- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

FAA Level 2 Award In First Aid For Youth Mental Health (RQF) Classroom (1 day course), Virtual (3 x 2½ hour sessions) Gives learners knowledge of Youth Mental Health First Aid Gives learners the skills to help young people with mental health problems and improve their mental health Course Contents: What is Youth Mental Health? The role of the mental health first aider Identifying mental health conditions Recognising and managing Stress Mental health conditions Recognising a range of mental health conditions:DepressionAnxietyPsychosisEating disordersSuicideSelf-harmPost-traumatic stress disorderConduct disorders - BullyingDrugs and alcohol Mental health first aid action plan Benefits of this course: These figures, taken from the Young Minds website show clearly how many young people suffer with their mental health... One in six children aged five to 16 are identified as having a probable mental health problem That means that, on average, five children in every classroom have a mental health problem 80% of young people with mental health needs agreed that the coronavirus pandemic had made their mental health worse Suicide was the leading cause of death for males and females aged between five to 34 in 2019 Around half of 17-19 year-olds with a diagnosable mental health disorder has self-harmed or attempted suicide at some point In 2018-19, 24% of 17-year-olds reported having self-harmed in the previous year, and seven per cent reported having self-harmed with suicidal intent at some point in their lives So please, learn more about how to help these youngsters, and give them the chance to live happy, healthy lives Accredited, Ofqual regulated qualification Our Mental Health First Aid Courses are nationally recognised, Ofqual regulated qualifications accredited by First Aid Awards Ltd in association with NUCO Training. This means that you can be rest assured that your Mental Health First Aid Certificates fulfill the upcoming legal requirements and are a very good way to make sure you and your employees have a supporting workplace to deal with staff's mental health conditions. The Ofqual Register number for this course is 603/7176/6

The Gold Card Training Programme is the most comprehensive electrician course available. We offer weekday, weekend and evening delivery options. JIB ECS (Gold) Card is quickly becoming a necessity when seeking work on commercial sites, or sub-contracting to larger contractors.

The shortage of electricians has lead to an increased demand nationwide and in turn a sharp rise in salary. Our training solutions can help you gain nationally recognised qualifications such as City & Guilds and NVQ. Not only you will train in state-of-the-art training centres, but you can also have the opportunity to attain the Work Based Performance Units and complete a portfolio of diverse evidence of onsite work.

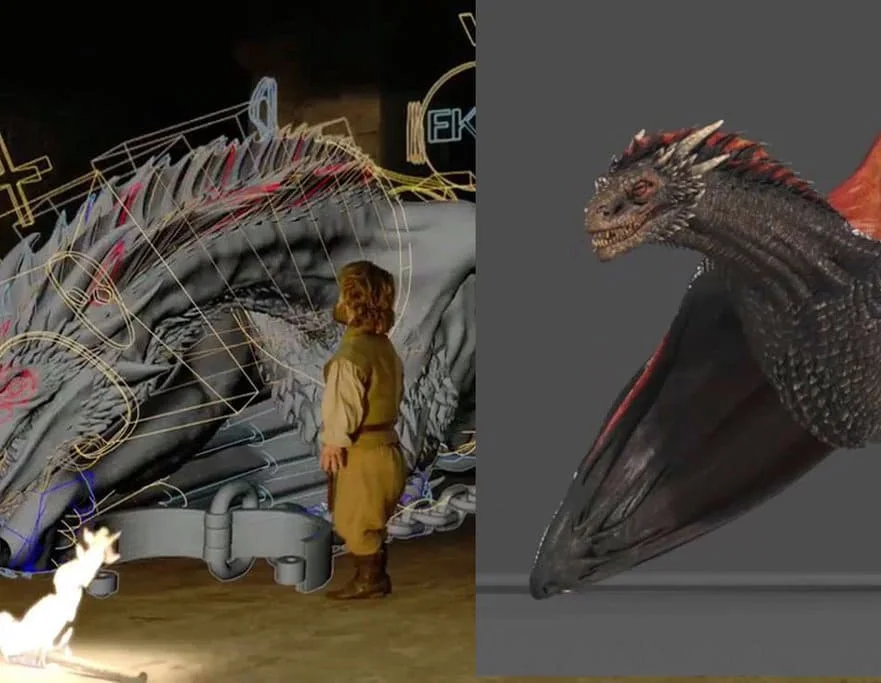

Diploma in Visual Effects for Film and Television Animation

By ATL Autocad Training London

Who is this course for? The Diploma in Visual Effects for Film and Television Animation is tailored for individuals aspiring to work in the Visual Effects, TV, Film, and 3D animation industry. Gain essential skills necessary for a successful career in these fields. Click here for more info: Website Duration: 120 hours of 1-on-1 Training. When can I book: 9 am - 4 pm (Choose your preferred day and time once a week). Monday to Saturday: 9 am - 7 pm (Flexible timing with advance booking). Course Overview for a 120-Hour Diploma Program in Game Design and Development Term 1: Introduction to Game Design and 3D Modeling (40 hours) Module 1: Introduction to Game Design (1 hour) Understanding the game development industry and current trends Exploring game mechanics and fundamental design principles Introduction to the game engines and tools utilized in the program Module 2: 3D Modeling with 3ds Max (25 hours) Familiarization with 3ds Max and its user interface Mastering basic modeling techniques like box modeling and extrusion Advanced modeling skills including subdivision and topology Texturing and shading techniques tailored for game development Module 3: Character Design and Animation (10 hours) Introduction to character design and its developmental process Creating and rigging characters specifically for games Keyframe animation techniques for character movement Term 2: Game Development and Unity 3D (40 hours) Module 4: Unity 3D Basics (20 hours) Navigating Unity 3D and understanding its interface Grasping fundamental game development concepts within Unity Creating game objects, writing scripts, and designing scenes Introduction to scripting using C# Module 5: Advanced Game Development with Unity 3D (10 hours) Constructing game mechanics including UI, scoring, and game states Working with physics and collision systems in Unity Crafting intricate game environments and level designs Module 6: Game Assets with Photoshop (10 hours) Exploring Photoshop tools and features for game asset creation Crafting game elements such as textures, sprites, and icons Optimizing assets for seamless integration into game development Term 3: Advanced Game Design and Portfolio Development (40 hours) Module 7: Advanced Game Design (20 hours) Delving into advanced game design concepts like balancing and difficulty curves Understanding player psychology and methods for engaging audiences Implementing game analytics and user testing for refinement Module 8: Portfolio Development (24 hours) Building a comprehensive portfolio showcasing acquired skills Effective presentation techniques for showcasing work Establishing a professional online presence and networking strategies Final Project: Creating and presenting a collection of best works in collaboration with tutors and fellow students Please note: Any missed sessions or absence without a 48-hour notice will result in session loss and a full class fee charge due to the personalized one-to-one nature of the sessions. Students can request pauses or extended breaks by providing written notice via email. What can you do after this course: Software Proficiency: Master industry-standard design tools for architectural and interior projects. Design Expertise: Develop a deep understanding of design principles and spatial concepts. Visualization Skills: Acquire advanced 2D/3D rendering and virtual reality skills for realistic design representation. Communication and Collaboration: Enhance communication skills and learn to collaborate effectively in design teams. Problem-Solving: Develop creative problem-solving abilities for real-world design challenges. Jobs and Career Opportunities: Architectural Visualizer Interior Designer CAD Technician Virtual Reality Developer 3D Modeler Project Coordinator Freelance Designer Visualization Consultant Students can pursue these roles, applying their expertise in architectural and interior design across various professional opportunities. Course Expectations: Maintain a dedicated notebook to compile your study notes. Schedule makeup sessions for any missed coursework, subject to available time slots. Keep meticulous notes and maintain a design folder to track your progress and nurture creative ideas. Allocate specific time for independent practice and project work. Attain certification from the esteemed professional design team. Post-Course Proficiencies: Upon successful course completion, you will achieve the following: Develop confidence in your software proficiency and a solid grasp of underlying principles. Demonstrate the ability to produce top-tier visuals for architectural and interior design projects. Feel well-prepared to pursue positions, armed with the assurance of your software expertise. Continued Support: We are pleased to offer lifetime, complimentary email and phone support to promptly assist you with any inquiries or challenges that may arise. Software Accessibility: Access to the required software is available through either downloading it from the developer's website or acquiring it at favorable student rates. It is important to note that student software should be exclusively utilized for non-commercial projects. Payment Options: To accommodate your preferences, we provide a range of payment options, including internet bank transfers, credit cards, debit cards, and PayPal. Moreover, we offer installment plans tailored to the needs of our students. Course Type: Certification. Course Level: Basic to Advanced. Time: 09:00 or 4 pm (You can choose your own day and time once a week) (Monday to Friday, 09 am to 7 pm, you can choose anytime by advance booking. Weekends can only be 3 to 4 hrs due to heavy demand on those days). Tutor: Industry Experts. Total Hours: 120 Price for Companies: £3500.00 (With VAT = £4200) For Companies. Price for Students: £3000.00 (With VAT = £3600) For Students.

Sustainable Excellence

By 4and20Million.

4and20Million run Sustainable Excellence, a course designed to help people unlock their productivity, without resorting to longer hours and unnecessary stress. For full details, further information and learning more about how to boost your career prospects, please contact: dan@4and20million.com alex@4and20million.com

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

If you have at least 5 years working experience and you would like to attain Gold Card status via the Experienced Worker route by joining the City & Guilds 2346 NVQ Level 3, you will also need to hold the below two pre-requisite qualifications: City & Guilds 2391-52 Inspection and Testing Course C&G 2382-22 BS7671 18th Edition

Plasma Fibroblast Skin Tightening Training

By Cosmetic College

Plasma skin tightening is a non-invasive precision technique that focuses on lifting and tightening loose skin on the face and body, with long-lasting results. Our plasma pen courses provide aesthetic practitioners with the ability to perform plasma pen treatments to a high standard; as the leading plasma pen training centre, we pride ourselves on training our practitioners to an extremely high standard to ensure their success. Our Plasma Fibroblast course has been structured from start to finish with you in mind to assure that when you complete your training, you will leave with the specialist skills that will help you feel confident in performing Plasma Fibroblast procedures. This intensive course includes theory study via our e-learning portal and practical training with model clients. All courses are kept small and focused, with a maximum of 6 learners in a class. Course prerequisites We accept students aged 18 and over. The student must have good written and spoken English. No prior experience or qualifications are required to enrol on this course. Course Structure Anatomy and physiology of the skin Infection control Sharps and hazardous waste training First aid and anaphylaxis training Pre-study plasma skin tightening theory Skin regeneration Skin tightening for face and neck lifting Reduce the appearance of stretch marks and scarring Full consultation process Faux skin peel practice Non-surgical skin tightening and lifting, including reduction of lines and wrinkles Practical training 1 model Clinical set up Professional live demonstrations Upgrade your training and include a medical-grade Beautier Plasma Pen with probes by Beautier Cosmetics for just 449 saving 550 Frequently Asked Questions How much is the course? Our Plasma Fibroblast training course is normally priced at 2,000. This course sometimes is available at a discounted rate subject to terms and conditions or specific promotional offers. How can I book? We have a few options for you to book. You can book by selecting an available training date above here on our website, by contacting us through email at hello@cosmetic.college or by contacting us on 0333 015 5117. What qualifications do I need to be able to enrol on this course? No previous experience or qualifications are required for you to enrol onto this course. Whether you are a beauty pro, aesthetician, permanent makeup artist or a complete novice, we will give you all the training you need to become a successful Plasma Fibroblast practitioner. What is the course duration? 1 day + pre-study via our online learning platform. Is there a kit included in the price? This course does not include a kit in the training fees however you can upgrade your training and include a medical-grade Beautier Professional Plasma Pen for 449 using our partnership discount exclusively for Cosmetic College students. Which accreditations does this course have? CPD Accreditation Group Certification provided on successful completion of the course Is a deposit required to book? All enrolments are charged an administration fee which is non-refundable. When you enrol you can elect to pay a deposit of 10% plus the administration fee or pay the total training course in full. We have full details of the terms and conditions of training course enrolments here Where is the Cosmetic College The Cosmetic College is located at: 3 Locks Court, 429 Crofton Road, Orpington, BR6 8NL

Search By Location

- 42 Courses in London

- 42 Courses in Birmingham

- 42 Courses in Glasgow

- 42 Courses in Liverpool

- 42 Courses in Bristol

- 42 Courses in Manchester

- 42 Courses in Sheffield

- 42 Courses in Leeds

- 42 Courses in Edinburgh

- 42 Courses in Leicester

- 42 Courses in Coventry

- 42 Courses in Bradford

- 42 Courses in Cardiff

- 42 Courses in Belfast

- 42 Courses in Nottingham