- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Grounding, Clearing and Protecting

By Neil Christey - The Holistic College

Syllabus: Holistic Protection and Energetic Practices Course Overview This course introduces essential spiritual practices for grounding, protection, and clearing. These skills create a foundation for personal and energetic stability, enhancing focus, clarity, and resilience. Through visualisation, meditation, and energy exercises, students will develop a profound understanding of grounding techniques, protective boundaries, and clearing practices. Module 1: Grounding - Core Techniques: Visualise roots or boulders for grounding; use the tree visualisation for strength. - Daily Application: Practical tips for staying present and connected. - Reflection: Journaling prompts to track emotional and physical responses. Module 2: Protection - Creating Boundaries: Use protective visualisations like light shields and cloaks. - Protective Tools: Elemental circles, crystals (e.g., black tourmaline), and symbols (Ankh, Eye of Horus). - Invocation Practices: Call upon Archangels and guides for energetic support. - Reflection: Journaling to observe the effects of protection techniques. Module 3: Clearing - Clearing Practices: Techniques for personal and environmental energy clearing. - Crystal Grids: Setup for maintaining energetic cleanliness. - Advanced Visualisations: Use the violet flame for thorough cleansing. - Reflection: Journaling on the experience of clearing exercises.

LNG Markets, Pricing, Trading & Risk Management

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course The LNG market is developing from a fully based market on long-term contracts, to a more flexible market based on a portfolio of contracts of different durations. The increase of LNG demand, fuelled by South Korea, Japan and several other emerging economies, are creating a base for a more flexible market, where the LNG spot market will be playing a key role. Changes in the LNG market can be identified in the following areas: development of terminals and plant sizes, increased integration throughout the supply chain, diversification of supply sources, increased contractual flexibility and increased geographical distance. This is creating the foundation for the development of the LNG spot market right here in Asia today. This 3 full-day intensive intermediate level course will give you cutting-edge knowledge needed in today's complex LNG market. Increase your knowledge and understanding of the LNG market and spot trading aspects by attending this course. Training Objectives By the end of this course, participants will be able to: Leverage on the current and global drivers of the world Natural gas and LNG markets Understand regional LNG pricing effects and who the key buyers and new sellers are Appreciate the trading structures of LNG and how to structure its risk management Understand the workings and future outlook of the Asian LNG Spot market Discover and exploit the arbitrage trading opportunities between the different markets Learn what LNG derivatives are and how it will become available for hedging and proprietary trading purposes Target Audience This course will benefit: LNG market development executives are drawn from both technical and non-technical (commercial, finance and legal) backgrounds. Participants in an LNG market development team, perhaps with expertise in one area of gas development, will benefit from the course by obtaining a good grounding of all other areas. The course is pitched at an intermediate level, although those with a basic knowledge will be able to grasp most of the concepts covered. Course Level Intermediate Trainer Your course leader is a skilled and accomplished professional with over 25 years of extensive C-level experience in the energy markets worldwide. He has strong expertise in all the aspects of (energy) commodity markets, international sales, marketing of services, derivatives trading, staff training and risk management within dynamic and high-pressure environments. He received a Master's degree in Law from the University of Utrecht in 1987. He started his career at the NLKKAS, the Clearing House of the Commodity Futures Exchange in Amsterdam. After working for the NLKKAS for five years, he was appointed as Member of the Management Board of the Agricultural Futures Exchange (ATA) in Amsterdam at the age of 31. While working for the Clearing House and exchange, he became an expert in all the aspects of trading and risk management of commodities. In 1997, he founded his own specialist-consulting firm that provides strategic advice about (energy) commodity markets, trading and risk management. He has advised government agencies such as the European Commission, investment banks, major utilities, and commodity trading companies and various energy exchanges and market places in Europe, CEE countries, North America and Asia. Some of the issues he has advised on are the development and implementation of a Risk Management Framework, investment strategies, trading and hedging strategies, initiation of Power Exchanges (APX) and other trading platforms, the set-up of (OTC) Clearing facilities, and feasibility and market studies like for the Oil, LNG and the Carbon Market. The latest additions are (Corporate) PPAs and Artificial Intelligence for energy firms. He has given numerous seminars, workshops and (in-house) training sessions about both the physical and financial trading and risk management of commodity and carbon products. The courses have been given to companies all over the world, in countries like Japan, Singapore, Thailand, United Kingdom, Germany, Poland, Slovenia, Czech Republic, Malaysia, China, India, Belgium and the Netherlands. He has published several articles in specialist magazines such as Commodities Now and Energy Risk and he is the co-author of a book called A Guide to Emissions Trading: Risk Management and Business Implications published by Risk Books in 2004. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Best Practices Procurement for Carbon Offsets in the Energy Industry

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course More energy companies today are setting ambitious net-zero targets and are expected to pour billions into the voluntary carbon offset market by the end of this decade. To get to net zero emissions, companies will need to balance emissions with nature and technology-based offsets. Markets are the best tool for connecting carbon sources and sinks. Many countries will not have enough supply inside their borders and will need to co-operate with those who have extra greenhouse gas removal potential. The energy industry is in search of effective climate tools as pressure mounts from investors and consumers for more progress on fighting rising emissions. Corporations fighting to cut their carbon footprint have for years focused on internal reduction measures. Many are now adding to that effort by turning to carbon credits, a process made easier as verification and registration tools mature. One particular category of carbon offsets leads the way: high-quality, nature-based carbon credits. These represent the largest category of carbon credit projects in the voluntary carbon market, comprising nearly half of credits issued. Public concern about this practice focused on the additionality, leakage, and integrity of carbon offsets that are created through reforestation, land preservation, carbon capture and other projects. Lack of standardization and government regulation has also increased uncertainty for all participants in carbon markets, creating risks for developers of credit-generating projects and offset purchasers. Demand for higher-quality offsets will value projects that were subjected to due diligence and rely upon reputable third-party verification. Companies purchasing offsets generated by permanent and quantifiable projects will therefore be in the best position moving forward. In this highly interactive training course, your course instructor will guide you through the latest developments and best procurement practices to successfully operate in the voluntary carbon market. Training Objectives At the end of this course, the participants will be able to: Discover the current state of the carbon economy Gain insights into the voluntary carbon market Learn about the different type carbon credits available Examine how companies can reach net zero target by using carbon offsets Uncover best practices in carbon credit procurement strategy Learn the pricing dynamics carbon credits Examine how to identify and ensure high quality credits Obtain key learning from flawed carbon offset projects Target Audience This course is intended for: Energy transition team leaders Carbon credit procurement professionals ESG strategy team leaders Finance and accounting professionals Low carbon business analysts or economists Corporate business sustainability professionals Legal, compliance and regulatory professionals Carbon trading professionals Course Level Intermediate Trainer Your expert course leader is a skilled and accomplished professional with over 25 years of extensive C-level experience in the energy markets worldwide. He has a strong expertise in all the aspects of (energy) commodity markets, international sales, marketing of services, derivatives trading, staff training and risk management within dynamic and high-pressure environments. He received a Master's degree in Law from the University of Utrecht in 1987. He started his career at the NLKKAS, the Clearing House of the Commodity Futures Exchange in Amsterdam. After working for the NLKKAS for five years, he was appointed as Member of the Management Board of the Agricultural Futures Exchange (ATA) in Amsterdam at the age of 31. While working for the Clearing House and exchange, he became an expert in all the aspects of trading and risk management of commodities. In 1997, he founded his own specialist-consulting firm that provides strategic advice about (energy) commodity markets, trading and risk management. He has advised government agencies such as the European Commission, investment banks, major utilities and commodity trading companies and various energy exchanges and market places in Europe, CEE countries, North America and Asia. Some of the issues he has advised on are the development and implementation of a Risk Management Framework, investment strategies, trading and hedging strategies, initiation of Power Exchanges (APX) and other trading platforms, the set-up of (OTC) Clearing facilities, and feasibility and market studies like for the Oil, LNG and the Carbon Market. The latest additions are (Corporate) PPAs and Artificial Intelligence for energy firms. He has given numerous seminars, workshops and (in-house) training sessions about both the physical and financial trading and risk management of commodity and carbon products. The courses have been given to companies all over the world, in countries like Japan, Singapore, Thailand, United Kingdom, Germany, Poland, Slovenia, Czech Republic, Malaysia, China, India, Belgium and the Netherlands. He has published several articles in specialist magazines such as Commodities Now and Energy Risk and he is the co-author of a book called A Guide to Emissions Trading: Risk Management and Business Implications published by Risk Books in 2004. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

S4F12 SAP Basics of Customizing for Financial Accounting: GL, AP, AR in SAP S/4HANA

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Application Consultant Business Process Owner / Team Lead / Power User Overview This course will prepare you to: Provide an overview of basic customizing settings in the main components of Financial Accounting with SAP S/4HANA Configure the Master Data Settings (G/L Accounts, Customer and Vendor Accounts) of Financial Accounting with SAP S/4HANA Configure the Document Control and Posting Control Settings of Financial Accounting with SAP S/4HANA Configure the Settings for Financial Document Clearing of Financial Accounting with SAP S/4HANA The course provides an overview of how to implement Financial Accounting capabilities of SAP S/4HANA in order to cover the related business requirements. You will gain the mandatory foundation knowledge required in order to understand and configure business processes for the SAP S/4HANA financials module in the areas of general ledger, accounts payable, and accounts receivable accounting. For the Master Data, the Document Control/Posting Control and Financial Document Clearing you will practice some configurations and verify the result by using the application. Course Outline Short Overview of SAP S/4HANA Core Financial Accounting (FI) Configuration Managing Organizational Units in Financial Accounting (FI) Checking the Basic Settings in New General Ledger (G/L) Accounting Outlining the Variant Principle Managing Fiscal Year Variants Master Data Maintaining General Ledger (G/L) Accounts Managing Customer and Vendor Accounts Document Control Configuring the Header and Line Items of Financial Accounting (FI) Documents Managing Posting Periods Managing Posting Authorizations Posting Control Analyzing Document Splitting Maintaining Default Values Configuring Change Control Configuring Document Reversal Configuring Payment Terms and Cash Discounts Maintaining Taxes and Tax Codes Posting Cross-Company Code Transactions Financial Document Clearing Performing Open Item Clearing Managing Payment Differences Additional course details: Nexus Humans S4F12 SAP Basics of Customizing for Financial Accounting: GL, AP, AR in SAP S/4HANA training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the S4F12 SAP Basics of Customizing for Financial Accounting: GL, AP, AR in SAP S/4HANA course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

WCNA training course description Wireshark is a free network protocol analyser. This hands-on course provides a comprehensive tour of using Wireshark to troubleshoot networks. The course concentrates on the information needed in order to pass the WCNA exam. Students will gain the most from this course only if they already have a sound knowledge of the TCP/IP protocols. What will you learn Analyse packets and protocols in detail. Troubleshoot networks using Wireshark. Find performance problems using Wireshark. Perform network forensics. WCNA training course details Who will benefit: Technical staff looking after networks. Prerequisites: TCP/IP Foundation for engineers Duration 5 days WCNA training course contents What is Wireshark? Network analysis, troubleshooting, network traffic flows. Hands on Download/install Wireshark. Wireshark introduction Capturing packets, libpcap, winpcap, airpcap. Dissectors and plugins. The menus. Right click. Hands on Using Wireshark. Capturing traffic Wireshark and switches and routers. Remote traffic capture. Hands on Capturing packets. Capture filters Applying, identifiers, qualifiers, protocols, addresses, byte values. File sets, ring buffers. Hands on Capture filters. Preferences Configuration folders. Global and personal configurations. Capture preferences, name resolution, protocol settings. Colouring traffic. Profiles. Hands on Customising Wireshark. Time Packet time, timestamps, packet arrival times, delays, traffic rates, packets sizes, overall bytes. Hands on Measuring high latency. Trace file statistics Protocols and applications, conversations, packet lengths, destinations, protocol usages, strams, flows. Hands on Wireshark statistics. Display filters Applying, clearing, expressions, right click, conversations, endpoints, protocols, combining filters, specific bytes, regex filters. Hands on Display traffic. Streams Traffic reassembly, UDP and TCP conversations, SSL. Hands on Recreating streams. Saving Filtered, marked and ranges. Hands on Export. TCP/IP Analysis The expert system. DNS, ARP, IPv4, IPv6, ICMP, UDP, TCP. Hands on Analysing traffic. IO rates and trends Basic graphs, Advanced IO graphs. Round Trip Time, throughput rates. Hands on Graphs. Application analysis DHCP, HTTP, FTP, SMTP. Hands on Analysing application traffic. WiFi Signal strength and interference, monitor mode and promiscuous mode. Data, management and control frames. Hands on WLAN traffic. VoIP Call flows, Jitter, packet loss. RTP, SIP. Hands on Playing back calls. Performance problems Baselining. High latency, arrival times, delta times. Hands on Identifying poor performance. Network forensics Host vs network forensics, unusual traffic patterns, detecting scans and sweeps, suspect traffic. Hands on Signatures. Command line tools Tshark, capinfos, editcap, mergecap, text2pcap, dumpcap. Hands on Command tools.

Signalling training course description An intensive course that defines and explores the signalling methods that are to be found in today's telecommunications services. What will you learn Describe the Functionality and Features of Signalling. Describe the Functionality of Analogue & Digital Subscriber Signalling. Describe the various types of signalling used on different network types. Describe the Functionality of Private Network Signalling. Describe the Functionality of Public Network Signalling. Signalling training course details Who will benefit: Personnel involved with systems design, implementation and support. Prerequisites: Telecommunications Introduction Duration 2 days Signalling training course contents Introduction What is Signalling?, Standards, ITU-T Recommendations, Signalling Categories - Supervisory Addressing, E.164, Call Information, Network Management, Network Components, Inband/Outband Switch Signalling, Analogue Vs Digital Signalling. Analogue Subscriber Signalling Analogue Local Loops/Switches/Trunks, Digital Switches/Local Loops, Telephone Handset, Accessing the Local Exchange, Pulse/Tone Dialling. Digital Subscriber Signalling Integrated Digital Access, DASS2 & DPNSS, DASS2 - Call, IMUX, Euro ISDN, Q.931 Call Control, Message Identification, Message Types, Call Establishment Messages, Call Clearing. Network Types Service Types, Circuit Switched, Packet Switched, Signalling Terminology, In-Channel Signalling, G.704, Performance and Quality, Digital Signalling, CAS, CAS Applications, Foreign Exchange, CCS, Break-In/Out Private Network Signalling Types Networking PABXs, Inter PABX Analogue Signalling Methods, E & M, Tone-On-Idle, Inter PABX Digital Signalling Methods, DPNSS, DPNSS Deployment, PABX Support for DPNSS, DPNSS Call, Q.Sig, Q.Sig support/functionality/protocol, Message Overview, Call Establishment. Public Network Signalling SS7, SS7 Operations, SS7 Topology, SSP, STP, SCP, Database Types - CMSDB NP LIDB HLR VLR, Signalling Modes, Link Types, Further Redundancy, Linksets, SS7 addressing, Point Codes, Sub-System, Global Title Addressing and Translation, ANSI PCs, ITU-T PCs, SS7 Protocol Stack, MTP Level 1, MTP Level 2, Flow Control, FISU, LSSU, MSU, MSU SIF, MTP Level 3, SCCP, TCAP, TUP, Facility Format, Main Facilities, Flow Control Negotiation, Closed User Groups, Reverse Charging, Fast Select Facility, Throughput Class Negotiation, Call Barring, On-Line Facility Registration. BTUP, ISDN ISUP, Supplementary Services, ISUP Call - IAM, Progress/Answer/Suspend/ Resume/Release Messages, Intelligent Network (IN) Introduction, IN Evolution, IN Conceptual Model, IN Target Services & Service Features, Service Independent Building Blocks

How to tackle difficult conversations

By Neupauer Ltd

Do you avoid difficult conversations? "When you avoid them you trade short term discomfort for long-term dysfunction." Is it worth it? Join our session to learn how to tackle difficult conversations

Project Risk Management: In-House Training

By IIL Europe Ltd

Project Risk Management: In-House Training Have you been surprised by unplanned events during your projects? Are you and your project team frequently fighting fires? Well, you are not alone. Uncertainty exists in any project environment. While it's impossible to predict project outcomes with 100% certainty, you can influence the outcome, avoid potential risks, and be ready to respond to challenges that arise. In this course, you'll gain the proper knowledge needed to identify, assess, plan for, and monitor risk in your projects. You'll learn how to set up and implement risk management processes, helping you to minimize uncertainty and achieve more consistent, predictable outcomes as a result. What You Will Learn You'll learn how to: Demonstrate to others how the risk management processes in A Guide to the Project Management Body of Knowledge (PMBOK® Guide) apply to your project's environment, especially for high-risk projects Adapt these processes for a particular high-risk project team's operating principles Explain the importance of using risk management best practices at single and enterprise project levels Lead an initiative to implement risk management best practices in your project environment Foundation Concepts Risk-related definitions The risk management process High-risk projects and project failures Classical failures in implementing risk management Plan Risk Management Project risk management and governance Risk management planning for high-risk projects High-risk variations on a risk management plan Identify Risk Adapting the risk identification process for high-risk projects Recognizing risks spontaneously Confirming and structuring risk events for treatment Wrapping up risk identification for high-risk projects Perform Qualitative Risk Analysis Adapting qualitative risk analysis for high-risk projects Accelerating risk analysis Clearing risk action Wrapping up qualitative risk analysis for the next level Perform Quantitative Risk Analysis Adapting quantitative risk analysis for high-risk projects Ensuring effective risk analyses with data quality assessments Building a foundation for quantitative risk analysis Using discrete quantitative tools Using continuous quantitative tools Wrapping up quantitative risk analysis for high-risk projects Plan Risk Responses Adapting risk response planning for high-risk projects Optimizing active risk response strategies Leveraging contingencies for high project performance Wrapping up risk response planning for high-risk projects Implement Risk Responses Implementing Risk Responses Process Executing Risk Response Plans Tools and Techniques Best Practices Continuous Risk Management Monitor Risks Adapting risk monitoring for high-risk projects Optimizing risk plan maintenance Weaving risk reassessment into the project's progress Maintaining a continuous 'vigil' in high-risk project environments

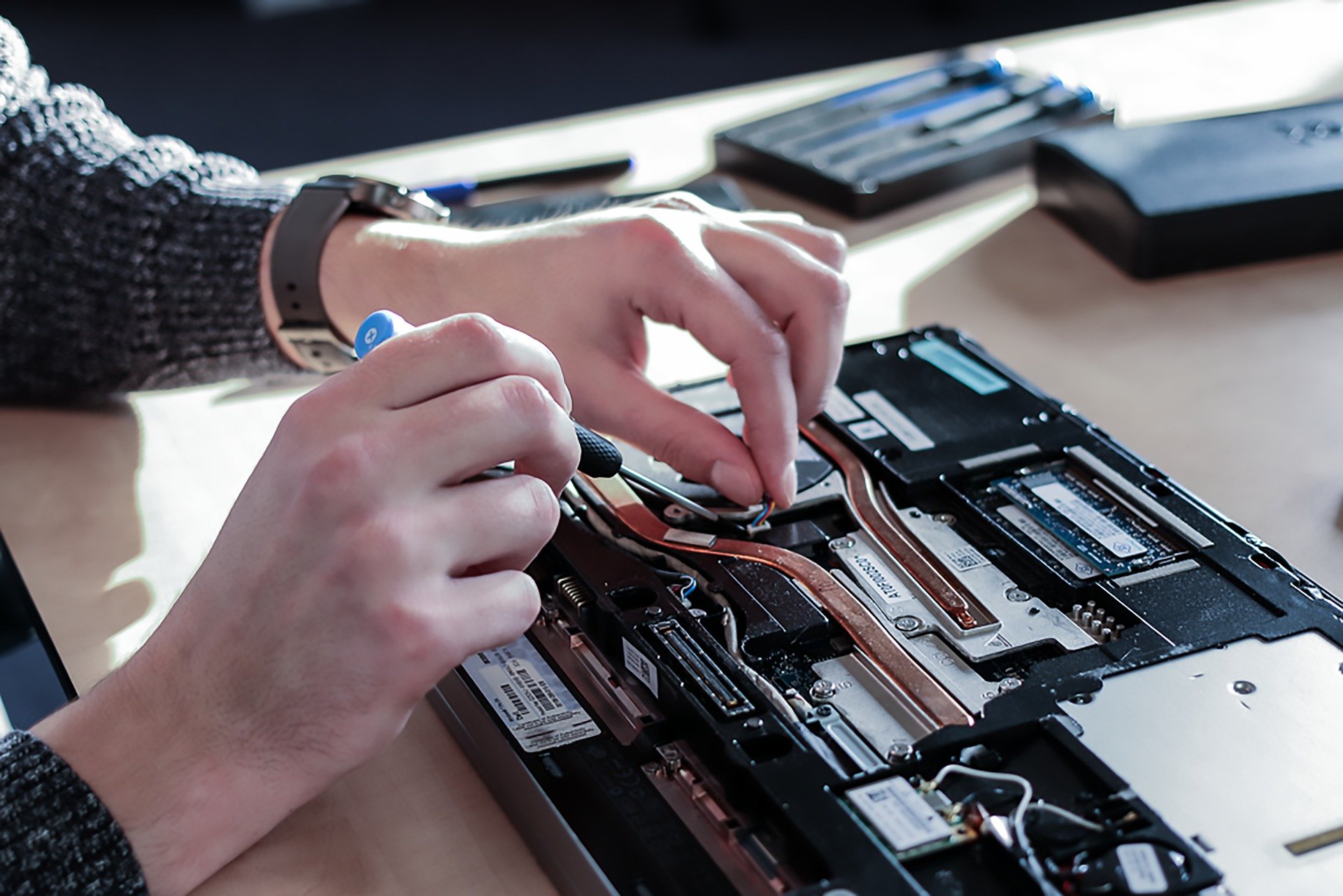

Computer Maintenance and Repair Course

By Hi-Tech Training

The Computer Maintenance & Repair Technician course aims to enable participants to diagnose and repair system level faults in computer-based systems at the foundation level.