- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Driscoll's Model of Reflection: A Guide to Personal and Professional Growth

By david hude

In this comprehensive blog post, we explore Driscoll's model of reflection, a powerful tool for enhancing personal and professional development. Learn about the three simple yet profound questions at the heart of the model, its benefits, and why Driscoll's model of reflection is good for anyone looking to improve their reflective practice.

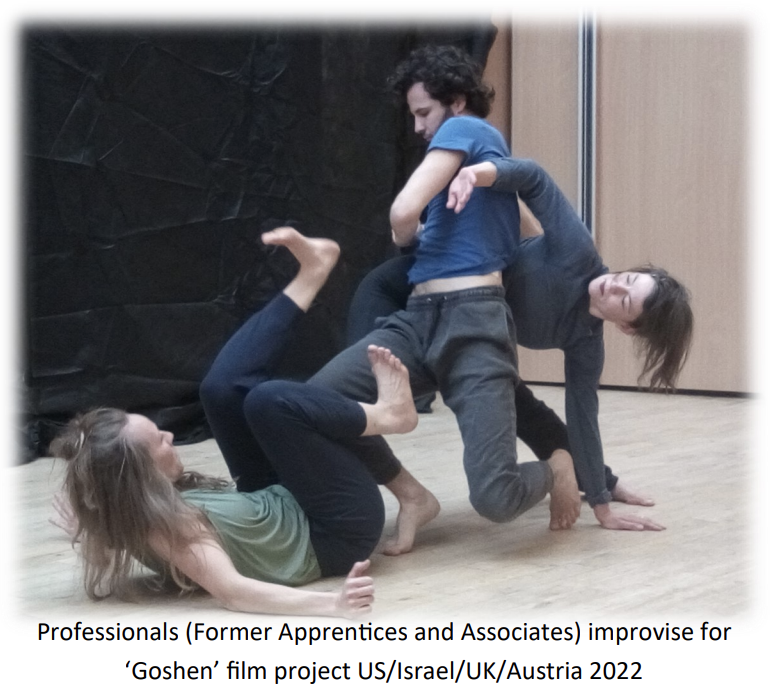

Advanced Professional Practice

By CORE theatre arts training

CORE is a professional level training company in physical theatre and acting with a solid emphasis on the classical “Theatre Apprenticeship” training model. With 30+ years experience and using proven training methods, combined with our unique mentoring approach, we develop the whole person, in order to equip our trainees to identify their God-given calling and use their gifts to impact culture and society for good. EQUIPPING YOU FOR LIFE One of our unique qualities lies in our ability to identify your strengths, regardless of your experience and training, and develop you further. You will be challenged, receive practical skills and confidence to make your next step, whether you want to take qualifications with Trinity College London, train as a teacher or get an agent as you step into the challenging world of the performing arts. Training groups are kept small to ensure individual attention and you receive a wealth of transferrable skills to equip you for life in the workplace. OUR UNIQUE APPROACH CORE's uniqueness lies in our attention to individual coaching, personal and professional development whilst maintaining a culture of excellence and rigorous discipline. We engage trainees in professional productions for on and off stage experience, and in collaborative works with other artists and musicians. Admission is by audition only (min age 16) no educational qualifications required, as admission is based on Potential, Passion and Perseverance that are essentials required to thrive in this industry and in life!

Intermediate Professional Practice

By CORE theatre arts training

CORE is a professional level training company in physical theatre and acting with a solid emphasis on the classical “Theatre Apprenticeship” training model. With 30+ years experience and using proven training methods, combined with our unique mentoring approach, we develop the whole person, in order to equip our trainees to identify their God-given calling and use their gifts to impact culture and society for good. EQUIPPING YOU FOR LIFE One of our unique qualities lies in our ability to identify your strengths, regardless of your experience and training, and develop you further. You will be challenged, receive practical skills and confidence to make your next step, whether you want to take qualifications with Trinity College London, train as a teacher or get an agent as you step into the challenging world of the performing arts. Training groups are kept small to ensure individual attention and you receive a wealth of transferrable skills to equip you for life in the workplace. OUR UNIQUE APPROACH CORE's uniqueness lies in our attention to individual coaching, personal and professional development whilst maintaining a culture of excellence and rigorous discipline. We engage trainees in professional productions for on and off stage experience, and in collaborative works with other artists and musicians. Admission is by audition only (min age 16) no educational qualifications required, as admission is based on Potential, Passion and Perseverance that are essentials required to thrive in this industry and in life!

Foundations in Professional Practice

By CORE theatre arts training

CORE is a professional level training company in physical theatre and acting with a solid emphasis on the classical “Theatre Apprenticeship” training model. With 30+ years experience and using proven training methods, combined with our unique mentoring approach, we develop the whole person, in order to equip our trainees to identify their God-given calling and use their gifts to impact culture and society for good. EQUIPPING YOU FOR LIFE One of our unique qualities lies in our ability to identify your strengths, regardless of your experience and training, and develop you further. You will be challenged, receive practical skills and confidence to make your next step, whether you want to take qualifications with Trinity College London, train as a teacher or get an agent as you step into the challenging world of the performing arts. Training groups are kept small to ensure individual attention and you receive a wealth of transferrable skills to equip you for life in the workplace. OUR UNIQUE APPROACH CORE's uniqueness lies in our attention to individual coaching, personal and professional development whilst maintaining a culture of excellence and rigorous discipline. We engage trainees in professional productions for on and off stage experience, and in collaborative works with other artists and musicians. Admission is by audition only (min age 16) no educational qualifications required, as admission is based on Potential, Passion and Perseverance that are essentials required to thrive in this industry and in life!

Level 4 Award in Immediate Life Support (ILS) Course

By NR Medical Training

The Level 4 Award in Immediate Life Support (RQF) is ideal for a wide range of healthcare professionals. This includes doctors, dental professionals, medical students, nurses, midwives, and physiotherapists who need an ILS qualification for their registration with regulatory bodies like the GMC, GDC, NMC, and HCPC. It's also perfect for those looking to advance in their careers or needing an ILS certification for new job opportunities.

Accounting Courses | Total Accounting | CPD Training

By Osborne Training

Total Accounting Courses It is a comprehensive practical accountancy training programme designed to build the bridge between knowledge and practical aspects of accounting and tax. With this programme various modules of tax and accounting are covered as well as Computerised based Accounting & Payroll. After completion of the modules you will have the chance to get hands on practical work experience which will open the door for lucrative Accounting, Tax & Payroll sector. Duration Accountancy Training: 10-12 Weeks (Weekdays/weekend/Evening) Accounting Work Experience 3 Months after the training You can start anytime of the year. The training takes place once each week. Once you finish your training modules then you can start job placement. What accounting jobs will I qualify for? Tax advisor Tax consultant Payroll Consultant Finance Officer Financial Accountant In these roles, you could earn up to £42,000 per annum (source: reed Salary Checker, UK Only). Benefits for Trainees Completion of this training will open new doors to exciting careers, as well as extending current skills if you are currently employed Free Job Placement(optional) Start your own accountancy Practice Work in a wide range of businesses Update your knowledge on tax and accountancy Improve your employability prospects A career path into tax and accountancy Ideal Continuing Professional Development course Gain a qualification to boost your CV Start your training soon without having to wait long for the new term to begin Free Tablet PC when paying in full upfront Gain Verifiable CPD Units Accounting Courses Contents Advanced Excel Bookkeeping VAT Training - Preparation and Submission Personal Tax Return Training Company Accounting and Tax Training Sage 50 Accounting Training Sage Payroll Training Accounting work experience (optional)

CHILD PROTECTION ADVANCED ONE DAY COURSE

By Child Protection Training Uk

Everyone shares responsibility for safeguarding and promoting the welfare of children and young people, irrespective of individual roles. This course is for those who have already completed a Level 1 course and need to gain an advanced knowledge of Child Protection, including working towards becoming a Designated Safeguarding Lead (DSL), manager or policy writer. This course is designed for individuals who work with children in either a paid or voluntary capacity. It relates to the issues surrounding safeguarding children by exploring the concepts of "child vulnerability", "child protection" and "significant harm"; coupled with the individual and organisational responsibilities of protecting children from abuse.

DATE: 15th February TIME: 4pm LOCATION: Classroom 2 St John Ambulance have kindly agreed to provide a First Aid Safety Information workshop to any interested Central Film School students. Areas of focus will include how to be safe on a night out, and also how to handle injuries specific to film sets (burns, electrocution, etc.) This is fantastic information to have both for your professional development and personal life. You never know when you may one day need to call upon what you've learnt. Be sure to book in advance and email academics@centralfilmschool.com if there are any issues or questions.

ACCA CPD Courses for Accountants in London | Birmingham | Online CPD Courses

By Osborne Training

Why do you need CPD Courses? CPD stands for Continuous Professional Development. As an accountant, it is vital to gain CPD points to comply with Professional Accounting Bodies (such as ACCA, AAT, CIMA, ICAEW etc.) requirement and to retain your membership. CPD Course Overview You can join various practical accounting cpd courses designed to build the bridge between knowledge and practical aspects of accounting and tax. With this cpd courses many modules of tax and accounting are covered in addition to Computerised Accounting & Payroll. After completing the cpd training you will have the chance to get hands on experience which will open the door for highly paid jobs in Accounting, Tax & Payroll sector. CPD Training Method Classroom Based - Osborne Training offers Daytime or Weekend sessions for accounting CPD Training Courses in London. Online Live - Osborne Training offers Evening or Weekend sessions for online CPD Training Courses through Virtual Learning Campus. A course certificate from Osborne Training, confirming CPD Points and Completion. Total Accounting Training with Job Placement Total Taxation Training Corporation Accounting and Tax Return Income Tax Return Advanced Excel Training

Search By Location

- Professional Development Course for Educators Courses in London

- Professional Development Course for Educators Courses in Birmingham

- Professional Development Course for Educators Courses in Glasgow

- Professional Development Course for Educators Courses in Liverpool

- Professional Development Course for Educators Courses in Bristol

- Professional Development Course for Educators Courses in Manchester

- Professional Development Course for Educators Courses in Sheffield

- Professional Development Course for Educators Courses in Leeds

- Professional Development Course for Educators Courses in Edinburgh

- Professional Development Course for Educators Courses in Leicester

- Professional Development Course for Educators Courses in Coventry

- Professional Development Course for Educators Courses in Bradford

- Professional Development Course for Educators Courses in Cardiff

- Professional Development Course for Educators Courses in Belfast

- Professional Development Course for Educators Courses in Nottingham