- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

830 Courses delivered Online

Business Management Training

By Compete High

ð Elevate Your Career with Our Exclusive Business Management Training Course! ð Are you ready to take your career to new heights and become a master in the world of business management? Look no further! Introducing our comprehensive online course: Business Management Training - Your Gateway to Success! ð Why Choose Our Course? â Expert Guidance: Learn from industry veterans and seasoned professionals who have successfully navigated the complex landscape of business management. â Comprehensive Curriculum: Our meticulously crafted modules cover everything from strategic planning and organizational development to effective leadership and decision-making. â Practical Insights: Gain real-world insights with case studies, simulations, and interactive exercises that bridge the gap between theory and application. â Flexibility and Convenience: Access our course from anywhere, anytime! Whether you're a busy professional or a student, our online platform allows you to learn at your own pace. â Lifetime Access: Once enrolled, enjoy lifetime access to course materials, updates, and an exclusive community of like-minded learners. ð What You Will Learn: Strategic Planning: Craft and implement effective business strategies to drive success. Leadership Excellence: Develop the skills needed to inspire and lead high-performing teams. Financial Management: Master the art of budgeting, forecasting, and financial decision-making. Effective Communication: Hone your communication skills to convey ideas with impact and influence. Organizational Development: Understand how to build and sustain a thriving organizational culture. ð Who Should Enroll? Aspiring Managers and Leaders Entrepreneurs and Small Business Owners Professionals Seeking Career Advancement Students Pursuing Business Studies ð¡ Invest in Your Future! Don't miss this opportunity to invest in yourself and unlock the doors to limitless career possibilities. Enroll in our Business Management Training course today and start your journey towards professional excellence! Course Curriculum Module 1-Introduction to Business Management Introduction to Business Management 00:00 Module 2- Operations Management Operations Management 00:00 Module 3-Performance Management Performance Management 00:00 Module 4-Strategic Analysis and Product Scope Strategic Analysis and Product Scope 00:00 Module 5 - Business Development and Succession Business Development and Succession 00:00 Module 6-Developing Personal Skills Developing Personal Skills 00:00 Module 7-Business Planning Business Planning 00:00

Level 2 Certificate in Employability Skills - CPD Certified

By Compete High

Product Overview: Level 2 Certificate in Employability Skills - CPD Certified The Level 2 Certificate in Employability Skills offers a comprehensive curriculum designed to enhance individuals' readiness for the dynamic landscape of the professional world. This CPD Certified course equips learners with essential skills vital for success in various professional settings. Through five meticulously crafted modules, participants delve into critical areas that form the backbone of effective employability. Module 1: Communication Skills and Productivity In Module 1, participants embark on a journey to sharpen their communication prowess and optimize productivity. Through interactive sessions and practical exercises, learners cultivate effective verbal and written communication skills, understand the nuances of non-verbal communication, and explore strategies to enhance time management and task prioritization. Module 2: Teamwork and Problem Solving Module 2 focuses on nurturing collaborative competencies and problem-solving acumen essential for thriving in team environments. Participants delve into the dynamics of teamwork, learn strategies for fostering synergy among diverse team members, and hone their ability to identify, analyze, and resolve challenges effectively through structured problem-solving approaches. Module 3: Adaptability and Interpersonal Skills In Module 3, emphasis is placed on cultivating adaptability and strengthening interpersonal relationships. Participants learn to navigate change with resilience, embrace diverse perspectives, and leverage interpersonal skills to build rapport and foster positive interactions within professional contexts. Module 4: Innovation and Conflict Resolution Module 4 explores the realms of innovation and conflict resolution, empowering participants to embrace innovation as a catalyst for growth while developing strategies to manage and resolve conflicts constructively. Through case studies and role-playing exercises, learners acquire the skills needed to foster a culture of innovation and navigate conflicts with tact and diplomacy. Module 5: Financial Literacy and Professional Etiquette The final module delves into the realms of financial literacy and professional etiquette, equipping participants with the knowledge and practices essential for sound financial management and professional conduct. Participants gain insights into budgeting, financial planning, and ethical practices while honing their understanding of professional decorum and etiquette in diverse professional settings. Throughout the course, participants engage in a blend of theoretical learning, practical exercises, and real-world applications, facilitated by experienced instructors dedicated to fostering an enriching learning environment. Upon successful completion of the Level 2 Certificate in Employability Skills, participants emerge equipped with a robust skill set poised to enhance their employability and thrive in today's competitive professional landscape. Course Curriculum Module 1_ Communication Skills and Productivity Communication Skills and Productivity 00:00 Module 2_ Teamwork and Problem Solving Teamwork and Problem Solving 00:00 Module 3_ Adaptability and Interpersonal Skills Adaptability and Interpersonal Skills 00:00 Module 4_ Innovation and Conflict Resolution Innovation and Conflict Resolution 00:00 Module 5_ Financial Literacy and Professional Etiquette Financial Literacy and Professional Etiquette 00:00

Accounting for Chartered Accountants

By Compete High

Unlock Your Potential with 'Accounting for Chartered Accountants' Are you ready to elevate your accounting expertise to the next level? Look no further than our comprehensive text course, 'Accounting for Chartered Accountants.' ð Whether you're a seasoned professional or just starting your journey in the world of finance, this course is designed to empower you with the knowledge and skills needed to excel in your career. Benefits of Taking 'Accounting for Chartered Accountants' Advanced Expertise: Dive deep into advanced accounting principles and techniques tailored specifically for chartered accountants. ð Gain a comprehensive understanding of complex financial concepts and strategies that will set you apart in the competitive field of accounting. Practical Application: Learn through real-world case studies and practical examples that bridge the gap between theory and practice. ð¼ Our course equips you with hands-on experience, ensuring that you're prepared to tackle the challenges of the modern accounting landscape. Career Advancement: Enhance your professional credibility and expand your career opportunities with a certification in accounting for chartered accountants. ð Whether you're seeking a promotion or exploring new job prospects, this course will give you the edge you need to succeed. Flexibility: Study at your own pace and convenience with our flexible online platform. ð Whether you're juggling work commitments or personal obligations, our self-paced format allows you to tailor your learning experience to fit your schedule. Expert Guidance: Benefit from the expertise of industry professionals who are committed to your success. ð Our instructors are seasoned accounting professionals with years of experience, ready to guide you every step of the way. Who is this for? 'Accounting for Chartered Accountants' is ideal for: Chartered accountants looking to enhance their skills and expertise. Accounting professionals seeking advanced training in financial management. Finance professionals aiming to earn a competitive edge in the job market. Individuals aspiring to become chartered accountants and excel in their careers. Career Path Upon completing 'Accounting for Chartered Accountants,' you'll be equipped to pursue a variety of rewarding career paths, including: Financial Controller Chief Financial Officer (CFO) Audit Manager Tax Consultant Financial Analyst Management Accountant Forensic Accountant FAQs Is this course suitable for beginners in accounting? While 'Accounting for Chartered Accountants' is tailored for professionals with a foundational understanding of accounting principles, beginners who are committed to learning and dedicated to their studies can also benefit from this course. How long does it take to complete the course? The duration of the course depends on your individual pace and schedule. On average, students typically complete the course within [insert average duration]. Is there a certification upon completion of the course? Yes, upon successfully completing the course and passing the assessment, you will receive a certification in 'Accounting for Chartered Accountants' to showcase your expertise and enhance your professional credentials. What are the prerequisites for enrolling in the course? While there are no strict prerequisites, a basic understanding of accounting principles and terminology is recommended to fully benefit from the course material. Are there any live sessions or is it entirely self-paced? 'Accounting for Chartered Accountants' is entirely self-paced, allowing you to study at your own convenience and pace. However, we do offer optional live webinars and Q&A sessions to supplement your learning experience and provide additional support. Can I access the course materials after completing the course? Yes, you will have lifetime access to the course materials, allowing you to review and revisit the content at any time. Is financial assistance available for the course? We offer various payment options and financial assistance programs to make the course accessible to individuals from diverse backgrounds. Please contact our support team for more information on available options. Don't miss out on this opportunity to take your accounting career to new heights. Enroll in 'Accounting for Chartered Accountants' today and embark on a journey toward professional excellence! ð Course Curriculum Module 1 Introduction to Accounting Principles Introduction to Accounting Principles 00:00 Module 2 Bookkeeping and Journal Entries Bookkeeping and Journal Entries 00:00 Module 3 Financial Statements Preparation and Analysis Financial Statements Preparation and Analysis 00:00 Module 4 Internal Controls and Fraud Prevention Internal Controls and Fraud Prevention 00:00 Module 5 Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6 International Accounting Standards International Accounting Standards 00:00

Bookkeeping in Xero

By Compete High

ð Master Bookkeeping in Xero: Unlock Your Financial Potential! ð Are you ready to streamline your bookkeeping processes and take your financial management skills to the next level? Introducing our comprehensive text course, 'Bookkeeping in Xero,' designed to equip you with the knowledge and expertise needed to navigate the world of bookkeeping with confidence and efficiency. Whether you're a small business owner, an aspiring accountant, or a seasoned financial professional, this course is your key to mastering the art of bookkeeping in the Xero platform. ð Why Choose 'Bookkeeping in Xero'? Expert-Led Instruction: Learn from experienced professionals with in-depth knowledge of bookkeeping principles and Xero software. Practical Applications: Gain hands-on experience with real-world examples and case studies to reinforce your learning. Convenient Text Format: Access course materials anytime, anywhere, allowing you to learn at your own pace and on your own schedule. Valuable Skills: Acquire essential bookkeeping skills that are highly sought after in today's job market, enhancing your professional credentials and opening up new career opportunities. ð Course Overview: Introduction to Xero: Familiarize yourself with the Xero platform and its key features for efficient bookkeeping. Basic Bookkeeping Principles: Learn the fundamentals of bookkeeping, including recording transactions, reconciling accounts, and generating financial reports. Advanced Xero Functions: Explore advanced features of Xero, such as payroll management, inventory tracking, and multicurrency transactions. Financial Analysis: Dive into financial analysis techniques to interpret financial data and make informed business decisions. Optimizing Workflow: Discover tips and tricks for optimizing your bookkeeping workflow in Xero to save time and increase productivity. ð¤ Who is this for? Small Business Owners: Take control of your finances and manage your business more effectively with Xero. Accounting Students: Gain practical experience with industry-standard software to prepare for a successful career in accounting. Finance Professionals: Enhance your skills and stay competitive in the ever-evolving field of finance with Xero proficiency. ð Career Path: Bookkeeper: Start your career as a bookkeeper, managing financial records and transactions for businesses of all sizes. Accountant: Advance your career as an accountant, leveraging your Xero expertise to provide strategic financial guidance and analysis. Financial Analyst: Explore opportunities as a financial analyst, using your Xero skills to analyze data and drive business growth. ð FAQs (Frequently Asked Questions): Is this course suitable for beginners? Absolutely! 'Bookkeeping in Xero' is designed for learners of all levels, from beginners to advanced users. Our comprehensive curriculum covers everything you need to know to get started with Xero and master bookkeeping principles. Do I need any prior experience in bookkeeping or accounting? No prior experience is required. Our course starts with the basics and gradually progresses to more advanced topics, ensuring that learners of all backgrounds can follow along and succeed. How long does it take to complete the course? The duration of the course varies depending on individual learning pace and schedule. On average, learners can expect to complete the course within a few weeks with regular study and practice. Is there a certification upon completion of the course? While this course does not offer a formal certification, learners will gain valuable knowledge and skills that can be applied in various professional settings. Additionally, you'll receive a certificate of completion to showcase your achievement. Can I access the course materials offline? Yes, once enrolled, you'll have access to downloadable course materials that you can access offline at your convenience. Additionally, you can access the course content via our online learning platform from any internet-enabled device. Is Xero software included with the course? Xero software is not included with the course, but learners can sign up for a free trial or use a demo account provided by Xero to practice the concepts covered in the course. ð Unlock Your Financial Potential Today! Don't miss out on the opportunity to enhance your bookkeeping skills and elevate your career prospects with 'Bookkeeping in Xero.' Enroll now and embark on a journey towards financial mastery and professional success. Your future awaits! ðð⨠Course Curriculum Module 1 Introduction to Bookkeeping and Xero Introduction to Bookkeeping and Xero 00:00 Module 2 Navigating Xero_s Interface and Features Navigating Xero_s Interface and Features 00:00 Module 3 Recording Transactions and Managing Finances Recording Transactions and Managing Finances 00:00 Module 4 Advanced Bookkeeping Techniques and Integrations Advanced Bookkeeping Techniques and Integrations 00:00 Module 5 Tax Compliance and Reporting in Xero Tax Compliance and Reporting in Xero 00:00 Module 6 Payroll Management and Employee Records Payroll Management and Employee Records 00:00

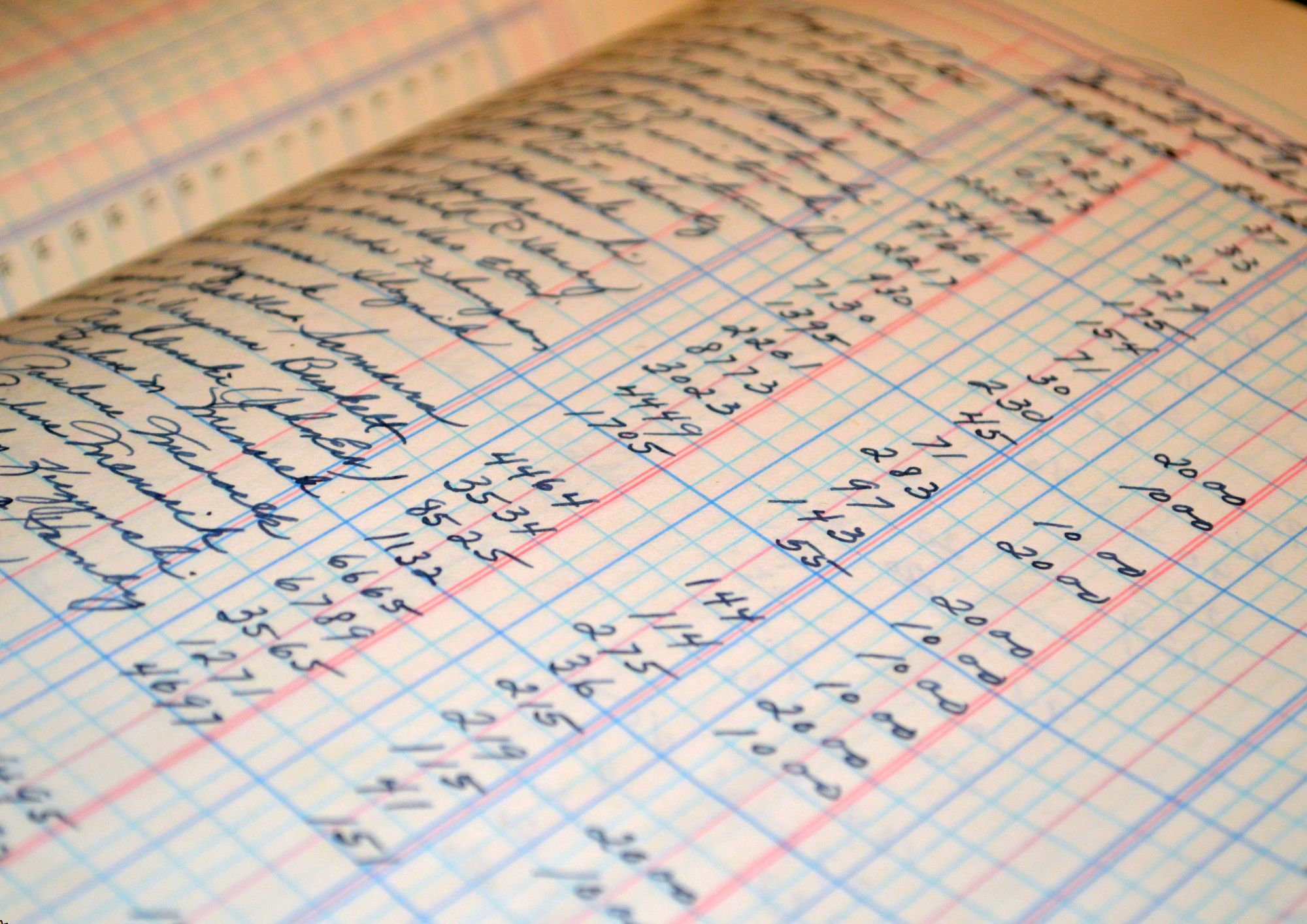

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Understanding the Association of Accounting Technicians

By Compete High

Unlock the Doors to a Successful Career with Understanding the Association of Accounting Technicians Text Course! Are you looking to embark on a rewarding journey in the world of finance and accounting? Do you aspire to become a proficient accounting technician, equipped with the knowledge and skills to excel in various financial settings? Look no further! Our comprehensive text course, 'Understanding the Association of Accounting Technicians,' is your key to unlocking a world of opportunities in the dynamic field of accounting. ð Why Choose Our Course? Our text course is meticulously designed to provide you with a solid foundation in the principles, practices, and regulations governing accounting and finance. Whether you're a beginner seeking to kickstart your career or a seasoned professional aiming to enhance your skills, our course offers something for everyone. Here are just a few reasons why our course stands out: Comprehensive Curriculum: Our course covers essential topics such as financial accounting, management accounting, taxation, and ethics, ensuring you gain a well-rounded understanding of accounting principles. Flexible Learning: Access the course material anytime, anywhere, at your own pace. Whether you're a full-time student, a working professional, or a busy parent, our flexible learning format allows you to study at your convenience. Expert Guidance: Learn from industry experts and experienced professionals who bring real-world insights and practical knowledge to the table. Benefit from their guidance and expertise as you navigate through the course material. Practical Assignments: Put your knowledge to the test with hands-on assignments and case studies designed to reinforce learning and enhance practical skills. Gain confidence in your abilities as you tackle real-world accounting scenarios. Recognized Certification: Upon successful completion of the course, receive a certification that validates your expertise and enhances your credibility in the eyes of employers and clients. ð Who is this for? Our course is ideal for: Aspiring accounting professionals seeking to kickstart their careers. Finance students looking to supplement their academic studies with practical knowledge. Working professionals aiming to enhance their accounting skills and advance their careers. Small business owners and entrepreneurs who want to gain a better understanding of financial management. No matter your background or experience level, our course is designed to accommodate learners of all profiles and help you achieve your career goals in the field of accounting. ð Career Path Upon completing our course, you'll be well-equipped to pursue a variety of exciting career opportunities in the accounting and finance sector. Some potential career paths include: Accounting Technician: As an accounting technician, you'll play a vital role in supporting the financial operations of organizations, handling tasks such as bookkeeping, payroll processing, and financial reporting. Tax Assistant: Specialize in taxation and assist individuals and businesses with tax planning, preparation, and compliance. Financial Analyst: Analyze financial data, trends, and performance metrics to provide insights and recommendations for strategic decision-making. Auditing Clerk: Conduct internal audits to ensure compliance with regulatory requirements and identify areas for improvement in financial processes and controls. Small Business Advisor: Provide financial advice and support to small businesses and startups, helping them navigate financial challenges and achieve their growth objectives. With the demand for skilled accounting professionals on the rise, the possibilities are endless for those who possess the knowledge and expertise gained from our course. ð FAQs Q: Is this course suitable for beginners with no prior accounting knowledge? A: Absolutely! Our course is designed to cater to learners of all levels, including beginners. We start with the fundamentals and gradually build upon them to ensure a comprehensive understanding of accounting principles. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and availability. On average, most learners complete the course within a few weeks to a few months. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course and any associated assessments, you will receive a certificate of completion that can be showcased to employers and clients. Q: Can I access the course material on mobile devices? A: Yes, our platform is mobile-friendly, allowing you to access the course material on your smartphone or tablet for convenient learning on the go. Q: Is there any support available if I have questions or need assistance during the course? A: Absolutely! Our dedicated support team is here to assist you every step of the way. Whether you have questions about course content or technical issues, we're here to help. Don't miss out on this opportunity to take your accounting career to new heights! Enroll in our Understanding the Association of Accounting Technicians text course today and embark on a journey toward professional success and fulfillment. Unlock your potential and achieve your goals with us! Course Curriculum Module 1_ Introduction to Financial Accounting Introduction to Financial Accounting 00:00 Module 2_ Recording Financial Transactions Recording Financial Transactions 00:00 Module 3_ Accounting Standards and Principles Accounting Standards and Principles 00:00 Module 4_ Financial Analysis and Interpretation Financial Analysis and Interpretation 00:00 Module 5_ Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6_ Internal Controls and Risk Management. Internal Controls and Risk Management. 00:00

Cashflow Management in Crisis

By Compete High

ð Introducing: Cashflow Management in Crisis ð In today's volatile economic landscape, businesses face unprecedented challenges. Uncertainty looms large, and the ability to navigate financial storms is paramount. ðªï¸ But fear not! Our comprehensive course, 'Cashflow Management in Crisis,' is here to equip you with the essential skills to steer your organization through tumultuous times and emerge stronger than ever before. ð Why Cashflow Management Matters Cashflow is the lifeblood of any business. It's the fuel that keeps operations running smoothly, empowers growth initiatives, and ensures financial stability. However, during times of crisis, maintaining healthy cashflow becomes even more critical. ð Fluctuating market conditions, unexpected disruptions, and evolving consumer behaviors can wreak havoc on cash reserves if not managed effectively. ð¼ Benefits of Taking Our Course By enrolling in 'Cashflow Management in Crisis,' you'll unlock a treasure trove of knowledge and strategies tailored to safeguard your organization's financial health in turbulent times. Here's what you can expect to gain: Resilience: Learn how to build a robust financial framework that withstands the shocks of crisis situations. From contingency planning to risk mitigation strategies, you'll be well-prepared to navigate unforeseen challenges with confidence. Strategic Decision-Making: Acquire the tools and insights needed to make informed financial decisions in the face of uncertainty. Discover how to prioritize expenditures, optimize cashflow streams, and identify opportunities for cost-saving initiatives. Adaptability: Master the art of agility in financial management. Our course will empower you to quickly adapt your cashflow strategies to changing market dynamics, ensuring your business remains agile and responsive in turbulent times. Stakeholder Confidence: Gain the trust and confidence of investors, lenders, and other stakeholders by demonstrating a proactive approach to cashflow management. Learn how to communicate effectively about your financial health and strategic resilience, fostering stronger relationships and support networks. Long-Term Sustainability: Build a solid foundation for future growth and sustainability. By honing your cashflow management skills, you'll lay the groundwork for enduring success, positioning your organization to thrive in any economic climate. ð¯ Who is this for? Business Owners: Whether you're a startup entrepreneur or a seasoned CEO, mastering cashflow management is essential for steering your business through both calm waters and stormy seas. Finance Professionals: Accountants, financial analysts, and CFOs will benefit from gaining specialized insights into crisis cashflow management, enhancing their ability to protect and optimize their organization's financial resources. Entrepreneurs: As a visionary entrepreneur, staying ahead of financial challenges is crucial for realizing your business goals. This course will empower you to navigate crises with resilience and creativity, ensuring your ventures remain on the path to success. ð Career Path Upon completing 'Cashflow Management in Crisis,' you'll be equipped with a highly sought-after skill set that opens doors to a variety of career opportunities, including: Financial Consultant: Help businesses of all sizes navigate financial challenges and optimize their cashflow management strategies. Risk Manager: Specialize in identifying and mitigating financial risks, ensuring organizations remain resilient in the face of uncertainty. Corporate Strategist: Guide strategic decision-making processes by providing valuable insights into cashflow dynamics and financial resilience. Don't let financial turbulence dictate the fate of your business. Enroll in 'Cashflow Management in Crisis' today and embark on a journey toward financial resilience and long-term success! ð°â¨ ð Frequently Asked Questions (FAQ) ð 1. What is cashflow management, and why is it important? Cashflow management involves monitoring, analyzing, and optimizing the flow of cash in and out of a business. It's essential because cashflow is the lifeblood of any organization, impacting its ability to pay bills, invest in growth, and weather financial storms. 2. How does crisis impact cashflow? Crises, such as economic downturns, natural disasters, or unexpected market shifts, can disrupt normal business operations, affecting revenue streams, supply chains, and customer demand. These disruptions can lead to cashflow challenges, including delayed payments, decreased sales, and increased expenses. 3. What are some common cashflow management strategies? Common cashflow management strategies include maintaining adequate cash reserves, managing accounts receivable and accounts payable effectively, implementing cost-cutting measures, diversifying revenue streams, and establishing contingency plans for emergencies. 4. Who can benefit from taking a cashflow management course? Anyone involved in managing finances, whether in a business or personal capacity, can benefit from learning about cashflow management. This includes business owners, entrepreneurs, finance professionals, managers, and individuals seeking to improve their financial literacy. 5. How can cashflow management skills help during a crisis? Cashflow management skills are invaluable during a crisis as they enable businesses to anticipate and respond to financial challenges effectively. By understanding cashflow dynamics, implementing proactive strategies, and maintaining financial resilience, organizations can mitigate risks, seize opportunities, and emerge stronger from crises. 6. Is cashflow management relevant across different industries? Yes, cashflow management is relevant across all industries and sectors. While specific challenges may vary depending on the nature of the business, the principles of cashflow management remain universally applicable. 7. Can I apply cashflow management principles to personal finances? Absolutely! Many of the principles and strategies taught in cashflow management courses can be applied to personal finances. By budgeting effectively, managing expenses, saving for emergencies, and optimizing income streams, individuals can improve their financial stability and resilience. 8. How can I learn more about cashflow management in crisis situations? Enrolling in a comprehensive cashflow management course, such as 'Cashflow Management in Crisis,' is an excellent way to deepen your understanding and acquire practical skills for navigating financial challenges. Additionally, staying informed through books, online resources, and professional networks can further enhance your knowledge and expertise in this critical area. Course Curriculum Chapter 1 Watching Birds Chapter 1 Watching Birds 00:00 Chapter 2 Equipment Chapter 2 Equipment 00:00 Chapter 3 Finding Different Types of Birds Chapter 3 Finding Different Types of Birds 00:00 Chapter 4 Finding and Feeding Birds Chapter 4 Finding and Feeding Birds 00:00 Chapter 5 Bird Grooming and Housing Chapter 5 Bird Grooming and Housing 00:00 Chapter 6 Landscaping Chapter 6 Landscaping 00:00

Sage 50 (Updated v.29)

By NextGen Learning

Sage 50 (Updated v.29) Course Overview This updated Sage 50 (v.29) course offers a comprehensive guide to using the latest version of Sage 50 for accounting and financial management. Designed for learners at all levels, it covers essential functions such as setting up your company, managing invoices, reconciling accounts, and generating reports. With the focus on providing valuable insights into financial management software, this course helps learners develop the skills to manage and control financial data with efficiency. By the end of the course, learners will have a solid understanding of Sage 50’s features and be able to use it confidently in real-world applications. The course is ideal for professionals looking to expand their software skills or those pursuing a career in accounting or finance. Course Description In this updated Sage 50 (v.29) course, learners will delve into all aspects of the software, from installation and company setup to mastering functions like invoicing, payroll management, and producing detailed financial reports. Key topics include maintaining the chart of accounts, tracking expenses, and reconciling bank statements. Learners will also gain a thorough understanding of Sage 50's advanced features, including managing VAT returns and automating financial processes. This course offers an engaging experience where learners can explore the various capabilities of Sage 50, ensuring that they can apply their knowledge effectively in the workplace. Upon completion, learners will possess the expertise to confidently utilise Sage 50 for efficient financial management. Sage 50 (Updated v.29) Curriculum Module 01: Introduction to Sage 50 (Updated v.29) Module 02: Setting Up Your Company and Preferences Module 03: Managing Customers and Suppliers Module 04: Invoicing and Payments Management Module 05: Bank Reconciliation and VAT Returns Module 06: Producing Financial Reports Module 07: Advanced Features in Sage 50 Module 08: Troubleshooting and System Maintenance (See full curriculum) Who is this course for? Individuals seeking to enhance their accounting software knowledge. Professionals aiming to advance in finance or accounting roles. Beginners with an interest in accounting software and financial management. Business owners or administrators seeking to streamline financial processes. Career Path Accounts Assistant Financial Administrator Sage 50 Support Specialist Bookkeeper Payroll Officer Financial Analyst

QuickBooks for the Self Employed

By NextGen Learning

QuickBooks for the Self Employed Course Overview This "QuickBooks for the Self Employed" course provides learners with a comprehensive understanding of using QuickBooks Self-Employed (QBSE) to efficiently manage finances, track income and expenses, and generate key financial reports. Designed for self-employed individuals, this course will equip learners with the skills to streamline accounting processes, ensuring financial accuracy and time-saving capabilities. Learners will also gain insights into setting up accounts, managing receipts, creating invoices, and preparing for tax season, all with the goal of simplifying the financial management aspect of self-employment. Upon completion, learners will be confident in using QuickBooks for tax reporting and overall financial management. Course Description This course offers a thorough exploration of QuickBooks Self-Employed (QBSE), covering key aspects of financial management tailored for freelancers and small business owners. The modules include connecting accounts, managing receipts, creating invoices, applying tax rules, and generating essential reports. Learners will delve into adding rules, creating and amending bank rules, and understanding the QuickBooks interface. Each section has been crafted to ensure learners can confidently navigate QBSE, setting them up for success in managing their finances effectively. The course also covers the integration of QBSE with QuickBooks Online (QBO), providing learners with an in-depth understanding of the software’s full potential. By the end of the course, learners will have gained the skills to manage their self-employed finances efficiently and prepare for tax season with ease. QuickBooks for the Self Employed Curriculum: Module 01: Introduction Module 02: First Account Connected Module 03: Receipts in Inbox Module 04: Adding Rules Module 05: Create an Invoice Module 06: Home Page Details Module 07: Connect Another Account Module 08: Creating Bank Rule on 070 Account Module 09: Amending the Rules Module 10: Reports Module 11: Transaction Adding – When Not on the Bank Module 12: QBSE and QBO Interface Module 13: Conclusion (See full curriculum) Who is this course for? Individuals seeking to manage their finances effectively as self-employed professionals. Professionals aiming to streamline their financial processes and reporting. Beginners with an interest in accounting software and financial management for freelancers. Entrepreneurs and small business owners looking to simplify accounting tasks. Career Path Freelance Accountant Financial Administrator for Small Businesses Self-Employed Entrepreneur Bookkeeping Assistant Tax Preparation Assistant

Accounting and Finance

By NextGen Learning

Accounting and Finance Course Overview: This Accounting and Finance course offers a comprehensive understanding of the key principles and practices involved in accounting and finance. Learners will gain insights into essential financial concepts, from understanding the role of accountants to analysing financial statements. The course equips learners with the skills needed to navigate the world of financial management, preparing them for a wide range of opportunities in the finance industry. By completing this course, learners will be able to confidently approach financial tasks, from budgeting to risk management, and develop a clear understanding of the financial decision-making process. Course Description: This course covers the fundamentals of accounting and finance, offering in-depth insights into financial processes, accounting mechanics, and the preparation and analysis of financial statements. Learners will explore the role of accountants, budgeting and budgetary control, and financial markets, while also gaining a strong foundation in financial risk management and investment strategies. With a focus on analytical skills, the course will help learners develop a deeper understanding of financial operations and decision-making. By the end of the course, participants will be well-equipped to analyse financial data, manage risks, and apply their knowledge in a range of financial contexts. Accounting and Finance Curriculum: Module 01: Introduction to Accounting and Finance Module 02: The Role of an Accountant Module 03: Accounting Process and Mechanics Module 04: Introduction to Financial Statements Module 05: Financial Statement Analysis Module 06: Budgeting and Budgetary Control Module 07: Financial Markets Module 08: Financial Risk Management Module 09: Investment Management Module 10: Auditing (See full curriculum) Who is this course for? Individuals seeking to gain a solid understanding of accounting and finance. Professionals aiming to develop their financial management skills. Beginners with an interest in the finance or accounting industries. Those looking to transition into a finance-focused career. Career Path: Accountant Financial Analyst Budget Analyst Investment Advisor Risk Manager Auditor Finance Manager Banking and Financial Services