- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

45 Courses

PgMP Exam Prep

By IIL Europe Ltd

PgMP® Exam Prep This course is designed and developed by PgMP® certified consultants and instructors. Its aim is to prepare professionals who are familiar with the principles of program management for the Program Management Professional (PgMP)® Examination. The course is based on PMI's The Standard for Program Management, A Guide to the Project Management Body of Knowledge (PMBOK® Guide), and PMI's Program Management Professional (PgMP)® Examination Content Outline (current versions). Through this learning experience, you will explore: Program management from a PMI standard perspective, including the interdependencies between the five performance domains, the three program phases, and the ten supporting activities in this new and improved program management standard The difference between the five performance domains in the new program management standard and the five practice domains in the examination content outline The role and competencies of the program manager The difference between project managers and program managers - and their relationship in a program environment The difference between program managers and portfolio managers - and their relationship in a program environment How program managers align and manage benefits The best ways to engage and involve program stakeholder groups How to establish governance across the program life cycle What You Will Learn At the end of this course, you will be able to: Differentiate between the practice domains in the PMI PgMP® Examination Content Outline and the performance domains in The Standard for Program Management - Fourth Edition Name and describe the three phases in the program management life-cycle phases Describe the mapping of the life-cycle phases with the supporting program activities Identify the key outputs of the supporting program activities Articulate the interrelationships between the program management supporting processes and the mapping of processes to Knowledge Areas and Process Groups in the PMBOK® Guide - Sixth Edition Apply program management knowledge to answer foundation and scenario-based questions Summarize the process and eligibility criteria for earning the PgMP® credential Getting Started Introductions Course structure Course goals and objectives Foundation Concepts Programs, projects, and portfolio definitions differences, and how they relate The definition of a component and how it relates to a program Representative program management life cycle Role of the program manager and the program office The difference between the program management practice and performance domains Program Register and Knowledge Asset Management Program registers, and how they are used to manage knowledge assets Knowledge asset management, beginning with the data, information, knowledge, and wisdom (DIKW) Model Knowledge assets and relationship to the performance domains The program manager as a knowledge asset manager Types of Programs Perspectives on programs to establish the 'right' perspective Categories of programs based on the program standard Scenario-based questions Program and Organization Strategy Alignment An overview of the Program Strategy Alignment performance domain Exploration of the elements of strategic alignment, i.e., the business case, program charter, and program roadmap Exploration of organization maturity and strategic alignment Scenario-based questions that reference both the Program Strategy Alignment performance domain and the Strategic Program Management practice domain Program Benefits An overview of the Program Benefits Management performance domain Exploration of each benefits management interaction with the representative program management life cycle: Benefits IdentificationBenefits Analysis and PlanningBenefits DeliveryBenefits TransitionBenefits SustainmentScenario-based questions that reference both the Program BenefitsManagement performance domain and the Benefits Management practice domain Program Stakeholder Engagement An overview of the Program Stakeholder Engagement performance domain Exploration of each stakeholder engagement performance domain activity: Program Stakeholder IdentificationProgram Stakeholder AnalysisProgram Stakeholder Engagement PlanningProgram Stakeholder EngagementProgram Stakeholder CommunicationsScenario-based questions that reference both the Program StakeholderEngagement performance domain and the Stakeholder Management practice domain Program Governance An overview of the Program Governance performance domain Exploration of each program governance performance domain activity: Program governance practicesProgram governance roles and responsibilitiesProgram governance design and implementationGovernance relationship within programsScenario-based questions that reference both the Program Governance performance domain and the Governance practice domain Program Life Cycle Management An overview of the Program Life Cycle Management performance domain Exploration of the three phases in the representative program life cycle: Program DefinitionProgram DeliveryProgram ClosureExploration of the interaction between program activities and integration managementScenario-based questions that reference both the Program Life CycleManagement performance domain and the Program Life Cycle practice domain Program Management Supporting Activities - Part 1 An overview of the program management supporting activities Exploration of 5 of 10 supporting activities: Program change managementProgram communications managementProgram financial managementProgram information managementProgram procurement managementScenario-based question(s) presented after each supporting activity Program Management Supporting Activities - Part 2 Exploration of the remaining 6 of 10 supporting activities: Program quality managementProgram resource managementProgram risk managementProgram schedule managementProgram scope managementScenario-based question(s) presented after each supporting activity Program Management Professional (PgMP®) Examination Application process and timeline General and special eligibility criteria International Institute's Online Learning Tool - access to sample examination questions Program Management Professional (PgMP®) Examination breakdown of domains and subdomains Terms and conditions of the exam PgMP® Professional Code of Conduct

Finance for Non-Finance Professionals in Oil & Gas Petroleum Fiscal Regimes & Applied Finance for Non-Finance Oil & Gas Professionals

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This separately bookable 3 full-day course is not designed to skill Oil & Gas engineers to be accountants, but to give the participants the confidence and ability to communicate with accountants and finance managers and to improve their own financial decision making. For technical professionals, a high level of single subject matter expertise is no longer sufficient for superior management performance. Oil & Gas technical professionals who wish to succeed in the resources industry are required to develop skills beyond their core functional knowledge. An understanding of financial information and management, and an awareness of the economic theory that drives value creation, are an integral part of the managers required suite of skills. This course can also be offered through Virtual Instructor Led Training (VILT) format. Training Objectives Workshop A: Finance for Non-Finance for Oil & Gas Professionals Attend this industry specific course and benefit from the following: Demystify financial jargon and fully interpret financial statements Understand Balance Sheets and Profit & Loss statements of Oil & Gas companies Discover the crucial distinction between cash flow and profit Understand how to make correct investment decisions using Net present Value and Internal Rate of Return Interpret oil and gas company financial reports using ratio analysis Learn the difference between cash costs and full costing of energy products Learn how to manage working capital for increased shareholder value Workshop B: Petroleum Fiscal Regimes and Applied Finance for Oil & Gas Industry Professionals Attend this advanced Training course to enhance your financial acumen from the following: Build and compare cash flow based models of both production sharing contract projects and royalty regime projects Gain an awareness of the different valuation methods for producing properties and undeveloped acreage Learn the industry specific accounting issues that apply when interpreting oil and gas company financial statements Understand how the physical characteristics of energy assets (e.g. reserves, reservoir quality) are translated into project valuations Learn how the investment analysts value oil and gas stocks and make buy/sell recommendations Target Audience This course is specifically designed for those with a non-finance background training from the Oil & Gas sector and requires only basic mathematical ability as a pre-requisite. It is presented in a manner that reduces the jargon to basic principles and applies them to numerous real-life examples. This course has been researched and developed for Managers, Superintendents, Supervisors, Engineers, Planners, Lawyers, Marketers, Team Leaders and Project Coordinators in the technical and non-technical departments in the Oil and Gas industry. Course Level Basic or Foundation Trainer Your expert course leader has presented over 300 courses and seminars in financial management. He began his career as a graduate in the Corporate Treasury of WMC Ltd having completed a degree in Applied Mathematics and Geology at Monash University. After five years with WMC, he pursued an MBA in finance and accounting at Cornell University in New York. He later gained a PhD in energy policy from the University of Melbourne. He worked for WMC Ltd in Perth as a Senior Financial Analyst in the Minerals Division and subsequently as an Energy Analyst in the Petroleum Division. In April 1997, he established an independent consultancy business providing advice to companies such as Woodside, Shell and Japan Australia LNG (MIMI). He spent many years as a consultant and commercial manager in the North West Shelf Gas project in Western Australia. Since 2006, he has been an Adjunct Fellow at the Macquarie University Applied Finance Centre where he teaches courses in valuation, financial statement modelling, and resources industry investment analysis. His background in geology and mathematics allows him to empathise with those who seek an understanding of finance but are approaching the learning experience with a technical mind. He receives consistently high ratings for his breadth of knowledge of the subject matter. He presents in a lively interactive style using real life examples and cases. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Cross Border Electricity Trading in Asia - Renewable Energy, Digital Technologies and New Operational Flexibility Solutions

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) This 3 half-day Virtual Instructor Led Training (VILT) course highlights the impact of the introduction of renewable energy, digital technologies and new operational flexibility solutions in the electricity trading market. These advancements facilitate unique opportunities and challenges for cross border trading of electricity. Most countries in Asia, have designed their own portfolio of climate actions with an accelerated penetration of renewable energy (or by importing renewable energy into their local grids). These changes are taking place at unprecedented speed and add further complexity to the operation of electricity trading markets, while presenting new opportunities. The Asian market, can tap into its vast potential of solar, wind and geothermal energy sources. A global, unified vision is emerging to support each of countries' energy needs and decarbonization goals. This VILT course will highlight priorities of each country to achieve its energy goals. The main operational flexibilities of each type of renewable resource are discussed in detail. The course also discusses the main components of Power Purchase Agreements and advancements in digitalization and how digital technologies can influence the energy market and cross border electricity trading. Key Takeaways: New Energy Market Design Cross Border Trading PPAs Mechanisms and Examples of PPAs The Increased Penetration of Renewable Resources in the Power Systems and How It Stimulates Cross Border Trading How Digital Innovation Drives Energy Markets and Cross Border Trading Training Objectives Upon completion of this VILT course, participants will be able to: Be familiar with the global vision of One Sun, One World, One Grid Understand the major trends reshaping the energy markets Learn how innovative digital technologies change the energy markets Understand why sustainable energy markets require a tighter coordination between transmission and distribution system operators Engage with each other to design the energy market of the future Target Audience This VILT course will benefit policy makers and regulators from energy agencies, transmission companies and utilities as well as power system engineers and power system operators from control centre and ISO. Training Methods The VILT will be delivered online in 3 half-day sessions comprising 4 hours per day, including time for lectures, discussion, quizzes and short classroom exercises. Course Duration: 3 half-day sessions, 4 hours per session (12 hours in total). Trainer Your expert course leader is a Utility Executive with extensive global experience in power system operation and planning, energy markets, enterprise risk and regulatory oversight. She consults on energy markets integrating renewable resources from planning to operation. She led complex projects in operations and conducted long term planning studies to support planning and operational reliability standards. Specializing in Smart Grids, Operational flexibilities, Renewable generation, Reliability, Financial Engineering, Energy Markets and Power System Integration, she was recently engaged by the Inter-American Development Bank/MHI in Guyana. She was the Operations Expert in the regulatory assessment in Oman. She is a registered member of the Professional Engineers of Ontario, Canada. She is also a contributing member to the IEEE Standards Association, WG Blockchain P2418.5. With over 25 years with Ontario Power Generation (Revenue $1.2 Billion CAD, I/S 16 GW), she served as Canadian representative in CIGRE, committee member in NSERC (Natural Sciences and Engineering Research Council of Canada), and Senior Member IEEE and Elsevier since the 90ties. Our key expert chaired international conferences, lectured on several continents, published a book on Reliability and Security of Nuclear Power Plants, contributed to IEEE and PMAPS and published in the Ontario Journal for Public Policy, Canada. She delivered seminars organized by the Power Engineering Society, IEEE plus seminars to power companies worldwide, including Oman, Thailand, Saudi Arabia, Malaysia, Indonesia, Portugal, South Africa, Japan, Romania, and Guyana. Our Key expert delivered over 60 specialized seminars to executives and engineers from Canada, Europe, South and North America, Middle East, South East Asia and Japan. Few examples are: Modern Power System in Digital Utilities - The Energy Commission, Malaysia and utilities in the Middle East, GCCIA, June 2020 Assessment of OETC Control Centre, Oman, December 2019 Demand Side management, Load Forecasting in a Smart Grid, Oman, 2019 Renewable Resources in a Smart Grid (Malaysia, Thailand, Indonesia, GCCIA, Saudi Arabia) The Modern Power System: Impact of the Power Electronics on the Power System The Digital Utility, AI and Blockchain Smart Grid and Reliability of Distribution Systems, Cyme, Montreal, Canada Economic Dispatch in the context of an Energy Market (TNB, Sarawak Energy, Malaysia) Energy Markets, Risk Assessment and Financial Management, PES, IEEE: Chicago, San Francisco, New York, Portugal, South Africa, Japan. Provided training at CEO and CRO level. Enterprise Risk methodology, EDP, Portugal Energy Markets: Saudi Electricity Company, Tenaga National Berhad, Malaysia Reliability Centre Maintenance (South East Asia, Saudi Electricity Company, KSA) EUSN, ENERGY & UTILITIES SECTOR NETWORK, Government of Canada, 2016 Connected+, IOT, Toronto, Canada September 2016 and 2015 Smart Grid, Smart Home HomeConnect, Toronto, Canada November 2014 Wind Power: a Cautionary Tale, Ontario Centre for Public Policy, 2010 POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Project Contract Management Skills: In-House Training

By IIL Europe Ltd

Project Contract Management Skills: In-House Training Contracts are a critical part of most large or strategic projects/programs. As such, it is imperative that Project and Program Managers be well versed on basic implications of a contract as well as best practices in contract management. While not as critical a need, anyone involved in projects that involve external relationships should have a healthy appreciation for the power of good contract management. The overall goal of the course is to provide knowledge to manage complex contracts in a global environment. What You Will Learn After this program, you will be able to: Explain overall project procurement process from a buyer and seller perspective Recognize the importance of key contractual terms and how they affect projects Evaluate and contribute to the pre-contract documents and processes Identify and mitigate common pitfalls throughout the procurement process Utilize techniques to administer contracts Getting Started Introductions Course structure Course goals and objectives Foundation Concepts The Importance of Contract Management Terms and Definitions Contract Management Process Legal Systems Codes of Conduct Planning Business Analysis Procurement Management Plan Procurement Statement of Work (SOW) Common Pitfalls Solicit Contract Market Analysis Bid documents Sellers' Proposals Pitfalls Execute Contract Evaluate and Award Contract Negotiate Contract Execute Contract Common Pitfalls Deliver the Contract Preparing to Deliver Project Plan Risk Management Common Pitfalls Administer Contract Enabling Contract Management Contract Performance Monitoring and Control Change Management Financial Management / Payment Dispute Management & Resolution Contract Completion and Closure

Enhance your SkillsBuilding on Level One and the skillset developed, you will be advancing onto more advanced machine polishing and cleaning techniques, to progress your detailing career and skillset further. Existing valeters and detailers confident in their skillset's reflection of Level One's content may also qualify to bypass to this level, should they be able to demonstrate their qualification by purchasing, taking, and passing with sufficient breadth, our online Level One assessment. Machines introduced at this level include forced rotation dual action polishers, every inception of Dual action polishers, both in throw and size. We'll also look at pad types, heavy cutting options and defect identification to assess what can be rectified and how. Interiors are explored in greater depth with higher yield services with 'dry' steam cleaning, odour removal, leather protection and treatment, and stain removal with the associated chemistry. Small area sanding and isolated correction are a key finish to this level and allow you to achieve fantastic results from otherwise irreparable damage Following your introduction skills learnt in Level One, you will be progressing onto more skilful machine polishing and cleaning techniques. Machines introduced at this level include forced rotation dual action polishers, every inception of Dual action polishers, both in throw and size. We'll also look at pad types, heavy cutting options and defect identification to assess what can be rectified and how. Interiors are explored in greater depth with higher yield services with dry steam cleaning, odour removal, leather protection and treatment, and stain removal with the associated chemistry. • Pad types • Compound grades • Rubber and plastic protection • Coatings after-care • Polymer and PTFE exterior LSPs • Glass sealants • Troubleshooting • Accreditations • Financial management • Insurance • Marketing • Pricing • Spot Sanding • Targeting your customer base • Safe working practice • Workshop planning • Intermediate chemical knowledge • Efficiency and time management • Matte finishes • Environmental considerations • Advanced cleaner chemistry • Bonded overspray and concrete • LSPs • Engine bay detailing • Plastic trim restoration • Odour removal • Steam cleaning • Stain removal & chemical principles • Fabric and leather protection • Paint types and their principles • Long and short throw DA machines • Forced action machines • Lighting • Defect identification Following the course, further case studies and exercises will allow the knowledge to develop further as you use it over a 3-6 month period, after which the Level 2 exam is sat to award certification. Course Length 2 Days (0930-1600) Group Size One-to-One Location UK Detailing Academy, 2 Purlieus Barn, Ewen, Cirencester, GL7 6BY Experience / Qualification Completion of Level 1 Refreshments or Lunch Refreshments included

Do you want to get some training in the hospitality sector? We are waiting here for you in Knight Training, come to get your Award in Licensed Hospitality Operations now and train with us! This qualification is designed for those new to running or looking to run, licensed retail premises. Don't waste any more time and give us a call on 0330 999 3199 to find more about it!

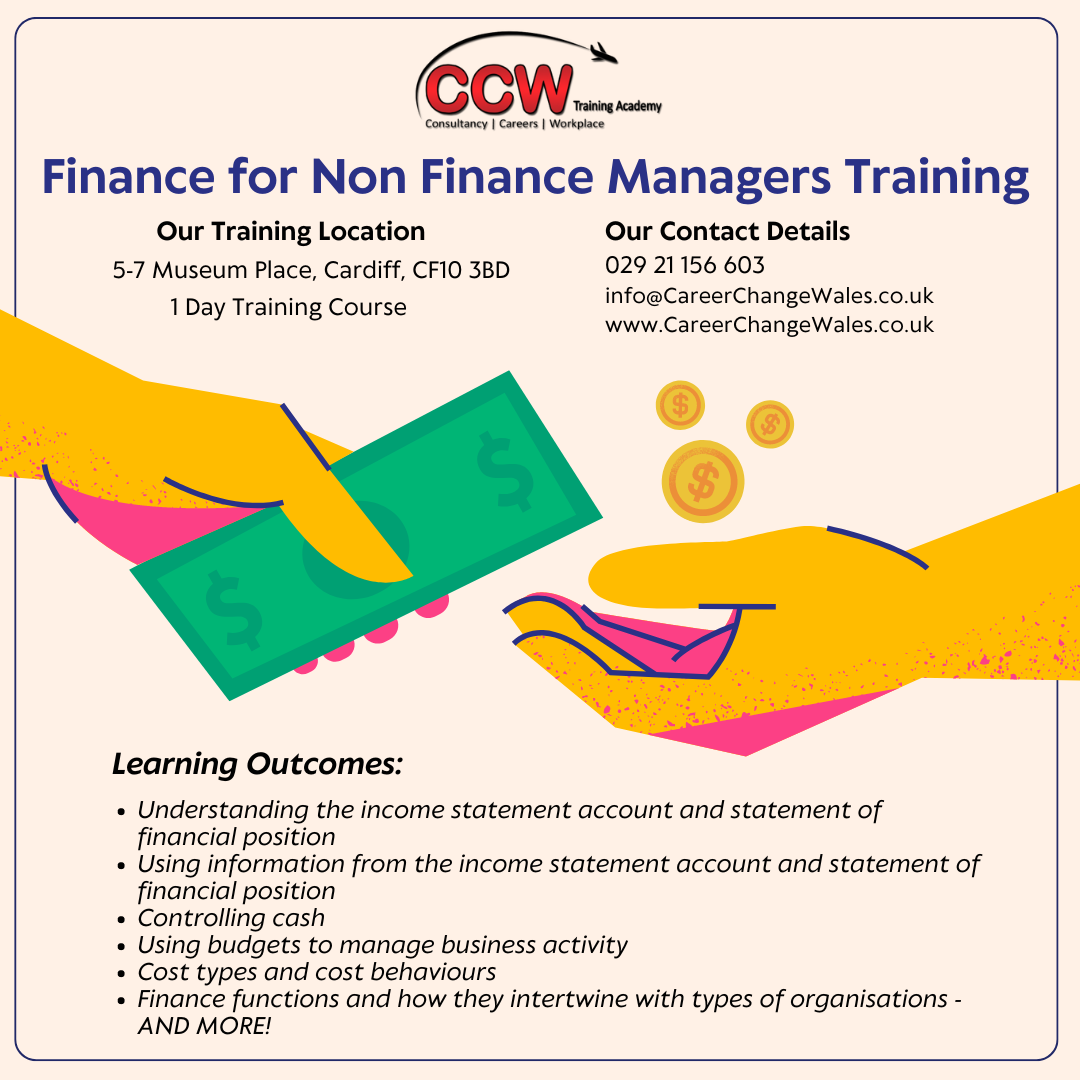

This finance for managers training course will help you to understand basic financial principals and the documents used in business. You will learn how to interpret the information in these documents, and use this to manage day-to-day business activity. This knowledge will enable you to be more effective in your managerial role and to be more sustainable.

Finance for Non Financial Managers

By Underscore Group

Learn the basics of financial awareness and better understand the language used by accountants and how financial statements fit together within organisations. Course overview Duration: 2 days (13 hours) This workshop will provide participants with a grasp of basic financial awareness, to help them to better understand the language used by accountants and how financial statements fit together. Training is done in a jargon-free way that is aimed building attendees’ confidence in using financial terms and concepts within their organisation. Competent financial management has many aspects, it is wide reaching and requires multiple skills but if participants work to become organised and effective in planning, these skills can be easily acquired. There is a misconception that to be a good operational manager dealing with financial decisions people must be accounting or numerical geniuses. There are basic skills that attendees can easily learn that will support them in those areas. Objectives By the end of the course you will be able to: Identify the importance of financial management and its impact Identify the link between financial information and decision making Set, manage, monitor and review budgets Analyse financial statements Demonstrate the link between the statements, budgets and decision making. Content Financial Management Budgeting process (generic / client specific if possible) Forecasting and re forecasting process The need for accurate forecasting Accrual v cash accounting revisited Financial Objectives of the business Users of the accounts Financial Tools Depreciation and Amortisation Accruals and Prepayments Deferred and Accrued Income Costs, Opex and Capex Financial Statements The Income Statement The Balance Sheet Understanding capital employed The relationship between balance sheet and income statement The cash flow statement Profitability: gross, operating and net margins Review of client’s management information reports Building the Business Case Break even analysis Discounted Cash Flow Discount factors Net Present Value (NPV) Internal Rate of Return (IRR)

Overview Internal auditing is an independent and objective activity to evaluate an organisation's internal operations. You'll learn how to initiate an audit, prepare and conduct audit activities, compile and distribute audit reports and complete follow-up activities. It is very important for the organisation to have a smooth flow of accounting as it plays a very important role in the development of the organisation. Financial Managers or any person who deals with Accounts need to see that the company accounts are very updated and are free from any risks that can become a problem during the time of Auditing. Objectives By the end of the course, participants will be able to: Efficiently dealing with senior leaders with confidence Effective Contribution and Strategically Analysing and Auditing towards business success Analysing and Evaluating as an effective internal audit leader How to manage key relationships with the audit committee Practical methods for managing the audit committee and senior management Describing the significance to help maximize the contribution to their organization

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: Overcome the barrier of the accountants' strange language Deal confidently with financial colleagues Improve their understanding of your organisation's finance function Radically improve their planning and budgeting skills Be much more aware of the impact of their decisions on the profitability of your organisation Enhance their role in the organisation Boost their confidence and career development 1 Review of the principal financial statements What each statement containsOutlineDetail Not just what the statements contain but what they mean Balance sheets and P&L accounts (income statements) Cash flow statements Detailed terminology and interpretation Types of fixed asset - tangible, etc. Working capital, equity, gearing 2 The 'rules' - Accounting Standards, concepts and conventions Fundamental or 'bedrock' accounting concepts Detailed accounting concepts and conventions What depreciation means The importance of stock, inventory and work in progress values Accounting policies that most affect reporting and results The importance of accounting standards and IFRS 3 Where the figures come from Accounting records Assets / liabilities, Income / expenditure General / nominal ledgers Need for internal controls 'Sarbox' and related issues 4 Managing the budget process Have clear objectives, remit, responsibilities and time schedule The business plan Links with corporate strategy The budget cycle Links with company culture Budgeting methods'New' budgetingZero-based budgets Reviewing budgets Responding to the figures The need for appropriate accounting and reporting systems 5 What are costs? How to account for them Cost definitions Full / absorption costing Overheads - overhead allocation or absorption Activity based costing Marginal costing / break-even - use in planning 6 Who does what? A review of what different types of accountant do Financial accounting Management accounting Treasury function Activities and terms 7 How the statements can be interpreted What published accounts contain Analytical review (ratio analysis) Return on capital employed, margins and profitability Making assets work - asset turnover Fixed assets, debtor, stock turnover Responding to figures EBIT, EBITEDIA, eps and other analysts' measure 8 Other key issues Creative accounting Accounting for groups Intangible assets - brand names Company valuations Fixed assets / leased assets / off-balance sheet finance

Search By Location

- financial managment Courses in London

- financial managment Courses in Birmingham

- financial managment Courses in Glasgow

- financial managment Courses in Liverpool

- financial managment Courses in Bristol

- financial managment Courses in Manchester

- financial managment Courses in Sheffield

- financial managment Courses in Leeds

- financial managment Courses in Edinburgh

- financial managment Courses in Leicester

- financial managment Courses in Coventry

- financial managment Courses in Bradford

- financial managment Courses in Cardiff

- financial managment Courses in Belfast

- financial managment Courses in Nottingham