- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Pelvic Floor Pilates

By Sharon Snowdon

A simple to follow Pilates course designed specifically for women who are suffering with stress incontinence and want to strengthen their pelvic floor.

Step into the specialist world of disability assessment with this all-in-one online training bundle. Designed for individuals looking to build expertise in disability analysis and related conditions, this course set covers the essentials you need to understand complex needs in a healthcare or support environment. From the foundations of disability assessment to deeper insight into autism, neurology, and dyslexia, this structured training path offers a knowledge-rich experience suitable for professionals across health and social care sectors. You’ll learn how to assess disability cases with accuracy and confidence, while gaining vital awareness of neurological conditions and learning differences that often impact assessment decisions. Delivered entirely online, the bundle allows you to study at your own pace without compromising on depth or relevance. Whether you're upskilling for a current role or moving into a specialist position, this bundle helps you build knowledge with a focus on clarity, accuracy, and informed decision-making. Key Features of Disability Assessor Training Bundle CPD Accredited Disability Assessor Training Course Instant PDF certificate Fully online, interactive Disability Assessor Trainingcourse Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Enrol now in this Disability Assessor Training Bundle course to excel! To become successful in your profession, you must have a specific set of Disability Assessor Training skills to succeed in today's competitive world. In this in-depth Disability Assessor Trainingtraining course, you will develop the most in-demand Disability Assessor Training skills to kickstart your career, as well as upgrade your existing knowledge & skills. Disability Assessor Training Curriculum Course 01: Disability Assessor Training Course 02: Neurology Course 03: Understanding Autism Level 3 Course 04: Dyslexia Awareness Accreditation This Disability Assessor Training bundle courses are CPD accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your Disability Assessor Training course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). CPD 40 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for all employees or anyone who genuinely wishes to learn more about Disability Assessor Training basics. Requirements No prior degree or experience is required to enrol in this course. Career path This Disability Assessor Training Course will help you to explore avariety of career paths in the related industry. Certificates Digital certificate Digital certificate - Included Hardcopy Certificate Hard copy certificate - Included Hardcopy Certificate (UK Delivery): For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99. Hardcopy Certificate (International Delivery): For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Whether you're aiming to broaden your expertise or pursue a new direction in health and social care, this Disability Assessor Essential Bundle offers structured, relevant knowledge that fits today’s care environment. Each course within the bundle is designed to build a strong foundation in assessing disabilities, deepening your understanding of neurological conditions, autism, and dyslexia—all central to making fair, informed, and respectful assessments. With flexible learning and no unnecessary filler, the content is purposeful, clear, and aligned with UK care expectations. This bundle combines four thoughtfully developed modules: Disability Assessor Training, Neurology, Understanding Autism Level 3, and Dyslexia Awareness. Whether you're preparing for a new role or enhancing existing knowledge, this collection offers the insights necessary to handle assessments with accuracy and confidence. Delivered entirely online, it’s ideal for those who prefer straightforward, well-organised learning that gets to the point—without overcomplication. Key Features of Disability Assessor Essential Bundle CPD Accredited Disability Assessor Essential Course Instant PDF certificate Fully online, interactive Disability Assessor Essential course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Enrol now in this Disability Assessor Essential Bundle course to excel! To become successful in your profession, you must have a specific set of Disability Assessor Essential skills to succeed in today's competitive world. In this in-depth Disability Assessor Essential training course, you will develop the most in-demand Disability Assessor Essential skills to kickstart your career, as well as upgrade your existing knowledge & skills. Disability Assessor Essential Curriculum Course 01: Disability Assessor Training Course 02: Neurology Course 03: Understanding Autism Level 3 Course 04: Dyslexia Awareness Accreditation This Disability Assessor Essential bundle courses are CPD accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your Disability Assessor Essential course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). CPD 40 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for all employees or anyone who genuinely wishes to learn more about Disability Assessor Essential basics. Requirements No prior degree or experience is required to enrol in this course. Career path This Disability Assessor Essential Course will help you to explore avariety of career paths in the related industry. Certificates Digital certificate Digital certificate - Included Hardcopy Certificate Hard copy certificate - Included Hardcopy Certificate (UK Delivery): For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99. Hardcopy Certificate (International Delivery): For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Tax Accounting

By NextGen Learning

Course Overview The Tax Accounting course provides a comprehensive introduction to the UK tax system, covering key areas such as income tax, corporation tax, VAT, and inheritance tax. Designed to equip learners with up-to-date knowledge of tax regulations and processes, this course offers valuable insights into tax administration, individual and corporate responsibilities, and submission of tax returns. Learners will develop a solid understanding of fundamental and advanced tax principles, payroll, and financial analysis. By the end of the course, participants will be able to navigate the complexities of taxation confidently and apply their knowledge in professional contexts. Whether aiming to launch a career in tax accounting or broaden existing financial expertise, this course supports learners in achieving their professional development goals and gaining skills that are in high demand across multiple sectors in the UK. Course Description This Tax Accounting course delves into the structure and operation of the UK tax system, offering detailed modules on personal and corporate taxation, VAT, capital gains, and national insurance contributions. Learners will explore both basic and advanced income tax calculations, understand payroll systems, and gain familiarity with self-assessment and double-entry accounting methods. The curriculum is structured to promote a clear and methodical understanding of tax reporting, compliance obligations, and financial analysis. With a strong emphasis on technical knowledge and regulatory frameworks, this course supports learners in building the analytical and accounting skills essential for a successful career in finance and taxation. Throughout the course, learners will benefit from clear explanations, real-world examples, and guided study that align with industry standards. By completion, participants will be well-prepared to pursue opportunities in accounting firms, corporate finance departments, and tax advisory roles. Course Modules Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Advanced Income Tax Module 07: Payee, Payroll and Wages Module 08: Capital Gain Tax Module 09: Value Added Tax Module 10: Import and Export Module 11: Corporation Tax Module 12: Inheritance Tax Module 13: Double Entry Accounting Module 14: Management Accounting and Financial Analysis Module 15: Career as a Tax Accountant in the UK (See full curriculum) Who is this course for? Individuals seeking to develop a strong foundation in tax accounting. Professionals aiming to enhance their accounting and financial expertise. Beginners with an interest in taxation, finance, or business management. Entrepreneurs wanting to understand tax obligations for businesses. Students planning a career in accounting, auditing, or tax consultancy. Career Path Tax Accountant Payroll Administrator VAT Specialist Income Tax Advisor Financial Analyst Management Accountant Corporate Tax Consultant Self-Assessment Practitioner Tax Compliance Officer Accounting Technician

Write a Compelling Company Overivew for Investors

By Entreprenure Now

The Company Overview section of your business plan must excite investors. From the founders’ bios and company history to your business location and business model, it must be clear that you’re poised to succeed. This learning stream helps you navigate the five essential sections to include in your plan: company profile, team, staffing, business model, and current status—all with examples, as well as solid business mindset tips and how to talk to investors. The workshop provides a walk-through of the tactical aspects of the learning stream will be walked-through in the workshop step-by-step.

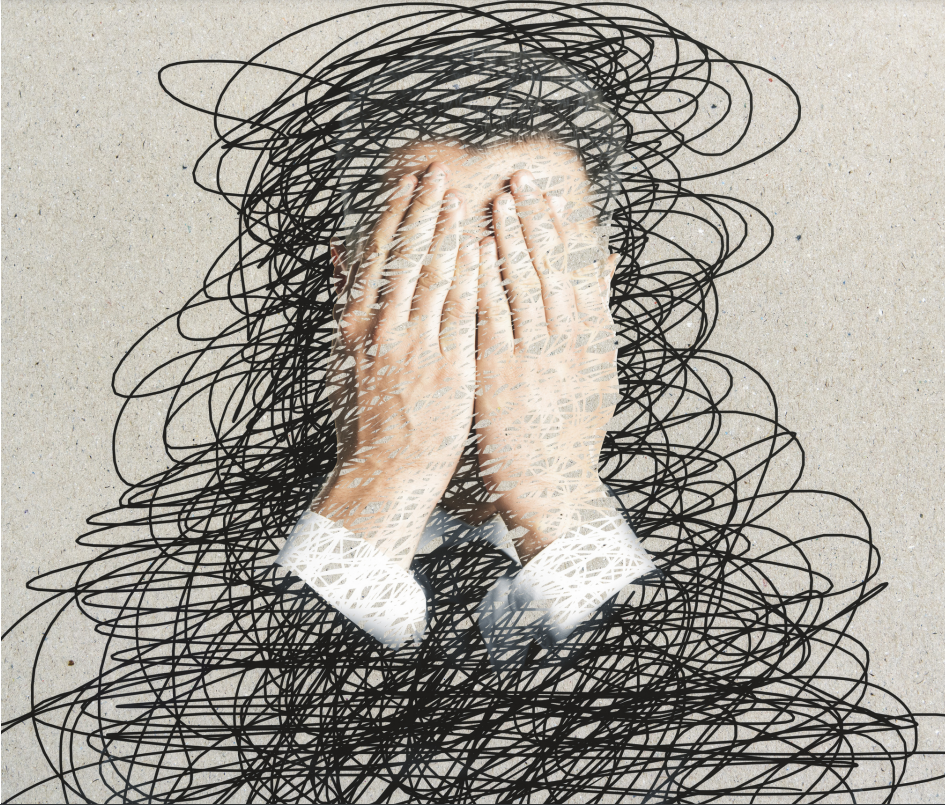

Let's Talk About Stress

By Happy Human Training

Stress. For a little word it sure creates a LOT of trouble and - well -there's certainly a LOT to be stressed about! Money, exams, work, relationships, health, family, the future. That's before we talk about global issues like human rights, energy and climate. Maybe we're now even stressed about our stress! It's easy to feel like we're sinking, like there's nothing can be done, that this is how it will always be. But, what if that's not the case? What if there's a way to have a different relationship with stress? What if you could boss your stress not the other way around?

UK Tax Accounting Course

By Wise Campus

UK Tax Accounting: UK Tax Accounting Course Do you want to know more about UK tax accounting? Then we have an amazing UK tax accounting course for you. Students who successfully complete this UK tax accounting course will gain knowledge of the principles of taxation. Furthermore discussed in this UK tax accounting course are indirect taxes, business taxes, and individual taxes. We also cover asset-related taxes in our UK tax accounting course. Additionally, this UK tax accounting course describes handling real-world compliance. This lesson from the UK tax accounting course also explains international taxes. Sign up in our UK Tax Accounting course to further your professional development and build confidence with coworkers. Learning outcome of UK tax accounting course Upon completing this UK tax accounting course, students will learn about: The foundations of taxation from this UK tax accounting course. Also, this UK tax accounting course explains individual taxation, corporate taxation and indirect taxes. Asset-related taxes are also describes in our UK tax accounting course. Moreover, this UK tax accounting course teaches to handle practical compliance. International taxation is also part of this UK tax accounting course lesson. Special Offers of this UK Tax Accounting: UK Tax Accounting Course This UK Tax Accounting: UK Tax Accounting Course includes a FREE PDF Certificate. Lifetime access to this UK Tax Accounting: UK Tax Accounting Course Instant access to this UK Tax Accounting: UK Tax Accounting Course Get FREE Tutor Support to this UK Tax Accounting: UK Tax Accounting Course UK Tax Accounting: UK Tax Accounting Course Unlock your potential with our comprehensive UK Tax Accounting: UK Tax Accounting course. This UK Tax Accounting: UK Tax Accounting course is designed to provide you with in-depth knowledge of the principles of taxation. Delve into indirect taxes, business taxes, and individual taxes, all thoroughly covered in our UK Tax Accounting: UK Tax Accounting curriculum. Learn about asset-related taxes and how to handle real-world compliance challenges. Additionally, our UK Tax Accounting: UK Tax Accounting course offers insights into international taxes, preparing you for a successful career in the field. Enroll now and master UK Tax Accounting: UK Tax Accounting! Who is this course for? UK Tax Accounting: UK Tax Accounting Course This UK Tax Accounting course is open to students who have no prior understanding of UK tax accounting. Requirements UK Tax Accounting: UK Tax Accounting Course To enrol in this UK Tax Accounting: UK Tax Accounting Course, students must fulfil the following requirements. To join in our UK Tax Accounting: UK Tax Accounting Course, you must have a strong command of the English language. To successfully complete our UK Tax Accounting: UK Tax Accounting Course, you must be vivacious and self driven. To complete our UK Tax Accounting: UK Tax Accounting Course, you must have a basic understanding of computers. A minimum age limit of 15 is required to enrol in this UK Tax Accounting: UK Tax Accounting Course. Career path UK Tax Accounting: UK Tax Accounting Course This UK tax accounting course will facilitate you for handsom jobs like: Corporate finance Tax compliance Tax advice Accountancy Financial consulting

Neuroscience of Dance theory to practice

By Sofia Amaral Martins

How does the brain produce dance? What is the impact of dance on the brain? In the workshops I provide the theory in a dynamic fashion, always applying it to practice promoting embodied cognition and equipping dancers with easy-to-apply techniques. In a fast-paced world where we are often disconnected from ourselves, my focus is to use the body as a tool of learning and give the what and the how in a practical and interesting way.

Building an Interpreter from Scratch

By Packt

In this course, we'll learn about runtime semantics and build an interpreter for a programming language from scratch. In the process, we'll build and understand a full programming language semantics.

Want to Drive Innovation? - Take a Coach Approach!

By IIL Europe Ltd

Want to Drive Innovation? - Take a Coach Approach! Are you struggling to get your team to innovate? Is there a lack of new ideas on your team? Do you want to increase autonomy and empowerment of your team? Taking a coach approach may be exactly what you need. This session will show you how to empower your team to solve problems and innovate, and it will help you ensure diverse perspectives are being surfaced. We will explore specific tactics and questions you can use to unlock others; whether in your own team, or with peers and clients. A simple coaching framework to get started Powerful questions to unlock creativity and empower others Tips for boosting your active listening skills Time back in your day