- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Managing Difficult Conversations.

By The Leadership Wizard

Difficult Conversations

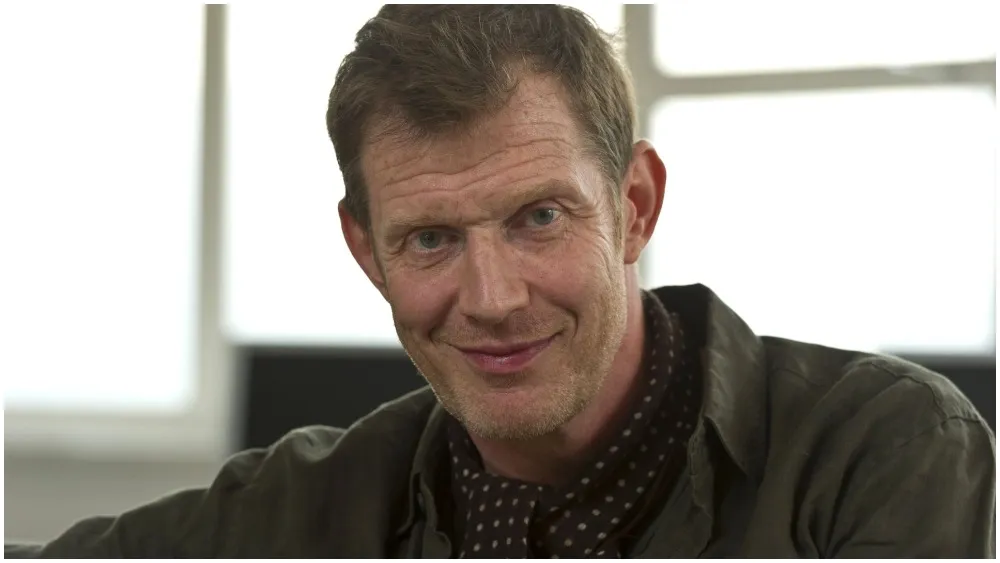

DATE: Tuesday 21st May TIME: 4pm LOCATION: Studio A The renowned and brilliantly-chameleonic actor Jason Flemyng is coming to Central Film School this month, and we couldn't be happier to have him. With an amazing CV including films and series such as Lock, Stock and Two Smoking Barrels, Boiling Point, A Town Called Malice and The Curious Case of Benjamin Button, Jason will be talking about his career, how the industry has changed and giving practical, down-to-earth advice for our actors. There will also be an opportunity for students to put their own questions to Jason, so make sure you book a ticket and come along!

Date: Monday 30th October Time: 4pm Location: Studio A Director Gus Van Sant (Good Will Hunting, Milk, Finding Forrester) creates a tender, meditative portrait of young gay men living off-grid in the early 1990s in My Own Private Idaho. Keanu Reeves and River Phoenix play best friends Scott and Mike, who turn tricks and hustle through difficulties living on the streets. Their bond and love is tested when ghosts from the past arise and they're forced onto the road to find answers. One of the most important films in LGBTQ+ cinema, My Own Private Idaho broke down barriers and flew in the face of taboo at the time of its release. Come and see this important story of celebrating gay culture on the big screen.

Date: Thursday 15th June Time: 4pm Location: Studio A - Landor Road Event Details: Tim Haines is a television producer and director, having worked on several highly-respected documentary and drama productions over a storied career. Tim will speak about the following topics as well as others at the event: Approaches to Documentary How a Documentary Gets Made The Purpose of a Documentary Modern Combinations of CGI & Live Action Throughout students will have the chance to ask questions about the topics being discussed, before wrapping up with a wider Q+A session at the end. A multiple Emmy and BAFTA winner, Tim has worked on many well known series, including: - Walking with Dinosaurs - Director & Producer - Primeval - Producer - The Loch - Producer - Surviving Earth (currently in production) - Producer This is a free event that all students are welcome to attend. Be sure to book tickets in advance though so that you don't miss out!

Total Accounting Training Course Package - With Guaranteed Job Placement

By Osborne Training

Total Accounting Training Course Package - With Guaranteed Job Placement It is a comprehensive practical accounting training program designed to build the bridge between knowledge and practical aspects of accounting and tax. With this accounting courses many modules of tax and accounting are covered as well as Computerised Accounting & Payroll. Moreover, After completing the modules you will have the chance to get hands on experience which will open the door for lucrative Accounting, Tax & Payroll sector. CompletOsborne Trainingion of this training program will earn you valuable verified CPD points. As an accountant, it is vital to gain CPD points to retain your accounting membership and to comply with Professional Accounting Bodies (such as ACCA, AAT, CIMA, ICAEW etc.) requirements. Advanced Excel Bookkeeping VAT Training - Preparation and Submission Personal Tax Return Training Company Accounting and Tax Training Sage 50 Accounting Training Sage Payroll Training

Company Accounting - tax return, Annual accounts and Annual return Training Course

By Osborne Training

Company Accounting - tax return, Annual accounts and Annual return Training Course If you want to work in a Finance or Tax department of a business or as an accountant in well-known accountancy firms it is vital that you know how to prepare accounts for the company and submit them to the right places. This UK Tax accounting course will upgrade your skills to higher level. Completing this course will enable you learn more about the procedures involved in submitting Corporate Tax Return. Once you are skilled on this, you can offer this as a service to potential business clients and earn £££. If you are running a business you can process your own Business Tax return and Accounts, instead of paying someone else to do it. It will save a lot of money (£££) every year. You will stay ahead of the competition if you are looking for a job in the Accounting or Tax Industry once you are skilled Business Accounting and Tax procedures. Identifying requirements to set up a UK Company Identifying Statutory Requirements for Companies Introduction to Confirmation Statement processing Identifying Types of Companies based on size Identifying Types and requirements of various Submissions available Identifying minimum requirements in a Balance Sheet and Profit & Loss Account Identifying Tax Return periods and deadlines Identifying Penalties for Late filing Identifying Closing Down Procedures for Companies Introduction to the Filing Company accounts procedure Company house forms and correspondences Understanding of IXBRL requirements Understanding submission procedures using HMRC Online CT600 (Webfiling) Using one Business(SME/Micro Entity) case to understand the procedures on Annual Submission for Company Tax Return and Accounts submission

Best SAP Training UK | Sap Courses Online

By Osborne Training

SAP Training Online | Sap Training in London, UK What is SAP? SAP is one of the largest ERP(Enterprise Resource Planning) software in the world. It provides end to end solution for Financials, Manufacturing, Logistics, Distributions etc. SAP applications, built around their latest R/3 system, provide the capability to manage financial, asset, and cost accounting, production operations and materials, personnel, plants, and archived documents. The R/3 system runs on a number of platforms including Windows and MAC and uses the client/server model. SAP Career Potential You can become a SAP consultant. SAP consultants analyze, design, and configure new computer software and systems in accordance with their employers' or clients' specifications, as well as write programs such as forms, specifications, and interfaces. They also test new interfaces to ensure that system workflows are optimized and interact with end-users to make changes as requested and obtain feedback. As a SAP consultant, you could expect to earn £80,000-£150,000 per year. Which SAP Module Osborne Training offers training on various sap modules such as Financial and Controlling Sales and Distribution Material Management CRM SRM HANA And many more... Study Options Instructor-Led Live SAP Online Training Students attending training through Online LIVE Training have a real-time, Live Instructor-Led student experience through the world-class Virtual Learning Campus. Online LIVE Training provides an engaging live classroom environment that allows students to easily interact with instructors and fellow students virtually. Classroom-Based Live SAP Training in London Osborne Training offers evening sessions for classroom-based training, where an experienced Tutor/Consultant goes through the whole SAP Training course from the London campus. Only selected modules are offered from the London campus. Free Certification from Osborne Training on completion. You may attempt for SAP certification exams online to get certificate directly from SAP. Syllabus varies depending on the module take. Please send a query to receive full syllabus information.

AAT Courses | AAT Level 2 Course

By Osborne Training

AAT Level 2 is the first level of qualification for people with limited or no accounts knowledge. This Foundation Certificate in accounting training equips you for an entry-level role in an Accounting or Finance department. Moreover, this AAT course also lays the groundwork for a promising future in the accounting profession. By the end of the course, you will have a greater understanding and skills of manual and computerised accounts and how to use them in a 'real business world' setting. Why AAT? Want a new direction for your career? Think Accountancy, according to statistics, the average salary for Accountants is £50,000; it is the sector where the employ-ability rate is greater than any other sector. What are the benefits after completing AAT courses? A newly qualified AAT member can expect to earn an average of £21,600. Some accounting technicians work as accounts assistant; others go on to become managing directors or finance directors of well-known companies. Some go to work as a self employed accountant as AAT allows the student to become chartered. Osborne Training is an AAT Approved Training Provider in London. In taking the Association of Accounting Technicians qualification with Osborne Training, you will make one of the greatest decisions of your career. Duration You can expect this qualification to take 1-1.5 year to complete for most students. Tutors Tutors are highly qualified with extensive knowledge of accountancy. Study Options Classroom Based - evening, Weekend and Daytime sessions for AAT course from London Campus. Osborne Training continuously opening new campuses throughout the UK. Online Live - Interactive online sessions through world-class Virtual Learning Campus with study materials are delivered to your home address. Distance Learning- Self-Study with Study Material and access to Online study Material through Virtual Learning Campus. Once you finish the AAT qualification and pass all exams successfully, you will receive a globally recognised AAT Level 2 Foundation Certificate in Accounting from AAT. AAT Level 2 Course syllabus Bookkeeping transactions Bookkeeping Controls Elements of Cost Work effectively in finance Using Accounting Software (i.e SAGE)

Did you know that: An estimated 55% of pregnancies in the UK are planned; the remainder are unplanned or associated with ambivalence1 12% of women aged 15–44 in heterosexual relationships report not using any method of contraception2 NICE guidance (2016) stipulates that women asking for contraception are given information about, and offered a choice of, all methods including long-acting reversible contraception (LARC)2 Over 1/3 of all women in England and Wales have ever an abortion3 Of all woman in England and Wales who had an abortion in 2021, 43% had had a previous abortion4 Why is SHIP training relevant to YOU? Do you worry about how to bring up the topic of contraception out of the blue? Find out how to outline key points about different methods of contraception to patients in a concise and time-efficient way Learn how to assess women to safely reissue combined hormonal contraception, progesterone only pill and injections Do you know what to do if you see a woman has had a recent abortion? Learn quick simple strategies to work out which methods of emergency contraception you should offer women We will help you become confident in bringing up and discussing contraceptive choices and make meaningful changes to your clinical practice! Basic Contraception 1 Differentiate between methods of contraception, including LARCs (long acting reversible contraception) Practice how to bring up contraception & promote LARC appropriately Establish guidelines for re-issuing combined hormonal contraception & progesterone only pill Establish guidelines for administering & re-issuing the contraceptive injection Basic Contraception 2 Manage requests for emergency contraception Outline and practise applying Fraser Guidelines Assess whether a woman is at risk of pregnancy and identify criteria for ‘near patient’ pregnancy testing Understand your role as general practice nurse in abortion referrals & aftercare Each session provides you with up-to-date resources to take back to your practice to support your consultations. References: Wellings K, Jones KG, Mercer CH et al. (2013) The prevalence of unplanned pregnancy and associated factors in Britain: findings from the third National Survey of Sexual Attitudes and Lifestyles (Natsal-3).Lancet 382: 1807–16 NICE Contraception Quality standard Published: 8 September 2016 nice.org.uk/guidance/qs129\ UK Government Abortion statistics, England and Wales https://www.gov.uk/government/statistics/report-on-abortion-statistics-in-england-and-wales-for-2016 Abortion Statistics, England and Wales: 2021, Office for Health Improvement and Disparities https://www.nice.org.uk/sharedlearning/sexual-health-in-practice-training-increases-hiv-testing-in-primary-care Pillay TD, Mullineux J, Smith CJ, et al. Unlocking the potential: longitudinal audit finds multifaceted education for general practice increases HIV testing and diagnosis. Sexually transmitted infections 2013;89(3):191-6. doi: 10.1136/sextrans-2012-050655 Click here to see how SHIP training in Haringey led to increases in testing & changes in practice

AAT Diploma in Accounting | AAT Level 4 | AAT Distance Learning

By Osborne Training

AAT Level 4 is the highest level or final stage of the AAT Accounting qualification. This qualification provides the skills necessary for a 'Finance Officer' role including the complex management accounting tasks, general management skills, drafting financial statements and specialist learning areas. This provides you with an opportunity to become a professional member of AAT and use it MAAT after your name. You are also entitled to exemptions in the UK's chartered and certified accounting qualifications. Besides, if you want to pursue your career further in University, you are entitled to exemptions for up to two years in various universities in the UK. What is AAT? AAT is an awarding body for vocational accountants. AAT is highly recognised globally with members over 130,000 worldwide. What are the benefits after completing AAT courses? A newly qualified AAT member can expect to earn an average of £21,600. Some accounting technicians work as accounts clerks; others go on to become managing directors or finance directors of well-known companies. Some go to work as a self employed accountant as AAT allows the student to become chartered. Osborne Training is an AAT Approved Training Provider in London. In taking the Association of Accounting Technicians qualification with Osborne Training, you will make one of the greatest decisions of your career. Duration You can expect this qualification to take 1-1.5 year to complete for most students. Tutors Tutors are highly qualified with extensive knowledge of accountancy. Study Options Distance Learning - Self Study with Study Material and access to Online study Material through Virtual Learning Campus. Osborne Books are delivered to students address with additional study materials and Tutorial support online. Online Live - Interactive tutorial sessions by expert tutors and access to world-class Virtual Learning campus for additional study materials. Classroom Based- Osborne Training offers Evening and Weekend sessions for AAT Level 4 from various centres in London, Watford, Birmingham etc. Once you finish AAT qualification and pass all exams successfully, you will be awarded globally recognised AAT Certificate in Accounting from AAT. AAT Level 4 Course Syllabus Management Accounting: Budgeting Management Accounting: Decision and Control Financial Statements of Limited Companies Accounting Systems and Controls Business Tax Personal Tax

Search By Location

- Ear Courses in London

- Ear Courses in Birmingham

- Ear Courses in Glasgow

- Ear Courses in Liverpool

- Ear Courses in Bristol

- Ear Courses in Manchester

- Ear Courses in Sheffield

- Ear Courses in Leeds

- Ear Courses in Edinburgh

- Ear Courses in Leicester

- Ear Courses in Coventry

- Ear Courses in Bradford

- Ear Courses in Cardiff

- Ear Courses in Belfast

- Ear Courses in Nottingham