- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

In this competitive job market, you need to have some specific skills and knowledge to start your career and establish your position. This Road to Passive Income course will help you understand the current demands, trends and skills in the sector. The course will provide you with the essential skills you need to boost your career growth in no time. The Road to Passive Income course will give you clear insight and understanding about your roles and responsibilities, job perspective and future opportunities in this field. You will be familiarised with various actionable techniques, career mindset, regulations and how to work efficiently. This course is designed to provide an introduction to Road to Passive Income and offers an excellent way to gain the vital skills and confidence to work toward a successful career. It also provides access to proven educational knowledge about the subject and will support those wanting to attain personal goals in this area. Learning Objectives Learn the fundamental skills you require to be an expert Explore different techniques used by professionals Find out the relevant job skills & knowledge to excel in this profession Get a clear understanding of the job market and current demand Update your skills and fill any knowledge gap to compete in the relevant industry CPD accreditation for proof of acquired skills and knowledge Who is this Course for? Whether you are a beginner or an existing practitioner, our CPD accredited Road to Passive Income course is perfect for you to gain extensive knowledge about different aspects of the relevant industry to hone your skill further. It is also great for working professionals who have acquired practical experience but require theoretical knowledge with a credential to support their skill, as we offer CPD accredited certification to boost up your resume and promotion prospects. Entry Requirement Anyone interested in learning more about this subject should take this Road to Passive Income course. This course will help you grasp the basic concepts as well as develop a thorough understanding of the subject. The course is open to students from any academic background, as there is no prerequisites to enrol on this course. The course materials are accessible from an internet enabled device at anytime of the day. CPD Certificate from Course Gate At the successful completion of the course, you can obtain your CPD certificate from us. You can order the PDF certificate for £4.99 and the hard copy for £9.99. Also, you can order both PDF and hardcopy certificates for £12.99. Career path The Road to Passive Income will help you to enhance your knowledge and skill in this sector. After accomplishing this course, you will enrich and improve yourself and brighten up your career in the relevant job market. Course Curriculum Section 01: Introduction Introduction 00:04:00 Section 02: What are Recurring Income Streams? What are Recurring Income Streams? 00:05:00 What Is the Recurring Revenue Model? 00:04:00 What Should You Sell to Make the Recurring Revenue Model Work? 00:05:00 The Importance of Recurring Revenue in a Thriving Business 00:03:00 Reasons Fortune 500 Companies Are Moving to Recurring Revenue Models 00:03:00 How Recurring Revenue Increases Business Value 00:06:00 Section 03: What is Residual Income? What is Residual Income? 00:04:00 What Is Residual Income And Why Do You Want It? 00:03:00 What is Residual Income & Why is it Important for Building Wealth? 00:04:00 Reasons Why Passive Income Is Important 00:04:00 How Does Residual Revenue Work? 00:04:00 Why Residual Income is Important for Financial Independence 00:05:00 Section 04: Types of Recurring Income Types of Recurring Income 00:04:00 Hard contracts 00:05:00 Auto renewal subscriptions 00:04:00 Build a Membership Program for Your Business 00:03:00 Become an Affiliate for Other Companies Products 00:03:00 Combine Online Membership and Physical Product Delivery 00:04:00 Section 05: Types of Residual Income Types of Residual Income 00:05:00 Consider Investing 00:04:00 Write a Book or E-Book 00:04:00 Build an Online Course 00:05:00 Create an App 00:04:00 Launch a Podcast 00:02:00 Section 06: Relationship between Recurring, Residual and Passive Income Relationship between Recurring, Residual and Passive Income 00:04:00 How They're Similar and also Different 00:04:00 What is Passive Income and Its Relationship to Passive and Residual Income? 00:04:00 Examples of Passive Income 00:04:00 The Truth about Active Income vs Passive Income 00:03:00 Active Income Becomes Passive Income 00:03:00 Section 07: Building Wealth Strategies Building Wealth Strategies 00:04:00 Effective Wealth Building Strategies Used by Personal Finance Pros 00:04:00 Develop a Wealthy Mindset 00:03:00 Strategies for Building Wealth 00:05:00 Strategies to Build Wealth Fast (That Your Financial Advisor Won't Tell You) 00:04:00 How to Begin to Build Wealth 00:04:00 Section 08: Conclusion Review 00:03:00 Certificate and Transcript Order Your Certificates or Transcripts 00:00:00

Financial Modelling for Decision Making and Business plan

By The Teachers Training

Overview Financial Modelling for Decision Making and Business plan Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Financial Modelling for Decision Making and Business plan Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Section 01: Introduction Introduction To The Course 00:02:00 Introduction To The Business Process 00:03:00 What Is Financial Modelling 00:08:00 Starting Point Of A Financial Model 00:04:00 First Steps Before Starting To Create Financial Model And Linking Business Model 00:07:00 Section 02: Case Study: Restaurant - Basic Model For Selecting Initial Idea Starting With End In Mind-Comparative P&L 00:13:00 Customer Acquisition Model 00:16:00 Revenue And Cost Models 00:22:00 Adding Product And Modelling Labour And Other Costs 00:21:00 Modelling Capital Investments And ROI Calc 00:10:00 Section 03: Business Plan And 3 Financial Statement Models Detailed Customer Acquisition Model And Revenue Model 00:17:00 Cost Of Sale Model 00:08:00 Modelling Labour Cost 00:07:00 Modelling Other Operating Expenses 00:14:00 Modelling Income Statement And Cash Flows 00:27:00 Modelling Balance Sheet 00:14:00 Fixing The Error In Financial Model And Brief Of RR 00:07:00 Financial Model For Business Plan For New Business 00:00:00 Assignment Assignment - Financial Modelling for Decision Making and Business plan 00:00:00

Accounting Basics

By The Teachers Training

Accounting Basics Course Overview In the UK alone, more than 600,000 new businesses spring to life every year, and they all have one thing in common: the need for sound financial management. That's where our Accounting Basics course comes in! A good grasp of our course might help you to take the first step to becoming a professional accountant. At the beginning of the Accounting Basics course, you will gain insights into the double entry system and fundamental accounting rules. Plus, you will acquire the skills to create essential financial statements such as income statements, balance sheet, and flow statements. Moreover, in this Accounting Basics course, you will become familiar with the significant accounting policies that need to be decided by companies. You will be introduced to the depreciation policies as well. Our Accounting Basics course will equip you with the knowledge of the basic accounting equation and how it's intertwined with the four financial statements. Here, you'll master the art of creating a chart of accounts and classifying accounts, ensuring that you can efficiently manage a company's finances. As you move deeper into the course, you will be able to record, analyze, and interpret external and internal transactions within a company, facilitating informed decision-making. After completing the course, you will have the skills to control operational fixed assets, manage inventory effectively, recognize revenue appropriately, and accurately account for expenses, all while optimizing working capital. Without further delay, enrol in the Accounting Basics course to prepare yourself for an accounting career. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Accounting Basics Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting 00:13:00 Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules 00:10:00 Lecture-3.Financial Accounting Process and Financial Statements Generates 00:14:00 Lecture-4.Basic Accounting Equation and Four Financial Statements 00:21:00 Lecture-5.Define Chart of Accounts and Classify the accounts 00:07:00 Lecture-6. External and Internal Transactions with companies 00:12:00 Lecture-7.Short Exercise to Confirm what we learned in this section 00:06:00 Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies 00:06:00 Lecture-9.Depreciation Policies 00:12:00 Lecture-10.Operational Fixed Asset Controls 00:13:00 Lecture-11.Inventory Accounting and Controls 00:11:00 Lecture-12.Revenue Accounting and Controls 00:08:00 Lecture-13.Expenses Accounting and Working Capital 00:12:00

Medical Coding and Billing for Medical Secretary Training Diploma

5.0(1)By Empower UK Employment Training

Medical Coding and Billing for Medical Secretary Training Diploma Step into the critical field of healthcare administration with our Medical Coding and Billing for Medical Secretary Training Diploma. This comprehensive course is designed to provide you with the in-depth knowledge and skills essential for Medical Secretaries. It covers everything from medical coding standards to denial management, ensuring that you are well-equipped to handle administrative tasks within healthcare settings. Learning Outcomes: Understand the Medical Secretary's pivotal role in managing medical records and terminology within healthcare settings. Master the ICD-10 general coding standards from a Medical Secretary's perspective. Become proficient in identifying and avoiding billing and coding errors as a Medical Secretary. Gain comprehensive insights into medical billing software programs and systems pertinent to a Medical Secretary. Develop the skills necessary for effective charge entry, claim submission, and coding as a Medical Secretary. Acquire the techniques for managing denials and reporting within Revenue Cycle Management (RCM) as a Medical Secretary. More Benefits: LIFETIME access Device Compatibility Free Workplace Management Toolkit Key Modules from Medical Coding and Billing for Medical Secretary Training Diploma: Medical Secretary's Role in Medical Records and Terminologies: Equip yourself with the foundational knowledge of medical records, terminologies, and their management from a Medical Secretary's lens. Medical Secretary and General Coding Standards of ICD-10: Master the universally recognized ICD-10 coding system, focusing on its applications and best practices for Medical Secretaries. Avoiding Billing and Coding Errors: A Medical Secretary's Perspective: Learn the methodologies and best practices to identify, prevent, and correct billing and coding errors, thereby enhancing accuracy and compliance. Medical Secretary's Guide to Medical Billing Software Programs and Systems: Gain a well-rounded understanding of the billing software landscape, empowering you to make informed decisions in the role of a Medical Secretary. Medical Secretary in Medical Coding, Charge Entry, and Claim Submission: Dive deep into the critical aspects of medical coding, charge entry, and claim submission, with a focus on efficiency and accuracy. Medical Secretary's Role in Denial Management and Reporting in RCM: Become proficient in managing denials and executing effective reporting strategies within the framework of Revenue Cycle Management as a Medical Secretary. Other Key Modules of This Medical Coding and Billing for Medical Secretary Training Diploma Include: Understand Insurance Plans Pre-registration and Insurance Verification Data Controller and Data Processor Transferring Data Outside of EEA And, Many More

Staff Retention Techniques

By OnlineCoursesLearning.com

Introduction: Staff retention is a growing concern, but by having a proper staff retention strategy in place you'll be able to keep your top employees. Recruiting and training a new employee is time-consuming and costs a great deal of revenue - it's much more beneficial to the business to keep current employees satisfied in their job. Understanding your employees and having proper retention strategies in place is key to retaining employees long-term. This course on staff retention will look at the four main trends that contribute to employees leaving their jobs, including compensation and benefits, career growth, flexible working schedules, and training and development, and how you can create a strategy to improve these areas and retain your employees. You Will Learn: What the main factors are that lead to employees leaving their jobs and what you can do to prevent this. How to come up with a competitive compensations and benefits plan. How to encourage career advancement and growth opportunities in your company. The benefits of flexible working, both to the employer and employee. How to implement various training and development techniques and the benefits of encouraging training in the workplace. Benefits of Taking This Course: You will learn what drives employees to leave and with this knowledge be able to implement preventative measures. You will learn how implementing employee retention programmes can help reduce unnecessary turnover costs. You will gain insight into retaining a positive and motivated body of staff. You will learn the benefits that retaining your staff can bring to your business. Your knowledge will allow you to formulate an effective retention plan that works for your employees and business. Course Modules/Lessons Module 1: Staff Retention Techniques Introduction Module 2: Compensation and Benefits Module 3: Career Advancement and Opportunities for Growth Module 4: Flexible Work Schedules Module 5: Training and Development

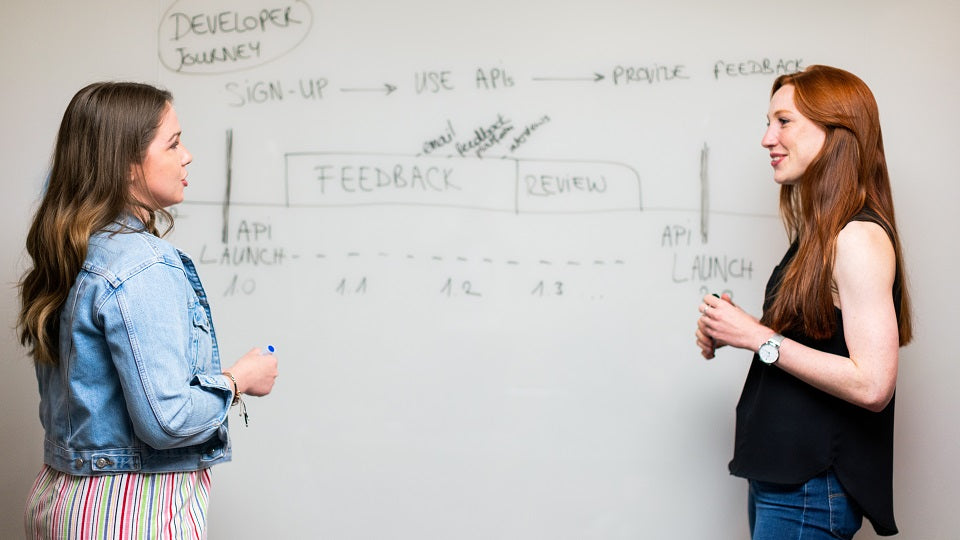

Kafka Streams API for Developers Using Java/Spring Boot 3.X

By Packt

This course is structured to give you both the theoretical and coding experience of developing Kafka Streams applications using Streams API. It also covers the techniques to use Enterprise Standard Kafka Streams application using Spring Boot and Streams API. You will build a real-time Kafka Streams application by the end of this course. Prior experience building Kafka applications is necessary.

>>24 Hours Left! Don't Let the Winter Deals Slip Away - Enrol Now!<< Are you looking to expand your business through social media but don't know where to start? Look no further! Our Social Media for Business course is designed to provide you with the essential knowledge and skills to establish and grow your online presence. In today's digital age, social media has become a crucial tool for businesses to connect with their audience, build brand awareness and drive sales. This Social Media for Business course will teach you how to utilise popular platforms such as Pinterest, Facebook, Twitter, Google+ Advertising and Networking, LinkedIn, and YouTube Channels to your advantage. With the help of our experienced tutors, you will learn how to create engaging content, increase your followers and reach, and utilise paid advertising to maximise your business potential. From mastering Pinterest boards to creating YouTube channels, this course will provide you with a comprehensive understanding of how to leverage social media for business success. By enrolling in our Social Media for Business course, you will gain a competitive edge in the digital landscape, enabling you to effectively market your business to a wider audience, connect with customers and boost your revenue. Don't miss out on this opportunity to take your business to the next level! Our Social Media for Business course has helped countless businesses achieve success in the online world. With our expert guidance and comprehensive curriculum, you can feel confident in your ability to navigate the social media landscape and build a thriving online presence. Enrol in our Social Media for Business course today and take the first step towards transforming your business into a digital success story! At the end of this Social Media for Busines course, you will learn: Develop a comprehensive understanding of popular social media platforms for business. Learn how to create engaging content and increase your online presence. Utilise paid advertising to maximise your business potential. Develop effective social media strategies to drive sales and boost revenue. Master the art of building a strong online community and engaging with customers. Utilise analytics and reporting tools to measure your success and make data-driven decisions. Why Prefer This Social Media for Busines Course? Opportunity to earn a certificate accredited by CPDQS. Get a free student ID card! (£10 postal charges will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! ****Course Curriculum**** Here is a breakdown of the course curriculum of this Social Media for Business course Module 01 - Pinterest Module 02 - Facebook Module 03 - Twitter Module 04 - Google+ Advertising and Networking Module 05 - LinkedIn Module 06 - YouTube Channels Assessment Process Once you have completed all the modules in the Social Media for Business course, your skills and knowledge will be tested with an automated multiple-choice assessment. You will then receive instant results to let you know if you have successfully passed the course. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Social Media for Business course is suitable for: Small business owners looking to expand their online presence Marketing professionals seeking to enhance their social media skills Individuals interested in pursuing a career in digital marketing Requirements You will not need any prior background or expertise to enrol in this course. Career path Enrolling on this course can lead you to the following career paths Social Media Manager: £25,000 - £45,000 annually Digital Marketing Specialist: £20,000 - £45,000 annually Social Media Marketing Coordinator: £18,000 - £35,000 annually Content Marketing Manager: £25,000 - £50,000 annually Digital Marketing Executive: £18,000 - £35,000 annually Online Community Manager: £20,000 - £40,000 annually Certificates CPDQS Accredited Certificate Digital certificate - £10 CPDQS Accredited Certificate Hard copy certificate - £29 If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Youtube and Instagram Video Production Training

By Course Cloud

Immerse yourself in the ultimate guide on Youtube and Instagram Video Production Training. This course empowers you to navigate the complexities of video production, starting with preparation: from selecting a compelling topic to choosing the right equipment. Delve into detailed filming techniques, ensuring you're adept in varied camera setups, filming in segments, and even troubleshooting when things don't go as planned. Navigate the intricacies of video importing, ensuring your content remains secure with robust storage and backup solutions. Discover the world of editing, exploring dynamic software options and accessing rich content libraries for a polished final product. Conclude your learning journey with expertise in rendering, exporting, and effectively uploading your masterpiece to digital platforms. Become the video content creator the digital world awaits! Career Path Content Creator: Craft unique content for YouTube and Instagram, driving engagement and revenue. Video Editor: Perfect videos in post-production for creators or studios. Production Adviser: Guide on equipment and shooting strategy for budding creators. Digital Marketing: Integrate video strategies in marketing campaigns to boost brand presence. Video Archivist: Manage video storage and cataloguing, ensuring content longevity for productions.