- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

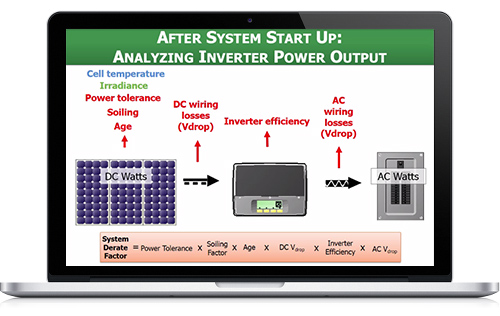

PVOL350: Solar Training - PV Systems - Tools and Techniques for Operations and Maintenance - Online

By Solar Energy International (SEI)

Discuss preventative and reactive maintenance plans and activities. Summarize safety procedures and PPE requirements for O&M technicians. Describe the field procedures required to evaluate the performance of PV systems. List appropriate requirements for meters, tools, and other equipment used in O&M activities. Define the theory, procedures, and processes behind insulation resistance testing, IV curve tracing, infrared cameras and thermal imaging, and other tools of the trade. Analyze test results to determine performance, compare baseline data, and pinpoint system issues. Describe inspection requirements for preventative maintenance inspections. Illustrate methods for locating and troubleshooting common PV array and system faults using appropriate methodologies and testing tools.

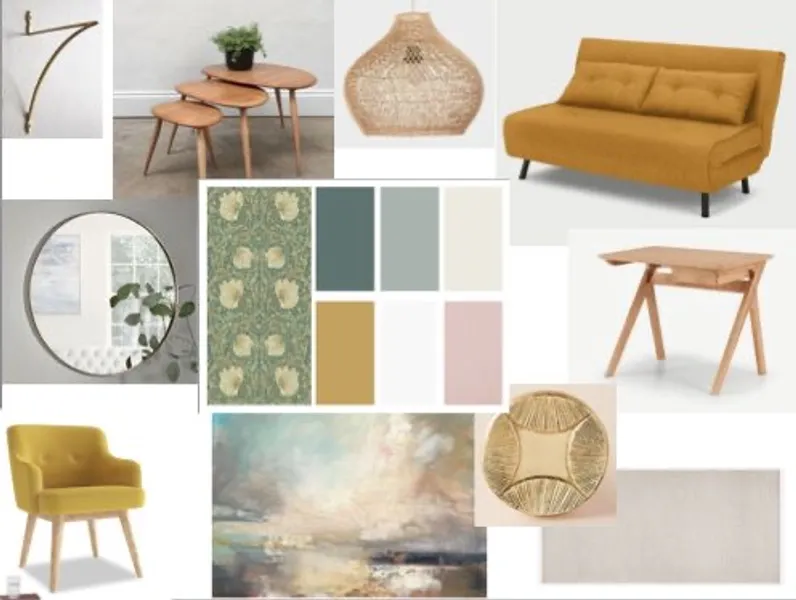

Design a room in your home with one to one consultations

By FLOCK interiors

This comprehensive online interior design course includes 12 self study modules, and weekly 1:1 telephone and or video consultations. I will personally guide and inspire you through your creative learning journey.

Estate Manager - QLS Endorsed Bundle

By Imperial Academy

10 QLS Endorsed Courses for Estate Manager | 10 QLS Endorsed Certificates Included | Life Time Access

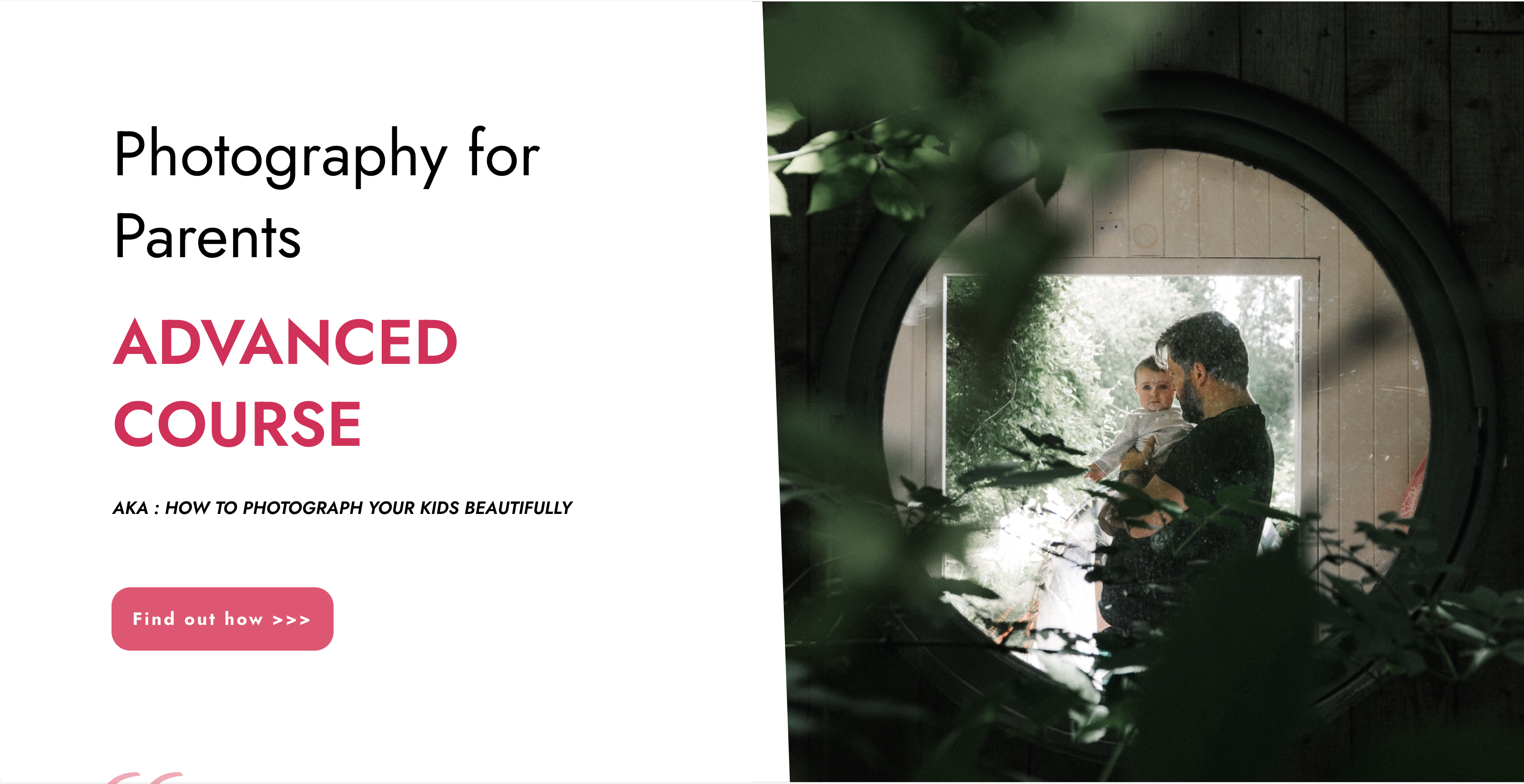

“Photography is my way of bearing witness to the joy I find in seeing the extraordinary in ordinary.” -Harold Feinstein Photography For Parents - Advanced Course Next course starts on 15th April 2024 6 week Photography course designed to help further advance your photography skill and move beyond simply capturing what's in front of you. Choose this course if you are already friends with your camera but want to learn how to shoot creatively in full manual, how to go beyond the basic composition rules and start expressing yourself through photography KEY COURSE INFO: Course type: Instructor-led or self paced Course duration: 6 weeks Course format: Online course with Interactive weekly live classes, personal photo feedback and support group WHAT YOU LEARN: In this course we build on the key photo skills we introduce in the Fundamentals Course and learn some new ones ( although completing the Fundamentals course is not a pre-requisite) You will love this course if you want to keep growing your photographic eye, truly control your camera and start making your photos reflect who you are and who your family are. This is the course where your photography really picks up the pace. We will support and challenge you to help you find your own voice in photography. creative use of manual mode creating strong compositions low light shooting capturing emotions introduction to flash using colour in photography THIS IS THE COURSE FOR YOU IF : Are already familiar with your camera - but want to get better at using it in full manual - with no overwhelm or frantic guesswork You want to take photographs that look more polished and that truly show you what you pictured in your head - still true to your kids and who they are You want to be able to capture true emotions and express yourself through photography You want to get more creative with light and colour to elevate your images and make them shine Next course starts on 15th April 2024 The bookings for this course are not open yet - request to be added to the waiting list to be offered priority booking and Early Bird prices when the course registration opens 5 core course modules Support Facebook group Weekly online Live class Personal Feedback on your images BONUS: extra module with ideas to keep your creativity flowing BONUS: PDF course workbook HERE IS WHAT YOU WILL LEARN in this course : This course was designed to help you grow your photography skills beyond just being able to take "nice looking photos". You will love this course if you want to keep growing your photographic eye, truly control your camera and start making your photos reflect who you are and who your family are. This is the course where your photography really picks up the pace. We will support and challenge you to help you find your own voice in photography. How do I get FULL control of my camera? - shooting in full manual - but with clarity and purpose When is the ‘correct’ exposure not the RIGHT one and why is my camera confused? And more importantly, how to fix it in camera? How do you capture genuine emotion and NOT just fake smiles? No more 'smile for Mummy' How to make your light AND SHADOWS work for you? and capture stunning images even if you think you have barely any light What makes a ‘strong image’ and how do I begin to get them more consistently? INSIDE THE MODULES - aka WHAT DO YOU LEARN? Module 1: Getting started in Manual mode First steps into shooting in full manual – understanding your exposure and metering, finding correct exposure for your subject, handling over and under exposure and adjusting your settings without even taking your camera away from your eyes. Major Takeaways: At the end of the module you will have gained full control of your camera - no more guessing game and unpredictable results with all the control going firmly to you. You will be able to understand your jump off points for different situations and how to adjust them to the changing light or environment Module 2: More on manual exposure and why your camera is often wrong Learning when the ‘correct’ exposure is not the “right exposure”, understanding and interpreting your histograms, learning how your environment can help you get the right exposure even in tricky light, dealing with challenging light situations. Major Takeaways: Knowing when to trust and not trust your camera's exposure assessment. Knowing exactly how to adjust things when the images don't turn out looking right out of the camera. Having a method to help you capture different colour accurately - especially when it comes to skin tones, or elements that are bright or dark Module 3: Powerful composition Learning what makes a strong image and learning to create your own, consistently, with the help of our advanced composition techniques – beyond the rule of thirds. Visual storytelling and creating connection to create images which go beyond just pretty. Major Takeaways: Learning new concepts in composition - things that will help you create exiting visual flow, help with impactful storytelling and draw the viewer's eye into the image rather than away from it. Next course starts on 15th April 2024Get your space now Module 4: No such thing as bad light There is no such thing as bad light - even with just a sliver of it you can make a statement in your images. In this module we teach you how to work with low light - through low key photography - playing with light and shadows. And we give you an introduction to Flash - for when you want to boost your existing natural light that little bit more. Major Takeaways: You will learn how to use light and shadows to your advantage, literally learning to paint with light - letting it uncover your subject, and hide what you want to stay out of light. Much like the light module in our Fundamentals course this is very much an AH-HA lesson that will shake your photography to its core. Module 5: Photographing emotions In this module we get under our subject's skin and focus on photographing emotions. We show you how to reply on more than facial expression to show emotions and how to use your creative toolkit, including colour theory to make the viewer see and understand the emotion felt in the moment. Major Takeaways: Learning how to capture genuine connection with your subject and their true emotions – whether happy or mad! Going beyond the smiles or frowny faces to portray your children’s true selves and capturing the moment. Using body language and other creative means – from colour theory, editing style and more! BONUS Module 6: Your creative self Exploring various photographic styles and conventions. Learning to recognise your own strengths and weaknesses and taking steps to grow further. Bonus creative exercises to take you outof your rut and help you continue to grow your photography. In my opinion Advanced level 2 is absolute must as it expand the knowledge from level 1 to the point, that you can take photos confidently, and knowing what you do. I did it online and my teachers were superb, passionate, helpful and very flexible. Aga Stefaniak Photography for Parents ADVANCED Book your space now: COURSE STARTS : 15th April 2024( 6 weeks incl 1 week break)COURSE COST : £279 (payment plans available) What’s included: 6 weekly modules covering all key aspects of children’s photography, weekly live online class ( also recorded) - on Wednesday evenings personal feedback and advice on your images private support group PDF workbook Photography for Parents ADVANCED But will it work for me? - our guarantee: We know our course works. We have seen a few thousands of students go through our courses and really improve. BUT, if you find that after the first couple of modules that it just doesn't work for you, you haven't learnt anything new, it's the wrong level for you, you haven't improved, or you simply don't get on or engage with it - we will simply refund you in full. Simple as that!

Microsoft Office 365 Online (with Teams for the Desktop)

By Nexus Human

Duration 1 Days 6 CPD hours This course is intended for This course is intended for business users and knowledge workers in a variety of roles and fields who have competence in a desktop-based installation of the Microsoft Office 2010, 2013, or 2016 edition of the Microsoft Office productivity suite, and who are now extending Microsoft Office to a collaborative cloud-based Office 365 environment. Overview In this course, you will build upon your knowledge of the Microsoft Office desktop application suite to work productively in the cloud-based Microsoft Office 365 environment. You will: Sign in, navigate, and identify components of the Office 365 environment. Create, edit, and share documents with team members using the Office Online apps, SharePoint, OneDrive© for Business, and Delve. Collaborate and work with colleagues using the Yammer and Planner apps. Use email and manage contacts with Outlook on the web. Collaborate using Teams. Configure Teams. This course introduces working with shared documents in the familiar Office 365 online apps?Word, PowerPoint©, and Excel©?as an alternative to installing the Microsoft© Office desktop applications. This course also introduces several productivity apps including Yammer?, Planner, and Delve© that can be used in combination by teams for communication and collaboration. Prerequisites Outlook - Part 1 PowerPoint - Part 1 Word 2016 - Part 1 Using Microsoft Windows 10 1 - GETTING STARTED WITH OFFICE 365 Topic A: Sign In to Office 365 Topic B: Navigate the Office 365 Environment 2 - COLLABORATING WITH SHARED FILES Topic A: Work with Shared Documents in SharePoint Topic B: Edit Documents in Office Online Topic C: Collaborate on the SharePoint Site Topic D: Work with OneDrive for Business and Delve 3 - USING PRODUCTIVITY APPS Topic A: Work with Productivity Apps in Combination Topic B: Broadcast Messages with Yammer Topic C: Manage Tasks with the Planner App 4 - USING OUTLOOK ON THE WEB Topic A: Send and Receive Email Topic B: Manage Contacts Topic C: Schedule Appointments Topic D: Personalize Outlook on the Web 5 - COLLABORATING WITH TEAMS Topic A: Overview of Microsoft Teams Topic B: Converse and Share in Teams Topic C: Call and Meet in Teams Topic D: Collaborate with Office 365 Apps and Teams 6 - CONFIGURING TEAMS Topic A: Configure Teams Topic B: Configure Channels Topic C: Configure Tabs

Introduction to Agile and Scrum: In-House Training

By IIL Europe Ltd

Introduction to Agile and Scrum: In-House Training This half-day course provides an overview of Agile principles and mindset, and the Scrum framework as a key Agile approach. It will provide you with the key benefits of an Agile approach, and its differences with the traditional Waterfall method. Lastly, as Agile is looked upon more frequently as an alternative delivery method, you will review situations where Agile can be adapted outside of software development, where it is most commonly used. What you will Learn At the end of this program, you will be able to: Explain the basics and benefits of using an Agile approach Describe the Scrum framework, its events, artifacts and roles and responsibilities Illustrate Agile approaches outside of Software Development Getting Started Introduction Course structure Course goals and objectives Agile Introduction What is Agile? Agile Benefits Agile Methods Overview of Scrum Scrum Overview Scrum Events Scrum Artifacts Scrum Roles Definition of Done Agile Approaches Outside of Software Development Agile in other environments Product Development Course Development Marketing Agile Project Candidates Summary What Agile is not... Concerns and Pitfalls

Managing Stress in Challenging Times: In-House Training

By IIL Europe Ltd

Managing Stress in Challenging Times: In-House Training This course looks at the symptoms and causes of stress and how these affect us emotionally, behaviorally, and physically. You will learn some simple stress-busting techniques that will have a positive influence on your beliefs and behaviors around stress. You will also have the opportunity to develop a personal action plan which will serve as an ongoing reference point for dealing with pressure in its many forms - home, family, social, and work. What You Will Learn At the end of this program, you will be able to: Recognize the symptoms and causes of stress Manage and reduce the effects of stress in your life with simple stress-busting techniques Create a simple personalized plan to manage stress and promote a healthier, happier, and more productive lifestyle Getting Started Foundation Concepts What is stress? Why stress matters Flight or fight response and role of hormones Work-Life Balance How to create balance and set boundaries Learning how to say 'no' Stress-Reduction Techniques Visualization and relaxation techniques Behaviors and beliefs Putting things in perspective Circle of influence (vs. circle of control) Slowing down Be Responsible and Kind to Yourself Basic human needs Honest communication Your responsibility to yourself and others Calming thoughts

How to be a Great Executive Sponsor: Virtual In-House Training

By IIL Europe Ltd

How to be a Great Executive Sponsor: Virtual In-House Training This three-hour course provides key tips and techniques for becoming an actively engaged, and impactful, Executive Sponsor of projects and programs. It will explain not just what your role is, but the very specific actions you can, and must, take to increase your project's probability of success. This three-hour course provides key tips and techniques for becoming an actively engaged, and impactful, Executive Sponsor of projects and programs. It will explain not just what your role is, but the very specific actions you can, and must, take to increase your project's probability of success. And, it will highlight the key personality and other traits that are found in successful Sponsors. Regardless if you're sponsoring an Agile software development project, a construction megaproject, or any other type of project in between, this course will help get you 'hit the ground running' and being an 'impact player' on day one. Various activities and discussions will acquaint you with this important role and what you need to do to become a great executive sponsor. What you Will Learn At the end of this program, you will be able to: Define project success so everyone is 'singing from the same sheet of music' Immediately apply the ten key attributes of a great sponsor on your project Recognize great sponsorship and determine if you're the right fit for the role Practice Sponsorship over the course of the project life cycle by engaging in very specific actions and activities Be a better investment manager by analyzing the behaviors of successful activist investors Foundation Concepts The quantifiable benefits of being an actively engaged Sponsor Sponsor defined Clarence Kelly Johnson and the SR-71 Blackbird: An example of the power of Sponsorship Defining Project Success Project success: More than meeting the triple constraints Benefits management: The Sponsor's focus The Investment - Life-cycle vs. the Project Life-cycle The three questions Sponsors need to ask to define project success 10 Key Attributes of a Great Sponsor 10 Key Attributes of a Great Sponsor The Makings of a Great Sponsor The most important skills and competencies of an executive sponsor What great Sponsors do and when Four Things a Great Sponsor Can Learn from an Activist Investor The story of Outerwall, Inc. and Glen Welling of Engaged Capital, LLC Sponsors and Activist Investors Sponsorship of the 2nd Avenue Subway in Manhattan: A classic textbook example

Introduction to Agile and Scrum: Virtual In-House Training

By IIL Europe Ltd

Introduction to Agile and Scrum: Virtual In-House Training This half-day course provides an overview of Agile principles and mindset, and the Scrum framework as a key Agile approach. It will provide you with the key benefits of an Agile approach, and its differences with the traditional Waterfall method. Lastly, as Agile is looked upon more frequently as an alternative delivery method, you will review situations where Agile can be adapted outside of software development, where it is most commonly used. What you will Learn At the end of this program, you will be able to: Explain the basics and benefits of using an Agile approach Describe the Scrum framework, its events, artifacts and roles and responsibilities Illustrate Agile approaches outside of Software Development Getting Started Introduction Course structure Course goals and objectives Agile Introduction What is Agile? Agile Benefits Agile Methods Overview of Scrum Scrum Overview Scrum Events Scrum Artifacts Scrum Roles Definition of Done Agile Approaches Outside of Software Development Agile in other environments Product Development Course Development Marketing Agile Project Candidates Summary What Agile is not... Concerns and Pitfalls

Managing Stress in Challenging Times: Virtual In-House Training

By IIL Europe Ltd

Managing Stress in Challenging Times: Virtual In-House Training This course looks at the symptoms and causes of stress and how these affect us emotionally, behaviorally, and physically. You will learn some simple stress-busting techniques that will have a positive influence on your beliefs and behaviors around stress. You will also have the opportunity to develop a personal action plan which will serve as an ongoing reference point for dealing with pressure in its many forms - home, family, social, and work. What You Will Learn At the end of this program, you will be able to: Recognize the symptoms and causes of stress Manage and reduce the effects of stress in your life with simple stress-busting techniques Create a simple personalized plan to manage stress and promote a healthier, happier, and more productive lifestyle Getting Started Foundation Concepts What is stress? Why stress matters Flight or fight response and role of hormones Work-Life Balance How to create balance and set boundaries Learning how to say 'no' Stress-Reduction Techniques Visualization and relaxation techniques Behaviors and beliefs Putting things in perspective Circle of influence (vs. circle of control) Slowing down Be Responsible and Kind to Yourself Basic human needs Honest communication Your responsibility to yourself and others Calming thoughts