- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4066 Courses in Cardiff delivered Online

Overview Financial analysis gives you a wide understanding of a company's financial information which further helps you to analyse risks in the future and improve business prospects. It plays a vital role in calculating business profit. Professionals with the necessary skills help you to know how your business and forecast the future of the business. It helps to analyse financial statements and also to appraise the present and future prospects of the business. This course is specially designed to enhance the skills of financial professionals, in financial analytics by having in-depth knowledge of fundamentals of financial statement analysis thereby empowering their analytical skills in measuring the risk business investors are dealing with and also asking the appropriate questions. It will enhance the skills of the participant and will boost their confidence uplifting their ability to comment on business activities and analyse financial health for management. These skills and the required technical knowledge will be put into practice throughout the course using interactive examples and case studies.

Overview In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know-how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions and budgets. All require some degree of financial knowledge.

Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS

4.7(47)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Step into the fascinating world of business and finance with our comprehensive Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS bundle. This rich, enlightening collection features 8 exceptional courses meticulously designed to bolster your understanding of the business, audit, and stakeholder management. The bundle proudly presents 3 QLS-endorsed courses in Business Management, Internal Audit Skills Diploma Level 5, and Stakeholder Management. These courses will furnish you with a profound understanding of business operations, internal auditing, and effective stakeholder engagement. Upon successful completion, you'll receive a hardcopy certificate, marking your journey of knowledge and achievement. Enhance your learning further with 5 CPD QS accredited courses: Financial Ratio Analysis for Business Decisions, Financial Management, Business Law, Financial Modelling for Decision Making and Business Plan, and Contracts Law UK 2021. These additional courses offer a well-rounded education in the diverse aspects of business and finance. Key Features of the Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Business Management QLS Course 02: Internal Audit Skills Diploma Level 5 QLS Course 03: Stakeholder Management 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Financial Ratio Analysis for Business DecisionsCourse 02: Financial ManagementCourse 03: Business LawCourse 04: Financial Modelling for Decision Making and Business planCourse 05: Contracts Law UK 2021 In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV WritingCourse 02: Job Search SkillsCourse 03: Self Esteem & Confidence BuildingCourse 04: Professional Diploma in Stress ManagementCourse 05: Complete Communication Skills Master Class Convenient Online Learning: Our Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes of the Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS Bundle: Understand core Business Management concepts and strategies. Acquire knowledge on Internal Audit procedures and guidelines. Master Stakeholder Management techniques. Comprehend the importance and application of Financial Ratio Analysis. Learn the essentials of Financial Management and Business Law. Develop skills in Financial Modelling for effective decision making. Understand the structure and regulations of Contracts Law UK 2021. The Business Management, Internal Audit, Stakeholder Management Level 4, 5 & 7 at QLS bundle is expertly crafted to deliver a thorough theoretical understanding of business operations, audit processes, and stakeholder management. This dynamic bundle integrates a broad spectrum of topics, from the fundamentals of Business Management to advanced concepts of Financial Modelling. The QLS-endorsed courses dive into Business Management, Internal Audit Skills, and Stakeholder Management, introducing you to the theoretical facets of these essential domains. In parallel, the 5 CPD QS accredited courses will guide you through Financial Ratio Analysis, Financial Management, Business Law, Financial Modelling for Decision Making, and Contracts Law UK 2021, ensuring a well-rounded comprehension of business and finance. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in gaining a theoretical understanding of business and finance. Aspiring business managers looking to broaden their knowledge. Accounting professionals aiming to delve into internal audit and financial management. Legal enthusiasts seeking to understand business law and contract law. Career path Business Manager: With an average salary of £30,000 - £60,000 per annum. Internal Auditor: With a salary range of £25,000 - £50,000. Stakeholder Manager: Average salary between £30,000 and £55,000. Financial Manager: With an average salary of £40,000 - £70,000. Contract Manager: With an average salary of £40,000 - £65,000. Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

Level 4 Logistics and Supply Chain Management

By Training Tale

Do you want to start a career in Logistics Management? Are you interested in learning the Logistics management skills and knowledge needed for this role but do not know where to start? To expand your professional career, enrol in this Level 4 Logistics Management Course right now. This Level 4 Logistics Management Course is designed to provide you with a solid understanding of logistics, ensuring that you are familiar with the components of a logistics system as well as the many types of logistics management. The course will also introduce you to the topic of business logistics and the goals of logistics management. This Level 4 Logistics Management course comprises a series of easy-to-digest, in-depth lessons that will offer you a deep, expert level of knowledge. This course will provide you with the skills you need to land your dream job. Enrol now and start learning. >> Courses are included in this Level 4 Logistics Management Bundle Course Course 01: Level 4 Logistics Management Course Course 02: Supply Chain Management [ Note: Free PDF certificate as soon as completing the Level 4 Logistics and Supply Chain Management Course] Course Curriculum Level 4 Logistics Management Module 01: An Overview of Logistics Management Module 02: Logistics, the Supply Chain and Competitive Strategy Module 03: Product Design, Cleaner Production and Packaging Module 04: Sustainable Purchasing and Procurement Module 05: Sustainable Warehousing Module 06: Understanding Customer Service Module 07: Basic Inventory Planning and Management Module 08: Freight Transport Management Module 09: Reverse Logistics and Recycling >> --------------------- << Assessment Method After completing each module of the Level 4 Logistics Management course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this Level 4 Logistics Management course, you will be entitled to a Certificate of Completion from Training Tale. Who is this course for? Level 4 Logistics and Supply Chain Management This Logistics and Supply Chain Management is perfect for - Job Seekers Student Fresh Graduate Organisational Manager Company Owner Special Note: Our Course is not a regulated course. If You want to get qualified, you can consider following options: Association of Business Executives (ABE) - Level 5 Diploma in Business Management (Supply Chain Management) Chartered Institute of Logistics and Transport (CILT) - Level 3 Certificate in Logistics and Transport Chartered Institute of Procurement and Supply (CIPS) - Level 3 Advanced Certificate in Procurement and Supply Operations Association of Accounting Technicians (AAT) - Level 3 Advanced Diploma in Accounting (Logistics and Transport) Open College Network West Midlands - Level 3 Certificate in Logistics and Transport AIM Awards - Level 3 Diploma in Logistics and Transport Pearson - Level 5 Diploma in Operations and Supply Chain Management Institute of Supply Chain Management (IoSCM) - Level 3 Certificate in Supply Chain and Operations Management Association of Project Management (APM) - Level 3 Certificate in Project Management for Logistics and Supply Chain The Skills Network - Level 5 Diploma in Operations and Supply Chain Management. Requirements Level 4 Logistics and Supply Chain Management There are no specific requirements for Level 4 Logistics Management Course because it does not require any advanced knowledge or skills. Career path Level 4 Logistics and Supply Chain Management Certificates Certificate of completion Digital certificate - Included

Overview Mastering payroll systems across regions has become crucial because of globalisation. The Payroll Management Course offers an expansive curriculum designed meticulously, considering the intricacies and latest trends in payroll systems, especially emphasising the UK model.Module 01 provides an in-depth view of the Payroll System in the UK, laying the foundation for the subsequent modules. The course paves the way for advanced knowledge, from understanding the payroll basics (Module 02) to getting acquainted with company and legislation settings (Modules 03 & 04). Delve into the essentials ofpension schemes (Module 05) and the intricacies of pay elements (Module 06), and get a grip on payroll processing basics (Module 10), among various other critical topics.As we move towards the latter modules,we address standard procedures and contingencies such as employee leaving (Module 21) andyear-end procedures (Module 24), ensuring a holistic grasp of payroll management. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment in this Payroll Management Course. It is available to all students, of all academic backgrounds.The Payroll Management Course is designed for professionals in payroll, HR, accounting, and business owners who want to master payroll systems, with a focus on the UK model. It covers a wide range of topics, from basics to advanced concepts, ensuring a holistic understanding of payroll management in the UK. Requirements Our Payroll Management Course has been designed to be fully compatible with tablets and smartphones. Here are some common requirements you may need: Computer, smartphone, or tablet with internet access. English language proficiency. Required software/tools. (if needed) Commitment to study and participate. There is no time limit for completing this course; it can be studied at your own pace. Career Path Popular and Top Career Paths in a Payroll Management Course: Payroll Specialist - Salary Range: £35,000 - £50,000 annually. Payroll Manager - Salary Range: £45,000 - £80,000 annually. HR Manager - Salary Range: £50,000 - £95,000 annually. Financial Analyst - Salary Range: £40,000 - £80,000 annually. Accounting Manager - Salary Range: £55,000 - £100,000 annually. It's essential to research specific job opportunities and market conditions in your area to get a more accurate understanding of potential salaries. Course Curriculum 1 sections • 24 lectures • 04:37:00 total length •Module 01: Payroll System in the UK: 01:05:00 •Module 02: Payroll Basics: 00:00:00 •Module 03: Company Settings: 00:08:00 •Module 04: Legislation Settings: 00:07:00 •Module 05: Pension Scheme Basics: 00:06:00 •Module 06: Pay Elements: 00:14:00 •Module 07: The Processing Date: 00:07:00 •Module 08: Adding Existing Employees: 00:08:00 •Module 09: Adding New Employees: 00:12:00 •Module 10: Payroll Processing Basics: 00:11:00 •Module 11: Entering Payments: 00:12:00 •Module 12: Pre-Update Reports: 00:09:00 •Module 13: Updating Records: 00:09:00 •Module 14: e-Submissions Basics: 00:09:00 •Module 15: Process Payroll (November): 00:16:00 •Module 16: Employee Records and Reports: 00:13:00 •Module 17: Editing Employee Records: 00:07:00 •Module 18: Process Payroll (December): 00:12:00 •Module 19: Resetting Payments: 00:05:00 •Module 20: Quick SSP: 00:10:00 •Module 21: An Employee Leaves: 00:13:00 •Module 22: Final Payroll Run: 00:07:00 •Module 23: Reports and Historical Data: 00:08:00 •Module 24: Year-End Procedures: 00:09:00

Description: Personal finance refers to the management of an individual's monetary sources. This is the process to ensure the need to budget, save, and spend wisely their resources. Learning how to do your finances will help you and your family achieve financial security. This course is designed to teach you personal banking and budgeting starting from the basics which will eventually lead you to develop your financial IQ. Who is the course for? For employees who are aiming to understand personal finances Anyone who is interested in attaining financial security and securing their future Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: This Advanced Diploma in Personal Finance course will be useful and would be beneficial for people who want to know more about their financial status. Also, this will be useful to different accounting and management occupations especially the following careers which help people in their finances: Accountant Bookkeeper Consultant Financial Adviser Financial Analyst Public Accountant. Introduction to Personal Finance Introduction 00:30:00 Setting Goals Towards Successful Financial Planning 00:30:00 Decide Your Spending Prudently 01:00:00 Dealing With Mountains Of Debt And Credit 01:00:00 All You Need To Know About Taxes 01:00:00 Jumping On The Right Insurance Plan 00:30:00 Getting Help From Professional Financial Experts 00:30:00 DIY With Personal Financial Software 00:30:00 Savings & Compounding Interest 00:30:00 Smart investments steps 01:00:00 Budgets and Money Management Finance Jeopardy 00:15:00 The Fundamentals of Finance 00:15:00 The Basics of Budgeting 00:15:00 Parts of a Budget 00:15:00 The Budgeting Process 00:30:00 Budgeting Tips and Tricks 00:15:00 Monitoring and Managing Budgets 00:15:00 Crunching the Numbers 00:15:00 Getting Your Budget Approved 00:15:00 Comparing Investment Opportunities 00:15:00 ISO 9001:2008 00:15:00 Directing the Peerless Data Corporation 00:30:00 Personal Banking and Budgeting 4 Tips For Understanding The Basic Banking Processes 01:00:00 5 Great Tips On Understanding Your Credit 00:30:00 4 Great Tips On Understanding Bank Fees 00:30:00 3 Great Tips On Setting Up And Maintaining A Budget 00:15:00 4 Great Tips On Reaching Your Savings Goals 01:00:00 4 Great Tips On Dealing With Errors And ID Theft 00:30:00 5 Great Tips On Fixing Your Credit Report 00:15:00 3 Great Tips On Choosing A Credit Card 00:30:00 3 Great Tips On Choosing An Installment Loan 00:30:00 3 Great Tips On Buying A Home 00:30:00 Developing Financial IQ Introduction To Financial IQ 01:00:00 Essential Ways To Build Wealth 01:00:00 When's The Right Time To Invest? 01:00:00 The Methods Of Financial Mess 01:00:00 Mock Exam Mock Exam- Advanced Diploma in Personal Finance 00:30:00 Final Exam Final Exam- Advanced Diploma in Personal Finance 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Business GCSE Distance Learning Course by Oxbridge

By Oxbridge

Heads up, aspiring business magnates!📣 If you have a knack for numbers, a budding enthusiasm for marketing, and envisage yourself spearheading a business or contributing significantly to an organisation's growth and success, then our AQA-accredited GCSE Business course is tailor-made for you. Engage in six comprehensive modules with our course, exploring the intricacies of business operations and finance, problem-solving and decision making, qualitative and quantitative data analysis, and much more. Your individual tutor will provide unlimited assistance as you dive into understanding the factors influencing an organisation's operations, decision-making processes, and the usage of appropriate business terminology. The competencies you develop will be highly coveted by colleges, universities, and a plethora of professions including accounting, law, management consultancy, stockbroking, and human resources. Designed for convenient online study at your pace, this AQA GCSE Business course provides unrestricted access to your personal tutor via email and telephone. The course induction and assignments are structured to nurture the skills and knowledge you need to thrive in your examinations. Expect: A newly minted course, crafted to the latest specification with engaging content Fast track available for this course (for exams in 2022) Access to our network of partner exam centres (guaranteed exam venue) Unlimited tutor support – personalised study plan and consistent support Exam pass guarantee (Don't pass the first time? We've got you covered for the next exam!) Immerse yourself in the dynamics of business operations, finance, problem-solving, and decision making, and data analysis! About the awarding body Awarding body: AQA Our course code: X807 Qualification code: 8132 Official Qualification Title: GCSE Business AQA qualifications are internationally acclaimed, taught in 30 countries worldwide, highly esteemed by employers and universities and designed to help young people advance to their next life stage. ⏱ Study Hours Allocate between 120 and 150 hours for studying, plus extra time for assignments. 👩🏫 Study Method Delivered via our dynamic online learning platform, the course includes various media resources such as videos, quizzes, and interactive activities. 📆 Course Duration Upon enrolment, you'll have two years to study and take your exams, with continued unlimited tutor support. Access the learning materials via MyOxbridge, our online platform. 📋 Assessment Enrolments are now open for examinations from Summer 2022. You'll be required to complete two standard GCSE written exams. Guaranteed exam spaces are provided at our nationwide centres. During the course, you'll complete assignments for tutor feedback and monitoring your progress. 👩🎓 Course Outcomes Upon successful completion, you'll earn a GCSE in Business, issued by AQA, a syllabus (8132) selected specifically for its suitability for distance learning. ℹ️ Additional Information Official Qualification Title - GCSE Business Difficulty - Level 2 Entry requirements - Strong reading and writing English skills are highly recommended. Course Content Business in the real world Influences on business Business operations Human resources Marketing Finance Each module covers the core areas of business, equipping you with understanding of functions and sectors, technology and ethical implications, personnel management, market research strategies and financial calculations, respectively. Unlock your potential in the business world with our GCSE Business Correspondence Programme! 🚀

ICA Diploma in Financial Crime Prevention

By International Compliance Association

ICA International Diploma in Financial Crime Prevention This advanced level qualification will better equip you to meet the many challenges associated with identifying, understanding, and mitigating financial crime risks including fraud, cybercrime, corruption, money laundering and terrorist financing. It will deepen your understanding and enhance your professional credibility. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate. This course is awarded in association with Alliance Manchester Business School, the University of Manchester. how will you learn 9-month course assessed by 3 written assignments (3,000 - 3,500 words) A mixture of guided online study and participation in live sessions:2 x virtual classrooms1 x immersive learning scenario (putting you at the centre of a story)3 x tutorials (a chance to discuss elements of the course in more depth)3 x assessment preparation sessions Videos covering the latest industry developments and case studies Access to the ICA members' portal containing additional reading and resources Proactive support throughout the course to help you stay on track Completion of the ICA Diploma in Financial Crime Prevention training course will produce the following outcomes: Professional qualification: ICA Diploma in Financial Crime Prevention-participants will be able to use the designation 'Dip (Fin.Crime).' Eligibility to apply for Professional membership of the ICA Detailed knowledge on the nature of financial crime Practical understanding of best practice and how to prevent financial crime This course is awarded in association with Alliance Manchester Business School, the University of Manchester. This ICA Diploma in Financial Crime Prevention provides Participants with in-depth knowledge and skills in the following areas: Understanding and managing financial crime Practical application of the International Standards The prevention and detection of specific financial crime risks Data and information security Bribery and corruption Electronic crime Investigation, prosecution and recovery.

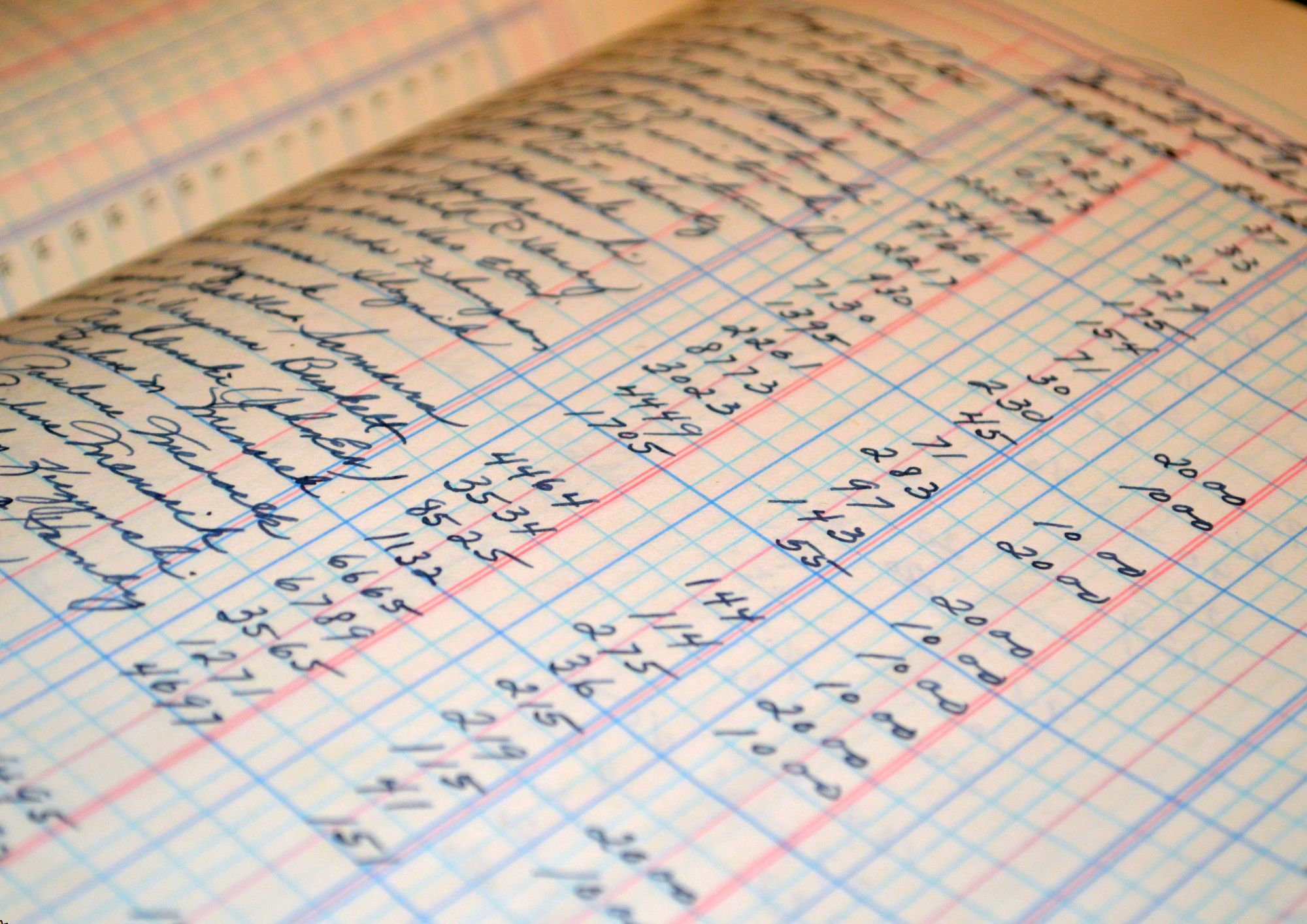

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Self Assessment Tax Return Filing UK

By iStudy UK

The Self Assessment Tax Return Filing UK course teaches you how to file an UK (United Kingdom) self-assessment tax return. You will also learn about the process of online self-assessment. If you need to submit a British self-assessment tax return and want a demonstration of how it is done, then the course is the best option for you. Throughout the course, you will look at the complete process that you need to face for submitting your UK tax return. However, the course does not focus on the bookkeeping or accounting side or how to calculation tax or the bookkeeping for allowable and disallowable expenses. Upon completion, you will be able to submit your UK tax return by yourself. What Will I Learn? File a UK (United Kingdom) self assessment tax return Understand the process of self-assessment Requirements Students need to be familiar with the UK HMRC organisation Module 01 Introduction to Self Assessment FREE 00:06:00 Logging into the HMRC System FREE 00:06:00 Fill in the Self Assessment Return 00:06:00 Module 02 Viewing the Calculation 00:03:00 Submitting the Assessment 00:02:00 Conclusion 00:05:00 Course Certification