- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Fraud (In-House)

By The In House Training Company

Fraud should not happen, but it does. It can happen at the highest to lowest levels in an organisation. Recent surveys show that incidents of fraud are not decreasing. Fraud costs companies money and, perhaps even more importantly, reputational damage. The losers are not just the shareholders, suppliers, customers, etc, but society as a whole. This programme shows why frauds happen, how organisations put themselves at risk and what they can do to prevent it. This programme will help directors and others understand: The motives for committing fraud Directors' responsibilities for identifying and reporting fraud What types of frauds there are How frauds are perpetrated How they can be prevented How regulators deal with fraud Above all, the principal objective of this programme is to help make your organisation as secure as possible from the threat of fraud. 1 Motives for committing fraud - drivers of fraud Session objective: to understand why people might commit fraud Drivers of fraudulent behaviourAmbitionGreedTheftConceit? And more! 2 Accounting mechanisms that allow fraud Session objective: to review the elements of the accounting, internal control and management processes that allow creative accounting Income or liability? Asset or expense? Coding errors and misclassification Netting off and grossing up Off-balance sheet items 3 Structures that allow fraud Session objective: to consider company and trading structures that allow frauds to be perpetrated Group structures Trading structures Tax havens Importing and exporting 4 Interpretations and other non-compliance that allow fraud Session objective: to look at how creative interpretations of law and accounting practice may permit fraud The place of accounting standards Accounting policies Trading methods The place of auditing standards 5 Money laundering Session objective: to review what constitutes money laundering Types of money laundering Identifying laundering Preventing laundering 6 Preventing fraud - proper management structures Session objective: to review the place of proper corporate governance Corporate governance Company management structure Audit committees The place of internal audit 7 Preventing fraud - proper accounting Session objective: to review best accounting and auditing practice Accounting standards Internal accounting policies Adequacy of internal controls Internal audit 8 Preventing fraud - regulation Session objective: to look at how regulators aim to prevent fraud The regulatory environment Financial services regulation 9 Conclusion Course review Open forum Close 10 Course summary - developing your own cost action plan Group and individual action plans will be prepared with a view to participants identifying their cost risks areas and the techniques which can be immediately applied to improve costing and reduce costs

Master Enterprise Risk Management and ISO 31000 with our comprehensive course. Delve into risk classification, ERM processes, and the application of ISO 31000 principles. Equip yourself to manage financial, operational, technology, legal, and social risks effectively in your organization.

Register on the Making Budget & Forecast today and build the experience, skills and knowledge you need to enhance your development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get a digital certificate as a proof of your course completion. The Making Budget & Forecast is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Making Budget & Forecast Receive a e-certificate upon successful completion of the course Get taught by experienced, expert instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Once the course has been completed and the assessment has been passed, all students are entitled to receive an endorsed certificate. This will provide proof that you have completed your training objectives, and each endorsed certificate can be ordered and delivered to your address for only £69. Please note that overseas students may be charged an additional £10 for postage. CPD Certificate of Achievement from Janets Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Endorsement This course and/or training programme has been endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. This course and/or training programme is not regulated by Ofqual and is not an accredited qualification. Your training provider will be able to advise you on any further recognition, for example progression routes into further and/or higher education. For further information please visit the Learner FAQs on the Quality Licence Scheme website. Method of Assessment In order to ensure the Quality Licensing scheme endorsed and CPD acknowledged certificate, learners need to score at least 60% pass marks on the assessment process. After submitting assignments, our expert tutors will evaluate the assignments and give feedback based on the performance. After passing the assessment, one can apply for a certificate. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring expert. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a Certificate of Achievement to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Making Budget & Forecast, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Unit-1. Introduction Lecture-1 - Why Budget and Forecasts 00:11:00 Lecture-2- Is budget planning a paper exercise 00:05:00 Lecture-3- Operational and Financial Budget 00:07:00 Unit-2. Detail Budget Requirement Lecture-4 - Components - Revenue Budgets 00:05:00 Lecture-5 - Components - Cost Budget 00:11:00 Lecture-6 - Qualitative Aspects 00:05:00 Unit-3. Process of Making Budget Lecture-7- Process of Budgeting - Logical Steps 00:09:00 Lecture-8 - Revenue Budget - What Information we need to make revenue budgets 00:08:00 Lecture-9- Example we used in Class to demonstrate a broad process in budget and planning 00:17:00 Lecture-10 - Cost Budget Process - Link from revenue and operational plan 00:05:00 Lecture-11-Cost Budget Process - Other aspects 00:10:00 Assignment Assignment - Making Budget & Forecast 4 days, 22 hours Order Your Certificate Order your Certificate QLS 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

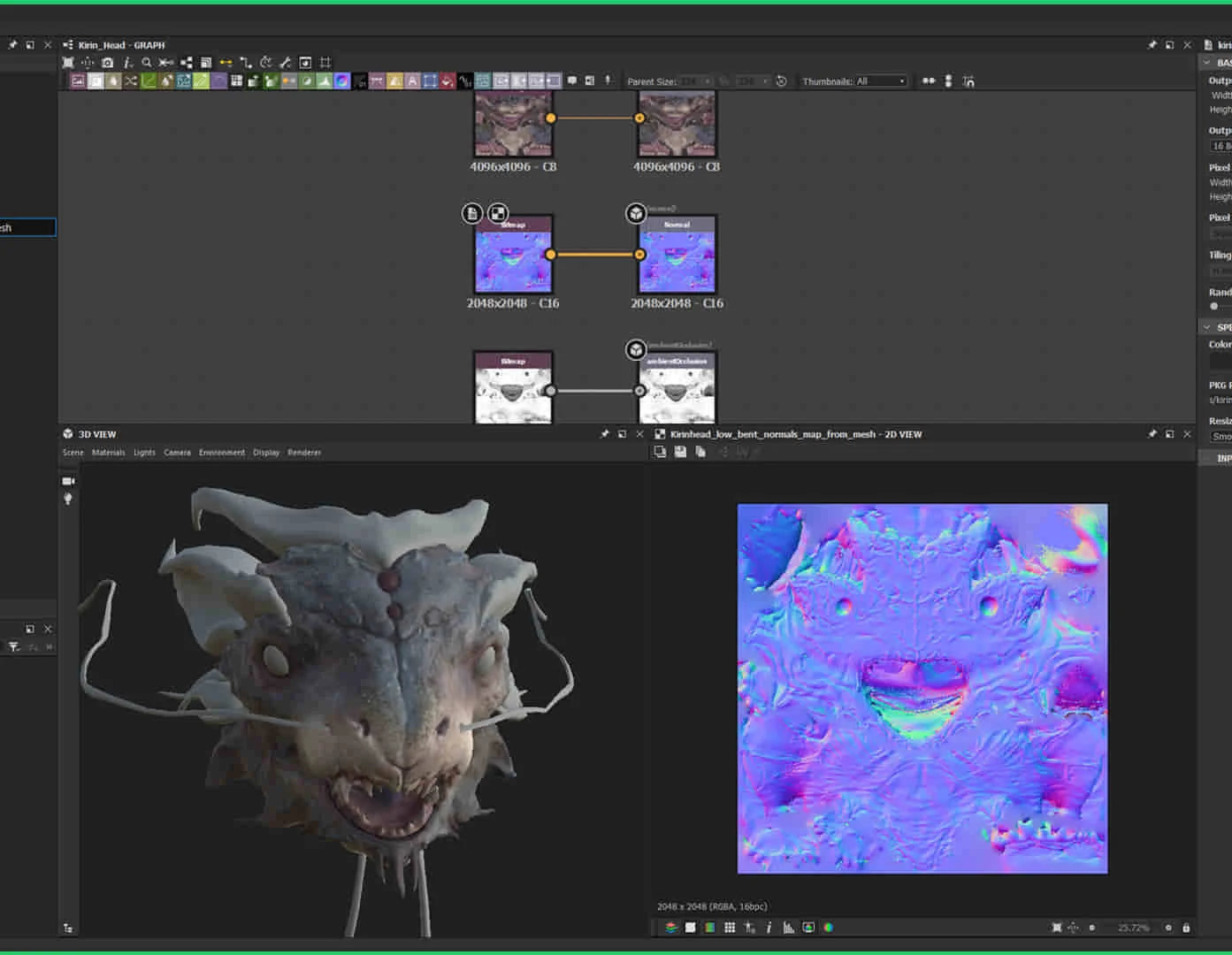

3ds Max and Unity 3D Game Designing Training Course

By ATL Autocad Training London

Who is this course for? The "3ds Max and Unity 3D Game Designing Training Course" is ideal for aspiring game designers, developers, graphic designers, students, and creative professionals. It's tailored for individuals keen on mastering 3D modeling, animation, and interactive game development using industry-standard software like 3ds Max and Unity 3D. Click here for more info: Website Scheduling: Available from Monday to Saturday, 9 a.m. to 7 p.m. Choose in-person or live online sessions over Zoom. Duration: 40 hours. Module 1: Introduction to 3ds Max (8 hours) Overview of 3ds Max interface and tools Basic 3D modeling techniques: primitives, Editable Poly, modifiers Material creation and application Introduction to lighting and rendering concepts Module 2: Advanced 3ds Max Techniques (8 hours) Advanced modeling: Splines, Loft, Extrude, and ProBoolean Animation basics: Keyframes, paths, and controllers Particle systems and dynamics Introduction to character rigging and animation Module 3: Introduction to Unity 3D (8 hours) Unity interface and project setup Importing 3D assets from 3ds Max Physics and colliders in Unity Basic scripting and interactions Module 4: Advanced Unity 3D Features (8 hours) Unity scripting: C# fundamentals Advanced physics and particle systems User interface design and implementation Integrating audio and visual effects Module 5: Game Design and Optimization (8 hours) Game design principles and mechanics Level design and interactive gameplay elements Optimizing game performance: LOD, batching, and asset optimization User testing and feedback incorporation Final Project (4 hours) Collaborative game development project using 3ds Max and Unity 3D Implementation of learned skills in a real-world scenario Presentation and feedback session Note: The course outline is designed to provide a comprehensive understanding of both 3ds Max and Unity 3D, covering fundamental and advanced topics. The final project aims to apply the acquired skills in a practical context, fostering creativity and collaboration among participants. Unity - Real-time 3D https://www.unity.com/. 3ds Max Trial https://www.autodesk.co.uk ⺠products ⺠free-trial Upon completion of the 40-hour 3ds Max and Unity 3D Game Design Masterclass, students will: Master 3D Modeling: Acquire proficient skills in creating detailed 3D models, understanding various techniques, and utilizing advanced tools in 3ds Max. Expertise in Animation: Gain expertise in animating characters and objects, employing keyframes, paths, and controllers for realistic motion. Material Creation and Texturing: Understand material creation, application, and advanced texturing techniques for creating visually appealing game assets. Unity Game Development: Learn Unity's interface, project setup, and scripting fundamentals to create interactive games. Physics and Interactivity: Explore physics systems, colliders, and interactive elements, enhancing gameplay experiences. Advanced Scripting: Develop proficiency in C# scripting, enabling the implementation of complex game mechanics and interactions. Optimization Techniques: Understand techniques to optimize game assets, improving performance and ensuring smooth gameplay. Game Design Principles: Grasp essential game design principles, including level design, user experience, and gameplay mechanics. Real-World Application: Apply learned skills in a collaborative final project, integrating 3D models, animations, scripting, and game design principles. Presentation Skills: Develop the ability to present and explain game concepts, designs, and mechanics effectively. Troubleshooting and Debugging: Gain skills in identifying and resolving common issues and errors in both 3ds Max and Unity 3D projects. Team Collaboration: Enhance teamwork and collaboration skills through the final project, working effectively with peers in a creative environment. Upon completing the course, students will have a well-rounded skill set in 3D modeling, animation, game design, and Unity development, making them proficient candidates for roles in game development studios, animation companies, or freelance projects. 3ds Max and Unity 3D Game Designing Training Course: Skills & Careers! Skills Acquired: Advanced 3D Modeling Texturing and Animation Unity 3D Game Development Lighting and Rendering Interactive UI/UX Design Career Opportunities: Game Developer 3D Modeler Texture Artist Game Tester UI/UX Designer Embrace Personalized Learning. Why Us? Discover the Benefits: One-on-One Training: Experience tailored coaching from practicing architects and designers, either face-to-face at (SW96DE) or in live online sessions. Available Monday to Saturday, 9 am to 7 pm. Customized Tutorials: Take home exclusive video tutorials crafted to enhance your learning journey. Comprehensive Resources: Access a digital reference book for thorough revision, ensuring a deep understanding of every concept. Free Ongoing Support: Enjoy continuous post-course assistance via phone or email, ensuring your success even after class completion. Flexible Syllabus: We adapt syllabus and projects to your needs, ensuring focused learning on what matters most to you. Official Certificate: Certificate upon course completion. Why Choose Us? Individualized Support: Our courses, ranging from 10 to 120 hours, offer unwavering assistance at every stage. With personalized homework assignments and free after-course support, we guide you toward mastering software with unparalleled expertise. Personal Attention, No Crowded Classrooms: Experience the intimacy of one-on-one learning. Bid farewell to crowded classrooms, ensuring you receive the undivided attention you deserve in a confident and comfortable environment. Financial Flexibility: Embarking on your educational journey shouldn't strain your finances. Diverse payment plans tailored to your needs. Explore available options and embark on your learning adventure today. Expert Instructors, Real-world Experience: Our instructors, chosen for their industry expertise and passion for teaching, are dedicated to imparting invaluable skills to eager learners.

Start Up and Grow Your Own 'Business'

By Training Tale

With the global financial markets in such turmoil, many people are looking for security in ways they may not have considered previously. This Start Up and Grow Your Own Business course is designed for students who want to learn the skills and knowledge required to develop a business start-up. It is crucial that you create an effective plan that will allow you to test your product or service and make any necessary changes and improvements. It all starts with developing a successful business idea. This Start Up and Grow Your Own Business course comprises several modules that will look into a different aspects of this subject. It will provide learners with an understanding of the initial processes and requirements of a Start Up, as well as knowledge of the first steps in Start Up, including marketing, legal, and financial requirements, as well as an understanding of how to write a business plan. Learning Outcomes After completing this Start Up and Grow Your Own Business course, you will be able to: Understand the steps for a business start-up. Understand what is required of you to start your own business. Polish your business idea. Build your competitive advantages. Increase self-awareness and aid personal development. Develop a Start-up Business Plan. Why Choose Business START UP Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. Other courses are included with Start Up and Grow Your Own Business Bundle Course Course 01: Start Up and Grow Your Own Business Course 02: Level 7 Diploma in Operations Management Course 03: Level 7 Diploma in Facilities Management Course Course 04: Level 5 Diploma in Business Analysis Course 05: Level 5 Diploma in Risk Management Course Course 06: Level 2 Diploma in Business Administration Course 07: Level 7 Diploma in Leadership and Management Course ***Others Included in this Bundle Course Free 7 PDF Certificate Access to Content - Lifetime Exam Fee - Totally Free Free Retake Exam [ Note: Free PDF certificate as soon as completing the course ] ***Start Up and Grow Your Own Business*** Detailed course curriculum Module 1: Fundamental Steps for a Business Start-up Basic Requirements of an Entrepreneur Identify the Type and Field of Business that is More Suitable for You Identify Your Skills and Creativity Related to New Business Opportunities Analyse the Commercial Potential of a Business Opportunity Module 2: Strategic Thinking about New Business Solving a Problem Beating the Deadlines Finding Products in Short Supply Opportunities Created by News or Events Investigating the Internet Thinking Start-to-finish Niche Strategies Demographic Trends Rethink Assumptions Module 3: The Best Business Ideas for You Case Study Screen Your Ideas List Field Study SWOT Analysis Module 4: Developing a Start-up Business Plan Introduction of Start-up Business Plan Executive Summary Company Description Products & Services Marketing Plan Operational Plan Management & Organisation Startup Expenses & Capitalization Financial Plan -------------- ***Level 5 Diploma in Business Analysis*** Module 01: What is a Business Analyst? Module 02: What Makes a Good Business Analyst? Module 03: Roles of the Business Analyst Module 04: The Business Analyst and the Solution Team Module 05: Define the Problem Module 06: Vision Phase Module 07: Process Phase - Gather The Information Module 08: Process Phase - Determine the Solution Module 09: Process Phase - Write the Solution Document Module 10: Production Phase - Producing the Product Module 11: Production Phase - Monitor the Product Module 12: Confirmation Stage -------------- ***Level 7 Diploma in Facilities Management Course*** Module 01: Introduction to Facilities Management Module 02: Developing a Strategy for Facilities Management Module 03: Facilities Planning Module 04: Managing Office WorkSpace Module 05: Vendor Management & Outsourcing Module 06: Managing Change Module 07: Managing Human Resources Module 08: Managing Risk Module 09: Facilities Management Service Providers Module 10: Managing Specialist Services Module 11: Public-Private Partnerships and Facilities Management Module 12: Health, Safety, Environment and UK Law -------------- ***Level 7 Diploma in Operations Management*** Module 01: Understanding Operations Management Module 02: Understanding Process Management Module 03: Understanding Supply Chain Management Module 04: Understanding Planning & Sourcing Operations Module 05: Understanding Talent Management Module 06: Understanding Procurement Operations Module 07: Understanding Manufacturing and Service Operations Module 08: Understanding Succession Planning Module 09: Understanding Project Management Module 10: Understanding Quality Control Module 11: Understanding Product and Service Innovation Module 12: Understanding Communication Skills Module 13: Understanding Negotiation Techniques Module 14: Understanding Change Management Module 15: Understanding Maintenance Management Module 16: Understanding Conflict Management Module 17: Understanding Stress Management Module 18: Understanding Business Ethics for the Office Module 19: Understanding Business Etiquette Module 20: Understanding Risk Management -------------- ***Level 5 Diploma in Risk Management Course*** Module 01: A Quick Overview of Risk Management Module 02: Risk and its Types Module 03: Others Types of Risks and its Sources Module 04: Risk Management Standards Module 05: Enterprise Risk Management Module 06: Process of the Risk Management Module 07: Risk Assessment Module 08: Risk Analysis Module 09: Financial Risk Management Module 10: The Basics of Managing Operational Risks Module 11: Technology Risk Management Module 12: Project Risk Management Module 13: Legal Risk Management Module 14: Managing Social and Market Risk Module 15: Workplace Risk Assessment Module 16: Risk Control Techniques Module 17: Ins and Outs of Risk Management Plan -------------- ***Level 2 Diploma in Business Administration*** Module 01: Communication in a Business Environment Module 02: Principles of Providing Administrative Services Module 03: Principles of Business Document Production and Information Management Module 04: Understand Employer Organisations Module 05: Manage Personal Performance and Development Module 06: Develop Working Relationships with Colleagues Module 07: Manage Diary Systems Module 08: Produce Business Documents Module 09: Health and Safety in a Business Environment Module 10: Handle Mail Module 11: Principles of Digital Marketing Module 12: Administer Finance Module 13: Understand Working in a Customer Service Environment Module 14: Principles of Team Leading Module 15: Principles of Equality and Diversity in the Workplace Module 16: Exploring Social Media Module 17: Understand the Safe Use of Online and Social Media Platforms -------------- ***Level 7 Diploma in Leadership and Management Course*** Module 1: Understanding Management and Leadership Module 2: Leadership over Yourself Module 3: Creativity and Innovation Module 4: Leadership and Teambuilding Module 5: Motivation and People Management Module 6: Communication and Leadership Module 7: Presentation, One-to-one Interview and Meeting Management Module 8: Talent Management Module 09: Strategic Leadership Module 10: Stress Management -------------- Assessment Method After completing each module of the Start Up and Grow Your Own Business, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Start Up and Grow Your Own Business This course is ideal for anyone who wants to start up his own business. Requirements Start Up and Grow Your Own Business There are no specific requirements for this Start Up and Grow Your Own Business course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Start Up and Grow Your Own Business Upon successful completion of this course, you may choose to become a: Business Owner Entrepreneur Business Analyst Business and Enterprise Advisor Business Development Executive Certificates Certificate of completion Digital certificate - Included

Description: Doing business analysis is identifying the needs of the business and how to solve issues in business. Most of these issues are concerned with financial needs or budgeting. To learn more about business analysis and how to solve issues like financial problems, you need to learn and have specific skills about it. Learning both might take you a lot of time, but since we created a course that will teach you both, then this course will be perfect for your needs. In this course, you will learn the necessary skills, information, and knowledge of business analysis. Who is the course for? Any business professionals who need to learn about business analysis People who have an interest in business and wants to pursue creating new business Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Advanced Business Analysis Course is a useful qualification to possess, and will be very helpful to have especially for these careers: Businessman/Businesswoman Business Analyst Business Development Specialist Business Development Manager Economist Statistician Strategist. Business Analysis Business Planning Basics 01:00:00 Market Evaluation 01:00:00 Analyze Competition 01:00:00 Determine A Marketing Strategy 01:00:00 Decide What Extras You May Need Like Staff etc 00:30:00 The Dangers In Not Making A Business Plan 00:15:00 Wrapping Up 00:15:00 Finance & Budgeting Financing Basics 01:00:00 Record Your Income 01:00:00 Make a List of Expenses First and Put Them in Categories 01:00:00 Countdown & Adjust 01:00:00 Review Regularly 01:00:00 Reference Book Business Analysis 00:00:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam- Advanced Business Analysis Course 00:30:00 Final Exam Final Exam- Advanced Business Analysis Course 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview of Managing Fraud Course Fraud management involves identifying illegal activities to stop important information from falling into the wrong hands. This Managing Fraud Course will guide you through the fundamentals of fraud management and its various strategies to mitigate risks and reduce financial losses. In this Managing Fraud course, you'll walk through a step-by-step process to implement an effective fraud policy for your business. First, the training will educate you about the importance of fraud management and its legal and ethical considerations. Then, it will introduce you to the various types of fraud and different techniques used in fraud detection and prevention. You'll also understand what to include in your fraud response plan and how to maintain regulatory compliance to mitigate risks. Course Preview Learning Outcomes Familiarise yourself with various fraud awareness techniques and tools Understand what is evidence and how to deal with exhibits Gain insights into the fraud risk management process Learn how to implement fraud management strategies to detect and prevent fraud Enrich your knowledge of fraud incident reporting and monitoring Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email Who Should Take this Managing Fraud Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Managing Fraud Course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ Managing Fraud Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Fraud Investigator Risk Manager Compliance Officer Forensic Accountant Internal Auditor Financial Crimes Analyst Legal Consultant in Fraud Management Fraud Management Specialist Module 1: Introduction to Fraud Management Introduction to Fraud Management 00:13:00 Module 2: Types of Fraud Types of Fraud 00:10:00 Module 3: Fraud Prevention Techniques Fraud Prevention Techniques 00:14:00 Module 4: Fraud Detection Methods Fraud Detection Methods 00:13:00 Module 5: Unveiling Fraudulent Evidence Unveiling Fraudulent Evidence 00:08:00 Module 6: Responding to Fraud Incidents Responding to Fraud Incidents 00:16:00 Module 7: Investigating Fraud Investigating Fraud 00:09:00 Module 8: Fraud Mitigation and Compliance Fraud Mitigation and Compliance 00:15:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Register on the Fundamentals of Corporate Finance today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Fundamentals of Corporate Finance is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Fundamentals of Corporate Finance Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Fundamentals of Corporate Finance, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Fundamentals of Corporate Finance Lesson 01: Introduction to Corporate Finance 00:38:00 Lesson 02: Financial Statement Analysis for Corporate Finance 01:19:00 Lesson 03: Time Value of Money Concepts 00:28:00 Lesson 04: Interest Rates 01:00:00 Lesson 05: How to Value Stocks 00:53:00 Lesson 06: Stock Valuation 00:53:00 Lesson 07: Risk and Returns in Capital Management 00:26:00 Lesson 08: Cost of Capitals - Fundamentals 00:21:00 Lesson 09: Cost of Capital and Effect of Leverage 00:38:00 Lesson 10: Systematic Risk and Portfolio Returns 00:06:00 Lesson 11: Investment Decision Rules and Calculating Cash Flow 01:13:00 Lesson 12: Working Capital Management - Part 1 00:57:00 Lesson 13: Working Capital Management - Part 2 01:07:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

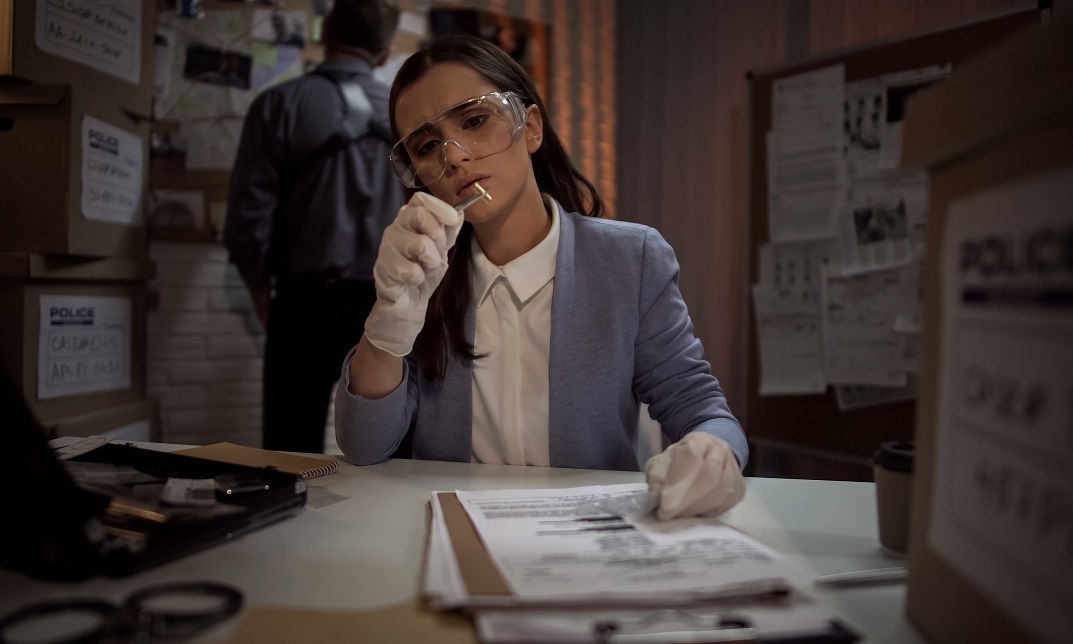

Crime Analysis

By The Teachers Training

Crime Analysis is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Crime Analysis and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 10 hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Module 01: Introduction to Crime Analysis Introduction to Crime Analysis 00:33:00 Module 02: The Criminal Justice System in England and Wales The Criminal Justice System in England and Wales 00:20:00 Module 03: Classification of Crime Classification of Crime 00:39:00 Module 04: Crime Scene Crime Scene 00:28:00 Module 05: Crime Mapping Crime Mapping 00:30:00 Module 06: Tactical Crime Analysis Tactical Crime Analysis 00:46:00 Module 07: Strategic and Administrative Crime Analysis Strategic and Administrative Crime Analysis 00:34:00 Module 08: Criminal Behaviour and Psychology Criminal Behaviour and Psychology 00:42:00 Module 09: Financial and Environmental Criminology Financial and Environmental Criminology 00:44:00 Module 10: Criminal Justice Criminal Justice 00:38:00 Module 11: Criminal Profiling: Science, Logic and Metacognition Criminal Profiling: Science, Logic and Metacognition 00:27:00 Module 12: Phases of Profiling Phases of Profiling 00:32:00 Module 14: Technology in Criminal Intelligence Analysis Technology in Criminal Intelligence Analysis 00:22:00 Module 13: Criminal Intelligence Analysis Criminal Intelligence Analysis 00:23:00 Module 15: Research Method and Statistics in Crime Analysis Research Method and Statistics in Crime Analysis 00:30:00 Module 16: Policing and Cyber Security Policing and Cyber Security 00:47:00 Module 17: Forecasting Future Occurrences and Prediction Forecasting Future Occurrences and Prediction 00:37:00

Mortgage Advisor: Mortgage Advisor Course Do you want to build confidence in this industry and be ready for real world experience? Then join our Mortgage Advisor: Mortgage Advisor Course. The full instruction on mortgage law, practice, and regulation offered by this Mortgage Advisor: Mortgage Advisor Course is thorough. Important subjects, including mortgage products, repayment strategies, and client counselling, are also covered in this Mortgage Advisor: Mortgage Advisor Course. You will also learn about actual world scenarios and the application procedure through this Mortgage Advisor: Mortgage Advisor Course. In addition, market research, interest rates, and planning permission are covered in this Mortgage Advisor: Mortgage Advisor Course. The Mortgage Advisor: Mortgage Advisor Course is ideal for building confidence in this industry and being ready for tests. Enter the vibrant UK mortgage market and open up a world of options. So, participate in the Mortgage Advisor: Mortgage Advisor Course. Special Offers of this CeMAP: Mortgage Advisor Course: This Mortgage Advisor: Mortgage Advisor Course includes a FREE PDF Certificate. Lifetime access to this Mortgage Advisor: Mortgage Advisor Course Instant access to this Mortgage Advisor: Mortgage Advisor Course 24/7 Support Available to this Mortgage Advisor: Mortgage Advisor Course Mortgage Advisor: Mortgage Advisor Course Get the Mortgage Advisor: Mortgage Advisor course and become a Mortgage Advisor: Mortgage Advisor expert today! As a Mortgage Advisor: Mortgage Advisor, you'll learn the ins and outs of the mortgage industry, including Mortgage Advisor: Mortgage Advisor best practices. With this Mortgage Advisor: Mortgage Advisor course, you'll be able to advise clients on the best mortgage options for their needs. Become a Mortgage Advisor: Mortgage Advisor with this comprehensive course today! Who is this course for? Mortgage Advisor: Mortgage Advisor Course Anyone dedicated to this field can take our Mortgage Advisor: Mortgage Advisor Course. Special Note: Our Course is knowledge Based course. Requirements Mortgage Advisor: Mortgage Advisor Course To enrol in this Mortgage Advisor: Mortgage Advisor Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Mortgage Advisor: Mortgage Advisor Course. Be energetic and self-motivated to complete our Mortgage Advisor: Mortgage Advisor Course. Basic computer Skill is required to complete our Mortgage Advisor: Mortgage Advisor Course. If you want to enrol in our Mortgage Advisor: Mortgage Advisor Course, you must be at least 15 years old. Career path Mortgage Advisor: Mortgage Advisor Course The mortgage advisor: mortgage advisor Course certification improves prospects in banking and financial services by opening doors for careers as brokers, financial consultants, and mortgage advisor: mortgage advisor.