- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

188 Courses in London delivered On Demand

Personal Tax Return Mini Bundle

By Compete High

Handle personal tax returns with confidence. Learn accounting, law, Power BI, and more—all online and on your schedule. 🔹 Overview: Personal tax can often feel like a yearly visit to a confusing maze. This Personal Tax Return Mini Bundle aims to straighten the path, offering key lessons on income tax, accounting, and how the law fits in—no Latin required. Whether you’re managing your own return or just trying not to cry during tax season, this bundle teaches you the essentials in a smart, structured way. With the added flair of Power BI and a dose of business law, you’ll be able to interpret, calculate, and report your tax matters like a pro (minus the stress headache). 🔹 Learning Outcomes: Understand personal income tax processes and key components Analyse personal financial data using structured accounting methods Interpret tax implications through a legal lens Use Power BI to visualise and explore financial return data Apply business law basics to tax-related financial decisions Improve accuracy in self-submitted personal tax return cases 🔹 Who is this Course For: Individuals handling their own personal tax each year Freelancers needing structured tax and finance understanding Business owners filing personal and business returns separately Students learning financial reporting and tax law basics Aspiring accountants focused on personal tax services Data enthusiasts exploring Power BI for financial reporting People wanting legal clarity in financial planning Professionals revisiting personal tax procedures and updates 🔹 Career Path: Personal Tax Advisor – £28,000–£40,000 per year Accounting Assistant – £23,000–£29,000 per year Finance Analyst – £30,000–£42,000 per year Power BI Finance Analyst – £32,000–£44,000 per year Business Law Assistant – £26,000–£35,000 per year Tax Return Support Officer – £25,000–£33,000 per year

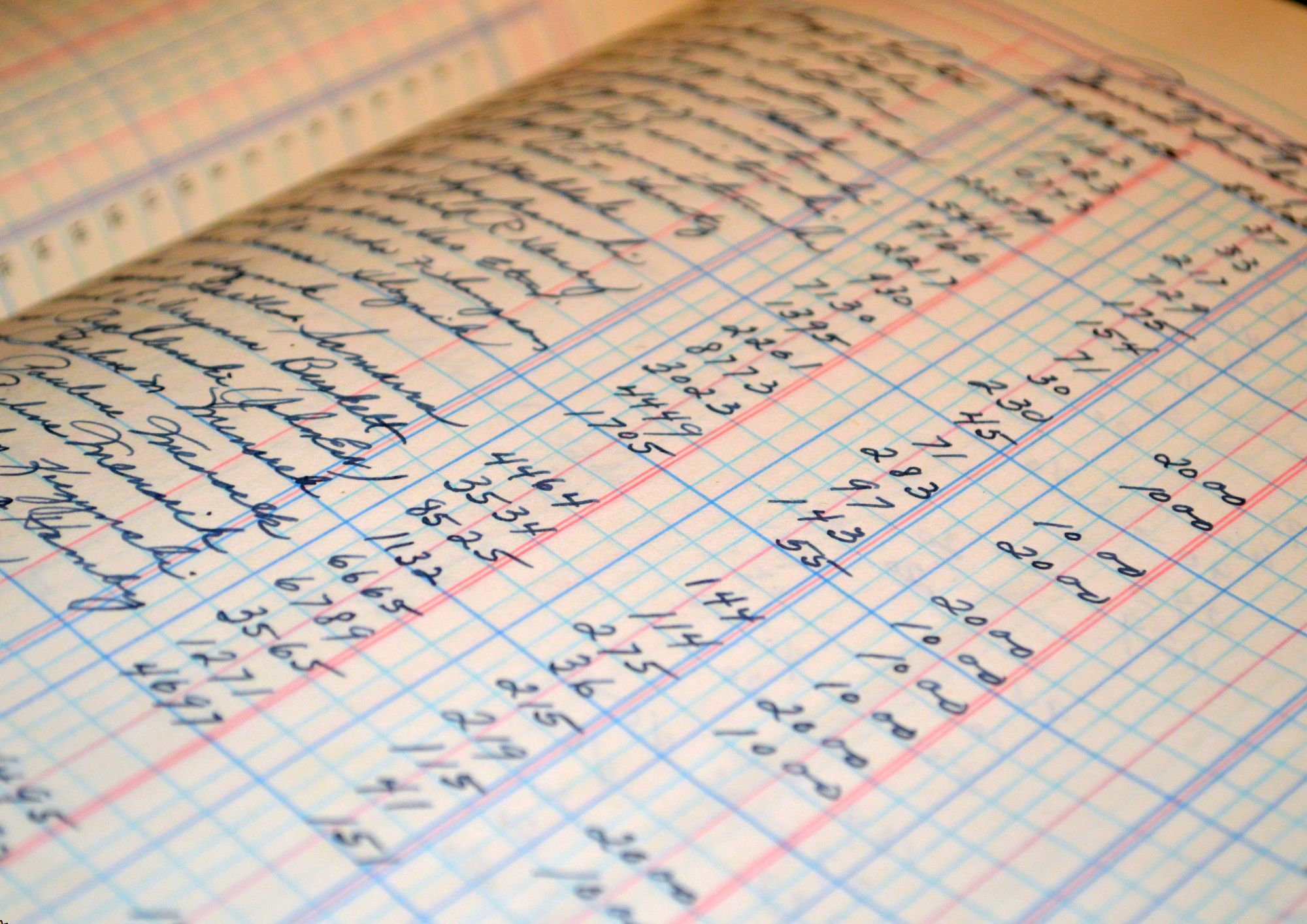

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Financial Management with Xero

By Compete High

Unleash Financial Mastery with 'Financial Management with Xero' Course! ð°ð Are you ready to take control of your finances and elevate your financial management skills to new heights? Look no further than our comprehensive 'Financial Management with Xero' course! ð Why Choose 'Financial Management with Xero'? ð Unlock the Power of Xero: Dive into the world of Xero, the leading cloud-based accounting software trusted by millions worldwide. Learn how to harness its robust features and functionalities to streamline your financial processes with ease. ð Gain Financial Clarity: Master the art of financial management, from budgeting and forecasting to cash flow management and financial analysis. Acquire the skills needed to make informed financial decisions that drive growth and success. ð¼ Enhance Career Opportunities: Stand out in today's competitive job market with in-demand financial management skills. Whether you're an aspiring accountant, small business owner, or finance professional, this course equips you with the expertise employers crave. ð§ Practical Hands-On Learning: Dive into real-world case studies, practical exercises, and interactive simulations to reinforce theoretical concepts and apply them to real-life scenarios. Gain practical experience that sets you apart from the competition. ð¨âð« Expert-Led Instruction: Learn from industry experts and seasoned financial professionals who bring years of experience and insights to the table. Benefit from their expertise as they guide you through every step of your financial management journey. Who is this for? ð©âð¼ Business Owners: Whether you're running a small startup or managing a growing enterprise, mastering financial management with Xero is essential for driving profitability and sustainable growth. ð Students: Aspiring accountants, finance majors, and business students looking to enhance their financial acumen and gain a competitive edge in their future careers will find immense value in this course. ð¼ Finance Professionals: From financial analysts and controllers to CFOs and accounting professionals, anyone looking to advance their career and excel in the field of finance will benefit from mastering Xero and financial management principles. Career Path ð Accountant: Unlock exciting opportunities as a certified accountant equipped with Xero expertise, offering financial management services to businesses of all sizes. ð¼ Financial Analyst: Dive into the world of financial analysis and reporting, leveraging your Xero skills to provide valuable insights and recommendations that drive business growth. ð Finance Manager: Lead financial strategy and decision-making processes as a finance manager, utilizing your Xero proficiency to optimize financial performance and drive profitability. ð Small Business Owner: Take your business to new heights with a solid understanding of financial management and Xero, empowering you to make informed decisions that fuel success and growth. FAQ Q: Is prior experience required to enroll in this course? A: No prior experience is necessary. This course is designed to accommodate learners of all levels, from beginners to advanced users. Q: How long does it take to complete the course? A: The duration of the course varies depending on individual learning pace and commitment level. However, most learners typically complete the course within [insert estimated duration]. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course requirements, you will receive a certificate of completion, showcasing your mastery of financial management with Xero. Q: Is this course accredited? A: While this course may not be accredited by a specific governing body, it provides valuable skills and knowledge that are highly sought after in the finance industry. Q: Can I access the course materials on any device? A: Yes, the course materials are accessible on any device with an internet connection, allowing you to learn anytime, anywhere. Q: Is there ongoing support available during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey, addressing any questions or concerns you may have along the way. Q: Will I have access to updated course materials? A: Yes, as part of your enrollment, you will have access to updated course materials to ensure you stay informed of the latest industry trends and developments. Enroll Now and Empower Your Financial Future! Don't miss out on this incredible opportunity to master financial management with Xero and take your career to new heights. Enroll now in our 'Financial Management with Xero' course and unlock the door to financial success and prosperity! ðð¼ð Course Curriculum Module 1 Introduction to Financial Management and Xero Introduction to Financial Management and Xero 00:00 Module 2 Financial Data Entry and Recording with Xero Financial Data Entry and Recording with Xero 00:00 Module 3 Streamlining Financial Workflows and Efficiency with Xero Streamlining Financial Workflows and Efficiency with Xero 00:00 Module 4 Advanced Financial Management and Compliance in Xero Advanced Financial Management and Compliance in Xero 00:00 Module 5 Integration Strategies and Continuous Improvement with Xero Integration Strategies and Continuous Improvement with Xero 00:00 Module 6 Cash Flow Management and Financial Planning with Xero Cash Flow Management and Financial Planning with Xero 00:00

Loans

By Compete High

Unleash Your Financial Freedom with 'Loans' Text Course! Are you ready to master the world of loans and unlock the keys to financial empowerment? Welcome to our comprehensive 'Loans' text course, your ultimate guide to understanding the ins and outs of borrowing, lending, and managing finances like a pro! ð Why Choose 'Loans' Text Course? In today's fast-paced world, financial literacy is the key to success. Whether you're a student, a working professional, or a seasoned entrepreneur, having a solid understanding of loans is essential for making informed financial decisions. Our 'Loans' text course offers a convenient and accessible way to dive deep into this crucial topic, providing you with the knowledge and skills you need to navigate the complex world of borrowing with confidence. By enrolling in our text course, you'll: Gain In-Depth Knowledge: From different types of loans to interest rates, terms, and repayment options, our course covers everything you need to know about loans, ensuring you have a comprehensive understanding of the subject. Learn Practical Strategies: Discover practical tips and strategies for choosing the right loan products, managing debt effectively, and optimizing your financial health. Stay Up-to-Date: With constantly updated content, you'll always have access to the latest information and trends in the world of loans, keeping you ahead of the curve. Access Anytime, Anywhere: Whether you're at home, in the office, or on the go, our text-based format allows you to learn at your own pace and convenience, eliminating the constraints of traditional classroom settings. Who is this for? Our 'Loans' text course is designed for individuals of all backgrounds and experience levels who want to enhance their financial literacy and take control of their financial future. Whether you're a college student preparing to enter the workforce, a young professional looking to build a solid financial foundation, or a seasoned investor seeking to expand your knowledge, this course is for you! Career Path Mastering the fundamentals of loans can open up a world of opportunities across various industries and professions. Here are just a few career paths where a strong understanding of loans can be invaluable: Finance Professionals: From financial analysts to loan officers, professionals working in the finance industry can benefit greatly from a deep understanding of loans, allowing them to better serve their clients and make informed investment decisions. Entrepreneurs: For aspiring entrepreneurs and small business owners, knowing how to navigate the world of business loans and financing options is essential for fueling growth and achieving success. Real Estate Agents: Understanding mortgage loans and financing options is crucial for real estate agents helping clients buy or sell properties, enabling them to provide valuable guidance throughout the home buying process. Personal Finance Advisors: Whether working independently or for financial institutions, personal finance advisors play a vital role in helping individuals and families manage their finances and plan for the future, making expertise in loans a valuable asset. FAQs Q: Is this course suitable for beginners? A: Absolutely! Our 'Loans' text course is designed to cater to individuals of all experience levels, including beginners who may have little to no prior knowledge of loans. Q: How long does it take to complete the course? A: The duration of the course can vary depending on your pace and schedule. However, most learners complete the course within a few weeks by dedicating a few hours each week to study. Q: Can I access the course materials on my mobile device? A: Yes, our text-based format allows you to access the course materials on any internet-enabled device, including smartphones and tablets, giving you the flexibility to learn on the go. Q: Are there any prerequisites for enrolling in the course? A: There are no specific prerequisites for enrolling in the course. However, having a basic understanding of financial concepts may be beneficial. Q: Will I receive a certificate upon completion of the course? A: While our course does not offer a formal certificate, you'll gain valuable knowledge and skills that can enhance your financial literacy and boost your confidence in managing loans. Q: Is there a money-back guarantee? A: Yes, we offer a 100% satisfaction guarantee. If you're not completely satisfied with the course, simply reach out to our support team within 30 days of enrollment for a full refund, no questions asked. Enroll Today and Take Control of Your Financial Future! Don't let confusion and uncertainty hold you back from achieving your financial goals. Empower yourself with the knowledge and skills you need to make informed decisions and secure your financial future. Enroll in our 'Loans' text course today and embark on a journey towards financial freedom! ð Course Curriculum Module 1 Introduction to Loans Introduction to Loans 00:00 Module 2 Personal Loans - Meeting Short-Term Financial Needs Personal Loans - Meeting Short-Term Financial Needs 00:00 Module 3 Mortgages - Unlocking Homeownership Mortgages - Unlocking Homeownership 00:00 Module 4 Business Loans - Fueling Entrepreneurial Ventures Business Loans - Fueling Entrepreneurial Ventures 00:00 Module 5 Student Loans - Investing in Education and Future Student Loans - Investing in Education and Future 00:00 Module 6 Auto Loans - Driving Towards Ownership and Mobility Auto Loans - Driving Towards Ownership and Mobility 00:00

Invoicing and Sales

By Compete High

ð Introducing: Invoicing and Sales Mastery Course! Are you ready to supercharge your business's financial success? Dive into the world of invoicing and sales with our comprehensive text course designed to elevate your skills and propel your career to new heights. Whether you're a seasoned entrepreneur, a budding freelancer, or a curious professional looking to expand your knowledge, this course is your ticket to mastering the art of invoicing and sales. ð Why Invoicing and Sales Matter: Unlock Your Business's Potential Invoicing and sales are the lifeblood of any successful enterprise. Efficient invoicing ensures timely payments, smooth cash flow, and stronger client relationships. Meanwhile, mastering the art of sales empowers you to close deals, expand your customer base, and drive revenue growth. With our course, you'll gain invaluable insights into crafting persuasive sales pitches, streamlining invoicing processes, and optimizing your financial workflows for maximum efficiency and profitability. ð What You'll Learn: Invoicing Essentials: Discover the fundamentals of creating professional invoices, including best practices for formatting, itemizing, and sending invoices to clients. Say goodbye to overdue payments and hello to prompt, hassle-free transactions. Sales Strategies: Uncover the secrets of effective sales techniques, from building rapport with prospects to overcoming objections and sealing the deal. Whether you're selling products, services, or ideas, our course equips you with the tools you need to close more deals and drive revenue. Financial Management: Learn how to manage your business's finances like a pro, from tracking expenses and revenue to forecasting cash flow and optimizing profitability. With our expert guidance, you'll gain the confidence to make informed financial decisions that propel your business forward. Customer Relationship Management: Cultivate lasting relationships with your clients by mastering the art of customer relationship management. From nurturing leads to providing exceptional post-sales support, you'll learn how to delight your customers at every touchpoint and turn them into loyal brand advocates. Automation and Efficiency: Harness the power of automation to streamline your invoicing and sales processes, saving time and reducing errors. Our course introduces you to cutting-edge tools and technologies that revolutionize how you do business, empowering you to work smarter, not harder. ð©âð¼ Who Is This For? Entrepreneurs: Whether you're running a startup or a seasoned business owner, mastering invoicing and sales is essential for driving growth and profitability. Freelancers: Take control of your freelance career by mastering the art of invoicing and sales. With our course, you'll learn how to attract clients, negotiate rates, and ensure timely payments for your services. Sales Professionals: Sharpen your sales skills and take your career to the next level with our comprehensive course. From entry-level sales reps to seasoned sales executives, there's something for everyone in our curriculum. Small Business Owners: Running a small business comes with its unique challenges, but mastering invoicing and sales doesn't have to be one of them. Our course provides you with the tools and strategies you need to succeed in today's competitive marketplace. ð Career Path: Sales Representative: Kickstart your career in sales with a solid foundation in sales techniques and strategies. Our course equips you with the skills you need to excel in entry-level sales roles and climb the corporate ladder. Sales Manager: Elevate your career to the next level by mastering advanced sales management techniques. With our course, you'll learn how to lead sales teams, drive revenue growth, and exceed targets with confidence. Entrepreneur: Launch and grow your own business with confidence, armed with the knowledge and skills to succeed in today's competitive marketplace. Our course provides you with the essential tools and strategies you need to turn your entrepreneurial dreams into reality. Financial Analyst: Leverage your expertise in financial management to pursue a career as a financial analyst. Our course equips you with the skills to analyze financial data, make informed recommendations, and drive strategic decision-making for businesses of all sizes. ð Frequently Asked Questions (FAQs): Q: Is this course suitable for beginners? A: Absolutely! Our course is designed to cater to learners of all levels, from beginners looking to build a strong foundation to seasoned professionals seeking to enhance their skills. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and availability. On average, most learners complete the course within a few weeks, but you're free to progress at your own pace. Q: Are there any prerequisites for enrolling in the course? A: There are no specific prerequisites for enrolling in the course. However, a basic understanding of business concepts and terminology may be beneficial. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successfully completing the course, you'll receive a certificate of achievement to showcase your newfound skills and expertise. Q: Is there ongoing support available after completing the course? A: Absolutely! We're committed to your success every step of the way. Our dedicated support team is on hand to answer any questions you may have and provide assistance as you apply your newfound skills in the real world. ð Unlock Your Potential: Enroll Today! Don't let the complexities of invoicing and sales hold you back from achieving your business goals. Join thousands of successful entrepreneurs, freelancers, and professionals who have transformed their careers with our Invoicing and Sales Mastery Course. Enroll today and take the first step towards unlocking your full potential! Course Curriculum Module 1_ Introduction to Invoicing and Sales Introduction to Invoicing and Sales 00:00 Module 2_ Creating Professional Invoices Creating Professional Invoices 00:00 Module 3 Invoicing Software and Tools Invoicing Software and Tools 00:00 Module 4 Sales Techniques and Strategies Sales Techniques and Strategies 00:00 Module 5 Effective Negotiation Strategies for Sales and Procurement Effective Negotiation Strategies for Sales and Procurement 00:00 Module 6 Contract Management and Business Agreements Contract Management and Business Agreements 00:00

Understanding Economics

By Compete High

ð Unlock the Secrets of the Economic World with 'Understanding Economics' Course! Are you intrigued by the forces that shape our global economy? Do you want to decode complex economic principles and apply them to real-world scenarios? Look no further! Our comprehensive 'Understanding Economics' course is your ticket to mastering the fundamentals of economics and gaining a competitive edge in today's dynamic market. ð¡ Why Understanding Economics Matters: Economics is the backbone of modern society, influencing everything from government policies to individual financial decisions. By delving into the intricacies of supply and demand, market structures, and macroeconomic trends, you'll gain invaluable insights into how economies function and evolve over time. Whether you're a business professional aiming to make informed strategic decisions, a student exploring future career paths, or simply a curious individual eager to understand the world around you, this course offers something for everyone. ð What You'll Learn: Our 'Understanding Economics' course covers a wide range of topics, including: Microeconomics: Explore the behavior of individuals and firms in markets, understand the concept of elasticity, and learn how to analyze consumer behavior. Macroeconomics: Gain insights into the broader economic factors such as inflation, unemployment, fiscal policy, and monetary policy. International Economics: Understand the complexities of global trade, exchange rates, and economic development. Economic History: Trace the evolution of economic thought and understand how historical events have shaped modern economic systems. With engaging lectures, real-world case studies, and interactive discussions, you'll develop a solid foundation in economics that you can apply to various personal and professional endeavors. ð©âð Who is this for? Students: Whether you're studying economics as part of your academic curriculum or looking to supplement your knowledge with practical insights, this course will provide you with the tools to excel in your studies and beyond. Professionals: From entrepreneurs and business owners to policymakers and analysts, understanding economics is essential for making informed decisions in today's competitive marketplace. Curious Minds: If you're simply curious about how the economy works and want to broaden your intellectual horizons, this course offers a stimulating learning experience for anyone with a thirst for knowledge. ð¼ Career Path: A solid understanding of economics opens doors to a wide range of career opportunities, including: Business and Finance: Pursue careers in finance, consulting, marketing, or entrepreneurship, where economic principles play a crucial role in decision-making processes. Government and Policy: Work in public policy, economic development, or regulatory agencies, shaping the economic landscape through informed policymaking. Research and Academia: Explore opportunities in economic research, academia, or think tanks, contributing to the advancement of economic theory and practice. International Relations: Dive into roles within international organizations, diplomatic corps, or multinational corporations, navigating the complexities of global economics and trade relations. No matter your career aspirations, a solid understanding of economics will set you apart from the competition and empower you to make meaningful contributions in your chosen field. ð Ready to Take the Next Step? Don't miss out on this opportunity to demystify the world of economics and embark on a journey of discovery and empowerment. Enroll in our 'Understanding Economics' course today and unlock the keys to success in the ever-changing economic landscape. Join thousands of students worldwide who have already transformed their understanding of economics and are ready to tackle the challenges of tomorrow with confidence. Start your journey today! FAQ (Frequently Asked Questions) for Understanding Economics Course Q1: What is Economics and why is it important? Economics is the study of how individuals, businesses, and societies allocate scarce resources to fulfill unlimited wants and needs. It explores decision-making processes, resource allocation, production, distribution, and consumption of goods and services. Understanding economics is crucial because it provides insights into how societies function, how policies impact individuals and businesses, and how resources can be managed efficiently to improve overall well-being. Q2: What are the main branches of Economics? Economics can be broadly divided into two main branches: Microeconomics and Macroeconomics. Microeconomics focuses on individual economic units such as households, firms, and markets, examining how they make decisions regarding resource allocation and pricing. Macroeconomics, on the other hand, deals with the economy as a whole, studying aggregate phenomena like inflation, unemployment, economic growth, and government policies' impacts on these factors. Q3: How does Economics relate to everyday life? Economics permeates various aspects of daily life, influencing decisions ranging from personal finance to government policies. Understanding economic principles can help individuals make informed choices about spending, saving, investing, and career planning. It also provides insights into broader societal issues such as income inequality, healthcare access, environmental sustainability, and international trade relations. Q4: What are some key concepts in Economics that students should understand? Several fundamental concepts form the backbone of economics education, including supply and demand, opportunity cost, scarcity, comparative advantage, elasticity, fiscal policy, monetary policy, inflation, and economic indicators like GDP (Gross Domestic Product) and unemployment rate. Mastery of these concepts allows students to analyze real-world economic issues critically and propose effective solutions. Q5: How can one excel in studying Economics? To excel in studying economics, students should actively engage with the material by attending classes regularly, participating in discussions, and seeking clarification when needed. It's essential to practice solving economic problems, analyzing data, and applying economic theories to real-life scenarios. Additionally, staying updated on current events and economic trends helps students understand the practical implications of economic theories and policies. Developing critical thinking, analytical, and quantitative skills is also crucial for success in economics. Course Curriculum Chapter 01 Basics of Economics Basics of Economics 00:00 Chapter 02 Understanding How Economists use Models and Graphs Understanding How Economists use Models and Graphs 00:00 Chapter 03 The Economy and Economics The Economy and Economics 00:00 Chapter 04 Capitalism Capitalism 00:00 Chapter 05 Deciding what to Produce and Market Deciding what to Produce and Market 00:00 Chapter 06 Inflation, Central banks and Monetary policy Inflation, Central banks and Monetary policy 00:00

Cashflow Management in Crisis

By Compete High

ð Introducing: Cashflow Management in Crisis ð In today's volatile economic landscape, businesses face unprecedented challenges. Uncertainty looms large, and the ability to navigate financial storms is paramount. ðªï¸ But fear not! Our comprehensive course, 'Cashflow Management in Crisis,' is here to equip you with the essential skills to steer your organization through tumultuous times and emerge stronger than ever before. ð Why Cashflow Management Matters Cashflow is the lifeblood of any business. It's the fuel that keeps operations running smoothly, empowers growth initiatives, and ensures financial stability. However, during times of crisis, maintaining healthy cashflow becomes even more critical. ð Fluctuating market conditions, unexpected disruptions, and evolving consumer behaviors can wreak havoc on cash reserves if not managed effectively. ð¼ Benefits of Taking Our Course By enrolling in 'Cashflow Management in Crisis,' you'll unlock a treasure trove of knowledge and strategies tailored to safeguard your organization's financial health in turbulent times. Here's what you can expect to gain: Resilience: Learn how to build a robust financial framework that withstands the shocks of crisis situations. From contingency planning to risk mitigation strategies, you'll be well-prepared to navigate unforeseen challenges with confidence. Strategic Decision-Making: Acquire the tools and insights needed to make informed financial decisions in the face of uncertainty. Discover how to prioritize expenditures, optimize cashflow streams, and identify opportunities for cost-saving initiatives. Adaptability: Master the art of agility in financial management. Our course will empower you to quickly adapt your cashflow strategies to changing market dynamics, ensuring your business remains agile and responsive in turbulent times. Stakeholder Confidence: Gain the trust and confidence of investors, lenders, and other stakeholders by demonstrating a proactive approach to cashflow management. Learn how to communicate effectively about your financial health and strategic resilience, fostering stronger relationships and support networks. Long-Term Sustainability: Build a solid foundation for future growth and sustainability. By honing your cashflow management skills, you'll lay the groundwork for enduring success, positioning your organization to thrive in any economic climate. ð¯ Who is this for? Business Owners: Whether you're a startup entrepreneur or a seasoned CEO, mastering cashflow management is essential for steering your business through both calm waters and stormy seas. Finance Professionals: Accountants, financial analysts, and CFOs will benefit from gaining specialized insights into crisis cashflow management, enhancing their ability to protect and optimize their organization's financial resources. Entrepreneurs: As a visionary entrepreneur, staying ahead of financial challenges is crucial for realizing your business goals. This course will empower you to navigate crises with resilience and creativity, ensuring your ventures remain on the path to success. ð Career Path Upon completing 'Cashflow Management in Crisis,' you'll be equipped with a highly sought-after skill set that opens doors to a variety of career opportunities, including: Financial Consultant: Help businesses of all sizes navigate financial challenges and optimize their cashflow management strategies. Risk Manager: Specialize in identifying and mitigating financial risks, ensuring organizations remain resilient in the face of uncertainty. Corporate Strategist: Guide strategic decision-making processes by providing valuable insights into cashflow dynamics and financial resilience. Don't let financial turbulence dictate the fate of your business. Enroll in 'Cashflow Management in Crisis' today and embark on a journey toward financial resilience and long-term success! ð°â¨ ð Frequently Asked Questions (FAQ) ð 1. What is cashflow management, and why is it important? Cashflow management involves monitoring, analyzing, and optimizing the flow of cash in and out of a business. It's essential because cashflow is the lifeblood of any organization, impacting its ability to pay bills, invest in growth, and weather financial storms. 2. How does crisis impact cashflow? Crises, such as economic downturns, natural disasters, or unexpected market shifts, can disrupt normal business operations, affecting revenue streams, supply chains, and customer demand. These disruptions can lead to cashflow challenges, including delayed payments, decreased sales, and increased expenses. 3. What are some common cashflow management strategies? Common cashflow management strategies include maintaining adequate cash reserves, managing accounts receivable and accounts payable effectively, implementing cost-cutting measures, diversifying revenue streams, and establishing contingency plans for emergencies. 4. Who can benefit from taking a cashflow management course? Anyone involved in managing finances, whether in a business or personal capacity, can benefit from learning about cashflow management. This includes business owners, entrepreneurs, finance professionals, managers, and individuals seeking to improve their financial literacy. 5. How can cashflow management skills help during a crisis? Cashflow management skills are invaluable during a crisis as they enable businesses to anticipate and respond to financial challenges effectively. By understanding cashflow dynamics, implementing proactive strategies, and maintaining financial resilience, organizations can mitigate risks, seize opportunities, and emerge stronger from crises. 6. Is cashflow management relevant across different industries? Yes, cashflow management is relevant across all industries and sectors. While specific challenges may vary depending on the nature of the business, the principles of cashflow management remain universally applicable. 7. Can I apply cashflow management principles to personal finances? Absolutely! Many of the principles and strategies taught in cashflow management courses can be applied to personal finances. By budgeting effectively, managing expenses, saving for emergencies, and optimizing income streams, individuals can improve their financial stability and resilience. 8. How can I learn more about cashflow management in crisis situations? Enrolling in a comprehensive cashflow management course, such as 'Cashflow Management in Crisis,' is an excellent way to deepen your understanding and acquire practical skills for navigating financial challenges. Additionally, staying informed through books, online resources, and professional networks can further enhance your knowledge and expertise in this critical area. Course Curriculum Chapter 1 Watching Birds Chapter 1 Watching Birds 00:00 Chapter 2 Equipment Chapter 2 Equipment 00:00 Chapter 3 Finding Different Types of Birds Chapter 3 Finding Different Types of Birds 00:00 Chapter 4 Finding and Feeding Birds Chapter 4 Finding and Feeding Birds 00:00 Chapter 5 Bird Grooming and Housing Chapter 5 Bird Grooming and Housing 00:00 Chapter 6 Landscaping Chapter 6 Landscaping 00:00

This Product Marketing Manager Course has been designed for those who want to understand the full lifecycle of product management from a marketing perspective. It explores how products are planned, developed, priced, positioned, and managed over time. You’ll gain insights into the structure of a product, how it evolves, and how marketing strategies influence its success in a competitive landscape. Through ten streamlined modules, you’ll learn to assess product portfolios, analyse market positioning, and make informed financial decisions. The course also covers the essentials of brand alignment, distribution channels, and how to shape marketing campaigns with purpose. Whether you're looking to strengthen your product marketing approach or explore new strategies, this course provides the foundations needed to support intelligent decision-making across the product journey. Key Benefits Accredited by CPD Instant e-certificate Fully online, interactive course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Curriculum Module 01: Introduction to Product Management Module 02: Product Classification Module 03: Developing the Product Plan Module 04: New Product Development Module 05: Levels of a Product and Product Life Cycle Module 06: Product Pricing Strategy Module 07: Product and Brand Portfolio Analysis Module 08: Channels Management Module 09: Basics of Marketing for Products Module 10: Financial Analysis for Product Management Course Assessment You will immediately be given access to a specifically crafted MCQ test upon completing an online module. For each test, the pass mark will be set to 60%. Certificate Once you've successfully completed your course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Product Marketing Manager training is ideal for highly motivated individuals or teams who want to enhance their skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Learn the essential skills and knowledge you need to excel in your professional life with the help & guidance from our Product Marketing Manager training. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

Partnership Accounting doesn’t have to feel like decoding an ancient scroll. Whether you're sorting profits, handling capital accounts, or working out who owes who (and how much), the numbers tell a story — and this course helps you read it. The Partnership Accounting Basics Course walks you through the essentials of partnership structures, adjustments, drawings, and everything that happens when partners join or leave. It's not just about maths; it’s about understanding the language of partnerships so you’re not lost when the balance sheet starts whispering secrets. Perfect for those dipping their toes into finance or brushing up on the basics, this course makes sure you won’t be side-eyed during partnership discussions. You’ll learn how to handle profit and loss sharing, partner changes, interest on drawings, and fixed vs fluctuating capital methods — all without needing a calculator surgically attached to your hand. It’s detailed, straight to the point, and built with clarity, not confusion. Let the books balance themselves (well, almost) while you build your confidence with numbers that finally make sense. Key Features of Partnership Accounting Basics Course: This Partnership Accounting Basics Course is CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum of Partnership Accounting Basics Module 01: Introduction to Partnership Accounting Module 02: Partnership Agreement and Formation Module 03: Partnership Capital Accounts Module 04: Partnership Income Allocation Module 05: Partnership Financial Statements Module 06: Changes in Partnership Module 07: Dissolution and Liquidation of Partnership Module 08: Partnership Taxation Basics Learning Outcomes of Partnership Accounting Basics Course: Analyze partnership agreements for sound financial foundations and strategic collaborations. Execute accurate financial calculations for partnership capital and income distributions. Construct comprehensive partnership financial statements demonstrating financial health and performance. Navigate changes within partnerships adeptly, ensuring financial continuity and adaptability. Facilitate dissolution and liquidation processes with precision and compliance. Demonstrate a nuanced understanding of partnership taxation essentials and their implications. Accreditation This Partnership Accounting Basics course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this Partnership Accounting Basics course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Accounting professionals seeking a specialised understanding of partnership financial dynamics. Business owners aiming to enhance their Accounting management skills. Finance students desiring a practical grasp of partnership accounting fundamentals. Entrepreneurs involved in or considering establishing Partnership Accounting. Individuals keen on advancing their expertise in partnership taxation and accounting. Career path Partnership Accountant Financial Analyst (Specialising in Partnerships) Tax Consultant for Partnerships Business Advisor with Focus on Financial Collaborations Partnership Financial Controller Auditor Specialising in Partnership Accounting Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Managing a salon requires more than just a keen eye for beauty trends; it’s about mastering the art of efficient operations. The Salon Operations Management course is designed for those looking to enhance their understanding of the inner workings of a salon business. Whether you’re already working in a salon or considering stepping into a managerial role, this course will provide you with the tools needed to ensure smooth operations, from inventory control to staff management. You'll delve into key areas such as budget management, customer service strategies, and effective scheduling, all while learning how to maximise business potential. With the beauty industry constantly evolving, keeping up with salon management is crucial to staying competitive. This course will guide you through the complexities of daily salon operations, helping you streamline processes and boost overall productivity. You’ll learn how to manage finances, oversee stock, and lead your team to success without missing a beat. Whether you aim to enhance your current role or take charge of your own salon, this course offers valuable insights into the operational side of the business. No matter the size of the salon, mastering these elements will set you up for success. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 01: Introduction to Salon Management Module 02: Business Planning and Development Module 03: Salon Operations and Infrastructure Module 04: Financial Management for Salons Module 05: Marketing and Promotion in the Salon Industry Module 06: Human Resource Management in Salons Learning Outcomes: Master business planning for your salon. Build and maintain a successful salon infrastructure. Manage your salon's finances with confidence. Develop effective marketing strategies for the beauty industry. Efficiently handle human resource management in your salon. Navigate the intricacies of salon management with ease. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Salon owners and managers looking to enhance their skills. Aspiring salon entrepreneurs seeking a competitive edge. Beauty professionals aiming to understand salon operations. Individuals interested in the salon industry's business side. Students pursuing a career in beauty and hair. Those keen on developing their business acumen. Anyone aspiring to excel in the beauty and hair industry. Individuals with a passion for entrepreneurship. Career path Salon Manager Beauty Salon Owner Spa Manager Hair Salon Director Beauty Business Consultant Beauty and Wellness Entrepreneur Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.