- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

ICA Certificate in Financial Crime Prevention

By International Compliance Association

ICA Certificate in Financial Crime Prevention A practical, introductory course that will give you a solid understanding of core financial crime, fraud, bribery, and corruption risks. This qualification explores: Financial crime - the risks Fraud controls - different strategies, systems, and controls in practice Fraud typologies in banking Bribery & corruption - the risks and international initiatives to combat these risks Fraud response policy - explore the objectives of a plan, the reporting channels and contingencies This course is awarded in association with Alliance Manchester Business School, the University of Manchester. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Students can expect the following outcomes Understanding of the key risks and controls essential for financial crime prevention. Knowledge to help protect a firm against the continuous threat of financial crime Verifiable evidence of learning ICA Certificate in Financial Crime Following successful completion of the ICA Certificate in Financial Crime Prevention training course, students will be able to use the designation 'Cert. (FCA).' This course is awarded in association with Alliance Manchester Business School, the University of Manchester. This ICA Certificate in Financial Crime Prevention training course develops knowledge and practical skills in the following areas: What is Financial Crime? What Are the Financial Crime Risks? Fraud Controls Banking - Fraud Typologies Identity Theft and Electronic Crime Bribery & Corruption Fraud Response Policy Criminal Offences - exploring the UK system At the end of the course there is a one hour multiple choice examination that is taken online.

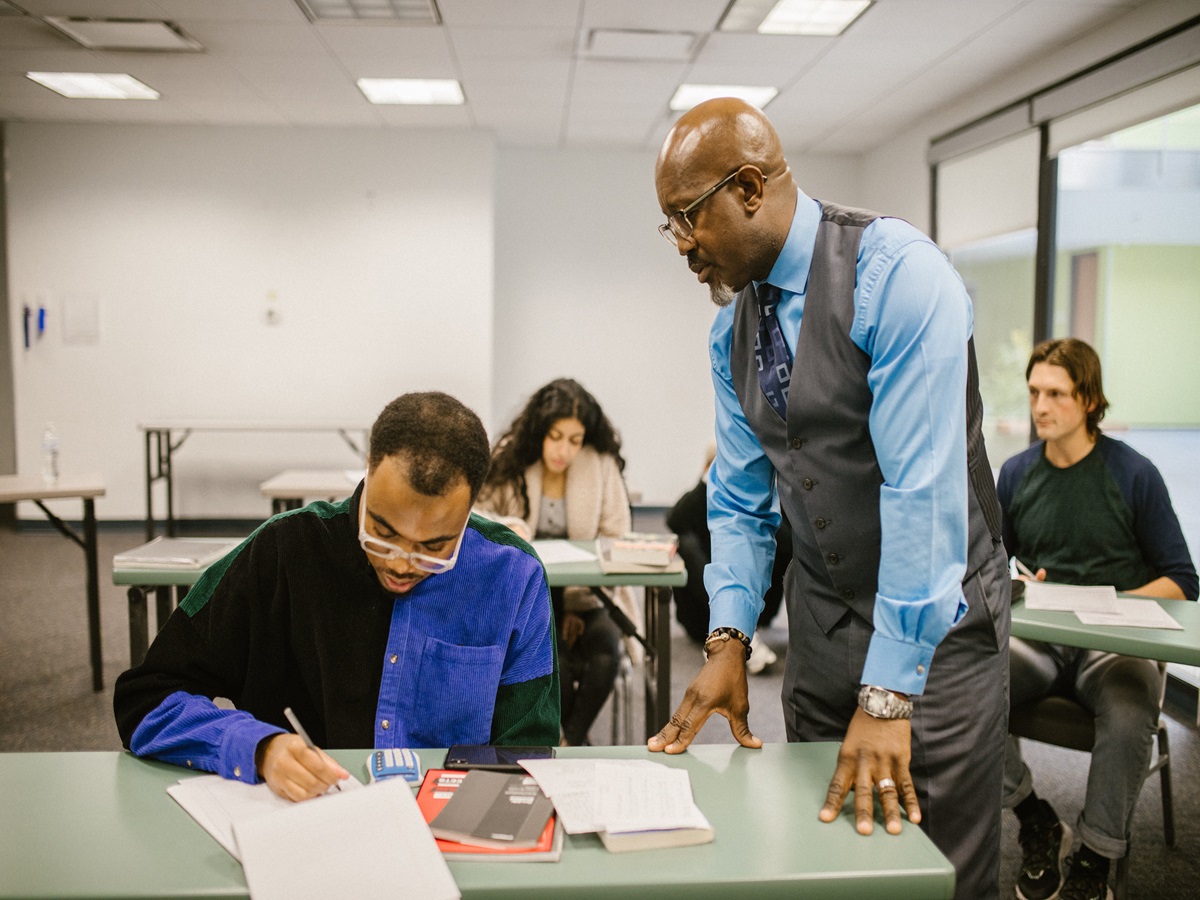

Level 3 Award in Education and Training

By Karen Blake Coaching

Level 3 Award in Education and Training: Elevate your career as a certified educator! Gain essential teaching skills, curriculum expertise, and effective classroom management. Flexible study options with ongoing support. Enrol now to advance your teaching journey

Facilitating Effective Meetings (Virtual)

By IIL Europe Ltd

Facilitating Effective Meetings (Virtual) Billions of dollars and exorbitant amounts of time are wasted annually across the globe because of organizations' meeting practices. This contributes to serious performance problems for both organizations and employees, and it has a serious impact on culture and morale. But despite the costs and consequences, every-day people in any role have the ability to change that. They can reduce cost, improve productivity, and enhance their workplace cultures by improving their meeting facilitation skills. And that is because facilitation skills start in the planning stage, not in the live meeting stage. In this course, participants will learn that their responsibility as a facilitator is to be a steward of time, money, relationships, and performance. To do that, they will learn to estimate costs of meetings and practice a variety of strategic thinking and analysis tasks to effectively plan results-aligned meetings. They will also apply several techniques and strategies to proactively prevent and deal with conflict in meetings, as well as give objective, constructive feedback to others in order to create behavior change during meetings. Participants must bring laptops with them and have internet access during the course (both virtual classroom and traditional classroom). The laptops are needed for specific activities. Also note that this course pairs well with IIL's Conflict Resolution Skills and Decision Making and Problem Solving courses, which go much deeper into related skills and tools that support effective meeting facilitation. What you will Learn At the end of this program, you will be able to: Estimate the financial and time costs of attendance for real-world meetings Use a performance formula to define the purpose of meetings Describe the responsibilities and qualities of an effective facilitator Analyze situations to determine when a meeting is necessary Articulate performance-driven meeting goals and results Align meeting goals and results Strategize to invite, involve, and exclude appropriate attendees Explain research-based best practices for meeting decisions and agenda development Create an effective agenda for a results-driven meeting Apply proactive tools and strategies for relationship-building dealing with meeting conflict Give constructive behavioral feedback using the Situation-Behavior-Impact® technique Getting Started The Business Case for Effective Facilitation Embracing the research on meetings Estimating the real costs of meetings Determining a meeting's performance value Clarifying the meeting facilitator's role Facilitating the Meeting Plan Determining if a meeting is necessary Aligning meeting goals with meeting types Identifying the right attendees Creating a strategically effective agenda Facilitating the Live Meeting Building relationships from the start Dealing with conflict proactively Giving feedback on unproductive behavior Summary and Next Steps

The BCS Essentials Certificate in Artificial Intelligence teaches the general principles of Artificial Intelligence, an introduction to Machine Learning and understand it's potential implications and capabilities. You will learn about human and artificial intelligence, the machine learning process, the different types of agents, the types of machine learning, the benefits, challenges and risks of a machine learning project, ethics in AI and the future of humans and machines in work. This is a great course for any person or organisation who needs to gain familiarity about Artificial Intelligence and Machine Learning before they commence a project; helping ensure the project approach is correct and avoid the common and costly pitfalls of technology projects.

Global Mobility, High Potential & Scale Up Visa

By Immigration Advice Service

Our Global Mobility, High Potential & Scale Up Visa course is a half-day course dedicated to covering these three visas and latest updates. View the Global Mobility, High Potential and Scale Up Visa training course dates below, delivered via Microsoft Teams. Course Overview: This course is dedicated to providing you with a comprehensive understanding of these visa routes. We will cover the requirements for each new visa category, equipping you with the knowledge to navigate the application processes successfully. Our expert trainers will guide you through the intricacies of the Global Mobility, High Potential, and Scale Up Visa routes, ensuring you have a thorough grasp of the eligibility criteria and essential documentation. You will gain insights into each category, allowing you to assist your clients or organisation in making informed decisions regarding talent recruitment and business expansion. This course will shed light on the sponsor license requirements for the Global Mobility category. Understanding these requirements is crucial for organizations seeking to employ international talent. We’ll also explore the sponsor license application processes, enabling you to navigate the necessary steps with confidence. Course Topics: Latest Changes & Announcements The requirements of each new category Application processes The sponsor license requirements for Global Mobility Sponsor license application processes Course joining links, materials and instructions are sent out 24hours before the course starts.

ISO 9001:2015 Lead Auditor (CQI and IRCA Certified)

By QUALITY ACADEMY

Become a certified ISO 9001:2015 Lead Auditor with our CQI and IRCA accredited course. Gain the skills to lead quality management audits and enhance your career. Enroll now!

Properly employed and supported, TRiM Practitioners can make a significant contribution to staff welfare by offering structured peer support and TRiM assessments to colleagues. TRiM practitioners are trained to identify the risk factors for the development of post traumatic stress and to know when to signpost colleagues to professional support.

ICA Specialist Certificate Series

By International Compliance Association

ICA Specialist Certificate Series ICA Certificate courses have been developed to meet the needs of people like you; regulatory or financial crime professionals working in a highly challenging, demanding and ever-changing environment. This is a series of short courses from which you can choose those that are relevant to your job role and aspirations, to enhance your knowledge. The courses available in this series are as follows:- ICA Specialist Certificate in Anti Corruption ICA Specialist Certificate in Combating the Financing of Terrorism ICA Specialist Certificate in Money Laundering Risk in Betting and Gaming ICA Specialist Certificate in Trade Based Money Laundering ICA Specialist Certificate in Financial Crime Risk in Global Banking and Markets ICA Specialist Certificate in Money Laundering Risk in Correspondent Banking ICA Specialist Certificate in Money Laundering Risk in Private Banking ICA Specialist Certificate in Financial Crime Risk in Mobile Financial Services ICA Specialist Certificate in Conduct Risk ICA Specialist Certificate in Anti Money Laundering and Art ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Training materials are delivered online and will include the course materials, self-assessment questions and recorded webinars. These courses are assessed by a one hour timed multiple choice assessment. For more detailed information about the content of these courses use the Request Information button and let us know which of the series you are interested in.

Autodesk 3ds Max Training One-to-One, Online or Face-to-Face Options

By Real Animation Works

Customized and Bespoke 3ds Max Training: Face-to-Face and Online Options