- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Description: Managing the employees of any company is a big undertaking as you not only have to hire people with the right skill set and are a perfect match, but also manage their salaries as well. Well if you get this Diploma in HR, Bookkeeping and Payroll Management course, then you can learn the basics of doing all those things and be a key figure in your company's growth. This diploma level course is divided into four sections each focusing on HR & leadership, Human Resource Management, Bookkeeping & Payroll Basics and Managing Payroll. In the first chapter you will learn a lot about leadership as you look into people recognition, managing performance & goals and the importance of a good team leader. Next chapter though focuses solely on HR management as you explore recruitment, interviewing and other related topics. Following that you will learn the basic terminologies, accounting methods, understand balance sheet in bookkeeping and payroll basics. Finally you learn about payroll management in detail. The course could prove to be extremely useful and if you decide to get it now, you will be at the top of any employers list. Who is the course for? People who want to work in human resources People looking to be successful in interviews by learning how interviewers think Professionals wanting to improve their skills in Payroll management Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Diploma in HR, Bookkeeping and Payroll Management is a useful qualification to possess and would be beneficial for any professions or career from any industry you are in such as: Payroll Administrator HR Manager Recruitment Consultant Manager Team Leader Diploma in HR, Bookkeeping and Payroll Management - Updated Version HR Introduction to Human Resources 00:20:00 Employee Recruitment and Selection Procedure 00:35:00 Employee Training and Development Process 00:24:00 Performance Appraisal Management 00:22:00 Employee Relations 00:19:00 Motivation and Counselling 00:22:00 Ensuring Health and Safety at the Workplace 00:19:00 Employee Termination 00:18:00 Employer Records and Statistics 00:17:00 Essential UK Employment Law 00:30:00 Introduction to Payroll Management Introduction to Payroll Management 00:10:00 An Overview of Payroll 00:17:00 The UK Payroll System Running the payroll - Part 1 00:14:00 Running the payroll - Part 2 00:18:00 Manual payroll 00:13:00 Benefits in kind 00:09:00 Computerised systems 00:11:00 Total Photo scenario explained 00:01:00 Brightpay Brightpay conclude 00:03:00 Find software per HMRC Brightpay 00:03:00 Add a new employee 00:14:00 Add 2 more employees 00:10:00 Payroll Settings 00:15:00 Monthly schedule - 1 Sara 00:14:00 Monthly schedule - Lana 00:14:00 Monthly schedule - James 00:08:00 Directors NI 00:02:00 Reports 00:02:00 Paying HMRC 00:05:00 Paying Pensions 00:04:00 RTI Submission 00:02:00 Coding Notices 00:01:00 Journal entries 00:07:00 Schedule 00:03:00 AEO 00:06:00 Payroll run for Jan & Feb 2018 00:13:00 Leavers - p45 00:03:00 End of Year p60 00:02:00 Installing Brightpay 00:13:00 Paye, Tax, NI PAYE TAX 00:13:00 NI 00:11:00 Pensions 00:06:00 Online calculators 00:07:00 Payslips 00:03:00 Journal entries 00:07:00 Conclusion and Next Steps Conclusion and Next Steps 00:07:00 Diploma in HR, Bookkeeping and Payroll Management - Old Version HR & Leadership Leader and HR Management 00:30:00 Commitment and HR Management 01:00:00 Team Management 00:30:00 Build A Mastermind Group 02:00:00 People Recognition in HR Management 00:30:00 Performance, Goals and Management 00:30:00 Think Outside The Box 00:30:00 Be Passionate about Your Work 00:30:00 The Importance Of A Good Team Leader 00:30:00 Human Resource Management Module One - Getting Started 00:30:00 Module Two - Human Resources Today 01:00:00 Module Three - Recruiting and Interviewing 01:00:00 Module Four - Retention and Orientation 01:00:00 Module Five - Following Up With New Employees 01:00:00 Module Six - Workplace Health & Safety 01:00:00 Module Seven - Workplace Bullying, Harassment, and Violence 01:00:00 Module Eight - Workplace Wellness 01:00:00 Module Nine - Providing Feedback to Employees 01:00:00 Module Ten - Disciplining Employees 01:00:00 Module Eleven - Terminating Employees 01:00:00 Module Twelve - Wrapping Up 00:30:00 Activities - Advanced Diploma in Human Resource Management 00:00:00 Bookkeeping & Payroll Basics Module One - Introduction 00:30:00 Module Two - Basic Terminology 01:00:00 Module Three - Basic Terminology (II) 01:00:00 Module Four - Accounting Methods 01:00:00 Module Five - Keeping Track of Your Business 01:00:00 Module Six - Understanding the Balance Sheet 01:00:00 Module Seven - Other Financial Statements 01:00:00 Module Eight - Payroll Accounting Terminology 01:00:00 Module Nine - End of Period Procedures 01:00:00 Module Ten - Financial Planning, Budgeting and Control 01:00:00 Module Eleven - Auditing 01:00:00 Module Twelve - Wrapping Up 00:30:00 Managing Payroll What Is Payroll? 00:30:00 Principles Of Payroll Systems 01:00:00 Confidentiality And Security Of Information 00:30:00 Effective Payroll Processing 01:00:00 Increasing Payroll Efficiency 01:00:00 Risk Management in Payroll 00:30:00 Time Management 00:30:00 Personnel Filing 00:30:00 When Workers Leave Employment 01:00:00 Hiring Employees 00:30:00 Paye and Payroll for Employers 01:00:00 Tell HMRC about a New Employee 01:00:00 Net And Gross Pay 00:30:00 Statutory Sick Pay 00:30:00 Minimum Wage for Different types of Work 01:00:00 Refer A Friend Refer A Friend 00:00:00 Mock Exam Mock Exam - Diploma in HR, Bookkeeping and Payroll Management Course 00:20:00 Final Exam Final Exam - Diploma in HR, Bookkeeping and Payroll Management Course 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

JavaScript Programming - JavaScript for Beginners

By Compete High

💻🚀 Ready to code? Learn JavaScript programming with Compete High! From basics to DOM manipulation, this self-paced JavaScript course is perfect for beginners & pros. Earn your certificate and boost your career! 🎓🔥

Python Machine Learning Bootcamp

By Packt

Welcome to the Bootcamp course. You will obtain a firm understanding of machine learning with this course. By doing so, you will be able to develop machine learning solutions for various challenges you might encounter and be prepared to start using machine learning at work or in technical interviews.

React JS Masterclass - Go From Zero To Job Ready

By Packt

This course offers everything you need to become a React developer, from basic to advanced concepts. The course delves deep into custom hooks, Tailwind CSS, React Router, Redux, Firebase, and React Skeleton. You will learn to build real-world apps with React (eCommerce, Movie Informer, Todolist Manager, Blog, and Word Counter).

Xero Accounting & Bookkeeping + Tax, Finance & Financial Management

By Compliance Central

***Small Businesses FEAR This Simple Financial Secret!** (Learn it with the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course!)*** Did you know that according to a recent Federation of Small Businesses report, 72% of small business owners in the UK believe strong financial management is crucial for success? The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course equips you with the theoretical knowledge and understanding to excel in this critical area. This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management comprehensive course is designed to provide a solid foundation in Xero accounting software, tax accounting principles, and financial management strategies. Throughout the course, you'll gain the theoretical knowledge needed to navigate the financial world with confidence, helping you make informed decisions for your business or future career. 3 CPD Accredited Courses Are: Course 01: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Course 02: Tax Accounting Course 03: Financial Management Learning Outcome: Going through our interactive modules of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course , you will be able to - Gain a working knowledge of Xero Accounting & Bookkeeping software. Master essential tasks like creating invoices, managing bills, and reconciling bank accounts in Xero. Understand core accounting principles like double-entry accounting and VAT returns. Develop strong financial management skills, including budgeting, analyzing financial statements, and interpreting financial data. Gain a theoretical grounding in tax accounting, including capital gains tax and import/export considerations. Confidently navigate the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management landscape. Key Highlights of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management: CPD Accredited Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Unlimited Retake Exam & 24/7 Tutor Support Easy Accessibility to the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Materials 100% Learning Satisfaction Guarantee Lifetime Access Self-paced online Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course Modules Covers to Explore Multiple Job Positions Curriculum Topics: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7e Xero Accounting & Bookkeeping + Tax, Finance & Financial Management begins with a deep dive into Xero accounting software. This course equips you with the theoretical knowledge to navigate Xero's functionalities for various bookkeeping tasks. You'll learn how to set up your Xero account, manage contacts, create invoices and bills, reconcile bank statements, and track inventory. Xero Accounting & Bookkeeping + Tax, Finance & Financial Management also covers essential bookkeeping principles like double-entry accounting and chart of accounts. Section 01: Introduction Introduction Section 02: Getting Started Introduction - Getting Started Signing up Quick Tour Initial Settings Chart of Accounts Adding a Bank Account Demo Company Tracking Categories Contacts Section 03: Invoices and Sales Introduction - Invoices and Sales Sales Screens Invoice Settings Creating an Invoice Repeating Invoices Credit Notes-03 Quotes Settings Creating Quotes Other Invoicing Tasks Sending Statements Sales Reporting Section 04: Bills and Purchases Introduction - Bills and Purchases Purchases Screens Bill Settings Creating a Bill Repeating Bills Credit Notes-04 Purchase Order Settings Purchase Orders Batch Payments Other Billing Tasks Sending Remittances Purchases Reporting Section 05: Bank Accounts Introduction - Bank Accounts Bank Accounts Screens Automatic Matching Reconciling Invoices Reconciling Bills Reconciling Spend Money Reconciling Receive Money Find and Match Bank Rules Cash Coding Remove and Redo vs Unreconcile Uploading Bank Transactions Automatic Bank Feeds Section 06: Products and Services Introduction - Products and Services Products and Services Screen Adding Services Adding Untracked Products Adding Tracked Products Section 07: Fixed Assets Introduction - Fixed Assets Fixed Assets Settings Adding Assets from Bank Transactions Adding Assets from Spend Money Adding Assets from Bills Depreciation Section 08: Payroll Introduction - Payroll Payroll Settings Adding Employees Paying Employees Payroll Filing Section 09: VAT Returns Introduction - VAT Returns VAT Settings VAT Returns - Manual Filing VAT Returns - Digital Filing Free Course 01: Tax Accounting Xero Accounting & Bookkeeping + Tax, Finance & Financial Management delves into the world of tax accounting. This course provides a theoretical understanding of tax principles, regulations, and calculations relevant to businesses. You'll explore topics like income tax, corporation tax, value added tax (VAT), and payroll taxes. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management equips you with the knowledge to identify tax implications for business transactions and ensure compliance with tax authorities. Module 01: Capital Gain Tax Module 02: Import and Export Module 03: Double Entry Accounting Module 04: Management Accounting and Financial Analysis Module 05: Career as a Tax Accountant in the UK Free Course 02: Financial Management Xero Accounting & Bookkeeping + Tax, Finance & Financial Management concludes with a focus on financial management. This course explores the theoretical underpinnings of financial decision-making. You'll learn how to create financial statements, analyze financial data, develop budgets and forecasts, and manage cash flow effectively. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management empowers you to make informed financial decisions that contribute to the overall success of a business. Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management Each topic has been designed to deliver more information in a shorter amount of time. This makes it simple for the learners to understand the fundamental idea and apply it to diverse situations through Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Certification Free CPD Accredited (CPD QS) Certificate. Quality Licence Scheme Endorsed Certificate of Achievement: Upon successful completion of the course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £129 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Disclaimer This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Besides, this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course particularly recommended for- Anyone interested in learning Xero can progress from a beginner to a knowledgeable user in just one day. Small business owners that want to handle their own accounting in Xero Xero Practice Manager Bookkeepers who wish to learn Xero rapidly Requirements Students seeking to enrol for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course should meet the following requirements; Basic knowledge of English Language is needed for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course, which already you have. Basic Knowledge of Information & Communication Technologies for studying Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course in online or digital platform. Stable Internet or Data connection in your learning devices to complete the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course easily. Career path The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will enable you to explore in Xero related trendy and demanding jobs, such as: Bookkeeping Specialist Client Experience Specialist Accounting Advisory Apprentice Cloud Accountant Education Specialist Management Accountant Finance Manager Tax Implementation Specialist Xero Practice Manager Certificates CPD QS Certificate of completion Digital certificate - Included After successfully completing this course, you can get CPD accredited digital PDF certificate for free.

Introduction to GITHub for Developers (TTDV7551)

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for This class assumes some prior experience with Git, plus basic coding or programming knowledge. Overview This course is approximately 50% hands-on, combining expert lecture, real-world demonstrations and group discussions with machine-based practical labs and exercises. Our engaging instructors and mentors are highly experienced practitioners who bring years of current 'on-the-job' experience into every classroom. Working in a hands-on learning environment led by our expert team, students will explore: Getting Started with Collaboration Understanding the GitHub Flow Branching with Git Local Git Configuration Working Locally with Git Collaborating on Your Code Merging Pull Requests Viewing Local Project History Streaming Your Workflow with Aliases Workflow Review Project: GitHub Games Resolving Merge Conflicts Working with Multiple Conflicts Searching for Events in Your Code Reverting Commits Helpful Git Commands Viewing Local Changes Creating a New Local Repository Fixing Commit Mistakes Rewriting History with Git Reset Merge Strategies: Rebase This is a fast-paced hands-on course that provides you with a solid overview of Git and GitHub, the web-based version control repository hosting service. While the examples in this class are related to computer code, GitHub can be used for other content. It offers the complete distributed version control and source code management (SCM) functionality of Git as well as adding its own features. It provides access control and several collaboration features such as bug tracking, feature requests, task management, and wikis for every project. Getting Started with The GitHub Ecosystem What is Git? Exploring a GitHub Repository Using GitHub Issues Activity: Creating A GitHub Issue Using Markdown Understanding the GitHub Flow The Essential GitHub Workflow Branching with Git Branching Defined Activity: Creating a Branch with GitHub Introduction Class Diagram Interaction Diagrams Sequence Diagrams Communication Diagrams State Machine Diagrams Activity Diagram Implementation Diagrams Local Git Configuration Checking your Git version Git Configuration Levels Viewing your configurations Configuring your username and email Configuring autocrif Working Locally with Git Creating a Local copy of the repo Our favorite Git command: git status Using Branches locally Switching branches Activity: Creating a New File The Two Stage Commit Collaborating on Your Code Collaboration Pushing your changes to GitHub Activity: Creating a Pull Request Exploring a Pull Request Activity: Code Review Merging Pull Requests Merge Explained Merging Your Pull Request Updating Your Local Repository Cleaning Up the Unneeded Branches Viewing Local Project History Using Git Log Streaming Your Workflow with Aliases Creating Custom Aliases Workflow Review Project: GitHub Games User Accounts vs. Organization Accounts Introduction to GitHub Pages What is a Fork? Creating a Fork Workflow Review: Updating the README.md Resolving Merge Conflicts Local Merge Conflicts Working with Multiple Conflicts Remote Merge Conflicts Exploring Searching for Events in Your Code What is GitHub? What is Git bisect? Finding the bug in your project Reverting Commits How Commits are made Safe operations Reverting Commits Helpful Git Commands Moving and Renaming Files with Git Staging Hunks of Changes Viewing Local Changes Comparing changes with the Repository Creating a New Local Repository Initializing a new local repository Fixing Commit Mistakes Revising your last commit Rewriting History with Git Reset Understanding reset Reset Modes Reset Soft Reset Mixed Reset Hard Does gone really mean gone? Getting it Back You just want that one commit Oops, I didn?t mean to reset Merge Strategies: Rebase About Git rebase Understanding Git Merge Strategies Creating a Linear History Additional course details: Nexus Humans Introduction to GITHub for Developers (TTDV7551) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Introduction to GITHub for Developers (TTDV7551) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Quickbooks and Xero Accounting Course

By iStudy UK

Overview Strengthen your expertise in Quickbooks and Xero accounting software by taking this Quickbooks and Xero Accounting Course. In this course, you'll learn how to utilise these programs to their full potential. The Quickbooks and Xero Accounting Course will explain the features of the two software in great detail. It will educate you about the system requirements for Quickbooks and Xero. You will learn how to use the software for creating invoices, charts, spreadsheets and business reports. You will be able to manage your expenses, purchases, and sales in one spot and make faster payroll calculations. Learning Outcomes Deepen your understanding of QuickBooks and Xero Understand what is a nominal ledger account Learn how to categorise customers in QuickBooks Be able to make your documents stand out in the crowd Have the skills to track your income and expenses Why You Should Choose Quickbooks and Xero Accounting Course Lifetime access to the course No hidden fees or exam charges CPD Qualification Standards certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment, and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential Who is this Course for? The Quickbooks and Xero Accounting Course is for anyone interested in increasing their QuickBooks and Xero proficiency. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Quickbooks and Xero Accounting Course is fully compatible with any kind of device. Whether you are using a Windows computer, Mac, smartphone or tablet, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any limitation. Career Path This course will provide you with the necessary knowledge and skills required to succeed in this sector. You will be ready to enter the relevant job market after completing this course. On top of that, the course will enhance your ability to earn an average salary of £52,500 annually. Quickbooks Getting prepared - access the software and course materials The structure of the course - first things first! FREE 00:05:00 Set up free trial FREE 00:03:00 Getting started Starting A New Company File 00:11:00 Setting up the system set up nominal accounts 00:11:00 Enter opening balances 00:02:00 Reverse opening balances - accruals and prepayments 00:05:00 report journal 00:05:00 Nominal ledger amend the nominal ledger 00:07:00 Report listing the nominal ledgers 00:02:00 Customers Enter customers 00:09:00 Report on customer contact information 00:01:00 Suppliers enter suppliers 00:05:00 supplier contact list 00:02:00 Sales ledger Enter invoices 00:09:00 Invoice entering 00:03:00 Invoice batch 00:06:00 Post Sales Credit Notes 00:08:00 Report showing Customer Activity 00:03:00 Aged Debtors 00:02:00 Purchases ledger Post Supplier Invoices 00:03:00 Entering a batch of supplier bills 00:09:00 Credit Notes Suppliers 00:05:00 Reclassify supplier bills - flash bulbs purchased 00:04:00 Supplier Account Activity Report 00:04:00 Sundry payments Post Cheques 00:07:00 Report showing supplier payments 00:01:00 Sundry receipts Receipts from customers 00:07:00 Report showing customer receipts 00:02:00 Petty cash Post Petty Cash Transactions and Report 00:04:00 Post cash payments to ledgers 00:02:00 Enter petty cash items 00:14:00 Report on Petty Cash Payments Proper 00:05:00 Post Sundry Payments 00:05:00 Report Bank Payments 00:03:00 VAT - Value Added Tax VAT Return 00:03:00 Bank reconciliation Reconcile The Bank 00:10:00 Provide A Report Showing Any Unreconciled Transaction 00:02:00 Payroll / Wages Post the Wages Journal 00:08:00 Posting Journal Adjustments 00:02:00 Reports Month end adjustments 00:03:00 Month end reports 00:06:00 Tasks Task- Crearing the accounts 00:06:00 Task - Customer report 00:01:00 Additional Resources Course Paper 00:00:00 Further Reading - QuickBooks Online 2014 The Handbook 00:00:00 Xero Accounting Introduction Introduction FREE 00:02:00 Getting Started Introduction - Getting Started FREE 00:01:00 Signing up to Xero 00:04:00 Quick Tour of Xero 00:12:00 Initial Xero Settings 00:13:00 Chart of Accounts 00:14:00 Adding a Bank Account 00:08:00 Demo Company 00:04:00 Tracking Categories 00:06:00 Contacts 00:12:00 Invoices and Sales Introduction - Invoices and Sales 00:01:00 Sales Screens 00:04:00 Invoice Settings 00:13:00 Creating an Invoice 00:18:00 Repeating Invoices 00:07:00 Credit Notes 00:06:00 Quotes Settings 00:03:00 Creating Quotes 00:07:00 Other Invoicing Tasks 00:03:00 Sending Statements 00:03:00 Sales Reporting 00:05:00 Bills and Purchases Introduction - Bills and Purchases 00:01:00 Purchases Screens 00:04:00 Bill Settings 00:02:00 Creating a Bill 00:13:00 Repeating Bills 00:05:00 Credit Notes 00:06:00 Purchase Order Settings 00:02:00 Purchase Orders 00:08:00 Batch Payments 00:13:00 Other Billing Tasks 00:02:00 Sending Remittances 00:03:00 Purchases Reporting 00:05:00 Bank Accounts Introduction - Bank Accounts 00:01:00 Bank Accounts Screens 00:07:00 Automatic Matching 00:04:00 Reconciling Invoices 00:06:00 Reconciling Bills 00:03:00 Reconciling Spend Money 00:05:00 Reconciling Receive Money 00:04:00 Find and Match 00:04:00 Bank Rules 00:09:00 Cash Coding 00:03:00 Remove and Redo vs Unreconcile 00:04:00 Uploading Bank Transactions 00:07:00 Automatic Bank Feeds 00:06:00 Products and Services Introduction - Products and Services 00:01:00 Products and Services Screen 00:02:00 Adding Services 00:03:00 Adding Untracked Products 00:03:00 Adding Tracked Products 00:07:00 Fixed Assets Introduction - Fixed Assets 00:01:00 Fixed Assets Settings 00:06:00 Adding Assets from Bank Transactions 00:06:00 Adding Assets from Spend Money 00:05:00 Adding Assets from Bills 00:02:00 Depreciation 00:04:00 Payroll Introduction - Payroll 00:01:00 Payroll Settings 00:15:00 Adding Employees 00:18:00 Paying Employees 00:10:00 Payroll Filing 00:04:00 VAT Returns Introduction - VAT Returns 00:01:00 VAT Settings 00:02:00 VAT Returns - Manual Filing 00:06:00 VAT Returns - Digital Filing 00:02:00

Advanced REST APIs with Flask and Python

By Packt

Take your REST APIs to a whole new level with this advanced Flask and Python course!

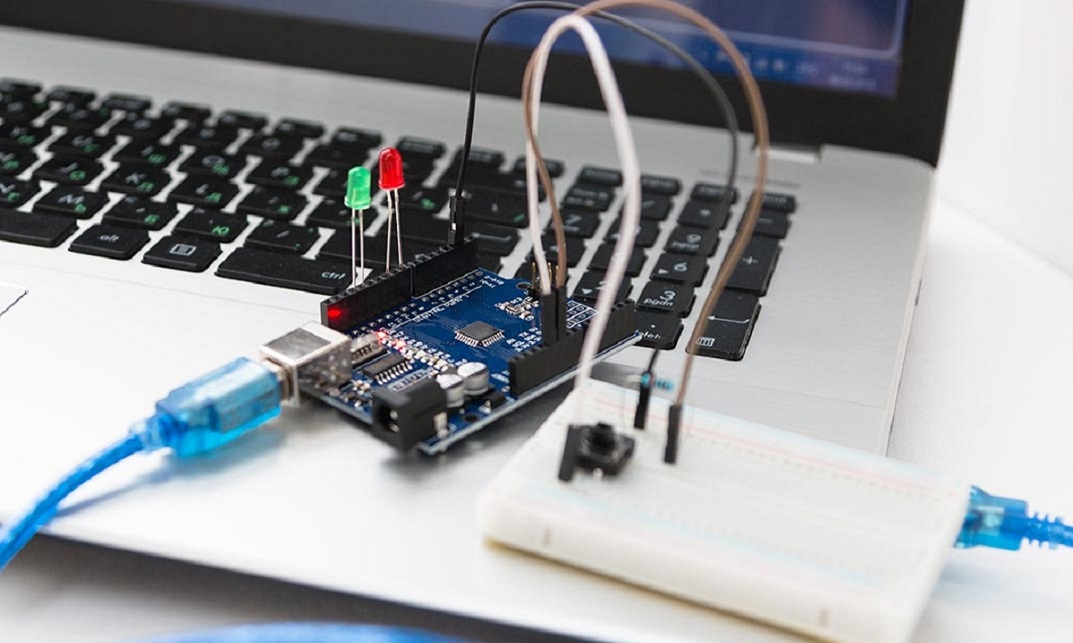

Register on the Advanced Arduino for Embedded Systems today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Advanced Arduino for Embedded Systems is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Advanced Arduino for Embedded Systems Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Advanced Arduino for Embedded Systems, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Unit 01: Introduction Module 01: Introduction 00:02:00 Unit 02: Introduction to Embedded System Module 01: Embedded System Lecture-1 00:09:00 Module 02: Embedded System Lecture-2 00:07:00 Module 03: Embedded System Lecture-3 00:07:00 Module 04: Embedded System Lecture-4 00:07:00 Module 05: Embedded System Lecture-5 Part 01 00:05:00 Module 06: Embedded System Lecture-5 Part 02 00:01:00 Unit 03: Introduction to Arduino Board Module 01: Introduction to Arduino Lecture 1 00:06:00 Module 02: Arduino LED Program Lecture 2 00:10:00 Module 03: Arduino Simulation Lecture 3 00:06:00 Unit 04: Difference between C Syntax of Arduino and C Coding Module 01: Arduino Vs C Differences 00:10:00 Module 02: C vs Arduino Differences 00:10:00 Unit 05: Breadboard Module 01: Breadboard 00:08:00 Unit 06: LED Interfacing Module 01: LED Chapter 1 00:08:00 Module 02: LED Chapter 2 00:06:00 Module 03: LED Chapter 3 00:01:00 Module 04: LED Chapter 4 00:05:00 Unit 07: Buzzer Module 01: Buzzer Chapter 1 00:04:00 Module 02: Buzzer Chapter 2 00:05:00 Unit 08: Switch Interfacing Module 01: Switch Interfacing Chapter-1 00:07:00 Module 02: Switch Interfacing Chapter-2 00:04:00 Module 03: Switch Interfacing Chapter-3 00:04:00 Module 04: Switch Interfacing Chapter-4 00:04:00 Unit 09: Serial Port Module 01: Serial Chapter 1 00:07:00 Module 02: Serial Chapter 2 00:04:00 Module 03: Serial Chapter 3 00:08:00 Module 04: Serial Chapter 4 00:07:00 Module 05: Serial Chapter 5 00:03:00 Module 06: Serial Chapter 6 00:08:00 Unit 10: LCD Interfacing Module 01: LCD Chapter 1 00:11:00 Module 02: LCD Chapter 2 00:08:00 Unit 11: Keypad Module 01: Concepts around keypad 00:10:00 Unit 12: Analog Input Module 01: Analog to Digital Converter Chapter 1 00:09:00 Module 02: Analog to Digital Converter Chapter 2 00:03:00 Module 03: Analog to Digital Converter Chapter 3 00:08:00 Module 04: Analog to Digital Converter Chapter 4 00:03:00 Module 05: Analog to Digital Converter Chapter 5 00:04:00 Unit 13: LDR Module 01: LDR Chapter 1 00:05:00 Module 02: LDR Chapter 2 00:02:00 Unit 14: Ultrasonic Distance Sensing Module 01: Ultrasonic Chapter 1 00:07:00 Module 02: Ultrasonic Chapter 2 00:08:00 Unit 15: DHT Sensor Module 01: DHDT Chapter 1 00:10:00 Unit 16: Relay Interfacing Module 01: Relay Interfacing Chapter 1 00:07:00 Module 02: Relay Interfacing Chapter 2 00:06:00 Module 03: Relay Interfacing Chapter 3 00:09:00 Unit 17: EEPROM Module 01: EEPROM 00:08:00 Unit 18: DC Motor Interfacing Module 01: DC Motor Interfacing Chapter 1 00:10:00 Module 02: DC Motor Interfacing Chapter 2 00:07:00 Unit 19: Servo Motor Interfacing Module 01: Servo Chapter 1 00:10:00 Module 02: Servo Chapter 2 00:09:00 Unit 20: PWM Module 01: PWM Chapter 1 00:06:00 Module 02: PWM Chapter 2 00:07:00 Module 03: PWM Chapter 3 00:04:00 Unit 21: I2C Module 01: I2C Chapter 1 00:10:00 Module 02: I2C Chapter 2 00:01:00 Module 03: I2C Chapter 3 00:04:00 Module 04: I2C Chapter 4 00:05:00 Unit 22: RTC Module 01: RTC Chapter 1 00:07:00 Module 02: RTC Chapter 2 00:10:00 Module 03: RTC Chapter 3 00:05:00 Module 04: RTC Chapter 4 00:10:00 Unit 23: SD Card Module 01: SD Chapter 1 00:06:00 Module 02: SD Chapter 2 00:07:00 Unit 24: Resources Module 01: File Download 00:00:00 Unit 25: Conclusion Module 01: Conclusion 00:01:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Advanced Arduino for Embedded Systems Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Advanced Arduino for Embedded Systems Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Advanced Arduino for Embedded Systems Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Advanced Arduino for Embedded Systems Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Advanced Arduino for Embedded Systems? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Advanced Arduino for Embedded Systems there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Advanced Arduino for Embedded Systems course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Advanced Arduino for Embedded Systems does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Advanced Arduino for Embedded Systems was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Advanced Arduino for Embedded Systems is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Unit 01: Introduction Module 01: Introduction 00:02:00 Unit 02: Introduction to Embedded System Module 01: Embedded System Lecture-1 00:09:00 Module 02: Embedded System Lecture-2 00:07:00 Module 03: Embedded System Lecture-3 00:07:00 Module 04: Embedded System Lecture-4 00:07:00 Module 05: Embedded System Lecture-5 Part 01 00:05:00 Module 06: Embedded System Lecture-5 Part 02 00:01:00 Unit 03: Introduction to Arduino Board Module 01: Introduction to Arduino Lecture 1 00:06:00 Module 02: Arduino LED Program Lecture 2 00:10:00 Module 03: Arduino Simulation Lecture 3 00:06:00 Unit 04: Difference between C Syntax of Arduino and C Coding Module 01: Arduino Vs C Differences 00:10:00 Module 02: C vs Arduino Differences 00:10:00 Unit 05: Breadboard Module 01: Breadboard 00:08:00 Unit 06: LED Interfacing Module 01: LED Chapter 1 00:08:00 Module 02: LED Chapter 2 00:06:00 Module 03: LED Chapter 3 00:01:00 Module 04: LED Chapter 4 00:05:00 Unit 07: Buzzer Module 01: Buzzer Chapter 1 00:04:00 Module 02: Buzzer Chapter 2 00:05:00 Unit 08: Switch Interfacing Module 01: Switch Interfacing Chapter-1 00:07:00 Module 02: Switch Interfacing Chapter-2 00:04:00 Module 03: Switch Interfacing Chapter-3 00:04:00 Module 04: Switch Interfacing Chapter-4 00:04:00 Unit 09: Serial Port Module 01: Serial Chapter 1 00:07:00 Module 02: Serial Chapter 2 00:04:00 Module 03: Serial Chapter 3 00:08:00 Module 04: Serial Chapter 4 00:07:00 Module 05: Serial Chapter 5 00:03:00 Module 06: Serial Chapter 6 00:08:00 Unit 10: LCD Interfacing Module 01: LCD Chapter 1 00:11:00 Module 02: LCD Chapter 2 00:08:00 Unit 11: Keypad Module 01: Concepts around keypad 00:10:00 Unit 12: Analog Input Module 01: Analog to Digital Converter Chapter 1 00:09:00 Module 02: Analog to Digital Converter Chapter 2 00:03:00 Module 03: Analog to Digital Converter Chapter 3 00:08:00 Module 04: Analog to Digital Converter Chapter 4 00:03:00 Module 05: Analog to Digital Converter Chapter 5 00:04:00 Unit 13: LDR Module 01: LDR Chapter 1 00:05:00 Module 02: LDR Chapter 2 00:02:00 Unit 14: Ultrasonic Distance Sensing Module 01: Ultrasonic Chapter 1 00:07:00 Module 02: Ultrasonic Chapter 2 00:08:00 Unit 15: DHT Sensor Module 01: DHDT Chapter 1 00:10:00 Unit 16: Relay Interfacing Module 01: Relay Interfacing Chapter 1 00:07:00 Module 02: Relay Interfacing Chapter 2 00:06:00 Module 03: Relay Interfacing Chapter 3 00:09:00 Unit 17: EEPROM Module 01: EEPROM 00:08:00 Unit 18: DC Motor Interfacing Module 01: EEPROM 00:08:00 Module 02: DC Motor Interfacing Chapter 2 00:07:00 Unit 19: Servo Motor Interfacing Module 01: Servo Chapter 1 00:10:00 Module 02: Servo Chapter 2 00:09:00 Unit 20: PWM Module 01: PWM Chapter 1 00:06:00 Module 02: PWM Chapter 2 00:07:00 Module 03: PWM Chapter 3 00:04:00 Unit 21: I2C Module 01: I2C Chapter 1 00:10:00 Module 02: I2C Chapter 2 00:01:00 Module 03: I2C Chapter 3 00:04:00 Module 04: I2C Chapter 4 00:05:00 Unit 22: RTC Module 01: RTC Chapter 1 00:07:00 Module 02: RTC Chapter 2 00:10:00 Module 03: RTC Chapter 3 00:05:00 Module 04: RTC Chapter 4 00:10:00 Unit 23: SD Card Module 01: SD Chapter 1 00:06:00 Module 02: SD Chapter 2 00:07:00 Unit 24: Resources Module 01: File Download 00:00:00 Unit 25: Conclusion Module 01: Conclusion 00:01:00 Assignment Assignment - Advanced Arduino for Embedded Systems 00:00:00