- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2732 Divi courses

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems. There are two options to complete the NVQ Level 3 in Electrical Installations, these are the C&G 2346 and C&G 2357. Successful completion of the NVQ and AM2 assessment will satisfy the entry criteria for JIB accredited electricians

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems.

If you want to start installing independently or with an electrical contractor look no further as this course will give you the skills and knowledge required. This package which will allow you to become a fully qualified domestic installer and enable you to join a Competent Person Self-Certification Scheme and certify your own domestic work.

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

CLAB Candle Artist Course

By Noel Candle

CLAB Candle Artist's professional candle certificate course teaches the principles of candle making and covers 29 unique candle items.

DIVINE ACTIVATION w/ CEREMONIAL CACO + SOUND

By Mystic Sisters

Join Barbra May from Mystic Sisters for Divine Feminine Activation w / Ceremonial Cacao and Sound.

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems. The EWR is for electricians who have been working in the industry for at least 5 years but have not formally completed an industry apprenticeship or Level 3 NVQ qualification. Successful completion of the NVQ and AM2 assessment will satisfy the entry criteria for JIB accredited Gold Card status. Bear in mind that the C&G 2391-50 and 18th Edition courses are pre-requisites to the Experienced Worker route. In case you don’t hold them, we can help you with a Pre-Experienced Worker Route package.

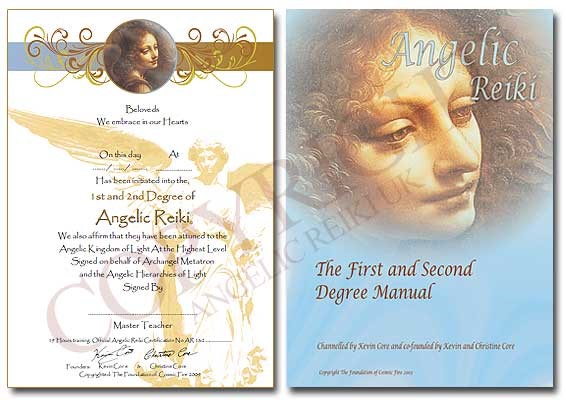

Angelic Reiki 1&2 Workshop

By Academy Of Angelic Healing

Learn Angelic Reiki with multi-award winning Master Teacher, Jayn Lee-Miller, who was one of the first to work professionally with angels and is now approaching her 18th year of teaching Angelic Reiki. Please email info@healingangels.co.uk for full details of this healing module which has been channelled through the Archangel Metatron especially for this time as the consciousness of humanity is collectively ascending to fifth dimension. The Angelic Kingdom of Light is assisting in helping us hold a place of unconditional love to help us remember the divine beings we truly are. In Angelic Reiki you are attuned by Angels to The Angelic Kingdom of Light and during healing exchanges you actually become the Angel you are channelling.

Existential Dialogue 2025: "Invention" with Dr. Betty Cannon

By Therapy Harley Street

Recognizing the brilliance of someone psychological disturbance normalizes their experience and opens the door to transformative change. We aim to explore the lived experiences on irregular perceptions of reality with an open mind. Each Saturday includes: a live dialogue between Prof. Ernesto Spinelli and an International Existential Therapist; a moment to share your thoughts and feelings with the teachers; and a final integration facilitated by Bárbara Godoy. This series of ten dialogues set out to explore the multifaceted dimentions and complexities associated with Existential Therapies. It attempts to engage with various interpretations of insanity through the lens of patients often painful, confounding, and deeply unsettling life experiences. Invention- between Prof. Ernesto Spinelli and Dr. Betty Cannon “When I first saw the topic of this year’s dialogues, I asked myself whether I had anything to contribute. After all, I told myself, I do not usually work with psychoses or other so-called ‘extreme’ or’ irregular’ states of consciousness. This started me thinking about a series of demonstration videos that I have been making with students and supervisees over the last couple of years as part of a book project. Do those videos display ‘extreme states’? To my surprise, the answer is yes. They are filled with experiences that might be described as hallucinations (positive and negative), dissociative states, paranoia, delusions, manic and depressive states, crippling anxiety, schizoid withdrawal, depersonalization and derealization, and body dysmorphic phenomena. Not to mention the so-called normal neurotic trances that Freud called transference, countertransference and defenses, psychedelically induced extreme states, and those nightly hallucinations, our dreams. So why did I not remember at least some of these states as being ‘extreme’? Perhaps the answer lies in my perspective on therapy, which is largely existential-phenomenological. I think that the following quote, from a letter that Sartre wrote to R.D. Laing, captures the essence of this perspective: “Like you, I believe that one cannot understand psychological disturbances from the outside, on the basis of a positivistic determinism or reconstruct them with a combination of concepts that remain outside the experience as lived and experienced. I also believe that one cannot study, let alone cure, a neurosis without a fundamental respect for the person of the patient, without a constant effort to grasp the basic situation and relive it, without an attempt to rediscover the response of the person to that situation and––like you, I think––I regard mental illness as the ‘way out’ that the free organism, in its total unity, invents in order to be able to live through an intolerable situation.”* When a client and I together are able to appreciate the true brilliance of this invention, my experience is that it not only normalizes the client’s experience, it also opens the doorway to change. It allows us to invent something new.” Dr. Betty Cannon. Betty Cannon, PhD, is a licensed psychologist who has taught and practiced in Boulder, Colorado, for over 40 years. She is Professor Emerita of the Colorado School of Mines and president and founder of the Boulder Psychotherapy Institute, which has trained mental health professionals in Applied Existential Psychotherapy since 1989. In addition to existential philosophy, especially the philosophy of Sartre, AEP has roots in Gestalt therapy, classical and contemporary psychoanalysis, humanistic psychology (especially the person-centered therapy of Carl Rogers), and body-oriented psychotherapy. Betty is a member of the editorial boards of the Journal for the Society of Existential Analysis and Sartre Studies International. She is the author of Sartre and Psychoanalysis and numerous articles and chapters on existential therapy. Her mentor was Hazel E. Barnes, who translated Sartre into English and who was the world’s foremost Sartre scholar until her death in 2008. Betty is her literary executor, and her book on Sartre is dedicated to Hazel. Prof. Ernesto Spinelli was Chair of the Society for Existential Analysis between 1993 and 1999 and is a Life Member of the Society. His writings, lectures and seminars focus on the application of existential phenomenology to the arenas of therapy, supervision, psychology, and executive coaching. He is a Fellow of the British Psychological Society (BPS) as well as an APECS accredited executive coach and coaching supervisor. In 2000, he was the Recipient of BPS Division of Counselling Psychology Award for Outstanding Contribution to the Profession. And in 2019, Ernesto received the BPS Award for Distinguished Contribution to Practice. His most recent book, Practising Existential Therapy: The Relational World 2nd edition (Sage, 2015) has been widely praised as a major contribution to the advancement of existential theory and practice. Living up to the existential dictum that life is absurd, Ernesto is also the author of an on-going series of Private Eye novels. Date and Time: Saturday 25 October from 2 pm to 3 pm – (UK time) Individual Dialogue Fee: £70 Venue: Online Zoom FULL PROGRAMME 2025: 25 January “Knots” with Prof. Ernesto Spinelli and Bárbara Godoy 22 February “Healing” with Dr. Michael Guy Thompson and Prof. Ernesto Spinelli 22 March “Difference” with Prof. Tod DuBose and Prof. Ernesto Spinelli 12 April “Polarisation” with Prof. Kirk Schneider and Prof. Ernesto Spinelli 3 May “Character” with Prof. Robert Romanyshyn and Prof. Ernesto Spinelli 21 June “Opening” with Dr. Yaqui Martinez and Prof. Ernesto Spinelli 19 July “Meaning” with Dr. Jan Resnick and Prof. Ernesto Spinelli 25 October “Invention” with Dr. Betty Cannon and Prof. Ernesto Spinelli 15 November “Hallucination” with Prof. Simon du Plock and Prof. Ernesto Spinelli 13 December “Hysteria” with Bárbara Godoy and Prof. Ernesto Spinelli Read the full programme here > Course Organised by:

KCCA Master Candle Course

By Noel Candle

KCCA Course teaches principles of candle making, including handmade techniques for 28 candle items. Association issues certification upon completion

Search By Location

- Divi Courses in London

- Divi Courses in Birmingham

- Divi Courses in Glasgow

- Divi Courses in Liverpool

- Divi Courses in Bristol

- Divi Courses in Manchester

- Divi Courses in Sheffield

- Divi Courses in Leeds

- Divi Courses in Edinburgh

- Divi Courses in Leicester

- Divi Courses in Coventry

- Divi Courses in Bradford

- Divi Courses in Cardiff

- Divi Courses in Belfast

- Divi Courses in Nottingham