- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1582 Finance Cert & Exam Prep courses delivered Online

Overview This comprehensive course on Strategic Planning and Analysis for Marketing will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Strategic Planning and Analysis for Marketing comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? After successfully completing the course you will be able to order your certificate, these are included in the price. Who is This course for? There is no experience or previous qualifications required for enrolment on this Strategic Planning and Analysis for Marketing. It is available to all students, of all academic backgrounds. Requirements Our Strategic Planning and Analysis for Marketing is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 3 sections • 11 lectures • 03:30:00 total length •Module 1: An Introduction to Strategic Planning: 00:15:00 •Module 2: Development of a Strategic Plan: 00:23:00 •Module 3: Strategic Planning for Marketing: 00:12:00 •Module 4: Strategic and Marketing Analysis: 00:13:00 •Module 5: Internal Analysis: 00:23:00 •Module 6: External Analysis: 00:23:00 •Module 7: Market Segmentation, Targeting and Positioning: 00:16:00 •Module 8: Approaches to Customer Analysis: 00:22:00 •Module 9: Approaches to Competitor Analysis: 00:23:00 •Mock Exam - Strategic Planning and Analysis for Marketing: 00:20:00 •Final Exam - Strategic Planning and Analysis for Marketing: 00:20:00

Overview This comprehensive course on Corporate Finance: Profitability in a Financial Downturn will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Corporate Finance: Profitability in a Financial Downturn comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Corporate Finance: Profitability in a Financial Downturn. It is available to all students, of all academic backgrounds. Requirements Our Corporate Finance: Profitability in a Financial Downturn is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 2 sections • 10 lectures • 02:42:00 total length •Module 1 - Introduction to Corporate Finance: 00:10:00 •Module 2 - Long Term Financial Planning and Growth: 00:28:00 •Module 3 - Analysis of the Financial Statement: 00:28:00 •Module 4 - Capital Budgeting: 00:26:00 •Module 5 - Financial Risk-Return Tradeoff: 00:18:00 •Module 6 - Profitability During Financial Downturn: 00:13:00 •Module 7 - Managing Profitability in Financial Downturn: 00:13:00 •Module 8 - Corporate Finance Regulations: 00:14:00 •Module 9 - Career Path in Corporate Finance: 00:12:00 •Assignment - Corporate Finance: Profitability in a Financial Downturn: 00:00:00

Overview This comprehensive course on History of Corporate Finance In a Nutshell will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This History of Corporate Finance In a Nutshell comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this History of Corporate Finance In a Nutshell. It is available to all students, of all academic backgrounds. Requirements Our History of Corporate Finance In a Nutshell is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 11 sections • 16 lectures • 02:11:00 total length •Introduction: 00:01:00 •Introduction.pdf: 00:02:00 •Financial and Capital Markets: 00:09:00 •The Importance of Intellectual Property Protection: 00:09:00 •Role of Government in Financial Markets: 00:12:00 •Market Efficiency and Market Crashes: 00:12:00 •Risk and Diversification: 00:15:00 •Call Options: 00:08:00 •Put Options: 00:03:00 •Shorting Call Options: 00:04:00 •Shorting Put Options: 00:03:00 •Mergers and Acquisitions: 00:25:00 •Takeovers, Leveraged Buyouts and Defence Tactics: 00:16:00 •2008 U.S. Financial Housing Collapse: 00:11:00 •Conclusion: 00:01:00 •Assignment - History of Corporate Finance In a Nutshell: 00:00:00

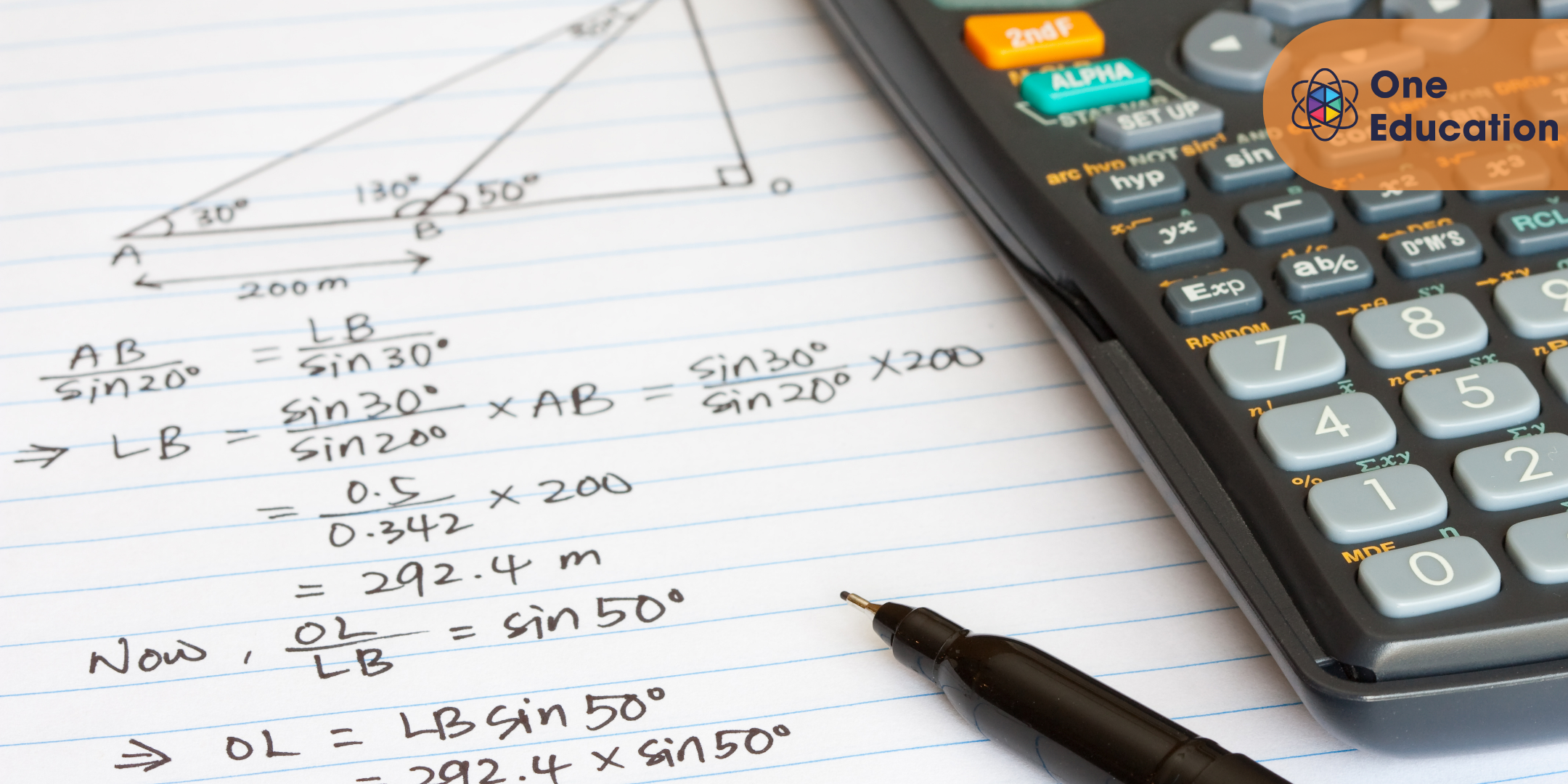

Mathematics Fundamentals - Fraction Course

By One Education

Fractions are the building blocks of many mathematical concepts, and this course is designed to make them approachable and clear. Whether you’re revisiting fractions after some time or encountering them with fresh curiosity, this course offers a straightforward exploration of how fractions work, why they matter, and how to confidently manipulate them. From recognising numerators and denominators to mastering addition, subtraction, multiplication, and division of fractions, you’ll develop a solid grasp that forms the foundation for further mathematical learning. With carefully structured lessons that break down each concept into digestible parts, this course avoids unnecessary jargon and keeps the focus on what really matters—understanding fractions with clarity and confidence. Suitable for learners at various levels, it provides the clarity and support needed to boost both knowledge and self-assurance. If numbers sometimes seem like a puzzle, this course is the friendly guide to making fractions less puzzling and more manageable. Learning Outcomes: Develop a foundational understanding of fractions and their applications in math Learn how to add, subtract, multiply, and divide fractions Gain confidence in solving fraction problems and applying mathematical concepts Expand your understanding of practical applications of fractions in real-world scenarios Prepare for more advanced math courses or exams that involve fractions The Mathematics Fundamentals - Fraction course is designed to provide learners with a comprehensive understanding of fractions and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve fraction problems. Upon completing this course, learners will have a solid foundation in fractions and be prepared for more advanced math courses or exams. With a focus on developing practical skills in adding, subtracting, multiplying, and dividing fractions, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Fraction Course Curriculum Introduction Introduction Fractions Lesson 1 - Finding fractions of whole numbers Lesson 2 - Multiplying fractions Lesson 3 - Simplifying fractions Lesson 4 - Simplifying fractions Lesson 5 - The 3 times table Lesson 6 - Tips for simplifying any fraction Lesson 7 - Multiplying fractions with whole numbers Lesson 8 - Dividing fractions Lesson 9 - Turning improper fractions into mixed fractions Lesson 10 - Turning improper fractions into mixed fractions Lesson 11 - Turning improper fractions into mixed fractions Lesson 12 - Turning improper fractions into mixed fractions Lesson 13 - Turing mixed fractions into improper fractions Lesson 14 - Turning mixed fractions into improper fractions Lesson 15 - Dividing fractions Lesson 16 - Dividing fractions Lesson 17 - Dividing with fractions and whole numbers Lesson 18 - Dividing with fractions and whole numbers Lesson 19 - Adding fractions Lesson 20 - Adding fractions Lesson 21 - Adding fractions Lesson 22 - Adding fractions Lesson 23 - Adding fractions Lesson 24 - Subtracting fractions Lesson 25 - Subtracting fractions Lesson 26 - Subtracting fractions Lesson 27 - Whole numbers subtracting fractions Lesson 28 - Whole numbers subtracting fractions Lesson 29 - Recap Lesson 30 - Practice questions Lesson 31 - Practice questions Lesson 32 - Practice questions Lesson 33 - Practice questions Lesson 34 - Practice questions Lesson 35 - Practice questions Lesson 36 - Practice questions Lesson 37 - Practice questions How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with fractions in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of fractions and their applications in math Students preparing for math exams or courses that involve fractions Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Engineer Architect Mathematician Statistician Financial analyst £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Xero Accounting & Bookkeeping + Tax, Finance & Financial Management

By Compliance Central

***Small Businesses FEAR This Simple Financial Secret!** (Learn it with the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course!)*** Did you know that according to a recent Federation of Small Businesses report, 72% of small business owners in the UK believe strong financial management is crucial for success? The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course equips you with the theoretical knowledge and understanding to excel in this critical area. This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management comprehensive course is designed to provide a solid foundation in Xero accounting software, tax accounting principles, and financial management strategies. Throughout the course, you'll gain the theoretical knowledge needed to navigate the financial world with confidence, helping you make informed decisions for your business or future career. 3 CPD Accredited Courses Are: Course 01: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Course 02: Tax Accounting Course 03: Financial Management Learning Outcome: Going through our interactive modules of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course , you will be able to - Gain a working knowledge of Xero Accounting & Bookkeeping software. Master essential tasks like creating invoices, managing bills, and reconciling bank accounts in Xero. Understand core accounting principles like double-entry accounting and VAT returns. Develop strong financial management skills, including budgeting, analyzing financial statements, and interpreting financial data. Gain a theoretical grounding in tax accounting, including capital gains tax and import/export considerations. Confidently navigate the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management landscape. Key Highlights of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management: CPD Accredited Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Unlimited Retake Exam & 24/7 Tutor Support Easy Accessibility to the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Materials 100% Learning Satisfaction Guarantee Lifetime Access Self-paced online Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course Modules Covers to Explore Multiple Job Positions Curriculum Topics: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7e Xero Accounting & Bookkeeping + Tax, Finance & Financial Management begins with a deep dive into Xero accounting software. This course equips you with the theoretical knowledge to navigate Xero's functionalities for various bookkeeping tasks. You'll learn how to set up your Xero account, manage contacts, create invoices and bills, reconcile bank statements, and track inventory. Xero Accounting & Bookkeeping + Tax, Finance & Financial Management also covers essential bookkeeping principles like double-entry accounting and chart of accounts. Section 01: Introduction Introduction Section 02: Getting Started Introduction - Getting Started Signing up Quick Tour Initial Settings Chart of Accounts Adding a Bank Account Demo Company Tracking Categories Contacts Section 03: Invoices and Sales Introduction - Invoices and Sales Sales Screens Invoice Settings Creating an Invoice Repeating Invoices Credit Notes-03 Quotes Settings Creating Quotes Other Invoicing Tasks Sending Statements Sales Reporting Section 04: Bills and Purchases Introduction - Bills and Purchases Purchases Screens Bill Settings Creating a Bill Repeating Bills Credit Notes-04 Purchase Order Settings Purchase Orders Batch Payments Other Billing Tasks Sending Remittances Purchases Reporting Section 05: Bank Accounts Introduction - Bank Accounts Bank Accounts Screens Automatic Matching Reconciling Invoices Reconciling Bills Reconciling Spend Money Reconciling Receive Money Find and Match Bank Rules Cash Coding Remove and Redo vs Unreconcile Uploading Bank Transactions Automatic Bank Feeds Section 06: Products and Services Introduction - Products and Services Products and Services Screen Adding Services Adding Untracked Products Adding Tracked Products Section 07: Fixed Assets Introduction - Fixed Assets Fixed Assets Settings Adding Assets from Bank Transactions Adding Assets from Spend Money Adding Assets from Bills Depreciation Section 08: Payroll Introduction - Payroll Payroll Settings Adding Employees Paying Employees Payroll Filing Section 09: VAT Returns Introduction - VAT Returns VAT Settings VAT Returns - Manual Filing VAT Returns - Digital Filing Free Course 01: Tax Accounting Xero Accounting & Bookkeeping + Tax, Finance & Financial Management delves into the world of tax accounting. This course provides a theoretical understanding of tax principles, regulations, and calculations relevant to businesses. You'll explore topics like income tax, corporation tax, value added tax (VAT), and payroll taxes. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management equips you with the knowledge to identify tax implications for business transactions and ensure compliance with tax authorities. Module 01: Capital Gain Tax Module 02: Import and Export Module 03: Double Entry Accounting Module 04: Management Accounting and Financial Analysis Module 05: Career as a Tax Accountant in the UK Free Course 02: Financial Management Xero Accounting & Bookkeeping + Tax, Finance & Financial Management concludes with a focus on financial management. This course explores the theoretical underpinnings of financial decision-making. You'll learn how to create financial statements, analyze financial data, develop budgets and forecasts, and manage cash flow effectively. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management empowers you to make informed financial decisions that contribute to the overall success of a business. Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management Each topic has been designed to deliver more information in a shorter amount of time. This makes it simple for the learners to understand the fundamental idea and apply it to diverse situations through Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Certification Free CPD Accredited (CPD QS) Certificate. Quality Licence Scheme Endorsed Certificate of Achievement: Upon successful completion of the course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £129 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Disclaimer This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Besides, this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course particularly recommended for- Anyone interested in learning Xero can progress from a beginner to a knowledgeable user in just one day. Small business owners that want to handle their own accounting in Xero Xero Practice Manager Bookkeepers who wish to learn Xero rapidly Requirements Students seeking to enrol for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course should meet the following requirements; Basic knowledge of English Language is needed for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course, which already you have. Basic Knowledge of Information & Communication Technologies for studying Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course in online or digital platform. Stable Internet or Data connection in your learning devices to complete the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course easily. Career path The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will enable you to explore in Xero related trendy and demanding jobs, such as: Bookkeeping Specialist Client Experience Specialist Accounting Advisory Apprentice Cloud Accountant Education Specialist Management Accountant Finance Manager Tax Implementation Specialist Xero Practice Manager Certificates CPD QS Certificate of completion Digital certificate - Included After successfully completing this course, you can get CPD accredited digital PDF certificate for free.

New Functions in Microsoft Excel 2021 Course

By One Education

Microsoft Excel 2021 has quietly slipped in a bundle of new functions that can turn even the most mundane spreadsheets into efficient data-processing machines. This course introduces the latest features like XLOOKUP, LET, FILTER, SEQUENCE, and TEXTSPLIT, which not only simplify formulas but make spreadsheets smarter and tidier. Whether you’re an analyst trying to avoid circular references or someone who’s simply tired of tangled VLOOKUPs, this course brings clarity to your cells—no pun intended. Tailored for Excel users who know the ropes but want to keep up with what's new, this course ensures you don’t fall behind the curve. You’ll explore function upgrades that tidy up old formulas, save time, and help you work cleaner and quicker. With a thoughtful structure and a lightly witty tone, the course content walks you through updates that genuinely make a difference—without drowning you in geek speak. Excel’s had a makeover, and it's about time your formulas caught up. Learning Outcomes: Understand the purpose and benefits of new Excel functions. Apply the RANDARRAY function to generate random data. Use the UNIQUE function to extract unique values from a data range. Create custom number sequences with the SEQUENCE function. Sort data effectively with the SORT and SORTBY functions. Filter data easily with the FILTER function. Unlock the full potential of Microsoft Excel with our new course, "The Theory of Constraints and Throughput Accounting." In just a few modules, you'll learn how to utilise the latest functions in Excel to quickly sort, filter, and analyse data. By the end of the course, you'll be equipped with the knowledge to efficiently organise even the most complex datasets. But this course isn't just about learning new functions - it's about applying them to real-world scenarios. With practical examples and exercises throughout the course, you'll learn how to use these functions in meaningful ways. The benefits of this course are clear: increased productivity, better data analysis, and more efficient workflow. Don't miss out on this opportunity to take your Excel skills to the next level - enroll in "The Theory of Constraints and Throughput Accounting" today. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data Analyst - £31,000 per year (average salary) Financial Analyst - £34,000 per year (average salary) Business Intelligence Analyst - £39,000 per year (average salary) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Mathematics Fundamentals - Percentages Course

By One Education

Percentages play a silent yet powerful role in our everyday decisions—whether it’s sorting out discounts, understanding interest rates, or figuring out proportions. The Mathematics Fundamentals - Percentages Course is tailored to help learners grasp the core principles of percentages without any complicated jargon or overwhelming equations. Clear, engaging, and neatly structured, this course takes the mystery out of percentage calculations and turns confusion into confidence. Designed for learners of all levels, this course breaks down the essentials into bite-sized, logical steps—making each concept stick with ease. Whether you're brushing up for exams, sharpening your skills for work, or just trying to finally make sense of supermarket sales, you’ll find this course refreshingly clear. From calculating increase and decrease to working through percentage change and reverse percentages, everything you need is right here—well explained and easy to follow. Learning Outcomes: Develop a foundational understanding of percentages and their applications in math Learn how to calculate percentages of numbers, increase or decrease numbers by percentages, and calculate compound interest Gain confidence in solving percentage problems and applying mathematical concepts Expand your understanding of practical applications of percentages in real-world scenarios Prepare for more advanced math courses or exams that involve percentages The Mathematics Fundamentals - Percentages course is designed to provide learners with a comprehensive understanding of percentages and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve percentage problems. Upon completing this course, learners will have a solid foundation in percentages and be prepared for more advanced math courses or exams. With a focus on developing practical skills in calculating percentages, increasing or decreasing numbers by percentages, and calculating compound interest, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Percentages Course Curriculum Introduction Introduction Percentages Lesson 1 - Finding 10% by dividing by 10 Lesson 2 - Dividing by 10 with numbers that don't end in a zero Lesson 3 - Dividing decimals by 10 Lesson 4 - Dividing by 10 with decimals less than 10 Lesson 5 - Dividing by 10 with whole numbers less than 10 Lesson 6 - Dividing pennies by 10 Lesson 7 - Finding 20% of a number Lesson 8 - Practise finding 20% of a number Lesson 9 - Finding 5% of a number Lesson 10 - Practise finding 5% of a number Lesson 11 - Finding 1% of a number Lesson 12 - Practise finding 1% of a number Lesson 13 - Finding 2% of a number Lesson 14 - Finding 50% of a number Lesson 15 - Practise finding 50% of a number Lesson 16 - Finding 25% of a number Lesson 17 - Finding any percentage of any number Lesson 18 - Ways to find different percentages Lesson 19 - Practise finding any percentage of any number Lesson 20 - Practise finding any percentage of any number Lesson 21 - Using a calculator Lesson 22 - Practise using a calculator to find percentages of numbers Lesson 23 - Let's practise Lesson 24 - Let's practise Lesson 25 - Let's practise Lesson 26 - Let's practise Lesson 27 - Let's practise Lesson 28 - Let's practise Lesson 29 - Let's practise Lesson 30 - Let's practise Lesson 31 - Let's practise Lesson 32 - Let's practise Lesson 33 - Increasing a number by a percentage Lesson 34 - Increasing a number by a percentage Lesson 35 - Increasing a number by a percentage Lesson 36 - Increasing a number by a percentage on a calculator Lesson 37 - Increasing a number by a percentage on a calculator Lesson 38 - Increasing a number by a percentage on a calculator Lesson 39 - Decreasing a number by a percentage Lesson 40 - Decreasing a number by a percentage Lesson 41 - Decreasing a number by a percentage Lesson 42 - Decreasing a number by a percentage on a calculator Lesson 43 - Decreasing a number by a percentage on a calculator Lesson 44 - Simple interest and compound interest Lesson 45 - Simple interest and compound interest Lesson 46 - Compound interest formula Lesson 47 - Interest questions Lesson 48 - Interest questions Lesson 49 - Reverse percentages Lesson 50 - Reverse percentages Lesson 51 - Reverse percentages How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with percentages in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of percentages and their applications in math Students preparing for math exams or courses that involve percentages Career path Accountant Financial analyst Statistician Data analyst Economist £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Financial investigators in the UK are essential in identifying and investigating financial crimes. This training provides an in-depth look into the part of financial investigators and the various financial crimes they investigate. In addition, it provides an understanding of the methods used by financial investigators to identify, analyse, and prosecute financial crimes. This Certificate in Financial Investigator Training at QLS Level 3 course is Endorsed by The Quality Licence Scheme Accredited by CPDQS (with 120 CPD points) Furthermore, this Financial Investigator course teaches students about the legal framework and regulations that financial investigators must follow when conducting investigations. By the end of this Financial Investigator course, students will have a comprehensive understanding of the role of financial investigators in the UK and the different financial crimes they investigate. Learning Outcomes of this Financial investigator course: Understand the Roles and Responsibilities of Financial Researchers Discover the signs and characteristics of severe financial crime Categories crimes and prevent further risk as a Financial Investigator Ability to prepare and Implement appropriate crime response plans Find out about evidence gathering and compliance with UK financial law Why Choose Our Financial Investigator at QLS Level 3 Course: Opportunity to earn certificate a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS after completing the Financial Investigator course. Get instant access to this Financial Investigator course. Learn Financial Investigator from anywhere in the world Financial Investigator is affordable and simple to understand Financial Investigator is entirely online, interactive lesson with voiceover audio Lifetime access to the Financial Investigator course materials Financial Investigator comes with 24/7 tutor support You will achieve your goals and prepare for your ideal future by taking this intensive Financial Investigator course. The Financial Investigator program gives students an in-depth learning experience that they can work on at their own pace to help them advance their careers. The Financial Investigator Training will teach you everything you need to know to advance in your chosen field. ***Curriculum Breakdown of Financial Investigator Course*** Module 1: Introduction Module 2: Introduction to Financial Investigation Module 3: Characteristics of Financial Crimes Module 4: Categories of Financial Crimes Module 5: Financial Crime Response Plan Module 6: Collecting, Preserving and Gathering Evidence Module 7: Laws against Financial Fraud Assessment Process Financial Investigator at QLS Level 3: You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. After passing the Financial Investigator Training at QLS Level 3 exam, you will be able to request a certificate at an additional cost that has been endorsed by the Quality Licence Scheme. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Professionals in the field of finance and accounting Law enforcement officers and detectives Compliance officers and auditors Financial analysts and forensic accountants Anyone seeking to enhance their knowledge of financial crime detection and prevention Individuals that are planning to take the financial investigator exams Requirements The Course has no formal entry criteria. Anyone with a desire to learn is welcome to enrol in this course without hesitation. Career path Developing your abilities in financial investigation will allow you to explore opportunities like: Financial Investigator Financial Confiscator Financial Intelligence Officer Finance Advisor Anti-Money Laundering Investigator And much more! Certificates CPD Accredited Certificate Digital certificate - Included Certificate in Financial Investor Training at QLS Level 3 Hard copy certificate - £89 After successfully completing the Certificate in Financial Investor Training at QLS Level 3, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with a pricing scheme of - 89 GBP inside the UK 99 GBP (including postal fees) for international delivery CPD Accredited Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (international delivery)

Overview Money moves to those who manage it well. The financial analysis gives insights into a company's financial condition. Therefore, businesses can make wise economic decisions and improve their profitability and cash flow. In this Financial Analysis Training, you'll learn how to perform financial analysis to help your business make informed choices for its economic conditions. Here, you'll learn how to prepare a balance sheet, income statement, and cash flow statement. In addition, the course will take you through the steps in financial reporting to track and analyse your business's cash inflows and outflows. You'll also learn how to perform a profitability analysis to understand your company's ability to generate income. Finally, the course will teach you about the methods of credit analysis, equity analysis, and ratio analysis and explain how they work. Course Preview Learning Outcomes Understand the methods of financial analysis Learn how to prepare financial statements for your company Find a comprehensive guide to the balance sheet and income statement Understand the importance of cash flow statements in business Identify the methods of profitability analysis Learn about ratio analysis to evaluate a company's liquidity, solvency and profitability. Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn From This Course? Financial Analysis Financial Statement Preparation Profitability Analysis Who Should Take this Financial Analysis Training? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Financial Analysis Training is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Financial Analysis Training provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Financial Analyst: £32,000 to £55,000 Credit Analyst: £26,000 to £40,000 Equity Analyst: £45,000 to £80,000 Risk Analyst: £26,000 to £45,000 Investment Analyst: £32,000 to £55,000 Accountant: £24,000 to £50,000 Module 01: Introduction to Financial Analysis Introduction to Financial Analysis 00:18:00 Module 02: The Balance Sheet The Balance Sheet 00:29:00 Module 03: The Income Statement The Income Statement 00:25:00 Module 04: The Cash Flow Statement The Cash Flow Statement 00:25:00 Module 05: Financial Reporting Financial Reporting 00:26:00 Module 06: Analysing Profitability Analysing Profitability 00:22:00 Module 07: The Applications and Limitations of EBITDA The Applications and Limitations of EBITDA1 00:27:00 Module 08: Credit Analysis Credit Analysis 00:32:00 Module 09: Equity Analysis Equity Analysis 00:18:00 Module 10: Ratio Analysis Ratio Analysis 00:28:00 Assignment Assignment - Financial Analysis Training 00:00:00 Order Your Certificate and transcript Order Your Certificate QLS 00:00:00

Description Master the best investment strategies with the Diploma in Stock Market Investing course. Stock Market is one of the fastest ways of making money. However, there are risks too. In this course, you will learn the potential strategies for getting benefit from your stock market investment. Firstly, the course clears your idea about the concept stock market along with its history. You will know whether you need a financial advisor or not and you will also able to determine the risks. Then you will learn to make textbook stock valuations. Next, the course guides you to think rationally and to think for a long time while investing. In short, you will be aware of the risks and other strategies for getting from stock market investing. Assessment: This course does not involve any MCQ test. Students need to answer assignment questions to complete the course, the answers will be in the form of written work in pdf or word. Students can write the answers in their own time. Once the answers are submitted, the instructor will check and assess the work. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Diploma in Stock Market Investing is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Diploma in Stock Market Investing is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Section 01 - Introduction to Investing in the Stock Market Stock Market FREE 00:03:00 Introduction to Investing 00:03:00 What is the Stock Market 00:06:00 Learn Stock Market History 00:05:00 Advice on Financial Advisors 00:06:00 Start Planning for Retirement 00:06:00 Old School Investment Strategies 00:02:00 Setup a Brokerage Account 00:01:00 Section 02 - Thinking Long Term Think Rationally About Investing 00:06:00 How the Housing Market Crashed 00:04:00 Determine Risk Appetite for Investing 00:05:00 Tempering Investment Expectations 00:03:00 Section 03 - Investing in Stocks to Maximize Return How to Maximize Return on Investment 00:11:00 Understand Price to Earnings Ratio of a Stock 00:06:00 Calculate Textbook Stock Valuations 00:07:00 What is the Worth of a Stock 00:04:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00