- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3ds max Basic to Advance Training Course 1-2-1

By Real Animation Works

Face to Face training customised and bespoke. Live online or Face to Face.

24 Hour Flash Deal **25-in-1 Advanced Firefighter Training Mega Bundle** Advanced Firefighter Training Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Advanced Firefighter Training package online with Studyhub through our online learning platform. The Advanced Firefighter Training bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Advanced Firefighter Training course provides complete 360-degree training on Advanced Firefighter Training. You'll get not one, not two, not three, but twenty-five Advanced Firefighter Training courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Advanced Firefighter Training courses are yours for as long as you want them once you enrol in this course This Advanced Firefighter Training Bundle consists the following career oriented courses: Course 01: Firefighter Training Certification Course 02: Fire Safety Course 03: Gas Safety Course Course 04: Emergency First Aid at Work Course 05: Ambulance and Emergency Care Assistant Certificate Course 06: Resuscitation and Life Support: Vital Skills and Techniques Course 07: Paediatric First Aid and Medical Emergency Training Course 08: Administration of Emergency Medical Gases Course 09: Oxygen First Aid Training - Online Course Course 10: Respiratory Protection and Safety Training Course Course 11: Infection Control Diploma Course 12: Workplace Health and Safety Advanced Diploma Course 13: Falls and Injury Prevention Specialist Certification Course 14: Wound Care and Tissue Viability Course 15: Pain Management Course 16: CSTF Patient Moving and Handling: Ensuring Safe Healthcare Practices Course 17: Psychological Wellbeing and Crisis Intervention Course 18: Evacuation Procedures Training Course 19: Crowd Management Course 20: Manual Handling Training Course 21: Crisis and Trauma Counselling in Early Childhood Course 22: Public Health and Safety Course 23: Emergency Care Worker Course 24: Site Management Safety Training Scheme (SMSTS) Course 25: Risk Assessment & Management The Advanced Firefighter Training course has been prepared by focusing largely on Advanced Firefighter Training career readiness. It has been designed by our Advanced Firefighter Training specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Advanced Firefighter Training Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Advanced Firefighter Training bundle course has been created with twenty-five premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Advanced Firefighter Training Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Advanced Firefighter Training Elementary modules, allowing our students to grasp each lesson quickly. The Advanced Firefighter Training course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. In this exclusive Advanced Firefighter Training bundle, you really hit the jackpot. Here's what you get: Step by step Advanced Firefighter Training lessons One to one assistance from Advanced Firefighter Trainingprofessionals if you need it Innovative exams to test your knowledge after the Advanced Firefighter Trainingcourse 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all twenty-five Advanced Firefighter Training courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Advanced Firefighter Training certificate and transcript on the next working day Easily learn the Advanced Firefighter Training skills and knowledge you want from the comfort of your home CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Advanced Firefighter Training training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Advanced Firefighter Training Requirements To participate in this Advanced Firefighter Training course, all you need is - A smart device A secure internet connection And a keen interest in Advanced Firefighter Training Career path You will be able to kickstart your Advanced Firefighter Training career because this course includes various courses as a bonus. This Advanced Firefighter Training is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Advanced Firefighter Training career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Focus Awards Level 3 Award in Education and Training (RQF)

By Britannia School of Academics

If you’re looking for a career in education and training, then the Level 3 Award in Education and Training (L3 AET) is the best choice for you.

Management of Value (MoV) Practitioner: In-House Training

By IIL Europe Ltd

Management of Value (MoV®) Practitioner: In-House Training This interactive MoV® Practitioner course provides a modular and case-study-driven approach to learning Management of Value (MoV). The core knowledge is structured and comprehensive; and well-rounded modules cover the methodology and various techniques. A case study is used to help appreciate the relevance of MoV in its practical application. What you will Learn The MoV Practitioner Course prepares you for the MoV Practitioner exam. Individuals certified at the MoV Practitioner level will be able to: Apply Management of Value (MoV) principles, processes and techniques, and advocate the benefits of this application appropriately to the senior Management. Develop a plan of MoV activities for the whole lifecycle of small and large projects and programs. Plan an MoV study, tailoring it to particular projects or programs and developing practical study or workshop handbooks as required. Understand and articulate value in relation to organizational objectives. Prioritize value drivers using function analysis and use these to demonstrate how value might be improved. Quantify monetary and non-monetary value using the Value Index, Value Metrics and the Value for Money ratio. Describe and comment on the application of various techniques relevant to MoV. Monitor improvements in value realized throughout a project lifecycle and capture learning which can be transferred to future projects. Offer suggestions and guidance about embedding MoV into an organization, including policy issues, undertake a health check, assess maturity and competence, and provide guidance on typical roles and responsibilities. Understand and articulate the use of MoV within other Best Management Practice methods and its contributions to them Benefits of Taking This Course Upon successful completion of this course, you will be able to: Organise and contribute constructively to a Management of Value (MoV) Study Demonstrate a knowledge of MoV principles, processes, approach, and environment Analyse a company, programme or project to establish its organisational value includes identification and weighting of Value Drivers Pass the AXELOS Practitioner Examination Function Analysis Customer FAST Diagram Value Tree Development Weighting Attributes Paired Comparisons Developing a Value Profile Developing a Value Index Value for Money Ratio Stimulating Innovation Value Engineering Option Evaluation and Selection Evaluation Matrix Value and Value for Money Timing and Planning Teams and Stakeholders MoV in the Organization Integrating with Best Management Practice Relationship between Process and Approach

Level 5 Diploma in Education and Training (DET - Previously DTLLS)

4.7(47)By Academy for Health and Fitness

***Note: Offer is Valid for the First 10 Learners Only*** DET: Level 5 Diploma in Education and Training (RQF) Are you passionate about teaching? Would you like to pursue a career in the education sector? If the answer is yes, the Focus Awards Level 5 Diploma in Education and Training (RQF) course is the perfect one to land a job with an average salary of £30,000 per year in the UK. Our meticulously designed curriculum covers various essential topics, from understanding educational theories to effective teaching methodologies. The Focus Awards Level 5 Diploma in Education and Training (RQF) course will boost your tutor skills. At the end of the period, you will be able to demonstrate proficient teaching and instructional skills and assess and evaluate student progress plus performance accurately. The Focus Awards Level 5 Diploma in Education and Training (RQF) course is not just about obtaining a diploma; it's about embracing your passion, unlocking your potential, and making a lasting impact on the lives of your future students. Why this is the Perfect Package for You! Grow and Boost Your Career: Drive your career forward by receiving a regulated qualification recognised by the British Government. Upgrade Your Knowledge and Skills: Upgrade your knowledge and refine your skills for better professional success. Be More Credible and Qualified: Enhance your credibility and qualifications, making you a standout candidate in your field. Get Unlimited Access to Entire Library: Enjoy unlimited access to our entire course library for a year. Seize this golden opportunity to advance your skills and achieve new heights! Support and Consultation from Experts: Receive valuable support and expert consultation to navigate challenges and opportunities in your career. 100% Money-Back Guarantee: Be confident with a 100% money-back guarantee, ensuring your investment in self-improvement is risk-free. So enrol in this DET: Level 5 Diploma in Education and Training (RQF) course to begin a smooth career in the education industry. Why choose focus awards? Focus Awards is recognised and regulated by Ofqual (The Office of Qualifications and Examinations Regulation) in the United Kingdom. Focus Awards qualification is respected worldwide, opening doors to diverse career opportunities. Therefore, the Level 5 Diploma in Education and Training (RQF) course is one of the best in the market due to Focus Awards accreditation. Stay ahead of the curve with the cutting-edge teaching methods and technologies of the Focus Awards. Benefits you will gain from this Focus Awards Level 5 Diploma in Education and Training (RQF): High-quality digital learning materials Intuitive e-learning platform Top-notch education standard Globally recognised certification Modules are available 24/7 for your convenience Exceptional customer support services DET: Level 5 Diploma in Education and Training (RQF) Curriculum Break Down and Credit Information for DET: Level 5 Diploma in Education and Training (RQF): The DET course has two unit groups in the curriculum. To achieve the qualification, learners must gain at least 120 credits (Group A - 75 credits and Group B - 45 credits). A minimum of 61 credits will have to be from Level 5. DET Group A-Mandatory Units: Unit 01: Teaching, Learning and Assessment in Education and Training [Achievement of the unit Theories, principles and models in education and training is a prerequisite for this unit.] Guidance to Achieving the Unit: Assignment Unit 02: Developing Teaching, Learning, and Assessment in Education and Training Guidance to Achieving the Unit: Assignment Unit 03: Theories, Principles and Models in Education and Training Guidance to Achieving the Unit: Assignment [Achievement of this unit is a prerequisite for the unit Developing Teaching, learning, and Assessment in education and training] Unit 04: Wider Professional Practice and Development in Education and Training Guidance to Achieving the Unit: Assignment DET Group B- Optional Units Unit 01: Developing, Using and Organising Resources in a Specialist Area Unit 02: Inclusive Practice Unit 03: Effective Partnership Working in the Learning and Teaching Context Guidance to Achieving the Units: Study Material Assignment Teaching Practice Requirement To get this level 5 DET qualification, you must practise for at least 100 hours and provide proof of your involvement in teaching groups of students. A crucial component of excellent beginning teacher preparation is the practice component. Each unit in this certificate has a unique practice requirement. Transfer of Practice There is no transfer of practice from a prior Level 3 Award in Education and Training(AET), including an approach that has been watched and assessed. Trainee teachers who have earned the Level 4 Certificate in Education and Training(CET) may apply twenty hours of practice and two hours of course that was observed and assessed towards the Level 5 Diploma in Education and Training's (DET) practice requirements. At least eight observations must be made, each lasting at least eight hours. Any observed practice finished as a part of the Level 3 Award in Education and Training is not included. Every single observation must last at least 30 minutes. Practice for the Education and Training units must occur in a classroom setting. A minimum of eight observations, of course, are required. The following necessary units must be connected to the eight observations: Teaching, learning, and assessment in education and training (Level 4) Developing teaching, learning, and assessment in education and training (Level 5). Qualification Study Time of Level 5 Diploma in Education and Training (DET - Previously DTLLS) Total Qualification Time of Level 5 Diploma in Education and Training (DET - Previously DTLLS): TQT is the approximate time a learner must complete all the course requirements to acquire his qualification. It entails preparing for classes, learning, researching, taking tests, etc. Total Qualification Time for this Level 5 Diploma in Education and Training (DET - Previously DTLLS) course - 1200 hours. Guided Learning Hours of Level 5 Diploma in Education and Training (DET - Previously DTLLS): GLH is the approximate duration a learner will require to meet all the course objectives for gaining his qualification under the presence of a supervisor or tutor. Total Guided Learning Hours for this course - 360 Who is this course for? DET: Level 5 Diploma in Education and Training (RQF) This DET: Level 5 Diploma in Education and Training (RQF) course is designed for those who want to work in the educational field as a competent professional. It provides excellent training to individuals who wish to obtain a sought-after educational and training qualification. Requirements DET: Level 5 Diploma in Education and Training (RQF) Learners must meet the following minimum criteria: Reading and communication skills should be adequate to meet the requirements of the training. Do not have a criminal background which prevents them working, with young people or vulnerable adults, as a teacher. Hold a relevant qualification at a level above that of their learners; ideally at least Level 3 in their area of specialism The minimum core of literacy, language, numeracy and ICT Career path DET: Level 5 Diploma in Education and Training (RQF) Lecturer / Teacher Assistant Teacher Coach or Trainer Teacher Primary School Teacher Secondary School Teacher Private Tutor Freelance Teacher/Trainer Certificates Hard Copy Certificate Hard copy certificate - Included

Tired of searching and accumulating all the relevant courses for this specific field? It takes a substantial amount of your time and, more importantly, costs you a fortune! Well, we have just come up with the ultimate solution for you by giving this all-inclusive Teachers Training mega bundle. This 40 courses mega bundle keeps you up-to-date in this field and takes you one step ahead of others. Keeping in mind the latest advancements in this ever-emerging sector, the Teachers Training bundle covers all the state-of-the-art tools and techniques required to become a competent worker in this area. You will encounter specific courses relevant to the sector. We take you from the most introductory fundamentals to advance knowledge in a step-by-step manner. In addition, the Teachers Training bundle also consists of courses related to some soft skills that you will need to succeed in any industry or job sector. This Teachers Training Bundle consists of the following premium courses: Course 01: Teaching Assistant Diploma Course 02: SEND Teaching Assistant Course 03: EYFS Teaching Assistant Course 04: Phonics Teaching Certificate Course 05: Remote Teaching Course 06: ADHD Awareness Course 07: The Complete Guide To Getting A Teaching Job Course 08: Nursery Nurse Course 09: Mental Health Teaching Assistant Course 10: Lesson Planning for Teaching Course 11: Learning Disability Nursing Course 12: Leadership in Teaching Course 13: Positive Handling in Schools Course 14: Blended Learning Course for Teachers Course 15: Understanding Autism Level 3 Course 16: Education Management Course 17: Education and Pedagogy Course 18: Learning to Learn - Super Learning Course 19: Educational Psychology Course 20: Health and Safety Training for School Administrators Course 21: Child Language Disorder (CLD) Course 22: Problem Solving Skills Course 23: Leadership Skills Course 24: Communication Skills Course 25: Team Management Course 26: Child Playwork Course 27: Child Neglect Awareness & Protection Course 28: Presentation Skills Course 29: Microsoft Office Course 30: Cross-Cultural Awareness Training Moreover, this bundles include 10 career-focused courses: Course 01: Career Development Plan Fundamentals Course 02: CV Writing and Job Searching Course 03: Interview Skills: Ace the Interview Course 04: Video Job Interview for Job Seekers Course 05: Create a Professional LinkedIn Profile Course 06: Business English Perfection Course Course 07: Networking Skills for Personal Success Course 08: Boost Your Confidence and Self-Esteem Course 09: Public Speaking Training Course 10: Learn to Fight Procrastination Our cutting-edge learning package offers top-notch digital aid and first-rate tutor support. You will acquire the crucial hard and soft skills needed for career advancement because this bundle has been thoroughly examined and is career-friendly. So don't overthink! Enrol today. Learning Outcomes This unique Teachers Training mega bundle will help you to- Quench your thirst for knowledge Be up-to-date about the latest advancements Achieve your dream career goal in this sector Know the applicable rules and regulations needed for a professional in this area Acquire some valuable knowledge related to Teachers Training to uplift your morale The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Certificate: PDF Certificate: Free for all 40 courses Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Teachers Training bundle is designed to assist anyone with a curious mind, anyone looking to boost their CVs or individuals looking to upgrade their career to the next level can also benefit from the learning materials. Requirements The courses in this bundle has been designed to be fully compatible with tablets and smartphones. Career path This Teachers Training bundle will give you an edge over other competitors and will open the doors for you to a plethora of career opportunities. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Teaching Assistant Diploma) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

121 Training & Behaviour Consultation

By Amplified Behaviour

Book a 121 and get this hand picked coaching course available exclusively for Hannah's 121 clients! Delve into the key training foundations, watching exercises again and again with family and friends and join the group discussion under every video! Course curriculum 1 The power of Yes Understanding Your Learner The Power of NO Attention Seeking 2 Training Foundations Luring & "This Way" Clicker Introduction Clicker Training Top Tips Click, Sit & Down Teaching your dog its name Wait & Stay Teaching Watch Relaxation Mat Training Reliable Recall! 9 Games to revolutionise your Recall! Using Punishment: Time Outs Are Dogs Dominant? Force Free Harness, Muzzle, Vet Collar & Jumper Fitting! 3 Loose Lead Walking For Life Why Dogs Pull Choosing a lead Teaching Close Let's Walk! It's Lead Time Pulling Doesn't Work Training without food Leadwork Trouble Shooting 4 Bonus Content Teaching Touch The Intelligence Test

Level 3 Health and Social Care with Care Assistance Training Course

By Kingston Open College

Premium Bundle of all Time | Ofqual Regulation + ATHE Awards + QLS Endorsement | Assessment & Tutor Support Included

Anti-Money Laundering (AML) Training For Fee Earners Course

By DG Legal

In January 2024 alone, reports were published about the SRA taking enforcement action against 3 firms and 4 individuals for failure to comply with the Money Laundering Regulations 2017. The fines issued for these non-compliances total over £570,000 plus costs. The absence of staff training, or requirement to complete additional training, was noted in a number of these cases. Many of the breaches resulting in enforcement action involved failures by the fee earners to conduct appropriate due diligence, adequately check the source of funds and/or wealth or recognise and report red flags. As highlighted by enforcement action being taken against individuals as well as firms, fee earners cannot hide behind their firm when AML failures occur and may be held personally accountable by the SRA for non-compliances with the MLR 2017. This course will cover the following to assist fee earners in the application of AML in their casework. How to comply with your obligations and stay compliant Written CRA & MRA Client Booms Risks – what to consider? PCPs – CDD &EDD POCA / TA SOF and SOW On going monitoring Reporting to MLRO/MLCO Tipping off Target Audience The online course is suitable for fee earners or legal practitioners that want to improve their AML knowledge. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

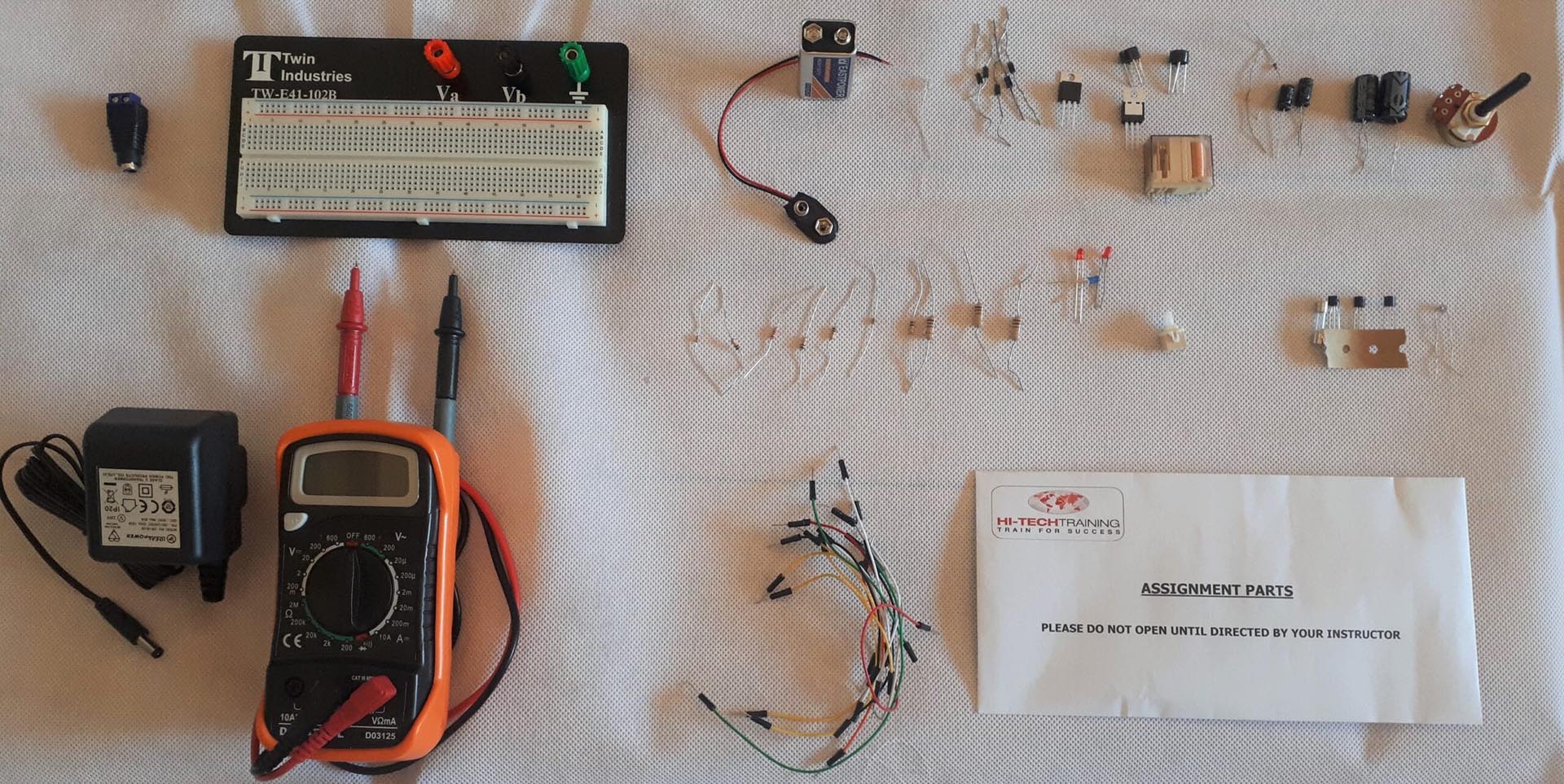

Electronics Repair 1 Course

By Hi-Tech Training

The Electronics Equipment Repair 1 equips participants with practical “Hands-On” skills relevant to the workplace and the theory required for certification. Participants on successful completion of the course will have the skills and knowledge to: Demonstrate the operation of a wide range of electronic components and circuits and their applications in modern electronic-based equipment such as amplifiers, Hi-Fi systems, stereos, and control systems Construct, test and fault-find the following popular basic circuits: Power supplies, amplifiers, timers, etc. Become competent in the correct use of electronic test and measurement equipment such as Analogue and Digital Multimeter and Oscilloscopes.