- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Description Ecg Assessment And Interpretation Diploma Unleash the world of cardiac rhythms and enhance your skillset with the Ecg Assessment And Interpretation Diploma. This online course offers a comprehensive overview of electrocardiography, extending beyond mere theory to ensure practical expertise. Offering complete flexibility, this course lets learners progress at their own pace, and is perfect for healthcare professionals looking to enrich their knowledge, or students aspiring to a career in healthcare. At the heart of the Ecg Assessment And Interpretation Diploma lies an in-depth exploration of Physiology and Cardiac Anatomy. The course delves into the structure and function of the heart, detailing the fundamentals that all healthcare practitioners should grasp. This essential foundation supports a solid understanding of the electrical workings within the heart, and how these translate into the waveforms we see on an ECG. Building on this foundation, the course proceeds to 'Getting a Rhythm Strip', exploring the techniques for obtaining accurate ECG readings. It covers the practical aspects of patient preparation and placement of ECG leads, critical factors in ensuring clear, interpretable readings. The course then seamlessly transitions into 'Interpreting Rhythm Strips', providing an analytical approach to recognise and understand common rhythm abnormalities. The Ecg Assessment And Interpretation Diploma then delves into the world of arrhythmias, offering comprehensive modules on Sinus Node, Atrial, Junctional, and Ventricular Arrhythmias. Here, learners will become well-versed in the identification and significance of various types of cardiac arrhythmias. The complex topic of Atrioventricular Blocks also gets thorough coverage, enlightening students on the nature and clinical implications of these conditions. As an invaluable addition to the curriculum, 'Treating Arrhythmias' imparts knowledge of interventions, from medication to pacing and defibrillation. This essential knowledge completes the full circle of ECG interpretation, leading to appropriate and effective treatment strategies. The pinnacle of the Ecg Assessment And Interpretation Diploma is the module on 'Obtaining and Interpreting 12-lead ECG'. This vital section goes beyond basic rhythm strips to a full 12-lead ECG, expanding the learner's proficiency in assessing and interpreting complex cardiac conditions. Overall, the Ecg Assessment And Interpretation Diploma is a thorough and detailed course, designed for individuals who seek a robust understanding of electrocardiography. The online learning platform allows learners to interact, ask questions, and clarify doubts, fostering an engaging, productive learning environment. Take the first step towards mastering ECG assessment and interpretation, and sign up for this diploma course today. With the Ecg Assessment And Interpretation Diploma, the complex world of cardiac rhythms becomes an open book, bringing invaluable skills within your reach. What you will learn 1:Physiology and Cardiac Anatomy 2:Getting a Rhythm Strip 3:Interpreting Rhythm Strips 4:Sinus Node Arrhythmias 5:Atrial Arrhythmias 6:Junctional Arrhythmias 7:Ventricular Arrhythmias 8:Atrioventricular Blocks 9:Treating Arrhythmias 10:Obtaining and Interpreting 12-lead ECG Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Description Performance Management Diploma Performance Management is an essential skill for professionals in today's fast-paced, competitive world. The Performance Management Diploma is a comprehensive online course that provides a thorough understanding of the techniques and tools needed to effectively manage, evaluate, and improve employee performance. The course begins with an introduction to Performance Management, detailing its significance in the modern workplace. As participants progress through the course, they will learn about the importance of Performance Management and how it plays a pivotal role in achieving organizational goals. This diploma offers practical insights into setting realistic and measurable performance objectives, a crucial step in the performance management process. The Performance Management Diploma covers a wide range of performance evaluation methods, including both traditional and contemporary techniques. This allows participants to understand and assess the strengths and weaknesses of different methods, empowering them to select the most suitable approach for their organization. Furthermore, participants will gain valuable insights into the art of providing constructive feedback and coaching to employees, a vital skill for any manager or supervisor. They will also learn how to develop effective performance improvement plans, tailored to the needs of individual employees, helping them to achieve their full potential. Performance Metrics and Key Performance Indicators (KPIs) are important elements of the performance management process, allowing organizations to track and measure their progress towards their objectives. The Performance Management Diploma offers an in-depth exploration of these crucial tools, enabling participants to identify and monitor the most relevant performance indicators for their organization. In addition to these key topics, participants will gain an understanding of Performance Appraisal and how it fits into the overall performance management process. This diploma course also delves into Performance Management Systems, exploring how technology can be used to enhance the performance management process, streamline workflows, and improve data accuracy. Finally, participants will learn about the importance of continuous improvement, and how organizations can implement it to achieve sustained growth and success. By completing the Performance Management Diploma, participants will have a comprehensive understanding of the entire performance management process, from setting performance objectives to evaluating performance and providing feedback, and developing performance improvement plans. They will also be well-equipped with the skills and knowledge needed to implement effective Performance Management Systems and drive continuous improvement in their organization. Overall, the Performance Management Diploma is an invaluable resource for professionals looking to enhance their skills and knowledge in performance management. Whether you are a manager, supervisor, or HR professional, this course will provide you with the tools and insights needed to effectively manage and improve employee performance, ultimately contributing to the success of your organization. What you will learn 1:Introduction to Performance Management 2:The Importance of Performance Management 3:Setting Performance Objectives 4:Performance Evaluation Methods 5:Feedback and Coaching 6:Performance Improvement Plans 7:Performance Metrics and KPIs 8:Performance Appraisal 9:Performance Management Systems 10:Continuous Improvement Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Overview Make sure that your business finances and account details are kept safe by completing this certified training. This course contains approved CAMS (Certified Anti Money Laundering Specialist) methods for effectively safeguarding fiscal and legal property. The Certificate in Anti Money Laundering (AML) course contains in-depth learning modules detailing the concept of money-laundering and how it contributes to illegal activities. Alongside this, you will be taught how to monitor for suspicious conduct and transactions in your business infrastructure, and how to keep records for instant identification purposes. By raising awareness in your organisation, you can prevent criminal theft and fraud from taking place and stop the perpetrators. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Certificate in Anti Money Laundering (AML) Diploma. It is available to all students, of all academic backgrounds. Requirements Our Certificate in Anti Money Laundering (AML) course is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 10 sections • 10 lectures • 02:52:00 total length •Module 01: Introduction to Money Laundering: 00:15:00 •Module 02: Proceeds of Crime Act 2002: 00:18:00 •Module 03: Development of Anti-Money Laundering Regulation: 00:24:00 •Module 04: Responsibility of the Money Laundering Reporting Office: 00:19:00 •Module 05: Risk-based Approach: 00:22:00 •Module 06: Customer Due Diligence: 00:22:00 •Module 07: Record Keeping: 00:14:00 •Module 08: Suspicious Conduct and Transactions: 00:20:00 •Module 09: Awareness and Training: 00:18:00 •Assignment - Certified Anti Money Laundering Specialist (CAMS) Diploma: 3 days

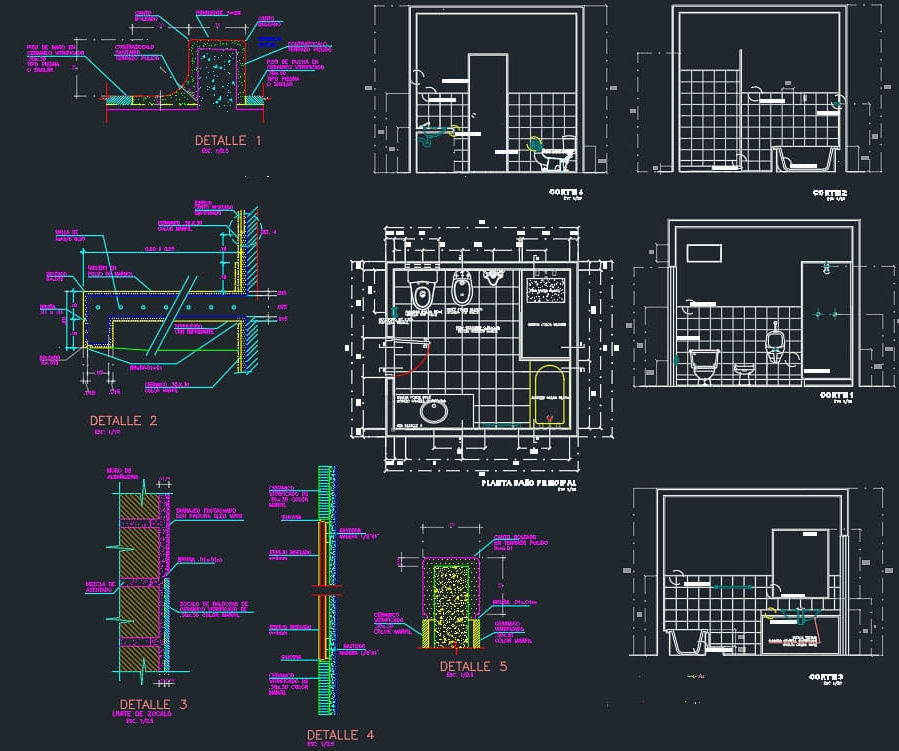

AutoCAD Basics-Advanced Training Classes

By London Design Training Courses

Why AutoCAD Basics-Advanced Training Classes? Click here for more info AutoCAD Basics to Advanced Level Training Master drawing, editing, and advanced techniques. Optimize productivity and customize workspace. Create precise 2D drawings for various industries. Access recorded lessons and lifetime email support. Duration: 16 hrs Method: 1-on-1, Personalized attention. Schedule: Tailor your own schedule by pre-booking a convenient hour of your choice, available from Mon to Sat between 9 am and 7 pm. The AutoCAD from Basics leading to Advanced Training Course offers a comprehensive learning experience for participants to become proficient in AutoCAD. Whether you're a beginner or an experienced user, this progressive program covers the full spectrum of AutoCAD functionality. Participants will learn core features like drawing, editing, annotations, and dimensioning, progressing to advanced topics such as object manipulation, workspace customization, and workflow optimization. Upon completion, participants will create precise 2D drawings and designs. Interactive learning experiences with experienced instructors are available in-person or through live online sessions. AutoCAD 2D Course Outline: Session 1: Introduction to AutoCAD interface, commands, and tools Managing drawings and drawing basic shapes Basic modification techniques (erase, move, rotate, scale) Session 2: Working with layers and properties Creating and modifying text and dimensions Introduction to blocks and attributes Session 3: Advanced object modification techniques (fillet, chamfer, trim, extend) Using grips to modify objects Creating and modifying polylines and splines Session 4: Creating and editing tables Working with layouts and viewports Printing and exporting drawings Construction detailing and Detailed sections Course Highlights: Engaging exercises and projects to reinforce skills. Q&A and troubleshooting support. Solid understanding of AutoCAD 2D for basic to intermediate drawings. List of Topics Covered: Drawing: Line, Polyline, Circle, Arc, Rectangle, Ellipse, Spline, Polygon, Ray, Hatching, Gradient. Inquiry: Measure and Select All. Modify: Move, Copy, Rotate, Mirror, Fillet, Trim, Extend, Erase, Offset, Explode, Array, Stretch, Break, Polyline Edit, Hatch Edit, Scale. Layers: Creating, Managing, Changing, Line Type, Line Weights. Annotation: Dimensions, Text, Dimension Style, Text Style, Leaders. Properties: Colors, Line weights, Line Types, Line Type Scaling. Blocks: Create, Insert, Edit, Explode, Export. Insert: Insert, Attach. View: Navigate, View, Windows. Plot/Print: Model Space, Layouts/Workspaces, Viewports, Layout Scaling, Paper Setup, What To Plot, Plot Scale, Plot Offset, Plot Options. Final Project: Create a Plan, Section, and Elevation drawing. Option for a personal project. Free Trial - Download AutoCAD Software & Toolsets: Participants can download a free trial of AutoCAD and industry-specific toolsets from Autodesk's official website: (https://www.autodesk.co.uk). Master AutoCAD Basics: Understand the interface, commands, and drawing tools. Create and Modify Drawings: Proficiently manage drawings and apply various modification techniques. Work with Layers and Annotations: Effectively use layers, text, and dimensions. Utilize Advanced Drawing Techniques: Apply advanced object modifications and work with polylines. Navigate Layouts and Viewports: Manage layouts, viewports, and printing/exporting. Hands-On Project Experience: Practice skills through exercises and a final project. Personalized Learning: Receive focused one-to-one attention. Convenient Options: Choose in-person or live online sessions. Lesson Recordings and Support: Access recorded lessons and receive ongoing email assistance. Enhance Career Opportunities: Develop valuable 2D drawing skills for career advancement.

Vray for Architects and Interior Designers 3ds max or Sketchup Training

By London Design Training Courses

Why Choose Vray for Architects and Interior Designers 3ds max or Sketchup Training Course? Click here for info Achieve stunningly realistic renders with our tailored course in V-Ray. Designed for experienced SketchUp and 3ds max users, this advanced training covers model preparation and rendering techniques, customized to your skill level and preferences. Duration: 10 hrs. Method: 1-on-1, Personalized attention. Schedule: Tailor your own hours of your choice, available from Mon to Sat between 9 am and 7 pm. SketchUp is renowned for its user-friendly interface and widespread usage in 3D modeling. Now, with V-Ray for SketchUp, users can take advantage of a powerful rendering tool for unparalleled visualization quality and realism. V-Ray seamlessly integrates into the SketchUp environment, allowing for efficient rendering within your existing workflows. Our course is ideal for those seeking to enhance their SketchUp proficiency by incorporating V-Ray's potent rendering capabilities for 3D models. We adapt the training to your current skill levels in both SketchUp and V-Ray and tailor the content to your modeling requirements and desired rendering quality. V-Ray Rendering Training Course. Course Duration: 10 hours Course Description: This 10-hour course enhances rendering skills with V-Ray, a leading 3D visualization engine. Participants master photorealistic renders, focusing on lighting, materials, and post-production. Covering key concepts, workflow, lighting techniques, material creation, rendering settings, and post-processing, the course ensures stunning visual results. Course Outline: Module 1: Introduction to V-Ray Rendering (1 hour) Overview of V-Ray and its role in 3D rendering Understanding the rendering workflow Setting up V-Ray for your 3D software platform Module 2: Essential Rendering Concepts (1 hour) Understanding global illumination and its impact on renders Exploring image sampling and antialiasing techniques Introduction to render elements for post-processing Module 3: Lighting Techniques (2 hours) Mastering various lighting types in V-Ray Creating natural lighting with HDRI maps Implementing artificial lighting with V-Ray lights Achieving realistic daylight with V-Ray sun and sky Module 4: Material Creation (2 hours) Creating realistic materials using V-Ray material editor Applying textures and procedural maps for added realism Understanding material reflections and refractions Advanced techniques for materials like glass, metal, and fabric Module 5: Rendering Settings and Optimization (1.5 hours) Exploring V-Ray rendering settings for different scenarios Understanding render output options and resolution settings Efficiently using V-Ray distributed rendering for faster results Module 6: Post-Processing with Photoshop (1.5 hours) Enhancing renders through post-processing techniques Compositing render elements for added control Adjusting colors, contrast, and lighting in Photoshop Adding effects and final touches to achieve photorealism Module 7: Advanced Rendering Techniques (1 hour) Working with V-Ray proxies and instancing for complex scenes Utilizing V-Ray displacement for intricate detailing Understanding depth of field and motion blur effects Module 8: Real-World Project (1 hour) Applying the skills learned to complete a real-world rendering project Guidance and feedback from the instructor

FORENSIC ANALYSIS BOOTCAMP

By Behind The Balance Sheet

The Forensic Analysis Bootcamp is an 8-week deep-dive into forensic equity analysis, featuring a 90-minute Zoom workshop each week. The content includes extensive use of real-life case studies and covers stocks spanning a wide range of sectors and regions. You will learn how companies manipulate expenses and inflate profits, how to spot balance sheet issues, weaknesses of the cash flow statement and issues and more.

Credit Products

By Capital City Training & Consulting Ltd

Offering insights into various types of credit facilities, including syndicated loans, corporate bonds, and revolving credit facilities. This overview encompasses both secured and unsecured lending, as well as specialized financing solutions like asset-based lending and mezzanine financing. What is Inside the manual? Introduction and Overview of Loans This section introduces the concept of loans, including syndicated loans, and differentiates between commitment and actual loans. It explains the basic instruments of term loans and revolving credits, highlighting their purposes, benefits, and how they serve as fundamental tools for financing in the corporate world. Syndication Process and Terms Details the process and rationale behind syndicated loans, contrasting them with bilateral loans. Exploring the key terms of loan agreements, including clauses, conditions precedent, interest periods, and repayment terms. It elucidates the complexity and intricacy of syndicated loans,. Borrower and Bank Perspectives Explores why borrowers opt for syndicated loans from their viewpoint and analyses the benefits these loans offer to banks. This insight underlines the mutual advantages, including risk distribution for banks and the ability to secure larger amounts of capital for borrowers, showcasing the synergy in syndicated loan transactions. Debt Structuring Fundamentals Investigates the hierarchy of claims, secured versus unsecured creditors, and the nuances of subordination. This section offers a deep dive into the mechanisms that protect creditors and structure debt in ways that manage risk and prioritize repayments, highlighting the legal and strategic considerations in debt structuring. Introduction to Bonds and Bond Issuance Covers the basics of bonds, including their types, valuation, and the role of rating agencies. Further exploring the process of bond issuance, the actors involved, and the strategic considerations from both the issuer and investor perspectives. This segment broadens the understanding of corporate financing through the lens of the bond market. Credit Products Beginning with a foundational exploration of loans, detailing syndicated, term, and revolving credits, and elaborates on the strategic implications of these instruments for corporate finance. The book covers the syndication process, offering insights from both borrowers' and banks' perspectives, and navigates through the intricacies of loan agreements and debt structuring, emphasizing the importance of managing risk and prioritizing repayments.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Improve your grasp of consumer rights and data protection with our complete course, "Consumer Rights Awareness." Explore the fundamentals of consumer rights and the Consumer Rights Act, comprehend the complexities of consumer contracts, and learn effective fraud prevention tactics. The course also covers the General Data Protection Regulations (GDPR), detailing your responsibilities, obligations, and lawful practices to ensure compliance. Empower yourself with the knowledge to protect and assert your rights confidently. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access In this course, you will learn about your rights as a consumer and how to protect yourself. The first section covers what consumer rights are and how laws, like the Consumer Rights Act, protect you. You'll understand different types of consumer contracts and how to avoid fraud. The second section focuses on the General Data Protection Regulations (GDPR). You'll learn about your responsibilities and rights under GDPR, how to handle breaches, and the lawful reasons for using personal data. By the end of the course, you'll have a solid understanding of consumer rights and data protection, empowering you to make informed decisions and protect your personal information. Course Curriculum: Section 1: Consumer Rights Awareness Module 01: Introduction to Consumer Rights Module 02: The Consumer Rights Act Module 03: Consumer Contracts Explained Module 04: Fraud Protection Section 2: General Data Protection Regulations Module 05: GDPR Basics Module 06: GDPR Explained Module 07: Lawful Basis for Preparation Module 08: Rights and Breaches Module 09: Responsibilities and Obligations Learning Outcomes: Understand basic principles of consumer rights awareness. Explain key elements of the Consumer Rights Act. Identify components of consumer contracts. Recognise strategies for fraud protection. Comprehend responsibilities under GDPR. Understand GDPR rights and breaches. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in consumer rights. People seeking knowledge of GDPR regulations. Business owners want legal compliance. Consumers are aiming for fraud protection. Employees handle consumer contracts. Career path Consumer Rights Advisor GDPR Compliance Officer Contract Manager Fraud Prevention Specialist Legal Assistant Data Protection Officer Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.