- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

28587 Development courses in Edinburgh delivered Online

Overview This course is designed to evaluate the financial statement, budget and making an effective decision. It will help to understand Discounted Cash Flow and its techniques, applications of financial statements and decision-making process. In this programme, you will challenge representatives to learn how to make use of financial statements to assess the strategic or financial performance of an organization. It will help to understand DCF Discounted Cash Flow techniques along with their apps for financial making decisions and making use of ratios in order to identify the major areas of concern. Find out the elements like weaker financial signals, major success factors, and robust financial signals within your own industry. It Projects future performance assuredly through real-world budgeting.

Health & Social Care, Medical Law & Public Health

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | 10 CPD Courses | Lifetime Access | 24/7 Tutor Support

Event management: Party Planner, Wedding and Kids Party Planner

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | 10 CPD Courses | Lifetime Access | 24/7 Tutor Support

Import/Export, Supply Chain Management and Purchase Ledger

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | 10 CPD Courses | Lifetime Access | 24/7 Tutor Support

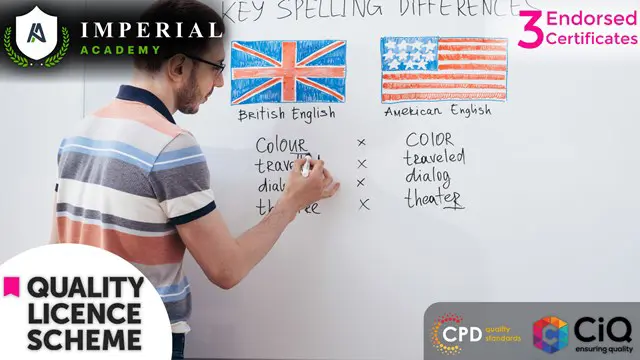

Functional Skills English, TEFL / TESOL with English Grammar

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

Journalism, Report Writing & Creative Writing Endorsed Training

By Imperial Academy

3 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

Mechanical Engineering, Engineering Management & Engineering Calculus

By Imperial Academy

Level 3 - Three QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

Hybrid Vehicle, Car Restoration and First Aid at Work - QLS Endorsed

By Imperial Academy

Level 3, 4 & 5 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

Admin, Secretarial & PA, Minute Taking, Office Management

By Imperial Academy

Level 3, 5 & 7 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

Overview Business modelling requires analysts to produce the quantitative models that top management uses to support their decision-making, but top management must also understand the strengths and weaknesses of the models if they are to use them effectively to support their decisions and robustly navigate the strategic negotiation landscape. This is particularly important for PPP projects where long-term commitments are made now based on bankability, value for money and risk allocation. During the course, participants will gain knowledge and skills on the frameworks, tools, and methodologies necessary to build quantitative models for financial decision-making in order to improve the financial viability and bankability of PPP projects. Participants will master modelling frameworks on capital budgeting, risk measurement, regression analysis and Monte Carlo Simulation among others.