- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Financial Management - (Accounting, Forecasting)

By Compliance Central

Financial Management course is for those who want to advance in this field. Throughout this Financial Management course, you will learn the essential skills and gain the knowledge needed to become well versed in Financial Management. Our Financial Management course starts with the basics of Financial Management and gradually progresses towards advanced topics. Therefore, each lesson of this Financial Management is intuitive and easy to understand. So, stand out in the job market by completing the Financial Management course. Get an accredited certificate and add it to your resume to impress your employers. 2 Free Courses with the Financial Management course Free Course 01: Introduction to Accounting Free Course 02: Making Budget & Forecast Key Highlights CPD Accredited Financial Management Course Unlimited Retake Exam & Tutor Support Easy Accessibility to the Financial Management Course Materials 100% Learning Satisfaction Guarantee Self-paced Financial Management Course Lifetime Access Financial Management Curriculum of the Financial Management Course Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Financial Management course. Requirements To enrol in this Financial Management course, all you need is a basic understanding of the English Language and an internet connection. Career path After completing this course, you can explore trendy and in-demand jobs related to Financial Management. Financial Analyst - £40,000-£60,000 per year. Financial Manager - £60,000-£90,000 per year. Investment Banker - £80,000-£150,000 per year. Corporate Treasurer - £50,000-£80,000 per year. Risk Manager - £50,000-£90,000 per year. Financial Consultant - £40,000-£70,000 per year. Certificates 3 CPD Accredited PDF Certificate Digital certificate - Included Get 3 CPD Accredited PDF Certificates for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

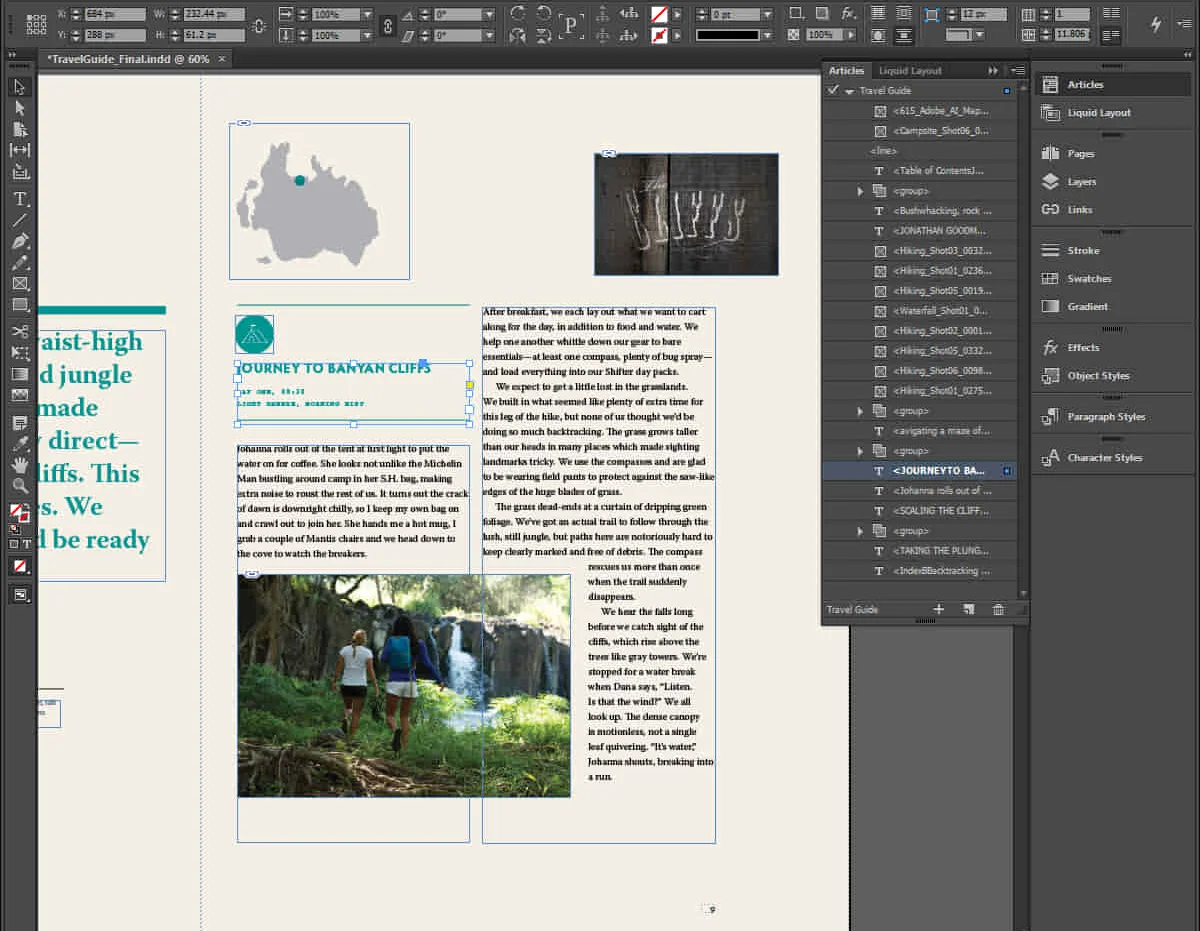

Advanced Adobe InDesign Training Program

By ATL Autocad Training London

Advanced Adobe InDesign Training Program Learn InDesign with a course at Real Animation Works. Choose from Weekend, Weekday or Evening Courses and learn from expert tutors. Benefit from professional InDesign training conducted by Adobe Certified Instructors with extensive graphic design expertise. Check our Website Duration: 10 hours. Approach: 1-on-1 and personalized attention. Schedule: 1-on-1 sessions, available Monday to Saturday from 9 am to 7 pm. Course Title: Comprehensive Adobe InDesign Training Duration: 10 Hours Session 1: Introduction to Adobe InDesign (1 hour) Overview of InDesign interface and tools Document setup: page size, margins, and columns Basic text formatting and paragraph styles Introduction to working with images and graphics Session 2: Advanced Text Formatting and Styles (1 hour) In-depth exploration of character and paragraph styles Advanced text composition techniques Managing text flow with threaded frames Incorporating special characters for typographic control Session 3: Mastering Images and Graphics (1 hour) Advanced image manipulation: resizing, cropping, and effects Text wrap options and integrating text with images Creating image frames and working with transparency Interactive elements: buttons and hyperlinks Session 4: Layout Design Techniques (1.5 hours) Grids and guides: precise alignment and spacing Working with layers for efficient design management Advanced object arrangement and distribution Utilizing master pages for consistent layout elements Session 5: Advanced Document Features (1.5 hours) Tables and data merge: organizing and automating data Interactive PDFs: forms, multimedia, and navigation Advanced print preparation: color management and preflighting Exporting for various digital and print outputs Session 6: Advanced Special Effects (1 hour) Creating drop shadows, gradients, and blending modes Working with typography on a path Advanced text and image effects Integrating Adobe Illustrator and Photoshop files Session 7: Project-Based Learning (1 hour) Participants work on a comprehensive project applying learned skills Instructor-guided project review and feedback Session 8: Tips, Tricks, and Time-Saving Techniques (1 hour) Productivity hacks and shortcuts Troubleshooting common issues and errors Best practices for efficient workflow and collaboration Session 9: Portfolio Building and Career Guidance (0.5 hour) Creating a professional portfolio showcasing InDesign projects Career advice and industry insights from the instructor Session 10: Q&A, Certification, and Course Completion (0.5 hour) Addressing participant questions and concerns Certificate of Completion distribution and course review Celebrating the completion of the Adobe InDesign training journey Upon completion of the Comprehensive Adobe InDesign Training course, participants will: Master Core Skills: Develop proficiency in essential InDesign tools, functions, and techniques for effective layout design. Advanced Text and Typography: Understand advanced text formatting, paragraph styles, and typographic controls for professional typography. Image Manipulation Expertise: Acquire skills in advanced image manipulation, text wrapping, transparency, and integration of multimedia elements. Advanced Layout Design: Learn precise layout techniques using grids, guides, layers, and master pages for consistency and visual appeal. Interactive Document Creation: Create interactive PDFs, forms, multimedia-rich content, and navigation elements for digital publications. Data Management and Automation: Master tables, data merge, and automation features for organized data presentation and streamlined workflow. Print and Export Proficiency: Understand color management, preflighting, and export settings for high-quality print and digital output. Special Effects and Integration: Apply advanced effects, gradients, blending modes, and integrate InDesign with Illustrator and Photoshop files seamlessly. Project-Based Expertise: Develop a comprehensive portfolio-worthy project, showcasing a range of InDesign skills and creativity. Efficient Workflow and Troubleshooting: Implement time-saving techniques, shortcuts, and troubleshoot common design challenges effectively. Career Readiness: Gain valuable insights into industry practices, portfolio building, and career guidance for pursuing opportunities in graphic design and desktop publishing. Versatile Learning Choices: Opt for either in-person sessions at our London center or engage in interactive online learning. Both options offer hands-on experience, detailed demonstrations, and ample chances for inquiries. Compatibility and Assistance: InDesign operates smoothly on Windows and Mac systems. Participants receive a comprehensive InDesign training manual for reference and an electronic certificate upon course completion. Additionally, enjoy lifelong email assistance from your InDesign instructor. Entry Requirements: No prior InDesign expertise is necessary. The training concentrates on InDesign 2023, relevant to recent software updates. Guarantees: We ensure exceptional value for your investment, guaranteeing your acquisition of essential skills and concepts during the training. Course Highlights: Master advanced typography techniques, including paragraph styles, character styles, and nested styles. Explore multi-page layout design, long document management, and advanced table formatting. Acquire skills to create and manipulate complex shapes, vector graphics, and custom illustrations. Learn efficient workflows for data merging, interactive documents, and digital/print output. Collaborate seamlessly with other Adobe Creative Cloud applications. Upon completion, receive a Certificate of Completion and access recorded lessons for self-paced learning. Expert Instruction: Learn from certified tutors and industry experts, gaining valuable insights, tips, and best practices for professional-level designs. Flexible Learning Options: Choose between in-person or live online sessions based on your schedule. Sessions are available Monday to Sunday, from 9 am to 8 pm, accommodating your convenience. Lifetime Support: Benefit from lifetime email support for continuous assistance. Our dedicated team is available to address your queries and challenges. Explore Adobe InDesign - Free Trial: https://www.adobe.com/uk/products/indesign/free-trial-download.html

Sage Bookkeeping & Tax Accounting

By Compliance Central

Are you looking to enhance your Sage Bookkeeping skills? If yes, then you have come to the right place. Our comprehensive courses on Sage Bookkeeping will assist you in producing the best possible outcome by learning the Sage Bookkeeping skills. This Sage Bookkeeping Bundle Includes: Course 01: Sage 50 Accounts Course 02: Xero Accounting and Bookkeeping Online Course 03: Introduction to Accounting Course 04: Tax Accounting Course 05: Financial Analysis Learning Outcome: How to setup customer and vendor How to create a project Learn about customer invoices, vendor invoices and credit memos How to evaluate capital assets Learn about bank payments and transfers Supplier and Customer Payment and DD STO How the Bank Reconciliation current account System Works Credit card account transfer ideas How to create salary structure How VAT-Expenditure Tax Returns and Year End Journals Work How to prepare accountant's report and correct errors So, enrol in our Sage Bookkeeping bundle now! Key Highlights for Sage Bookkeeping Course: Lifetime Access to All Learning Resources An Interactive, Online Course A Product Created By Experts In The Field Self-Paced Instruction And Laptop, Tablet, And Smartphone Compatibility 24/7 Learning Support Free Certificate After Completion Curriculum Breakdown of the Sage Bookkeeping course: Sage 50 Bookkeeper - Coursebook Introduction and Task 1 Task 2 Setting up the System Task 3 a Setting up Customers and Suppliers Task 3 b Creating Projects Task 3 c Supplier Invoice and Credit Note Task 3 d Customer Invoice and Credit Note Task 4 Fixed Assets Task 5 a and b Bank Payment and Transfer Task 5 c and d Supplier and Customer Payments and DD STO Task 6 Petty Cash Task 7 a Bank Reconnciliation Current Account Task 7 b Bank Reconciliation Petty Cash Task 7 c Reconciliation of Credit Card Account Task 8 Aged Reports Task 9 a Payroll 9 b Payroll Journal Task 10 Value Added Tax - Vat Return Task 11 Entering opening balances on Sage 50 Task 12 a Year end journals - Depre journal Task 12 b Prepayment and Deferred Income Journals Task 13 a Budget Task 13 b Intro to Cash flow and Sage Report Design Task 13 c Preparation of Accountants Report & correcting Errors (1) Certification CPD Accredited (CPD QS) Certificate Digital (PDF) & Hardcopy certificates are available CPD 50 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this course. However, This course particularly effective for- Students related to Sage Bookkeeping Recent graduates Job Seekers in related field Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill Requirements Learners seeking to enrol for the Sage Bookkeeping Course should meet the following requirements; Basic knowledge of English Language, which you have already Be age 16 years or above Basic Knowledge of Information & Communication Technologies for studying online or digital platform. Stable Internet or Data connection in your learning devices. Career path After completing this course, you can explore trendy and in-demand jobs related to Sage Bookkeeping, such as- Bookkeeper Payroll Specialist Payroll Administrator Accounts Payable and Payroll Account Assistant Payroll Manager Explore each of the roles available and how you can start your career in Sage Bookkeeping course. Certificates CPD Accredited PDF Certificate Digital certificate - Included

UI Design for Voice Assistants: Creating Conversational Interfaces

By Compete High

Overview: UI Design for Voice Assistants: Creating Conversational Interfaces Welcome to the future of user interfaces! In today's digital landscape, voice assistants are becoming increasingly prevalent, revolutionizing the way users interact with technology. Our comprehensive course, 'UI Design for Voice Assistants: Creating Conversational Interfaces,' equips you with the knowledge and skills needed to craft engaging and intuitive conversational experiences. Module 1: Introduction to Voice Assistants and Conversational UI Get acquainted with the fundamentals of voice assistants and conversational user interfaces. Explore the evolution of voice technology and its impact on user interactions. Learn about the key principles and challenges of designing for conversational UI. Module 2: User-Centered Design for Voice Assistants Put the user at the center of your design process. Discover techniques for understanding user needs, behaviors, and preferences in the context of voice interactions. Learn how to conduct user research and usability testing to create user-centric voice experiences. Module 3: Designing Effective Voice Interactions Master the art of crafting natural and meaningful voice interactions. Explore best practices for structuring conversations, managing dialogue flow, and providing clear prompts and feedback. Dive into the psychology of conversation and learn how to create engaging user experiences. Module 4: Speech Recognition and Natural Language Understanding (NLU) Gain insights into the underlying technologies powering voice assistants. Understand the principles of speech recognition and natural language understanding (NLU). Learn how to leverage NLU to interpret user inputs accurately and respond intelligently. Module 5: Designing Voice User Interfaces (VUI) Learn the principles of designing intuitive voice user interfaces (VUI). Explore techniques for organizing information, designing navigation systems, and creating voice commands. Understand how to optimize VUI for accessibility and inclusivity. Module 6: Visual Design for Voice Assistants Explore the role of visual design in enhancing the user experience of voice assistants. Learn how to leverage visual elements such as typography, color, and layout to complement voice interactions. Discover strategies for designing multimodal interfaces that seamlessly integrate voice and visual components. Whether you're a seasoned UI/UX designer looking to expand your skill set or a newcomer eager to dive into the world of voice interfaces, our course provides a comprehensive foundation for designing compelling conversational experiences. Join us and embark on a journey to shape the future of human-computer interaction with UI Design for Voice Assistants: Creating Conversational Interfaces. Course Curriculum Module 1_ Introduction to Voice Assistants and Conversational UI Introduction to Voice Assistants and Conversational UI 00:00 Module 2_ User-Centered Design for Voice Assistants User-Centered Design for Voice Assistants 00:00 Module 3_ Designing Effective Voice Interactions Designing Effective Voice Interactions 00:00 Module 4_ Speech Recognition and Natural Language Understanding (NLU) Speech Recognition and Natural Language Understanding (NLU) 00:00 Module 5_ Designing Voice User Interfaces (VUI) Designing Voice User Interfaces (VUI) 00:00 Module 6_ Visual Design for Voice Assistants Visual Design for Voice Assistants 00:00

Navigating numbers isn’t just about calculators and spreadsheets—it’s about strategy, precision, and a firm grasp of financial dynamics. The Account & Finance Manager Course offers an engaging dive into the key concepts, methods, and responsibilities expected of those managing accounts and overseeing finance. From budgeting and forecasting to financial reporting and risk oversight, this course equips learners with the theoretical and strategic knowledge needed to make sound financial decisions and manage accounts with confidence. Whether you're aiming to understand ledgers or lead balance sheets, you’ll find the content refreshingly clear and firmly focused. This course doesn’t promise magic formulas or boardroom secrets, but it does offer structured guidance through the often-chaotic corridors of modern finance. It’s been designed for learners who value solid theory, well-organised content, and the kind of accounting insight that helps one decode balance sheets faster than you can say “year-end audit.” Whether you're brushing up your knowledge or looking to shift into a management role, the content is engaging enough to keep you interested—and sharp enough to keep you ahead. Key Benefits Accredited by CPD Instant e-certificate Fully online, interactive course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Curriculum: Module 01: Introduction to Accounting Module 02: The Role of an Accountant Module 03: Accounting Concepts and Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income statement Module 07: Financial statements Module 08: Cash Flow Statements Module 09: Understanding Profit and Loss Statement Module 10: Financial Budgeting and Planning Module 11: Auditing Finance & Investment Module 12: Introduction to Finance Module 13: Essential Skill for Financial Advisor Module 14: Financial Planning Module 15: Wealth Management and Guide to Make Personal Financial Statements Module 16: Financial Risk Management and Assessment Module 17: Investment Planning Module 18: Divorce Planning Module 19: Google Analytics for Financial Advisors Course Assessment You will immediately be given access to a specifically crafted MCQ test upon completing an online module. For each test, the pass mark will be set to 60%. Certificate Once you've successfully completed your course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Account & Finance Manager training is ideal for highly motivated individuals or teams who want to enhance their skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Learn the essential skills and knowledge you need to excel in your professional life with the help & guidance from our Account & Finance Manager training. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

Materials Handling Safety Training

By Compete High

Course Overview: Materials Handling Safety Training In today's industrial and warehouse environments, the efficient and safe handling of materials is paramount. The 'Materials Handling Safety Training' course is designed to equip participants with the knowledge and skills necessary to navigate various hazards and challenges associated with material handling operations. From loading docks to forklift operations, this comprehensive training program focuses on promoting a culture of safety and adherence to best practices. Module 1: Introduction to Loading Dock Safety Equipment and Maintenance Understanding the importance of loading dock safety Identifying loading dock hazards Proper maintenance and inspection of loading dock equipment Safety protocols for loading and unloading procedures Module 2: Safe Forklift Operations and Hazardous Materials Handling Forklift operation fundamentals Pre-operation inspection and maintenance procedures Techniques for safe maneuvering and load handling Handling hazardous materials safely and responsibly Module 3: Fall Protection and Fire Safety Recognizing fall hazards in the workplace Implementing fall prevention measures and equipment Fire prevention and extinguishing techniques Emergency evacuation procedures Module 4: Material Handling and Traffic Management Efficient material handling techniques Traffic management in busy warehouse environments Pedestrian safety protocols Organizing and optimizing material flow for productivity and safety Module 5: Hazard Communication and Security Awareness Understanding chemical hazards and safety data sheets Proper labeling and storage of hazardous materials Recognizing and reporting security threats Protocols for handling suspicious packages or activities Module 6: Incident Reporting and Safety Culture Importance of incident reporting and investigation Procedures for documenting and reporting accidents or near misses Promoting a culture of safety and accountability in the workplace Continuous improvement and feedback mechanisms for enhancing safety practices Course Format: Each module consists of interactive presentations, case studies, and practical exercises. Participants will have access to online resources and materials for further learning. Assessments and quizzes will be conducted to ensure understanding and retention of key concepts. Experienced instructors will be available for guidance and clarification throughout the course. Who Should Attend: Warehouse workers Material handlers Forklift operators Safety officers Supervisors and managers overseeing material handling operations By completing this course, participants will not only enhance their own safety awareness but also contribute to creating a safer and more efficient work environment for themselves and their colleagues. Course Curriculum Module 1 Introduction to Loading Dock Safety Equipment and Maintenance Introduction to Loading Dock Safety Equipment and Maintenance 00:00 Module 2 Safe Forklift Operations and Hazardous Materials Handling Safe Forklift Operations and Hazardous Materials Handling 00:00 Module 3 Fall Protection and Fire Safety Fall Protection and Fire Safety 00:00 Module 4 Material Handling and Traffic Management Material Handling and Traffic Management 00:00 Module 5 Hazard Communication and Security Awareness Hazard Communication and Security Awareness 00:00 Module 6 Incident Reporting and Safety Culture Incident Reporting and Safety Culture 00:00

PyTorch for Deep Learning and Computer Vision

By Packt

Learn to build highly sophisticated deep learning and Computer Vision applications with PyTorch

Professional Certificate Course in The Macroeconomics Environment in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of a course on "Macroeconomics Environment" is to provide students with an understanding of the economy as a whole, including its significant aggregates, such as national income, output, employment, and inflation. The course explores the relationship between these variables and the factors influencing them, including monetary policy, fiscal policy, international trade, and globalization.After the successful completion of the course, you will be able to learn about the following, Define and measure national income. Appreciate the circular flow and its components. Understand the Government policies, instruments, and objectives. Understand aggregate demand and Analyze aggregate supply. Understand the nature and application of Fiscal policy, monetary policy, inflation, its types, inflationary and deflationary gaps, and employment and unemployment dynamics. Explore concepts such as the balance of payment and exchange rate to understand international trade and globalization. The course aims to explore the relationship between these variables and the factors that influence them, including monetary policy, fiscal policy, international trade, and globalization. Students will learn about the various macroeconomic theories and models that explain the behaviour of the economy in the short run and the long run. They will also be introduced to the different macroeconomic policy tools that governments and central banks use to stabilize the economy, such as interest rate adjustments, government spending, and taxation. The course aims to explore the relationship between these variables and the factors that influence them, including monetary policy, fiscal policy, international trade, and globalization. Students will learn about the various macroeconomic theories and models that explain the behavior of the economy in the short run and the long run. They will also be introduced to the different macroeconomic policy tools that governments and central banks use to stabilize the economy, such as interest rate adjustments, government spending, and taxation. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. The Macroeconomic Environment Self-paced pre-recorded learning content on this topic. The Macroeconomics Environment Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Economist Macroeconomic Analyst Policy Analyst Financial Analyst Investment Banker Central Banker International Economist Economic Consultant Research Analyst Risk Management Analyst Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Fundamentals of Corporate Finance

By The Teachers Training

Overview Fundamentals of Corporate Finance Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Fundamentals of Corporate Finance Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Fundamentals of Corporate Finance Lesson 01: Introduction To Corporate Finance 00:38:00 Lesson 02: Financial Statement Analysis For Corporate Finance 01:19:00 Lesson 03: Time Value Of Money Concepts 00:28:00 Lesson 04: Interest Rates 01:00:00 Lesson 05: How To Value Stocks 00:53:00 Lesson 06: Stock Valuation 00:53:00 Lesson 07: Risk And Returns In Capital Management 00:26:00 Lesson 08: Cost Of Capitals - Fundamentals 00:21:00 Lesson 09: Cost Of Capital And Effect Of Leverage 00:38:00 Lesson 10: Systematic Risk And Portfolio Returns 00:06:00 Lesson 11: Investment Decision Rules And Calculating Cash Flow 01:13:00 Lesson 12: Working Capital Management - Part 1 00:57:00 Lesson 13: Working Capital Management - Part 2 01:07:00