- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6729 Courses delivered Online

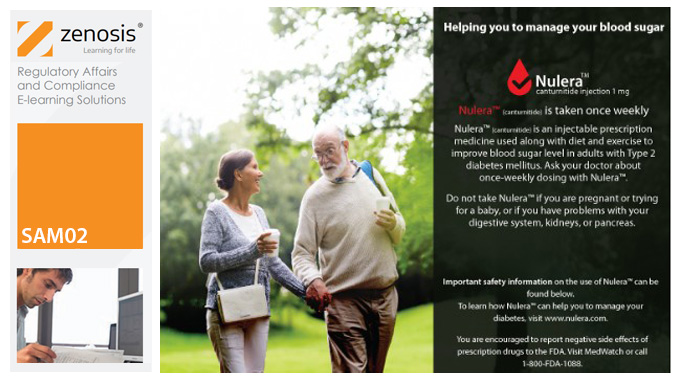

SAM02: Regulatory Requirements and Guidance on Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we explain how to advertise and promote prescription drugs in various media, whether to healthcare professionals or consumers, in compliance with legal requirements and guidance from the FDA.

MS-721T00 Collaboration Communications Systems Engineer

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for Collaboration Communications Systems Engineers are responsible for planning, deploying, configuring, maintaining, and troubleshooting Microsoft Teams Phone, meetings, and personal and shared space devices, including Microsoft Teams Rooms and Surface Hub. Collaboration Communications Systems Engineers have a fundamental understanding ofÿnetworking, telecommunications, audio/visual and meeting room technologies, identity and access management. They are proficient in managing and monitoring Teams Phone, meetings, and certified devices using the Microsoft Teams admin center, PowerShell, the Microsoft Teams Rooms Pro Portal, and the Call Quality Dashboard. They deploy and configure Microsoft Teams Phone with PSTN connectivity through Microsoft Calling Plans, Operator Connect, Teams Phone Mobile, and Direct Routing. Collaboration Communications Systems Engineers work with Teams Administrators, Microsoft Identity and Access Administrators, and Microsoft 365ÿAdministrators. In addition, they may work with owners of other workloads, including facilitiesÿmanagers, network engineers, security engineers, device manufacturers, telephony providers, and Microsoft Certified solutions providers. This training course is designed to give participants the knowledge and skills to become a Collaboration Communications Systems Engineer. Participants should understand the fundamentals of networking, telecommunications, audio/visual and meeting room technologies, identity and access management, and Microsoft Teams. They will gain hands-on experience configuring and deploying Microsoft Teams Phone, meetings and certified devices including Microsoft Teams Rooms and Surface Hub. The course will also cover how to manage and monitor Teams Phone, meetings, and certified devices using the Microsoft Teams admin center, PowerShell, the Microsoft Teams Rooms Pro Portal, and the Call Quality Dashboard. In addition, the course will cover configuring and deploying Microsoft Teams Phone with PSTN connectivity through Microsoft Calling Plans, Operator Connect, Teams Phone Mobile, and Direct Routing. Prerequisites Microsoft 365 and Microsoft Teams Networking, telecommunications, and audio/visual basics Identity and access management basics 1 - Introduction to Teams meetings and calling Overview of Teams meetings and events Overview of Teams Phone Overview of auto attendants and call queues Overview of Teams devices 2 - Plan for Teams Phone Plan to deploy Teams Phone Plan for Teams Phone PSTN connectivity Determine license requirements Plan for Teams Phone devices Plan and design Teams Phone features Plan for voicemail 3 - Plan for Microsoft Teams Rooms and Surface Hub Determine license requirements for Microsoft Teams Rooms and shared devices Understand differences between Microsoft Teams Rooms on Android and Windows Understand Microsoft Teams Rooms on Surface Hub 2S Understand and plan Teams Room accessories, components, and peripherals Understand Teams Rooms management options 4 - Plan and optimize network performance for Teams media Understand Teams network requirements Design network for media optimization Design and implement QoS 5 - Configure and deploy Teams Phone Configure emergency calling for Teams Calling Plans Manage and configure Microsoft PSTN numbers Configure Operator Connect and Teams Phone Mobile Configure Teams Phone policies Create and manage Teams policies Configure Audio Conferencing 6 - Configure and deploy Teams Phone with Direct Routing Design Direct Routing call flows Implement SIP trunking with Direct Routing Configure Emergency Calling for Direct Routing Extend Teams Direct Routing infrastructure Deploy and maintain a survivable branch appliance 7 - Extend Teams Phone with additional services Understand how Teams interacts with additional services Configure compliance recording in Teams Configure and integrate a certified contact center in Teams Design and deploy voice bots in Teams 8 - Manage meetings and events experiences Explore meetings and events in Microsoft Teams Configure meeting settings Create and manage meeting policies Configure audio conferencing Create and manage meeting templates and template policies Create and manage meetings customization policies Configure live events settings Create and manage live events policies Examine live events across Microsoft 365 9 - Guided project - Create and assign Teams policies to meet business requirements in Microsoft Teams Prepare 10 - Configure and manage voice users Enable users for Teams Phone Enable users for Direct Routing with Teams Phone Enable additional calling features for Teams Phone Enable users for Teams Phone Mobile 11 - Configure auto attendants and call queues Design call flows for auto attendants and call queues Configure auto attendants and call queues Deploy a channel-based call queue Configure resource accounts Configure Microsoft 365 groups for voicemail Interpret call queue conference modes Interpret call queue routing methods Configure holidays for auto attendants and call queues Configure custom music on hold 12 - Configure, deploy, and manage Teams devices Manage Microsoft Teams Phones Manage Microsoft Teams Room Systems Microsoft Teams Rooms management options Manage Surface Hub 2S devices Configure Microsoft Teams SIP gateway Manage Microsoft Teams displays Remote provisioning and sign in for Teams Phones Update Microsoft Teams devices remotely Manage Microsoft Teams device tags 13 - Guided project - Prepare meeting room experiences Prepare 14 - Monitor and troubleshoot Teams collaboration communications systems Diagnose and troubleshoot phone number assignment Diagnose and troubleshoot Teams client issues Diagnose and troubleshoot call failure and call quality issues Report on and troubleshoot Teams calls with Call Quality Dashboard Diagnose and troubleshoot Direct Routing issues Troubleshoot and monitor Teams devices Troubleshoot Teams meetings and calling Troubleshoot Teams Rooms devices

Highfield Level 1 Award In Food Safety In Manufacturing (RQF) Half day course Food business operators are required by law, to ensure that food handlers receive appropriate supervision and instruction/training in food hygiene in line with their work activity and should enable them to handle food safely This Level 1 Award in Food Safety in Manufacturing helps to prepare people for working in a low-risk role in a factory, where they will be handling, or around, food Course Contents: The Importance of Food Safety Legal responsibilities of food handlers Personal hygiene Contamination and cross contamination The importance of keeping one's work areas clean Pest control Basic bacteriology Benefits of this course: Businesses have a duty to their customers to produce food that is safe for consumption. There are one million cases of food poisoning in the UK each year. More than 6,000 are admitted to hospital. In 2014/2015, businesses in Chesterfield were issued 344 written enforcement notices. Derby received 1,116. Doing our Ofqual regulated, nationally accredited course ensures that nothing of importance is left out. EU and UK regulations state that all food handlers must receive appropriate training in food safety practices relevant to their duties. The Food Standards Agency says that 'Food business operators are required by law, to ensure that food handlers receive appropriate supervision and instruction/training in food hygiene in line with their work activity and should enable them to handle food safely’. This Highfield Level 1 Award in Food Safety in Manufacturing (RQF) is a nationally accredited qualification especially suitable for people working in, or planning to work in, the food retail industry where some food handling takes place Accredited, Ofqual regulated qualification: This Level 1 Food Safety in Manufacturing training course is a nationally recognised, Ofqual regulated qualification accredited by Highfield Qualifications. This means that you can be rest assured that your level 1 Food safety in Manufacturing certificate fulfils the legal requirements and is a very good way to make sure your low-risk employees are trained appropriately in Food Safety. The Ofqual Register number for this course is 603/2616/5

Health and Safety in the Workplace - Level 3 CPD Accredited Certification

5.0(5)By Online Training Academy

The Health and Safety at Work, etc. Act 1974 requires UK companies to focus on guaranteeing the safety of their employees. This may present specialists with the option to work as a Health and Safety Executive - HSE officer and earn an average salary of £24,999 to £56,999 annually. Why Should You Take this Workplace Health and Safety Course? 1.4 million workers in the UK are thought to be afflicted with a work-related ailment. Every year, over 72,000 injuries are reported due to the lack of health and safety monitoring at work, up to 160 workers die in workplace accidents and injuries, and millions of working days are missed as a result of work-related illnesses and injuries. The sad reality is that workplace diseases, accidents, and injuries may be prevented in practically all cases. However, workplace health and safety can only be fully optimised when every employee makes an equal contribution to the cause. Key Features This Health and Safety in the Workplace - Level 3 Course Includes: This Health and Safety Course is CPD QS Certified Free Certificate Developed by Specialist Lifetime Access Course Curriculum Health and Safety in the Workplace - Level 3 Module 01: Identifying Hazards and Injuries in Manual Handling Module 02: Managing Incidents in the Workplace Module 03: Addressing Minor Injuries in the Workplace Module 04: Handling Electrical Health and Safety Module 05: Strategies for Ensuring Fire Health and Safety Module 06: Comprehensive Understanding of Fires Module 07: Emergency Response: Evacuation Procedures for Fires Module 08: Developing and Implementing Fire Plans and Safety Protocols Module 09: Risk Control and Reduction Measures Module 10: Crafting Personal Emergency Evacuation Plans (PEEP) Module 11: Emergency Protocol Communication Module 12: Navigating Health and Safety Laws in the Workplace Learning Outcomes After Completing this Health and Safety in the Workplace Course You will Able to: Identify manual handling hazards, reducing workplace injuries through proactive Health and Safety measures. Effectively manage workplace incidents, ensuring swift and organised Health and Safety response procedures. Address minor injuries promptly, applying appropriate first aid in diverse scenarios. Handle electrical incidents competently, minimising risks and ensuring personnel health and safety. Devise and implement robust fire safety strategies, emphasising preventive health and safety measures. Navigate health and safety laws adeptly, ensuring compliance and workplace well-being. Certification After completing this Health and Safety in the Workplace course, you will get a free Certificate. ________________________________________ Please Note: This is not a regulated and professional course. To get a professional qualification, you can choose: Health and Safety Management for Construction (UK) Level 3 Certificate in Occupational Health and Safety NEBOSH National Diploma in Occupational Health and Safety NEBOSH National General Certificate in Occupational Health & Safety NEBOSH, International General Certificate in Occupational Health & Safety Level 6 Diploma - Occupational Health and Safety Management Courses from the Institution of Occupational Safety and Health ProQual Level 5 NVQ Diploma in Occupational Health and Safety Practice ProQual Level 6 NVQ Diploma in Occupational Health and Safety Practice ISO 45001 Occupational Health and Safety National Examination Board in Occupational Safety and Health Level 3 NVQ Health and Safety CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? Health and Safety in the Workplace - Level 3 CPD Accredited Certification Employees in all industries seeking comprehensive workplace health and safety knowledge. Supervisors and managers responsible for incident response and safety implementation. Health and safety officers aiming to enhance their regulatory understanding and compliance. Individuals aspiring to create a safer workplace environment for themselves and colleagues. Anyone seeking to deepen their knowledge of emergency response protocols in workplaces Career path Health and Safety in the Workplace - Level 3 CPD Accredited Certification Health and Safety Officer - £25K to 40K/year. Fire Safety Advisor - £30K to 45K/year. Risk Management Consultant - £35K to 50K/year. Health and Safety Manager - £40K to 60K/year. Compliance Coordinator - £25K to 40K/year. Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Master the art of Information Governance with our comprehensive course – explore Data Protection, Privacy Management, Records & Data Governance, Cybersecurity, Compliance, and more. Acquire the skills to navigate the complex landscape of information, ensuring ethical data use and compliance with global regulations. Join us for a transformative learning experience

The Pharmaceutical Marketing Essentials Course offers a deep dive into the world of marketing within the pharmaceutical industry. Understanding the complexities of this sector is essential, and this course equips you with the knowledge needed to navigate it successfully. From regulatory environments to effective strategies for brand positioning, you'll discover the vital components of marketing pharmaceuticals. With a focus on the legal and ethical aspects of the industry, this course ensures you gain the knowledge to work within the strict boundaries that define pharmaceutical marketing. In this course, you’ll explore the key concepts behind market research, product launch strategies, and how to communicate value propositions in a way that resonates with healthcare professionals and patients. Learn about the various marketing channels that dominate the pharmaceutical industry, including digital and traditional media, and how to create campaigns that are both impactful and compliant. If you're seeking to grasp the fundamentals of pharmaceutical marketing while aligning with the industry’s specific challenges, this course provides the clarity and insight to help you excel. Get ready to hone your skills in this ever-evolving field and make informed, strategic decisions that can truly move the needle in the industry. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Pharmaceutical Marketing Module 02: Pharmaceutical Product Development and Regulatory Approval Process Module 03: UK Marketing Strategies and Medical Engagement Module 04: Digital Transformation and Compliance Module 05: UK Pharmaceutical Pricing and Market Access Strategies Module 06: Ethical Marketing Practices and Compliance Module 07: Future Trends and Innovations Learning Outcomes: Introduction to Marketing: Grasp foundational concepts in pharmaceutical marketing strategies and principles. Product Development Mastery: Understand the intricacies of pharmaceutical product development and regulatory approval. UK Marketing Expertise: Gain insights into effective UK marketing strategies and medical engagement. Digital Transformation Insight: Explore the role of digital transformation in pharmaceutical marketing compliance. Pricing Strategies Mastery: Learn about UK pharmaceutical pricing and effective market access strategies. Ethical Marketing Practices: Navigate the ethical dimensions of marketing, ensuring compliance and best practices. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring Pharmaceutical Marketers Regulatory Affairs Professionals Marketing Strategy Enthusiasts Healthcare Industry Professionals Compliance and Ethics Advocates Career path Pharmaceutical Marketing Specialist Regulatory Affairs Officer Medical Engagement Coordinator Digital Transformation Analyst Pricing and Market Access Strategist Ethical Marketing Compliance Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Internal Audit Fundamentals and Best Practices

By Compliance Central

Are you looking to enhance your Internal Audit skills? If yes, then you have come to the right place. Our comprehensive course on Internal Audit will assist you in producing the best possible outcome by mastering the Internal Audit skills. The Internal Audit course is for those who want to be successful. In the Internal Audit course, you will learn the essential knowledge needed to become well versed in Internal Audit. Our Internal Audit course starts with the basics of Internal Audit and gradually progresses towards advanced topics. Therefore, each lesson of this Internal Audit course is intuitive and easy to understand. Why would you choose the Internal Audit course from Compliance Central: Lifetime access to Internal Audit course materials Full tutor support is available from Monday to Friday with the Internal Audit course Learn Internal Audit skills at your own pace from the comfort of your home Gain a complete understanding of Internal Audit course Accessible, informative Internal Audit learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Internal Audit Study Internal Audit in your own time through your computer, tablet or mobile device A 100% learning satisfaction guarantee with your Internal Audit Course Internal Audit Curriculum Breakdown of the Internal Audit Course Course Outline: Module 01: Auditing as a Form of Assurance Module 02: Internal Audit Procedures Module 03: Technology-based Internal Audit Module 04: Internal Control and Control Risk Module 05: Audit Interviews Module 06: Reporting Audit Outcome Module 07: UK Internal Audit Standards Module 08: Career as an Auditor CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Internal Audit course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Internal Audit. It is also great for professionals who are already working in Internal Audit and want to get promoted at work. Requirements To enrol in this Internal Audit course, all you need is a basic understanding of the English Language and an internet connection. Career path Internal Auditor: £35,000 to £65,000 per year Risk Manager: £45,000 to £80,000 per year Compliance Officer: £30,000 to £60,000 per year Financial Analyst: £35,000 to £70,000 per year Audit Manager: £55,000 to £95,000 per year Fraud Investigator: £40,000 to £75,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Have you ever seen "The Godfather"? Do you remember the famous line, "I'm gonna make him an offer he can't refuse"? Well, we have an offer for you that you won't be able to resist! Introducing the Quality Assurance (QA) Manager bundle - the ultimate package for those looking to elevate their career in the field of quality management. This bundle includes 11 comprehensive courses, with the first one being QLS-endorsed, which means you'll get a QLS hardcopy certificate for free! Having a QLS hardcopy certificate will add immense value to your resume and showcase your expertise in the field of quality management. The remaining 10 courses in this bundle are relevant and CPD-QS accredited, providing you with the knowledge and skills needed to succeed as a Quality Assurance Manager. From Quality Tools and Methods Management to Customer Relationship Management, this bundle covers everything you need to know to become a successful QA Manager. Enrolling in this bundle will not only enhance your knowledge but also boost your career prospects. With the demand for Quality Assurance Managers increasing day by day, this bundle will make you a valuable asset to any organisation. Don't miss this opportunity to take your career to the next level. Enrol in the Quality Assurance (QA) Manager bundle today and become a master in your field! This Quality Assurance (QA) Manager Bundle Package includes: Course 01: Certificate in Quality Assurance (QA) Manager at QLS Level 3 10 Premium Additional CPD QS Accredited Courses - Course 01: Quality Tools and Methods Management Course 02: Quality Management and Strategic Training - ISO 9001 Course 03: Operations Management: Process Mapping & Supply Chain Course 04: Supply Chain Advisor Course 05: Production Manager Course 06: Lean Process and Six Sigma Training Course Course 07: Supervisor Training Course 08: Compliance Risk and Management Course 09: Customer Relationship Management Course 10: Internal Audit Analyst Training Why Prefer This Quality Assurance (QA) Manager Bundle? You will receive a completely free certificate from the Quality Licence Scheme Option to purchase 10 additional certificates accredited by CPD Get a free Student ID Card - (£10 postal charges will be applicable for international delivery) Free assessments and immediate success results 24/7 Tutor Support After taking this Quality Assurance (QA) Manager bundle courses, you will be able to learn: Understand the principles of Quality Assurance Management Develop skills in Quality Tools and Methods of Management Gain knowledge in Quality Management and Strategic Training - ISO 9001 Learn about Operations Management, Process Mapping, and Supply Chain Develop skills in Lean Process and Six Sigma Training Gain knowledge in Compliance Risk and Management Learn about Internal Audit Analyst Training ***Curriculum breakdown of Quality Assurance (QA) Manager*** Concept of Quality Concept of Quality Key Terms Categories Customer Input to Quality Customer Input Plan Quality Plan Quality Design of Experiments Quality Control Quality Control Control Charts Sampling Six Sigma Six Sigma The Steps The 6 Six Sigma Challenges How is the Quality Assurance (QA) ManagerBundle Assessment Process? You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you successfully pass the exams. CPD 220 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is perfect for: Professionals looking to enhance their knowledge in Quality Assurance Management Individuals seeking to advance their career in Quality Assurance Individuals looking to develop their skills in Quality Tools and Methods of Management Anyone who wants to learn about Operations Management, Process Mapping, and Supply Chain Career path Our courses will prepare you for a range of careers, including: Quality Assurance Manager: £30,000 - £70,000 per year Operations Manager: £25,000 - £65,000 per year Production Manager: £25,000 - £55,000 per year Supply Chain Advisor: £35,000 - £60,000 per year Compliance Manager: £30,000 - £70,000 per year Internal Auditor: £25,000 - £55,000 per year Certificates Certificate in Quality Assurance (QA) Manager at QLS Level 3 Hard copy certificate - Included CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location.

Safe Lifting Training

By Compete High

ð Discover the Power of Safe Lifting Training: Elevate Your Workplace Safety Standards! Welcome to the groundbreaking course on Safe Lifting Techniques - a comprehensive program designed to revolutionize the way you approach lifting operations. Our course is meticulously crafted to empower individuals and organizations with the knowledge and skills needed to foster a culture of safety and prevent workplace injuries. Let's take a closer look at the six modules that make up this transformative training: ð Module 1: Introduction to Safe Lifting Techniques & Principles of Body Mechanics Embark on your journey by laying the foundation for safe lifting practices. Understand the key principles of body mechanics and how they play a crucial role in injury prevention during lifting operations. ðª Module 2: Risk Assessment and Physical Fitness Conditioning for Safe Lifting Dive into the intricacies of risk assessment and learn how to tailor physical fitness conditioning to enhance the safety of lifting tasks. Equip yourself with the tools to identify potential hazards and mitigate risks effectively. ð¤ Module 3: Lifting Aids and Communication in Lifting Operations Master the art of communication in lifting operations and explore the range of lifting aids available. From basic equipment to advanced tools, this module ensures you have the knowledge to optimize communication and safely execute lifting tasks. ð Module 4: Advanced Body Mechanics and Injury Prevention in the Lifting Environment Elevate your skills with advanced body mechanics techniques. Discover strategies for injury prevention and gain insights into addressing challenges specific to the lifting environment. This module equips you with the expertise needed for a safer workplace. ð Module 5: Creating a Culture of Safety and Applying Safe Lifting Practices Learn how to instill a culture of safety within your organization. Explore practical ways to apply safe lifting practices in daily activities, fostering a workplace where safety is not just a priority but a way of life. ð Module 6: Safe Lifting in Specialized Environments & Commitment Navigate through the nuances of lifting in specialized environments, from healthcare settings to industrial workplaces. Conclude your training by solidifying your commitment to maintaining a safe lifting culture within your organization. ð Key Benefits: Reduced Workplace Injuries: Implement proven techniques to minimize the risk of injuries during lifting operations. Enhanced Productivity: Safely execute lifting tasks, promoting efficiency and productivity. Cultivate Safety Culture: Foster a workplace where safety is ingrained in every activity. Legal Compliance: Stay abreast of safety regulations and ensure compliance with industry standards. Join us on this transformative journey towards safer lifting practices. Elevate your skills, protect your team, and create a workplace where safety is paramount. Enroll in our Safe Lifting Training today! ðð¡ï¸ Course Curriculum Module 1- Introduction to Safe Lifting Techniques Principles of Body Mechanics Introduction to Safe Lifting Techniques Principles of Body Mechanics 00:00 Module 2- Risk Assessment and Physical Fitness Conditioning for Safe Lifting Risk Assessment and Physical Fitness Conditioning for Safe Lifting 00:00 Module 3- Lifting Aids and Communication in Lifting Operations Lifting Aids and Communication in Lifting Operations 00:00 Module 4- Advanced Body Mechanics and Injury Prevention in the Lifting Environment Advanced Body Mechanics and Injury Prevention in the Lifting Environment 00:00 Module 5- Creating a Culture of Safety and Applying Safe Lifting Practices in Daily Activities Creating a Culture of Safety and Applying Safe Lifting Practices in Daily Activities 00:00 Module 6- Safe Lifting in Specialized Environments Commitment Safe Lifting in Specialized Environments Commitment 00:00

Good Laboratory Practice Refresher and Hot Topics

By Research Quality Association

Course Information Join us for a comprehensive refresher focusing on crucial Good Laboratory Practice (GLP) requirements, including an emphasis on data integrity, recent developments, and emerging trends gleaned from MHRA inspections. The programme dives into specific domains such as risk assessment, OECD guidance on sponsor influence, and the advisory from OECD on QA. Additionally, delegates can benefit from a dedicated GLP clinic, facilitating discussions on understanding and upholding GLP compliance. Is this course for you? This course is tailored for study directors, principal investigators, test facility management, and QA professionals seeking to refresh their knowledge and responsibilities within the GLP framework. Tutors Tutors will be comprised of (click the photos for biographies): Vanessa Grant -, - Tim Stiles Consultant, Qualogy Ltd Programme Please note timings may be subject to alteration. Day 1 09:00 Registration, Welcome and Introduction 09:20 Development of Good Laboratory Practice A reminder of the history of GLP, its current scope and application, with a synopsis of current UK, European and international standards. 09:50 Roles and Responsibilities of Study Director, Test Facility Management, Principal Investigator, Test Site Management, Study Staff and QA A reminder of the roles and responsibilities with regard to the GLP management and oversight of the Test Facility and the management and control of the study, as defined by GLP. 10:30 Break 10:45 Workshop 1 Workshop 1 Roles and responsibilities 11:15 Influence of Sponsors The published OECD Position Paper No. 21 regarding Possible Influence of Sponsors on conclusions of GLP Studies is reviewed and discussed. 11:45 Data Integrity The fundamentals of data integrity according to the OECD Guidance No. 22 on Data Integrity is discussed along with the responsibilities of Study Director, Test Facility Management, and study staff in ensuring the integrity of the GLP study data. 12:30 Lunch 13:15 Quality Assurance and GLP OECD Advisory No. 23 (Revision of OECD No.4)- A walk through of the changes to the OECD Guidance on the role and activities of Quality Assurance 13:45 Quality Improvement Tools and GLP The tools that might be considered for GLP and their role and operation when used in Test Facilities- OECD Position Paper No.24 published July 2022 14:15 Workshop 2 Workshop 2 Change control 14:30 Risk Assessment How should we assess risk and how can we use the process to assist in evaluation audit findings? 15:00 Break 15:15 Current hot topics in GLP Explore the current issues in Industry and trends /types of Regulatory inspection findings 15:50 GLP Clinic An opportunity to discuss any other issues regarding understanding and maintaining GLP Compliance. 16:30 Close of Course Extra Information Course Material This course will be run completely online. You will receive an email with a link to our online system, which will house your licensed course materials and access to the remote event. Please note this course will run in UK timezone. The advantages of this include: Ability for delegates to keep material on a mobile device Ability to review material at any time pre and post course Environmental benefits – less paper being used per course Access to an online course group to enhance networking. You will need a stable internet connection, a microphone and a webcam. CPD Points 7 Points Development Level Learn