- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Rigging a Character in After Effects for Animation

By Study Plex

Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum Introduction to Rigging a Character What You Will Learn In This Course 00:06:00 Download After Effects 00:02:00 Download Duik 15 00:02:00 Import The Character 00:01:00 Rigging The Character Set Up Joints 00:05:00 Pre Compose Layers for Replacement Animation 00:03:00 Set Up Forward Kinematics 00:06:00 Fixing PreComp Sizes 00:04:00 Set Up Joints and Forward Kinematics for Pre Comps 00:04:00 Set up Inverse Kinematics 00:10:00 Set Up Switch Layer 00:07:00 Set Up L_Hand PreComp for Replacement Animation 00:06:00 Set Up Time Remap 00:03:00 Set Up Switch for Replacement Animation 00:13:00 Set Up Mouth for Lip Sync 00:13:00 Finishing Off Extra Details 00:07:00 Extra Tip for animating Replacement Animation 00:03:00 Conclusion 00:02:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

Oracle Primavera P6 PPM Professional Advanced Features

By Packt

With an emphasis on intermediate-level abilities, this course covers Oracle Primavera Project Manager P6 PPM Professional Client's advanced features. The tool's database administration and setup instructions are also included. Upgrade your skills in Oracle Primavera Project Manager P6 PPM Professional Client with this advanced course.

Excel Power Query and Power Pivot

By Underscore Group

Learn how to work with and connect multiple data sets to effectively analyse and report on data. Course overview Duration: 1 day (6.5 hours) Within Excel you have some powerful features to enable you to connect and analyse multiple data sources. Power Query enables you to import and manipulate your data, Power Pivot enables you to connect multiple data sources and create pivot tables and pivot charts from them. This course is an introduction to Power Query and Power Pivot in Excel to get you started on creating a powerful reporting capability. Knowledge of working with Excel workbooks and relational databases would be an advantage. Objectives By the end of the course you will be able to: Import data from multiple data sources Edit and transform data before importing Add extra columns of data Append data Merge data from other tables Create data models Build data relationships Build Pivot Tables Build Pivot Charts Use Slicers and Timeline Filters Content Importing data Data sources Importing data Transforming data Editing your data Setting data types Removing columns/rows Choosing columns to keep Setting header rows Splitting columns Appending queries Appending data from other tables Adding text Columns from example Custom columns Conditional columns Merge queries Setting up and using merge queries Merging in columns of data Creating a data model The data model Multiple data tables Connecting tables Building relationships Relationship types Building visuals from multiple tables Analysing information using pivot tables Creating and modifying a Pivot Table Recalculating the Pivot Table Filtering the Pivot Table Searching the Pivot Table Drilling down to underlying data Customising field names Changing field formatting Pivot charts, slices and timelines Creating Pivot Charts Adding and using Slicers

Level 5 Diploma in Good Manufacturing Practice (GMP) - QLS Endorsed

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Did you know that over 20% of UK product recalls are due to manufacturing non-compliance? Are you passionate about ensuring quality and safety in production processes? Are you equipped with the skills to thrive in this dynamic industry? This bundle combines essential courses in Manufacturing, Good Manufacturing Practice (GMP), and Product Management to give you a well-rounded understanding of bringing high-quality products to market. This Good Manufacturing Practice Bundle equips you with the knowledge and skills to excel across the manufacturing value chain. You'll gain insights into modern manufacturing practices, ensuring efficient production processes. Learn the fundamentals of Good Manufacturing Practice (GMP) to guarantee product quality and regulatory compliance. Master product management principles to develop, launch, and manage successful products that meet customer needs. This Good Manufacturing Practice at QLS Level 5 course is endorsed by The Quality Licence Scheme and accredited by CPD QS (with 150 CPD points) to make your skill development & career progression more accessible than ever! With a single payment, you will gain access to Good Manufacturing Practice course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Good Manufacturing Practice (GMP) Bundle Package includes: Main Course : Diploma in Good Manufacturing Practice (GMP) at QLS Level 5 10 Additional CPD Accredited Premium Courses related to Manufacturing: Course 01: Modern Manufacturing Course 02: Product Management Course 03: Retail Management Skills Course 04: SAP Controlling (CO) - Product Costing S4HANA Course 05: Operations Management: Process Mapping & Supply Chain Course 06: Certificate in Purchasing and Procurement Course 07: Quality Assurance Course 08: Warehouse Safety Course 09: Import/Export Course 10: Business Law & Commercial Law Enrol today and take a significant step towards a rewarding career in Manufacturing & Product Management! Learning Outcomes of Good Manufacturing Practice (GMP) Master Good Manufacturing Practices (GMP) and quality assurance principles. Understand modern manufacturing techniques and product lifecycle management. Implement effective operations management and supply chain optimization. Ensure regulatory compliance and adhere to industry standards. Develop expertise in purchasing, procurement, and warehouse safety. Gain insights into product costing, retail strategies, and business law. Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Good Manufacturing Practice Get a free student ID card with Good Manufacturing Practice Training program (£10 postal charge will be applicable for international delivery) The Good Manufacturing Practice is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Good Manufacturing Practice course materials The Good Manufacturing Practice comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Main Course : Diploma in Good Manufacturing Practice (GMP) at QLS Level 5 Module 01: Basic Concept Of GMP And Safety Regulations Module 02: Good And Bad Manufacturing Practice Module 03: Preventing And Controlling Contamination Module 04: Maintenance And Hygiene Module 05: GMP For Pharmaceutical Industry Module 06: GMP For Food Industry Module 07: GMP For Cosmetics Industry Module 08: IT Applications On GMP Course 01: Modern Manufacturing Section 01: Introduction Section 02: Electric Discharge Machining Section 03: Electrochemical Machining Section 04: Abrasive Jet Machining Section 05: Ultrasonic Machining Section 06: Laser Beam Machining Section 07: Plasma Arc Machining Section 08: Electron Beam Machining Section 09: The Finish Line Course 02: Product Management Module 01: Introduction To Product Management Module 02: Product Classification Module 03: Developing The Product Plan Module 04: New Product Development Module 05: Levels Of A Product And Product Life Cycle Module 06: Product Pricing Strategy Module 07: Product And Brand Portfolio Analysis Module 08: Channels Management Module 09: Basics Of Marketing For Products Module 10: Financial Analysis For Product Management =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your QLS Endorsed Certificates and CPD Accredited Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £119) CPD 255 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Manufacturing & Good Manufacturing Practice (GMP) bundle is suitable for Manufacturing Professionals Retail Managers Product Managers SAP Consultants Requirements You will not need any prior background or expertise. Career path This Good Manufacturing Practice (GMP) bundle will allow you to kickstart or take your career in the following sectors: Manufacturing Manager: £35,000 - £80,000 Product Manager: £40,000 - £100,000 Retail Operations Manager: £30,000 - £60,000 SAP Consultant: £45,000 - £100,000 Visual Merchandiser: £20,000 - £40,000 Quality Assurance Manager (GMP): £30,000 - £70,000 Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. Diploma in Good Manufacturing Practice (GMP) at QLS Level 5 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

Description MailChimp, one of the best marketing automation platforms invented so far that helps in sharing email and ad campaigns with clients, customers, and other interested individuals. In this Mastering Mailchimp course, you will learn how to start using MailChimp to create outstanding campaigns and become successful with Email Marketing and Search Engine Marketing. This course explains the ins, outs, and advantages of this incredible tool to adequately market to your audience directly from their inbox. This course also provides some helpful resources to use, and you will explore Email Marketing in such a way that will provide you with the high return on investment than any other marketing strategy. Master MailChimp with this best-selling course and start making profits from creating an email list today! Assessment: This course does not involve any MCQ test. Students need to answer assignment questions to complete the course, the answers will be in the form of written work in pdf or word. Students can write the answers in their own time. Once the answers are submitted, the instructor will check and assess the work. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Mastering Mailchimp is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Mastering Mailchimp is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Module: 01 Introduction FREE 00:01:00 Register for MailChimp 00:05:00 MailChimp Landing Page Builder 00:06:00 Creating a New List & Adding The Optin Code to New Pages 00:10:00 PopUp Optin Code 00:04:00 Module: 02 Campaign Paid Ads 00:05:00 Sending Your First Broadcast Email 00:04:00 Templates 00:03:00 List & Import Settings 2 00:11:00 List Settings II 00:07:00 MailChimp Reports 00:02:00 Module: 03 Setting Up Your Autoresponder 00:04:00 Why Email Everyday 00:03:00 Soap Opera Sequence 00:01:00 Seinfeld Email Sequence 00:11:00 My Squeeze Page Example 00:05:00 Squeeze Page Secrets 00:12:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Tax Accounting Certificate

By NextGen Learning

Ignite your dynamic career and strengthen your deep insight knowledge by signing up for Tax Accounting Certificate. This course is the ideal approach for you to obtain a thorough understanding and knowledge of the subject. We are concerned about the progression of your career. Therefore, after conducting extensive studies and consulting with experienced personnel, we formulated this outstanding Tax Accounting Certificate course to improve your pertinent skills. In this easy-to-digest course, you will get exclusive training, which will enable you to stand out in this competitive market. However, the course covers all of the recent materials in order to keep you up to date with the job market and make you a good fit for your career. This top-notch Tax Accounting Certificate course curriculum comprises basic to advanced levels of modules that will increase your skill sets. After completing this programme, you will attain the productivity to succeed in your organisation. So, if you are eager to see yourself in a gratifying career, then enrol in the course today! What will Make You Stand Out? On completion of this Tax Accounting Certificate online course, you will gain: CPD QS Accredited course After successfully completing the Course, you will receive a FREE PDF Certificate as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials. Enroling in the Course has no additional cost. 24x7 Tutor Support You can study and complete the course at your own pace. Course Curriculum Tax Accounting Certificate Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Advanced Income Tax Module 07: Payee, Payroll and Wages Module 08: Capital Gain Tax Module 09: Value Added Tax Module 10: Import and Export Module 11: Corporation Tax Module 12: Inheritance Tax Module 13: Double Entry Accounting Module 14: Management Accounting and Financial Analysis Module 15: Career as a Tax Accountant in the UK Show off your new skills with a certificate of completion. After successfully completing the course, you can order your CPD Accredited Certificates as proof of your achievement absolutely free. Please Note: The delivery charge inside the U.K. is £4.99, and international students have to pay £8.99. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Is This Course the Right Option for You? This Tax Accounting Certificate course is open to everybody. You can access the course materials from any location in the world and there are no requirements for enrolment. Requirements Without any formal requirements, you can delightfully enrol in this Tax Accounting Certificate course. Just get a device with internet connectivity and you are ready to start your learning journey. Thus, complete this course at your own pace. Career path The aim of this exclusive Tax Accounting Certificate course is to help you toward your dream career. So, complete this course and enhance your skills to explore opportunities in relevant areas.

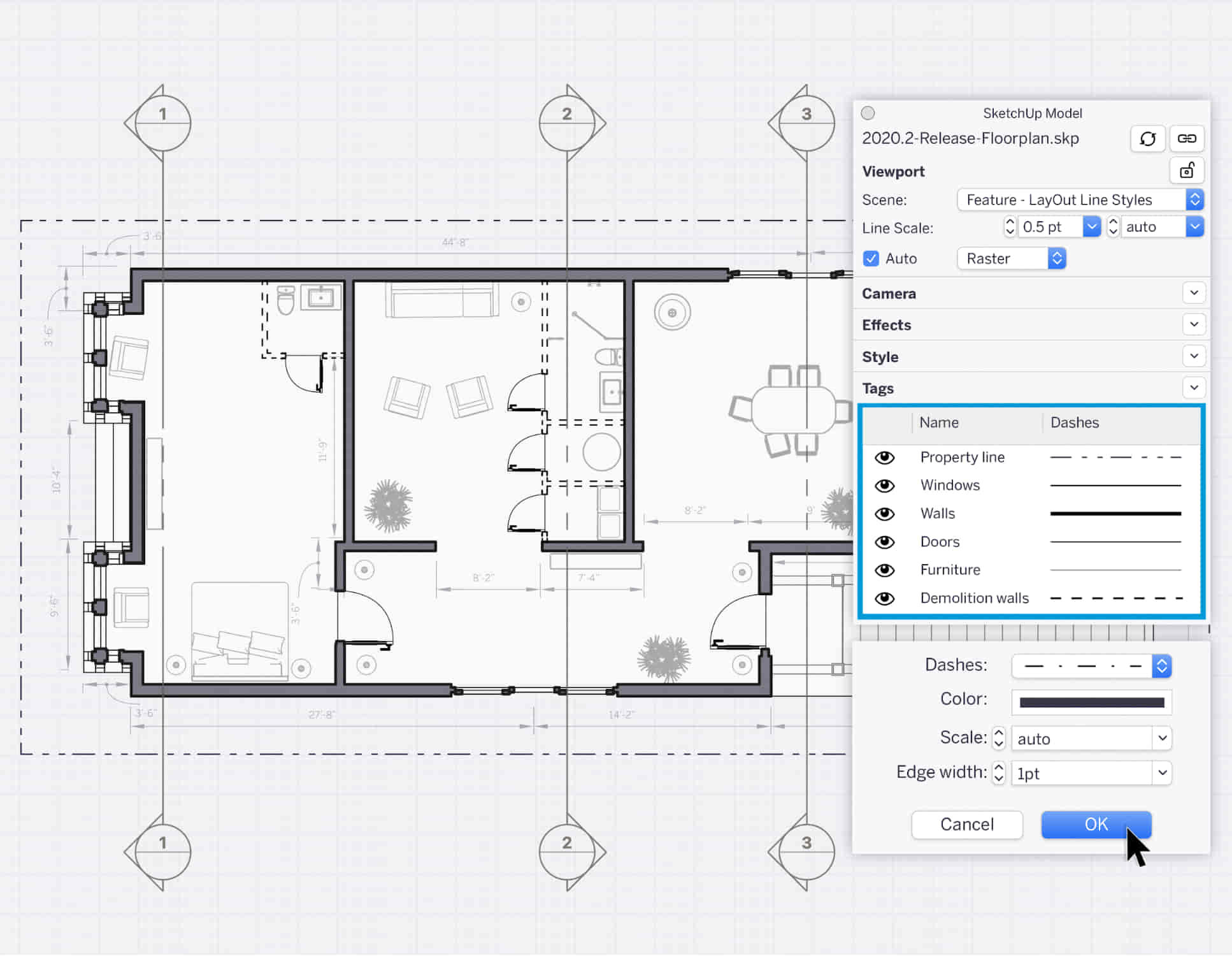

SketchUp Course With Layout and V-Ray

By ATL Autocad Training London

Why Opt for SketchUp Course With Layout and V-Ray? Learn SketchUp with Layout and V-Ray for professional 3D modeling, detailed modeling, and high-quality rendering. Essential for architects and designers for creating visualizations and precise presentations. Check our Website When can I Enrol? 1-on-1 training. Mon to Sat 9 am and 7 pm Book over the Phone 02077202581. Training Duration: 10 hours. You have the flexibility to split these hours over multiple days. Training Method: In-person or live online. Course Outline: SketchUp, Layout, and V-Ray - 10-Hour Training Module 1: Introduction to SketchUp (1 Hour) SketchUp Interface: Explore the basics of the SketchUp user interface. Navigation and View Tools: Learn how to navigate and manipulate 3D space. Module 2: SketchUp Fundamentals (1 Hour) Drawing and Modeling: Begin creating 3D objects and structures. Editing Tools: Manipulate and modify objects efficiently. Module 3: Advanced SketchUp Techniques (1 Hour) Components and Groups: Understand component and group organization. Layers and Scenes: Organize your model and create dynamic views. Module 4: SketchUp for Architectural Design (1 Hour) Architectural Modeling: Explore architectural modeling techniques. Interior Design: Apply SketchUp to interior space design. Module 5: Landscape Design with SketchUp (1 Hour) Landscape Modeling: Use SketchUp for outdoor environment design. Terrain and Topography: Model terrain and natural landscapes. Module 6: Introduction to Layout (1 Hour) Layout Basics: Get familiar with the Layout interface. Setting Up Viewports: Begin using viewports for presenting your SketchUp models. Module 7: Creating Layout Documents (2 Hours) Document Setup: Set up and customize your layout documents. Inserting SketchUp Models: Import SketchUp models into Layout viewports. Dimensioning and Labeling: Add dimensions and labels to your layout documents. Module 8: Presentation and Export (1 Hour) Styling and Rendering: Enhance your SketchUp models for presentations. Exporting and Printing: Learn how to export and print your Layout documents. Module 9: Introduction to V-Ray (1 Hour) V-Ray Interface: Get acquainted with the V-Ray user interface. Materials and Lighting: Learn the basics of materials and lighting in V-Ray. Module 10: Advanced V-Ray Rendering (1 Hour) Advanced Materials: Explore advanced material creation and customization. Realistic Lighting: Master V-Ray lighting techniques for photorealistic renders. By the end of this 10-hour course, you'll have a comprehensive understanding of SketchUp for 3D modeling, Layout for professional documentation, and V-Ray for rendering, empowering you to create stunning 3D designs and presentations. Upon completing this course, you will: Master SketchUp: Create 3D models with precision and creativity. Layout Proficiency: Produce professional design documentation. V-Ray Rendering Skills: Craft photorealistic visualizations. Advanced Techniques: Explore advanced modeling and rendering. Project Experience: Apply skills to real-world projects. Job Opportunities: Architectural Designer Interior Designer Landscape Designer CAD Technician 3D Modeler Rendering Specialist Visualization Artist Layout Specialist Freelance Designer Urban Planner Learning Objectives: Mastering SketchUp with Layout: Learn to create precise 2D floor plans, elevations, and construction documents using SketchUp's Layout tool. Advanced Rendering with V-Ray: Dive into V-Ray to create photorealistic renders, enhancing your visualizations with lighting, textures, and realistic materials. Collaborative Design: Develop skills for collaborative project planning and presentation, enabling effective communication with clients and teams. Job Opportunities: Architectural Visualization Specialist: Create detailed architectural visualizations and presentations for clients and marketing purposes. Interior Designer: Design interior spaces, produce detailed layouts, and create realistic renders for residential and commercial projects. 3D Visualization Artist: Work in the gaming or animation industry, creating 3D models and environments. Freelance Rendering Expert: Offer specialized rendering services to architectural firms, interior designers, or real estate developers. Layout Designer: Specialize in creating professional 2D layouts and construction documents for architectural projects. Why Choose Us? Tailored One-on-One Training: Personalized coaching from industry experts, in-person or online, Monday to Saturday. Customized Tutorials: Enhance skills with exclusive video tutorials designed for your learning journey. Comprehensive Resources: Access a digital reference book for thorough concept revision. Free Ongoing Support: Enjoy continuous assistance via phone or email even after the course ends. Flexible Syllabus: Adapted to your needs for focused and efficient learning. Official Certification: Ccertificate upon course completion. Why Us? Supported Individual Learning: Unwavering support with personalized homework and post-course assistance. Personalized Attention: Experience one-on-one learning, fostering a confident and comfortable environment. Financial Flexibility: Choose from various payment plans tailored to your budget. Expert Instructors: Learn from industry experts dedicated to your success.

VAT Accounting, Preparation and Submission Training Course

By Osborne Training

VAT Accounting, Preparation and Submission Training Course Overview: Knowledge of how to prepare and submit VAT Return can help you to stand out from the crowd of job seekers. Moreover, if you are running a business or thinking of running a business, the vat training course will help you to understand the issues relating to vat more clearly and help process VAT Return more accurately and efficiently. Our VAT Training courses are eligible CPD Training for accountants and attending this course can give you a more detailed understanding of how to do a VAT return correctly. What is VAT Return? Almost every business has to submit a VAT Return. VAT Return contains Output VAT and Input VAT information to be submitted to Taxman (HMRC). Through the VAT return, HMRC knows exactly how much the business owes to HMRC. Moreover, HMRC can pay back any VAT amount overpaid which only can be determined through an accurate VAT return. How to do VAT Return Firstly, businesses need to register with HMRC before they can process a VAT Return. Businesses must fulfil the criteria to become VAT registered and to get a VAT Registration no. Once the business is registered they can then regularly submit the VAT return using specified VAT forms. There are many VAT Schemes available in general. There are some specialised VAT schemes available only for specific industries. Certificate of Attendance Understanding VAT Principles Analysis of different VAT Scheme Preparing VAT in Spreadsheet Reconciliation of VAT Completing a VAT return Import and Export VAT analysis Calculating VAT for a business with mixed zero-rated and standard-rated sales, using Spreadsheet Introduction of TOMS (Tour Operator Margin Scheme) Submission Steps of VAT Return to HMRC Introduction to Making Tax Digital(VAT) scheme

VAT Bookkeeping Course Online

By Osborne Training

Overview Knowledge of how to prepare and submit VAT Return can help you to stand out from the crowd of job seekers. Moreover, if you are running a business or thinking of running a business, the vat training course will help you to understand the issues relating to vat more clearly and help process VAT Return more accurately and efficiently. Our VAT Training courses are eligible CPD Training for accountants and attending this course can give you a more detailed understanding of how to do a VAT return correctly. What is VAT Return? Almost every business has to submit a VAT Return. VAT Return contains Output VAT and Input VAT information to be submitted to Taxman (HMRC). Through the VAT return, HMRC knows exactly how much the business owes to HMRC. Moreover, HMRC can pay back any VAT amount overpaid which only can be determined through an accurate VAT return. How to do VAT Return Firstly, businesses need to register with HMRC before they can process a VAT Return. Businesses must fulfil the criteria to become VAT registered and to get a VAT Registration no. Once the business is registered they can then regularly submit the VAT return using specified VAT forms. There are many VAT Schemes available in general. There are some specialised VAT schemes available only for specific industries. Understanding VAT Principles Analysis of different VAT Scheme Preparing VAT in Spreadsheet Reconciliation of VAT Completing a VAT return Import and Export VAT analysis Calculating VAT for a business with mixed zero-rated and standard-rated sales, using Spreadsheet Introduction of TOMS (Tour Operator Margin Scheme) Submission Steps of VAT Return to HMRC Introduction to Making Tax Digital(VAT) scheme

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Think about the backbone of any successful organization. It's the administrative team, the secretarial staff, and the PAs who keep things running smoothly. A recent study in the UK found that demand for skilled administrative professionals has grown by 15% in the last two years. Are you ready to step up and take on a leadership role in this essential field? This comprehensive Level 7 Diploma equips you with the advanced skills and knowledge to excel in administrative, secretarial, and personal assistant positions. You'll master essential areas like business communication, time management, project coordination, and legal procedures. Additionally, you'll gain expertise in using the latest Microsoft Office tools and navigate complex areas like GDPR and payroll. This Admin, Secretarial & PA at QLS Level 7 course is endorsed by The Quality Licence Scheme and accredited by CPD QS (with 180 CPD points) to make your skill development & career progression more accessible than ever! With a single payment, you will gain access to Admin, Secretarial & PA course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Admin, secretarial & PA Bundle Package includes: Course 01: Advanced Diploma in Admin, Secretarial & PA at QLS Level 7 10 Additional CPDQS Accredited Premium Courses - Course 01: Complete Microsoft Word Course 02: Microsoft Excel - Beginner, Intermediate & Advanced Course 03: Legal Secretary Course 04: GDPR Course 05: Payroll Course 06: Administrative Management Course 07: Leadership & Management Diploma Course 08: HR Assistant Course 09: Decision-Making in High-Stress Situations Course 10: Workplace Health and Safety Empower yourself to become an indispensable asset in today's competitive workplace. Enrol today and take your career to the next level! Learning outcome of this Admin, Secretarial & PA: Apply advanced administrative procedures for optimal efficiency. Demonstrate exceptional communication skills in written and verbal formats. Effectively manage time and prioritize tasks in a fast-paced environment. Utilize advanced Microsoft Office applications to streamline workflows. Navigate complex legal and regulatory requirements with confidence. Develop leadership qualities to motivate and support colleagues. Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Admin, secretarial & PA Get a free student ID card with Admin, secretarial & PA Training program (£10 postal charge will be applicable for international delivery) The Admin, secretarial & PA is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Admin, secretarial & PA course materials The Admin, secretarial & PA comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Course 01: Advanced Diploma in Admin, Secretarial & PA at QLS Level 7 Module 1: Personal Assistant Module 2: Admin Support Module 3: Administrative Management Module 4: Organisational Skills Module 5: Telephone Etiquette Module 6: Business Writing Module 7: Time Management Module 8: Body Language and Effective Communication Module 9: Meeting Management Module 10: Excel Basics Module 11: PowerPoint Basic Course 01: Complete Microsoft Word Manipulating Images Using Custom Graphic Elements Collaborating On Documents Adding Document References And Links Securing A Document Using Forms To Manage Content Automating Repetitive Tasks With Macros Course 02: Microsoft Excel - Beginner, Intermediate & Advanced Section 01: Getting Started Section 02: Excel Basics Section 03: Excel Essential Functions Section 04: XLookup Only For Excel 2021 And Office 365 Section 05: Get Data And Tools Section 06: Formatting Data And Tables Section 07: Pivot Tables Section 08: Excel Charts Section 09: Advanced Excel Charts Section 10: Pivot Charts Section 11: Maps Chart Above 2019 Section 12: Business-Geo Charts Section 13: Named Ranges Section 14: Import Data Into Excel Section 15: Advanced Excel =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your QLS Endorsed Certificates and CPD Accredited Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £139) CPD 255 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Seasoned Admin, Secretarial & PA professionals seeking career growth. Aspiring executive and personal assistants. Career changers entering Admin, Secretarial & PA roles. Individuals specialising in Admin, Secretarial & PA. Advanced administrative skills seekers. Requirements No prior background or expertise is required for this Admin, secretarial & PA bundle. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Executive Assistant: £25,000 - £50,000 Office Manager: £30,000 - £45,000 PA to CEO: £35,000 - £60,000 Administrative Director: £45,000 - £80,000 Operations Manager: £35,000 - £70,000 Business Development Manager: £35,000 - £70,000 Certificates Advanced Diploma in Admin, Secretarial & PA at QLS Level 7 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free.