- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

**6 FREE CPD Accredited Certificates and Included with Lifetime Access** Indulge in our 6-course bundle, originally priced at £120, now available for a limited time at the exclusive rate of £100. Enjoy an instant savings of £20! Welcome to a realm where financial security is not just a buzzword, but a practice rooted in expertise and adherence to the highest standards. To reach these high standards our Introduction to UK AML/CFT Risk Management and Compliance comes in handy. This bundle consists of the following CPD Endorsed Courses: Course 01: Anti Money Laundering (AML) Course 02: Fraud Awareness and Prevention Training Course 03: Know Your Customer (KYC) Course 04: Security Risk and Fraud Prevention Course 05: GDPR UK Training Course 06: Corporate Governance Key Features 6 FREE CPD Accredited Certificate Fully online, interactive course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Imagine you're navigating the intricate landscape of financial transactions, grappling with the pervasive challenge of money laundering, feeling the weight of security risks, and yearning for a robust shield against fraud. The frustration of combating these complex issues is real. But fear not - our tailored courses serve as your beacon, guiding you through the labyrinth of financial intricacies. As you dive into the intricacies of Anti Money Laundering, Fraud Awareness, and Know Your Customer protocols, a new world unfolds. Imagine gaining a profound understanding of security risks and fraud prevention, and acquiring the tools to shield your organisation. The GDPR UK Training we offer is not just a compliance necessity but a strategic advantage. Corporate Governance ties it all together, offering you the compass to navigate the ever-evolving corporate landscape. Enrol now and let your frustration be replaced with empowerment as you equip yourself with the knowledge and skills to not only navigate but master the intricacies of AML/CFT risk management and compliance. This is your journey to resilience, excellence, and unwavering confidence in the face of financial complexities. Learning Outcomes: Identify and mitigate financial risks for robust compliance. Implement effective fraud prevention strategies in diverse contexts. Master client vetting techniques for thorough KYC practices. Develop strategies to prevent security risks and financial fraud. Navigate the nuances of GDPR compliance within the UK. Instil ethical decision-making through a deep understanding of corporate governance. Certificate After completing this course, you will be able to claim your FREE PDF and Hardcopy certificates, which are CPD accredited. Job Vacancies There are currently over 15,000 job vacancies in the UK for AML/CFT Risk Management and Compliance professionals. The most popular roles include: AML/CFT Compliance Officer Sanctions Officer Anti-Money Laundering Analyst Transaction Monitoring Analyst Financial Crime Analyst Future Job Openings The UK AML/CFT Risk Management and Compliance sector is expected to grow in the coming years. There are a number of reasons for the strong demand for AML/CFT Risk Management and Compliance professionals. The reasons are increased regulatory focus along with evolving financial landscape. Also, the growing international cooperation and technological advancements has led to an increased demand for qualified professionals who can carry out these tasks. The job market for this profession is strong, with a predicted 25% growth in employment from 2022 to 2027. Salaries in the UK The salaries for AML/CFT Risk Management and Compliance professionals vary depending on their experience and qualifications. However, most professionals in this field can expect to earn a competitive salary. The average salary for an AML/CFT Compliance Officer in the UK is £35,000 - £55,000 per year. Satisfaction A recent survey found that 77% of AML/CFT Risk Management and Compliance professionals are satisfied with their jobs. The most common reasons given for job satisfaction were: Meaningful and impactful work Intellectual challenge and problem-solving Competitive salary and benefits Potential for specialisation and career progression Dynamic and ever-changing environment CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Financial analysts and compliance officers Banking and finance professionals Risk management specialists Legal and regulatory affairs professionals Business executives and managers Aspiring professionals entering the finance sector Corporate governance enthusiasts Individuals seeking a comprehensive compliance skill set Career path Risk Analyst Compliance Officer Financial Investigator Fraud Prevention Specialist Data Protection Officer Corporate Governance Advisor Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included Hardcopy Certificate (UK Delivery): For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99. Hardcopy Certificate (International Delivery): For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Compliance Management

By The Teachers Training

Ensure your organization adheres to regulations and ethical standards with compliance management. Learn how to navigate regulations, mitigate risks, and maintain ethical standards effectively. Enrol now to protect your organization's reputation and ensure regulatory compliance.

Production Sharing Contracts (PSC) & Related Agreements

By EnergyEdge - Training for a Sustainable Energy Future

Gain a deep understanding of Production Sharing Contracts (PSC) and related agreements through our expert-led course. Enroll now and excel in your field with EnergyEdge.

Certificate in Anti Money Laundering

By Learn Era

Overview Our comprehensive course is designed to provide you with the necessary skills and knowledge to excel in your field. Developed by professionals with years of experience, this course is perfect for anyone looking to kick start their career or advance their skills. It features an audio-visual presentation and easy-to-learn modules, allowing for a self-paced learning experience. Our expert online support team is available during weekdays to assist you throughout the course. Learning Outcomes Upon completion of the course, you will be able to: Understand the fundamentals and its applications. Develop the necessary skills to succeed in the field . Apply your newly acquired knowledge to real-world scenarios. Create effective and efficient solutions for relevant topics. Enhance your employability and career prospects. It is designed to provide you with the knowledge needed to stand out in the competitive job market. With lifetime access to course materials and the ability to learn at your own pace, this course is the perfect opportunity to improve your skills and advance your career. You can learn at your own pace, from the comfort of your home, as all course materials are accessible online at any time. Why Choose Us? Lifetime access to course materials Full tutor support is available Monday through Friday for all courses Learn essentials skills at your own pace from the comfort of your home Gain a thorough understanding of the course Access informative video modules taught by expert instructors 24/7 assistance and advice available through email and live chat Study the course on your computer, tablet, or mobile device Improve your chances of gaining professional skills and earning potential by completing the course. Why should you study this course? The course offers a comprehensive introduction to the subject matter and provides a solid foundation for further study. It will also help students to gain knowledge and skills that can be applied in their professional or personal life. Assessment The course includes a series of quizzes that will test your understanding and retention of the material covered in the course. The quizzes will help you to identify areas where you may need further practice, and you will have the opportunity to review the course materials as needed. Upon successfully passing the final quiz, you will be able to order your certificate of achievement. Career Path The course is designed to equip you with the skills and knowledge you need to succeed in the field. After completing the course, you will be able to pursue a variety of career opportunities in different industries. Course Features Lectures 15 Quizzes 0 Duration 6 Hours 30 Minutes Skill level Beginner Language English Students 65 Assessments Yes Certificate in Anti Money Laundering Lecture1.1 Introduction to Money Laundering Lecture1.2 Proceeds of Crime Act 2002 Lecture1.3 Development of Anti-Money Laundering Regulation Lecture1.4 Responsibility of the Money Laundering Reporting Officer Lecture1.5 Sanctions and Embargoes Lecture1.6 Risk-based Approach Lecture1.7 Know Your Customer (KYC) Lecture1.8 Customer Due Diligence Lecture1.9 Record Keeping Lecture1.10 Suspicious Conduct and Transactions Show more items Assessment Lecture2.1 AssessmentCopy Order Your Certificate Lecture3.1 Order Your CertificateCopy FAQs What is the format of the Certificate in Anti Money Laundering course? The course is self-paced and consists of video lectures, quizzes, and hands-on exercises. What is the duration of the course? The course is self-paced, so you can complete it at your own pace and schedule. Do I need any prior experience or qualifications to enrol in the course? No, there are no prerequisites for the course. Anyone with an interest in Certificate in Anti Money Laundering can enrol. What type of support is available during the course? Full tutor support is available from Monday to Friday, and you can also access 24/7 help or advice from our email and live chat teams.

Credit control and debt recovery - legal issues (In-House)

By The In House Training Company

It is essential that those charged with responsibility for credit control and debt recovery have a full appreciation of the relevant law: no-one can negotiate effectively to recover a debt if they don't understand the ultimate sanctions they can apply. This programme is designed to give them a practical, up-to-date understanding of the law as it applies to your particular organisation. This course will help ensure that participants: Understand the relevant laws Know how and when to invoke legal processes Avoid legal pitfalls in debt collection negotiations Specific, practical learning points include: Definition of 'harassment' How to set up an in-house collection identity Whether cheques in 'full and final settlement' are binding The best steps to trace a 'gone away'... and many, many more. 1 Data protection and debt recovery There are a whole range of things which can be checked on members of the public and which are not affected by the restraints of the Data Protection Act. These will be explained in simple, clear terms so that staff can use this information immediately. 2 County Court suing The expert trainer will show how to sue for money owed, obtain judgment and commence enforcement action without leaving your desk. This module is aimed at showing how to make the Courts work for you instead of the other way around! 3 Enforcement of judgments There are many people who have a County Court Judgment (CCJ) against their debtor but who still remain unpaid. This session explains each of the enforcement methods and how to use them to best effect. Enforcement methods covered include: Warrant of Execution Using the sheriff (now known as High Court Enforcement Officers) Attachment of earnings Third Party Debt Orders Charging Orders (over property and goods) Winding-up companies and making individuals bankrupt 4 Office of Fair Trading rules on debt recovery Surprisingly few people are aware of the Office of Fair Trading rules on debt recovery and many of those that do know think they don't apply to them - but they do. Make sure you know what you need to! 5 New methods to trace elusive, absentee and 'gone away' debtors Why write the money off when you can trace the debtor and collect the money you are owed? 6 Credit checking of new and existing customers It makes sense to credit check would-be, new and existing customers to evaluate the likelihood of payment delays or perhaps not being paid at all. This session shows a range of credit checking steps, many of which can be done completely free of charge, including a sample credit application/ account opening form. 7 Late Payment of Commercial Debts Regulations Do your staff understand this legislation and how to use it to make people pay quicker than ever before? The trainer shows how. 8 The Enterprise Act The Enterprise Act made some startling changes to corporate and personal insolvency. What are the implications for credit control and debt recovery within your organisation?

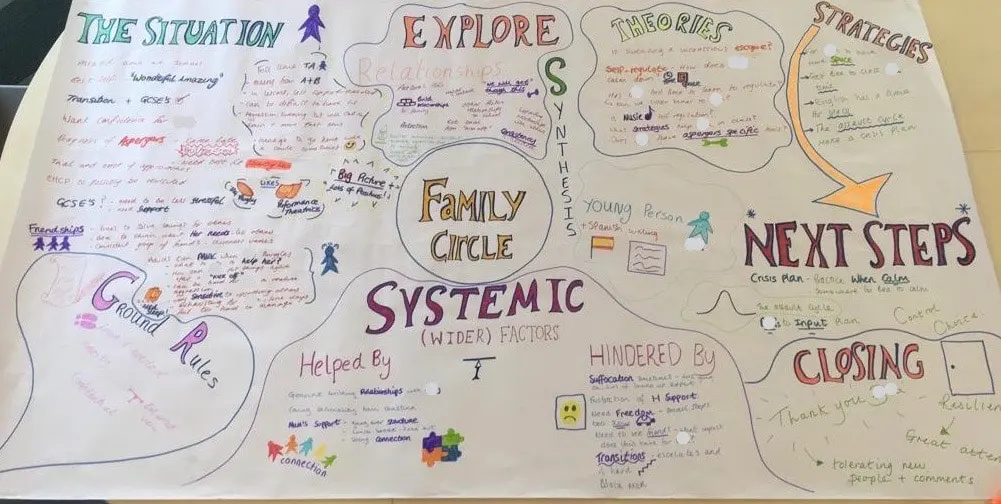

FAMILY CIRCLES

By Inclusive Solutions

Click to read more about this training, in which we demonstrate a live problem solving approach which is based on the active participation of family members. Course Category Inclusion Parents and Carers Behaviour and relationships Problem Solving Description In this training we demonstrate a live problem solving approach which is based on the active participation of family members. ‘Family Circles’ is an evolving new approach to problem solving with families and is based on our years of family work and the development and use of the Circle of Adults process. Inspired by our own Parent Solutions work and the Circle of Adults process as well as Family Group Conferencing and other Restorative Interventions we bring you Family Circles. Essentially the approach involves gathering a family together for a process that is facilitated but majors on the family members offering each other their wisdom and ideas. The approach is capacity focused, person centred approach to working with families rather than the dominant deficit oriented and ‘medical model’ of viewing and planning for or doing things to families. This training can be modelled with a group of professionals or better still with a family. In our work with families we develop the importance of naming stories or theories and seeking linkages and synthesis between what is found out and explored about the family situation and its history. We like participants to sit with the uncertainty, to reflect on the question ‘why’ but without judgement of each other. Deeper reflections may span a whole range of perspectives from ‘within person’ considerations, to situational or systemic possibilities. Health or emotional issues can be reflected on alongside organisational or transactional aspects of what is going on for the family. The better the shared understanding the better the strategy or actions which emerge from these meetings. Quality hypotheses with a close fit to reality lead to more effective implementation in the real world. We encourage ‘loose’ thinking, a search for connections, deeper listening, an ‘open mind’, speculation and exploration without moral judgements. From this stance self-reflection as well as reflection on the situation can produce remarkable insights. The quality of theories or new stories generated is directly influenced by family members’ experiences and the models of learning, behaviour and emotion, systems, educational development, change and so on that they have been exposed to. Learning Objectives To provide opportunities for: Shared problem solving in a safe exploratory climate in which the family will find its own solutions. Individuals to reflect on their own actions and strategies An exploration of whole-family processes and their impact Emotional support and shared understandings of issues at a child, parent, family, school and community level. Feed back to each other on issues, ideas and strategies that are agreed to be worth sharing with them. Who Is It For? Anyone interested in working with families in a way that builds and makes use of their capacities rather than focus on their challenges and difficulties. Social Care teams School staff Community organisers Educational Psychologists Course Content True family empowerment Deepening shared stories and understandings Facilitating groups Problem solving process Handling family group communication Allowing direct feedback and challenge between participants in a safe way Building relationships Process: Family members are welcomed: Introductions are carried out, ground rules and aims clarified whilst coffee is drunk. A recap from the last session is carried out: To follow up developments and reflections after the last meeting. One issue is selected for the main focus Issue presentation: The family member who raised the concern is asked questions to tell the ‘story’ of the issue or problem. Additional questions/information from the group about the problem are gathered: Ground rules may need to be observed carefully here. Individual participants need to be kept focused and prevented from leaping to premature conclusions or to making ‘helpful’ suggestions about strategy. Relationship aspects to the problem are explored. Metaphors and analogies are invited. How would a fly on the wall see your relationship? If you were alone together on a desert island, what would it be like? Impact of previous relationships/spillage from one relationship to another are explored. Eg what situation they are reminded of? For instance, does this situation remind you of any of those angry but helpless feelings you had with your other son when he was an adolescent? This provides opportunities to reflect on how emotions rub off on other people. The parent feels really frustrated, and on reflection we can see that so does the child System/Organisation factors (Family system/school and community systems and so on): What aspects help or hinder the problem? For instance, does the pastoral system of the local school provide space, or time and skilled personnel able to counsel this young person and work actively with their parents? Synthesis. At this stage the Graphic facilitator summarises what they have heard. They then go on to describe linkages and patterns in what they have heard. This can be very powerful. The person doing the graphic work has been able to listen throughout the presentation process and will have been struck by strong messages, emotions and images as they have arisen. The story and meaning of what is happening in the situation may become a little clearer at this point. Typical links may be ‘mirrored emotions’ strong themes such as loss and separation issues, or repeated processes such as actions triggering rejection. This step provides an excellent grounding for the next process of deepening understanding. What alternative strategies/interventions are open to be used? Brainstormed and recorded. ’Either/ors’ need to be avoided at this time also. This needs to be a shared session in which the family member who is presenting the concern contributes as much as anyone. Care is needed to ensure that this person is not overloaded with other people’s strategies. The final selection of strategy or strategies from the brainstormed list is the problem presenter’s choice. Strategies might include: a special time for the young person, a meeting with the child’s parents to explore how she is being managed at home and to share tactics, a home-school diary, counselling, or an agreed action plan that all are aware of, agreed sanctions and rewards and so forth. Strategies may productively involve processes of restitution and restoration, when ‘sorry’ is not enough. Making it right, rather than punishments or rewards, may then becomes the focus. First Steps. The problem presenter is finally asked to agree one or two first steps which they can carry out over the next 3-7 days. It can help to assign a ‘coach’ who will check in with them to ensure they have carried out the action they have named. This is a time to be very specific. Steps should be small and achievable. The person is just ‘making a start’. A phone call, or making an agreement with a key other person not present at the meeting would be ideal examples. Final reflections. Sometimes referred to as a ‘round of words’ help with closure for all involved. Reflections are on the process not the problem. In large families this is best done standing in a circle. In smaller groups all can remain sitting. Passing around a ‘listening stick’ or something similar such as a stone or light heighten the significance of the process ending and improve listening. Finally the problem presenter is handed the ‘Graphic’ this is their record of the meeting and can be rolled and presented ceremoniously by the facilitators for maximum effect! If you liked this course you may well like: Parent Solutions

Fraud Prevention

By Ideas Into Action

Fraud Prevention: A Guide for Small and Medium Sized Enterprises Course Description Copyright Ross Maynard 2021 Course Description Business fraud is a significant, and growing problem. Hardly a day goes by without news reports of organisations being hacked or having their data hijacked. Phishing scams and ID theft are also serious threats to businesses. According to data produced by Accenture, 43% of cyber attacks are aimed at small or medium sized organisations, but only 14% of those organisations are well protected. Around 60% of successful internet fraud cases are the result of phishing emails, and 30% of cases result from ID theft. These two approaches are increasingly being combined in business internet fraud. The aim of this course is to help managers in small or medium sized organisations understand the fraud risk that they face, and to take action to mitigate the risk. The course covers frauds risks, creating an anti-fraud culture and developing an fraud risk management strategy. The course comes with a fraud risk mini-audit and sample anti-fraud policies, and related policy documents. The best way to prevent fraud is to have clear anti-fraud policies and procedures which all staff understand, and which are rigorously enforced; coupled with an open, communicative environment, where staff feel safe and supported to question actions and raise concerns. To help your organisation put these elements in place, this course has five parts: Part 1: What is Fraud and Who Commits it? Part 2: Creating an Anti-Fraud Culture Part 3: Fraud Risk Management Part 4: Managing Bribery Risk Part 5: Appendices with sample anti-fraud policies, fraud response plans, a whistleblowing policy and anti-bribery policy. I hope you find the course helpful. Key Learning Points On completion of the course, delegates will be able to: Define meaning and nature of business fraud Appreciate the variable nature of people’s honesty and how that can tip into fraud Understand the personality types of people who commit business fraud Identify the elements of an anti-fraud culture Explain the steps required to guard against internet fraud Understand the elements of a fraud risk management strategy Outline the sanctions available for those committing fraud Develop an Anti-Fraud Policy, Fraud Response Plan, Whistleblowing Policy and Anti-Bribery Policy for their organisation Begin to audit the level of fraud risk and bribery risk in their organisation Curriculum Part 1: What is Fraud and Who Commits it? L1: What is Fraud? L2: The Variable Nature of Honesty Part 2: Creating an Anti-Fraud Culture L3: Creating an Anti-Fraud Culture L4: Internet Fraud and Cybercrime Part 3: Fraud Risk Management L5: The Fraud Risk Management Strategy Part 1 L6: The Fraud Risk Management Strategy Part 2 L7: Sanctions for Fraud L8: Tips to Help Prevent Fraud L9: The Fraud Risk Mini-Audit L10: Fraud Prevention Exercises Part 4: Managing Bribery Risk L11: The Bribery Act 2010 L12: The Bribery Risk Mini-Audit Part 5: Appendices Sample Anti-Fraud Policy 1 Sample Anti-Fraud Policy 2 Sample Fraud Response Plan 1 Sample Fraud Response Plan 2 Sample Whistleblowing Policy Sample Anti-Bribery Policy Pre-Course Requirements There are no pre-course requirements Additional Resources PDF copies of the following documents are provided with the course: Sample Anti-Fraud Policy 1 Sample Anti-Fraud Policy 2 Sample Fraud Response Plan 1 Sample Fraud Response Plan 2 Sample Whistleblowing Policy Sample Anti-Bribery Policy Sample Code of Ethics CIMA Fraud Risk Management Guide 2016 The Honesty Questionnaire The Fraud Risk Mini-Audit The Bribery Risk Mini Audit Course Tutor Your tutor is Ross Maynard. Ross is a Fellow of the Chartered Institute of Management Accountants in the UK and has 30 years’ experience as a process improvement consultant specialising in business processes and organisation development. Ross is also a professional author of online training courses. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Do you need a qualification in data protection or are you thinking about learning more about data protection for your organisation? The BCS Practitioner Certificate in Data Protection designed for those with some data protection responsibilities in an organisation and wish to achieve and demonstrate a broad understanding of the law and progresses from what is taught in the BCS Foundation Certificate in Data Protection.

Explore the intricacies of sea export forwarding with our comprehensive course. Gain expertise in documentation, regulations, and procedures, covering pre-shipment to post-shipment processes. Stay ahead with insights into future trends and technology shaping the industry. Join us to master the essentials of sea export, logistics, compliance, and emerging technologies, ensuring success in the dynamic global trade landscape.