- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3449 Courses delivered Online

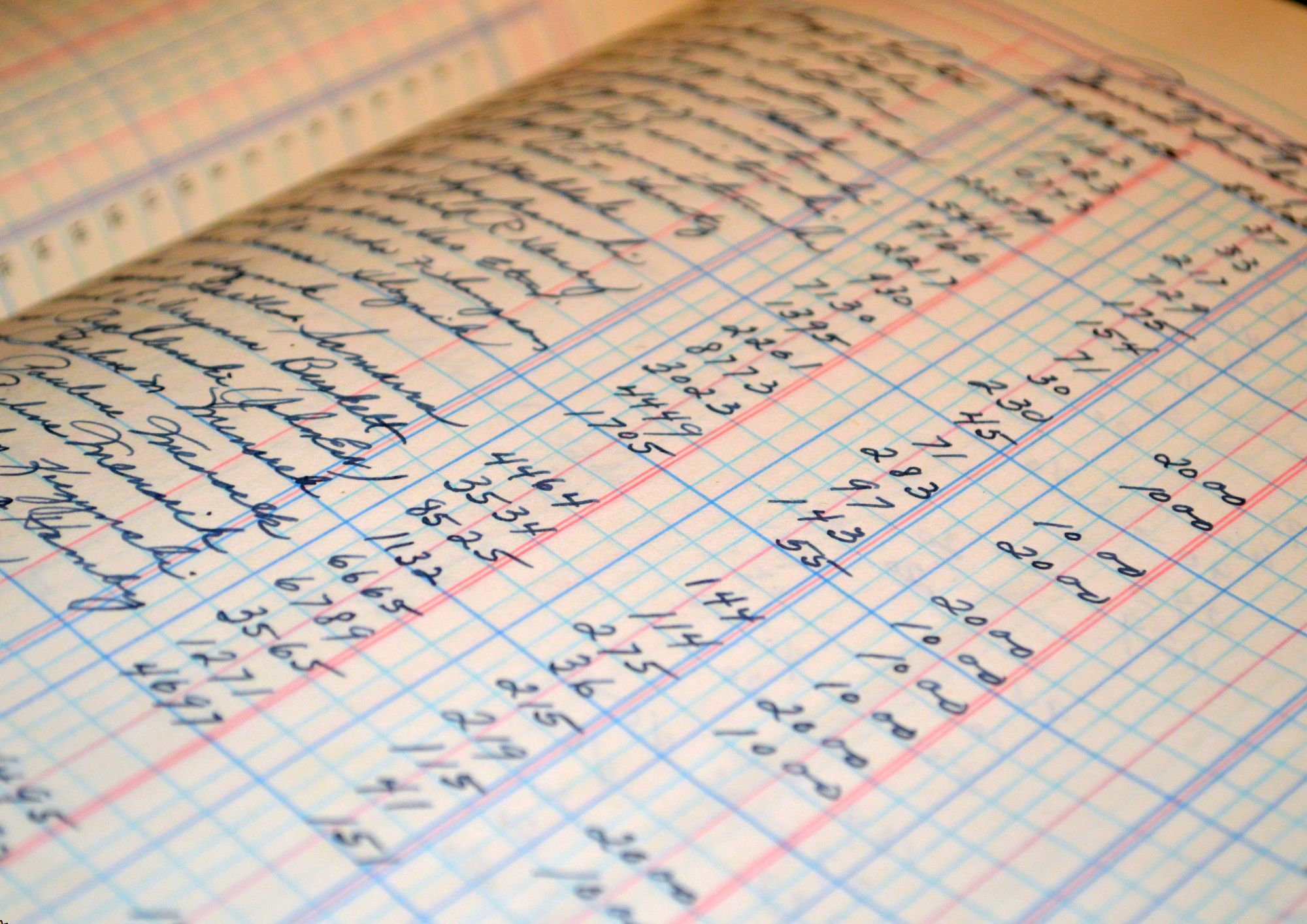

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Sage 50 (Updated v.29)

By NextGen Learning

Sage 50 (Updated v.29) Course Overview This updated Sage 50 (v.29) course offers a comprehensive guide to using the latest version of Sage 50 for accounting and financial management. Designed for learners at all levels, it covers essential functions such as setting up your company, managing invoices, reconciling accounts, and generating reports. With the focus on providing valuable insights into financial management software, this course helps learners develop the skills to manage and control financial data with efficiency. By the end of the course, learners will have a solid understanding of Sage 50’s features and be able to use it confidently in real-world applications. The course is ideal for professionals looking to expand their software skills or those pursuing a career in accounting or finance. Course Description In this updated Sage 50 (v.29) course, learners will delve into all aspects of the software, from installation and company setup to mastering functions like invoicing, payroll management, and producing detailed financial reports. Key topics include maintaining the chart of accounts, tracking expenses, and reconciling bank statements. Learners will also gain a thorough understanding of Sage 50's advanced features, including managing VAT returns and automating financial processes. This course offers an engaging experience where learners can explore the various capabilities of Sage 50, ensuring that they can apply their knowledge effectively in the workplace. Upon completion, learners will possess the expertise to confidently utilise Sage 50 for efficient financial management. Sage 50 (Updated v.29) Curriculum Module 01: Introduction to Sage 50 (Updated v.29) Module 02: Setting Up Your Company and Preferences Module 03: Managing Customers and Suppliers Module 04: Invoicing and Payments Management Module 05: Bank Reconciliation and VAT Returns Module 06: Producing Financial Reports Module 07: Advanced Features in Sage 50 Module 08: Troubleshooting and System Maintenance (See full curriculum) Who is this course for? Individuals seeking to enhance their accounting software knowledge. Professionals aiming to advance in finance or accounting roles. Beginners with an interest in accounting software and financial management. Business owners or administrators seeking to streamline financial processes. Career Path Accounts Assistant Financial Administrator Sage 50 Support Specialist Bookkeeper Payroll Officer Financial Analyst

Financial Wellness: Managing Personal Cash Flow

By NextGen Learning

Financial Wellness: Managing Personal Cash Flow Course Overview This course provides a comprehensive guide to managing personal cash flow effectively, empowering learners to take control of their finances with confidence. Covering essential concepts such as budgeting, borrowing, credit management, and tax strategies, it equips participants with the knowledge to plan and optimise their financial wellbeing. Learners will develop a clear understanding of personal money management, insurance, and the relationship between mental health and finances. By the end of this course, individuals will be able to create and maintain a realistic budget, manage debts responsibly, and make informed financial decisions to enhance their overall financial stability and security. Course Description Delving deeper into the foundations of personal finance, this course explores key topics including cash flow planning, accounting principles for personal use, and effective money management strategies. Learners will gain insight into borrowing options, credit systems, and how to manage debt wisely. The course also covers personal insurance, tax considerations, and the design of tailored financial strategies. Emphasising the connection between financial health and mental wellbeing, it offers a well-rounded approach to managing money. Throughout the learning experience, participants will build critical skills to plan budgets, evaluate financial choices, and implement strategies that support long-term financial security in a clear and structured manner. Financial Wellness: Managing Personal Cash Flow Curriculum: Module 01: Introduction To Personal Cash Flow Module 02: Understanding The Importance Of Personal Finance Module 03: Accounting And Personal Finances Module 04: Cash Flow Planning Module 05: Understanding Personal Money Management Module 06: Borrowing, Credit And Debt Module 07: Managing Personal Insurance Module 08: Understanding Tax And Financial Strategies Module 09: Designing A Personal Budget Module 10: Money And Mental Health (See full curriculum) Who is this course for? Individuals seeking to improve their personal financial management skills. Professionals aiming to enhance their understanding of personal cash flow. Beginners with an interest in personal finance and budgeting. Anyone wishing to gain confidence in managing debt and credit. Career Path Financial Planning Assistant Personal Finance Advisor Budget Analyst Credit Management Officer Insurance Consultant Tax Support Specialist

Course Overview In order to manage money, wealth management employs a variety of financial disciplines, including retirement planning, legal or estate planning, accounting and tax services, and financial and investment advice. This Wealth Manager training course is designed to meet the needs of investors, advisers, or organisations and will impart knowledge that may be used right away. This course covers all facets of wealth management and emphasises the need for effective investment management. With the help of this curriculum, you can investigate the most recent business tactics, assess and use cutting-edge investment strategies, and examine important market trends and difficulties. By concentrating on asset management, business strategy and development, and investment strategy and execution, this program’s main goal is to maximise your competitive edge. Enrol in this Wealth Manager course to learn new wealth management strategies from the greatest academics and business professionals. Learning Outcomes After completing the Wealth Manager course, students will be able to: Discover the duties of a wealth manager and the services they offer. Identify effective techniques and allocations for investing a variety of assets. Recognise all the phases involved in the financial planning process. Learn the foundational concepts of financial risk and return. Understand how to manage large investment programmes and diverse portfolios Learn how to apply your understanding of the UK tax system to achieve the greatest results. Assessment and Certification At the end of the course, you will be required to sit for an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39. Career Path Wealth management career involves rendering Financial Advisory Services, Accounting Services, Estate Planning, Insurance Policies, Investments in Equity & Debt Markets, Retirement Planning, etc. It’s quite well known that this extensive course on wealth management helps people get ready for work chances in the UK. It also helps you develop your career in the relevant sector. This online course will help one to develop the skills necessary to do a better job. Salary ranges for jobs requiring a similar level of knowledge in the UK today range from £47,000 to £59,000 per year. It could be useful for any related industry job, such as: Wealth Manager Financial Manager Wealth Management Administrator

Safeguarding Children (Awareness to L3)

By Prima Cura Training

To increase your awareness and understanding of what safeguarding children means, in order to increase your confidence to enable you to make a positive contribution towards the process.

WM154 IBM MQ V9 System Administration (using Linux for labs)

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for This course is designed for technical professionals who require the skills to administer IBM© MQ queue managers on distributed operating systems, in the Cloud, or on the IBM© MQ Appliance. Overview Describe the IBM© MQ deployment optionsPlan for the implementation of IBM© MQ on-premises or in the CloudUse IBM© MQ commands and the IBM© MQ Explorer to create and manage queue managers, queues, and channelsUse the IBM© MQ sample programs and utilities to test the IBM© MQ networkEnable a queue manager to exchange messages with another queue managerConfigure client connections to a queue managerUse a trigger message and a trigger monitor to start an application to process messagesImplement basic queue manager restart and recovery proceduresUse IBM© MQ troubleshooting tools to identify the cause of a problem in the IBM© MQ networkPlan for and implement basic IBM© MQ security featuresUse accounting and statistics messages to monitor the activities of an IBM© MQ systemDefine and administer a simple queue manager cluster This course provides technical professionals with the skills that are needed to administer IBM© MQ queue managers on distributed operating systems and in the Cloud. In addition to the instructor-led lectures, you participate in hands-on lab exercises that are designed to reinforce lecture content. The lab exercises use IBM© MQ V9.0, giving you practical experience with tasks such as handling queue recovery, implementing security, and problem determination. Describe the IBM© MQ deployment optionsPlan for the implementation of IBM© MQ on-premises or in the CloudUse IBM© MQ commands and the IBM© MQ Explorer to create and manage queue managers, queues, and channelsUse the IBM© MQ sample programs and utilities to test the IBM© MQ networkEnable a queue manager to exchange messages with another queue managerConfigure client connections to a queue managerUse a trigger message and a trigger monitor to start an application to process messagesImplement basic queue manager restart and recovery proceduresUse IBM© MQ troubleshooting tools to identify the cause of a problem in the IBM© MQ networkPlan for and implement basic IBM© MQ security featuresUse accounting and statistics messages to monitor the activities of an IBM© MQ systemDefine and administer a simple queue manager cluster

S4F20 SAP Business Processes in Management Accounting

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Application Consultant Business Analyst Business Process Owner / Team Lead / Power User Help Desk / COE Support Program / Project Manager Overview This course will prepare you to: Describe the motivation for SAP S/4HANA Enterprise Management Provide an overview of basic business processes in the main components of Financial Accounting with SAP S/4HANA Participants of this course will gain an overview of the Financial Accounting capabilities of SAP S/4HANA. You will learn how SAP S/4HANA covers the Financial Accounting related business requirements and how the fundamental business processes and tasks are executed in the system. General Ledger Accounting, Accounts Payable, Accounts Receivable, Asset Accounting and Bank Accounting and their integration are all discussed in this course. Especially if you are new to Financial Accounting in SAP S/4HANA, this course is the right starting point for you. If you plan to take the academy and certification for Financial Accounting, this course will help you to better understand the certification courses. For the actual certification, it is recommended, but not mandatory. Overview of SAP S/4HANA Providing an Overview of the SAP S/4HANA Using the SAP Fiori Front-En Overview of Financial Accounting (FI) in SAP S/4HANA Outlining Financial Accounting (FI) Components in SAP S/4HANA General Ledger (G/L) Accounting Outlining Organizational Elements in Financial Accounting (FI) Maintaining G/L Master Records Posting Transactions in the G/L Accounts Payable Maintaining Vendor Master Records Maintaining Accounts Payable Transactions Managing the Integration between Accounts Payable and Materials Management Performing Accounts Payable Closing Operations Accounts Receivable Maintaining Customer Master Records Managing Accounts Receivable Transactions Managing Customer Correspondence Creating Accounts Receivable Dispute Cases Managing the Integration between Accounts Receivable and Sales Order Management Performing Accounts Receivable Closing Operations Asset Accounting Maintaining Asset Master Records Executing Asset Transactions Executing Asset Accounting Period-End Closing Activitie Bank Accounting Maintaining Bank Accounting Master Records Managing Bank Accounting Transactions Closing Operations in General Ledger Accounting Performing General Ledger (G/L) Closing Operations Additional course details: Nexus Humans S4F20 SAP Business Processes in Management Accounting training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the S4F20 SAP Business Processes in Management Accounting course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

WM153 IBM MQ V9 System Administration (using Windows for labs)

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for This course is designed for technical professionals who require the skills to administer IBM© MQ queue managers on distributed operating systems, in the Cloud, or on the IBM© MQ Appliance. Overview After completing this course, you should be able to:Describe the IBM© MQ deployment optionsPlan for the implementation of IBM© MQ on-premises or in the CloudUse IBM© MQ commands and the IBM© MQ Explorer to create and manage queue managers, queues, and channelsUse the IBM© MQ sample programs and utilities to test the IBM© MQ networkEnable a queue manager to exchange messages with another queue managerConfigure client connections to a queue managerUse a trigger message and a trigger monitor to start an application to process messagesImplement basic queue manager restart and recovery proceduresUse IBM© MQ troubleshooting tools to identify the cause of a problem in the IBM© MQ networkPlan for and implement basic IBM© MQ security featuresUse accounting and statistics messages to monitor the activities of an IBM© MQ systemDefine and administer a simple queue manager cluster This course provides technical professionals with the skills that are needed to administer IBM© MQ queue managers on distributed operating systems and in the Cloud. In addition to the instructor-led lectures, you participate in hands-on lab exercises that are designed to reinforce lecture content. The lab exercises use IBM© MQ V9.0, giving you practical experience with tasks such as handling queue recovery, implementing security, and problem determination. Note: This course does not cover any of the features of MQ for z/OS or MQ for IBM© i. Course introductionIBM© MQ reviewIBM© MQ installation and deployment optionsCreating a queue manager and queuesExercise: Using commands to create a queue manager and queuesIntroduction to IBM© MQ ExplorerExercise: Using IBM© MQ Explorer to create queue managers and queuesTesting the IBM© MQ implementationExercise: Using IBM© MQ sample programs to test the configurationImplementing distributed queuingExercise: Connecting queue managersIBM© MQ clientsExercise: Connecting an IBM© MQ clientImplementing trigger messages and monitorsExercise: Implementing a trigger monitorDiagnosing problemsExercise: Running an IBM© MQ traceImplementing basic security in IBM© MQExercise: Controlling access to IBM© MQBacking up and restoring IBM© MQ messages and object definitionsExercise: Using a media image to restore a queueExercise: Backing up and restoring IBM© MQ object definitionsIntroduction to queue manager clustersExercise: Implementing a basic clusterMonitoring and configuring IBM© MQ for performanceExercise: Monitoring IBM© MQ for performanceCourse summary

Administering Cisco Unified Communications (Call Manager) (ACUCC v12.5)

By Nexus Human

Duration 5 Days 30 CPD hours This one of kind Cisco UC in-depth course takes student from initial endpoint configuration to a full solution deployment using all of the Cisco UC Components. Students will have extensive labs in which they will Administer and troubleshoot a Cisco 12.5 UC Deployment.Participants will gain in-depth practical knowledge with exercises on administering and troubleshooting of all Cisco UC Components. Tools for Managing UC Collaboration 12.5 Prime Collaboration Deployment Manager Overview 12.5 Bulk Admin Tool (BAT) Importing and Exporting Settings Importing and Exporting Users Importing and Exporting Phones Phone Migrations Unsupported IP Phone Models CUCM Upgrades Loading COP Files Unified Communication Manager 12.5 Cisco Smart Licensing Cisco Unified Communication Manager Overview Cisco UCM Configuration Redundancy Services Service Parameters Enterprises Parameters User Configuration LDAP Integration Synchronization Authentication Attribute Mapping Filters Endpoint Configuration Creating and Modifying Phone and Configuration Call Routing Implementing Calling Privileges Partitions and CSSs Configuration Implementing Extension Mobility Media Resources Cisco Meeting Server Troubleshooting UCM Features CAR (CDR Accounting and Reporting) Tool Reports Dialed Number Analyzer RTMT Log Collection Use RTMT to View Performance Counters Troubleshooting Common Endpoint Registration Issues Disaster Recovery System Remote Site Redundancy Gateway Gateway Overview Cisco H323 Gateways Cisco MGCP Gateways Cisco IOS SIP Gateways Troubleshooting IOS Gateways Cisco Emergency Responder (CER) 12.5 CER Overview Emergency Notifications CER Redundancy and Clustering Integration with CUCM Cisco Emergency Responder Administration Interfaces Configuring Users and Role-Based System Access Configuring Cisco Emergency Responder Notification by IP Subnet SNMP Overview Adding new switches Notification by Switch Port Cisco Unified Communications Mobile and Remote Access (MRA) MRA Overview Expressway Edge MRA Licensing MRA Components Certificates Integrating Cisco Unified IM and Presence 12.5 IM&P and Jabber Overview Configure Service Discovery DNS Record Requirements Install Cisco Jabber Cisco Jabber in Softphone Mode Set Up Cisco Jabber in Full UC Mode Integrating CUCM and IM&P Configuring CUCM Services for Jabber Troubleshooting Jabber Integrating Cisco Unity Connection 12.5 Cisco Unity Connection Overview Cisco Unity Connection Integration Using SIP Cisco Unity Connection Call Handlers Configuring Search spaces and Partitions Cisco Unity Connection Administration Cisco Unity Connection Integration Troubleshooting Tools RTMT Using Port Monitor to Troubleshoot Voice Mails Cisco Unity Audiotext Application Unified Messaging Cisco Meeting Server (CMS) Introduction to Cisco Meeting Server Configuring CMS Configuring Meetings with CMS Configuring Spaces with CMS Scheduling Meeting with TMS Cisco UCCX Cisco Unified Contact Center Express Overview Cisco Unified Contact Center Express Administration Agents Skills Queues Basic Scripting (Overview) Finesse Reporting CUIC Cisco Paging Server (InformaCast) InformaCast Overview InformaCast Administration IP Phone Paging Analog Paging Multicast Requirements Using InformaCast Troubleshooting Using Troubleshooting Methodology Analyze the Troubleshooting Process Troubleshooting Methodology in Complex Environments Define the Problem Gather Facts Consider Possibilities Create an Action Plan Implement an Action Plan Observe Results Restart the Problem-Solving Process Document Facts Using Troubleshooting and Monitoring Tools Cisco Unified Serviceability Cisco Unified RTMT Performance Monitor and Data Logging Trace File Collection Troubleshooting Common Gateway and Endpoint Registration Issues IP Phone Initialization Common DHCP-Related and TFTP-Related Issues Using Ping to Cisco IP Phones Cisco Unified IP Phone Status Messages Cisco Unified IP Phone Network Configuration Additional course details: Nexus Humans Administering Cisco Unified Communications (Call Manager) (ACUCC v12.5) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Administering Cisco Unified Communications (Call Manager) (ACUCC v12.5) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.