- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

18969 Courses delivered Online

Microsoft Excel Introduction - Online classroom

By Microsoft Office Training

Course Objectives This course aims to provide delegates with a foundation for Excel knowledge and skills. ' Customer Feedback Great course and excellent trainer. Thanks Tracy Preston - Western Power Distribution Very helpful course. Would definitely take another one. Pedro was very patient and made it fun and engaged with us all. Laura Smith - James Grant Very professional and well mannered, fun and pleasant at the same time. I learnt a lot Carolina Foster - CNN 1 year email support service Take a look at the consistent excellent feedback from trainees visiting our site ms-officetraining co uk With more than 20 years experience, we deliver courses on all levels of the Desktop version of Microsoft Office and Office 365; ranging from Beginner, Intermediate, Advanced to the VBA level. Our trainers are Microsoft certified professionals with a proven track record with several years experience in delivering public, one to one, tailored and bespoke courses. Tailored in company training courses: You can choose to run the course exactly as they are outlined by us or we can customise it so that it meets your specific needs. A tailored or bespoke course will follow the standard outline but may be adapted to your specific organisational needs. Please visit our site (ms-officetraining co uk) to get a feel of the excellent feedback our courses have had and look at other courses you might be interested in. What is Excel? The Excel Interface Ribbon, Tabs and Groups Microsoft Office Backstage view Working with Workbooks Create a blank Workbook Create a Workbook using a Template Opening and saving Files Working with worksheets Worksheet navigation Select one or multiple Worksheets Insert, Move, Copy or Delete a Worksheet Working with Cells, Rows & Columns Cell References How to select cells or ranges Different types of data Move, Copy and Delete cells Pasting Options Find and Replace Working with Rows and Columns Overview of formulas in Excel Autocalculation The parts of an Excel formula Using calculation operators in Excel formulas The difference between Absolute, Relative and Mixed references Using Excel functions; Sum, Average, Max and Min Cell Formatting Font Format options Number Format options Change the Fill and Borders Cell Alignment An Introduction to Charts Create a simple Chart Format your chart Page Layout and Print Page Layout and Page Break View Change the Page Orientation Set Page Margins Headers and Footers in a worksheet Print a worksheet or workbook Who is this course for? Who is this course for? For those who want to explore in more detail formulas and functions, data analysis and data presentation. Requirements Requirements General knowledge of the Windows OS Career path Career path Excel know-how can instantly increase your job prospects as well as your salary. 80 percent of job openings require spreadsheet and word-processing software skills Certificates Certificates Certificate of completion Digital certificate - Included

Asset Management Foundation Award

By Asset Management Consulting (Asset Management Academy)

Our Asset Management Foundation Award course has been developed from our extensive and highly successful IAM Certificate courses to bring critical Asset Management principles and terminology delegates who need an introduction to Asset Management.

Meditation for health and wellbeing

By Estar Wellbeing

This 8-week course is aimed specifically at promoting your overall health and wellbeing. Amanda will teach you some simple yet surprisingly effective techniques drawn from the Zen tradition to help you manage your everyday life. These techniques will help you deal with stress, pain, improve your concentration and focussing skills and boost your general health and wellbeing. Frequently asked questions Who is this course for? This 8-week course is suitable for anyone who is looking for an introduction to meditation and mindfulness. It is useful for those looking for ways to help cope with stress-related problems, depression, illness and pain. It is equally useful for anyone wishing to boost their health, wellbeing and general enjoyment of life. How much time do I need to commit during the 8-week course? Where is it? There is one class each week and it lasts for 1.5 hours. You need to commit to listening to just one 30-minute meditation every day. You can take the course in person at a small studio in Lincolnshire, convenient for Louth, Horncastle and Spilsby. Alternatively, I can deliver 1-to-1 and pair classes in your own home. Corporate clients - your venue. Online via Zoom. What do I need to wear and bring to class? Wear comfortable clothing. Nothing too tight that restricts you from relaxing. Please bring: Something to rest your head on like a small pillow A blanket You will be provided with: A welcome pack with course book 8 audio recordings of the meditations we do in class A cup of tea/coffee etc if you are in person with me as the kettle’s always on! How much does it cost? All prices are per person: Group classes (max 12) In-person: £180 Online: £160 Pair In-person: £200 Online: £180 One to one In-person: £250 Online: £230 What are your meditation qualifications? I am a graduate of the Zen Mediation and Mindfulness course for Health and Wellbeing (100 hrs) taught by Zenways. This course is accredited by the International Mindfulness Teachers Association (IMTA). Learn more: Zenways IMTA How is this course different to MBSR/MBCT-based courses? This Zenways course is purely meditation and mindfulness based, with no admixtures of psychotherapy. The orientation is teacher-student rather than therapist-client. Although these practices are being used in the NHS and other healthcare settings, we take a much wider view of wellbeing, believing that it’s more than simply alleviating psychological distress or stress reduction.

Introduction to Frame Loom Weaving - A Beginners Guide

By Elka

'An Introduction to Frame Loom Weaving' is a self-paced online course which will teach you everything you need to know to get set up and weaving from the comfort of your home. The course will guide you through materials and equipment, how to set up your loom for weaving, basic weaving techniques including techniques for creating texture, finishing and trouble shooting. On enrolment you gain lifetime access to the course.

C205-MATERIALS

By CWCT

Outline: This course is intended to provide an introduction to some key materials and components used in contemporary building envelopes. This course will identify key British, European and CWCT standards and guides relevant to those elements. NOTE: The material for this course is based on previous MTCP and CWDC courses. Target audience: This course is aimed at those who specify and use the more common materials that are used in the construction of contemporary building envelopes. Learning objectives: Understand the factors affecting the durability of key façade metals, Understand commonly used coatings, Understand key performance criteria of key polymeric materials, Understand different insulation and thermal break materials, Appreciate different commonly used panel and board materials, Appreciate key production and fabrication issues relating to façade materials. Assessment: Assessment will be via a series of multiple-choice questions following the course, The assessment is timed and must be passed in order to receive a CPD certificate for the course, If the assessment is failed, one re-take will be permitted. Prerequisites: None, although C201 Introduction to contemporary cladding and façade systems is recommended. Course availability: 30 September - 27 October 2024 Lecture time: 1 day Price: Member price Non-Member price £180 + VAT £360 + VAT

C202- GLASS AND GLAZING

By CWCT

Outline: This course is intended to provide an introduction to the manufacture and processing of glass, its safe use, mechanical performance, thermal performance, and issues associated with design, installation and inspection. The course identifies relevant British, European and CWCT standards and guides which relates to the use of glazing in the building envelope. NOTE: The material for this course is based on previous MTCP and CWDC courses. Target Audience: This course is aimed at all those with an interest in the performance, specification and design of glazing in the building envelope. Learning objectives: Understand how different glass types and produced and processed, Understand the performance of different glass types, Understand the requirements for safety glass, Appreciate glass risk assessment, Understand key factors affecting glass quality, Understand the performance of coated glass, Basic understanding of the structural behaviour of monolithic and laminated glass. Assessment: Assessment will be via a series of multiple-choice questions following the course, The assessment is timed and must be passed in order to receive a CPD certificate for the course, If the assessment is failed, one re-take will be permitted. Prerequisites: None, although C201 Introduction to contemporary cladding and façade systems is recommended. Course availability: 09 September - 06 October 2024 Lecture time: 1 day Price: Member price Non-Member price £180 + VAT £360 + VAT

Do you want your dating to be an enjoyable and empowered experience? Would you like to develop a healthier, more intentional approach to dating? Sign up to Rachel's eight week course and get the tools you need to become more resilient and understand the psychological processes going on with dating.

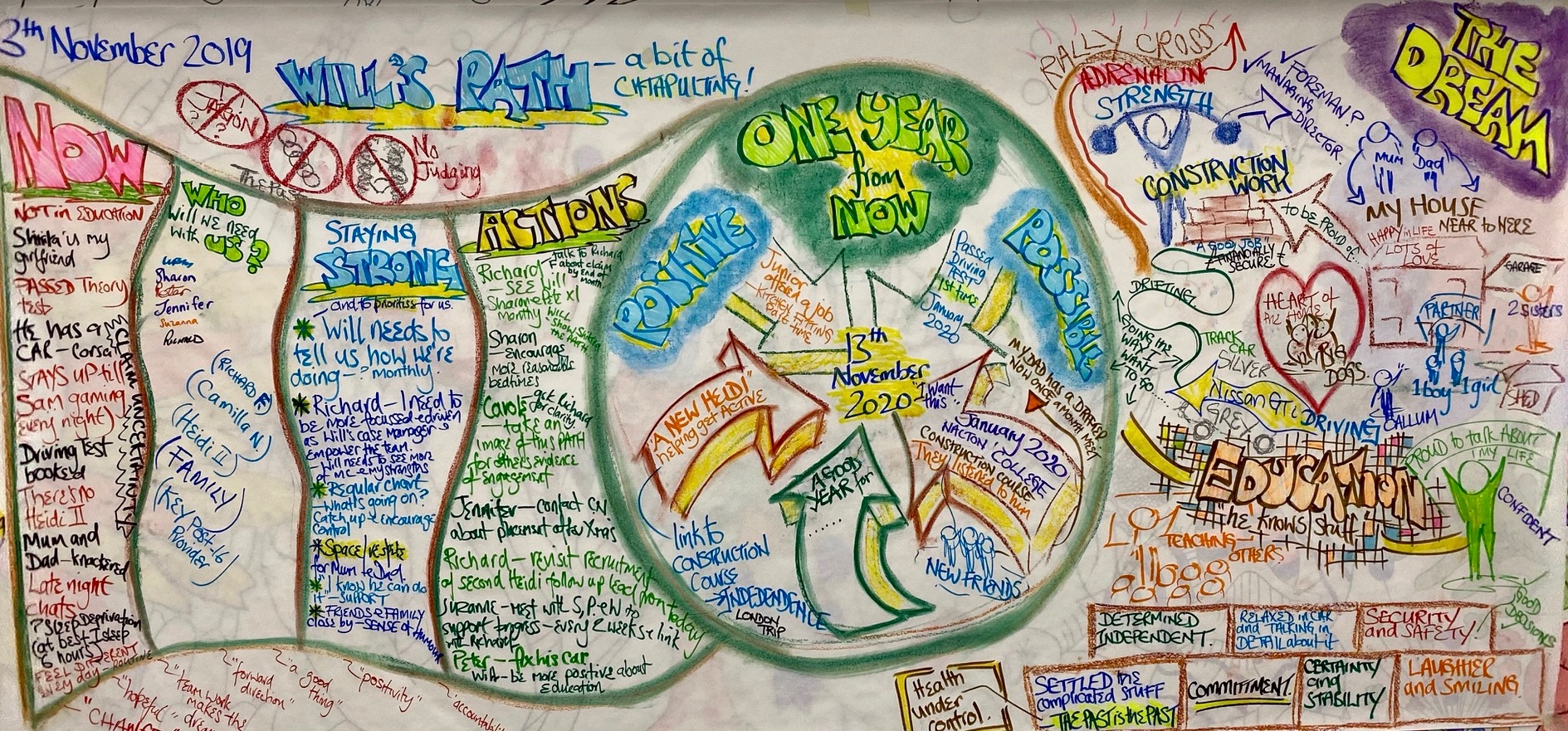

Person Centred Planning in Action

By Inclusive Solutions

An hour long educational and inspirational introduction to person centred planning in action

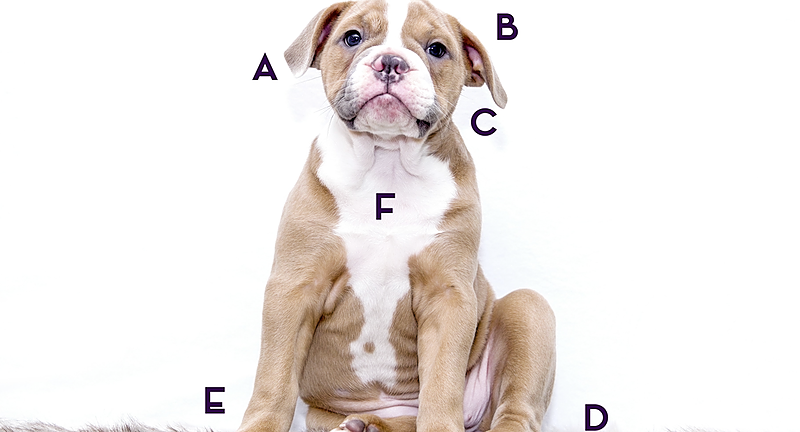

iPET Network Level 2 Award in Canine Body Language

By Amplified Behaviour

The only OFQUAL regulated dog body language qualification in the UK, giving pet professionals and dog lovers a Level 2 Award in Canine Body Language in a one day live and remote seminar format. Learn to Speak Dog The ultimate bargain bucket bundle combining Dog Body Language Chapters 1, 2 & 3 plus a bonus module to practise your growing observation skills with force free harness fitting. A must have course for any dog owner, pet professional or dog lover! Common myths and mistakes are explained and debunked - you'd be amazed about how much of what we take for granted as "doggy truth" is actually wrong Learn the A B C of dog communication, how to observe each body part, zoom out on the context and spot postural words or phrases Identify tell tale signs of worry and distress that will help you keep your dog safe around children and other dogs Teach your dog to be comfortable and confident wearing a harness, muzzle, vet collar or jazzy jacket with a practical lesson in force free handling! Understand the full suite of dog greetings, how to spot a good dog to mix with AND recognise the all important flags to fair and unfair play between dogs! Dog Body Language Course Curriculum Becoming fluent in dog makes your personal and professional relationship with dogs stronger than it's ever been before. Learning a new language is for life! And this one is utterly fascinating. Here's a breakdown of your lesson plan.. 1 Welcome! Important Docs For Your Qualification Your Student Contract and course information 2 Dog Body Lang Chapter 1: Dog Watching Dog Watching: Scent Become Fluent in Dog! Firm Foundations Zooming In & Behaviour in Context Body Language Myths & Misconceptions Introduction To The Tail Tail Speed & Posture Do Dogs Want Their Tummies Tickled? The Eyes The Ears The Mouth Dog Body Language Level 1 Retention Quiz 3 Dog Body Language Chapter 2: Calming Signals & Avoiding Aggression Introduction Calming Signals Part 1 Calming Signals Part 2 Aggression & Bites Poses of Confidence & Relaxation How To Greet A Dog Dog Body Language Level 2 Retention Quiz 4 Force Free Harness, Muzzle, Vet Collar & Jumper Fitting! Force Free Harness, Muzzle, Vet Collar & Jumper Fitting! 5 Dog Body Language Chapter 3: Dog Greetings & Play Introduction The Dog Handshake Greeting Strategies The Approach The 'Now What?' Fair Play Unfair Play Family Play Getting Involved with Dog-Dog Play Dog Body Language Level 3 Retention Quiz 6 Bonus Talk - Dominance Theory In Detail Let's Talk About Dominance A comprehensive regulated qualification including a live practical skills day and over 15 bite sized video learning modules for you to watch again and again! Put your new-found dog watching skills straight into practise! One of the most important building blocks for any dog owner, understanding body language is Hannah's speciality. She's written the book, she's written the course and now she's written the UK's 1st OFQUAL regulated qualification with iPET Network! This package combines all three dog body language levels, practical application module 'Force Free Harness, Muzzle & Cone fitting' and an 8 HOUR LIVE TRAINING DAY to help you put your new-found dog watching skills straight into practise!