Inventory 00:03:00 Working Capital - Case Study 00:05:00 Section 06: Return on Investments Return on Investments 00:04:00 Return on Investments - Calculations 00:04:00 Section 07: A broader Perspective Five Traps 00:04:00 Section 08: How much have you learned Course Completion 00:01:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Overview This comprehensive course on Corporate Finance and Investment Decisions will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Corporate Finance and Investment Decisions comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Corporate Finance and Investment Decisions. It is available to all students, of all academic backgrounds. Requirements Our Corporate Finance and Investment Decisions is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 14 sections • 27 lectures • 03:45:00 total length •Introduction: 00:07:00 •Financing Growth: 00:11:00 •Managing Working Capital: 00:11:00 •Capital Structure: 00:09:00 •What is Leverage?: 00:09:00 •Factors for Capital Structure: 00:06:00 •Term of Funding: 00:06:00 •Risk Appetite & Corporate Strategy: 00:08:00 •Corporate Strategy with Market Condition: 00:09:00 •Cost of Equity: 00:04:00 •Implications of Capital: 00:12:00 •Return of Equity: 00:11:00 •Senior Secured Debt: 00:05:00 •Cost of Capital: 00:08:00 •Cost of Preferred Equity: 00:06:00 •Expected ROE: 00:06:00 •Expected Returns: 00:08:00 •WACC: 00:11:00 •Independent Projects: 00:06:00 •Time Value of Money: 00:08:00 •Time Value of Money - Excel Model: 00:11:00 •Ongoing Maintanence: 00:10:00 •Cash Flows as PAT: 00:10:00 •Discount Rate: 00:10:00 •Time Value of Money: 00:08:00 •Ranking the Projects: 00:06:00 •Conclusion: 00:09:00

Do you need to enhance your financial proficiency and insight? Then this course is for you. Description: Many workers do not have the enough financial understanding important to settle on key organisational choices. This course attempts to ease this challenge by creating financial recognition and analytical skills to advance long haul financial well-being. This course helps the students to manage their cash flow according to their current need and future goals. It also empowers the students to think to create new various financial options. Finally, it introduces them to the most important rule of investing and helps them get out of a financial mess. Who is the course for? Individuals who might want to learn more about investing. Individuals who view themselves as business visionaries. Individuals looking for creating extra streams of income. Individuals who want to have control over their financial future. Individuals who are financially struggling. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Developing Financial IQ is a useful qualification to possess, and would be beneficial for the following careers: Financial accountant. Strategy manager. Finance administrator. Operation director. Financial advisor. Consultant (Finance and Accounts). Chapter-01 Introduction To Financial IQ 01:00:00 Chapter-02 Essential Ways To Build Wealth 01:00:00 Chapter-03 When's The Right Time To Invest? 01:00:00 Chapter-04 The Methods Of Financial Mess 01:00:00 Mock Exam Mock Exam- Developing Financial IQ 00:20:00 Final Exam Final Exam- Developing Financial IQ 00:20:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Navigate the complexities of financial resilience with our course, 'Corporate Finance: Profitability in a Financial Downturn'. This curriculum, thoughtfully structured into nine modules, offers an enriching learning experience focused on maintaining and enhancing corporate financial health during challenging economic times. Starting with an introduction to the principles of corporate finance, the course sets a strong foundation, preparing learners for more intricate topics. Advancing through the modules, participants are guided through long-term financial planning and growth strategies, crucial for sustaining business operations. The course delves into detailed financial statement analysis, capital budgeting techniques, and the balancing act of financial risk and return. Special attention is given to navigating periods of financial downturn, with two dedicated modules on sustaining and managing profitability during such challenging times. Learning Outcomes Gain a comprehensive understanding of corporate finance fundamentals. Develop strategic insights into long-term financial planning and growth. Master the skill of thorough financial statement analysis. Learn capital budgeting techniques and understand the risk-return tradeoff. Acquire strategies for managing and sustaining profitability during financial downturns. Why choose this Corporate Finance: Profitability in a Financial Downturn course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Corporate Finance: Profitability in a Financial Downturn course for? Business executives and managers aiming to fortify their financial decision-making skills. Financial analysts and advisors seeking advanced knowledge in corporate finance. Entrepreneurs and business owners desiring to navigate financial downturns effectively. Students and professionals aspiring to build a career in corporate finance. Corporate finance regulators and policy makers looking to deepen their industry understanding. Career path Financial Manager: £40,000 - £80,000 Investment Analyst: £35,000 - £70,000 Corporate Finance Advisor: £45,000 - £90,000 Chief Financial Officer (CFO): £60,000 - £120,000 Risk Management Specialist: £30,000 - £60,000 Financial Planner: £28,000 - £55,000 Prerequisites This Corporate Finance: Profitability in a Financial Downturn does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Corporate Finance: Profitability in a Financial Downturn Module 1 - Introduction to Corporate Finance 00:10:00 Module 2 - Long Term Financial Planning and Growth 00:28:00 Module 3 - Analysis of the Financial Statement 00:28:00 Module 4 - Capital Budgeting 00:26:00 Module 5 - Financial Risk-Return Tradeoff 00:18:00 Module 6 - Profitability During Financial Downturn 00:13:00 Module 7 - Managing Profitability in Financial Downturn 00:13:00 Module 8 - Corporate Finance Regulations 00:14:00 Module 9 - Career Path in Corporate Finance 00:12:00 Assignment Assignment - Corporate Finance: Profitability in a Financial Downturn 00:00:00

Household Financing

By Compete High

Unlock Financial Freedom with Household Financing Mastery! ð ð° Are you tired of feeling overwhelmed by your household finances? Do you want to take control of your financial future and build wealth for you and your family? Look no further! Our comprehensive text course, 'Household Financing,' is your key to unlocking financial freedom and mastering the art of managing your household finances like a pro. Why Choose 'Household Financing'? In today's fast-paced world, managing household finances can be challenging. From budgeting and saving to investing and retirement planning, there's a lot to consider. Our text course provides you with the essential knowledge and practical strategies you need to navigate the complexities of household financing with confidence. Expert Guidance: Learn from seasoned financial experts who have years of experience in managing household finances successfully. Our instructors will guide you through every aspect of household financing, providing you with invaluable insights and tips along the way. Comprehensive Curriculum: Our text course covers a wide range of topics, including budgeting, saving, investing, debt management, insurance, and retirement planning. Whether you're a beginner or have some experience with household finances, you'll find valuable information and resources to help you achieve your financial goals. Flexible Learning: With our text-based format, you can learn at your own pace and on your own schedule. Whether you prefer to study on your morning commute, during your lunch break, or in the comfort of your own home, our course allows you to access the material whenever and wherever it's convenient for you. Practical Tools and Resources: Gain access to practical tools, worksheets, and resources that you can use to apply what you've learned to your own household finances. From budget templates to investment calculators, we provide you with everything you need to put your newfound knowledge into action. Lifetime Access: Once you enroll in our course, you'll enjoy lifetime access to all course materials and updates. Whether you want to revisit a specific topic or stay up-to-date on the latest trends and best practices in household financing, you'll have access to our resources for years to come. Who is This For? Our 'Household Financing' text course is perfect for anyone who wants to take control of their household finances and build a secure financial future. Whether you're a young professional just starting out, a newlywed couple planning for the future, or a seasoned homeowner looking to optimize your finances, this course is for you. No prior experience or expertise in finance is required - just a desire to learn and improve your financial literacy. Career Path While 'Household Financing' is primarily designed for personal finance management, the skills and knowledge you gain from this course can also open doors to various career opportunities in the financial services industry. Whether you're interested in becoming a financial advisor, investment analyst, or personal finance consultant, the insights and expertise you acquire through this course will provide a solid foundation for pursuing a career in finance. FAQs Q: Is this course suitable for beginners? A: Absolutely! Our 'Household Financing' course is designed to cater to individuals of all levels of experience with household finances. Whether you're a beginner looking to build a solid financial foundation or someone with some experience seeking to refine your skills, you'll find value in our course. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and the amount of time you dedicate to studying each module. However, most students complete the course within a few weeks to a couple of months. Q: Can I access the course materials on my mobile device? A: Yes, absolutely! Our text-based format allows you to access the course materials on any device with an internet connection, including smartphones and tablets. Study on the go, at your own convenience. Q: Is there a money-back guarantee? A: Yes, we offer a 100% satisfaction guarantee. If you're not completely satisfied with the course, simply let us know within 30 days of enrollment, and we'll issue a full refund, no questions asked. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course, you will receive a certificate of achievement to showcase your newfound knowledge and skills in household financing. Don't Wait - Enroll Today! Don't let financial uncertainty hold you back from achieving your dreams. Take control of your household finances today with our 'Household Financing' text course and embark on the path to financial freedom and security. Enroll now and start building a brighter financial future for you and your loved ones! ððµ Course Curriculum Module 1 Foundations of Household Financing Foundations of Household Financing 00:00 Module 2 Creating and Managing Your Household Budget Creating and Managing Your Household Budget 00:00 Module 3 Building Wealth through Saving and Investing Building Wealth through Saving and Investing 00:00 Module 4 Managing Debt Responsibly for Financial Freedom Managing Debt Responsibly for Financial Freedom 00:00 Module 5 Building Financial Resilience through Emergency Funds Building Financial Resilience through Emergency Funds 00:00 Module 6 Navigating the World of Credit Scores and Reports Navigating the World of Credit Scores and Reports 00:00 Module 7 Safeguarding Your Financial Future through Risk Management and Insurance Safeguarding Your Financial Future through Risk Management and Insurance 00:00