- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

450 Engineering courses in Kimberley delivered Live Online

DevSecOps Foundation (DSOF)?

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for The target audience for the DevSecOps Foundation course are professionals including: Anyone involved or interested in learning about DevSecOps strategies and automation Anyone involved in Continuous Delivery toolchain architectures Compliance Team Business managers Delivery Staff DevOps Engineers IT Managers IT Security Professionals, Practitioners, and Managers Maintenance and support staff Managed Service Providers Project & Product Managers Quality Assurance Teams Release Managers Scrum Masters Site Reliability Engineers Software Engineers Testers Overview You will learn: The purpose, benefits, concepts, and vocabulary of DevSecOps How DevOps security practices differ from other security approaches Business-driven security strategies and Best Practices Understanding and applying data and security sciences Integrating corporate stakeholders into DevSecOps Practices Enhancing communication between Dev, Sec, and Ops teams How DevSecOps roles fit with a DevOps culture and organization In this course, students will gain a solid understanding of how DevSecOps provides business value, enhancing your business opportunities, and improving corporate value. The core DevSecOps principles taught can support an organizational transformation, increase productivity, reduce risk, and optimize resource usage. This course explains how DevOps security practices differ from other approaches then delivers the education needed to apply changes to your organization. Participants learn the purpose, benefits, concepts, vocabulary and applications of DevSecOps. Most importantly, students learn how DevSecOps roles fit with a DevOps culture and organization. At the course?s end, participants will understand ?security as code? to make security and compliance value consumable as a service. This course prepares you for the DevSecOps Foundation (DSOF) certification. Realizing DevSecOps Outcomes Origins of DevOps Evolution of DevSecOps CALMS The Three Ways Defining the Cyberthreat Landscape What is the Cyber Threat Landscape? What is the threat? What do we protect from? What do we protect, and why? How do I talk to security? Building a Responsive DevSecOps Model Demonstrate Model Technical, business and human outcomes What?s being measured? Gating and thresholding Integrating DevSecOps Stakeholders The DevSecOps State of Mind The DevSecOps Stakeholders What?s at stake for who? Participating in the DevSecOps model Establishing DevSecOps Best Practices Start where you are Integrating people, process and technology and governance DevSecOps operating model Communication practices and boundaries Focusing on outcomes Best Practices to get Started The Three Ways Identifying target states Value stream-centric thinking DevOps Pipelines and Continuous Compliance The goal of a DevOps pipeline Why continuous compliance is important Archetypes and reference architectures Coordinating DevOps Pipeline construction DevSecOps tool categories, types and examples Learning Using Outcomes Security Training Options Training as Policy Experiential Learning Cross-Skilling The DevSecOps Collective Body of Knowledge Preparing for the DevSecOps Foundation certification exam Additional course details: Nexus Humans DevSecOps Foundation (DevOps Institute) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the DevSecOps Foundation (DevOps Institute) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Cisco Implementing and Operating Cisco Security Core Technologies v1.0 (SCOR)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Security engineer Network engineer Network designer Network administrator Systems engineer Consulting systems engineer Technical solutions architect Network manager Cisco integrators and partners Overview After taking this course, you should be able to: Describe information security concepts and strategies within the network Describe common TCP/IP, network application, and endpoint attacks Describe how various network security technologies work together to guard against attacks Implement access control on Cisco ASA appliance and Cisco Firepower Next-Generation Firewall Describe and implement basic email content security features and functions provided by Cisco Email Security Appliance Describe and implement web content security features and functions provided by Cisco Web Security Appliance Describe Cisco Umbrella security capabilities, deployment models, policy management, and Investigate console Introduce VPNs and describe cryptography solutions and algorithms Describe Cisco secure site-to-site connectivity solutions and explain how to deploy Cisco Internetwork Operating System (Cisco IOS) Virtual Tunnel Interface (VTI)-based point-to-point IPsec VPNs, and point-to-point IPsec VPN on the Cisco ASA and Cisco Firepower Next-Generation Firewall (NGFW) Describe and deploy Cisco secure remote access connectivity solutions and describe how to configure 802.1X and Extensible Authentication Protocol (EAP) authentication Provide basic understanding of endpoint security and describe Advanced Malware Protection (AMP) for Endpoints architecture and basic features Examine various defenses on Cisco devices that protect the control and management plane Configure and verify Cisco IOS software Layer 2 and Layer 3 data plane controls Describe Cisco Stealthwatch Enterprise and Stealthwatch Cloud solutions Describe basics of cloud computing and common cloud attacks and how to secure cloud environment The Implementing and Operating Cisco Security Core Technologies (SCOR) v1.0 course helps you prepare for the Cisco© CCNP© Security and CCIE© Security certifications and for senior-level security roles. In this course, you will master the skills and technologies you need to implement core Cisco security solutions to provide advanced threat protection against cybersecurity attacks. You will learn security for networks, cloud and content, endpoint protection, secure network access, visibility, and enforcements. You will get extensive hands-on experience deploying Cisco Firepower© Next-Generation Firewall and Cisco Adaptive Security Appliance (ASA) Firewall; configuring access control policies, mail policies, and 802.1X Authentication; and more. You will get introductory practice on Cisco Stealthwatch© Enterprise and Cisco Stealthwatch Cloud threat detection features. This course, including the self-paced material, helps prepare you to take the exam, Implementing and Operating Cisco Security Core Technologies (350-701 SCOR), which leads to the new CCNP Security, CCIE Security, and the Cisco Certified Specialist - Security Core certifications. Describing Information Security Concepts* Information Security Overview Assets, Vulnerabilities, and Countermeasures Managing Risk Vulnerability Assessment Understanding Common Vulnerability Scoring System (CVSS) Describing Common TCP/IP Attacks* Legacy TCP/IP Vulnerabilities IP Vulnerabilities Internet Control Message Protocol (ICMP) Vulnerabilities TCP Vulnerabilities User Datagram Protocol (UDP) Vulnerabilities Attack Surface and Attack Vectors Reconnaissance Attacks Access Attacks Man-in-the-Middle Attacks Denial of Service and Distributed Denial of Service Attacks Reflection and Amplification Attacks Spoofing Attacks Dynamic Host Configuration Protocol (DHCP) Attacks Describing Common Network Application Attacks* Password Attacks Domain Name System (DNS)-Based Attacks DNS Tunneling Web-Based Attacks HTTP 302 Cushioning Command Injections SQL Injections Cross-Site Scripting and Request Forgery Email-Based Attacks Describing Common Endpoint Attacks* Buffer Overflow Malware Reconnaissance Attack Gaining Access and Control Gaining Access via Social Engineering Gaining Access via Web-Based Attacks Exploit Kits and Rootkits Privilege Escalation Post-Exploitation Phase Angler Exploit Kit Describing Network Security Technologies Defense-in-Depth Strategy Defending Across the Attack Continuum Network Segmentation and Virtualization Overview Stateful Firewall Overview Security Intelligence Overview Threat Information Standardization Network-Based Malware Protection Overview Intrusion Prevention System (IPS) Overview Next Generation Firewall Overview Email Content Security Overview Web Content Security Overview Threat Analytic Systems Overview DNS Security Overview Authentication, Authorization, and Accounting Overview Identity and Access Management Overview Virtual Private Network Technology Overview Network Security Device Form Factors Overview Deploying Cisco ASA Firewall Cisco ASA Deployment Types Cisco ASA Interface Security Levels Cisco ASA Objects and Object Groups Network Address Translation Cisco ASA Interface Access Control Lists (ACLs) Cisco ASA Global ACLs Cisco ASA Advanced Access Policies Cisco ASA High Availability Overview Deploying Cisco Firepower Next-Generation Firewall Cisco Firepower NGFW Deployments Cisco Firepower NGFW Packet Processing and Policies Cisco Firepower NGFW Objects Cisco Firepower NGFW Network Address Translation (NAT) Cisco Firepower NGFW Prefilter Policies Cisco Firepower NGFW Access Control Policies Cisco Firepower NGFW Security Intelligence Cisco Firepower NGFW Discovery Policies Cisco Firepower NGFW IPS Policies Cisco Firepower NGFW Malware and File Policies Deploying Email Content Security Cisco Email Content Security Overview Simple Mail Transfer Protocol (SMTP) Overview Email Pipeline Overview Public and Private Listeners Host Access Table Overview Recipient Access Table Overview Mail Policies Overview Protection Against Spam and Graymail Anti-virus and Anti-malware Protection Outbreak Filters Content Filters Data Loss Prevention Email Encryption Deploying Web Content Security Cisco Web Security Appliance (WSA) Overview Deployment Options Network Users Authentication Secure HTTP (HTTPS) Traffic Decryption Access Policies and Identification Profiles Acceptable Use Controls Settings Anti-Malware Protection Deploying Cisco Umbrella* Cisco Umbrella Architecture Deploying Cisco Umbrella Cisco Umbrella Roaming Client Managing Cisco Umbrella Cisco Umbrella Investigate Overview and Concepts Explaining VPN Technologies and Cryptography VPN Definition VPN Types Secure Communication and Cryptographic Services Keys in Cryptography Public Key Infrastructure Introducing Cisco Secure Site-to-Site VPN Solutions Site-to-Site VPN Topologies IPsec VPN Overview IPsec Static Crypto Maps IPsec Static Virtual Tunnel Interface Dynamic Multipoint VPN Cisco IOS FlexVPN Deploying Cisco IOS VTI-Based Point-to-Point IPsec VPNs Cisco IOS VTIs Static VTI Point-to-Point IPsec Internet Key Exchange (IKE) v2 VPN Configuration Deploying Point-to-Point IPsec VPNs on the Cisco ASA and Cisco Firepower NGFW Point-to-Point VPNs on the Cisco ASA and Cisco Firepower NGFW Cisco ASA Point-to-Point VPN Configuration Cisco Firepower NGFW Point-to-Point VPN Configuration Introducing Cisco Secure Remote Access VPN Solutions Remote Access VPN Components Remote Access VPN Technologies Secure Sockets Layer (SSL) Overview Deploying Remote Access SSL VPNs on the Cisco ASA and Cisco Firepower NGFW Remote Access Configuration Concepts Connection Profiles Group Policies Cisco ASA Remote Access VPN Configuration Cisco Firepower NGFW Remote Access VPN Configuration Explaining Cisco Secure Network Access Solutions Cisco Secure Network Access Cisco Secure Network Access Components AAA Role in Cisco Secure Network Access Solution Cisco Identity Services Engine Cisco TrustSec Describing 802.1X Authentication 802.1X and Extensible Authentication Protocol (EAP) EAP Methods Role of Remote Authentication Dial-in User Service (RADIUS) in 802.1X Communications RADIUS Change of Authorization Configuring 802.1X Authentication Cisco Catalyst© Switch 802.1X Configuration Cisco Wireless LAN Controller (WLC) 802.1X Configuration Cisco Identity Services Engine (ISE) 802.1X Configuration Supplicant 802.1x Configuration Cisco Central Web Authentication Describing Endpoint Security Technologies* Host-Based Personal Firewall Host-Based Anti-Virus Host-Based Intrusion Prevention System Application Whitelists and Blacklists Host-Based Malware Protection Sandboxing Overview File Integrity Checking Deploying Cisco Advanced Malware Protection (AMP) for Endpoints* Cisco AMP for Endpoints Architecture Cisco AMP for Endpoints Engines Retrospective Security with Cisco AMP Cisco AMP Device and File Trajectory Managing Cisco AMP for Endpoints Introducing Network Infrastructure Protection* Identifying Network Device Planes Control Plane Security Controls Management Plane Security Controls Network Telemetry Layer 2 Data Plane Security Controls Layer 3 Data Plane Security Controls Deploying Control Plane Security Controls* Infrastructure ACLs Control Plane Policing Control Plane Protection Routing Protocol Security Deploying Layer 2 Data Plane Security Controls* Overview of Layer 2 Data Plane Security Controls Virtual LAN (VLAN)-Based Attacks Mitigation Sp

Short Circuit Analysis for HV Three Phase Systems

By NextGen Learning

Short Circuit Analysis for HV Three Phase Systems Course Overview This course on Short Circuit Analysis for HV Three Phase Systems provides an in-depth exploration of fault analysis in high voltage electrical systems. Focusing on the theoretical and practical application of various analysis methods, the course equips learners with the skills to assess and model electrical faults in three-phase systems. By covering core topics such as symmetrical and asymmetrical faults, per unit analysis, and transformer modelling, this course ensures that participants are prepared for real-world fault diagnosis and system modelling challenges. Learners will gain a thorough understanding of fault behaviour and how to perform accurate short circuit analysis, which is essential for enhancing system stability and safety. Course Description The course delves into the key aspects of short circuit and fault analysis for high voltage (HV) three-phase systems. Participants will explore various analysis techniques, including per-phase and per-unit analysis, along with the importance of base changes and transformer modelling. The course introduces symmetrical components and covers advanced topics such as asymmetrical three-phase fault analysis and system modelling. Learners will develop a clear understanding of how to assess the impact of short circuits on the electrical network and identify the appropriate mitigation strategies. The course is designed to provide learners with both the theoretical foundation and technical knowledge to perform detailed fault analysis and optimise system performance. Short Circuit Analysis for HV Three Phase Systems Curriculum Module 01: Introduction to Short Circuit Analysis for HV Three Phase Systems Module 02: Short Circuit & Fault Analysis Overview Module 03: Per Phase Analysis Module 04: Per Unit Analysis Module 05: Change of Base Module 06: Transformers & Per Unit Analysis Module 07: Symmetrical Components Module 08: Asymmetrical Three Phase Fault Analysis Module 09: System Modeling (See full curriculum) Who is this course for? Individuals seeking to understand short circuit analysis in electrical systems. Professionals aiming to enhance their knowledge in HV power system analysis. Beginners with an interest in electrical engineering and fault analysis. Engineers looking to advance their skills in power system design and fault management. Career Path Electrical Engineer Power System Analyst HV Systems Designer Electrical Maintenance Engineer Power Network Consultant Utility System Planner

Particle Physics

By NextGen Learning

Particle Physics Course Overview This Particle Physics course offers a comprehensive introduction to the fundamental constituents of matter and the forces governing their interactions. Learners will explore the nature of elementary particles, the structure of the atomic nucleus, and the principles behind nuclear physics. The course also covers the technology behind particle accelerators and radiation detectors, providing insight into modern experimental methods. By completing this course, learners will gain a solid understanding of the Standard Model of particle physics and the key concepts that underpin contemporary physics research. This knowledge will equip students with the theoretical and analytical skills essential for further study or careers in physics, research, and related scientific fields. Course Description Delving deeply into the world of subatomic particles, this course covers the classification and properties of elementary particles, the composition and behaviour of atomic nuclei, and the foundational aspects of nuclear physics. Learners will study the design and function of particle accelerators and radiation detectors, essential tools in particle physics experiments. The course elaborates on the Standard Model, explaining its role in unifying particle interactions and forces. Through engaging lectures and detailed explanations, students will develop critical thinking and analytical skills necessary to understand cutting-edge physics. Suitable for those with a keen interest in physics, the course fosters a clear understanding of complex concepts and prepares learners for advanced academic or professional pathways within scientific research and technology sectors. Particle Physics Curriculum Module 01: Introduction to Particle Physics Module 02: Elementary Particles Module 03: The Nucleus Module 04: Nuclear Physics Module 05: Particle Accelerators Module 06: Radiation Detectors Module 07: The Standard Model (See full curriculum) Who is this course for? Individuals seeking to understand the fundamental principles of particle physics. Professionals aiming to develop their knowledge for careers in physics or scientific research. Beginners with an interest in the composition of matter and the universe. Students preparing for advanced study in physics or related scientific disciplines. Career Path Research Scientist in Particle or Nuclear Physics Laboratory Technician in Physics or Engineering Science Communicator or Educator specialising in Physics Technical Specialist in Particle Accelerator Facilities Analyst in High-Energy Physics or Related Industries

Hospitality Management Level 5

By NextGen Learning

Course Overview The Hospitality Management Level 5 course offers a comprehensive insight into the dynamic and fast-paced world of hospitality. Designed to build a strong foundation in management practices, service excellence, and operational efficiency, the course equips learners with the knowledge and leadership skills required for success in the industry. Covering critical areas such as front office operations, food and beverage management, customer satisfaction, and marketing in travel and tourism, it ensures a well-rounded understanding of hospitality business functions. The curriculum also embraces modern developments such as e-hospitality and the use of technology in operations. Upon completion, learners will have developed key competencies in managing service quality, human resources, and financial aspects of hospitality enterprises. This qualification is ideal for those seeking career progression or wishing to enter this vibrant sector, offering valuable insights into creating memorable guest experiences and efficient business practices within hotels, resorts, and related hospitality organisations. Course Description The Hospitality Management Level 5 course delves deeper into the essential principles, operational challenges, and strategic approaches within the hospitality sector. Learners will explore the structure and evolution of the hotel industry, the importance of efficient recruitment and training processes, and the management of core areas including front office, housekeeping, food and beverage, and security operations. In addition, the programme highlights the significance of customer satisfaction, quality service delivery, marketing strategies, and financial management within hospitality environments. Contemporary topics such as e-hospitality and technology adoption are also integrated to reflect current industry trends. Throughout the course, participants will gain valuable knowledge, analytical capabilities, and management techniques that are crucial for sustaining high service standards and fostering business growth. The course structure is designed to cater to a wide range of learners, providing the flexibility to support both career advancement and entry into this dynamic field. Course Modules Module 01: Introduction to Hospitality Management Module 02: An Overview of Hotel Industry Module 03: The Process of Selection and Recruitment in Hospitality Industry Module 04: The Process of Development and Training in Hospitality Industry Module 05: Management of Front Office Operations Module 06: Management of Housekeeping, Engineering and Security Operations Module 07: Management of Food and Beverage Operations Module 08: Management of Service Quality in Hospitality Industry Module 09: Marketing in Travel and Tourism Business Module 10: Accounting in Hospitality Industry Module 11: Customer Satisfaction Module 12: E-Hospitality and Technology (See full curriculum) Who is this course for? Individuals seeking to start a career in hospitality management. Professionals aiming to enhance their expertise in hospitality leadership and operations. Beginners with an interest in the hospitality and tourism industries. Entrepreneurs planning to launch or manage hospitality ventures. Employees wishing to transition into supervisory or management roles within hospitality. Career Path Hotel Manager Front Office Manager Food and Beverage Manager Guest Relations Manager Hospitality Operations Manager Housekeeping Manager Resort Manager Travel and Tourism Consultant Event Coordinator within Hospitality Industry Hospitality and Tourism Marketing Executive

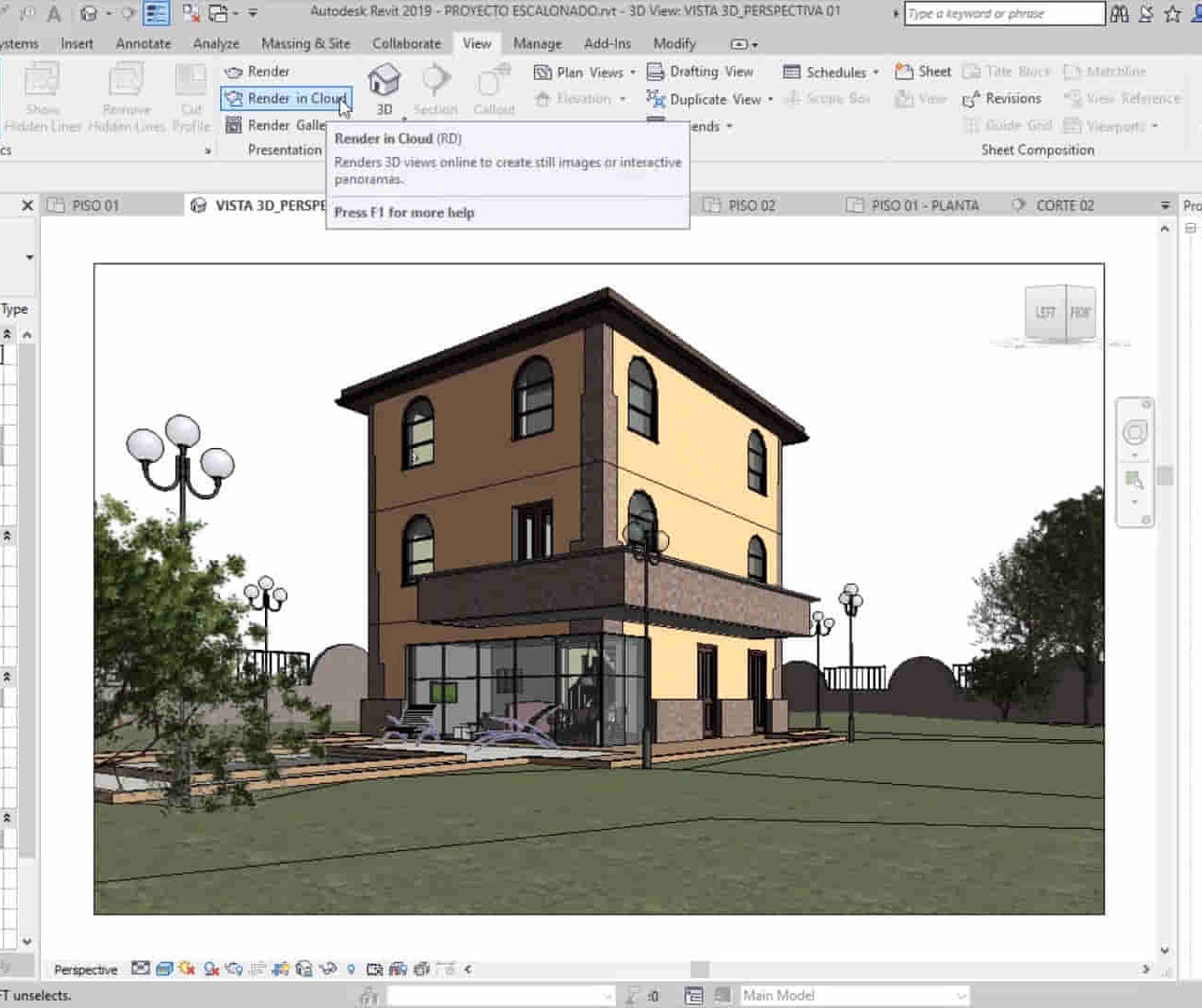

Revit Basic to Advanced Training Course

By ATL Autocad Training London

Why Book Revit Basic to Advanced Training Course? Learn BIM and Revit for engineers and architects, supporting 2-D and 3-D design for large-scale projects and combing with AutoCAD. Check our Website How to Book? 1-on-1 training tailored to your schedule. Book your sessions from Monday to Saturday between 9 am and 7 pm or call 02077202581 to book over the phone. Training Details: Duration: 16 hours Flexible scheduling, split across multiple days Method: 1-on-1 (In-person or Live Online) and Personalized attention Course Overview: I. Revit Fundamentals (1 hour) Understanding Revit's Purpose and Applications Navigating the Revit Interface and Essential Tools Mastering Navigation and Viewport Controls Creating and Managing Projects II. Project Setup (1 hour) Initiating a New Project Configuring Project Levels, Grids, and Site Information Defining Project Units for Precision III. Basic Modeling Techniques (2 hours) Building Walls, Doors, and Windows Designing Floors, Ceilings, Roofs, Stairs, and Railings IV. Advanced Modeling Skills (4 hours) Crafting Custom Parametric Families Utilizing Conceptual Modeling Tools Designing Complex Forms and Shapes Enhancing Models with Lighting and Materials Achieving Realism through 3D Rendering V. Views, Sheets, and Annotations (2 hours) Managing Views and Sheets Effectively Incorporating Schedules and Tags Crafting Detail Annotations for Construction Documents VI. Phasing, Worksharing, and Collaboration (2 hours) Understanding Phasing and Design Options Mastering Work Sharing and Collaboration Techniques VII. Project Collaboration and Management (1 hour) Establishing Work Sharing Environments Monitoring Worksets and User Activities Synchronizing Worksets for Seamless Collaboration VIII. Advanced Documentation Skills (2 hours) Creating Advanced Schedules and Legends Developing Construction Documents with Sheets and Title Blocks Customizing Schedules and Keynotes for Precision IX. Course Conclusion and Next Steps (1 hour) Reviewing Course Highlights Exploring Further Learning Resources and Tips Interactive Q&A Session and Feedback Opportunities Download Revit Master Revit Proficiency: Acquire advanced skills in Revit for 3D modeling, parametric design, and efficient project management. Craft Complex Architectural Designs: Create intricate building components, custom families, and detailed construction documents. Seamless Collaboration: Expertise in project collaboration, phasing, and work sharing, ensuring smooth teamwork and synchronization. Enhanced Visualization: Learn advanced rendering techniques for realistic 3D visualizations of architectural concepts. Customize Workflows: Adapt Revit tools, optimize workflows, and enhance efficiency in project execution. Career Opportunities: Architectural Designer: Create architectural plans, 3D models, and construction documents. BIM Specialist: Develop detailed digital models in collaboration with architects and engineers. Construction Documenter: Prepare comprehensive construction documents, including plans and schedules. Project Manager: Oversee projects, ensuring timely completion and adherence to design specifications. Revit Specialist/Trainer: Provide Revit training and support services to individuals, firms, or educational institutions. Elevate Your Revit Skills with Our Advanced Training! Our Revit Basic to Advanced Training Course is tailored to enhance your expertise in Autodesk Revit. Delivered through in-person or live online sessions, this program covers advanced modeling, parametric families, collaboration tools, and project phasing. Course Benefits: Master Advanced Skills: Learn intricate 3D modeling, design complex building components, and implement advanced BIM workflows. Expert Instruction: Industry professionals guide you through advanced concepts via engaging demonstrations and hands-on exercises. Flexible Learning: Choose in-person or live online sessions with interactive instruction and personalized guidance. Lesson Recordings: Access class recordings for convenient review and practice, reinforcing your learning. Lifetime Support: Benefit from lifetime email support for ongoing guidance from our experienced instructors. Enhance your Revit proficiency, streamline design processes, and boost project efficiency. Whether you're an architect, engineer, or design professional, this course unlocks advanced Revit skills. Join our training for comprehensive learning and expert support! Individualized Training: Experience personalized attention and tailored guidance. Flexible Learning Hours: Select your preferred schedule for training sessions. Ongoing Support: Access complimentary online assistance even after course completion. Comprehensive Learning Materials: Receive detailed PDF resources for effective learning. Certificate of Attendance: Earn a certificate acknowledging your course completion. Affordable Pricing: Enjoy budget-friendly training rates. Software Setup Help: Get assistance with software configuration on your device. Referral Benefits: Receive discounts on future courses by referring a friend. Group Discounts: Avail special rates for group training sessions. Extended Availability: Access training sessions every day with extended operating hours. Customized Curriculum: Engage in tailored training designed to meet your specific requirements.

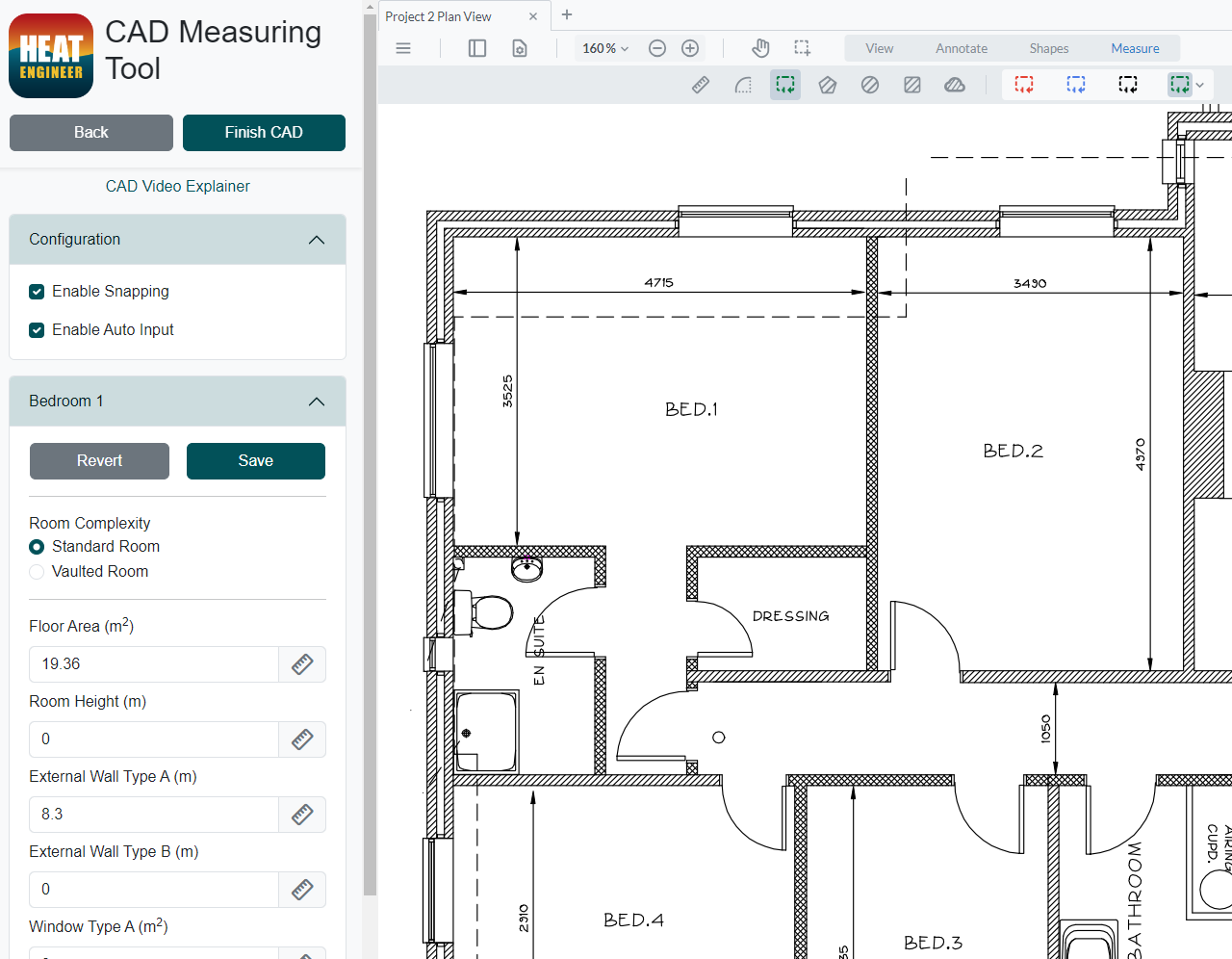

Discover how to begin measuring dimensions directly from your drawings and watch as all measurements automatically synchronise with your heat loss survey. This revolutionary feature is designed to significantly enhance your workflow, making your desktop heat loss analysis both faster and more efficient.

Enscape Rendering Training Course

By ATL Autocad Training London

Who is this course for? Enscape Rendering Training Course. The Enscape Rendering Training Course is tailored for architects, interior designers, and design students aiming to learn realistic visualizations using Enscape. Whether you prefer 1-on-1 in-person or online courses, this training is best for you. Click here for more info: Website Training duration: 5 hrs Method: 1-on-1 and Tailored content Schedule: Customize your training. Choose any hour from Mon to Sat, 9 am to 7 pm Call 02077202581 or WhatsApp at 07970325184 to book. Course Outline: Enscape Rendering Software Training (5 hours) Course 1: Enscape for Revit Hour 1: 1. Introduction to Enscape: Overview of Enscape rendering software, its features, and benefits. 2. Installing and Setting up Enscape: Step-by-step guidance on installing and configuring Enscape for Revit. 3. Enscape Interface: Familiarizing with the Enscape user interface and navigation controls within Revit. Hour 2: 4. Enscape Materials: Exploring material creation, application, and customization within Enscape for Revit. 5. Lighting in Enscape: Understanding different lighting options, adjusting light settings, and creating realistic lighting effects. Hour 3: 6. Enscape Camera Settings: Manipulating camera angles, perspectives, and settings for optimal visualization. 7. Enscape Rendering Settings: Exploring various rendering settings and techniques to enhance the quality of the final output. Hour 4: 8. Enscape Rendering Workflow: Demonstrating a step-by-step workflow for generating renderings and walkthroughs using Enscape in Revit. 9. Advanced Features: Introduction to advanced features such as creating panoramas, virtual reality (VR) walkthroughs, and creating animations in Enscape. Hour 5: 10. Tips and Tricks: Sharing tips and techniques for maximizing efficiency and achieving high-quality results in Enscape for Revit. 11. Q&A and Troubleshooting: Addressing participant questions, providing troubleshooting guidance, and discussing common challenges and solutions. OR Course Outline: Enscape Rendering Software Training (5 hours) Course 1: Enscape for Sketchup Hour 1: 1. Introduction to Enscape: Overview of Enscape rendering software, its features, and benefits for SketchUp users. 2. Installing and Setting up Enscape: Step-by-step guidance on installing and configuring Enscape for SketchUp. 3. Enscape Interface: Familiarizing with the Enscape user interface and navigation controls within SketchUp. Hour 2: 4. Enscape Materials: Exploring material creation, application, and customization within Enscape for SketchUp. 5. Lighting in Enscape: Understanding different lighting options, adjusting light settings, and creating realistic lighting effects. Hour 3: 6. Enscape Camera Settings: Manipulating camera angles, perspectives, and settings for optimal visualization in SketchUp. 7. Enscape Rendering Settings: Exploring various rendering settings and techniques to enhance the quality of the final output. Hour 4: 8. Enscape Rendering Workflow: Demonstrating a step-by-step workflow for generating renderings and walkthroughs using Enscape in SketchUp. 9. Advanced Features: Introduction to advanced features such as creating panoramas, virtual reality (VR) walkthroughs, and creating animations in Enscape. Hour 5: 10. Tips and Tricks: Sharing tips and techniques for maximizing efficiency and achieving high-quality results in Enscape for SketchUp. 11. Q&A and Troubleshooting: Addressing participant questions, providing troubleshooting guidance, and discussing common challenges and solutions. Learning Outcome: After completing the Enscape (VR) Training and Interactive Workshop, participants will master real-time walkthroughs, set up VR applications, efficiently migrate models, navigate designs dynamically, update objects in real-time, control visual styles, adjust day-time settings, export and share designs, utilize the asset library, and gain a comprehensive overview of Enscape. These skills will enable them to confidently visualize and display 3D designs without cloud uploads or external software, enhancing communication and collaboration in architectural projects. What does the Enscape Training & Interactive Workshop offer? The Enscape Training & Interactive Workshop is designed to help you get up and running with Virtual Reality (VR) in a cost-effective manner. It covers hardware and software setup, navigation techniques, real-time updates, material settings, and more. The workshop also allows participants to experience VR firsthand. What are the benefits of attending the Enscape (VR) Training and Interactive Workshop? By attending this workshop, you will gain the ability to perform real-time walkthroughs of your designs in 3D. You can view your projects in VR without the need for cloud uploads or exporting to other 3D software. The workshop offers extensive asset libraries, collaboration, and annotation sharing, enhancing your design visualization capabilities. What are the prerequisites for attending the Enscape (VR) Training and Interactive Workshop? No prior knowledge of Enscape is required. However, assistance from IT management may be necessary for hardware and software installation. Logistics, such as room suitability and technical requirements, will be discussed before the workshop. What will I learn in the Enscape (VR) Training and Interactive Workshop? The workshop covers hardware setup, software installation, and configuration. You will learn how to migrate models from Revit and SketchUp into VR, navigate through designs, update objects and materials in real-time, and utilize various visual styles and settings. The course also includes interactive workshops with support from our expert tutors. Enscape rendering courses offer valuable benefits: Real-time Visualization: Instantly visualize designs for quick iterations and informed decisions. Seamless Integration: Streamline rendering by integrating with popular design software. High-Quality Visuals: Create photorealistic presentations and walkthroughs. Efficient Design Communication: Enhance collaboration and communication during presentations. Enhanced Design Iteration: Explore options and make informed decisions in real-time. Time and Cost Savings: Reduce rendering time and deliver projects more efficiently. Portfolio Enhancement: Elevate your portfolio with visually striking renderings, opening new opportunities.

Environmental legislation (In-House)

By The In House Training Company

A thorough account of the UK and European legal framework and its requirements as regards managing environmental performance. This course will help staff to understand: The framework of UK and European legislation and its enforcement The principal features of the legislation as they apply to your organisation's activity/product/service The benefit of having an Environmental Management System such as ISO 14001 How their own actions and decisions can either expose or protect the organisation in relation to its legal obligations 1 Introduction and objectives 2 Introduction to environmental law and enforcement Sources of law (European and UK) Structure and enforcement Key legislation 3 Integrated Pollution Prevention and Control (IPPC) and Local Air Pollution and Control (LAPC) Pollution and Prevention Control Act 1999 EC Directives on PPC The meaning of BAT Transitional provisions Fit and proper persons Control of emissions to air National Air Quality Strategy 4 Packaging and producer responsibilities Who, what and how The Producer Responsibility Obligations (Packaging Waste) Regulations Obligations and exemptions Registration Recycling and recovery obligations Records Duties of the Environment Agency Offences Developments 5 Waste management National Waste Strategy Waste minimisation (re-use/recycling) Waste definition Disposal and recovery Controlled waste management Hazardous waste management 6 Proposed Legislation and EC Directives EU Commission's waste and resources strategies Implementation of ELV (End of Life Vehicles) Directive WEEE (Waste Electrical and Electronic Equipment) Directive transposition into UK legislation Other producer responsibility initiatives Other proposals from the EU 7 Conclusion Open forum Summary Close