- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2632 Courses in Cardiff delivered Live Online

1:1 Science-based Relationship and Dating Coaching FOR WOMEN

By Single To Couple Consulting

Are you tired of “rocky” relationships, bad dates or feeling lonely? Most of us have learned the hard way, the cost of getting a relationship wrong can be enormous. The rewards of getting it right are immeasurable! That is why, as a certified Relationship & Dating Coach, I help clients avoid the pitfalls and find lasting happiness. So, do you really want to do it right this time around? Take charge of your love lfie today and book a free confidential 30-minute introductory session.

Equality, Diversity & Inclusion

By Prima Cura Training

Equality is everyone’s right and everyone’s responsibility’. This training promotes the requirements of the Equality and Diversity Act. This session will strengthen understanding of Equality & Diversity.

Advanced Bookkeeping Excel Courses online | Excel Training in Campus

By Osborne Training

Why Join Digital Marketing Training Course at Osborne Training Osborne Training is well Recognised for quality Regular Lectures led by Industry Expert Tutors Unlimited Access to the State of the Art Virtual Learning Campus Exclusive Access to High quality study materials Flexible payment option available Join Digital Marketing Training course as Pure Online or Blended with Classroom Delivery Access to Digital Marketing Internship for 3 months at the end of the training Unlimited Tutorial Support from expert tutors Get a Student Discount Card from NUS* Get a Free Tablet PC for limited period* Practical Hands-on Projects, Practical focused Assignments and Group-work for greater skills enhancement and understanding real life issues for real life problems Once you complete the bookkeeping course, you will get a certificate from Osborne Training confirming your professional Digital Marketing Qualifications. What jobs could I qualify for? Senior Digital Marketing Manager Digital Marketing Coordinator Executive Digital Marketing Strategist Digital Marketing Consultant In these roles, you could earn on average more than £40,000 annually (source: Reed Salary Checker, UK). Moreover, many go on to become successful (Millionaire sometime) entrepreneur by offering Digital Marketing services or formulating successful Digital Marketing Strategy for their own business. Digital Marketing Qualifications Digital Marketing Qualifications at Osborne Training are developed in Association with Google. Osborne Training offers Total Digital Marketing Course which combines all major skills required to be a successful Digital Marketeer and you also have option to join a complementary Internship at the end of your course. In joining the Total Digital Marketing Course at Osborne Training, you will make one of the greatest decision of your career and can look forward to a successful career in digital marketing. Digital Marketing Course Overview Total Digital Marketing Course covers major areas of Digital Marketing to make you completely ready for the digital era. The Digital Marketing course comes with optional Internship at the end of the training making you highly employable. Practical focused and hands-on approach of the training method helps you to be ready to offer real life solutions for real life problems. Digital Marketing Training Course Content Basics of marketing Marketing In Digital Era All About Web Search Engine Optimization Search Engine Marketing Affiliate Marketing Social Media Marketing Email marketing and nurturing (inbound) Mobile app marketing Content marketing Web, mobile and app analytics Growth Hacking Creating robust digital marketing strategy

Women in Construction Management Course

By The Power Within Training & Development Ltd

Supporting Women in Leadership Throughout The UK Our women in leadership course is specifically designed to target challenges and support women in developing their leadership and management careers. AWARD WINNING LEADERSHIP DEVELOPMENT PROGRAMME Discover Our Women in Construction Management Course The Power Within is dedicated to helping women in construction across England and Scotland achieve business success through our Motivational Intelligence framework. Motivational Intelligence is the third level of intelligence, and the science behind it has won a Nobel Prize. Our women leadership in construction course supports women by improving their motivation, self-belief, decision-making, and leadership skills. This programme is designed to help female business leaders adapt more quickly to their environment, handle adversity more effectively, take productive action, and thrive during times of change. Each is a vital skill needed in today’s ever-changing business environment. When completed, you’ll have the skills needed to make decisions more effectively that help your business grow, become more resilient, and take opportunities when others are stuck. "This course has completely changed my outlook on my responsibilities as a manager/leader. In 26 years with Pfizer, I have never participated in a programme that has as profoundly changed my perspective on my role, my responsibilities and my ability to positively impact my team." FEMALE DIRECTOR OF BUSINESS SERVICES, PFIZER LEADING WITH MOTIVATIONAL INTELLIGENCE What is our Women in Construction Course? In the past five years, we’ve supported thousands of business leaders and managers in nurturing the skills and mindset needed to achieve and exceed their business goals. The Power Within knows women are incredibly effective and consistent at applying our Motivational Intelligence techniques to their lives and business. Our women in construction management course is designed to give you the skills you need to take charge of your business and ensure constant growth while future-proofing your business. The training is perfect for women in construction who are managers or leaders looking to: Quickly Adapt Their Team to Change Effectively Mentor Every Team Member Improve Communication and Collaboration Gain More Buy-In to New Goals or Strategies Transform Their Team Culture Increase Initiative and Self-Motivation Across Their Team How We Help Women in the Construction Industry Our course focuses on imparting fundamental skills, tactical best practices, and powerful insights into the human side of the business. You’ll be provided with valuable knowledge needed to be successful leaders and managers of all levels. We’ll focus on addressing the challenges new businesses around the world face, like leading teams and developing businesses in turbulent and transitional times as well as overcoming the challenges of being women in the construction industry. Throughout the course, particular emphasis is given to helping leaders raise motivational intelligence and foster a growth mindset within their team. LEADING WITH MOTIVATIONAL INTELLIGENCE Our Leading with Motivational Intelligence (MQ) Executive Diploma Programme is specifically designed to help participants create the “complete game” of leadership and management. Leveraged by more than 40% of the largest Fortune 500 companies and implemented around the world, the Leading with Motivational Intelligence (MQ) consistently receives a participant buy-in rate in excess of 97%. However, the most important statistic is: 12 months after completing the course more than 93% of participants continue to use the skills and techniques taught on a daily basis. SQA APPROVED EXECUTIVE DIPLOMA What Skills Do We Help Women in Construction Develop? The skills we teach through our women in construction management courses are delivered through seven modularised sessions, each between three and three-and-a-half hours per session, with all sessions starting at 9:30 am via Zoom. An additional two hours per week is spent working on the online training assignments and leadership development plan. Each session will provide the education and information needed to establish yourself in your business. Here is more information regarding each session and the skills taught: SESSION 1: SELF-LEADERSHIP & THE SECRET TO PERSONAL SUCCESS Our first module is focused on setting course expectations and creating the right environment for learning. We’ll introduce the format and logistics, then discuss leading through turbulent times and how we can take control of ourselves, our thoughts, and our actions to lead growth. There is also a discussion on adult learning techniques and how leaders can leverage them to improve the effectiveness of their teams. We’ll also explore how turbulence and transition have changed how we manage and lead our teams. SESSION 2: THE ROLE OF INTELLIGENCE WHEN LEADING In this session, we’ll discuss the three levels of human intelligence and show how they each play in an individual’s performance and behaviors. Through two distinct mindsets, you’ll be shown how an individual’s motivational intelligence ultimately influences their emotional intelligence and intelligence quotient (IQ). Depending on which mindset a person operates under ultimately dictates their view of themselves, opportunities, and the work at which they will allow themselves to succeed. Finally, we’ll discuss switching your team to a growth mindset. SESSION 3: THE PILLARS OF HUMAN PERFORMANCE Completing this session will allow you to deconstruct the components that create a motivational intelligence growth mindset. Through discussion, you’ll see how most organizational challenges can be directly tied back to lapses in these components. We’ll review the leaders who’ve had the most significant influence on the meeting participants and shows the commonalities that make these leaders stand out. Lastly, we’ll introduce terminology, tools, and techniques that leaders can leverage to better coach and mentor their team. SESSION 4: MANAGEMENT VERSUS LEADERSHIP: THE TWO CRITICAL AND CO-DEPENDENT SKILLSETS FOR CREATING TEAM SUCCESS We’ll discuss the difference between a manager’s and a leader’s focus. The discussion focuses on the two most common management mistakes and how they undermine team culture and individual performance. The final debate focuses on the five critical best practices of excellent management, including clearly defining and communicating goals, creating alignment and buy-in, setting proper expectations, monitoring performance, and recognizing and rewarding performance. Our final portion will work to define what management is. Session 5: Exploring and Defining Leadership: Dispelling the Myths that Surround It Session 5 strives to define leadership. Building on this definition is a follow-up discussion regarding how people develop their leadership abilities. We’ll explore the underpinnings of what creates a successful leader. It also includes the importance of asking questions and active listening. We’ll review the five behavioral characteristics associated with motivational intelligence and how leaders can assess the relative strengths or weaknesses of the characteristics within their team. Lastly, we’ll explore great leaders’ five critical best practices, including communicating a compelling vision, modeling the correct behaviors, establishing a team culture anchored in responsibility, consistently building team confidence and self-esteem, and proactively coaching and mentoring. SESSION 6: BUILDING A LEADERSHIP TOOLBOX FOSTERING ADAPTABILITY, RESILIENCE, AND COURAGE We’ll provide information regarding tools and techniques that leaders can utilize to foster greater accountability and ownership win their teams. The Power Within will explore self-esteem’s critical role in the relative strength or weakness of a person’s motivational intelligence and adaptability in life. We’ll discuss how self-esteem has formed and how it will influence how a person interprets feedback in life. Lastly, we’ll explore levels of self-esteem and the associated behaviors of each. SESSION 7: HELPING EMPLOYEES DEVELOP A HEALTHY PERSPECTIVE AND RESILIENT ATTITUDE During the final session, we’ll explore self-esteem’s critical role in the relative strength or weakness of a person’s motivational intelligence and adaptability in life. We’ll talk about how self-esteem is formed and how it influences how a person interprets feedback. Finally, we’ll explore levels of self-esteem and the behaviors of each and the influence of comfort zones, and the tools that leaders can use to help people escape the fear of change. Our Course Leaders The Power Within was founded by husband and wife team James and Enas Fleming, to inspire people worldwide to think bigger, be better, and achieve more. They both work on a personal level with individuals, businesses, and organisations to help them create leaders and build environments where they can thrive. James and Enas challenge the limits with the Motivational Intelligence formula to help you broaden your perspective and create a future on your terms. Here is more about your course instructors: James Fleming James Fleming – James Fleming, the co-creator of The Power Within. He wanted to inspire people around the world to think better, be better, and achieve more. James believes everyone can do whatever they set their minds to. Founding The Power Within allowed James to turn that deep knowledge into a business that helps others think bigger, better, and achieve more daily. He strives to give leaders the tools and knowledge to achieve their full potential while increasing their self-confidence and self-belief through the Motivational Intelligence Revolution. James wants to support today’s businesses to become tomorrow’s leaders. Mari Steyn Mari is the go-to person for building self-esteem, offering new perspectives and stepping up in Life. With an endless abundance of excitement and love for all people, combined with degrees in Psychology, Knowledge and Information Management and is a Master NLP and Transformation Coach and International NLP and Coaching Trainer and Executive Coach, Mari offers an attractive, fresh, expert approach to Emotional Freedom, Motivational Intelligence, Leadership Development and ReWriting your Story. We undoubtedly have the power within to alchemize ourselves and any situation! Seeing the light go on in someone’s eyes is my ultimate joy. Take Charge with Our Women in Construction Course The Power Within is a Motivational Intelligence company dedicated to helping businesses and leaders become more accountable, resilient, adaptable, and capable of handling all challenges, regardless of the complexity. Our women in construction management course build upon best practices, strategic insights, and lessons learned over three decades of building leadership universities for Fortune 500 companies. Throughout the course, emphasis is given to helping leaders raise their motivational intelligence and foster a growth mindset within their team. You’ll gain the skills you need to successfully lead your team and overcome adversity while ensuring your company is profitable. To learn more about our course or to register, reach out today.

Personal Goal Setting Workshop

By Leadership Management International (LMI) UK

This workshop is being run jointly by LMI UK and LMI Ireland and offers a framework and toolkit for setting and achieving personal goals in all all areas of your life.

New Leader in Early Years training.

By The Leadership Wizard

This is for New leaders/Managers working within early years. This programme is consists of 6 topics which all include work based projects. 1. What does good leadership look like? 2 Enhance your communication skills .3. Promoting good teamwork. 4 Managing Difficult Conversations. 5. Getting to know sector relevant documents. 6. The importance of wellbeing for yourself and for your team. This programme of training ensures new leaders are professional, knowledgeable and confident in leading teams of people. The work based projects gives the opportunity to practise new skills and then reflect on that practise with the trainer. The programme is delivered individually for maximum impact either face to face or virtually depending on the location The trainer has 24 years experience of managing teams of people in the early years and can relate to the busy, challenging emotional environments that Early Years Leaders work in. Each session is 1.5hrs.

Data Governance Masterclass: Unlocking the True Value of Your Data

5.0(3)By The Data Governance Coach

Building the Case for Data Governance Masterclass with Nicola Askham (The Data Governance Coach) and Alex Leigh

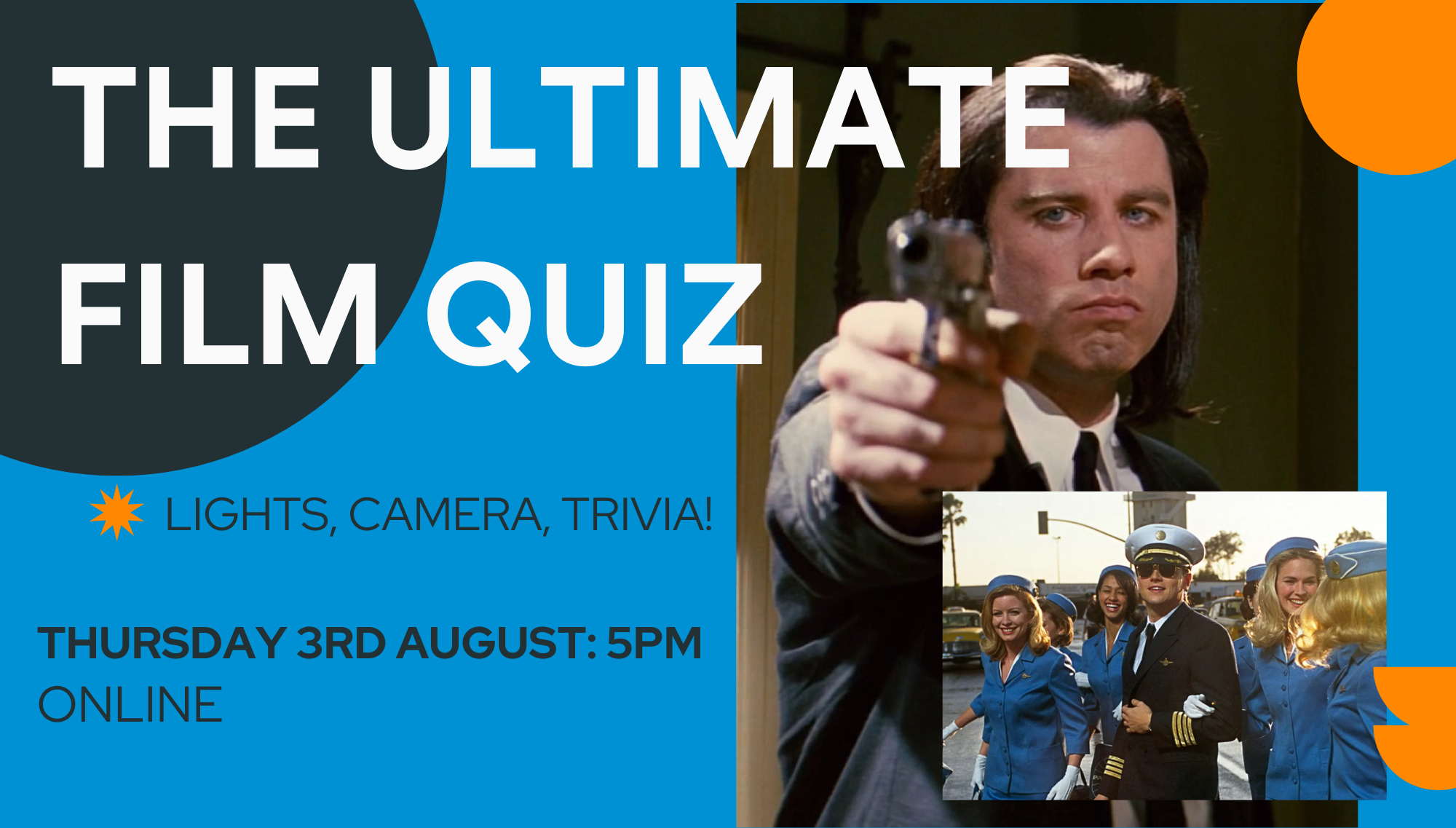

Date: Thursday 3rd August Time: 5pm Location: Online Come and meet your future classmates while you showcase your cinematic wisdom at our Ultimate Film Quiz! Event Details:Whether you're an aspiring filmmaker, actor or screenwriter, this quiz will test even our most cinema-savvy students! We'll be testing your knowledge on the timeless classics, heartwarming dramas and pulse pounding action masterpieces.So grab your popcorn and get ready to showcase your movie knowledge next Thursday, August 3rd at 5pm. The deadline to book this event is Monday 31st July 2023.