- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

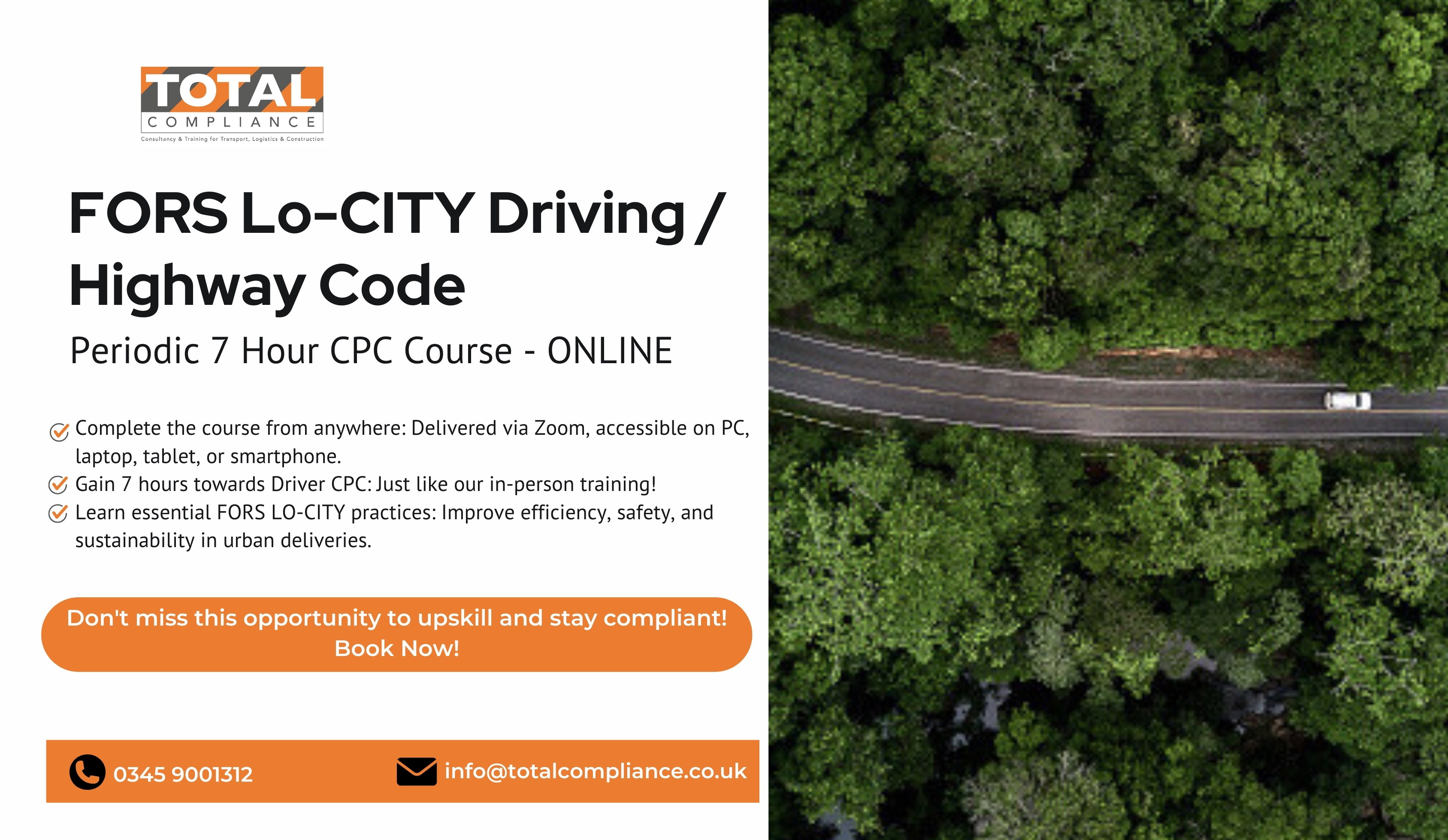

FORS Lo-City Driving & Highway Code - Periodic 7 Hour CPC Course July 2025

By Total Compliance

Registration starts at 7:30 AM. The training will begin promptly at 8:00 AM. Please plan your arrival accordingly to ensure you don't miss any important information. Reduce Emissions, Save Costs, Earn a CPC Hours, and Ensure Full Compliance Topics Covered: FORS Lo-CITY Driver Training (3.5 hours): • Relationship between driving style, fuel consumption, and environmental impact • Benefits of regular vehicle maintenance and checks • Fuel-efficient driving techniques • Utilising in-vehicle technology for fuel economy • Benefits of journey planning • Alternative fuels for commercial vehicles Highway Code Training Content: Course introduction, objectives, and expectations. Introduction to the Highway Code and its relevance. Types of road users and training for various groups. Respecting and understanding the risks to different road user categories. Confirmation of knowledge quizzes covering all aspects of the Highway Code and traffic regulations. Course Details: Format: Remote Session (7 hours) CPC Hours: Yes Cost: £89.50 - Includes course fee, Driver CPC Upload fee, VAT This award-winning program (awarded the prestigious Education in Transport award at the 2017 National Courier Awards) is perfect for any fleet operator looking to: Meet FORS Gold accreditation requirements. Improve driver performance and fuel efficiency. Reduce their environmental footprint. Enhance corporate social responsibility. Please note that this course is delivered online and provides 7 hours of Driver CPC training. Ready to get started? Book online or feel free to contact our training department at training@totalcompliance.co.uk or call 0345 9001312 to register for this valuable course. Please review our Terms and Conditions for more information.

C&G 2391-52, Initial and Periodic Inspection and Testing of Electrical Installations

By Technique Learning Solutions

City & Guilds 2391-52 Combined Course: Course Description The new Testing and Inspection City & Guilds 2391-52 Combined Course qualification replaces and is improved on the former 2394/2395 that was previously available to electricians but has since been withdrawn. City & Guilds 2391-52 course runs over five consecutive days, the first three days covering fundamental theory. The fourth day covering Initial Verification practical and revision. The fifth day of the City & Guilds 2391-52 course covering Periodic Inspection practical and revision with an open book 2 hours Multiple choice exam. A 5 day City & Guilds 2391-52 course for a student possessing knowledge of the wiring regulations and with minimal knowledge of inspection and testing, We strongly recommend City and Guilds 2382 is achieved prior to sitting this course, though this is NOT an entry requirement. In order to claim the full City & Guilds 2391-52 qualification, students must successfully complete the following: Completed during the course each student will sit a 2 hours online Multiple choice exam (open book) Then will have to reattend and complete a Practical Assessment which is 4hrs. Assessment – 2391-52 Task A – Visual Inspection – 30mins Task B – Periodic Inspection and Test – 2hrs and 30mins Task C – Short Answer Questions – 1hr and 20mins To further support this course, we offer a 1 day practical workshop (at the cost of £120.00 Net VAT) available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical exam. Most students who take this option elect to complete this the day before their practical assessment. The City & Guilds 2391-52 course costs include examination entry fees. The Tutors: Our Tutors are qualified, highly experienced, enthusiastic, knowledgeable and extremely friendly, you can take full advantage of all the tips of the trade, personal experiences and practical advice they offer. This short theory course is intensive, but no compromise is made on the course content. The atmosphere is relaxed and enjoyable which creates a good learning environment. On-site Available Group Rate: (up to 8 people): £895.00 + VAT Per Day* plus £50.00 + VAT Exam Entry Fee per Student *(over 8 people, please call on 0800 112 3310 to discuss Group Rate) This course replaces City & Guilds 2394/2395 combined – Level 3. Essential Book supplied *throughout* course!First exam fee included!

C&G 2391-50, Initial Verification of Electrical Installations

By Technique Learning Solutions

The City and Guilds 2391-50 electrical course has been designed to meet the needs of the electrical installation industry, and is aimed at practising electricians who have not carried out inspection and testing since qualifying or who require some update of training before going on to other City and Guilds qualifications. Candidates who achieve the City and Guilds 2391-50 qualification could progress on to the City and Guilds 2391-51: the Level 3 Certificate in Inspection, Testing and Certification of Electrical Installations. The City and Guilds 2391-50 course will focus on the teaching and learning of initial verification and certification of electrical installations. In order to claim the full City and Guilds 2391-50 qualification, students must successfully complete: One 1 hour 30 minute online multiple choice test to be completed during the courseOne 3 hour 30 minute practical test to be completed after the course, broken into two sections as follows:Task A – Initial Verification and Certification of the Complete Installation – 2hrs and 30minsTask B – Short Answer Questions – 1hr To further support this course, we offer a 1 day practical workshop (at the cost of £120.00 Net VAT) available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical exam. Most students who take this option elect to complete this the day before their practical assessment. The City and Guilds 2391-50 course costs include examination entry fees.

C&G 2391-51, Periodic Inspection and Testing of Electrical Installations

By Technique Learning Solutions

City and Guilds 2391-51, level 3, is ideal for people with limited experience of periodic inspection of electrical installations. If you are already working as an Electrician, but have not carried out inspection and testing since qualifying, or you require to update before moving onto other qualifications, then this 5 day City and Guilds 2391-51 course will be right for you. City and Guilds 2391-51 Course Content: Principles, practices and legislation for the periodic inspection, testing and condition reporting of electrical installations. Requirements for completing the safe isolation of electrical circuits and installations Requirements for inspecting, testing and recording the condition of electrical installations Requirements for completing the periodic inspection of electrical installations Differences between periodic inspection and initial verification Requirements for safe testing of electrical installations which have been put in to service Requirements for testing before circuits are live. Requirements for testing live installations Understanding and interpreting test results Requirements for the completion of electrical installation condition reports and associated documentation Confirmation of safety of system and equipment prior to completion of inspection, testing and commissioning Carrying out inspection of electrical installations prior to them being put into service Ability to test electrical installations prior to them being put into service Produce a condition report with recording observations and classification In order to claim the full City and Guilds 2391-51 qualification, students must successfully complete: One x1 hour 30 minute online multiple choice (Open Book) Exam to be completed during the course One x3 hours 30 minute practical test to be completed after the course, broken into sections as follows: Task A – Visual Inspection – 30mins Task B – Periodic Inspection and Test – 2hrs Task C – Short Answer Questions – 1hr To further support this course, we offer a 1 day practical workshop (at the cost of £120.00 Net VAT) available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical exam. Most students who take this option elect to complete this the day before their practical assessment. The City and Guilds 2391-51 course costs include examination entry fees.

Level 3, 4 & 5 Introduction to VAT at QLS

By Imperial Academy

Level 5 QLS Endorsed Course | Endorsed Certificate Included | Plus 5 Career Guided Courses | CPD Accredited

Register on the Introduction to VAT today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Introduction to VAT is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Introduction to VAT Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Introduction to VAT, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Understanding VAT Understanding VAT 00:36:00 Module 02: VAT Terminology and Calculation VAT Terminology and Calculation 00:35:00 Module 03: VAT Taxable Persons VAT Taxable Persons 00:46:00 Module 04: VAT Registration VAT Registration 00:40:00 Module 05: VAT Rates VAT Rates 00:32:00 Module 06: Invoicing and Records Invoicing and Records 00:27:00 Module 07: VAT Application in Goods, Services and Vehicles VAT Application in Goods, Services and Vehicles 00:31:00 Module 08: Supply Supply 00:43:00 Module 09: The VAT Return The VAT Return 00:25:00 Module 10: Tips on VAT Compliance Tips on VAT Compliance 00:21:00 Module 11: VAT Exemptions and Zero-Rated VAT VAT Exemptions and Zero-Rated VAT 00:39:00 Module 12: Miscellaneous VAT Issues and Penalties Miscellaneous VAT Issues and Penalties 00:41:00 Module 13: Making Tax Digital Making Tax Digital 00:26:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

UK VAT

By Compete High

Unlock the Secrets of UK VAT with Our Comprehensive Text Course! Are you navigating the complex world of UK Value Added Tax (VAT) and feeling overwhelmed? ð¤ Do you want to master the intricacies of VAT regulations to enhance your business operations or career prospects? Look no further! Our expertly crafted text course, 'UK VAT,' is your ultimate guide to understanding the ins and outs of VAT in the United Kingdom. Why Choose Our 'UK VAT' Text Course? Our course is designed to demystify the complexities of UK VAT, offering you a clear and concise roadmap to success. Here's why thousands of learners trust our course: Comprehensive Coverage: Dive deep into the fundamentals of UK VAT, from registration and compliance to invoicing and reclaiming VAT. Our course covers all the essential topics you need to know to navigate the VAT landscape with confidence. Expert Guidance: Learn from industry experts who bring years of experience in VAT consultancy and compliance. Benefit from their insights, practical tips, and real-world examples that will empower you to make informed decisions in your business or career. Flexible Learning: Our text-based format allows you to learn at your own pace, whenever and wherever it's convenient for you. Whether you're a busy professional or a full-time student, our course fits seamlessly into your schedule. Interactive Quizzes: Reinforce your learning with interactive quizzes and assessments that test your understanding of key concepts. Track your progress and identify areas for improvement as you work through the course. Practical Resources: Gain access to downloadable resources, templates, and case studies that enrich your learning experience and provide valuable reference materials for future use. Who is This Course For? Our 'UK VAT' text course is perfect for: Business Owners: Whether you're a small business owner or the finance manager of a multinational corporation, understanding UK VAT is crucial for managing your finances efficiently and ensuring compliance with HM Revenue & Customs (HMRC) regulations. Accountants and Finance Professionals: Expand your skill set and stay ahead of the curve in today's competitive job market. Our course equips you with the knowledge and expertise to handle VAT-related tasks with confidence and precision. Students and Aspiring Professionals: Kickstart your career in accounting, finance, or business management by mastering the fundamentals of UK VAT. Our course provides a solid foundation that will set you apart from your peers and impress potential employers. Career Path Upon completing our 'UK VAT' text course, you'll unlock a world of exciting career opportunities, including: VAT Consultant: Offer expert advice to businesses on VAT matters, helping them optimize their VAT strategies and minimize tax liabilities. Tax Accountant: Specialize in VAT compliance and reporting, ensuring that businesses fulfill their tax obligations accurately and efficiently. Financial Controller: Take on a leadership role within an organization, overseeing VAT-related activities and providing strategic financial guidance. Entrepreneur: Use your newfound knowledge of UK VAT to launch and grow your own business, confidently navigating tax implications and maximizing profitability. Auditor: Conduct thorough examinations of financial records to ensure compliance with VAT regulations and identify any potential risks or discrepancies. FAQs Q: Is this course suitable for beginners? A: Absolutely! Our 'UK VAT' text course is designed to cater to learners of all levels, from beginners with little to no prior knowledge of VAT to seasoned professionals looking to deepen their expertise. Q: How long does it take to complete the course? A: The duration of the course varies depending on your learning pace and schedule. On average, learners complete the course within a few weeks, but you can progress at your own speed. Q: Will I receive a certificate upon completion? A: Yes, upon successfully finishing the course and passing the final assessment, you will receive a certificate of completion to showcase your newfound expertise in UK VAT. Q: Can I access the course on mobile devices? A: Absolutely! Our platform is fully responsive, allowing you to access the course materials on any device, including smartphones, tablets, and desktop computers. Q: Is there a support system available if I have questions or encounter difficulties? A: Yes, we provide dedicated support to assist you throughout your learning journey. If you have any questions or encounter technical difficulties, our team is here to help via email or our online support portal. Don't let the complexities of UK VAT hold you back! Enroll in our 'UK VAT' text course today and embark on a journey toward VAT mastery. With expert guidance, comprehensive coverage, and flexible learning options, success is within your reach. Take the first step toward VAT excellence and unlock a world of opportunities! ð Course Curriculum Module 1 Introduction to VAT and its Importance Introduction to VAT and its Importance 00:00 Module 2 VAT Legal Framework and Regulations VAT Legal Framework and Regulations 00:00 Module 3 VAT Treatment of Goods and Services VAT Treatment of Goods and Services 00:00 Module 4 VAT Accounting and Record Keeping VAT Accounting and Record Keeping 00:00 Module 5 VAT and Business Transactions VAT and Business Transactions 00:00 Module 6 VAT and Cross-Border Trade VAT and Cross-Border Trade 00:00 Module 7 VAT Compliance and Digital Solutions VAT Compliance and Digital Solutions 00:00

Essentials of UK VAT

By iStudy UK

Essentials of UK VAT Overview Feeling overwhelmed by VAT? You're not alone! Value Added Tax can be a tricky subject for businesses in the UK. But worry no more! This 'Essentials of UK VAT' course is your clear and concise guide to understanding VAT and keeping your taxes in order. We'll break down VAT into simple steps, starting with the basics. You'll learn key terms and how to calculate VAT amounts yourself. We'll cover who needs to register for VAT and the different rates that apply to various products and services. From creating proper invoices to understanding how VAT applies to things like car purchases, this course gives you all you need to know. By the end, you'll be a whiz at filing your VAT returns and keeping your business compliant. We'll also cover situations where you don't need to pay VAT, and any penalties you want to avoid. As a bonus, the course explores Making Tax Digital (MTD), a new government initiative that affects how you submit your VAT information. This course is perfect for anyone who deals with UK VAT, from business owners to accountants and even those just starting out. Learning Outcomes Gain a solid understanding of Value Added Tax (VAT) in the UK. Master key VAT terminology and confidently perform VAT calculations. Understand who is required to register for VAT and navigate the registration process. Apply VAT accurately to different business transactions, including goods, services, and vehicles. Learn how to create compliant VAT invoices and maintain proper records. Navigate VAT return submissions and ensure compliance with Making Tax Digital (MTD). Why You Should Choose Essentials of UK VAT Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Essentials of UK VAT is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Essentials of UK VAT is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Essentials of UK VAT Module 01: Understanding VAT Understanding VAT 00:36:00 Module 02: VAT Terminology And Calculation VAT Terminology and Calculation 00:35:00 Module 03: VAT Taxable Persons VAT Taxable Persons 00:46:00 Module 04: VAT Registration VAT Registration 00:40:00 Module 05: VAT Rates VAT Rates 00:32:00 Module 06: Invoicing And Records Invoicing and Records 00:27:00 Module 07: VAT Application In Goods, Services And Vehicles VAT Application in Goods, Services and Vehicles 00:31:00 Module 08: Supply Supply 00:43:00 Module 09: The VAT Return The VAT Return 00:25:00 Module 10: Tips On VAT Compliance Tips on VAT Compliance 00:21:00 Module 11: VAT Exemptions And Zero-Rated VAT VAT Exemptions and Zero-Rated VAT 00:39:00 Module 12: Miscellaneous VAT Issues And Penalties Miscellaneous VAT Issues and Penalties 00:41:00 Module 13: Making Tax Digital Making Tax Digital 00:26:00