- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

15 Courses in Liverpool delivered Live Online

LNG Terminal Operations & Safety

By EnergyEdge - Training for a Sustainable Energy Future

Elevate your expertise in LNG terminal operations safety through our classroom training course. Energyedge provides industry-leading expertise and guidance.

Carbon Capture and Storage (CCS): Project Risks & How to Manage Them

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) Governments, regulators and energy companies are pursuing CO2 storage technologies to meet their net-zero carbon commitments as well as targets set by the international Paris Agreement on climate change. For successfully executing Carbon Capture & Storage (CCS) projects, various technical, operational, economic and environmental risks and associated stakeholders need to be managed. In this 5 half-day Virtual Instructor Led Training (VILT) course, the methods for managing risk in CCS projects are addressed with a focus on CO2 injection and storage. The VILT course will also demonstrate how to assess storage capacity of a potential CO2 storage reservoir, model framing techniques, and well injectivity issues related to CO2 injection. The potential leak paths will be discussed such as reservoir seals, leakage along faults and aspects of well integrity. In the VILT course, the design of a monitoring programme will also be discussed. The VILT course will be supported by various case studies. This VILT course will cover the following modules: CCS projects in an international context Site selection and site characterization Storage capacity assessment Injectivity assessment Containment assessment Measurement, monitoring & verification Training Objectives On completion of this VILT course, participants will be able to: Uncover the functions and associated components required to capture, transport and store CO2 in subsurface aquifers and (depleted) hydrocarbon reservoirs Find a systematic and integrated approach to risk identification and assessment for CO2 storage projects (maturation) Appreciate the requirements (physics modelling) and uncertainties to assess the CO2 storage capacity of a selected site. Understand the challenges, data and methods to assess CO2 well injectivity and well integrity Identify the leakage pathways of a selected storage site, and understand the assessment methods and associated uncertainties Learn how to design a monitoring program Target Audience This VILT course is intended for all surface and subsurface engineers such as facility engineers, geologists, geophysicists, reservoir engineers, petrophysicists, production technologists/engineers, well engineers and geomechanical specialists. Also, (sub)surface team leads, project managers, business opportunity managers, decision executives, and technical risk assessment & assurance specialists will benefit from this VILT course as it provides a common framework and workflow to develop a CCS project. For each class, it is highly recommended that a mix of disciplines mentioned above are represented to facilitate discussions from different perspectives. Course Level Basic or Foundation Training Methods This VILT course is built around cases in which teams work to identify and assess CO2 storage site issues using a systematic thought approach in this course. In addition, exercises are used to practise the aspects of the CCS risk assessment process. The VILT course provides a venue for discussion and sharing of good practices as well as opportunities to practise multi-discipline co-operation and facilitation. Participants are encouraged to bring their own work issues and challenges and seek advice from the expert course leaders and other participants about all aspects of CCS. This VILT course will be delivered online in 5 half-day sessions comprising 4 hours per day, with 2 breaks of 10 minutes per day. Trainer Trainer 1: Your expert course leader has more than 36 years of experience in the oil & gas industry with Shell. He gained broad experience in petroleum engineering, with expertise in integrated production systems from subsurface, wells and surface. He has had assignments in Production Technology, R&D, Production Chemistry, Rock Mechanics and Reservoir Engineering cEOR, with a proven track record in technology screening, development and deployment, field development planning, conceptual well design and Production System Optimization (PSO) of gas and oil fields as well as preparing Well, Reservoir & Facility Management (WRFM) strategies and plans. He had also worked on assignments in NAM and did fieldwork in Oman, Gabon and Shell Nigeria. He is a skilled workshop facilitator. He discovered his passion for teaching following an assignment in Shell Learning. During his time in Shell, he developed and taught technical courses to Shell professionals via blended learning. Trainer 2: Your second expert course leader has over 30 years of experience identifying, assessing and mitigating technical risks with Shell. The main focal point of his experience is in subsurface and Geomechanical risks. He is the the founding father of various innovations in how we assess risks by tool development (for bore hole stability, 3D geomechanical field evaluations and probabilistic assessment). He also developed an eye for people motivation, change management and facilitation. He was also responsible for the Geomechanical competence framework, and associated virtual and classroom training programme in Shell for 10 years. Trainer 3: Your third expert course leader has more than 30 years of experience in Shell, focusing on research and development in drilling and offshore systems. His areas of expertise is in project management, finance, business planning, investment, development studies and economics models. In 2021, he worked on a project that looked into the economic evaluation of P18A field complex for CO2 storage. He has an MSc in Mechanical Engineering (M.E.) TU Delft Netherlands (Hons) and a baccalaureate from Erasmus University Rotterdam. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Innovation Project Management: Virtual In-House Training

By IIL Europe Ltd

Innovation Project Management: Virtual In-House Training Companies need growth for survival. Companies cannot grow simply through cost reduction and reengineering efforts. This program describes the relationship that needs to be established between innovation, business strategy, and project management to turn a creative idea into a reality. We will explore the importance of identifying the components of an innovative culture, existing differences, challenges, and the new set of skills needed in innovation project management. Companies need growth for survival. Companies cannot grow simply through cost reduction and reengineering efforts. Innovation is needed and someone must manage these innovation projects. Over the past two decades, there has been a great deal of literature published on innovation and innovation management. Converting a creative idea into reality requires projects and some form of project management. Unfortunately, innovation projects, which are viewed as strategic projects, may not be able to be managed using the traditional project management philosophy we teach in our project management courses. There are different skill sets needed, different tools, and different life-cycle phases. Innovation varies from industry to industry and even companies within the same industry cannot come to an agreement on how innovation project management should work. This program describes the relationship that needs to be established between innovation, business strategy, and project management to turn a creative idea into a reality. We will explore the importance of identifying the components of an innovative culture, existing differences, challenges, and the new set of skills needed in innovation project management. What you Will Learn Explain the links needed to bridge innovation, project management, and business strategy Describe the different types of innovation and the form of project management each require Identify the differences between traditional and innovation project management, especially regarding governance, human resources management challenges, components of an innovative culture and competencies needed by innovation project managers Establish business value and the importance of new metrics for measuring and reporting business value Relate innovation to business models and the skills needed to contribute in the business model development Recognize the roadblocks affecting innovation project management and their cause to determine what actions can be taken Determine the success and failure criteria of an innovation project Foundation Concepts Understanding innovation Role of innovation in a company Differences between traditional (operational) and strategic projects Innovation management Differences between innovation and R&D Differing views of innovation Why innovation often struggles Linking Innovation Project Management to Business Strategy The business side of innovation project management The need for innovation targeting Getting close to the customers and their needs The need for line-of-sight to the strategic objectives The innovation enterprise environmental factors Tools for linking Internal Versus External (Co-creation) Innovation Open versus closed innovation Open innovation versus crowdsourcing Benefits of internal innovation Benefits of co-creation (external) innovation Selecting co-creation partners The focus of co-creation The issues with intellectual property Understanding co-creation values Understanding the importance of value-in-use Classification of Innovations and Innovation Projects Types of projects Types of innovations Competency-enhancing versus competency-destroying innovations Types of innovation novelty Public Sector of Innovation Comparing public and private sector project management Types of public service innovations Reasons for some public sector innovation failures An Introduction to Innovation Project Management Why traditional project management may not work The need for a knowledge management system Differences between traditional and innovation project management Issues with the 'one-size-fits-all' methodology Using end-to-end innovation project management Technology readiness levels (TRLs) Integrating Kanban principles into innovation project management Innovation and the Human Resources Management Challenge Obtaining resources Need for a talent pipeline Need for effective resource management practices Prioritizing resource utilization Using organizational slack Corporate Innovation Governance Types of innovation governance Business Impact Analysis (BIA) Innovation Project Portfolio Management Office (IPPMO) Using nondisclosure agreements, secrecy agreements, confidentiality agreements, and patents Adverse effects of governance decisions Innovation Cultures Characteristics of a culture for innovation Types of cultures Selecting the right people Linking innovation to rewards Impact of the organizational reward system Innovation Competencies Types of innovation leadership The need for active listening Design thinking Dealing with ambiguity, uncertainty, risks, crises, and human factors Value-Based Innovation Project Management Metrics Importance of innovation project management metrics Understanding value-driven project management Differences between benefits and value - and when to measure Traditional versus the investment life cycle Benefits harvesting Benefits and value sustainment Resistance to change Tangible and intangible innovation project management metrics Business Model Innovation Business model characteristics Impact of disruptive innovation Innovation Roadblocks Roadblocks and challenges facing project managers Ways to overcome the roadblocks Defining Innovation Success and Failure Categories for innovation success and failure Need for suitability and exit criteria Reasons for innovation project failure Predictions on the Future of Innovation Project Management The Six Pillars of changing times Some uses for the new value and benefits metrics

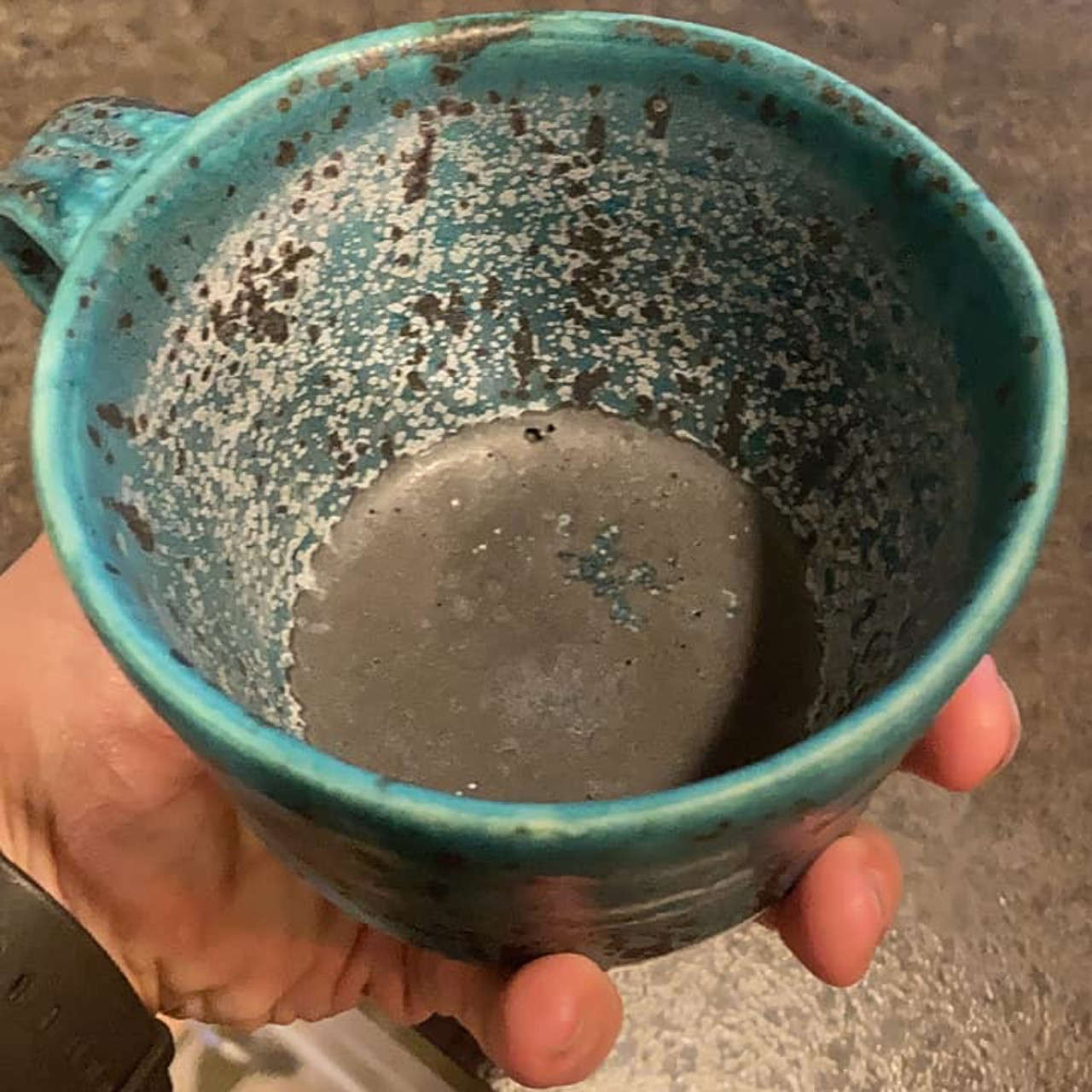

Food Safe and Stable Glazes

By Tim Thornton

If you mix up your own glazes for your pottery, this course will teach you all about food safety and glaze stability, and understand the underlying chemistry.

Finance for project managers and engineers (In-House)

By The In House Training Company

What do engineers and project managers need to know of finance? 'Nothing - leave it to the accountants!' No, no, no! Engineers must be conversant with the terminology and statements that accountants use. Technical expertise in projects, service delivery, production or other areas can only really be harnessed if the managers understand the accounting and reporting that drives businesses. This course gives the necessary understanding to project, production and technical managers. It develops their skills in understanding financial and management accounting. Accountants may not always like it but a major part of their work is to be the 'servants of business' and to gather, compile and present your figures. So you must understand the figures - they belong to you, your processes or projects. There are many reasons for maintaining accurate accounts. This course focuses on the strategic issues (those over-used words) - what figures reveal about the drivers of business and what they reveal about the day-to-day issues that accountants bother you with. The course will enhance your understanding of finance and of the accounting issues which affect your projects, production and technical areas of business. This course will help you: Understand the business world in figures - make sense of what the accountants are telling you Appreciate what drives business - and how this affects your role in your part of the business Relate your activities to the success of the business - through figures Gain the skills to advance in management - financial awareness is a 'must have' if you are to progress in your career 1 What do accountants do? The finance function, types of accountant, financial v management accounting and the treasury function Understanding the role of the finance function and how the information you provide may be used 2 The basic financial statements Balance sheets and income statements (P&L accounts) What they are, what they contain and above all what they can reveal - how to read them The accounting process - from transactions to financial statements What underpins the statements - accounting systems and internal controls 3 Why be in business - from a financial perspective The driving forces behind financial information Performance measures - profitability, asset utilisation, sales and throughput, managing capital expenditure 4 Accounting rules - accounting standards Accounting concepts and the accounting rules: accruals, 'going concern' - substance over form and other 'desirable qualities' Accruals - why the timing of a transaction is so important to the finance function Depreciation and amortisation - the concepts and practice Accounting standards - the role of International Financial Reporting Standards 5 Cash The importance of cash flow - working capital management Cash flow statements - monitoring overall cash flows Raising cash - levels of borrowing, gearing Spending cash - an outline of capital expenditure appraisal 6 Budgeting Why budget? - good and bad practice Determining why budgets play a key role and should not be simply an annual ritual Justifying your budgets - the link between the strategic plan and day-to-day budgeting - alignment of company culture Budgets as motivators - the importance of the right culture Techniques to improve budgeting - whether day-to-day or capital budgeting 7 Costing The type and detail of costing very much depends on your business - eg, manufacturing piston rings is quite different from the construction of a power plant Issues with overhead allocation Accounting for R&D 8 Reading financial statements Annual financial statements - why they are produced, what's in them and what you should look for Learning what a set of accounts reveals about a company's current situation, profitability and future prospects 9 Performance measurement - analytical reviews and ratio analysis ROI/ROCE Profitability, margins and cost control Sales - asset turnover Efficiency (asset / stock turnover, debtor / creditor days) 'City' measures Investment (interest / dividend cover, earnings per share, dividend yield)