- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Become a financial crime prevention superhero with LGCA’s help! Pick up everything you need to know to join a company’s AML function and start fighting crime with your newfound knowledge and skills. The Certificate in AML provides participants with a thorough understanding of what constitutes Money Laundering (ML) and how financial institutions should respond to increasingly complex attempts by criminal individuals and entities to process proceedings from illegal activities in a manner that enables them to enjoy such illegal proceedings. Study method Online, self-paced Duration 25 hours Access to content 360 days Certification Certificate in Anti Money Laundering (AML) Additional info Exam(s) / assessment(s) is included in price Description About the Certificate Participants will investigate what is ML, what constitutes a risk-based approach in dealing with ML and the relevant policies and procedures that may be adopted by a financial institution as part of a coherent AML Strategy. In addition, participants will be provided with an overall assessment of international economic sanctions and how these are valuable tools in combating ML. The Certificate also offers participants, a practical perspective of how AML attempts have been formally incorporated and have led to the creation of legal frameworks that aim to prevent ML practices. The knowledge obtained by undertaking this Certificate is an invaluable asset for professionals that seek to enhance their career prospects in AML which is becoming an increasingly significant issue for financial institutions. Topics covered • Money laundering methods, techniques, red flags, key risk areas and compliance best practices & checklists • KYC and CDD: Beneficial ownership, money laundering risks in gatekeeper roles, politically exposed persons, and much more • Economic Sanctions and relevant frameworks • Vulnerabilities of Financial Institutions • Legal Framework for AML – A practical perspective • Case Studies and analysis Expected Learning Outcomes • Identify ML-related risks and dangers that need to be dealt with through a rigid AML strategy • Understand ML risk assessment and management and learn how to design a comprehensive AML risk-based approach • Review the relevant processes and procedures that need to be adopted as part of an AML strategy • Gain a practical perspective through a review of the relevant legal framework that covers AML • Understand the importance of sanctions and how these can be utilised as a tool to combat ML Format • Register at any time • Study in your own time and at your own pace (you have up to 3 months to complete the Certificate) • Assessed by an online multiple-choice exam What is included • 25 hours of self-paced online interactive learning including analysis of 5 practical case studies • 1-year free AGRC membership • Online Exam and AGRC Certificate Completion Requirements • Success in all the unit tests. Each unit is allocated two, three or four Multiple Choice questions (MCQs). In total 33 MCQs with a pass mark of 70% and an unlimited number of attempts. Each unit test is 10 minutes. • Success in the final test of 40 MCQs for the completion and award of the Certificate in Anti Money Laundering, issued by the Association of Governance, Risk and Compliance (AGRC). The pass mark is 70% and two attempts are permitted. The final test is 60 minutes. Who is this course for? Individuals who aspire to a career in AML, staff with specific anti-money laundering duties and staff working in financial services who want a comprehensive training in AML. No previous knowledge or experience is required although it is assumed that participants have good knowledge of English and a sound education background. Requirements No previous knowledge or experience is required though it is assumed that participants have good knowledge of English and sound educational background. Career path AML Officer, MLRO, Head of Back Office, Compliance Officer, Risk Manager, Manager, Director

ICA Specialist Certificate in Money Laundering Risk in Correspondent Banking

By International Compliance Association

ICA Specialist Certificate in Money Laundering Risk in Correspondent Banking Analyse the fundamentals of correspondent banking and the vulnerabilities that may allow for money laundering. Explore the risk assessment and management approaches and the importance of robust due diligence as risk control. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? When you undertake the course, in addition to the essential concepts of AML and CTF, you will cover the following areas: Essential AML concepts Fundamentals of correspondent banking Regulatory frameworks Money laundering risk is inherent in correspondent banking Approaching due diligence in correspondent banking Monitoring Sanctions

ICA Specialist Certificate in Financial Crime Risk in Global Banking and Markets

By International Compliance Association

ICA Specialist Certificate in Financial Crime Risk in Global Banking and Markets Gain an understanding of money laundering risks and vulnerabilities in capital markets by exploring the financial market product, customer risk and service risk typologies. The course will examine the specific financial crime risk factors involved in key customer types such as funds and exchanges. It compares the vulnerabilities of major financial markets products, such as derivatives and foreign exchange. You will also learn more about the importance of the CDD process in mitigating these risks. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. Regulatory environment, risks and impacts on the world of corporate banking and financial markets Market abuse, fraud and manipulation, tax evasion, sanctions risk Risk exposure and specific customer typologies Financial markets products and their susceptibility to financial crime The CDD process

Description Competition Law Diploma Embarking on a learning journey with the Competition Law Diploma course paves the way for a deep understanding of the nuanced and imperative field of competition law. This comprehensive online course encapsulates vital aspects, beginning with the historical background of competition law, offering participants a well-rounded and detailed exploration into its evolution and establishing a robust foundation to build subsequent knowledge upon. Understanding the key concepts and principles of competition law becomes paramount, and this diploma doesn't shy away from imparting rigorous knowledge in this area. It meticulously covers the essentials, exploring various frameworks and legislations that shape and guide competitive practices within varied market structures. Learners will gain insights into how these principles play a crucial role in ensuring fair trade practices, protecting businesses, and safeguarding consumers' interests. A spotlight on regulatory bodies and their significant roles offers participants a profound understanding of the mechanisms and structures that enforce and oversee the application of competition law. It underscores the workings of various regulatory entities, elucidating their impact, jurisdiction, and authority in managing and ensuring adherence to stipulated competition laws and practices. The module addressing anti-competitive agreements sheds light on the nature, types, and implications of agreements that thwart competitive practices in the market. It delves into the intricacies of different anti-competitive practices, exploring the legal repercussions and offering participants a thorough understanding of the critical aspects that differentiate healthy competition from prohibited agreements. Dominance and its abuse in the market garner special attention in the Competition Law Diploma, ensuring learners comprehend the delicate balance that law seeks to maintain between allowing businesses to flourish and preventing them from exploiting their dominant position to the detriment of others. The course navigates through various scenarios and case studies to help participants discern the fine line between competitive and abusive dominant behaviours. In the realm of merger control, the diploma facilitates a rich understanding of the processes, legislations, and implications related to mergers in the competitive landscape. It elucidates how merger control plays a pivotal role in maintaining a balanced market, protecting smaller entities, and preventing the creation of monopolies or anti-competitive structures. Exploring the enforcement and sanctions related to competition law, the course ensures that participants become adept at comprehending the consequences, legal frameworks, and procedures involved in enforcing competition law. It propounds on various sanctions and their applications, offering a robust view into the aftermath of breaches in competition law. The interplay of UK and EU competition law, especially in the light of recent political developments, offers a riveting study into how national and international laws coexist, influence, and navigate through the complex terrains of global and local markets. It elucidates how laws within the UK intertwine with those in the larger EU context, and how this interplay impacts businesses operating across borders. Sector-specific competition issues and the future of competition law are pivotal components of the Competition Law Diploma, providing a forward-looking perspective and enabling participants to anticipate, understand, and navigate through the possible future shifts and challenges in competition law. Engaging with the Competition Law Diploma not only offers a profound theoretical understanding but also imparts practical knowledge through case studies, real-world examples, and interactive sessions, ensuring that learners are well-equipped to navigate through the intricate world of competition law. In the fast-evolving digital world, this online course provides flexible learning options, allowing participants to learn at their own pace, ensuring that distance and schedules are not barriers to acquiring quality education in competition law. The Competition Law Diploma stands out as a remarkable choice for anyone seeking to immerse themselves in the multifaceted world of competition law, whether they are legal professionals, business leaders, or ambitious learners aspiring to carve a niche in this vital sector. Enrol in the Competition Law Diploma course today to unlock a world where robust knowledge of competition law becomes your tool to navigate through the compelling world of market competition, legal frameworks, and fair business practices. What you will learn 1:Historical Background of Competition Law 2:Key Concepts and Principles 3: Regulatory Bodies and their Roles 4:Anti-Competitive Agreements 5:Dominance and its Abuse 6:Merger Control 7:Enforcement and Sanctions 8:The Interplay of UK and EU Competition Law 9:Sector-Specific Competition Issues 10:Future of Competition Law Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

ICA Specialist Certificate in Trade Based Money Laundering

By International Compliance Association

ICA Specialist Certificate in Trade Based Money Laundering Trade-based money laundering is a highly effective way to launder the proceeds of crime or finance terrorism. By exploiting the complexities of international trade, criminals can transmit vast amounts of value across borders and fund wider organised crime. This course will enable you to understand and compare trade-based money laundering typologies such as variable pricing and goods, understand how financial crime risk can manifest and be mitigated against in this huge global marketplace. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? In addition to the essential concepts of AML and CTF, you will also cover the following areas: International trade and receivables finance Introduction to money laundering, terrorist financing and proliferation International laws, regulations and industry guidance Managing risk Money laundering typologies Terrorist financing, resourcing and sanctions Further financial crime risk considerations

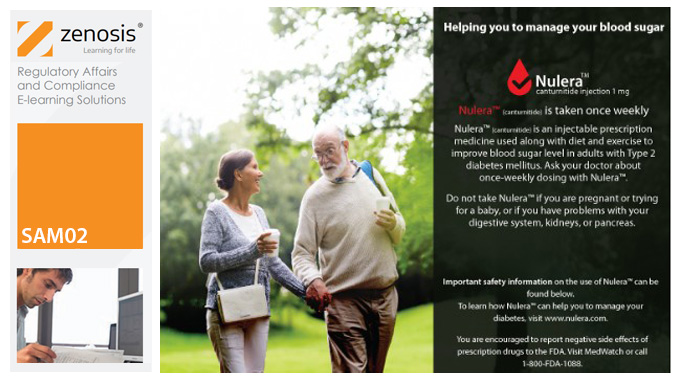

SAM02: Regulatory Requirements and Guidance on Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we explain how to advertise and promote prescription drugs in various media, whether to healthcare professionals or consumers, in compliance with legal requirements and guidance from the FDA.

SAM01: Legal and Regulatory Framework for Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we set out the legal framework for the regulation of advertising and promotion of prescription drugs in the USA. We identify the regulatory authorities and sources of guidance. We summarize basic requirements that advertisements and promotional labeling must meet, and we identify consequences that may follow failure to comply.

SAM03: Consumer-directed Advertising and Online Promotion of Prescription Drugs in the USA

By Zenosis

Unlike the great majority of other countries, the advertising of prescription drugs directly to consumers is permitted in the USA. Spending by drug companies on direct-to-consumer (DTC) advertising of prescription drugs has increased more than four-fold over two decades, with a dramatic increase in the number of TV ads. In addition, the Internet and social media platforms have increasingly enabled companies to engage more actively with the public.

ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC)

By International Compliance Association

ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC) Course This leadership programme has been designed to sharpen the strategic skills of senior practitioners and those aspiring to hold the highest anti-money laundering/financial crime position within a firm. This expert qualification offers: Specialist knowledge - the highest level in the field Strategic thinking - helps your leadership ambitions Innovation - explores new ideas, best practice, and future developments from a global perspective Fellowship of ICA - become automatically eligible for the highest grade of membership Networking - grow with other like-minded, senior professionals. With a focus on anti-money laundering, managing fraud and anti-bribery, and corruption, this qualification has helped hundreds of senior financial crime compliance professionals from all over the world unlock career growth opportunities. This course is awarded in association with Alliance Manchester Business School, the University of Manchester. How will the course be delivered This course is delivered online with materials delivered for you to study in your own time and at your own pace. There will be eight 3-hour virtual masterclasses over four weekends and seven live virtual classrooms spread over the duration of the course. Upon successful completion of the course, course materials and assessment, you will be awarded the ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC). This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. Assessment This course will be assessed via: The production of 8 x 1000-1500 word masterclass commentaries: these are summaries of the key learning points outlined in the masterclasses and its impact on your own practice, which forms the reflective journal. A three hour competency-based interview, using information describing your career to date and other evidence you wish to submit to map your knowledge, skills and experience against the National Occupational Standards The syllabus covers a variety of key issues relevant at a senior level and is designed to provide an insight into risks and potential hurdles faced by your organisation. The syllabus is delivered by an exclusive series of high-profile masterclasses covering relevant topics. Standards, research and assessment Financial crime risks: science or art? Ethics, corporate governance & responsibility Managing the internal AML enemy Cyber security: threats to the organisation FinTech and financial crime compliance Fraud and internal threat Risk based approach: too busy or too afraid Sanctions: a changing landscape.

ICA International Advanced Certificate in Anti Money Laundering

By International Compliance Association

ICA International Advanced Certificate in Anti Money Laundering This ICA International Advanced Certificate in Anti Money Laundering training course is an intermediate level programme designed to develop Participants existing skills and knowledge base in anti-money laundering. You can study at home through online learning and also attend two highly interactive workshops if these are offered in your jurisdiction. All material for this training course is now delivered online, making it more accessible and environmentally sound. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate The expected outcomes of this ICA International Advanced Certificate in Anti Money Laundering training course are as follows: Reduced exposure to reputational and financial risk for your organisation Enhanced workplace performance Full preparation to advance to the diploma programmes Increased potential for career progression Students successfully completing this training course will receive the ICA International Advanced Certificate in Anti Money Laundering and will also be able to use the designation 'Adv. Cert. (AML)'. This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. During this ICA International Advanced Certificate in Anti Money Laundering training course, students will cover the following subjects: What are the Money Laundering, Terrorist Financing and Sanctions Risks that must be Managed? The International Bodies and Standard Setters National Legal and Regulatory Frameworks Taking an AML/CFT Risk-based Approach and Managing the Risks Initial and 'Ongoing' Customer Due Diligence (CDD) Monitoring Activity and Transactions Recognising and Reporting Suspicions The Vulnerabilities of Specific Services and Products How will you be assessed? Assessed by a one-hour, question-based exam and one research-based assignment