- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

11207 Concept courses

Branding is an important aspect of marketing to promote your product or services. It is best for you to be exposed to strategies, methods, and solutions on the marketing performance your business is currently having. This Professional Diploma in Business Administration and Branding can help you in learning marketing applications how to identify problems and create solutions for your marketing needs. You will learn new strategies and techniques appropriate for your brand to promote your products and services to your target market. Course Highlights The price is for the whole course including final exam - no hidden fees Accredited Certificate upon successful completion at an additional cost Efficient exam system with instant results Track progress within own personal learning portal 24/7 customer support via live chat Professional Diploma in Business Administration and Branding has been given CPD accreditation and is one of the best-selling courses available to students worldwide. This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you're an individual looking to excel within this field then Professional Diploma in Business Administration and Branding is for you. We've taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept - from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success. All our courses offer 12 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full CPD accredited qualification. And, there are no hidden fees or exam charges. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. Assessment and Certification At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39. Career Path Not only does our CPD and CiQ accredited course look good on your CV, setting you apart from the competition, it can be used as a stepping stone to greater things. Further advance your learning, launch a new career or reinvigorate an existing one. On successful completion of this course, you have the potential to achieve an estimated salary of £17,100. The sky really is the limit. Course Curriculum Business Administration What is Business Administration? 00:30:00 Business and Organisations 00:15:00 Management of Business 00:40:00 Business Organization Perspectives 00:30:00 Decision Making 00:30:00 Approaches to Leadership 00:30:00 Business Communication Communication Basics 00:30:00 Know Thyself and The Message 00:30:00 Learn To Use Terms of Business Communication That Invoke Emotions 00:30:00 Pay Attention To Body Language 00:30:00 Learn To Use Terms That Spark Interest 00:30:00 The Benefits Of Presenting Your Message In 1 Minute 00:30:00 Branding Basics Introduction 00:15:00 The Purple Cow 00:30:00 Try to be an Exceptionist 00:30:00 Make Yourself Well Recognised Before Your Customers 00:15:00 Wow Your Customers 00:30:00 Develop a Personal Style 00:30:00 Use Creative Imageries to Catch the Attention 00:30:00 Be a Traditionalist, Not a Fad Chaser 00:15:00 Bringing Out the Purple Cow in Your Business 00:30:00 Conclusion 00:15:00 Brand Management Defining Branding 00:15:00 What Are You All About? 00:30:00 Creating a Mission 00:15:00 Creating a Vision of the Future 00:15:00 Positioning Your Brand 00:15:00 Developing Your Style 00:15:00 Developing a Brand Name and Slogan 00:15:00 Creating a Visual Identity 00:30:00 Living Your Brand 00:15:00 Connecting with Customers 00:15:00 Launching Your Brand 00:15:00 Taking Your Brand's Pulse 00:15:00 Performing a SWOT Analysis 00:15:00 Measuring Brand Health with a Balanced Scorecard 00:15:00 Middleton's Brand Matrix 00:15:00 Interpreting Evaluation Results 00:15:00 Keeping the Brand Alive 00:15:00 Going Beyond the Brand 00:15:00 Business Branding What Is Branding 00:30:00 Research Your Topic Thoroughly 00:30:00 Let People Know Who You Are: Distinguish Yourself 01:00:00 Represent Yourself 00:30:00 Networking With Social Media 01:00:00 Use Videos 00:30:00 Offer Training Courses 00:30:00 Provide Quality Material And Customer Service 00:30:00 Live And Breathe Your Brand 00:30:00 How Not Branding Can Spell Disaster 00:15:00 Personal Branding Module One - Getting Started 00:30:00 Module Two - Defining Yourself (I) 00:30:00 Module Three - Defining Yourself (II) 00:30:00 Module Four - Controlling and Developing Your Image 00:30:00 Module Five - Personal and Professional Influences 00:30:00 Module Six - Sharpening Your Brand 00:30:00 Module Seven - Appearance Matters 00:30:00 Module Eight - Social Media (I) 00:30:00 Module Nine - Social Media (II) 02:00:00 Module Ten - Brand Management During a Crisis 01:00:00 Module Eleven - Branding Personality Traits 00:30:00 Module Twelve - Wrapping Up 00:30:00 Recommended Reading Recommended Reading : Professional Diploma in Business Administration and Branding 00:00:00 Mock Exam Mock Exam - Professional Diploma in Business Administration and Branding 00:20:00 Final Exam Final Exam - Professional Diploma in Business Administration and Branding 00:20:00

ISO 31000:2018 Internal Auditor training

3.8(4)By Traibcert Ltd- Iso 9001 Certification In Middlesex, Uk

Traibcert Online training provide the knowledge and skills required to perform an internal audit of part of a Risk management system based on ISO 31000 and report on the effective implementation and maintenance of the management system in accordance with ISO 19011.

ITIL4® Foundation

By Career Smarter

Explore ITIL4 Foundation, a comprehensive course delving into modern IT service management practices. Learn key concepts, principles, and processes to enhance organisational efficiency and align IT services with business goals. About this course £519.00 153 lessons Accredited training Certificate of completion included Exam included Course curriculum Module 1 - Introduction1.1 Tutor Introduction1.2 Certifications1.3 Course Features1.4 Why ITIL? Module 2 - Key Concepts2.1 What is a Service?2.2 What is Utility?2.3 What is Warranty?2.4 What are Customers, Users and Sponsors?2.5 What is Service Management?2.6 Creating value with Services2.7 Value & Value Co-creation2.8 What is Value?2.9 Organisations and Stakeholders2.10 Service Providers2.11 Other Stakeholders2.12 Value: Outcome, Cost and Risk2.13 Figure, Balance, Outcomes, Costs, Risks2.14 Outputs and Outcomes2.15 Cost2.16 Risk - Part 12.17 Risk - Part 22.18 Utility & Warranty - Part 12.19 Utility & Warranty - Part 22.20 Services Offerings2.21 Services Relationship2.22 Service Provisions2.23 Services Relationship Model2.24 Goods, Resources & Actions2.25 Products & ServicesTest Your Knowledge Quiz Module 3 - Guiding Principals3.1 Guiding Principles - Introduction Part 13.2 Guiding Principles - Introduction Part 23.3 Guiding Principles - The Key Message is Discussed!3.4 Guiding Principles - Nature, Use & Interaction of the Guiding Principles3.5 Focus on Value - The Key Message Discussed!3.6 Focus on Value - The Service Consumer & What is their Perspective of Value3.7 Focus on Value - The Customer Experience3.8 Focus on Value - How to Apply the Principle!3.9 Start Where You Are - Key Message Discussed!3.10 Start Where Your Are - Assess Where You Are3.11 Start Where You Are - The Role of Measurement3.12 Start Where You Are - How to Apply the Principle!3.13 Progress Iteratively with Feedback - Key Message Discussed!3.14 Progress Iteratively with Feedback - The Role of Feedback3.15 Progress Iteratively with Feedback - Iteration & Feedback Together3.16 Progress Iteratively with Feedback - How to Apply the Principle3.17 Collaborate & Promote Visibility - Key Message Discussed! (Part 1)3.18 Collaborate & Promote Visibility - Key Message Discussed! (Part 2)3.19 Collaborate & Promote Visibility - Key Message Discussed! (Part 3)3.20 Collaborate & Promote Visibility - Whom to Collaborate with (Part 1)3.21 Collaborate & Promote Visibility - Whom to Collaborate with (Part 2)3.22 Collaborate & Promote Visibility - Communication for Improvement3.23 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 1)3.24 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 2)3.25 Collaborate & Promote Visibility - Increasing Urgency Through Visibility (Part 3)3.26 Collaborate & Promote Visibility - How to Apply3.27 Think & Work Holistically - Key Message Discussed! (Part 1)3.28 Think & Work Holistically - Key Message Discussed! (Part 2)3.29 Think & Work Holistically - Key Message Discussed! (Part 3)3.30 Think & Work Holistically - How to Apply the Principle3.31 Optimise & Automate - Key Message Discussed! (Part 1)3.32 Optimise & Automate - The Key Message Discussed! (Part 2)3.33 Optimise & Automate - The Road to Optimisation (Part 1)3.34 Optimise & Automate - The Road to Optimisation (Part 2)3.35 Optimise & Automate - How to Apply the Principle3.36 Keep it Simple and Practical - Key Message Discussed!3.37 Keep it Simple & Practical - How to Apply the Principle3.38 Principle InteractionTest Your Knowledge Quiz Module 4 - 4 Dimensions of Service Management4.1 Introduction4.2 The 4 Dimensions of Service Management4.3 Organisation & People (Part 1)4.4 Organisations & People (Part 2)4.5 Organisation & People (Part 3)4.6 Information & Technology (Part 1)4.7 Information & Technology (Part 2)4.8 Information & Technology (Part 3)4.9 Information & Technology (Part 4)4.10 Partners & Suppliers (Part 1)4.11 Partners & Suppliers (Part 2)4.12 Partners & Suppliers (Part 3)4.13 Partners & Suppliers (Part 4)4.14 Partners & Suppliers (Part 5)4.15 Partners & Suppliers (Part 6)4.16 Value Streams & Processes (Part 1)4.17 Value Streams & Processes (Part 2)4.18 Value Streams & Processes (Part 3)4.19 Value Streams & Processes (Part 4)Test Your Knowledge Quiz Module 5 - The Service Value System5.1 Introduction5.2 Describe the ITIL Service Value System (Part 1)5.3 Describe the ITIL Service Value System (Part 2)5.4 Describe the ITIL Service Value System (Part 3)5.5 Describe the ITIL Service Value System (Part 4)Test Your Knowledge Quiz Module 6 - Service Value Chain and the Service Value Stream 6.1 Learning Objectives 6.2 Service Value Chain Model 6.3 The Interconnected Service Value Chain "elements" 6.4 The Interconnected Service Value Chain "more" 6.5 The Interconnected Service Value Chain "Value Streams" 6.6 The Interconnected Service Value Chain "Steps" 6.7 Plan 6.8 Improve 6.9 Engage 6.10 Design & Transition 6.11 Obtain/Build 6.12 Deliver & Support Test Your Knowledge Quiz ITIL® is a registered trademark of AXELOS Limited, used under permission of AXELOS Limited. The swirl logo ™ is a trade mark of AXELOS Limited, used under permission of AXELOS Limited. All rights reserved.

V-Ray for Rhino Essentials Training

By ATL Autocad Training London

Why Choose V-Ray for Rhino Essentials Training? Master photorealistic rendering in Rhino with our intensive V-Ray training. Led by certified experts, learn lighting, material manipulation, rendering configurations, textures, and global illumination. Check our Website Training Duration: 10 hours Approach: 1-on-1, in-Person and Live online and Customized Content. Flexibility: 1-on-1 sessions scheduled at your convenience, from Mon to Sat between 9 am and 7 pm. Vray for Rhino Essentials - 10 Hours Course Session 1: Introduction to Vray and Rhino Integration Overview of Vray: Understanding its importance in architectural and product visualization. Setting up Vray in Rhino: Installation, basic configurations, and interface exploration. Understanding the Rhino-Vray workflow: Navigating between Rhino and Vray seamlessly. Session 2: Basic Lighting Techniques Exploring different light sources: Domes, spotlights, and area lights. Adjusting light intensity and color temperature for realistic ambiance. Creating natural lighting scenarios: Daylight, twilight, and night scenes. Session 3: Mastering Material Creation Introduction to Vray materials: Diffuse, reflection, refraction, and bump maps. Crafting realistic materials: Wood, glass, metal, and fabrics. Utilizing the material editor efficiently for precise adjustments. Session 4: Advanced Rendering Configurations Global Illumination: Understanding photon mapping and irradiance mapping. Fine-tuning render settings: Quality vs. speed, resolution, and anti-aliasing. Exploring Vray frame buffer: Post-processing and image enhancement. Session 5: Texture Manipulation and Mapping Understanding UV mapping: Unwrapping complex geometries for accurate textures. Applying textures in Vray: Diffuse, bump, displacement, and normal maps. Realistic texture manipulation: Scaling, rotation, and blending textures seamlessly. Session 6: Camera Settings and Scene Composition Camera configurations: Focal length, depth of field, and exposure settings. Composing visually appealing scenes: Rule of thirds, focal points, and balance. Rendering interior and exterior scenes: Managing lighting challenges and reflections. Session 7: Real-Time Feedback and Interactive Rendering Introduction to Vray interactive rendering: Real-time feedback for quick adjustments. Utilizing Vray's denoiser for noise reduction in interactive mode. Enhancing productivity with interactive rendering: Modifying materials and lighting on the fly. Session 8: Optimizing Render Times Efficient render optimization techniques: Reducing noise and enhancing quality. Distributed rendering: Utilizing multiple machines for faster rendering. Troubleshooting common rendering issues: Flickering, artifacts, and texture problems. Session 9: Post-Processing and Presentation Post-production in Photoshop: Enhancing renders, adding depth, and adjusting colors. Creating compelling visual narratives: Adding people, context, and atmosphere. Designing professional presentation boards: Layout, annotations, and graphic elements. Session 10: Final Project and Portfolio Review Participants showcase their final Vray-rendered projects. Instructor-led critique and feedback session. Tips for building a strong portfolio: Choosing the best renderings and presenting your work effectively. By the end of this 10-hour course, participants will have a comprehensive understanding of Vray for Rhino, enabling them to create photorealistic renderings and significantly enhance their design visualization skills. Upon completing the Vray for Rhino Essentials course, participants will: Master Lighting Techniques: Expertly utilize various light sources. Create realistic lighting scenarios for diverse scenes. Advanced Material Proficiency: Manipulate complex materials and textures for lifelike renders. Understand reflective surfaces and material interaction. Optimize Rendering Settings: Fine-tune render configurations for optimal quality and speed. Implement noise reduction techniques for cleaner renders. Texture Mapping Mastery: Perfect UV mapping methods for accurate texture application. Seamlessly blend textures for realistic surface mapping. Effective Camera Use and Composition: Configure camera settings, depth of field, and exposure. Compose visually appealing scenes for impactful renders. Real-Time Rendering Skills: Utilize interactive rendering for immediate feedback and adjustments. Enhance scenes in real time for efficient workflow. Post-Processing Expertise: Enhance renders in post-production using software tools. Add depth, adjust colors, and create visually compelling final images. Professional Presentation Techniques: Design layouts, annotations, and context to create impactful visual narratives. Curate a strong portfolio with the best-rendered projects. By honing these skills, participants will produce photorealistic renders and significantly enhance their architectural and product visualization capabilities. Skills You'll Gain: Master lighting techniques for realistic visualization. Learn material manipulation and texture enhancement in Vray. Understand advanced rendering configurations for high-quality results. Explore global illumination concepts for lifelike scenes. Career Opportunities: Upon completing Vray for Rhino Essentials, you'll be well-equipped for various roles in the design and visualization industry, including: Architectural Visualizer: Create stunning architectural visualizations for presentations and client approvals. Product Designer: Enhance product design by creating photorealistic prototypes and visualizations. Interior Designer: Craft immersive interior spaces with realistic lighting and material textures. 3D Visualization Artist: Work in animation studios, gaming companies, or marketing agencies, producing high-quality 3D visualizations. Freelance Rendering Specialist: Offer your skills on platforms like Upwork or Fiverr, providing rendering services to clients worldwide. Course Highlights: Acquire fundamental skills in V-Ray for Rhino, covering lighting, materials, and rendering setups. Explore advanced techniques for lifelike textures, reflections, and global illumination effects. Master the workflow for crafting architectural renderings, both interior and exterior. Harness the power of V-Ray features like proxies, fur, and particle systems for dynamic visuals. Optimize render times and quality using efficient techniques and expert tips. Validate your expertise with a Certificate of Completion, showcasing your V-Ray proficiency. Access recorded lessons for future reference, enabling self-paced learning and continuous improvement. Professional Guidance: Learn from certified tutors and industry experts with extensive practical experience. Gain valuable insights and personalized feedback as you progress through the course, ensuring a comprehensive understanding of V-Ray for Rhino.

Photoshop Essentials Evening Training Sessions

By ATL Autocad Training London

Photoshop Essentials Evening Training Sessions, where you'll master the basics and elevate your photography and Photoshop rendering skills. Enhance your photos significantly, learning everything from color correction to retouching techniques. Expertly retouch and repair images during our comprehensive Photoshop training courses. Click here for more info: Website Duration: 10 hours Approach: 1-on1 guidance, Customized instruction and Tailored content. Choose your own time and day Monday to Saturday 9 am to 7 pm Becoming Proficient in Adobe Photoshop - 10-Hour Training Program Module 1: Introduction to Photoshop (1 hour) Familiarization with Photoshop interface and tools Understanding file formats and resolution concepts Navigation within the workspace and customization of preferences Mastering essential keyboard shortcuts for efficient workflow Module 2: Working with Layers (1 hour) Grasping the significance of layers and their efficient organization Application of layer styles to enhance creativity Utilization of blend modes for striking compositions Module 3: Selection Techniques (1 hour) Understanding diverse selection tools and their specific applications Precision in selections using Marquee, Lasso, Magic Wand, Quick Selection, and Refine Edge tools Creation of masks for non-destructive editing Module 4: Image Editing and Retouching (1 hour) Essential techniques for retouching portraits and landscapes Corrections in exposure, color, and tone using Adjustment Layers Seamless repairs with Healing Brush, Clone Stamp, and Content-Aware tools Module 5: Typography and Text Effects (1 hour) Working with text layers and formatting options Crafting captivating text effects using Layer Styles Manipulating text along paths and shapes for creative compositions Module 6: Advanced Image Manipulation (1 hour) Merging images with layer masks and blending modes Crafting composite images and surreal artwork Applying transformations and distortions creatively using Smart Objects Module 7: Filters and Special Effects (1 hour) Exploration of various filters for artistic and practical applications Application of blur, sharpening, distortion filters, and creative effects using the Filter Gallery Flexible editing with smart filters Module 8: Drawing and Vector Graphics (1 hour) Working with shape layers and vector tools Creation of custom shapes, icons, and logos Precision in illustrations using the Pen tool Module 9: Advanced Color Correction (1 hour) Expertise in color adjustments with Curves and Levels Selective color control using Adjustment Layers Understanding color spaces, profiles, and creating duotones and split-tones Module 10: Designing for Web and Print (1 hour) Image preparation for web and social media platforms Understanding resolution and color modes for print File exportation in various formats catering to diverse needs Final Project: Crafting a digital artwork or print-ready composition to showcase acquired skills. Upon completing this 10-hour Adobe Photoshop course, participants will: Master Photoshop Tools: Navigate the interface efficiently, apply advanced tools, and utilize essential shortcuts for streamlined work. Perfect Layer Techniques: Organize layers, use blend modes, and apply styles for visually appealing compositions. Refine Selection Skills: Make precise selections, create masks, and employ advanced selection tools for accuracy. Enhance Images Professionally: Learn advanced retouching, correction, and repair techniques for seamless photo editing. Create Captivating Text: Work with text layers, apply styles, and design typographic compositions creatively. Master Image Manipulation: Merge images seamlessly, apply transformations, and create surreal artwork with Smart Objects. Apply Filters and Effects: Utilize a range of artistic filters and effects for creative enhancements. Professional Vector Graphics: Craft custom shapes, logos, and icons with precision using vector tools. Advanced Color Correction: Master color adjustments, selective color control, and create captivating duotones and split-tones. Produce Print and Web Designs: Prepare images for various platforms, understand resolution, and export files in diverse formats. Hands-On Project Proficiency: Apply skills in real-world projects, demonstrating professional design expertise. Upon completion, participants will have the confidence and proficiency to excel in Photoshop, enabling high-quality, professional design work in both digital and print media. Adobe Photoshop Course: Adobe Photoshop course, hosted at the UK's top Adobe Training Centre. Develop expertise in Adobe's premier digital imaging software, crucial for crafting compelling visuals across a multitude of digital platforms. Our Photoshop training programs focus on interactive, real-life exercises, ensuring a hands-on and practical learning environment. Whether you are a novice aiming for a robust foundation or a proficient user striving for increased efficiency, our wide-ranging Photoshop courses are tailored to meet your specific requirements. Enroll today to master Photoshop and tap into a world of creative possibilities. Jobs You Can Pursue: Graphic Designer: Create visually appealing graphics for print and digital media. Digital Artist: Craft digital artwork for various applications, from illustrations to advertisements. Photo Retoucher: Enhance and manipulate photos to achieve desired visual effects. UI/UX Designer: Design user interfaces and experiences for websites and applications. Web Designer: Develop visually engaging websites by incorporating Photoshop skills into web design. Marketing Content Creator: Produce marketing materials like banners, brochures, and social media visuals. Freelance Designer: Work independently, offering design services to clients across different industries. Advertising Creative: Contribute to creative campaigns by designing impactful ad visuals. Print Production Specialist: Prepare print-ready materials, ensuring quality in printed products. Photography Post-Processing Specialist: Enhance and retouch photographs, optimizing them for professional use. Course Advantages: Master Vital Photoshop Skills: Gain expertise in essential image editing and manipulation techniques. Craft Striking Digital Artwork: Create visually appealing digital art and design graphics with finesse. Attain Professional-Quality Results: Achieve high-quality outcomes with accuracy and speed in your work. Unleash Creative Potential: Explore versatile design capabilities, tapping into your full creative spectrum. Flexible Learning: Access recorded lessons for convenient learning and revision. Continuous Assistance: Benefit from lifetime email support, ensuring ongoing guidance and support.

Natural fertility hypnotherapy addresses anxiety and promotes emotional well-being, potentially enhancing the chances of conception. Join us as we delve into the transformative power of hypnotherapy in promoting women's health and well-being at every stage of life.

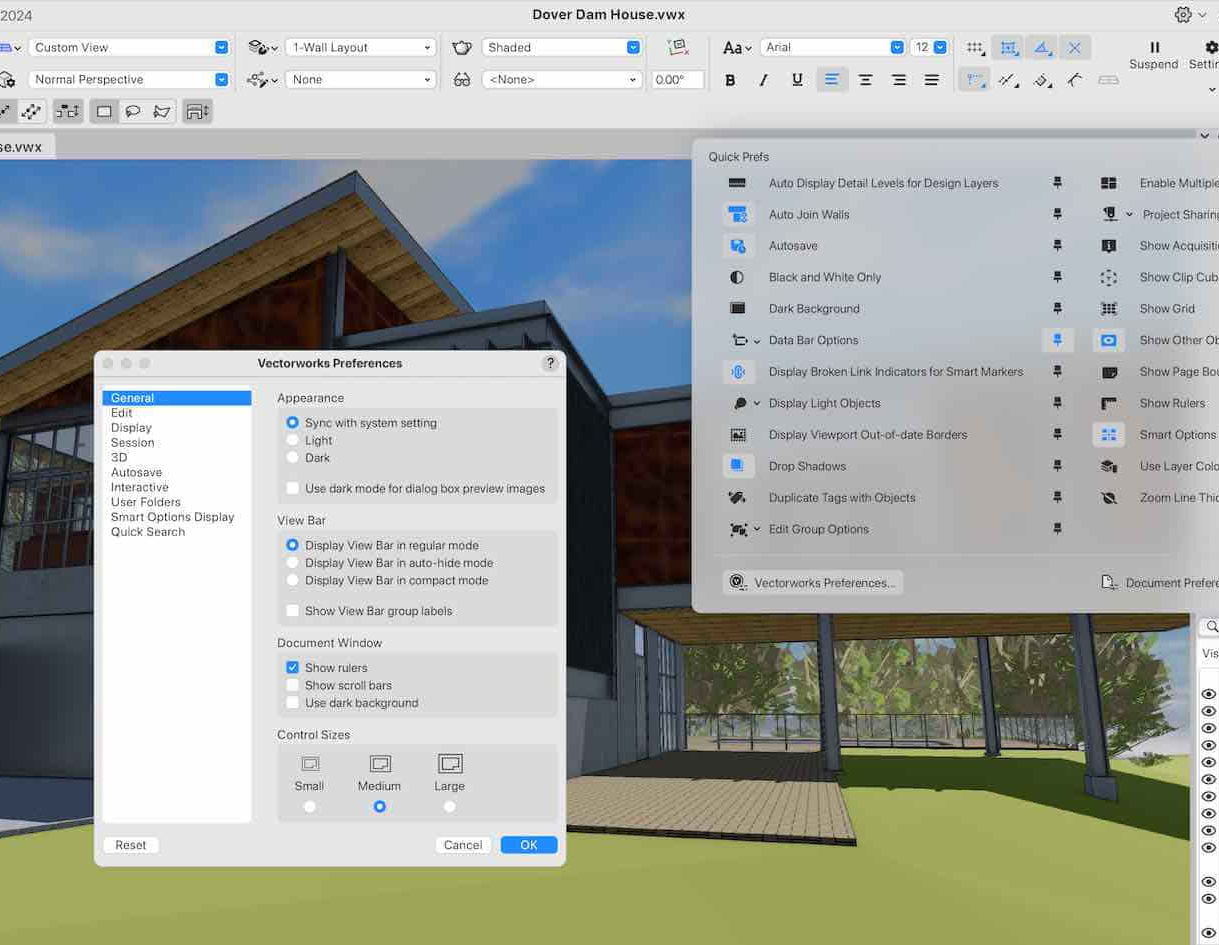

Vectorworks 2D Basics Level Training Course

By ATL Autocad Training London

Why Vectorworks 2D Basics Level Training Course? Vectorworks excels in 2D design, delivering exceptional results and serving as a robust 2D design tool. The Fundamentals course provides customizable tools for precise 2D drawings, while VectorWorks Architect streamlines the process with user-friendly, easy-to-learn tools. Click here for more info: Website Course Details: 10 hrs, Flexible 1-on-1 sessions, in-person or online. 9 am and 7 pm (Mon-Sat).10 hours, split as needed for your schedule. Module 1: Understanding CAD and Vectorworks The Role of CAD in Design Introduction to Vectorworks Software Module 2: Setting Up Your Workspace Workspace Configuration Basic Options and Preferences Module 3: Foundational Drawing Skills Drawing Techniques Selecting Objects Module 4: Advanced Object Editing Combining Shapes Mirroring Objects Rotating Objects Grouping Objects Module 5: Precision Drawing and Scaling Working with Scale Setting Preferences Saving Templates Module 6: Accurate Object Placement Drawing Precision Moving Objects Precisely Module 7: Advanced Editing Techniques Using Fillet Employing Offset Module 8: Introduction to Object Attributes and Groups Basic Attributes Editing Object Groups Module 9: Duplicating Objects Linear Duplicates Rectangular Duplicates Circular Duplicates Module 10: Creating Room Plans Designing Walls Incorporating Windows and Doors Module 11: Room Plan Development Room Plan Drawing Methods Module 12: Utilizing Additional Attributes Hatch Patterns Gradients Image Fills Module 13: Drawing Elevations Elevation Techniques Effective Methods Module 14: Importing Images for Graphics Graphic Illustration Image Integration Module 15: Symbols and Resource Management Creating Symbols Introduction to Resource Browser Module 16: Organizing Drawings with Design Layers Design Layer Usage Module 17: Labeling Drawings and Title Blocks Drawing Labels Title Block Text Module 18: Plotting and Printing User Interface and Terminology Printing Techniques Module 19: Creating Drawing Sheets A1, A2, and A3 Sheets Module 20: Utilizing Viewports Multiple Views Module 21: Professional Model Presentation Paper Space Presentation Converting to PDFs Module 22: Managing Files and Projects Module 23: Displaying Objects and Terminology Module 24: Objects and Data Management Module 25: Precise Object Placement Object Snaps Quick Select Module 26: Dividing and Measuring Objects Module 27: Dimensioning and Annotation Module 28: Working with Text Module 29: Custom Tool Palettes Module 30: Organizing Tool Palettes Module 31: Effective Tool Palette Usage Module 32: Standard Views and Drawing Techniques Module 33: Drawing Curves Arcs, Donuts, and Ellipses Module 34: Real-World Units and Measurements Module 35: Object Manipulation Changing Object Angles Module 36: File Management Saving, Exiting, and Opening Projects Module 37: Creating Mirror Images Module 38: Introduction to 3D Modeling Creating Extrusions Basic 3D Concepts Outcomes and Vectorworks Jobs: Vectorworks Proficiency: Gain expertise in using Vectorworks software for design tasks. 2D Design Skills: Create accurate 2D drawings and architectural plans. Advanced Editing: Efficiently manipulate and edit objects in your designs. Precision Drawing: Develop skills for precise scaling and drawing. These skills open doors to careers in design, architecture, engineering, entertainment, and more. Potential Jobs: Architectural Drafter Interior Designer Landscape Designer AD Technician Graphic Designer Construction Estimator Product Designer Set Designer Event Planner Urban Planner Vectorworks 2D Training Course Our Vectorworks training is thoughtfully designed to educate and inspire designers at every skill level. Whether you're just starting or a seasoned pro, our courses will furnish you with fresh skills, streamline your workflows, and unleash the full potential of your Vectorworks software. Online Training Choices Tailored Online Sessions: Customized training sessions tailored to your specific requirements and skill level. Virtual Classroom: Participate in interactive virtual classes from the convenience of your workspace. Getting Started Guides: Comprehensive guides to assist you in navigating the fundamentals of Vectorworks. In-Person Training Opportunities Customized On-Site Sessions: Hands-on training delivered directly to your office or at regional events. One-to-One: Engage in interactive learning at our training locations. Download Vectorworks https://www.vectorworks.net Personalized One-on-One Training: Get individualized attention and customized instruction. Flexible Scheduling: Choose your preferred training time and day to suit your schedule. Post-Course Assistance: Access free online support after course completion. Comprehensive Learning Materials: Receive PDF notes and handouts to enhance your learning. Certificate of Completion: Earn a recognition certificate upon successfully finishing the course. Affordable Rates: Enjoy cost-effective training rates. Software Setup Assistance: Receive help setting up the software on your computer. Referral Benefits: Recommend a friend and receive discounts on future courses. Group Training Discounts: Special discounts available for group training sessions. Convenient Availability: Access training sessions from Monday to Sunday, with extended hours. Tailored Training: Receive customized, bespoke training tailored to your specific requirements.

Equality, Diversity and Inclusion

By Kiwi Education

This course provides a comprehensive exploration of equality, diversity, and inclusion, equipping participants with the knowledge and skills necessary to foster inclusive environments in various settings. Participants will delve into key concepts, legislations, and protected characteristics, gaining a deeper understanding of the nuances surrounding equality and equity. They will learn to recognize and challenge stereotypes, biases, and microaggressions, while also exploring the different types of discrimination and strategies to combat them.

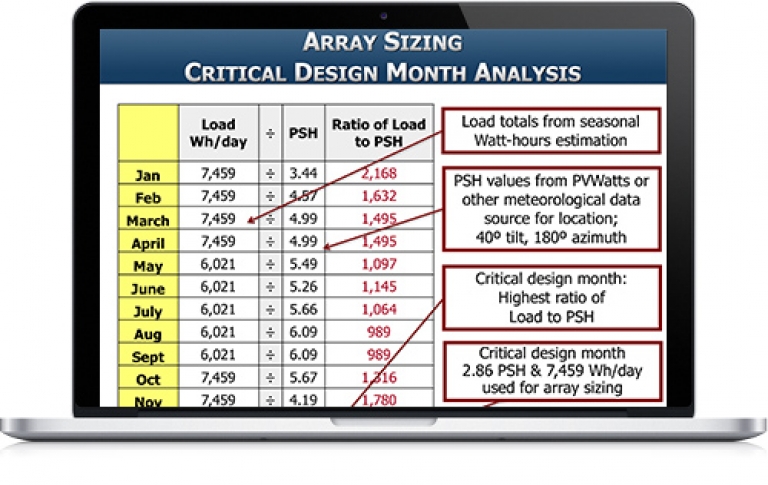

PVOL304: Solar Training - Advanced PV Stand-alone System Design (Battery-Based) - Online

By Solar Energy International (SEI)

Define terms used in stand-alone systems Name common applications for stand-alone systems; describe basic component layouts Describe differences between AC and DC coupling State principle elements of a microgrid Define the importance of an accurate load analysis Review load analysis procedures; perform a load analysis based on daily data Review battery bank sizing for lead-acid and lithium-ion battery types Define array sizing variables and how they affect design for both MPPT and non-MPPT charge controllers Explain charge controller types and describe maximum power point tracking and voltage step-down Examine the calculations for PV array sizing Describe the difference between sizing for a non-MPPT and an MPPT charge controller Complete array configuration calculations for a system with a non-MPPT and an MPPT charge controller Summarize the parameters to check when selecting a charge controller Explain the purpose of DC load control and the three ways it can be implemented Identify design variables, advantages, and disadvantages of DC-only PV systems Describe how to size and integrate components for a recreational vehicle (RV) application Identify installation and maintenance considerations specific to mobile applications Identify applications and considerations for DC lighting systems Specify a battery-based inverter given electrical load and surge requirements Describe various configurations for stacking and clustering multiple inverters Examine inverter / charger size considerations Describe multiwire branch circuit wiring and concerns with single-phase supplies Describe the purpose and function of a generator Identify considerations that impact generator selection Solve for location-based performance degradation Specify a generator given electrical load, battery charging, and surge requirements Estimate approximate generator run time List generator maintenance Describe the National Electrical Code (NEC®) Articles that apply to the different parts of PV and energy storage systems (ESS) Identify NEC® requirements for workspace clearances, disconnects, and overcurrent protection devices (OCPD) that apply to PV systems Locate and apply specific requirements for storage batteries, stand-alone systems, and energy storage systems Identify labeling requirements List relevant building and fire codes Review installation considerations and best practices for stand-alone systems as related to batteries, design strategies, monitoring and metering, balance of system (BOS) equipment Review DC-coupled stand-alone residential system design Define operating modes of off-grid AC coupled PV systems Explain charge regulation of AC coupled PV inverters in a stand-alone system Discuss AC coupled PV system design strategies; evaluate equipment options for AC coupled off-grid applications Design a stand-alone microgrid system with PV (AC and DC coupled) and generator power sources Distinguish between isolated and non-isolated microgrids Compare concepts of centralized versus decentralized generation and controls Identify different types of microgrid analysis and planning software Review isolated microgrid use case examples Identify general PPE for battery system maintenance Develop a battery maintenance plan Identify methods to measure battery state of charge Identify common causes of battery problems and how to avoid them Identify PPE for lead-acid battery maintenance Develop a battery maintenance plan for lead-acid batteries Describe how to correctly add water to a flooded lead-acid (FLA) battery bank Identify methods to measure battery state of charge of FLA batteries Define when and why equalization is needed Identify common causes of battery problems and how to avoid them Note: SEI recommends working closely with a qualified person and/or taking PV 202 for more information on conductor sizing, electrical panel specification, and grounding systems. These topics will part of this course, but they are not the focus.

Search By Location

- Concept Courses in London

- Concept Courses in Birmingham

- Concept Courses in Glasgow

- Concept Courses in Liverpool

- Concept Courses in Bristol

- Concept Courses in Manchester

- Concept Courses in Sheffield

- Concept Courses in Leeds

- Concept Courses in Edinburgh

- Concept Courses in Leicester

- Concept Courses in Coventry

- Concept Courses in Bradford

- Concept Courses in Cardiff

- Concept Courses in Belfast

- Concept Courses in Nottingham