- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

ONE SPACE LEFT! 24th September Lucy Brownridge #Agent121. Looking for: PICTURE BOOKS

5.0(3)By I Am In Print

LOOKING FOR: CHILDREN'S: PICTURE BOOK TEXTS, NON-FICTION, POETRY Lucy Brownridge is Editorial Director at Wide Eyed Editions and Frances Lincoln Children’s Books, and formerly Thames & Hudson where she helped to establish the Children’s list. She specialises in highly illustrated picture books and non-fiction (including poetry) for children. She has commissioned and edited books which have gone on to win the Carnegie Awards, The British Book Awards, the Klaus Flugge Prize, the Blue Peter Prize and have been translated into over 30 languages. She has been editor to Alan Ahlberg, Quentin Blake, Mariajo Ilustrajo, Yuval Zommer and Children’s Laureate Joseph Coelho among many others. She is the author of The Fantastical Safari and The Cat Family series, and many other books for children. She is interested in the history of illustrated children’s books and is always looking for innovative ways to use the book format. ABOUT YOU Include a covering letter, in a Word document, telling Lucy about yourself and your sources of inspiration. If you have one, include a link to your website. She is keen to read stories she hasn't seen before or see artwork with a distinctive style rather than something that fits with trends. She has particular experience with picture books and illustrated narrative non-fiction. PICTURE BOOKS Please send one or two (max) full manuscripts, in a Word document, starting with a short summary/blurb. Make the summary punchy and engaging. Remember that the best picture book stories are simple and every word should count. Do you see this book as part of a series? NON-FICTION PROPOSALS Please send a paragraph explaining your idea, a contents list, if appropriate, and a sample piece of text. (In addition to the paid sessions, Lucy is kindly offering one free session for low income/under-represented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Monday 15th September 2025 at 10:00am UK BST

This course provides a comprehensive introduction to foodborne viruses, focusing on their properties, transmission, and impact on food safety. Designed for professionals at all levels, it covers detection methods, contamination risks, and prevention strategies to help businesses mitigate viral threats in food supply chains. Delivered by an industry expert, the course includes an interactive Q&A session for deeper insights. No prior knowledge is required.

Process Control and Instrumentation

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This course will begin with a presentation of topics to familiarize Process and Instrumentation Engineers with procedures and practices involved in the choice of sensors related to the measurement of temperature, pressure, level and flow in relation to single-phase flows. It will provide guidance on the optimum commercially available devices through a detailed comparison of their relative merits. At the heart of this course is sensor calibration which is a crucial element for these topics. The course will also examine the various types of flow control valve, including Globe, Slide, Needle, Eccentric plug and Ball valves and their characteristics in industrial application, while focusing on the problems of Cavitation and Flashing and methods to minimise or eradicate these issues. With the use of examples, industry case studies and a wide range of videos, this course will also cover all aspects of proportional (P), derivative (D) and integral (I) control. In particular, it will address the advantages and disadvantages of PI and PID control. It will also describe Cascade, Feed forward, Split Range, Override and Ratio Control techniques. Training Objectives By attending this course, participants will acquire the following knowledge and skills: Apply an in-depth knowledge to the measurement of temperature, pressure, level and flow as well as to the fluid mechanics of pipe flows Assess the advantages and disadvantages of the major flowmeter types including the differential pressure, rotary positive displacement, rotary-inferential, electromagnetic, ultrasonic and Coriolis mass flowmeters to determine the optimum choice for a given application Make a considered judgement of the choice of fluid level measurement devices Understand the various types of flow calibration, metering systems and provers Carry out tank measurement and tank calibration methods and to calculate net sellable quantities Discuss valve characteristics & trim selection and illustrate the process of control valve sizing Explain the terms Open and Closed loop Define Process Variable, Measured Variable, Set Point and Error Define Direct and Reverse controller actions Explain the terms Process Lag, Measurement Lag, Transmission Lag, and Response Lag and their effect on controllability Explain ON/ OFF Control and the inherent disadvantages Explain Proportional Control, Offset, Gain and Proportional Band and the advantages and disadvantages of Proportional only control Explain the fundamentals and operation principles of Integral (I) Action and the disadvantages of proportional plus integral control Explain the fundamentals and operation principles of Derivative (D) Action in conjunction with P action Describe the operating principles of a PID Controller and explain the applications and advantages of PID control Describe Cascade, Forward, Split Range and Ratio Control operation principles Target Audience This course will benefit instrumentation, inspection, control, custody metering and process engineers and other technical staff. It is also suitable for piping engineers, pipelines engineers, mechanical engineers, operations engineers, maintenance engineers, plant/field supervisors and foremen and loss control coordinators. Trainer Your expert course leader is a Senior Mechanical & Instrumentation Engineer (UK, B. Sc., M.Eng., Ph D) with over 45 years of industrial experience in Process Control & Instrumentation, Pumps, Compressors, Turbines and Control Valve Technology. He is currently a Senior Independent Consultant to various petrochemical industries in the UK, USA, Oman, Kuwait and KSA where he provides consultancy services on both the application and operational constraints of process equipment in the oil & gas industries. During his early career, he held key positions in Rolls Royce (UK) where he was involved in the design of turbine blading for jet engines, subject to pre-specified distributions of pressure. During this period and since, he has also been closely involved in various aspects of Turbomachinery, Thermodynamics and Fluid Mechanics where he has become a recognised authority in these areas. Later, he joined the academic staff of University of Liverpool in the UK as a Professor in Mechanical Engineering Courses. A substantial part of his work has been concerned with detailed aspects of Flowmetering - both of single & multiphase flows. He has supervised doctoral research students in this area in collaboration with various European flowmeter manufacturers. He joined Haward Technology Middle East in 2002 and was later appointed as European Manager (a post which has since lapsed) and has delivered over 150 training courses in Flowmeasurement (single- and multi-phase), Control, Heat Exchangers, Pumps, Turbines, Compressors, Valve and Valve Selection as well as other topics throughout the UK, USA, Oman and Kuwait. During the last two years, he has delivered courses with other training companies operating in the Far and Middle East. He has published about 150 papers in various Engineering Journals and International Conferences and has contributed to textbooks on the topics listed above. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Embark on a comprehensive exploration of UK commercial law and consumer protection with our specially crafted training. Delve into the intricate framework that underpins the nation's legal system, starting with a robust introduction to UK laws and progressing through to complex international trade contracts. As businesses evolve, so too does the legal landscape; this course offers insights into current practices and regulations, ensuring you're at the forefront of legal knowledge. The curriculum intricately weaves together critical components of UK commercial law, from the foundations of agreements and contracts to the delicate nuances of international trade laws. Moreover, with an in-depth look into consumer protection and remedies for contract breaches, you're set to gain a holistic perspective of the legal spectrum, essential for both domestic and international operations. Learning Outcomes Gain a solid understanding of the UK's commercial law framework and its evolution. Grasp the key concepts of agreements, contractual intentions, and the terms within a contract. Understand consumer protection laws and their implications on businesses. Delve into the specifics of insurance contract laws, contracts for employees, and privity of contracts. Acquire knowledge on international trade contracts and the legal aspects governing them. Why choose this Certificate in UK Commercial Law and Consumer Protection at QLS Level 3 course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Certificate in UK Commercial Law and Consumer Protection at QLS Level 3 course for? Individuals pursuing a career in commercial law within the UK. Entrepreneurs and business owners wanting to familiarise themselves with UK legal guidelines. Legal consultants and advisers aiming to enhance their portfolio with a specific UK focus. International trade professionals seeking insights into the UK's trade laws and regulations. Students and fresh graduates in the fields of law, business, or commerce. Career path Commercial Lawyer: £60,000 - £100,000+ Legal Consultant: £40,000 - £70,000 Consumer Rights Advocate: £30,000 - £45,000 Trade Regulations Specialist: £50,000 - £80,000 Legal Compliance Officer: £35,000 - £60,000 Contract Manager: £40,000 - £65,000 Prerequisites This Certificate in UK Commercial Law and Consumer Protection at QLS Level 3 does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for only £85 to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Course Curriculum Module 01: Introduction to UK Laws Introduction to UK Laws 00:12:00 Module 02: Ministry of Justice Ministry of Justice 00:14:00 Module 03: Agreements and Contractual Intention Agreements and Contractual Intention 00:15:00 Module 04: Considerations and Capacities of Contact Laws Considerations and Capacities of Contact Laws 00:18:00 Module 05: Terms within a Contract Terms within a Contract 00:23:00 Module 06: Misinterpretations and Mistakes Misinterpretations and Mistakes 00:25:00 Module 07: Consumer Protection Consumer Protection 00:29:00 Module 08: Privity of Contract Privity of Contract 00:16:00 Module 09: Insurance Contract Laws Insurance Contract Laws 00:20:00 Module 10: Contracts for Employees Contracts for Employees 00:22:00 Module 11: Considerations in International Trade Contracts Considerations in International Trade Contracts 00:13:00 Module 12: Laws and Regulations for International Trade Laws and Regulations for International Trade 00:30:00 Module 13: Remedies for Any Contract Breach Remedies for Any Contract Breach 00:21:00 Mock Exam Mock Exam- Certificate in UK Commercial Law and Consumer Protection at QLS Level 3 00:20:00 Final Exam Final Exam- Certificate in UK Commercial Law and Consumer Protection at QLS Level 3 00:20:00 Order your QLS Endorsed Certificate Order your QLS Endorsed Certificate 00:00:00

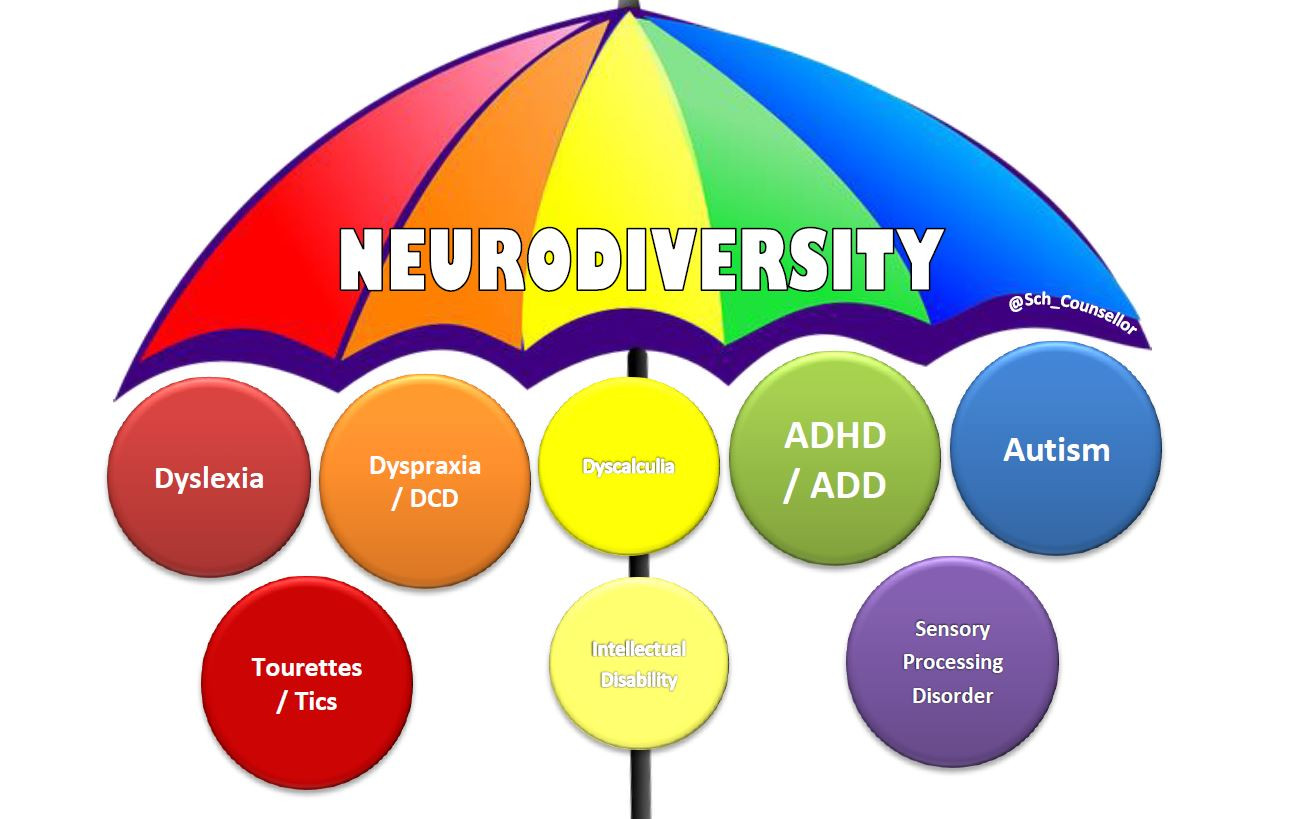

EMDR With Neurodivergent Clients 26th of September 2025

By Dr Jonathan Hutchins

A workshop on EMDR with clients who are Neurodivergent on 13th of May 2025.

HR and Payroll Management for the UK

By Compliance Central

Are you looking to enhance your HR and Payroll Management skills? If yes, then you have come to the right place. Our comprehensive course on HR and Payroll Management will assist you in producing the best possible outcome by mastering the HR and Payroll Management skills. The HR and Payroll Management course is for those who want to be successful. In the HR and Payroll Management course, you will learn the essential knowledge needed to become well versed in HR and Payroll Management. Our HR and Payroll Management course starts with the basics of HR and Payroll Management and gradually progresses towards advanced topics. Therefore, each lesson of this HR and Payroll Management course is intuitive and easy to understand. Why would you choose the HR and Payroll Management course from Compliance Central: Lifetime access to HR and Payroll Management course materials Full tutor support is available from Monday to Friday with the HR and Payroll Management course Learn HR and Payroll Management skills at your own pace from the comfort of your home Gain a complete understanding of HR and Payroll Management course Accessible, informative HR and Payroll Management learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the HR and Payroll Management bundle Study HR and Payroll Management in your own time through your computer, tablet or mobile device. A 100% learning satisfaction guarantee with your HR and Payroll Management Course Improve your chance of gaining in demand skills and better earning potential by completing the HR and Payroll Management HR and Payroll Management Curriculum Breakdown of the HR Course Section 1: Introduction Section 2: Core Concepts Section 3: Best Employee Retention Strategies That Actually Work Section 4: Employee Benefits & Retention Strategies Used by World's Top Companies Section 5: Practical Tips to Retain Employees in Your Organisation Section 6: Bonus Section: Building a Strong Relation with Employees Section 7: Conclusion Curriculum Breakdown of the Payroll Management Course Introduction The UK Payroll System Brightpay Paye, Tax, NI Conclusion and Next Steps CPD 20 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The HR and Payroll Management course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in HR and Payroll Management. It is also great for professionals who are already working in HR and Payroll Management and want to get promoted at work. Requirements To enrol in this HR and Payroll Management course, all you need is a basic understanding of the English Language and an internet connection. Career path The HR and Payroll Management course will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to HR and Payroll Management. Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

>> Deal Price is Active Now! Save: £403 GBP! Offer Ends Soon, Hurry Up!! << Special Course : Made Exclusively for Lucrative Career Optimists This provides an excellent opportunity to gain the skills and knowledge you'll need to advance in your career. Take this course anywhere and at any time. Don't let your lifestyle limit your learning or your potential. This will provide you with the right CPD Accredited qualifications that you'll need to succeed. Gain experience online and interact with experts. This can prove to be the perfect way to get notice by a prospective employer and stand out from the crowd. This has been rated and reviewed highly by our learners and professionals alike. We have a passion for teaching, and it shows. All of our courses have interactive online modules that allow studying to take place where and when you want it to. The only thing you need to take the course is Wi-Fi and a screen. You'll never be late for class again. Experienced tutors and mentors will be there for you whenever you need them, and solve all your queries through email and chat boxes.. Why choose UK Employment Law? Opportunity to earn a certificate accredited by CPD after completing this course Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Globally accepted standard structured lesson planning Innovative and engaging content and activities Assessments that measure higher-level thinking and skills Complete the program in your own time, at your own pace Each of our students gets full 24/7 tutor support Experts created the course to provide a rich and in-depth training experience for all students who enrol in it. Enrol in the course right now and you'll have immediate access to all of the course materials. Then, from any internet-enabled device, access the course materials and learn when it's convenient for you. Start your learning journey straight away with this course and take a step toward a brighter future! *** Course Curriculum *** Here are the topics you will cover on the Course: Module 01: Basics of Employment Law What is Employment Law Purpose Individuals the Law Covers The entity the Law Covers Module 02: Legal Recruitment Process Recruitment & the Equality Act 2010 Ways to Avoid Unlawful Discrimination in Recruitment Employers' Legal Duties Employees' Duties The Main Legal Issues Advertising for a Job Application Form Shortlisting Interviews Adjustments for Candidates with Disabilities Selection Automated Decision-making Making an Offer of Employment Carrying out Checks on Potential Employees Restrictions on the Employment of Children and Young Persons Employers' Guide to Criminal Record Checks Module 03: Employment Contracts Written Statement 2020's Law Regarding Employment Contracts Type of Contracts Contents of Lawful Employment Contracts The Risk of Not Giving a Written Employment Contract on Day-one Module 04: Employee Handbook Staff Handbooks A Written Statement by the Law Mandatory Information in a Statement Content of a Lawful Employee Handbook Related Written Policies Supporting Statutory Rights Module 05: Disciplinary Procedure A Fair Disciplinary Procedure A Fair Investigation A Fair Disciplinary hearing A Fair Penalty Right of Appeal ACAS guidelines Module 06: National Minimum Wage & National Living Wage The National Minimum Wage 2020 Calculating the National Minimum Wage Pay Reference Period (PRP) Training On-call or standby time Keeping Record of the Working Hour Module 07: Parental Right, Sick Pay & Pension Scheme Pregnant Employees' Rights Statutory Maternity Leave Statutory Maternity Pay (SMP) Statutory paternity Leave Statutory Paternity Pay (SMP) Statutory Adoption Pay and Leave Statutory Parental Bereavement Pay and Leave Statutory Sick Pay (SSP) Workplace Pension Scheme Module 08: Discrimination in the Workplace Discrimination & Equality Act 2010 Medical Condition Regarding Disability Disability Discrimination Failure to Make Reasonable Adjustments Areas of Reasonable Adjustments Sex Discrimination Sexual Orientation Discrimination Race Discrimination Module 09: Health & Safety at Work The Health and Safety at Work Act 1974 Role of Health & Safety Representative Smoking Law at Work Suspensions from Work for Medical Reasons Workplace Temperatures Module 10: Dismissal, Grievances and Employment Tribunals Necessary Paperwork to Face Employment Tribunal Claim Types of Dismissal Grievance Procedure Employment Tribunal hearings Module 11: Workplace Monitoring & Data Protection Data Protection principles Rights Under the Data Protection Act 2018 Personal Data an Employer Can Keep about an Employee What an Employer Should Inform an Employee Assessment Process Once you have finished the learning stages in the course, your abilities will be assessed by an automated multiple-choice question session, after which you will receive the results immediately. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Is This Course Right for You? The course has been professionally-designed for motivated learners who are looking to add a new skill to their CV and stand head and shoulders above the competition. Learn the latest industry-specific information with the UK Employment Law. Enrol on the course and learn a new professional skill from anywhere, at any time! Requirements Enrol on the course with no formal entry requirements! If you have a passion for knowledge and want to learn something new, register on the course without any delay. We only ask that all students have a passion for learning and literacy, and be over the age of 16. Complete the course from your computer, tablet, or smartphone, and learn in a way that suits you. Career path After completing this course, you are to start your career or begin the next phase of your career in this field. Our entire course will help you to gain a position of respect and dignity over your competitors. The certificate enhances your CV and helps you find work in the field concerned. Certificates CPD Accredited Certificate Digital certificate - £10 CPD Accredited Certificate Hard copy certificate - £29 If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

UK Tax Accounting Course

By Wise Campus

UK Tax Accounting: UK Tax Accounting Course Do you want to know more about UK tax accounting? Then we have an amazing UK tax accounting course for you. Students who successfully complete this UK tax accounting course will gain knowledge of the principles of taxation. Furthermore discussed in this UK tax accounting course are indirect taxes, business taxes, and individual taxes. We also cover asset-related taxes in our UK tax accounting course. Additionally, this UK tax accounting course describes handling real-world compliance. This lesson from the UK tax accounting course also explains international taxes. Sign up in our UK Tax Accounting course to further your professional development and build confidence with coworkers. Learning outcome of UK tax accounting course Upon completing this UK tax accounting course, students will learn about: The foundations of taxation from this UK tax accounting course. Also, this UK tax accounting course explains individual taxation, corporate taxation and indirect taxes. Asset-related taxes are also describes in our UK tax accounting course. Moreover, this UK tax accounting course teaches to handle practical compliance. International taxation is also part of this UK tax accounting course lesson. Special Offers of this UK Tax Accounting: UK Tax Accounting Course This UK Tax Accounting: UK Tax Accounting Course includes a FREE PDF Certificate. Lifetime access to this UK Tax Accounting: UK Tax Accounting Course Instant access to this UK Tax Accounting: UK Tax Accounting Course Get FREE Tutor Support to this UK Tax Accounting: UK Tax Accounting Course UK Tax Accounting: UK Tax Accounting Course Unlock your potential with our comprehensive UK Tax Accounting: UK Tax Accounting course. This UK Tax Accounting: UK Tax Accounting course is designed to provide you with in-depth knowledge of the principles of taxation. Delve into indirect taxes, business taxes, and individual taxes, all thoroughly covered in our UK Tax Accounting: UK Tax Accounting curriculum. Learn about asset-related taxes and how to handle real-world compliance challenges. Additionally, our UK Tax Accounting: UK Tax Accounting course offers insights into international taxes, preparing you for a successful career in the field. Enroll now and master UK Tax Accounting: UK Tax Accounting! Who is this course for? UK Tax Accounting: UK Tax Accounting Course This UK Tax Accounting course is open to students who have no prior understanding of UK tax accounting. Requirements UK Tax Accounting: UK Tax Accounting Course To enrol in this UK Tax Accounting: UK Tax Accounting Course, students must fulfil the following requirements. To join in our UK Tax Accounting: UK Tax Accounting Course, you must have a strong command of the English language. To successfully complete our UK Tax Accounting: UK Tax Accounting Course, you must be vivacious and self driven. To complete our UK Tax Accounting: UK Tax Accounting Course, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this UK Tax Accounting: UK Tax Accounting Course. Career path UK Tax Accounting: UK Tax Accounting Course This UK tax accounting course will facilitate you for handsom jobs like: Corporate finance Tax compliance Tax advice Accountancy Financial consulting

Level 7 Diploma In Accounting & Finance - Pathway To MSc Accounting & Finance Degree

4.9(261)By Metropolitan School of Business & Management UK

Level 7 Diploma In Accounting & Finance - Pathway To MSc Accounting & Finance Degree Level 7 Diploma in Accounting & Finance (QCF) – 6 - 8 Months Credits: 120 Credits This qualification is designed for learners who wish to pursue a career in the financial services industry, professional accountancy, banking, and finance or management. The qualification equips learners with the essential skills and knowledge needed to pursue high-level careers in all types of organizations in the public and private sector and within industry and commerce, both in the UK and abroad. The Level 7 Diploma in Accounting and Finance qualification also provides learners with the opportunity to work toward a relevant master’s programme with advanced standing. This programme is a Pathway programme to MSc Accounting & Finance Degree Course Details Assessment: Assignments Objectives: contemporary and specialized approaches to accountancy and finance key practical, theoretical and empirical issues, and academic research the complexity of the ever-changing legal framework in which the financial sector operates the latest developments in accountancy and reporting required by local, national and European governments. Accreditation All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. University Progression University Top-up On completion of this course, students have the opportunity to complete a Master degree programme from a range of UK universities. The top-up programme can be studied online or on campus. The top-up comprises the final 60 credits which consist of either a dissertation or a dissertation and one module. (The course tuition fee listed above does NOT include the top-up fees) University Progression Click here to see University routes and fee information for progression. Entry Requirements For entry onto the Level 7 Diploma in Human Resource Management leading to the MA Human Resource Management qualification, learners must possess: An honours degree in related subject or UK level 6 diploma or equivalent overseas qualification i.e. Bachelors Degree or Higher National Diploma OR Mature learners (over 25) with at least 5 years of management experience if they do not possess the above qualification (this is reviewed on a case by case basis) Workshops Workshops are conducted by live webinars for all students. Visa Requirements There is no Visa requirement for this programme.

Level 7 Diploma In International Business Law Pathway To LLM International Business Law

4.9(261)By Metropolitan School of Business & Management UK

Level 7 Diploma In International Business Law Pathway To LLM International Business Law Level 7 Diploma in International Business Law (QCF) – 6 - 8 Months Credits: 120 Credits The objectives of the OTHM Level 7 Diploma in International Business Law qualification are to enable learners to gain knowledge and understanding of various branches of law, develop an analytical and critical approach to the application of the UK and International legal principles and understand the appropriateness of dealing with certain aspects of behaviour within the law.The qualification provides learners with an understanding of law in the context of business to equip them with the abilities needed to work with advanced issues.By the end of the qualification, learners will be able to: To understand a range of subjects in international business law. Develop an understanding of legal frameworks that govern international business transactions within the industry. Demonstrate an understanding of commercial trust law, company law, international trade law, intellectual property law, and the law of financial crimes. Develop research skills and have the ability to write on key areas in law. This programme is a Pathway programme to L.L.M Degree Accreditation All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. University Progression University Top-up Upon completion of this course, students have the opportunity to complete a Master's degree programme from a range of UK universities. The top-up programme can be studied online or on campus. The top-up comprises the final 60 credits which consist of either a dissertation or a dissertation and one module. (The course tuition fee listed above does NOT include the top-up fees) University Progression Click here to see University routes and fee information for progression. Entry Requirements For entry onto the Level 7 Diploma in International Business Law leading to L.L.M qualification, learners must possess: An honours degree in a related subject or the UK level 6 diploma or equivalent overseas qualification i.e. Bachelors Degree or Higher National Diploma OR Mature learners (over 25) with at least 5 years of management experience if they do not possess the above qualification (this is reviewed on a case by case basis) Workshops Workshops are conducted by live webinars for all students. Visa Requirements There is no Visa requirement for this programme.