- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1962 Design courses in Belfast delivered On Demand

Investment - Key Concepts and Techniques

By Compliance Central

Are you looking to enhance your Investment - Key Concepts and Techniques skills? If yes, then you have come to the right place. Our comprehensive course on Investment - Key Concepts and Techniques will assist you in producing the best possible outcome by mastering the Investment - Key Concepts and Techniques skills. The Investment - Key Concepts and Techniques is for those who want to be successful. In the Investment - Key Concepts and Techniques, you will learn the essential knowledge needed to become well versed in Investment - Key Concepts and Techniques. Our Investment - Key Concepts and Techniques starts with the basics of Investment - Key Concepts and Techniques and gradually progresses towards advanced topics. Therefore, each lesson of this Investment - Key Concepts and Techniques is intuitive and easy to understand. Why would you choose the Investment - Key Concepts and Techniques from Compliance Central: Lifetime access to Investment - Key Concepts and Techniques materials Full tutor support is available from Monday to Friday with the Investment - Key Concepts and Techniques Learn Investment - Key Concepts and Techniques skills at your own pace from the comfort of your home Gain a complete understanding of Investment - Key Concepts and Techniques Accessible, informative Investment - Key Concepts and Techniques learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Investment - Key Concepts and Techniques bundle Study Investment - Key Concepts and Techniques in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your Investment - Key Concepts and Techniques Improve your chance of gaining in demand skills and better earning potential by completing the Investment - Key Concepts and Techniques Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. Investment - Key Concepts and Techniques Course Curriculum: Module 1: Introduction Module 2: Types and Techniques Module 3: Key Concepts in Investment Module 4: Understanding the Finance Module 5: Investing in Bond Market Module 6: Investing in Stock Market Module 7: Risk and Portfolio Management CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Investment - Key Concepts and Techniques helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Investment - Key Concepts and Techniques. It is also great for professionals who are already working in Investment - Key Concepts and Techniques and want to get promoted at work. Requirements To enrol in this Investment - Key Concepts and Techniques, all you need is a basic understanding of the English Language and an internet connection. Career path The Investment - Key Concepts and Techniques will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to Investment - Key Concepts and Techniques. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Rigging Safety Level-1 Training Course

By TUVSW Academy

This online Rigging and Slinging Safety course is designed to provide participants with a basic level of knowledge of rigging gear, proper rigging procedures & load control includes covering practices and techniques to safely sling and rig loads according to the OSHAD CoP 34, BS 7121 p1 & best practices . It also adheres to ANSI (American National Standards Institute) and ASME (American Society of Mechanical Engineers) standards. Certificate Validity: 1 Year Upon successful completion of this online course, a certificate of completion will be available for download and printing. COURSE ASSESSMENT: Online quiz A mark of 70% must be achieved in order to receive a certificate of completion. Language of Training: English

Embark on a journey into the world of financial mastery with our 'Budget Analysis and Financial Report Building' course. In an age where informed decision-making is the key to thriving, understanding the nuances of budgets and financial reports is more vital than ever. From deciphering financial statements to forecasting with precision, our meticulously structured modules empower you to harness the power of finance. Dive deep into budgeting intricacies, make impeccable purchasing choices, and even gain insights into the legal world, all designed to refine your financial acumen. Learning Outcomes Comprehend the foundational elements of financial statements and their analysis. Develop a robust understanding of budget formulation, management, and monitoring. Utilise advanced forecasting techniques for more informed financial planning. Understand the strategic nuances in making astute purchasing decisions. Gain insights into legal considerations in the financial realm. Why choose this Budget Analysis and Financial Report Building course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Budget Analysis and Financial Report Building Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Budget Analysis and Financial Report Building course for? Finance students aiming to bolster their analytical skills. Business owners seeking to optimise their financial decision-making. Managers responsible for departmental budgeting and forecasting. Financial analysts keen to deepen their knowledge base. Professionals looking to transition into finance roles. Career path Budget Analyst: £30,000 - £50,000 Financial Reporting Manager: £50,000 - £70,000 Finance Officer: £28,000 - £40,000 Financial Planner: £35,000 - £55,000 Purchasing Manager: £40,000 - £60,000 Legal Financial Advisor: £45,000 - £70,000 Prerequisites This Budget Analysis and Financial Report Building does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Budget Analysis and Financial Report Building was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Budgets and Financial Reports Module One - Getting Started 00:15:00 Module Two - Glossary 00:30:00 Module Three - Understanding Financial Statements 00:30:00 Module Four - Analyzing Financial Statements (I) 01:00:00 Module Five - Analyzing Financial Statements (II) 00:30:00 Module Six - Understanding Budgets 00:30:00 Module Seven - Budgeting Made Easy 00:30:00 Module Eight - Advanced Forecasting Techniques 00:30:00 Module Nine - Managing the Budget 00:30:00 Module Ten - Making Smart Purchasing Decisions 01:00:00 Module Eleven - A Glimpse into the Legal World 01:00:00 Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Improve your Financial Intelligence Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Improve your Financial Intelligence Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Improve your Financial Intelligence Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Improve your Financial Intelligence Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Improve your Financial Intelligence? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Improve your Financial Intelligence there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Improve your Financial Intelligence course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Improve your Financial Intelligence does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Improve your Financial Intelligence was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Improve your Financial Intelligence is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Introduction Introduction - Don't be Afraid 00:04:00 Section 02: The Three Key Financial Statements Key Financial Statements - Introduction 00:01:00 The Balance Sheet - Introduction 00:03:00 The Balance Sheet - Assets, Liabilities, Owners Equity 00:04:00 The Balance Sheet - How it relates to you 00:06:00 The Income Statement - Introduction 00:04:00 The Income Statement - How it relates to you 00:03:00 The Cashflow Statement - Introduction 00:04:00 The Cashflow Statement - How it relates to you 00:01:00 Key Financial Statements - Summary 00:01:00 Section 03: Ratio Analysis The Money Making Metrics 00:03:00 Ratio Analysis 00:02:00 Profitability Ratios 00:03:00 Operating Ratios 00:02:00 Liquidity and Leverage Ratios 00:03:00 How Ratio Analysis Impacts you 00:03:00 Section 04: Profit vs Cash Profit â Cash 00:03:00 Profit but No Cash 00:04:00 Cash but no Profit 00:05:00 Why understanding the Cashflow statement matters 00:04:00 Section 05: Managing Working Capital Managing Days Sales Outstanding 00:04:00 Managing Inventory 00:03:00 Working Capital - Case Study 00:05:00 Section 06: Return on Investments Return on Investments 00:04:00 Return on Investments - Calculations 00:04:00 Section 07: A broader Perspective Five Traps 00:04:00 Section 08: How much have you learned Course Completion 00:01:00

Level 5 Accounting and Finance

By Training Tale

***Level 5 Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Level 5 Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting and Finance There are no specific requirements for this course because it does not require any advanced knowledge or skills. Students who intend to enrol in this this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Accounting and Finance Level 5

By Training Tale

***Accounting and Finance - Level 5*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Accounting and Finance - Level 5 course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Accounting and Finance - Level 5 course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Accounting and Finance - Level 5*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Accounting and Finance - Level 5 course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Accounting and Finance - Level 5 course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Accounting and Finance - Level 5 This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Accounting and Finance - Level 5 There are no specific requirements for this course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Accounting and Finance - Level 5 This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5 Accounting and Finance Couse

By Training Tale

***Level 5 Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Module 2: Types of Cost Data and Cost Analysis Module 3: Contribution Analysis Module 4: Break-Even and Cost-Volume-Profit Analysis Module 5: Relevant Cost and Making Short-Term Decisions Module 6: Forecasting Cash Needs and Budgeting Module 7: Cost Control and Variance Analysis Module 8: Managing Financial Assets Module 9: Managing Accounts Receivable and Credit Module 10: Managing Inventory Module 11: The Time Value of Money Module 12: Capital Budgeting Decisions Module 13: Improving Managerial Performance Module 14: Sources of Short-Term Financing Module 15: Considering Term Loans and Leasing Module 16: Long-Term Debt and Equity Financing Module 17: Accounting Conventions and Recording Financial Data Assessment Method After completing each module of the Level 5 Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting and Finance There are no specific requirements for course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Financial Advisor Training

By Training Tale

Financial : Financial Advisor Training Discover Your Path to Success as a Financial Advisor with Our Comprehensive Course Are you ready to embark on a rewarding and lucrative career as a financial advisor? Look no further! Our comprehensive Financial Advisor Course is designed to equip you with the knowledge, skills, and confidence to excel in the dynamic world of financial planning. Why Choose Our Financial Advisor Course? Expert-Led Curriculum: Our course is crafted by seasoned financial advisors with extensive industry experience. You'll learn from professionals who have successfully navigated the complexities of the financial advisory field, gaining insights and strategies that are tried and tested. Comprehensive Skill Development: We cover a wide range of essential topics, including investment planning, retirement strategies, risk management, tax planning, and more. Our curriculum is designed to provide you with a holistic understanding of financial advisory principles, ensuring you're well-prepared to meet the diverse needs of your clients. Practical Learning Opportunities: Theory alone is not enough. Our financial advisor course incorporates practical exercises, case studies, and simulations to enhance your real-world problem-solving abilities. You'll develop hands-on skills, analyze complex financial scenarios, and create tailored solutions that align with your clients' goals. Industry-Recognized Certification: Upon completion of the course, you'll receive a prestigious certification that carries weight in the industry. This financial advisor credential will not only validate your expertise but also open doors to career opportunities with established financial firms, banks, or as an independent advisor. Networking Opportunities: Our financial advisor course provides a platform to connect with fellow aspiring advisors and established professionals. Networking events, industry guest speakers, and online forums offer opportunities to build relationships, gain mentors, and expand your professional network. Don't miss out on the chance to launch your successful career as a financial advisor. Enroll in our Financial Advisor Course today and unlock your potential in the world of finance. Take the first step towards a fulfilling and prosperous future. Invest in yourself and seize the opportunity to make a meaningful difference in people's lives as a trusted financial advisor. Enroll now and let our course be your stepping stone to a successful and rewarding career. Courses: Course 01: Financial Advisor Course 02: Level 5 Accounting and Finance Course 03: Supply Chain Management Financial : Financial Advisor Training Industry Experts Designed this Financial Advisor course into 05 detailed modules. Assessment Method of financial advisor After completing each module of the Financial Advisor course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification of financial advisor After completing the MCQ/Assignment assessment for this Financial Advisor course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. Who is this course for? Financial : Financial Advisor Training The Financial Advisor course is ideal for those already working in this field or are interested in becoming one. This Financial Advisor course is designed to broaden your knowledge and boost your CV. Requirements Financial : Financial Advisor Training There are no specific requirements for this Financial Advisor course because it does not require any advanced knowledge or skills. Career path Financial : Financial Advisor Training

Learn the Fundamentals of Financial Accounting Course

By One Education

Understanding financial accounting is no longer just for number crunchers in grey suits—it’s a core skill that brings clarity to the often-confusing world of business finances. This course introduces you to the bedrock principles of financial accounting, designed in a logical flow that even your sleep-deprived inner auditor would approve of. From double-entry bookkeeping to balance sheets and income statements, you’ll gain insight into how businesses track, report, and evaluate financial performance with purpose and precision. Whether you’re trying to make sense of your business's financial reports or just tired of nodding blankly during budget meetings, this course offers you the language of numbers in a way that makes sense. With a structured, theory-based format, you'll explore the essential components of accounting with clarity and relevance. Perfect for professionals, entrepreneurs, or those with a healthy distrust of spreadsheets, this is your chance to understand the financial ropes—minus the accounting jargon headache. Learning Outcomes: Understand the basics of financial accounting Learn the balance sheet equation and how to prepare financial statements Acquire knowledge of the recording process in financial accounting Gain an understanding of adjusting entries and their impact on financial statements Be able to complete the accounting cycle The Learn the Fundamentals of Financial Accounting course is designed to provide students with a comprehensive understanding of the basics of financial accounting. The course covers the balance sheet equation, financial statements, the recording process, adjusting entries, and completing the accounting cycle. Students will gain a deep understanding of the concepts and principles behind financial accounting and how they are applied in real-world scenarios. This course is perfect for anyone who wants to gain a solid understanding of financial accounting, whether they are new to the field or have some prior knowledge. It is also ideal for small business owners who want to manage their finances more effectively and make informed decisions based on financial data. â±â± Learn the Fundamentals of Financial Accounting Course Curriculum Module 01: Introduction to Business Module 02: Balance Sheet Equation Module 03: Financial Statements Module 04: Recording Process Module 05: Adjusting Entries Module 06: Completing the Account How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is designed for individuals who are interested in learning the fundamentals of financial accounting. It is suitable for: Students who want to pursue a career in accounting or finance Business owners who want to manage their finances effectively Professionals who want to enhance their accounting skills for career advancement Individuals who want to improve their personal finance management skills Anyone who is interested in learning about financial accounting Career path Accounting Clerk: £16,000 - £25,000 per year Bookkeeper: £18,000 - £30,000 per year Accounts Payable/Receivable Clerk: £18,000 - £30,000 per year Financial Analyst: £30,000 - £50,000 per year Certified Public Accountant (CPA): £40,000 - £90,000 per year Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

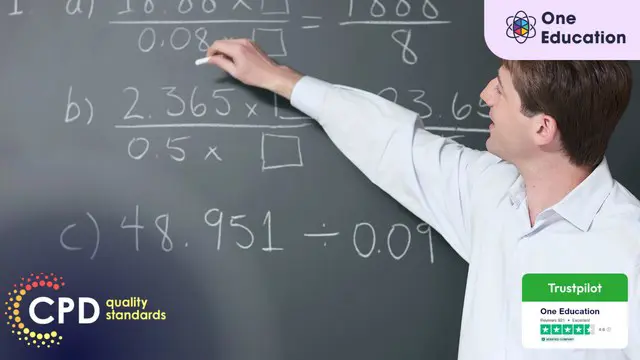

Functional Maths Training Course

By One Education

Functional Maths is about making numbers make sense – not just for passing exams, but for managing life’s everyday calculations with confidence. Whether it’s understanding bills, working out measurements, or getting to grips with percentages, this course is designed to build a solid foundation in essential maths skills, with clarity and a touch of common sense. Created for learners who want to feel more in control when numbers show up in daily life, this course breaks down the basics in a straightforward and engaging way. No confusing jargon, no unnecessary waffle – just clear explanations and useful examples. Perfect for brushing up rusty skills or gaining the confidence to take the next step, it’s a practical route to sharper numeracy that fits neatly into your schedule. Learning Outcomes: Master mathematical concepts such as integers, rational numbers, and decimals. Apply mathematical principles to solve everyday problems with ease. Simplify complex calculations using BODMAS rules. Estimate values using scientific notation and approximation techniques. Understand basic financial calculations such as profit, loss, discounts, and taxes. Work confidently with resources and materials to improve your mathematical skills This Functional Maths Training Course provides an extensive curriculum designed to help you gain practical mathematical skills. You will learn the principles of integers, rational and decimal numbers, percentages, ratios and proportions, and the unitary method. Additionally, you will understand how to calculate profit, loss, discounts, and taxes, making you an expert in basic financial calculations. The course provides a range of benefits, including the ability to estimate values using scientific notation, apply BODMAS rules to simplify complex calculations, and use fractions to solve problems. You will also gain the ability to work with resources and materials that help improve your mathematical skills. By the end of this course, you will have a solid foundation in maths, making it easier to solve problems in everyday life. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK (An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data entry clerk (£17,000 - £23,000) Retail sales assistant (£14,000 - £22,000) Bank cashier (£15,000 - £25,000) Administrative assistant (£17,000 - £25,000) Stock control clerk (£16,000 - £23,000) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.