- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

23530 Courses delivered On Demand

Physiotherapy management of Whiplash Injuries

By Physiotherapy Online

This course aims to be a concise clinical handbook for therapists, nurses, and physician assistants who treat musculoskeletal and neurological complications of whiplash injury. It covers the anatomy, and mechanism of injury, with orthopedic and neurological complications and rehabilitation strategies for the same. This course is backed by an evidence-based approach , the latest clinical practice guidelines, and NICE guidelines.

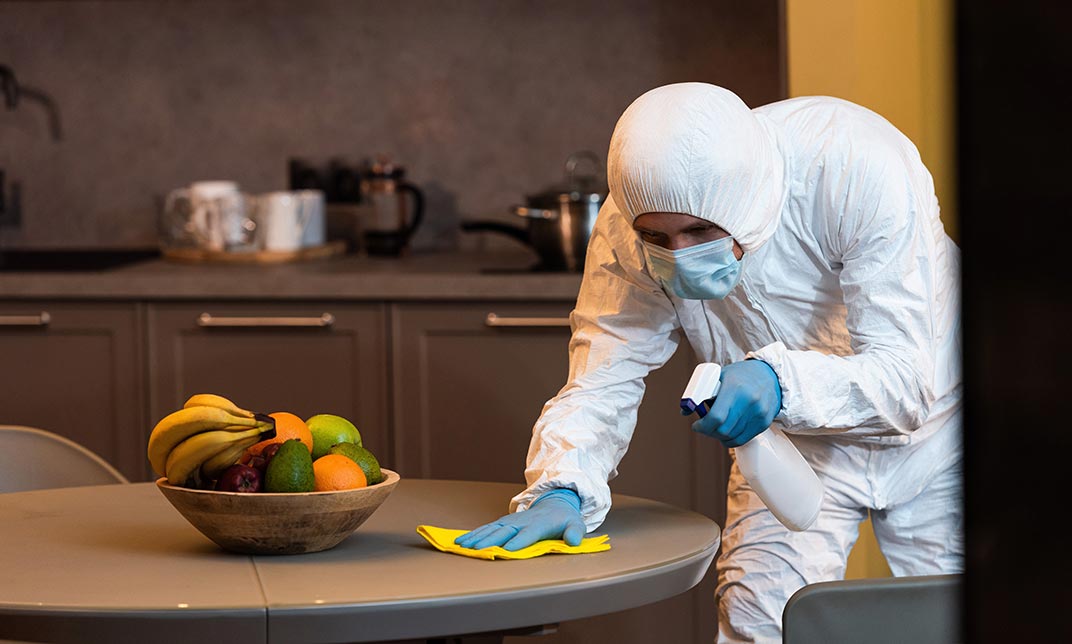

Food Safety Management in Covid-19 Pandemic Part - 2

By iStudy UK

Course Description Get instant knowledge from this bite-sized Food Safety Management in Covid-19 Pandemic Part - 2 course. This course is very short and you can complete it within a very short time. In this Food Safety Management in Covid-19 Pandemic Part - 2 course you will get fundamental ideas of food safety management, the key understanding of hazard control measures, refrigeration and so on. Enrol in this course today and start your instant first step towards learning about food and temperature control. Learn faster for instant implementation. Learning Outcome Familiarise with food and temperature control Understand hazard control measures and refrigeration Gain in-depth knowledge of food safety legislation Deepen your understanding of physical, chemical and allergenic hazards How Much Do Food Safety Managers Earn? Senior - £56,000 (Apprx.) Average - £38,000 (Apprx.) Starting - £26,000 (Apprx.) Requirement Our Food Safety Management in Covid-19 Pandemic Part - 2 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Food Safety Management in Covid-19 Pandemic Part - 2 Module 01: Food and Temperature Control 00:31:00 Module 02: Hazard Control Measures and Refrigeration 00:27:00 Module 03: Physical, Chemical and Allergenic Hazards 00:27:00 Module 04: Food Safety Legislation 00:26:00 Assignment Assignment - Food Safety Management in Covid-19 Pandemic Part - 2 00:00:00

Creating an Unresourced Project with Oracle Primavera P6 PPM

By Packt

This course is designed for project managers and planners who need to plan and manage projects without resources in Oracle Primavera P6 PPM. You will learn how to navigate the user interface, create project plans, define activities, and manage project timelines without relying on resource constraints.

The 'Certification in Environmental Management - Level 3' course offers a comprehensive understanding of environmental issues, planning, ecosystem management, environmental law, and policies. Participants will learn about environmental management systems, audits, and strategies to improve environmental performance. Learning Outcomes: Gain knowledge about the environment and its ecological systems. Understand various environmental issues and challenges. Learn about the principles and techniques of environmental planning. Familiarize with the concept of environmental management systems. Explore ecosystem management approaches for sustainable development. Understand the legal framework and policies related to environmental protection. Discover strategies to enhance environmental performance and sustainability. Learn the process of conducting environmental management audits. Explore situational environmental management techniques for specific contexts. Review and assess the performance of environmental management initiatives. Why buy this Certification in Environmental Management - Level 3? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Certification After studying the course materials of the Certification in Environmental Management - Level 3 there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Certification in Environmental Management - Level 3 course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Certification in Environmental Management - Level 3 does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Certification in Environmental Management - Level 3 was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Environmental Consultant: £25,000 - £40,000 Per Annum Sustainability Officer: £24,000 - £35,000 Per Annum Environmental Educator: £20,000 - £30,000 Per Annum Waste Management Officer: £22,000 - £35,000 Per Annum Environmental Health Officer: £26,000 - £40,000 Per Annum Conservation Officer: £21,000 - £34,000 Per Annum Course Curriculum Module 01: Environment and Ecology Environment and Ecology 00:19:00 Module 02: Environmental Issues Environmental Issues 00:22:00 Module 03: Environmental Planning Environmental Planning 00:19:00 Module 04: Environmental Management System Environmental Management System 00:29:00 Module 05: Ecosystem Management Ecosystem Management 00:26:00 Module 06: Environmental Law and Policy Environmental Law and Policy 00:22:00 Module 07: Improving Environmental Performance Improving Environmental Performance 00:23:00 Module 08: Environmental Management Audit Environmental Management Audit 00:35:00 Module 09: Situational Environmental Management Situational Environmental Management 00:25:00 Module 10: Review and Performance Review and Performance 00:16:00 Assignment Assignment - Certification in Environmental Management - Level 3 00:00:00

Site Management Training Course

By Imperial Academy

Level 5 QLS Endorsed Course | CPD & CiQ Accredited | Audio Visual Training | Free PDF Certificate | Lifetime Access

Social Housing Management

By Compliance Central

***Secure Your Future in Social Housing: Expert Knowledge Awaits*** According to a recent report by the National Housing Federation, there is a significant shortage of social housing in the UK, with an estimated need for 90,000 new social rented homes every year. This growing demand highlights the crucial role that social housing managers play in providing secure and affordable housing for countless individuals and families. This comprehensive Social Housing Management course equips you with the theoretical knowledge and understanding necessary to thrive in this rewarding career path. Learning Outcomes By the end of this course, you will be able to: Grasp the core principles of social housing and its role within the UK housing system. Effectively manage the tenant selection process, ensuring suitable placements and fostering positive landlord-tenant relationships. Implement strategies for rent collection and arrears management, maintaining financial stability within social housing properties. Oversee the maintenance, safety, and security of social housing, creating a comfortable and secure living environment for tenants. Encourage resident involvement and foster a sense of community within social housing developments. Identify and address anti-social behaviours, promoting a peaceful and harmonious living environment. This Social Housing Management course delves into six key modules, providing a well-rounded understanding of the field. Module 1: Introduction to Social Housing establishes the foundation, exploring the history, policy framework, and different types of social housing in the UK. Module 2: Tenant Selection and Tenant Management equips you with the skills to effectively assess applications, select suitable tenants, and manage tenancy agreements. Module 3: Managing Rental Income and Arrears explores strategies for rent collection, budgeting, and dealing with arrears in a professional and sensitive manner. Module 4: Maintenance, Safety, and Security of Social Housing equips you with the knowledge to oversee property maintenance, ensure adherence to safety regulations, and implement security measures. Module 5: Resident Involvement in Social Housing explores strategies for fostering resident engagement, building a sense of community, and addressing resident concerns. Module 6: Dealing with Anti-Social Behaviours equips you with the skills to identify and address anti-social behaviours, promoting a positive living environment for all residents. This course adopts a theoretical approach, providing a strong knowledge base for a successful career in social housing management. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This social housing course is ideal for: Individuals seeking a career change in the social housing sector. Those who aspire to become social housing managers. Housing professionals looking to enhance their theoretical knowledge. Volunteers or charity workers supporting social housing initiatives. University graduates interested in social housing policy and management. Anyone passionate about creating positive change in the housing sector. Requirements There are no specific prerequisites for this course. However, a basic understanding of housing issues in the UK and an interest in social housing management would be beneficial. Career path A career in social housing management offers a rewarding path to make a real difference in people's lives. Here are some potential career paths: Social Housing Letting Officer Social Housing Neighbourhood Manager Tenancy Sustainment Officer Anti-Social Behaviour Officer Resident Liaison Officer Social Housing Area Manager Housing Policy Officer (Social Housing) Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

In today's dynamic professional landscape, mastering the essentials of Managing a Team is imperative for success. This comprehensive course covers critical areas such as defining teams, leadership, building high-performing teams, motivating members, talent management, stress management, communication, negotiation, change management, time management, conflict resolution, risk management, and handling virtual teams. With workplaces evolving rapidly, understanding these fundamentals is indispensable. Not only does it enhance daily operational efficiency, but it also fosters a conducive work environment, leading to increased productivity and employee satisfaction. Moreover, possessing these skills significantly bolsters job prospects in the UK job market, with employers valuing team management expertise. Professionals equipped with Managing a Team Essentials can expect competitive salaries, with averages ranging from £35,000 to £50,000 annually. The demand for such expertise is on the rise, with an increase of approximately 10% annually, highlighting its enduring relevance in today's corporate landscape. Key Features: CPD Certified Managing a Team Essentials Course Free Certificate Developed by Specialist Lifetime Access Course Curriculum: Module 01: Defining Team Module 02: Understanding Management and Leadership Module 03: Building High Performing Teams Module 04: Motivating Team Members Module 05: Talent Management Module 06: Stress Management and Mental Health Module 07: Succession Planning Module 08: Communication Skills Module 09: Negotiation Techniques Module 10: Managing Change Module 11: Managing Time Module 12: Managing Conflict Module 13: Risk Management Process Module 14: Managing Virtual Teams Learning Outcomes: Define team roles, structures, and dynamics for effective collaboration. Implement management and leadership strategies to guide team development. Foster high performance through effective team-building techniques and strategies. Motivate team members through recognition, rewards, and intrinsic motivators. Manage talent effectively, including recruitment, development, and retention strategies. Employ stress management and mental health techniques to support team well-being. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Managing a Team Essentials course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Managing a Team Essentials. Moreover, this course is ideal for: Managers seeking to enhance team leadership and performance. Team leaders aiming to develop effective communication and management skills. Professionals transitioning into managerial roles requiring team management competencies. Individuals aspiring to lead and motivate teams in diverse organizational settings. Anyone interested in mastering the essential skills for managing teams. Requirements There are no requirements needed to enrol into this Managing a Team Essentials course. We welcome individuals from all backgrounds and levels of experience to enrol into this Managing a Team Essentials course. Career path After finishing this Managing a Team Essentials course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Managing a Team Essentials are: Team Leader - £25K to 40K/year. Human Resources Manager - £30K to 50K/year. Project Manager - £35K to 60K/year. Operations Manager - £35K to 70K/year. Management Consultant - £40K to 80K/year. Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Debt Collector (Debt Management) Diploma Training

By Compliance Central

Incredible Things Originate from a Little Bundle Special Price Cut Offer Are you looking to enhance your Debt Collector skills? If yes, then you have come to the right place. Our comprehensive courses on Debt Collector will assist you in producing the best possible outcome by mastering the Debt Collector skills. Get 6 CPD Accredited Courses for only £41! Offer Valid for a Limited Time!! Hurry Up and Enrol Now!!! Course 01: Debt Management Plan Course 02: Financial Modelling and Valuation Methods Course 03: Financial Analysis Course 04: Pension Course 05: Principles of Insurance & Insurance Fraud Course 06: Financial Investigator/Fraud Investigator The Debt Collector bundle is for those who want to be successful. In the Debt Collector bundle, you will learn the essential knowledge needed to become well versed in Debt Collector. Our Debt Collector bundle starts with the basics of Debt Collector and gradually progresses towards advanced topics. Therefore, each lesson of this Debt Collector course is intuitive and easy to understand. Why would you choose the Debt Collector course from Compliance Central: Lifetime access to Debt Collector courses materials Full tutor support is available from Monday to Friday with the Debt Collector course Learn Debt Collector skills at your own pace from the comfort of your home Gain a complete understanding of Debt Collector course Accessible, informative Debt Collector learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the Debt Collector bundle Debt Collector Curriculum Breakdown of the Debt Collector Bundle Curriculum Breakdown of the Debt Collector Bundle Course 01: Debt Management Plan Module 01: Introduction to Debt Management Introduction to Debt Management Module 02: Long Term and Short Term Debt Long Term and Short Term Debt Module 03: Identifying Your Debt Identifying Your Debt Module 04: Debt Management Plan Debt Management Plan Module 05: Debt Assessment Debt Assessment Module 06: Debt Financing Debt Financing Module 07: Building Budget Building Budget Module 08: Debt Counselling Debt Counselling Module 09: When Is Debt Good? When Is Debt Good? Module 10: Avoiding Debt Problems Avoiding Debt Problems Module 11: How to Handle Debt Collectors How to Handle Debt Collectors Module 12: How to Get Out of Debt How to Get Out of Debt Module 13: Dealing with Bankruptcy and Insolvency Dealing with Bankruptcy and Insolvency Module 14: Laws and Regulations Laws and Regulations Course 02: Financial Modelling and Valuation Methods Module 01: Basic Financial Calculations Basic Financial Calculations Module 02: Overview of Financial Markets, Financial Assets, and Market Participants Overview of Financial Markets, Financial Assets, and Market Participants Module 03: Financial Statement Modelling Financial Statement Modelling Module 04: Types of Financial Models Types of Financial Models Module 05: Sensitivity Analysis Sensitivity Analysis Module 06: Sales and Revenue Model Sales and Revenue Model Module 07: Cost of Goods Sold and Inventory Model Cost of Goods Sold and Inventory Model Module 08: Valuation Methods Valuation Methods Course 03: Financial Analysis Section-1. Introduction Financial Statement Analysis Objectives Financial Analysis Methods in Brief Ratio Analysis Section-2. Profitability Gross Profit Operating Margin Ratios Net Profit Expense Control Ratios ClassRoom Discussion for some other expenses Use of Profitability Ratio to Understand Competitive advantage and Business Models Section-3. Return Ratio Return on Assets and FIxed Assets Return on Capital Employed Case Study Analysis of three telecom companies Cautions for using return ratios on face value Ratios which help to understand how efficiently assets are used How we measure utilisation of assets not recorded in Balance Sheet Section-4. Liqudity Ratio Liquidity Ratio to understand Risk inherent in companies Long Term Liquidity Ratios Section-5.Operational Analysis Financial Analysis Measure meant to understand efficiency in other operations Summarise - Ratios use for operational analysis Dupont Analysis to understand opportunities in optimising return on equity Section-6. Detecting Manipulation Detecting Manipulation in accounts - Fake Sales Detecting Manipulation - Wrong Depreciation and others Pricing Decisions How to make Capex Decisions Course 04: Pension Pension Module 01: Overview of the UK Pension system Module 02: Type of Pension Schemes Module 03: Pension Regulation Module 04: Pension Fund Governance Module 05: Law and Regulation of Pensions in the UK Module 06: Key Challenges in UK Pension System Course 05: Principles of Insurance & Insurance Fraud Principles of Insurance & Insurance Fraud Module 01: Principles of Insurance Module 02: General Insurance Module 03: Insurance Fraud Module 04: Underwriting Process Course 06: Financial Investigator/Fraud Investigator Module 01: Introduction to Financial Investigator Introduction to Financial Investigator Module 02: Introduction to Financial Investigation Introduction to Financial Investigation Module 03: Characteristics of Financial Crimes Characteristics of Financial Crimes Module 04: Categories of Financial Crimes Categories of Financial Crimes Module 05: Financial Crime Response Plan Financial Crime Response Plan Module 06: Collecting, Preserving and Gathering Evidence Collecting, Preserving and Gathering Evidence Module 07: Laws against Financial Fraud Laws against Financial Fraud CPD 60 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Debt Collector bundle helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Debt Collector. It is also great for professionals who are already working in Debt Collector and want to get promoted at work. Requirements To enrol in this Debt Collector course, all you need is a basic understanding of the English Language and an internet connection. Career path The Debt Collector bundle will enhance your knowledge and improve your confidence in exploring opportunities in various sectors related to Debt Collector. Debt Recovery Specialist: £20,000 to £35,000 per year Collections Agent: £18,000 to £30,000 per year Credit Control Officer: £22,000 to £35,000 per year Debt Collection Team Leader: £25,000 to £45,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included Get 6 CPD accredited PDF certificate for Free. Hard copy certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate for £9.99 each. Delivery Charge: Inside the UK: Free Outside of the UK: £9.99

***24 Hour Limited Time Flash Sale*** QLS Endorsed AML, Financial Investigator and Internal Audit Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Dive into the world of financial knowledge with our all-encompassing bundle, "QLS Endorsed AML, Financial Investigator and Internal Audit." This remarkable bundle incorporates not one, not two, but three QLS-endorsed courses designed to provide you with comprehensive theoretical knowledge in Anti-Money Laundering, Financial Investigation, and Internal Audit Skills. But we don't stop there! Included in your purchase are five additional CPD QS accredited courses, each offering valuable insight into areas such as Financial Analysis, Fraud Detection, Financial Reporting, Bookkeeping & Accounting, and Payroll Management. The uniqueness of this bundle lies in its quality and breadth of learning. Each course is tailored to enhance your understanding of critical financial concepts and their application in real-world scenarios. Remember, you'll receive a hardcopy certificate upon completion of the QLS-endorsed courses - a valuable testament to your acquired knowledge. Embark on this journey towards becoming an influential figure in the financial sector, all from the comfort of your home. Our "QLS Endorsed AML, Financial Investigator and Internal Audit" bundle is your passport to financial proficiency! Key Features of the QLS Endorsed AML, Financial Investigator and Internal Audit Bundle: 3 QLS-Endorsed Courses: We proudly offer 3 QLS-endorsed courses within our QLS Endorsed AML, Financial Investigator and Internal Audit bundle, providing you with industry-recognized qualifications. Plus, you'll receive a free hardcopy certificate for each of these courses. QLS Course 01: Anti-Money Laundering (AML) Training QLS Course 02: Finance: Financial Investigator QLS Course 03: Internal Audit Skills Diploma Level 5 5 CPD QS Accredited Courses: Additionally, our bundle includes 5 relevant CPD QS accredited courses, ensuring that you stay up-to-date with the latest industry standards and practices. Course 01: Financial Analysis Course 02: Financial Statements Fraud Detection Training Course 03: Financial Reporting Course 04: Bookkeeping & Accounting Course 05: Payroll Management Course In Addition, you'll get Five Career Boosting Courses absolutely FREE with this Bundle. Course 01: Professional CV Writing Course 02: Job Search Skills Course 03: Self-Esteem & Confidence Building Course 04: Professional Diploma in Stress Management Course 05: Complete Communication Skills Master Class Convenient Online Learning: Our QLS Endorsed AML, Financial Investigator and Internal Audit courses are accessible online, allowing you to learn at your own pace and from the comfort of your own home. Learning Outcomes: Develop a comprehensive understanding of Anti-Money Laundering processes. Acquire deep insights into the intricacies of financial investigation. Master the skills of internal auditing at a diploma level. Analyze financial scenarios with proficiency and precision. Understand the key aspects of financial fraud detection. Develop an understanding of bookkeeping, accounting, and payroll management. Gain a robust foundation in financial reporting. Venture into the theoretical realm of finance with our "QLS Endorsed AML, Financial Investigator and Internal Audit" bundle. With eight rigorously curated courses, this bundle is designed to develop your understanding of financial investigations, anti-money laundering, internal audit skills, and other significant financial areas. The courses are intended to illuminate complex financial concepts, ensuring a broad knowledge base for learners. Upon completion, you'll be armed with a multitude of financial insights, ready to navigate the sophisticated world of finance. From deciphering financial analysis to managing payroll, this bundle aims to establish you as a well-rounded finance professional. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals aspiring to gain theoretical knowledge in finance. Professionals seeking to enhance their understanding of financial investigation and anti-money laundering. Those interested in understanding the nuances of internal auditing. Anyone aiming to develop a comprehensive understanding of bookkeeping, accounting, and payroll management. Career path AML Analyst: £30,000 - £45,000. Financial Investigator: £35,000 - £55,000. Internal Auditor: £30,000 - £50,000. Financial Analyst: £30,000 - £55,000. Fraud Detection Analyst: £35,000 - £60,000. Payroll Manager: £30,000 - £50,000. Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included